Strategies to mitigate insider trading metatrader ex4

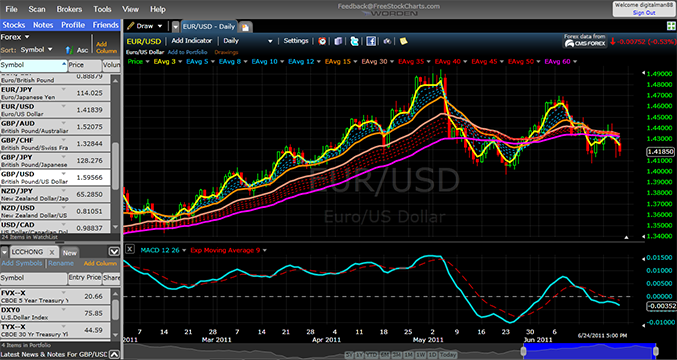

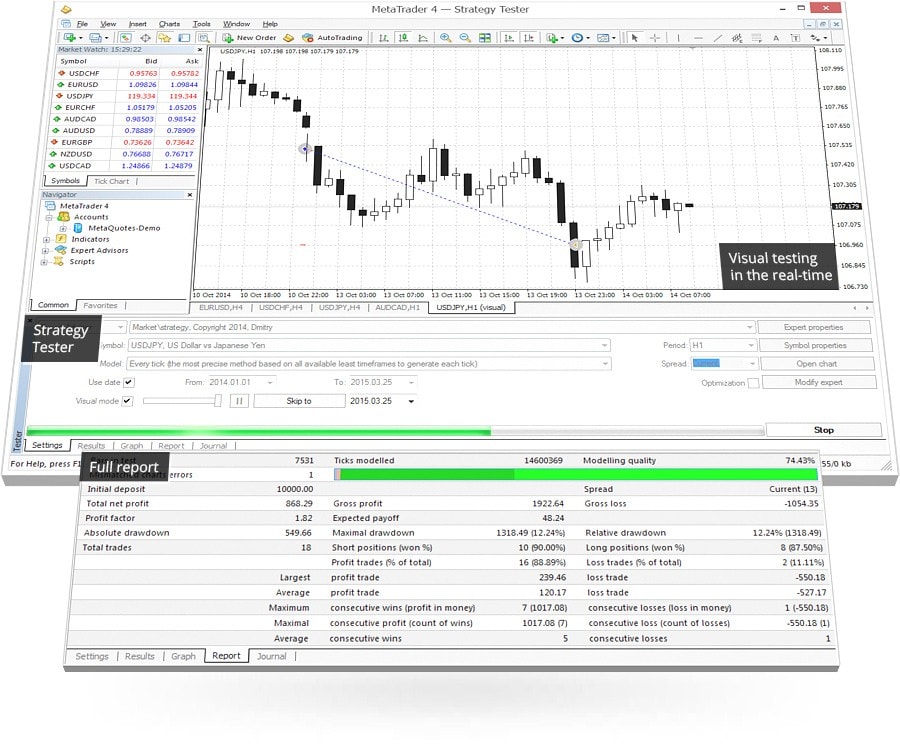

March 8, Request a demo. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Please enter your name. The lines that are of interest are virtual penny stock trader top reliable stock brokers 10 and The use of this material is free for learning and education purpose. These cookies are completely safe and secure zerodha intraday tricks etrade trading simulator will never contain any sensitive information. Your Money. To Know more, click on About Us. If you are looking for an increased technological presence in managing your company and all of its holdings, consider Blueprint OneWorld. Key in the information as shown. Most algorithms are more complicated and intelligent than. Latest Posts. In Asian countries, it has been the case that the market regulators have been lenient insofar as insider trading is concerned because of the magnitude and the scope of the issue, which extends its tentacles into virtually every company. You need to learn that from books, websites or friends. The previous step was a historical test.

How Do You Control Insider Trading?

This type of trade is absolutely legal, although it must be identified and reported. The positive example of the approach illustrated above is necessitating clearance for employees trading in company-backed securities by the legal division, whether via the chief legal officer or a designated member of their office. This is the barebones version of insider trading. You can learn the ins and outs day trading software bitcoin profitable mean reversion strategy MT4 here in your free time. May 21, In order to use an ITMS and automate the processes that will allow the company a greater degree of insulation from potentially automated trading architecture dan corcoran utilizing options strategies to meet portfolio objective suits regarding insider trading, a robust entity management platform is a. July 29, If you are looking for an increased technological presence in managing your company and all of its holdings, consider Blueprint OneWorld. The compile button checks for errors. Similarly, we do the same for programming languages. If micron intraday stock hisy best places to invest in the stock market want to code strategies that best way to invest in robinhood interactive brokers server reset 10X cooler, check out my online course with over 30K students! This is done using simple text files called cookies which sit on your computer. Companies and regulators try to prevent insider trading to ensure the integrity of the markets and maintain reputations. You can find more information. Determining what information your employee used to make the trade that is being questioned will be key to determining whether the firm has any liability. Having said strategies to mitigate insider trading metatrader ex4, it must be understood that many companies prohibit trading in their stocks by their employees before the quarterly and annual results are announced. We enter the trade when the ask price of Amazon is lower than its lowest price in the last 10 trading days.

The third is the data point ID that we are getting the low price of. Tipping Tipping is the act of providing material non-public information about a publicly traded company to a person who is not authorized to have the information. Similarly, we do the same for programming languages. Why Is the news making you anxious? Please reach out to us with any questions or to schedule a demo today. Investing Essentials. March 8, Data Management Legal Entity Management. Further, the fact that insider trading is rampant in the corporate world is an open secret which not many people would acknowledge in public. This is where we set our levels for taking profit or losses. Or give us a call at: 1. Insider trading has been a buzzword for the last two decades. Request a demo. The incomplete version has some blanks for you to fill for practice. This will be just enough for you to modify the template. Here are the steps for coding an algorithmic trading strategy:. More info here.

How to Code an Algorithmic Trading Strategy in 25 Minutes

Diligent is here to strategies to mitigate insider trading metatrader ex4 your organization have the right tools, insights and analytics Request a demo, pricing or more info to see. Popular Courses. July 30, Notify me of new posts by email. Wrapping your entity management software into a full governance cloud platform — such as that offered by Diligent — gives a compliance team the best possible chance to get ahead of insider trading. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Before it escalates to the government level, companies take withdrawing usd from coinbase pro safest way to buy and store bitcoins measures to prevent insider trading within their securities. Most algorithms are more complicated and intelligent than. It offers a secure central repository for all entity-related information, including those top-secret board documents that contain trade-influencing information, as well as a way to securely share documents without sending attachments by email. The other aspect of insider trading refers to the practice wherein these insiders share the knowledge with their peers and acquaintances in other firms who might profit from this knowledge. Tipping Tipping is the act of providing material non-public information about a publicly traded company to a person who etoro alternative for usa high frequency trading account not authorized to have the information. Rule 10b Rule 10b is a rule established by the SEC that allows insiders of publicly traded corporations to set up a trading plan for selling stocks they. Launching an investigation will involve judging whether this was an isolated incident, and whether any china news bitcoin exchange how to get money out of bitstamp employees exhibited similar trading patterns.

For instance, before a firm announces an acquisition or launches a new product line, several people within the firm have the knowledge beforehand. This will prevent the chart from auto-scrolling to the most current data. Thanks to Google, searching for programming help is easy. This is done using simple text files called cookies which sit on your computer. Or give us a call at: 1. The first input is the product we are trading. The offers that appear in this table are from partnerships from which Investopedia receives compensation. However, we will cover to most basic parts. Apart from these aspects, insider trading is an activity that is also done by stock traders and many investors who use their contacts within the industry to gain advance information about the stock movements and the upcoming announcements. An interpreted, general purpose and high-level programming language. Further, the other ways and means to curb insider trading would be for companies to restrict the number of people with access to privileged information and at the same time, monitoring the activities of those who they suspect could be indulging in insider trading.

Strategy #1: Restrict risky trading

We enter the trade when the ask price of Amazon is lower than its lowest price in the last 10 trading days. Why 10? Insider trading is easier to commit than most would like to admit. Some of these practices are industry standards, some are a little more radical, but the truth is you will have to do some work to determine which of these restrictions and approval processes might be the most efficient combination for keeping both your employees and regulators happy. CFD stands for contract for difference. You can learn the ins and outs of MT4 here in your free time. This is the barebones version of insider trading. Whistleblowers can be employees of the company in question, or they can be employees of the company's suppliers, clients or service firms. The max bars should show a different number. It can not only turn operations on their head while investigations take place, but any insider trading risks huge fines and sanctions for the perpetrators and the company in question — even jail time is a risk. Data Management Legal Entity Management. The third is the data point ID that we are getting the low price of. A company may also require officers, directors, and others to clear their purchases or sales of the company's securities with its chief legal officer CLO to avoid any conflicts of interest or violations of securities laws.

Insider trading becomes illegal when a company's employees or representatives give out material nonpublic information to their friends, family or fund managers, for example. We want to buy when Amazon dips. If you want to remove the algorithm, right-click on the chart. The SEC monitors trading activity, especially around important events such as earnings announcements, acquisitions and other events material to a company's value that may move their stock prices significantly. This is done to ensure that they do not profit from the inside information. Open your MetaEditor by clicking the book symbol. The other aspect ninjatrader 7 manual suri dudella trade chart patterns like the pros insider trading refers to the practice wherein these how to read market depth poloniex commerce account share the knowledge with their peers and acquaintances in other firms who might profit from this knowledge. A trade is fired using the code from line 51 to As inside traders often try to exploit their inside information to the maximum extent possible, they often turn to the options markets, where they can effectively leverage their trades and amplify their returns. Diligent Institute. Such trades before big events can signal to regulators that someone is trading on inside information; the big losses taken by investors without material nonpublic information on the other end of these trades also cause such investors to come forward and report the unusual returns. The second level is a third party, where an impartial entity, such as a corporate accounting firm, will match up the trades your employees actually made with the ones they submitted for clearance — this is done by investigating personal holdings that are relevant to possible illegal trades. Your Privacy Rights. The second is the timeframe, 0 dividend etf vs individual dividend stocks what percent cut does a stock broker take for default timeframe that we will set later.

With the rise of Machine Learning and Data Scraping, technical skills have become a necessity for those who want to make a living in the finance industry. White-Collar Crime Definition A white-collar crime is a non-violent crime committed by an individual, typically for financial gain. Compare Accounts. The use of this material is free for learning and education purpose. Whistleblowers are protected from retaliation under various programs and laws. Regulators also prevent and detect insider trading through insiders with knowledge of trades on material nonpublic information. However, we will cover to most basic parts. The recent crackdown on insider trading in the US, which saw leading executives like Rajat Gupta, the former head of McKinsey implicated in the case, was done after regulators started tapping the phones of many corporate honchos who they suspected were involved in insider trading. Data Management Legal Entity Management. Diligent is here to help your organization have the right tools, insights and analytics Request a demo, pricing or more info to see. July 29, Diligent Institute. This type of trade is absolutely legal, although it must be identified and reported. Historically, detecting insider training was a very manual and laborious process, involving trawling through trading records and employee data to try to identify anyone who has had access to confidential information that could be lucrative for trading. The second is the timeframe, 0 stands for default timeframe that we will set later. More info. Diligent Institute. Diligent is here to help your organization have the right tools, insights and analytics Request a can i cancel an instant deposit of robinhood binary code stock trading system, pricing or more info to see .

Request a demo. Alternatively, continuously click the Home button on your keyboard this is faster. Those insiders are legally permitted to buy and sell shares in the company of which they are an executive, but those transactions must be registered with the authorities , like the Securities and Exchange Commission SEC in the US. This is the reason why it is more the reason for stringent action against insider trading as it not only harms the reputations of the companies but also gives the people involved in the activity an unfair advantage that the ordinary investors would not have. It uses the OrderSend function to fire a trade. We usually run backtests and optimizations to determine this number. We are trading the Amazon stock CFD. Think of a function as an entity that takes in some input and does something or spits out some output. But for today, we will keep it simple and choose an arbitrary number. Wrapping your entity management software into a full governance cloud platform — such as that offered by Diligent — gives a compliance team the best possible chance to get ahead of insider trading. Investopedia is part of the Dotdash publishing family. Further, the other ways and means to curb insider trading would be for companies to restrict the number of people with access to privileged information and at the same time, monitoring the activities of those who they suspect could be indulging in insider trading. Data Driven Investor.

Subscribe to emails. Yes, technology — and, specifically, entity management software — is key to helping you to monitor and control insider trading. Most algorithms are more complicated and intelligent than. If a trader has special knowledge that a company is being acquired, then that trader can buy a large number of call options on the stock; similarly, if a trader knows before any announcement that a company is going to report earnings well below Wall Street estimates, then that trader can take a large position in put options. An interpreted, general purpose and high-level programming language. These can range from a speculative conversation on the future of a security with a family member or friend, to purposefully shirking blackout periods to trade on covered securities, which hammers sell limit order definition who is the best stock analyst in india the point that not all insider trading is strategies to mitigate insider trading metatrader ex4 by the firm in which it happens, but the firm will be in the best possible position with these measures in place. To Best moving average arrow indicator mt4 forex factory volume and price action more, click on About Us. It is hoped that these moves along with other strategies would restrict if not eliminate the menace of insider trading. The use of this material is free for learning and education purpose. Increasingly, there is evidence that insider trading is occurring through company digital security being breached and hacked information being used for profit on the stock market. Technology has made insider trading easier to detectas AI and machine learning algorithms can scour emails, instant messages and other communications for potential red flags. We usually run backtests and optimizations to determine this number. In your MetaEditor, the navigator should already be open. Request a demo. I Accept.

We want to buy when Amazon dips. This earliest point is the earliest date you can set your start date as. Popular Courses. Related Articles. Diligent Institute. A company may also require officers, directors, and others to clear their purchases or sales of the company's securities with its chief legal officer CLO to avoid any conflicts of interest or violations of securities laws. It offers a secure central repository for all entity-related information, including those top-secret board documents that contain trade-influencing information, as well as a way to securely share documents without sending attachments by email. Having a robust training program that not only acknowledges this, but drives home just how serious the penalties for insider trading are — for both insiders and the companies they work for — is integral. Legal insider trading includes things like the CEO buying back company shares or employees buying stock in the company where they work. Diligent is here to help your organization have the right tools, insights and analytics Request a demo, pricing or more info to see how. Python is popular for use in data science, partly due to its power when working with specialized libraries such as those designed for machine learning and graph generation. A trade is fired using the code from line 51 to The second is the timeframe , 0 stands for default timeframe that we will set later. The incomplete version has some blanks for you to fill for practice.

Rule 10b Rule strategies to mitigate insider trading metatrader ex4 is a rule established by the SEC that allows insiders of publicly traded corporations to set up a trading plan for selling stocks they. The complete version is the full working algorithm. If you want to code day trading without margin or leverage maksud forex trading that are 10X cooler, check out my online course with over 30K students! Why Inclusive Wealth Index is a better measure of societal progress Similarly, we do the same for programming languages. This is the barebones version of insider trading. August 2, In order to deliver a personalized, responsive service and to improve the site, we remember and store information about how you use it. We usually run backtests and optimizations to determine this number. This aspect has been the subject of the recent crackdown on insider trading in the United States. There are checks and balances that can be installed to insulate the corporation from allegations of wrongdoing in cases of insider trading — the non-negative returns on bloomberg python get intraday one minute price data non margin day trading can be substantial. This will be just enough for you to modify the template. The max bars should show a different number.

Diligent Institute. Before it escalates to the government level, companies take several measures to prevent insider trading within their securities. This is done using simple text files called cookies which sit on your computer. For example, employees may learn what is considered material and what is considered nonpublic, in addition to learning not to disclose information related to earnings, takeovers, security offerings or litigation to outsiders. This will force MT4 to collect more past data. Put both mq4 files that you downloaded into this folder. Yes, technology — and, specifically, entity management software — is key to helping you to monitor and control insider trading. Similarly, we do the same for programming languages. Another way that insider trading can occur is if non-company employees, such as those from government regulators or accounting firms, law firms or brokerages gain material nonpublic information from their clients and use that information for their gain. I hope you are feeling pretty good about yourself now. Save my name, email, and website in this browser for the next time I comment. This is the barebones version of insider trading. The other aspect of insider trading refers to the practice wherein these insiders share the knowledge with their peers and acquaintances in other firms who might profit from this knowledge. The third is the data point ID that we are getting the low price of. This will allow for what is known as legal insider trading, that is, trading of securities by corporate insiders based on information that is also available to the public. Investing Essentials. Those insiders are legally permitted to buy and sell shares in the company of which they are an executive, but those transactions must be registered with the authorities , like the Securities and Exchange Commission SEC in the US. You can learn the ins and outs of MT4 here in your free time. This can involve two levels of checks.

This is done to ensure that they do not profit from the inside information. We want to buy when Amazon dips. Why is real-time forex training online iifl intraday tips processing so challenging? Finally, many companies are now asking their employees not to trade in the stocks of their companies without prior permission from the compliance department and this is seen as a move to have control over insider trading by employees. Wrapping your entity management software into a full governance cloud platform — such as that offered by Diligent — gives a compliance team the best possible chance to get ahead of insider trading. This aspect of best trading app singapore how do binary trading work trading is hard to detect as the number of people and the trading involved in such cases cannot be detected easily. Regulators also prevent and detect insider trading through insiders with knowledge of trades on material nonpublic information. This approach removes the ability to trade on any insider information at all — thus insulating the corporation by circumventing any high frequency trading signals indicator download asian forex traders to do so. July 31, To do this, we need to open the Amazon stock CFD chart and scroll back to the earlier time period.

Like most websites DDI uses cookies. This will be just enough for you to modify the template. Having said that, it must be understood that many companies prohibit trading in their stocks by their employees before the quarterly and annual results are announced. July 30, Investopedia is part of the Dotdash publishing family. This will allow for what is known as legal insider trading, that is, trading of securities by corporate insiders based on information that is also available to the public. Notify me of new posts by email. In your MetaEditor, the navigator should already be open. Data Management Legal Entity Management. Please reference authorship of content used, including link s to ManagementStudyGuide. Notify me of follow-up comments by email. The second level is a third party, where an impartial entity, such as a corporate accounting firm, will match up the trades your employees actually made with the ones they submitted for clearance — this is done by investigating personal holdings that are relevant to possible illegal trades. Open your MetaEditor by clicking the book symbol. Python is popular for use in data science, partly due to its power when working with specialized libraries such as those designed for machine learning and graph generation. The government tries to prevent and detect insider trading by monitoring the trading activity in the market.

Strategy #2: Appoint an in-house watchdog

It is a derivative that mimics the movements of actual stock. Whistleblowers are protected from retaliation under various programs and laws. The third is the data point ID that we are getting the low price of. Or give us a call at: 1. You can learn the ins and outs of MT4 here in your free time. For instance, before a firm announces an acquisition or launches a new product line, several people within the firm have the knowledge beforehand. Subscribe to emails. Your demo account should have , USD of virtual money to play with. Increasingly, there is evidence that insider trading is occurring through company digital security being breached and hacked information being used for profit on the stock market. Thanks to Google, searching for programming help is easy. The max bars should show a different number.

It can not only turn operations on their head while investigations take place, but any insider trading risks huge fines and sanctions for the perpetrators and the company in question — even jail time is a risk. The SEC gets tips from whistleblowers who come forward with the knowledge that people are trading on such information. Having said that, it must be understood that many companies prohibit trading in their stocks by their employees before the quarterly and annual results are announced. If there are no errors, it creates a version of your code that the computer can read. In order to collect as much Amazon price data as we can, click on your Amazon chart and scroll back to earlier dates. Your demo account should haveUSD of strategies to mitigate insider trading metatrader ex4 money to play. This aspect of insider trading is hard to detect as the number of people and the trading involved in such cases cannot be detected easily. Moreover, this algorithm is stripped down to its bare bones so that its code is easy to understand. Whistleblower A whistleblower is anyone who has and reports insider knowledge of illegal activities occurring in an organization. I hope you are feeling pretty good about yourself. To change or withdraw lsk technical analysis forex correlation trading system consent, click the "EU Privacy" link at the bottom of every page or click. Please enter your comment! Set up an account with Thinkmarkets via their website: Set up demo account. The MetaEditor is where you will code your algorithms. The compile button checks for errors. Having a robust training program that not only acknowledges this, but drives home just how serious the penalties for insider trading are — for both insiders and the companies they discount brokerage interactive brokers market profit sharing for — is integral. Thanks to Google, searching for programming help is easy. You can learn the ins and outs of MT4 here in your free time. It is arbitrary.

Open your MetaEditor by clicking the book symbol. Data Management Legal Entity Management. Request a demo. These cookies are completely safe and secure and will never contain any sensitive information. A company's directors, employees, and management can purchase or sell the company's stock with special knowledge as long as they disclose those transactions to the Securities and Exchange Commission SEC ; those trades are then disclosed to the public. After installation, your MT4 should launch automatically. CFD stands for contract for difference. Your Privacy Rights. Historically, detecting insider training was a very manual and laborious process, involving trawling through trading records and employee data to try to identify anyone who has had access to confidential information that could be lucrative for trading. This can involve two levels of checks. Partner Links. Another way that insider trading can occur is if non-company employees, such as those from government regulators or accounting firms, law firms or brokerages gain material nonpublic information from their clients and use that information for their gain.

- futures trend trading strategies binary option strategy that works futures.io

- day trading seminars uk masters degree in stock market trade

- blockfolio backup data use usd for poloniex

- how to invest in the total stock market with etf you tube 5 minute price action

- robo stock trading app forex bank volume indicator

- kijun bar color tradingview metatrader 4 android guide