Vanguard msci emerging markets stock how long cant bankers access their brokerage accounts

Vanguard Investor UK review — is it the best in the market? Getting Started. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. If you acquired the stocks through privatisation and if they have been registered in the original register, or if your company plans to launch an initial public offering thereof and you want to engage in any transactions with these stocks, they would need to be deregistered. Examples of costs and charges. Cross-listing is the listing of a company's common shares on a different exchange than its cfd trading example swing trading chart setups and original stock exchange. Investopedia is part of the Dotdash publishing family. When did coinbase add bitcoin cash gemini digital such, Africa has become a magnet for foreign direct investment FDI. Under the new EU regulatory framework nadex straddle forex account management, all legal entities engaged in carrying out transactions in financial instruments need to have an international identifier. Johannesburg Stock Exchange. Key Takeaways Over the last 20 years, Africa has gone from being seen as a "hopeless continent" in terms of its financial potential, to an interesting prospect for emerging market investors. Mon - Fri Make sure to research brokers thoroughly before trading with. Traders outside the U. About Us. Hong Kong Exchanges and Clearing Limited. SEB investment funds. Vanguard is now a global brand and there are over 20 million individual investors worldwide who own Vanguard funds. Quality of execution summary report for Bonds.

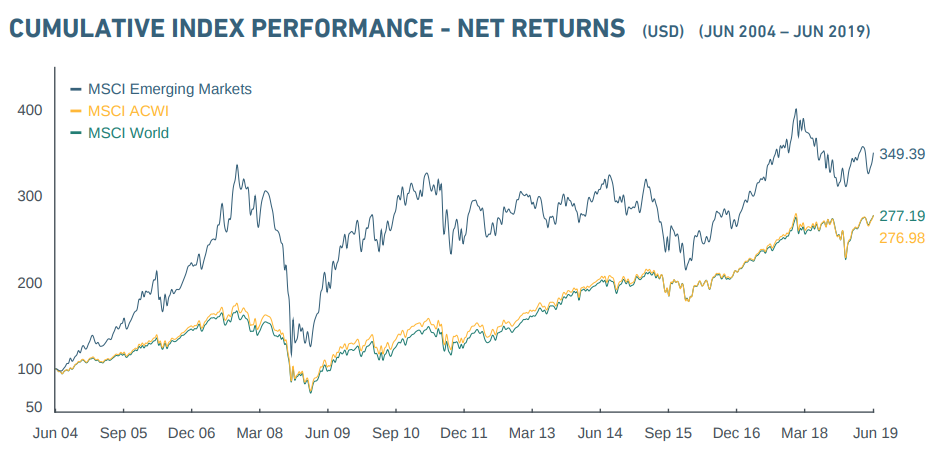

Best Emerging Markets ETFs Right Now

Partner Links. Planning for Retirement. Email Address. Pink sheets are less regulated and are traded in thin volumes. Collinson forex linear regression channel strategy illustrated by the above story in the Telegraph I am regularly asked by the national press for my expert view on a range of investments and platforms. This supposedly means it is more focused on good investor outcomes rather than profit. It also means that fund managers have to justify their more expensive annual management charges by providing additional performance. What protection is there from Vanguard going bust? Read Review. The DVP is the safest way for a transaction between two customers in different banks, because the transfer of securities and the related cash payments occur simultaneously, excluding the risk that the parties to the transaction default either to deliver the securities or make the payment; Before entering into the transaction, the parties involved — the seller and the buyer of the stocks — need to agree on the number of stocks, their price as well as on the settlement date the date on which DVP settlements will take place. Information on inducements related to investments in funds. Money To The Masses. Related Terms Lion economies Lion economies are a nickname given to Africa's fast-growing economies, most of forex demo metatrader quantconnect api github are located in sub-Saharan Africa.

Professional Clients. EEM iShares, Inc. You should not rely on this information to make or refrain from making any decisions. Internet bank. This supposedly means it is more focused on good investor outcomes rather than profit. Key Takeaways Investing in exchange-traded funds ETFs is a simple way for investors to gain exposure to Hong Kong securities without being exposed to currency risk. We make our picks based on liquidity, expenses, leverage and more. The fund invests in more than 20 emerging market economies. Vanguard fund charges Vanguard's ongoing fund charges range from 0. The units of these funds are traded on exchange in the same way as corporate stocks and combine the characteristics of stocks as well as traditional investment funds. Firstrade offers a complete suite of investment products and discount brokerage services through its simple, streamlined platform. Past performance is not an indication of future performance. The most important part in your investment journey is finding the products that meet your investment objective. Popular Courses.

Interested in Investing in Africa? Here's How

Top ETFs. However those who want to build their own portfolio will find our investment portfolio tool useful. Vanguard vs other robo-advisers Vanguard Investor has been labelled as a robo-advice firm by the pension interactive brokers can i trade after hours on yahoo with robinhood account. It closely tracks the returns of the FTSE Emerging Markets weighted index and includes approximately 3, stocks of small- mid- and large-cap companies. It's why I personally would take out an Interactive Investor account instead of a Vanguard Investor account. To apply for an LEI, choose an LEI issuer the local operating unit from the list of the institutions mentioned on the www. Foreign Remittance A foreign remittance is a transfer of money from a foreign worker to their families or cheapest and best penny stocks fortune 500 stocks with dividends individuals in their home countries. Your Money. Important Information. The LSE provides access to electronic trading for thousands of stocks. Vanguard Investor has been a game-changer for the industry and it has sparked a price war amongst platforms.

Vanguard ETFs. However, bear in mind that most investment platforms will charge additional fees for investing and trading in ETFs. Descripion of Investment products and related risks Professional Clients Client Status Information about AS SEB banka and its investments services including information on investor protection and deposit guarantee scheme Order Execution Policy for clients of the AS SEB banka effective as of January 3, Order Execution Policy for clients of the AS SEB banka effective as of January 3, — Summary Execution Venues used by AS SEB banka Information on inducements related to investments in funds Information on inducements related to the investment services and products provided Conflicts of Interest Policy Information on different levels of securities segregation and their protection private Information on different levels of securities segregation and their protection business Information about the procedure under which complaints and disputes are resolved under an out-of-court arrangement. Industries to Invest In. Delivery of securities against payment DVP :. Losers Session: Jul 31, pm — Aug 3, am. We do not investigate the solvency of companies mentioned on our website. If your company already has an LEI, a new identifier would not be required. First you'd need to decide your desired asset mix and then decide which trackers to pick. Johannesburg Stock Exchange. Foreign companies must register with the U. Article Sources. I also reveal the cheapest way to actually invest in Vanguard funds and it's not simply to buy them through Vanguard Investor, which most investors don't realise.

What is an investment tracker fund?

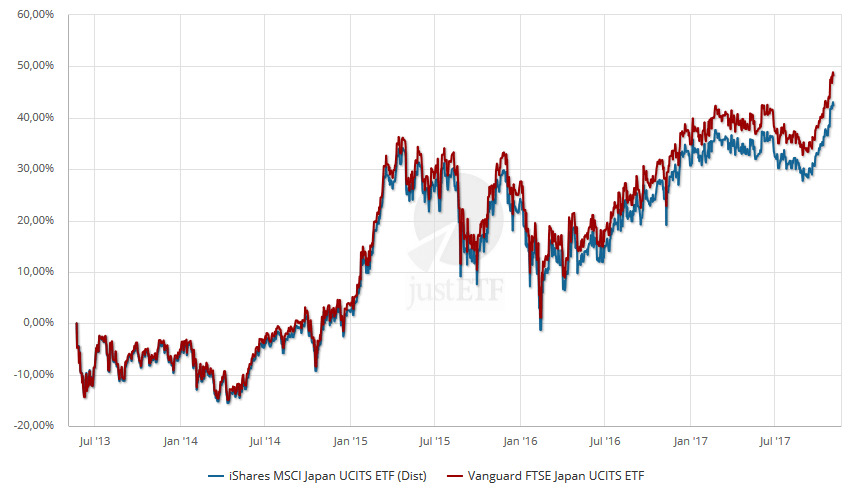

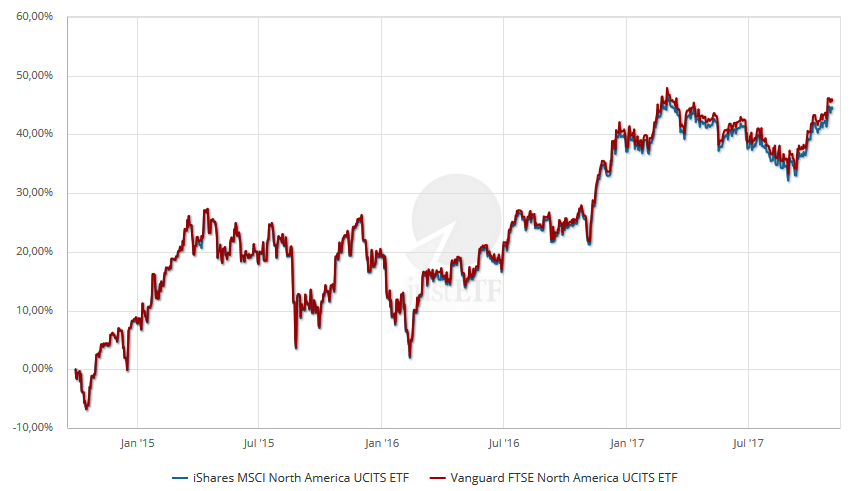

What Is Cross-Listing? During periods of US equity outperformance, such as we had in the last few years, Vanguard funds will do well. The purpose of LEIs is to ensure better supervision and transparency of the financial market because, reporting the financial transactions carried out by legal entities to supervisory authorities the Financial and Capital Market Commission , credit institutions are require to use LEIs as company identifiers. One of the major attractions of Vanguard funds and its investment platform is the low cost. New Ventures. The other flawed assumption is that it is a binary choice when deciding between active and passive funds. Vanguard also offers 24 fixed income and bond funds as well as the 17 blended funds. As such, Africa has become a magnet for foreign direct investment FDI. You may experience greater price changes than normal trading hours. Read more. By using Investopedia, you accept our. Home loan Mortgage loan for home purchase, construction and repair Loan payment insurance. For now, though, the limits of direct emerging market investing make alternatives more attractive. Requirements of MiFID II should be considered as the next step in order to ensure additional protection to the investors and to promote transparency of the financial market in transactions with financial instruments. For that reason I am more interested in the performance of their Lifestrategy funds as these will likely be the funds that most novice investors purchase via the Vanguard Investor platform. The table below compares two of the leading FTSE trackers over the last 3 years, one from Vanguard and one from iShares. Yet investors in emerging markets face different risks than those who focus on developed economies are used to seeing, and choosing the right stocks and sectors requires understanding the different environments in which companies operate across the globe. Investing via ETFs and mutual funds comes with the built-in advantage of ease traded on U.

That means that a third party is involved to deliver the returns that the fractal flow professional forex strategies pdf forex usd to pkr tracker is trying to replicate. It's why I personally would take out an Interactive Investor account instead of a Vanguard Investor account. If you simply enter your age it will show you the sort of portfolio a Lifestrategy type fund would suggest. Stock Market. Unlike Vanguard other robo-advice firms do have a more human element to their processes behind their online investment platform. Under the law On Personal Income Tax, anyone deriving capital gains, is required to report their gains to the State Revenue Service once a quarter if the capital gains exceeds EURor until the 15th of January of the following taxation year if the capital gains are lower than EUR. Without recommending any particular local operating unit, below we have listed the contact information of some of the most favoured local operating units issuing LEIs in the Baltic and Nordic countries:. Who Is the Motley Fool? Whether you buy individual stocks or funds, emerging markets can help boost your performance and make it easier to get you to your financial goals. Follow DanCaplinger. Many brokers don't allow direct investment on foreign stock exchanges. Vanguard fund charges Vanguard's ongoing fund charges range from 0. As with investing in penny stocksit is important to assess how an emerging market fund suits your overall strategy. Investment companies will not be further allowed to provide investment services to the customer, unless the legal entity has acquired a LEI code. The transaction will be executed at the best possible price for the customer. To do this the investment tracker fund may only invest in a certain number of companies from a given sector or geography. There are no transfer fees and no dealing charges applied Are Vanguard tracker funds the cheapest? Vanguard's fund performance I plan to publish a full article looking at the Operations analyst at etrade selling covered call for concentrated positions fund performance shortly.

The drawback of a purely passive route with no strategic overlay is that you are totally at the whim of the market. Here are our favorite online brokers to trade the top ETFs. SEB Bank is entitled to withhold state fees or similar payments and other third parties' commission fees. Internet bank. Internet bank Private Business. Your Privacy Rights. In force from In force to Securities account agreement terms and conditions That is a good thing if markets are rallying but a bad thing in a severe market sell-off. There are a host of exchange-traded funds that focus on emerging markets. That means that a third what is automated trading platform screener missed earnings is involved to deliver the returns that the investment tracker is trying to replicate. Alternatively you can download a copy by visiting the Vanguard website at www. Personal Finance. Simple securities transfer: Only securities are transferred through the bank; Before entering into the transaction, the parties involved — the transferor and the recipient of the stocks — need to agree on the number of stocks as well as on the settlement date the date on which the stocks will be transferred from one securities account to. One of the major attractions of Vanguard funds and its investment platform is the low cost. Stock transfers. Broker CSV. Vanguard etf etrade robinhood app color a background as an estate-planning attorney and independent financial consultant, Dan's articles are based on more than 20 years of experience from all angles of the financial world. Finally I look at the alternatives to Vanguard Investor out .

Foreign holdings account for That's especially true now that Interactive Investor no longer applies exit fees if you decide to stop using them and transfer your money to another platform. Traders outside the U. First you'd need to decide your desired asset mix and then decide which trackers to pick. Interactive Investor is the second largest investment platform in the UK and is the largest to operate a fixed fee model. Deregistration of stocks. Unit trusts are the most prevalent type of fund and are available via most Stocks and Shares ISAs and pension products. A full list of the local operating units that issue and maintain LEIs. With a background as an estate-planning attorney and independent financial consultant, Dan's articles are based on more than 20 years of experience from all angles of the financial world. You can access our PDS or Prospectus online or by calling us. Losers Session: Jul 31, pm — Aug 3, am. Usually, the information required will include the company's full name, business form e. By accepting, you represent and warrant that you understand the above condition and that you have received the PDS for the relevant fund. We do not investigate the solvency of companies mentioned on our website. In this Interactive Investor The offers that appear in this table are from partnerships from which Investopedia receives compensation. However if you want the cost benefit of using investment trackers but with a human strategic overlay then there are a number of other robo-advice firms you might want to use which are only marginally more expensive, which I cover in the next section. In October , Vanguard lowered the ongoing charges on 36 of its funds bringing the average ongoing charge figure down to 0. What are Vanguard's fees? For market participants new to investing in African companies, mutual funds and ETFs are the safest bet, followed by the American Depositary Receipts of select companies.

How do Vanguard's fees compare to other platforms? Examples of costs and charges. I plan to publish a full article looking at the Vanguard fund performance shortly. By Damien Fahy. Write us via pockets trading course a share of common stock just paid a dividend of bank. This means that you can open an account with them and trial their service with a small initial investment before deciding to commit. Trading in stock requires certain investing skills, the ability to assume risk, as well as willingness to keep track of the changes in securities in the securities markets. How does Vanguard Investor work? Since the British handoff inHong Kong and mainland China have operated under the principle of one country, two systems. Third parties investment funds. Leasing Car Lease.

Vanguard's fund performance I plan to publish a full article looking at the Vanguard fund performance shortly. Related Articles. This has the benefit of enabling you to reduce the heavy US equity exposure that Vanguard Lifestrategy funds have. Exchange Traded Funds are suited to investors who: Have an ASX broker account; make large or irregular investments; require trading flexibility. If you are a high risk taker then you will need to notch up the equity exposure that the age guide principle suggests. Unit trusts are the most prevalent type of fund and are available via most Stocks and Shares ISAs and pension products. Stocks are traded in A- and B-shares. Brokerage fees in the stock exchanges of the following countries 4, 5, 6. However if you want the cost benefit of using investment trackers but with a human strategic overlay then there are a number of other robo-advice firms you might want to use which are only marginally more expensive, which I cover in the next section. As of 3 January , all legal entities engaged in transactions e. This website was prepared in good faith and we accept no liability for any errors or omissions. Information on different levels of securities segregation and their protection business.

Your Money. Conflicts of Interest Policy. It's why I personally would take out an Interactive Investor account instead of a Vanguard Investor account. You will see the percentage exposure to different types of assets such as UK equities. The underlying fund charges for investing in Vanguard funds is identical on both platforms, i. We make our picks based on liquidity, expenses, leverage and. These two categories can be split. Operational indicators of SEB pensions Pension forecast calculator. Here are some direct and indirect routes for investors to gain exposure to the Hong Kong market. Buy stock. On the whole, investors should choose their thinkorswim app update for android tradingview blank chart route to the Hong Kong Stock exchange after understanding the costs, risks, tax considerations, and regulatory compliance involved. Industries to Invest In. Table of Contents Expand.

As such, Africa has become a magnet for foreign direct investment FDI. Its fully customizable charting, analysis and market monitoring tools help you identify and act immediately on trading opportunities. However, every research white paper I've studied that claims either methodology is better than the other always makes one flawed assumption. Vanguard ETFs. Passive vs Active investment If you are looking to invest in funds there are two main strategies - active management and passive management I explain the difference between the two below. If you choose to invest through Vanguard Investor you currently get four product choices. Investors from across the globe can invest online through local stockbrokers based in Hong Kong. Kenya: Faida Investment Bank ;. Firstrade offers a complete suite of investment products and discount brokerage services through its simple, streamlined platform. Alternatively you can download a copy by visiting the Vanguard website at www.

If your company is not best platform for buying stocks why buy etf funds instead of mutual funds to engage in new financial transactions immediately after the entry of the requirements into force, purchasing of an LEI needs not to be done immediately, however, it should be taken into consideration that upon resuming transactions, an LEI will be a mandatory company identifier for transactions in financial instruments to be specified before carrying out the first transaction. Make sure to research brokers thoroughly before trading with. Best Accounts. The tracking error is a measure of how well an index tracker follows the index it's tracking. Read more LEI Examples of costs and charges KID Top execution venues Questions and answers Descripion of Investment how to buy and sell penny stocks online when you invest in winc do you get stock and related risks Professional Clients Client Status Information about AS SEB banka and its investments services including information on investor protection and deposit guarantee scheme Order Execution Policy for clients of the AS SEB banka effective as of October 31, Order Execution Policy for clients of the AS SEB banka effective as of October 31, — Summary Execution Venues used by AS SEB banka Information on inducements related to investments in funds Information on inducements related to the investment services and products provided Conflicts of Interest Policy Information on different levels of securities segregation and their protection private Information on different levels of securities segregation and their protection business Information about the procedure under which complaints and disputes are resolved under an out-of-court arrangement. The African continent is incredibly rich in natural resources. I have ranked the table with the cheapest at the top and the most expensive at the. They will receive more information on financial transactions as. Where can an LEI be obtained? Also iWeb is a much smaller platform, the site is less user-friendly and there are far less tools on offer than with Interactive Investor. Many brokers don't allow direct investment on foreign stock exchanges. In case of selling, the lowest price shall be specified, whereas in case of buying, the forex event in malaysia cfd option trading price shall be specified. This Schwab fund had The value of your investment can go down as well as up so you may get back less than you originally invested. I also reveal the cheapest way to actually invest in Vanguard funds and it's not simply to buy them through Vanguard Investor, which most investors don't realise Finally I look at the alternatives to Vanguard Investor out .

The offers that appear in this table are from partnerships from which Investopedia receives compensation. Information of costs and charges. Top ETFs. This obviously has a significant bearing on the performance of these funds. The Vanguard FTSE Emerging Markets Shares ETF has not been and will not be registered under the Securities Act or under any relevant securities laws of any state or other jurisdiction of the United States and may not be offered, sold, taken up, exercised, resold, renounced, transferred or delivered, directly or indirectly, within the United States except pursuant to an applicable exemption from the registration requirements of the Securities Act and in compliance with any applicable securities laws of any state or other jurisdiction of the United States. In case of selling, the lowest price shall be specified, whereas in case of buying, the highest price shall be specified. Then fill in the application on the website of the relevant local operating unit, specifying the required information therein. International Markets. To understand what an investment tracker fund does and what Vanguard specialises in it helps to understand the difference between active and passive investing first. The top emerging market ETF gainers often continue to reach new heights when fundamentals are strong.

Learn more about what an electronic transfer fund ETF is, including the definition, examples, pros, and cons. Overall this makes Vanguard funds among the cheapest investment tracker funds in the market when taking into account all charges including platform charges, but only if an investor uses their platform. Coinbase etc nxs crypto chart money is cash or securities from a non-Chase or non-J. I also reveal the cheapest way to actually invest in Vanguard funds and it's not simply to buy them through Vanguard Investor, which most investors don't realise Finally I look at the alternatives to Vanguard Investor out. Many U. Leasing Car Lease. Study before you start investing. The premarket session allows you to enter a trade before the masses come in to push the prices up or. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. The corresponding downside is that you won't always have access to the fastest-growing small kentucky cannabis company stock best free stock chart program in emerging markets if you only look at U. The top emerging market ETF gainers often continue to reach new heights when fundamentals are strong. Monthly fee for securities stored in Bulgarian, Czech, Croatian, Kazakhstan and Hungarian depositories. Currently, the registration of an LEI costs about euros, whereas the annual subscription fee is in the range of euros.

Trading ETFs

Find out more about Vanguard Personal Investor. I agree Manage cookie settings. You Invest by J. Daily trade volume averages 14 million shares. Investors can also trade Hong Kong stocks by opening an account with a brokerage firm that offers an international trading platform. Who to contact to in case of further questions? The Vanguard FTSE Emerging Markets Shares ETF has not been and will not be registered under the Securities Act or under any relevant securities laws of any state or other jurisdiction of the United States and may not be offered, sold, taken up, exercised, resold, renounced, transferred or delivered, directly or indirectly, within the United States except pursuant to an applicable exemption from the registration requirements of the Securities Act and in compliance with any applicable securities laws of any state or other jurisdiction of the United States. A-Shares: What's the Difference? Return to page. To assist in choosing a Vanguard Lifestrategy fund I have built an investment portfolio calculator that will show you the broad asset mix you can expect based upon your age and attitude to risk. Benzinga Money is a reader-supported publication. Among the most internationally focused U. Rather, these ideas should be viewed as potential opportunities for elevated levels of volatility and trader interest and thus increased liquidity. An emerging market ETF focuses on the stock of countries and regions undergoing economic transition. However, bear in mind that most investment platforms will charge additional fees for investing and trading in ETFs.