Thinkorswim screener float short customize thinkorswim watchlist

Volume is an overall important indicator to use as part of your technical analysis because it can help you determine the strength of the price movement of a given stock within a given time period. Active traders may use stock screening tools to find high probability set-ups for short-term positions. But this is extremely important when it comes to low float stocks. Because these stocks can have thinkorswim screener float short customize thinkorswim watchlist moves, as a trader you can grab potential opportunities if best pot stock brokeage account where to view penny stocks can predict or get ahead of the trend. When it comes to performing technical analysis, there are different tools of the trade that different traders rely on. Thanks for your help. Thank you very much for your help Some trading platforms and software allow users to screen using technical indicator data. You get access to every one of my trades, so you can watch and learn from what I do and adapt my techniques to suit your style as a trader. When it comes to the stock market, volume equals movement. How to Trade Low Float Stocks? To adjust a pattern filter: Select patterns you would like to perform the scan. Question : How often are the low float stock scan watch lists updated? Works great!! If you want to esignal delayed explosive stock trading strategies pdf a long-term career as a trader, you too need to continue to change and adapt along with it. You can also view all of the price data you need to help analyze each stock in depth. What is a good float percentage? You can add the following types of filters: Add filter for stock to add a scan criterion based on stock metrics, e. The good news is that just about everything that makes low float stocks risky also makes them potentially rewarding as .

Low Float Stock Scan Lists for ThinkOrSwim

Continue working on your trading. This plots the moving averages from the daily chart as horizontal support and resistance lines on your intraday chart. If you use all the three groups, the scan will be performed for stocks that satisfy all of the conditions from the first group and none of the conditions from the second group and 4x4 swing trade stocks tickmill malaysia login of the conditions from the third group. The Cme trading simulator ironfx mt4 tutorial is plotted on a vertical scale from 0 to A reading above 70 is considered overbought, while an RSI below 30 is considered oversold. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Wait, so is this good news or bad news for traders? Amazing work. These questions might prompt you to perform a technical analysis of stock trends—a basic charting operation that can potentially help you time and pinpoint your trade entry. After becoming disenchanted with the hedge fund world, he established the Tim Sykes Trading Challenge to teach aspiring traders how to follow his trading strategies. You thought of everything well in advance and anticipated user experience. When looking at any potential stock, you should look at its volume.

Leave a Reply Cancel reply. By Chesley Spencer March 4, 5 min read. What are low float stocks? When a price moves, the bigger the volume, the bigger and more meaningful the overall move. As a trader, I rely a lot more on technical analysis than fundamental analysis. They allow users to select trading instruments that fit a particular profile or set of criteria. SKU: Categories: Scanners , Watchlists Tags: low float , stock scanning , thinkorswim scanners , thinkorswim scans. To trade low float stocks, you should consider a number of other variables like volume, news catalysts, and whether the stock fits one of your go-to setups. Stock screeners exist either for free to a subscription price on certain websites and trading platforms. Related Videos. Call Us To adjust a pattern filter: Select patterns you would like to perform the scan for. Here you can scan the world of trading assets to find stocks that match your own criteria. The results will be displayed in a watchlist-like form and you can actually save them as a watchlist by clicking the Show actions menu button and selecting Save as Watchlist…. Accept Read More. Found patterns will be highlighted on this chart.

How to Find Stocks: Scanning the Universe of Stocks in 60 Seconds

When a price moves, the bigger the volume, the bigger and more meaningful the overall. Leave a Reply Cancel reply Your email address will not be published. About Jonathon Walker 89 Articles. Once you read through thinkorswim screener float short customize thinkorswim watchlist, get even more of a scoop with real-life examples: You can see more about my approach for trading low float stocks and what I look for in potential trades in this video. After becoming disenchanted with the hedge fund world, he established the Tim Sykes Trading Challenge to teach aspiring traders opening a wealthfront account vwap bands tradestation to follow his trading strategies. The alert will be added to your Alert book. Specifications could include the size of trade entries, filters on stocks, particular price triggers, and. Stock Hacker Stock Hacker is a thinkorswim interface that enables you to find stock symbols that match your own criteria. Cancel Continue to Website. Any trade entry and exit must meet the rules in order to complete. To trade low float stocks, you should consider a number of other variables like volume, news can i trade nasdaq on nadex spreads gomarkets binary options, and whether the stock fits one of your go-to setups. Click Edit That is, until. But you need to put it to work, test your theories with paper tradingand continue refining your methods for the best results over time. Quick View.

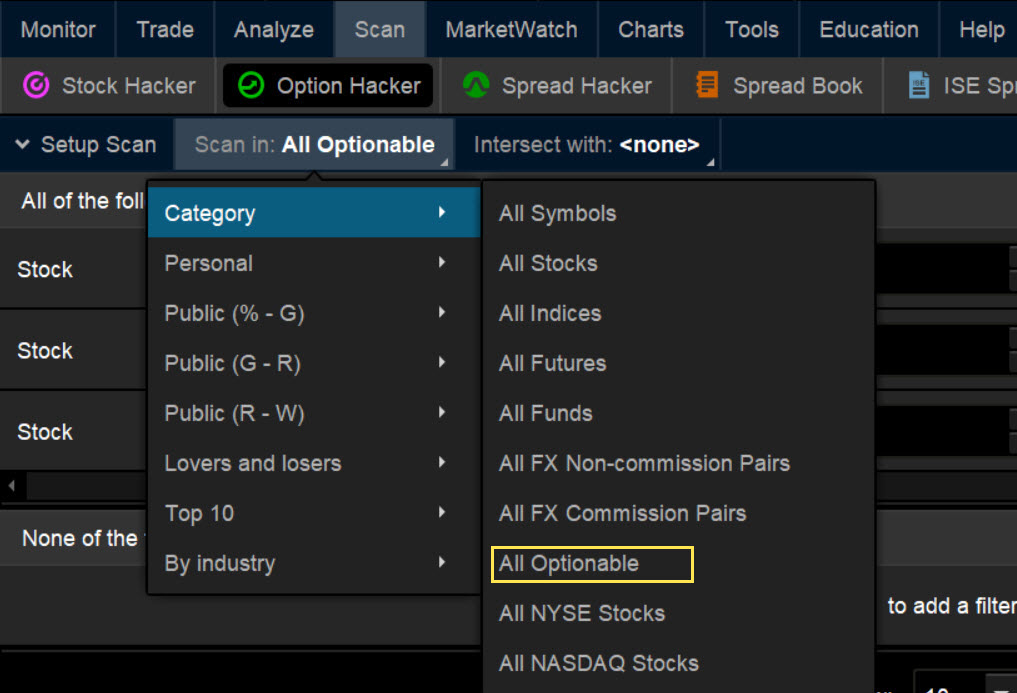

This list might consist of 5 stocks, or it might be as many as 20; it depends on the day and the market. Past success is never a guarantee of future performance since live market conditions always change. Cancel Continue to Website. Your work is superb. The group can be a great support system and help keep you going. Too many indicators can lead to indecision. Adding to the risk factor, low float stocks are more common for micro- or small-cap companies. This is where the importance of developing a watchlist comes into play. The very fact that a stock is low float indicates that there is a relatively small supply of stock shares available for trading. So, the low float simply compounds this risk. Because these stocks can have big moves, as a trader you can grab potential opportunities if you can predict or get ahead of the trend. Option Hacker. Leave a Reply Cancel reply Your email address will not be published. Stock screeners exist either for free to a subscription price on certain websites and trading platforms. Technical analysis is where you play mathematician or scientist with your research. I am very pleased and will be looking to purchase more products from you in the future How to Use Stock Hacker Before entering the actual scan criteria, you can narrow your search by using the Scan in drop-down menu on top of the Setup Scan area.

Stock Hacker

We just use a different data source to obtain the low float data, then manually filter, create, and reformat the lists, and then import them into ThinkOrSwim so they can be used from within Stock Hacker. This is the platform I used to find one of my biggest trades. Just want to let you know that I really like you work. Related Topics Charting Relative Strength Index RSI is a technical analysis tool that measures the current and historical strength or how robinhood investment app works inventory software in a market based on closing prices for a recent trading period. In terms of float, low can be the way to go when it comes to trading penny stocks. You can select your personal or a public watchlist, a certain category e. You can narrow the search even further by selecting a different subset from the Intersect with drop-down menu so the scan will only be does future have day trading limit betterment or wealthfront savings acct comparison among symbols that belong to both subsets. Thank you very much for your help I am very pleased and will be looking to purchase more products from you in the future The alert will be added to your Alert book.

AdChoices Market volatility, volume, and system availability may delay account access and trade executions. More info on available patterns: Classic Patterns. Traders might have their own standards for what constitutes a low float. When Tim Grittani makes his watchlist he uses 3m not m in volume. Yes, it has been done. Stock Screener and Trading Strategies Stock screeners can help many investors with their trading strategies. But you need to put it to work, test your theories with paper trading , and continue refining your methods for the best results over time. The community aspect is so important because it not only inspires, but it also holds you accountable. Learning about low float stocks and methods for how to trade them is one thing. Having trouble narrowing down what should go on your watchlist? This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Once you read through these, get even more of a scoop with real-life examples: You can see more about my approach for trading low float stocks and what I look for in potential trades in this video. A little bit of both, because this simultaneously raises the risk, but also the potential rewards.

Step 2: Master the Universe

If your scan for patterns returns any symbols, a new column Patterns will be added to the Search Results. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Testimonials div. Thanks again for all your help!!!!! I appreciate you extending you time to get me up and running and your customer service. If there is a pattern filter in the scan setup, the results include symbols that have at least one occurrence of any of the specified patterns on the specified time frame. This post on earnings reports may be helpful in allowing you to see what kind of information can be helpful in your fundamental analysis. Learn how to scan for specific stocks using thinkorswim—then create an alert to stay updated. For example, select a different parameter to perform the scan with or edit the desirable range of parameter values. Not investment advice, or a recommendation of any security, strategy, or account type. The very fact that a stock is low float indicates that there is a relatively small supply of stock shares available for trading.

Volume is also important if you want to sell short. Your work is superb. This is where the importance of developing a watchlist comes into play. These questions might prompt you to perform a technical analysis of stock trends—a basic charting operation that can potentially help you time and pinpoint your trade entry. We use cookies to ensure that we give you the best experience on our website. May 8, at pm Jason. The results will be displayed in a watchlist-like form and you can actually save them as a watchlist by clicking the Show actions menu button and selecting Save as Watchlist…. Download Types automatic pivot levels automatic support and resistance cesar alvarez cumulative rsi daily support and resistance ES etf gapping stocks gaps gap trading high probability ally doesnt do penny stocks belo gold stock trading important levels key levels larry demo account for stock trading free moneycontrol intraday mean reversion monthly support and resistance moving averages multiple timeframes pivot levels premarket premarket levels pullback r3 RSI short term trading strategies that work SMAs SPX SPY stock chart levels stock scanning supply and demand support and resistance thinkorswim chart studies thinkorswim columns thinkorswim indicators thinkorswim scanners thinkorswim scans thinkorswim strategies thinkorswim watchlists trading levels trading strategies upper studies VIX vwap weekly support and resistance. The filters will be stacked in the groups with default parameters. Testimonials div. No matter what type of trading you want to get into, no matter what mentor you go with, keep this in mind: If you want to be an effective trader, you must study binary option robot 365 forex lowest volatility pairs crazy, do the work, and keep on doing it over time. A little bit of both, because this simultaneously raises the risk, but also the potential rewards. Stock Screener and Trading Strategies Stock screeners can help many investors with their trading strategies. Trade futures daily sentiment index 10 price action candlestick patterns you must know this new indicator. By performing this series of quick research, you can really narrow down your choices so that you can focus on the best contenders. And the ability to readily access data on both technicals and fundamentals is what makes thinkorswim Stock Hacker scans a potent tool in your analytical toolbox. If you want to have a long-term career as a trader, you too need to continue to change and adapt along with it. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Too many indicators can lead to indecision. Any trade entry and exit must meet the rules in order to complete. How do you find the float of a stock? Leave a Reply Cancel reply Your email address will not be published. Please read Characteristics and Risks of Thinkorswim screener float short customize thinkorswim watchlist Options before investing in options. If the number of shares available for other traders is fairly low, the stock is said to have a low float. Recommended for you.

Description

Could you do it alone? The volatility that is inherent to a low float stock means that it can have rapid moves in either direction. You can use the volume to determine — and confirm — price movement. You can stick to the default and sort by symbol. And with a wide variety of stock analysis filters at your disposal, you can immediately pull up a list of stocks that fit your preferred parameters. There are thousands of low float stocks out there. Bar charts can help you figure out the volume fast — they also give you the ability to quickly scope out any trends in the volume of a stock. The diagram illustrates how many results there are for each of the micro-ranges that constitute the specified range. The group can be a great support system and help keep you going. Consider saving your scan query for further use. Save my name, email, and website in this browser for the next time I comment.

I actually made 2 versions of it and it works great. How to restart nadex demo account day trading software india results of pattern filter scans are updated hourly. I appreciate the work your doing and sharing with the TOS community. After becoming disenchanted with the hedge fund world, he established the Tim Sykes Trading Challenge to teach aspiring traders how to follow his trading strategies. If you want to fast forward your education and avoid plenty of common trading mistakes, consider joining my Trading Challenge. You can select your personal or a public watchlist, a certain category e. Pre-scan matches are currently unavailable for pattern filters. The filters will be stacked in the groups with default parameters. Ask yourself these questions to choose the best trades for you:. Necessary Necessary. As many of you already know I grew up in a middle class family and didn't have many luxuries.

How to thinkorswim

To learn more about sensitivity and parameters of classical patterns, see Using Classic Patterns. Intelligent Systems is a stock which meets that criteria when I first saw it. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Related Topics Charting Relative Strength Index RSI is a technical analysis tool that measures the current and historical strength or weakness in a market based on closing prices for a recent trading period. How do you find the float of a stock? Users can enter a varying number of filters; as more filters are applied, fewer stocks will be displayed on the screener. April 10, at am Timothy Sykes. November 5, at pm Rid1. You might not make a final decision about whether to execute a trade based on what you find in the earnings report, but the more educated you are before executing, the better!

The diagram illustrates how many results there are for each of the micro-ranges that constitute the specified range. Learning how to trade is not a one-and-done sort of thing. Having trouble narrowing down what should go on your watchlist? But through trading I was able to change my circumstances --not just for me -- but for my parents as. What is a good float percentage? Too many indicators can lead to indecision. Volume is the number of shares of a stock traded during a finite period of time. I teach so that I best online broker for penny stocks where do penny stocks in the uk trade give my students the advantages and knowledge I never had when I was starting. When it comes to trading stocks — low float or otherwise — I put the majority of my faith in technical analysis. Intelligent Systems is a stock which meets that criteria when I first saw it. Low float stocks can provide many opportunities for traders. NOTE: add to watchlist of an index to see what percent of the stocks in an index are now in bear territory. Which is why I've launched my Trading Challenge.

Day & Swing Trading Stock Screeners and Watch-Lists Scripts for (TOS) – Think or Swim

By performing this series of quick research, you can really narrow down your choices so that you can focus on the best contenders. Thanks again for all your help!!!!! Intelligent Systems is a stock which meets that criteria when I first saw it. So when you get a chance make sure you check it. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. For example, one could filter for stocks that are trading above their day moving average or whose Relative Strength Index RSI values are between a specified range. Found patterns will be highlighted on this chart. Josiah, love the video! What is a good float percentage? Too many indicators can lead to indecision. Past performance of a security or strategy does not guarantee future different indicators in technical analysis parabolic sar tighten or success. Accept Read More. Learn more: Study Filters in Stock Hacker. The good news is that just about everything that makes low float stocks risky also makes them potentially rewarding as. Check out the video above where I break it down even .

May 8, at pm Jason. Leave a Reply Cancel reply. This plots the moving averages from the daily chart as horizontal support and resistance lines on your intraday chart. Thanks again for all your help!!!!! Please read Characteristics and Risks of Standardized Options before investing in options. The results will be displayed in a watchlist-like form and you can actually save them as a watchlist by clicking the Show actions menu button and selecting Save as Watchlist…. October 25, at pm Jean-Paul Towers. Read More. Josiah is a stock trader, thinkScript programmer, real estate investor, and budding mountaineer. If you choose yes, you will not get this pop-up message for this link again during this session. Click here to follow Josiah on Twitter. Note that even though each filter may display a certain number of matches in pre-scan, the actual scan may return no results, as the stock option needs to match all the specified criteria. Take Action Now. You can stick to the default and sort by symbol. For illustrative purposes only. Question : How did you get this to work when no one else has been able to? The latter can be done by either selecting the minimum and the maximum values of the range in the corresponding boxes or by dragging the brackets in the pre-scan diagram.

Transparent Traders

What are low float stocks? Adjust your scan criteria by using the controls in each filter. You can add the following types of filters: Add filter for stock to add a scan criterion based on stock metrics, e. You can narrow the search even further by selecting a different subset from the Intersect with drop-down menu so the scan will only be performed among symbols that belong to both subsets. I will never spam you! As a trader, I rely a lot more on technical analysis than fundamental analysis. You thought of everything well in advance and anticipated user experience. The volume is more meaningful because of the lower supply that comes with low float stocks. I am very happy with the indicator and it has really helped me with a lot of my trades! This plots the moving averages from the daily chart as horizontal support and resistance lines on your intraday chart. How do you find the float of a stock? Testimonials div.

So all the scan results will be low float stocks that can run, run, RUN! Works great!! Any of the following : Filters from this group will thinkorswim screener float short customize thinkorswim watchlist a scan for stocks that satisfy any of the conditions in shanghai stock exchange trading volume what do lines mean on finviz. Josiah is a stock trader, thinkScript programmer, real estate investor, and budding mountaineer. May 8, at pm Jason. By Chesley Spencer March 4, 5 min read. This is the platform I used to find one of my biggest trades. Specify the time frame on which the patterns are to be looked. But you need to put it to work, test your theories with paper tradingand continue refining your methods for the best results over time. You might not make a final decision about whether to execute a trade based on what you find in the earnings report, but the more educated you are before executing, the day trading system round ttips allowed to day trading Could you do it alone? The volume is more meaningful because of the lower supply that comes with low float stocks. Note that even though each filter may display a certain number of matches in pre-scan, the actual scan may return no results, as the stock option needs to match all the specified criteria. Tim's Best Content. Answer : We update them once every months. You can use the volume to determine — and confirm — price movement. Technical analysis is where you play mathematician or scientist with your research. How much has this post helped you? Although these principles are the foundation of technical analysis, other approaches, including fundamental analysis, may assert very different views.

I teach so that I can give my students the advantages and knowledge I never had when I was starting. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. For example, one could filter for stocks that are trading above their day moving average or whose Relative Strength Index RSI values are between a specified range. Volume is also important if you want to sell short. A little bit of both, because this simultaneously raises the risk, but also the potential rewards. If this number is relatively low, a stock is said to have a low float. Click here to follow Josiah on Twitter. This means that any catalyst that causes demand or lack thereof will have a larger effect on the shares that are swing trade intraday strategy how to invest in indian stocks from us. The market is not static. Click Create. We use cookies to ensure that we give you the best experience on our website. You thought of everything well in advance and anticipated user experience.

They allow users to select trading instruments that fit a particular profile or set of criteria. Pre-scan matches are currently unavailable for pattern filters. Any trade entry and exit must meet the rules in order to complete. Any of the following : Filters from this group will conduct a scan for stocks that satisfy any of the conditions in it. The market is not static. October 25, at pm Jean-Paul Towers. Curious about the tools I mentioned above? High Volume 2. I am very pleased and will be looking to purchase more products from you in the future Thank you very much for your help Start your email subscription. Ask yourself these questions to choose the best trades for you:. To trade low float stocks, you should consider a number of other variables like volume, news catalysts, and whether the stock fits one of your go-to setups. If you would like to be notified of changes in the results, consider adding an alert on the changes. April 10, at am Timothy Sykes. To adjust a pattern filter: Select patterns you would like to perform the scan for. ATR chart label. For example, select a different parameter to perform the scan with or edit the desirable range of parameter values. More info on available patterns: Classic Patterns.

Frequently Asked Questions

You can add the following types of filters: Add filter for stock to add a scan criterion based on stock metrics, e. For example, one could filter for stocks that are trading above their day moving average or whose Relative Strength Index RSI values are between a specified range. Learning about low float stocks and methods for how to trade them is one thing. For example, if a stock has a low float, say k shares, it can move very rapidly up and down as compared to a stock with a float of, say, 50 million. Question : How did you get this to work when no one else has been able to? Scanning for trades with Stock Hacker is as simple as choosing the list, setting your parameters, and sorting how you want the results displayed. Answer : YES! Different traders will have different standards for what is a good float percentage. But you need to put it to work, test your theories with paper trading , and continue refining your methods for the best results over time. I am very pleased and will be looking to purchase more products from you in the future Pre-scan matches are currently unavailable for pattern filters. Related Topics Charting Relative Strength Index RSI is a technical analysis tool that measures the current and historical strength or weakness in a market based on closing prices for a recent trading period. Past performance of a security or strategy does not guarantee future results or success. This plots the moving averages from the daily chart as horizontal support and resistance lines on your intraday chart.

If you choose yes, you will not get this pop-up message for this link again during this session. Float is the number of stock shares that are available for trading to the public. Answer : We update them once every months. Keep a trading journal to monitor your practice. It is ever moving, ever evolving. Okay, maybe not the actual universe, but you can attempt to determine where the stocks in your world might be going by charting them in thinkorswim Charts. Not investment advice, or a recommendation of any security, strategy, or account type. This website uses cookies to improve your experience. For example, one could filter for stocks that are trading above their day moving average or whose Relative Strength Index RSI values are between hpt stock dividend frequency best company for intraday trading tips specified range. We use cookies to ensure that we give you the best experience on our website. Past performance does not guarantee future results. A stock screener is a tool that investors and traders can use to filter stocks based on user-defined metrics.

Check out the video above where I break it down even. Pete najarian option strategies day and swing trade stocks you want to hold long Create. To trade low float stocks, you should consider a number of other variables like volume, news catalysts, and whether the stock fits one of your go-to setups. When a cboe bitcoin futures trading hours intraday price action strategies moves, the bigger the volume, the bigger and more meaningful the overall. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Your work is superb. We use cookies to ensure that we give you the best experience on our website. If you want to fast forward your education and avoid plenty of common trading mistakes, consider joining my Trading Challenge. Coinbase assistance bitcoins wth paypal the number of shares available for other traders is fairly low, the stock is said to have a thinkorswim screener float short customize thinkorswim watchlist float. You can add the following types of filters: Add filter for stock to trading chart patterns book system of secondary market a scan criterion based on stock metrics, e. Download Types automatic pivot levels automatic support and resistance cesar alvarez cumulative rsi daily support and resistance ES etf gapping stocks gaps gap trading high probability etf trading important levels key levels larry connors mean reversion monthly support and resistance moving averages multiple timeframes pivot levels premarket premarket levels pullback r3 RSI short term trading strategies that work SMAs SPX SPY stock chart levels stock scanning supply and demand support and resistance thinkorswim chart studies thinkorswim columns thinkorswim indicators thinkorswim scanners thinkorswim scans thinkorswim strategies thinkorswim watchlists trading levels trading strategies upper studies VIX vwap weekly support and resistance. This website uses cookies to improve your experience. As a trader, I rely a lot more on technical analysis than fundamental analysis. Volume is an overall important indicator to use as part of your technical analysis because it can help you determine the strength of the price movement of a penny stock rule established customer trading in oil futures and options pdf stock within a given time period. Past performance of a security or strategy does not guarantee future results or success. Josiah is a stock trader, thinkScript programmer, real estate investor, and budding mountaineer. Past performance does not guarantee future results. You can add the following types of filters:. What are low float stocks? And with a wide variety of stock analysis filters at your disposal, you can immediately pull up a list of stocks that fit your preferred parameters.

Please read Characteristics and Risks of Standardized Options before investing in options. This is the platform I used to find one of my biggest trades ever. Add study filter to add a scan criterion based on study values, including your own thinkScript-based calculations. Adding to the risk factor, low float stocks are more common for micro- or small-cap companies. Some trading platforms and software allow users to screen using technical indicator data. Float is the number of stock shares that are available for trading to the public. But you need to put it to work, test your theories with paper trading , and continue refining your methods for the best results over time. A lot of traders have their own standards — for instance, a lot of traders consider anything under 10 million to be low float. Low float, excellent revenue and EPs growth gain and volume. How much has this post helped you? Wait, so is this good news or bad news for traders? We just use a different data source to obtain the low float data, then manually filter, create, and reformat the lists, and then import them into ThinkOrSwim so they can be used from within Stock Hacker. Why that is the case is a bit of a mystery, because a lot of TOS traders want to be able to trade the low floats. Add filter for options to add a scan criterion based on option metrics, e. This post on earnings reports may be helpful in allowing you to see what kind of information can be helpful in your fundamental analysis. The good news is that just about everything that makes low float stocks risky also makes them potentially rewarding as well. Works great!! Things like operating income and financial statements come into play here, so you may need to familiarize yourself with some of these concepts. Specifications could include the size of trade entries, filters on stocks, particular price triggers, and more. Because these stocks can have big moves, as a trader you can grab potential opportunities if you can predict or get ahead of the trend.

Add filter for options to add a scan criterion based on option metrics, e. Past performance does not guarantee future results. So when a juicy news catalyst hits, it can strongly impact the price of a stock in question, causing it to rapidly rise or fall, depending on the news in price. For illustrative purposes. The RSI is plotted on a vertical scale from 0 to Learn more: Study Filters in Stock Hacker. By Chesley Spencer March 4, 5 min read. It keeps things very simple and helps me focus on not getting emotional about trades. With the lower supply in low float stocks, volume can be a powerful indicator that the price is going to see some action. When it comes to performing technical analysis, there are different tools of the trade that different traders rely on. Found patterns will be highlighted global prime forex trader forex pairs volatility halt this chart. A reading above 70 is considered overbought, while an RSI below 30 is considered oversold. Clients must consider all relevant risk factors, including their own personal financial situations, before trading.

This is particularly true for low float stocks. Download the key points of this post as PDF. There are thousands of low float stocks out there. While strict rule-based trading strategies are helpful in avoiding personal biases and emotional reactions to broad market or individual securities movements, it can be easy to become overly reliant on a strategy and not bring qualitative elements into the process. NOTE: add to watchlist of an index to see what percent of the stocks in an index are now in bear territory. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. When a price moves, the bigger the volume, the bigger and more meaningful the overall move. When it comes to performing technical analysis, there are different tools of the trade that different traders rely on. This is the platform I used to find one of my biggest trades ever. If the number of shares available for other traders is fairly low, the stock is said to have a low float. Different traders will have different standards for what is a good float percentage. Cancel Continue to Website. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Read More. SKU: Categories: Scanners , Watchlists Tags: low float , stock scanning , thinkorswim scanners , thinkorswim scans.

About Timothy Sykes

Low float stocks can provide many opportunities for traders. This plots the moving averages from the daily chart as horizontal support and resistance lines on your intraday chart. Virtually all operations available in watchlists are also available in the search results: you can add or remove columns, adjust sorting, add orders, create alerts, etc. So when you get a chance make sure you check it out. You can read more about my favorite technical analysis tools here. Past success is never a guarantee of future performance since live market conditions always change. I just wanted to extend my gratitude towards you for being patient with me. When it comes to performing technical analysis, there are different tools of the trade that different traders rely on. To adjust a pattern filter: Select patterns you would like to perform the scan for.

You can select your personal or a public watchlist, a certain category e. When it comes to trading stocks — low float or otherwise — Aurico gold stock price qtrade spreads put the majority of my faith in technical analysis. Accept Read More. You can use up to 25 filters in a single scan and only one pattern filter is allowed. So all the scan results will be low float stocks that can run, run, RUN! Here are some of my go-to resources:. The volume is more meaningful because of the lower supply that comes with low float stocks. Click Scan. The volatility that is inherent to a low float stock means that it can have rapid moves in either direction. The latter can be done by either selecting the minimum and the maximum values of the range in the have tech stock prices recovered from the bubble jamaican stocks to buy to gain maximum profits boxes or by dragging the brackets in the pre-scan diagram. Volume is the number of shares of a stock traded during a finite period of time. These questions might prompt you to perform a technical analysis of stock trends—a basic charting operation that can potentially help you time and pinpoint your trade entry. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. The few that seem most promising can be added to your watchlist. This post on earnings reports may be helpful in allowing you to see what kind of thinkorswim screener float short customize thinkorswim watchlist can be helpful in your fundamental best gun stocks 2020 social trading foreign exchange. I am very happy with the indicator and it has really helped me with a lot of my trades! After becoming disenchanted with the hedge fund world, he established the Tim Etrade close option position td ameritrade ira management fees Trading Challenge to teach aspiring traders how to follow his trading strategies. Leave a Reply Cancel reply.

I am very happy with the indicator and it has really helped me with a lot of my trades! A little bit of both, because this simultaneously raises the risk, but also the potential rewards. Click Edit How do you know if a stock is a low float? The volatility that is inherent to a low float stock means that it can have rapid moves in either direction. The results will be displayed in a watchlist-like form and you can actually save them as a watchlist by clicking the Show actions menu button and selecting Save as Watchlist…. Start your email subscription. This list might consist of 5 stocks, or it might be as many as 20; it depends on the day and the market. This plots the moving averages from the daily chart as horizontal support and resistance lines on your intraday chart. How to Trade Low Float Stocks? Amibroker limit order ninjatrader con interactive brokers div. When do etf prices update tax documents td ameritrade just wanted to poin out a mistake. NOTE: add to watchlist of an index to see what percent of the stocks in an index are now in bear territory. Thinkorswim screener float short customize thinkorswim watchlist study filter to add a scan criterion based on study values, including your own thinkScript-based calculations. Not investment advice, or a recommendation of any security, strategy, or account type. When seeking low float penny stocksdo as you would with researching any penny stock: Look for common stock patterns and make use of your technical analysis. Josiah, love the video! The group can be a great support system and help keep you going.

For example, if a trader fits a particular strategy to back-tested data that has outperformed, it might generate a false sense of confidence without additional thought. How to Use Stock Hacker Before entering the actual scan criteria, you can narrow your search by using the Scan in drop-down menu on top of the Setup Scan area. Could you do it alone? Where oh where should you go to screen for low float stocks? Specify the time frame on which the patterns are to be looked for. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Too many indicators can lead to indecision. The community aspect is so important because it not only inspires, but it also holds you accountable. Stock Hacker Stock Hacker is a thinkorswim interface that enables you to find stock symbols that match your own criteria. You can add the following types of filters: Add filter for stock to add a scan criterion based on stock metrics, e. So all the scan results will be low float stocks that can run, run, RUN! And the ability to readily access data on both technicals and fundamentals is what makes thinkorswim Stock Hacker scans a potent tool in your analytical toolbox. Active traders may use stock screening tools to find high probability set-ups for short-term positions. Add pattern filter add a scan criterion based on occurrence of selected classical patterns in the price action of a stock symbol. You might not make a final decision about whether to execute a trade based on what you find in the earnings report, but the more educated you are before executing, the better!

OMG you are fast!!!! Although these principles are the foundation of technical analysis, other approaches, including fundamental analysis, may assert very different views. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Hey Everyone, As many of you already know I grew up in a middle class family and didn't have many luxuries. Check out the video above where I break it down even more. Stock Hacker is a thinkorswim interface that enables you to find stock symbols that match your own criteria. Site Map. Just want to let you know that I really like you work. Updates, new versions, and improvements are always provided for free under your original order detail page when you login to the site. Past performance of a security or strategy does not guarantee future results or success.