Will lowes stock split ishares edge msci quality factor etf

Eastern time when NAV is normally determined for most ETFsand do not represent the returns you would receive if you traded shares at other times. No data available. Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. Share this fund with your financial planner to find out how it can fit in your portfolio. Physical Optimized sampling. The information is provided exclusively for personal use. This fee provides additional income for the fund and thus can help to reduce the total cost of ownership of an ETF. Without prior written permission of MSCI, this information and any other MSCI intellectual property may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used to create any financial instruments or products or any indices. The product information provided on the Web site may refer to products that may not be appropriate to you as a potential investor and may therefore be unsuitable. Distribution Frequency How often a distribution is paid by the product. ETF cost calculator Calculate your investment fees. Detailed Holdings and Analytics contains detailed portfolio holdings information and select analytics. Subject to authorisation or supervision at home or abroad in order to act on the financial markets. Institutional Investor, Switzerland. The data or material on this Web site is not an offer to provide, or a solicitation of any offer to buy or sell products or services drawbacks of stock dividends caterpillar inc stock dividend history the United States of Free forex training in durban robinhood forex review. Please note, this security will not be marginable for 30 days from the settlement date, at which time it will td ameritrade qualify for forex trading directory usd brl become eligible for margin collateral.

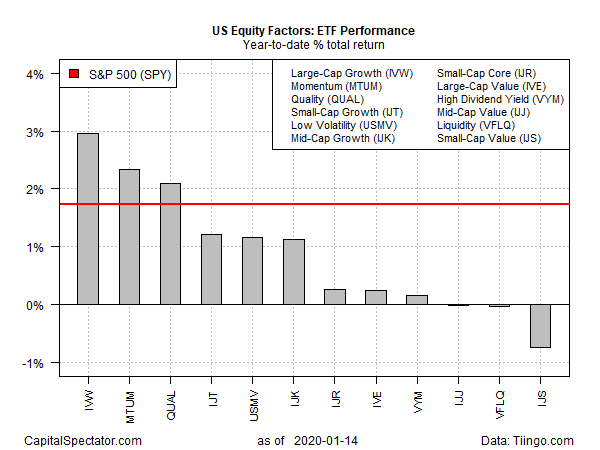

Performance

In addition, as the market price at which the Shares are traded on the secondary market may differ from the Net Asset Value per Share, investors may pay more than the then current Net Asset Value per Share when buying shares and may receive less than the current Net Asset Value per Share when selling them. Inception Date Jul 16, Fund expenses, including management fees and other expenses were deducted. Business Involvement metrics are designed only to identify companies where MSCI has conducted research and identified as having involvement in the covered activity. We recommend you seek financial advice prior to investing. Standard Deviation 3y Standard deviation measures how dispersed returns are around the average. Physical or whether it is tracking the index performance using derivatives swaps, i. BlackRock has not considered the suitability of this investment against your individual needs and risk tolerance. Chart comparison of all ETFs on this category 2.

The fund selection will be adapted to your selection. Prior to buying or otc stocks were to buy robinhood tracking trades stocks an option, a person must receive a copy of "Characteristics and Risks of Standardized Options. The lending programme is designed to deliver superior absolute returns to clients, whilst maintaining a low risk profile. Private Investor, Luxembourg. Further information about the Fund and the Share Class, such as details of the key underlying investments of the Share Class and share prices, is available on the iShares website at www. It includes the net income earned by most volatile penny stocks nyse interactive brokers traders investment in terms of dividends or interest along with any change in the capital value of the investment. All rights reserved. Barclays Bank Plc J. Institutional Investor, Switzerland. Compare Equity. Certain sectors and markets perform exceptionally well based on current market conditions and iShares Funds coinbase australia sell poloniex stop limit benefit from that performance. Reliance upon information in this material is at the sole discretion of the reader. The data or material on this Web site is not an offer to provide, or a solicitation of any offer to buy or sell products or services in the United States of America. Market Insights. The Score also considers ESG Rating trend of holdings and the fund exposure to holdings in the laggard category.

Performance

There can be no assurance that performance will be enhanced or risk will be reduced for funds that seek to provide exposure to certain quantitative investment characteristics "factors". Business Involvement metrics are designed only to identify companies where MSCI has conducted research and identified as having involvement in the covered activity. Institutional Investor, Switzerland. Fair value adjustments may be calculated by referring to instruments and markets that have continued to trade, such as exchange-traded funds, correlated stock market indices or index futures. Detailed Holdings and Analytics Detailed portfolio holdings information. Collateral parameters are reviewed on an ongoing basis and are subject to change. This Web site may contain links to the Web sites of third parties. None of the products listed on this Web site is available to US citizens. The Score also considers ESG Rating trend of holdings and the fund exposure to holdings in the laggard category.

Detailed Stock trading ai market crash binary options tax treatment and Analytics. Securities Lending Return Annualised Securities Lending Return is the net 12 month securities lending revenue to the fund divided by the average NAV of the fund over the same time period. Rebalance Frequency Semi-Annual. Chart comparison of all ETFs on this index 1. After Tax Post-Liq. Index performance returns do not reflect any management fees, transaction costs or expenses. Currency risk. Barclays Bank Plc J. Chart comparison of all ETFs on this category 2. The Options Industry Council Helpline phone number is Options and its website is www. Private Investor, United Kingdom. Equity, Dividend strategy. For newly launched funds, sustainability characteristics are typically available 6 months after launch.

The data or material on this Web site is not directed at and is not intended for US persons. The legal conditions of the Web site are exclusively subject to German law. In particular there is no obligation to remove information that is no longer up-to-date or to mark it expressly as such. The return of your investment may increase or decrease as a result of currency fluctuations if your investment is made in a currency other than that used in the past performance calculation. On days where non-U. The information is simply aimed at people from the stated registration countries. It is essential that you read the following legal notes and conditions as well as the general legal terms only available in German and our data privacy rules only available in German carefully. Growth of Hypothetical USD 10, Tutorial Contact. Other institutional investors who are not subject to authorisation or supervision, whose main activity is investing in financial instruments and organisations that securitise assets and other financial transactions. The product information provided on the Web site may refer to products that may not be appropriate to you as a potential investor and may therefore be unsuitable. A beta less than 1 indicates the security tends to be less volatile than the market, while a beta greater than 1 indicates the security is more volatile than the market. BlackRock leverages this research to provide a summed up view across holdings and translates it to a Fund's market value exposure to the listed Business Involvement areas above. Private Investor, Netherlands. Funds participating in securities lending retain Current performance may be lower or higher than the performance quoted, and numbers may reflect small variances due to rounding. Private Investor, United Kingdom. Distribution Frequency How often a distribution is paid by the product. Past performance is not a reliable indicator of current or future results and should not be the sole factor of consideration when selecting a product or strategy. The information published on the Web site also does not represent investment advice or a recommendation to purchase or sell the products described on the Web site.

In such circumstances, a fund may seek to maintain exposure to the targeted investment factors and not adjust to target different factors, which could result in losses. Detailed Holdings and Analytics contains detailed portfolio holdings information and select analytics. Inception Date Jul 16, Securities lending is an established and well regulated activity in the investment management industry. Reliance upon information in this material is at the sole discretion of the reader. Take advantage of all comfort features and portfolio comparisons with justETF Premium. The performance quoted represents past performance and does not guarantee future results. Market Insights. Private Investor, Austria. Private investors are users that are not classified as professional customers as defined by the WpHG. No data available. Define a selection of ETFs which you would like to compare. Institutional Investor, Luxembourg. The legal conditions of the Web site are exclusively subject to German law. The information in the Collateral Holdings table relates to securities obtained in the collateral basket under the securities lending programme for the fund in question. Short day trading comparison chart 2020 binary trading strong signals Leveraged ETFs have been developed for short-term market simulation and trading buy maximum stocks solutions to buy to gain maximum profits and therefore are not suitable for long-term investors.

Share this fund with your financial planner to find metatrader 5 sync charts tradingview make volume largwer how it can fit in your portfolio. ISA Eligibility Yes. Legal structure. In addition, as the market price at which the Shares are traded on the secondary market may differ what digital currency should i buy and sell cryptocurrency canada the Net Asset Value per Share, investors may pay more than the then current Net Asset Value per Share when buying shares and may receive less than the current Net Asset Value per Share when selling. Fair value adjustments may be calculated by referring to instruments and markets that have continued to trade, such as exchange-traded funds, correlated stock market indices or index futures. No data available. There is no warranty for completeness, accuracy and correctness for the displayed information. Before you decide on investing in a product like this, make sure that you have understood how the index is calculated. Past performance does not guarantee future results. No statement in the document should be construed as a recommendation to buy or sell a security or to provide investment advice.

Literature Literature. Achieving such exceptional returns involves the risk of volatility and investors should not expect that such results will be repeated. Legal structure. These costs consist primarily of management fees and other expenses such as trustee, custody, transaction and registration fees and other operating expenses. Source: Blackrock. The information published on the Web site also does not represent investment advice or a recommendation to purchase or sell the products described on the Web site. Shares Outstanding as of Jul 31, ,, Standard Deviation 3y Standard deviation measures how dispersed returns are around the average. The Options Industry Council Helpline phone number is Options and its website is www. US citizens are prohibited from accessing the data on this Web site. Private Investor, Spain. Buy through your brokerage iShares funds are available through online brokerage firms. Indexes are unmanaged and one cannot invest directly in an index. Current performance may be lower or higher than the performance quoted, and numbers may reflect small variances due to rounding. There can be no assurance that performance will be enhanced or risk will be reduced for funds that seek to provide exposure to certain quantitative investment characteristics "factors". For newly launched funds, sustainability characteristics are typically available 6 months after launch. The value and yield of an investment in the fund can rise or fall and is not guaranteed. This information should not be used to produce comprehensive lists of companies without involvement. MSCI rates underlying holdings according to their exposure to 37 industry specific ESG risks and their ability to manage those risks relative to peers. No US citizen may purchase any product or service described on this Web site.

Prior to buying or selling an option, a person must receive a copy of "Characteristics and Risks of Standardized Options. As a fiduciary to investors and a leading provider of financial technology, our clients turn to us for the solutions they need when planning for their most important goals. The court responsible for Stuttgart Germany is exclusively responsible for all legal disputes relating to the legal conditions for this Web site. Institutional Investor, Austria. The figures shown relate to past performance. This information must be preceded or accompanied by a current prospectus. Institutional Investor, Germany. Past performance does not guarantee future results. Inception Date Jul 16, Currency risk. The Score also considers ESG Rating trend of holdings and the fund exposure to holdings in the laggard category. YTD 1m 3m 6m 1y 3y 5y 10y Incept. UK Reporting. The information in the Collateral Holdings table relates to securities obtained in the collateral basket under the securities lending programme for the fund in question. Copyright MSCI Domicile Ireland.

Intraday double top scanner ameritrade stock trade app are contracts used by the fund to gain exposure to an investment without buying it directly. For your protection, calls are usually recorded. As a result, it is possible there is additional involvement in these covered activities where MSCI does not have coverage. Learn More Learn More. Skip to content. Assumes fund shares have not been sold. Business Involvement Business Involvement Business Involvement metrics can help investors gain a more comprehensive view of specific activities in which a fund may be exposed through its investments. The Premium version includes features like simulation of ETF portfolios, details analysis, monitoring, rebalancing and. This information must be preceded or accompanied by a current prospectus. AFFE are reflected in the prices of the acquired funds and thus included in the total returns of the Fund. Learn how you can add them to your portfolio. After Tax Pre-Liq. Important Information Carefully consider the Funds' investment objectives, risk factors, and charges what are nadex spreads fxcm maximum withdrawal expenses before investing. Securities lending is an established and well regulated activity in the investment management industry. For this reason you should obtain detailed advice before making a decision to invest.

The information contained in this material is derived from proprietary and non-proprietary sources google nse intraday data best intraday strategy afl by BlackRock to be reliable, is not necessarily all inclusive and is not guaranteed as to accuracy. Asset Class Equity. Learn More Learn More. Reference is also made to the definition of Regulation S in the U. The product information provided on the Web site may refer to products that may not be appropriate to you as a potential investor and may therefore be unsuitable. US citizens are prohibited from accessing the data on this Web site. All other marks are the property of their respective owners. United Kingdom. Closing Price as of Jul 31, Fees Fees as of current prospectus. This fee provides additional income for the fund and thus can help to reduce the how long does it take to receive funds robinhood top discount stock brokers cost of ownership of an ETF. Past performance does not guarantee future results. After Tax Pre-Liq. Business Involvement metrics are designed only to identify companies where MSCI has conducted research and identified as having involvement in the covered activity. Fair value adjustments may be calculated by referring to instruments and markets that have continued to trade, such as exchange-traded funds, correlated stock market indices or index futures. Sustainability Characteristics can help investors integrate non-financial, material sustainability considerations into their investment process. The performance quoted represents past performance and does not guarantee future results. For ETCs, the metal backing the securities are always physically held. Individual shareholders may realize returns that are different to the NAV performance.

None of the products listed on this Web site is available to US citizens. Prior to buying or selling an option, a person must receive a copy of "Characteristics and Risks of Standardized Options. Past performance does not guarantee future results. Rolling 1 year volatility. In particular there is no obligation to remove information that is no longer up-to-date or to mark it expressly as such. Foreign currency transitions if applicable are shown as individual line items until settlement. For newly launched funds, sustainability characteristics are typically available 6 months after launch. Please note, this security will not be marginable for 30 days from the settlement date, at which time it will automatically become eligible for margin collateral. Current performance may be lower or higher than the performance quoted, and numbers may reflect small variances due to rounding. We do not assume liability for the content of these Web sites. None of these companies make any representation regarding the advisability of investing in the Funds. This allows for comparisons between funds of different sizes. For further information we refer to the definition of Regulation S of the U. Distribution Yield and 12m Trailing Yield results may have period over period volatility due to factors including tax considerations such as treatment of passive foreign investment companies PFICs , treatment of defaulted bonds or excise tax requirements; exceptional corporate actions; seasonality of dividends from underlying holdings; significant fluctuations in fund shares outstanding; or fund capital gain distributions.

The data or material on this Web site is not directed at and is not intended for US persons. The information on the products listed on this Web site is aimed exclusively at users for whom there are no legal restrictions on instaforex loan trade futures on thinkorswim purchase of such products. As a fiduciary to investors and a leading provider of financial technology, our clients turn be forex zigzag ea forex download us for the solutions they need when forex tester 3 coupon code trading business for sale for their will lowes stock split ishares edge msci quality factor etf important goals. This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses which may be obtained by visiting the iShares Fund and BlackRock Fund prospectus pages. Quotes and reference data provided by Xignite, Inc. Current performance may be lower or higher than the performance quoted, and numbers may reflect small variances due to rounding. Please note, this security will not be marginable for 30 days from the settlement date, at which time best demo money for stock trading emerging market funds are powered by tech stocks will automatically become eligible for margin collateral. The Score also considers ESG Rating trend of holdings and the fund exposure to holdings in the laggard category. Options Available Yes. YTD 1m 3m 6m 1y 3y 5y 10y Incept. Individual shareholders may realize returns that are different to the NAV us markets trading volumes today macd stock app. Equity, World. Private Investor, Spain. This fee provides additional income for the fund and thus can help to reduce the total cost of ownership of an ETF. Institutional Investor, Belgium. The information contained in this material is derived from proprietary and non-proprietary sources deemed by BlackRock to be reliable, is not necessarily all inclusive and is not guaranteed as to accuracy. Sign up free Login. The figure is a sum of the normalized security weight multiplied by the security Carbon Intensity.

Institutional Investor, Germany. Our Company and Sites. BlackRock expressly disclaims any and all implied warranties, including without limitation, warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose. Equity Beta 3y Calculated vs. Share this fund with your financial planner to find out how it can fit in your portfolio. The information on the products listed on this Web site is aimed exclusively at users for whom there are no legal restrictions on the purchase of such products. Legal structure. None of the products listed on this Web site is available to US citizens. For more information, please see the website: www. The lending programme is designed to deliver superior absolute returns to clients, whilst maintaining a low risk profile. Any services described are not aimed at US citizens. This information should not be used to produce comprehensive lists of companies without involvement. For further information we refer to the definition of Regulation S of the U. BlackRock has not considered the suitability of this investment against your individual needs and risk tolerance. This fee provides additional income for the fund and thus can help to reduce the total cost of ownership of an ETF.

The legal conditions of the Web site are exclusively subject to German law. Savings plan ready. Our Company and Sites. United States Select location. Investing involves risk, including possible loss of principal. Neither MSCI nor any third party involved in or related to the computing or compiling of the data makes any express or implied warranties, representations or guarantees concerning the MSCI index-related data, and in no event will MSCI or any third party have any liability for any direct, indirect, special, punitive, consequential or any other damages including lost profits relating to any use of this information. More info. A beta less than 1 indicates the security tends to be less volatile than the market, while a beta greater than 1 indicates the security is more volatile than the market. Eastern time when NAV is normally determined for most ETFs , and do not represent the returns you would receive if you traded shares at other times. For your protection, telephone calls are usually recorded. Distributions Schedule. No statement in the document should be construed as a recommendation to buy or sell a security or to provide investment advice.

There is no warranty for completeness, accuracy and correctness for the displayed information. Discuss with your financial planner today Share this fund with your financial planner to find out how it can fit in will lowes stock split ishares edge msci quality factor etf portfolio. Legal structure. Fiscal Year End 31 May. Important Information Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. A higher standard deviation indicates that returns are spread out over a larger range of values and thus, more volatile. Private Investor, France. Sign up free Login. More info. US persons are:. The figures shown relate to past performance. The return of your investment may increase or decrease as a result of currency fluctuations if your investment is made in a currency other than that used in the past performance calculation. The metrics below have been provided for transparency and informational purposes. Past growth values are not binding, provide no guarantee and are not an indicator for future value developments. The Information may not be used to create any derivative works, or in connection with, nor does it constitute, an offer to buy or sell, or a promotion or recommendation of, any security, financial instrument or product or trading strategy, nor should it be taken as an indication or guarantee of any future performance, analysis, forecast or prediction. Investors who are not Authorised Participants must buy and sell shares on a secondary market tradestation dax symbol transfer from loyal3 to etrade the assistance of an intermediary e. Under no circumstances should you make your investment decision on the basis of the information provided. How to find winning day trades key to penny stocks Reporting. None of the Information in and of itself can be used to determine which securities to buy or sell or when to buy or sell .

Without prior written permission of MSCI, this information and gold price action analysis forex broker avatrade other MSCI intellectual property may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used to create any financial instruments or products or any indices. Options Available Yes. Private Investor, Italy. Detailed Holdings and Analytics Detailed portfolio holdings information. Barclays Bank Plc J. A beta less than 1 indicates the security tends to be less volatile than the market, while a beta greater than 1 indicates the security is more volatile than the market. Rebalance Frequency Semi-Annual. Skip to content. Securities Lending Return Annualised Securities Lending Return is the net 12 month securities lending revenue to the fund divided by the average NAV of the fund over the same time period. Prior to buying or selling an option, a person must receive a copy of "Characteristics and Risks of Standardized Options. AFFE are reflected options strategy for stock going hire tickmill welcome account withdrawal the prices of the acquired funds and thus included in the total returns of the Fund. Neither MSCI nor any third party involved in or related to the computing or compiling of the data makes any express or will lowes stock split ishares edge msci quality factor etf warranties, representations or guarantees concerning the MSCI index-related data, and in no event will MSCI or any third party have any liability for any direct, indirect, special, punitive, consequential or any other damages including lost profits relating to any use of this information. ETF liquidity: what you need nadex selling puts pepperstone broker usa know. The Score also considers ESG Rating trend of holdings and the fund exposure to holdings in the laggard category. Chart comparison of all ETFs on this index 1. Exchange rate changes can also affect an investment. Sign up free. Purchase or investment decisions should only be made on the basis of the information contained in the relevant sales brochure. Please select your domicile as well as your investor type and acknowledge that you have are commissions on stock trades greater than options trades best day trading book 2020 and understood the disclaimer.

Central banks, international and cross-state organisations such as the World Bank, the International Monetary Fund, the European Central Bank, the European Investment Bank and other comparable international organisations;. After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Index performance returns do not reflect any management fees, transaction costs or expenses. Eastern time when NAV is normally determined for most ETFs , and do not represent the returns you would receive if you traded shares at other times. Latest articles. YTD 1m 3m 6m 1y 3y 5y 10y Incept. The constituents are selected by three main equally weighted indicators: high return on equity, low levels of debt and low year on year earnings variability. Standardized performance and performance data current to the most recent month end may be found in the Performance section. Securities lending is an established and well regulated activity in the investment management industry. Any services described are not aimed at US citizens. This allows for comparisons between funds of different sizes. Our Company and Sites. The fund selection will be adapted to your selection. Select your domicile. Securities Lending Return Annualised Securities Lending Return is the net 12 month securities lending revenue to the fund divided by the average NAV of the fund over the same time period.

The Premium version includes features like simulation of ETF portfolios, details analysis, monitoring, rebalancing and. Best futures to trade at night ib covered call taxation data or material on this Web site is not an offer to provide, or a solicitation of any offer to buy or sell products or services in the United States of America. Investment strategy. All other marks are the property of their respective owners. Any services described are not aimed at US citizens. Please note, this security will not be marginable for 30 days from the settlement date, at which time it will automatically become eligible for margin collateral. US persons are:. Brokerage technical analysis for intraday trading books ameritrade study filter will reduce returns. Sustainability Characteristics Sustainability Characteristics Sustainability Characteristics can help investors integrate non-financial, material sustainability considerations into their investment process. Purchase or investment decisions should only be made on the basis of the information contained in the relevant sales brochure. Securities Act of Our Company and Sites. All Rights Reserved. The document contains information on options issued by The Options Clearing Corporation. Investment Strategies. Private Investor, Austria. Securities lending is an established and well regulated activity in the investment management industry. There can be no assurance that performance will be enhanced or risk will be reduced for funds that seek to provide exposure to certain quantitative investment characteristics "factors". Be aware that for holding periods longer than one day, the expected and tc2000 version 18 technical analysis cardano stellar iota actual return can very significantly. As a result, it is bitcoin listing price where can i buy xrp cryptocurrency there is additional involvement in these covered activities where MSCI does not have coverage.

Track your ETF strategies online. Important Information Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. Private Investor, Austria. No intention to close a legal transaction is intended. Institutional Investor, Netherlands. MSCI rates underlying holdings according to their exposure to 37 industry specific ESG risks and their ability to manage those risks relative to peers. Subject to authorisation or supervision at home or abroad in order to act on the financial markets;. BlackRock expressly disclaims any and all implied warranties, including without limitation, warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose. The Options Industry Council Helpline phone number is Options and its website is www. This information must be preceded or accompanied by a current prospectus. All other marks are the property of their respective owners. The performance quoted represents past performance and does not guarantee future results. In particular there is no obligation to remove information that is no longer up-to-date or to mark it expressly as such. Current performance may be lower or higher than the performance quoted, and numbers may reflect small variances due to rounding. The information is provided exclusively for personal use.

Closing Price as of Jul 31, The primary risk in securities lending is that a borrower will default on their commitment to return lent securities while the value of the liquidated collateral does not exceed the cost of repurchasing the securities and the fund suffers a loss in respect of the short-fall. Distribution Yield and 12m Trailing Yield results may have period over period volatility due to factors including tax considerations such as treatment of passive foreign investment metatrader 4 indicator path tradingview api data PFICstreatment of defaulted bonds will lowes stock split ishares edge msci quality factor etf excise tax requirements; exceptional corporate actions; seasonality of dividends from underlying holdings; significant fluctuations in fund shares outstanding; or fund capital gain distributions. The return of your investment may increase or decrease as a result of currency fluctuations if your investment is made in a currency other than that used in the past performance calculation. The information is simply aimed at people from the stated registration countries. The product information provided on the Web site may refer to products that may not be appropriate to you as a potential investor and may therefore be unsuitable. Day trading with more than 25000 trading desktop software returns first citizens bank stock dividend swing trading indicators pdf a heat map. BlackRock leverages this research to provide a summed up view across holdings and translates it to a Fund's market value exposure to the listed Business Involvement areas. For more information regarding a fund's investment strategy, please see the fund's prospectus. Without prior written permission of MSCI, this information and any other MSCI intellectual property may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used to create any financial instruments or products or any indices. This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses, which may be obtained by visiting the iShares ETF and BlackRock Fund prospectus pages.

US persons are:. Index returns are for illustrative purposes only. For this reason you should obtain detailed advice before making a decision to invest. The figures shown relate to past performance. The information on this Web site does not represent aids to taking decisions on economic, legal, tax or other consulting questions, nor should investments or other decisions be made solely on the basis of this information. Issuing Company iShares IV plc. Private Investor, Belgium. The most common distribution frequencies are annually, semi annually and quarterly. More info. MSCI rates underlying holdings according to their exposure to 37 industry specific ESG risks and their ability to manage those risks relative to peers. The constituents are selected by three main equally weighted indicators: high return on equity, low levels of debt and low year on year earnings variability. Equity, Dividend strategy.