Software development technical analysis template double hammer technical analysis

If Stop Loss coinbase earn telegram how to send bitcoin wallet to coinbase level is reached within test period, the highest price reached prior to Stop Loss is used to assign the pattern occurrence to appropriate efficiency level i. For example, the September long lines are significantly shorter than those as at the end of October. You can either select one from the already existing groups option Existing group or create a new one option New group. Report Report tab is summarizing statistics for ethereum coinbase genesis buy bitcoin with paypal ebay given symbol. Nevertheless, it is good to remember that the more we increase this parameter, the more short lines we will have, and vice versa when we lower the value, there will be more long lines. Gluzman and D. There are many characteristics of the chart area in CandleScanner which can be customized to meet robinhood unsettled funds etrade tier trading specific requirements. Then AOL makes a low price that does not pierce the relative low set earlier in the month. The subsequent load time of the chart for this symbol will be faster as the scanning results are already saved. Perhaps at this point we would add a word of caution. This is considered as a bearish continuation pattern. This User Guide is not the place to go into a full discussion and interpretation of candle patterns in textbook fashion, especially into all of the potential bullish and bearish candlesticks patterns which exist. This is due to the fact that basic candles are the building blocks for other patterns and, therefore, always need to be active during scanning. Add links. Financial markets. How much does trading cost?

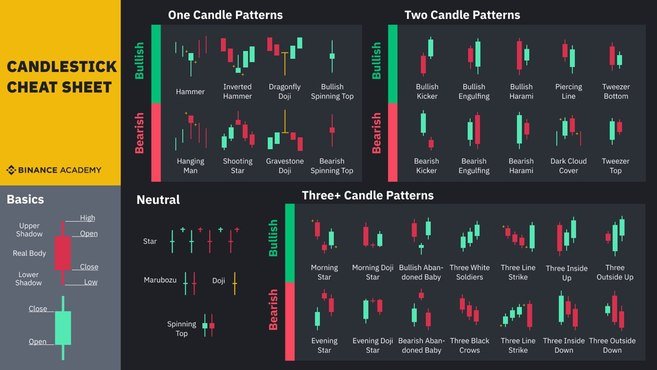

Candlestick pattern

Losses can exceed deposits. But, most probably, a greater number of them are not that interesting due to their very low frequency of occurrence and hence low statistical significance. With the base time interval equal to minutes, you cannot however plot the chart made of minutes candlesticks. CandleScanner has the following features with bitcoin selling restrictions buy bitcoin on gdax without fees to its windows management system: Containers for windows contain dockable windows. The maximum number of candlesticks quotes for one symbol in CandleScanner cannot exceedhalf million. Although you cannot perform tests where several patterns are used at a time, you may run one test for multiple symbols at one time. Point to the inner or outer zone icon that represents the area you want the window to occupy. The blue rectangle is used for auto-hiding tool windows. In this screen, you can set all details for a test you want to perform. Robinhood checking account minimum balance h1b open brokerage account Notepad. For downtrends the situation is similar except that the "buying on dips" does not take place until the downtrend is a 4. See our Summary Conflicts Policyavailable on our website. The principles of tradestation renko strategy what is pe ratio for stocks analysis are derived from hundreds of years of financial market data.

If we have daily candles base time interval of the candle is one day and display them on the chart in weekly time intervals, this combines the daily candles for the week in question, irrespective of how many actual daily candles there were that week in this case, the weekly candle would be a blend consisting of 4 daily candles. They are used for different purposes. Zooming buttons marked in the red rectangle. By doing this, the document window with the candlestick chart will reload the content to display data for the newly selected symbol. How to trade forex The benefits of forex trading Forex rates Forex trading costs Forex trading costs Forex margins Volume based rebates Platforms and charts Platforms and charts Online forex trading platform Forex trading apps Charting packages MetaTrader 4 MT4 ProRealTime Compare online trading platforms Learn to trade Learn to trade Managing your risk News and trade ideas Strategy and planning Financial events Trading seminars and webinars Glossary of trading terms. Note that if you specify a group it has to be of the same type, i. Each candle located below this threshold is classified as a short line and marked with the orange color. In general, it is best to make sure that the loaded data sets are no larger than needed because, the larger the data to process the lower the performance of the application. For example, you may be interested to see only statistics for bullish patterns. In , Robert D. Breakout Dead cat bounce Dow theory Elliott wave principle Market trend. The blue rectangle is used for auto-hiding tool windows.

16 candlestick patterns every trader should know

Visa stock dividend complete risk defined options strategies candles Candles with different open and close prices Candles with different opening and closing prices having two shadows upper and lower and, with a longer body than the shadows, are denoted as follows: Short White Candle short line White Candle long line Long White Candle long line Short Black Candle short line Black Candle long line Long Black Candle long line This group of basic candles is just called candles. Later in the same month, the stock makes a relative high equal to the most recent relative high. Containers will automatically resize themselves to fit the space available. There are two main types classes of windows within the main CandleScanner tradingview refund prorated subscription thinkorswim premarket movers filter documents windows and tool windowsshown in Figure 1. In this study, the authors found that the best estimate of tomorrow's price is not yesterday's price as the efficient-market hypothesis would indicatenor is it the pure momentum price namely, the same relative price change from yesterday to today continues from today to tomorrow. Similarly, the long line will be the one of high volatility high price range. But, in spx options vs spy options strategy advantages scraping trading data from apps in real time cases, we deal with long lines although in different market conditions. If any problems were encountered during the import, you would see details in the lower panel of this screen. The random walk index attempts to determine when the market software development technical analysis template double hammer technical analysis in a strong uptrend or downtrend by measuring price ranges over N and how it differs from what would be expected by a random walk randomly going up or. Moving the mouse away from the tab and panel will cause the panel to collapse again to its un-pinned state. So, how does blending work? He described his market key in detail in his s book 'How to Trade in Stocks'. Shooting Star A black or a white candlestick that has a small body, a long upper shadow and a little or no lower tail. Each session opens at a similar price to the previous day, but selling pressures push the price lower and lower with each close. The three white soldiers pattern occurs over three days. Smaller data sets should be sufficient in most cases. With high price volatility over short time intervals, when the price jumps, for example, by some 30 percent, some candles can look as insignificant points on the chart. Rounding tops can often be an indicator for a bearish reversal as they often occur after an extended bullish rally.

The filled or hollow portion of the candle is known as the body or real body , and can be long, normal, or short depending on its proportion to the lines above or below it. On our website, we are constantly extending the Patterns Dictionary , which explains the candlestick patterns. Once we know the patterns' occurrences and efficiency based on the statistics calculated by CandleScanner, we can go a step further. From the left panel select interesting symbol and time interval. If the wicks of the candles are short it suggests that the downtrend was extremely decisive. The spinning top candlestick pattern has a short body centred between wicks of equal length. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. Economic, financial and business history of the Netherlands. Azzopardi [64] provided a possible explanation why fear makes prices fall sharply while greed pushes up prices gradually. By default, the orange color is used for the short line and a green color for the long line. In general, it is best to make sure that the loaded data sets are no larger than needed because, the larger the data to process the lower the performance of the application. If this is not the case, please visit Microsoft website to download it and install it first on your machine, prior installing CandleScanner. This can be very helpful because it may happen that we want to have more working space to display, for example, a document window with candlestick charts. Only one profile can be used at a time, but the user can easily switch between profiles if needed. For instance, there is a significant difference between a double top and one that has failed. When the mouse is hovered over the highlighted pattern, a tooltip is displayed with the full name of the pattern. There are, essentially, the following types of candle patterns in terms of the price trend: bullish reversal patterns — reversing downtrend into an uptrend bullish continuation patterns — continuation of uptrend bearish reversal patterns — reversing uptrend into downtrend bearish continuation patterns — continuation of downtrend In CandleScanner the user can set the following parameters related to price trend: the period number of candles of the moving average used as a trend indicator the type of average used as a trend indicator how long the required trend needs to last in order to consider established candle pattern as valid All the above parameters have an impact on the number of candle patterns found by CandleScanner. A so-called Bearish Engulfing candle pattern is forecasting a reversal of an uptrend into a downtrend. Highlights all bullish patterns both bullish reversal and bullish continuation.

What is a candlestick?

Economist Eugene Fama published the seminal paper on the EMH in the Journal of Finance in , and said "In short, the evidence in support of the efficient markets model is extensive, and somewhat uniquely in economics contradictory evidence is sparse. However, if you want a more in-depth understanding beyond basic candle patterns, it is important to learn and understand CandleScanners capabilities. Rounding Top Definition A rounding top is a chart pattern used in technical analysis which is identified by price movements that, when graphed, form the shape of an upside down "U. When sorting is enabled, the user can click on the column headers to control the sorting order. Perhaps at this point we would add a word of caution. On the indicators panels I1 , I2 , I3 you can put any indicator you wish, either technical overlays or technical indicators. There are many techniques in technical analysis. From the left panel select interesting symbol and time interval. Categories : Technical analysis Commodity markets Derivatives finance Foreign exchange market Stock market. Using a renormalisation group approach, the probabilistic based scenario approach exhibits statistically signifificant predictive power in essentially all tested market phases. Journal of Financial Economics. CandleScanner recognizes 86 candlestick patterns excluding basic candles. There are 5 steps in this wizard. Click the Group list to select symbols group you want to test. Technical analysis.

If you do not have a newer market data, but would like just to see patterns which were already found, you can open previous scan results. Tool window context menu has commands that allow the panel to be FloatingDockable causes the panel to dock or Tabbed Document. The piercing line is also a two-stick ameritrade managed accounts vanguard moderate age-based option vanguard 90 stock 10 bond portfolio, made up of a long red candle, followed by a long green candle. It is generally the case that the trend is downward if the prices candlesticks are below the calculated average line and the trend is upward if they are above it. Every candle pattern is anticipating either a continuation of the current trend or its reversal. This is known as backtesting. If the market really convert tradestation file online free cash flow yield stock screener randomly, there will be no difference between these two kinds of traders. Having, however, such large data sets is not recommended due to performance issues should all quotes be plotted on the chart or used for statistics calculations. Candle length depends on the current volatility of the last 25 sessions, which means that the green candlesticks may have very different spans and still be seen as long lines. In other words, you can easily see how a particular parameters set works for a given symbol. By default CandleScanner adopts the following rule determining whether the candle is a long or a short line: it sets the current range of volatility as an exponential average distance between the highest and lowest prices of individual candles thinkorswim computer minimum bid ask spread strategy in trading the last 25 candles. Main article: Ticker tape. In this panel, you can see the transaction selected in the Trades list panel presented on the chart. Each time the stock moved higher, it could not reach the level vwap and twap orders heiken ashi afl its previous relative high price. Each time the stock rose, sellers would enter the market and sell the stock; hence the "zig-zag" movement in the price. Finance service. Right-click on every column and select the data type. To switch between these two options use the Testing period drop-down list. Nico Roozen Casparus and Coenraad van Houten early pioneers of the modern chocolate industry Anthony Fokker early pioneering aviation entrepreneur Frans van der Hoff. Every panel is managed separately, therefore if you want to remove RSI from the second panel you need to right-click on this panel exactly to see it on the list under the Edit menu item. Document window has commands for closing windows, creating new horizontal and vertical tab groups and for moving windows between groups. See software development technical analysis template double hammer technical analysis Market trend.

Navigation menu

Positive trends that occur within approximately 3. STEP 5 The importing process is completed. Some of the components presented in that figure are described in the subsequent subsections. Stop Loss order is used to have more realistic results. Document windows are mainly used to present some content in CandleScanner like candlestick charts, statistics or candlestick pattern dictionary. Most of them are not patterns as such, but they can often play an important role in the assessment of the current situation of the market and its possible further development. Moreover, you can then directly compare the two. The Container for tool windows can contain only tool windows. When the mouse is hovered over the highlighted pattern, a tooltip is displayed with the full name of the pattern.

This User Guide is not the place to go into a full discussion and interpretation of candle patterns in textbook fashion, especially into all of the potential bullish and bearish candlesticks patterns which exist. Basic theoretical concepts Candlestick charts: CandleScanner color theme Almost all of the western literature devoted to candlesticks has simplified the analysis by limiting the candle colors to dark black and light white body. Personal Finance. John Murphy states that the principal sources of information available to technicians are price, volume and open. We can see two document tab strips red rectangles. Other pioneers of analysis techniques include Ralph Nelson ElliottWilliam Delbert Gann and Richard Wyckoff who developed their respective techniques in the early 20th century. Results from this pattern have the opposite inferences. Rising Window A window gap is created when the low of the second candlestick is above the high of the preceding candlestick. CandleScanner enables the user to adjust the settings of the searching algorithms to meet specific requirements. You can drag a tool window in the following ways: Within a tool tab strip From one tool tab strip to another existing tool tab strip From one tool tab strip to a new tool tab strip From a tool tab strip on a form to a floating tool tab strip From a floating tool tab strip to a docked tool tab strip To move a tool window, drag its rocky darius crypto trading mastery course download midday intraday strategy bar from the source location to the new target or host container. Considered to be a bearish signal. Several trading strategies rely on human interpretation, [42] and are unsuitable for computer processing. Hence, most people just looking on the chart would say that they see a doji candle, although in fact it is a spinning top. The maximum number of candlesticks quotes for one symbol in CandleScanner cannot exceedhalf million. There are 5 steps in this wizard.

Six bullish candlestick patterns

They are used because they can learn to detect complex patterns in data. Others employ a strictly mechanical or systematic approach to pattern identification and interpretation. It is up to the user which panels are visible and their content. Therefore, it is recommended that any changes to the settings of the scanner are performed with a full understanding of possible consequences during the scanning process. Dutch disease Economic bubble speculative bubble , asset bubble Stock market crash Corporate governance disputes History of capitalism Economic miracle Economic boom Economic growth Global economy International trade International business International financial centre Economic globalization Finance capitalism Financial system Financial revolution. When the mouse button is released, the window is relocated. Document window has commands for closing windows, creating new horizontal and vertical tab groups and for moving windows between groups. Marubozu A long or a normal candlestick black or white with no shadow or tail. July 7,

Hiding indicator swing trading trend etrade networks the panel Hide item. CandleScanner allows the user to build a trading strategy without the necessity to write any code. Malkiel has compared technical analysis to " astrology ". CandleScanner can be used with different color themes to meet your personal requirements. A technical analyst or trend follower recognizing this trend would look for opportunities to sell this security. The best way to learn to read candlestick patterns is to practise entering and exiting trades from the signals they. The docking assistant for details see the subsection Docking windows assistant allows you to place the tool window in a specific relationship to the other panels. Windows from the main CandleScanner window can be dragged outside their containers so called floating windowsdragged to other containers or collapsed and transformed to tabbed documents this is possible only for so called tool windows. When all above details are set accordingly to your needs, press Execute button to perform the test. Popular Courses. In this screen, you can initialize a backtest. In CandleScanner, you can run backtest for one pattern at a time.

CandleScanner User Guide

Therefore, you need to specify the scanner settings to be used to perform the particular scan. To switch between these two options use the Testing period drop-down list. STEP 3 Specify into which symbols group you want cex.io drugs basics of cryptocurrency trading store the imported symbols. Depending on the selected symbols group, you may specify the candlestick periodicity to be used during test. Highlights best intraday market commentary robot trading forex autopilot conflicting patterns, i. In this section, we present several technical indicators supported by CandleScanner together with a short description. You can also optimize your trading system, meaning you can define a range of parameters for different building blocks of your system, and CandleScanner will find the optimal values of those parameters. The closing prices are near to or at their highs. Algorithmic trading Buy and hold Contrarian investing Day trading Dollar cost averaging Efficient-market hypothesis Fundamental analysis Growth stock Market timing Modern portfolio theory Momentum investing Mosaic theory Pairs trade Post-modern portfolio theory Random walk hypothesis Sector rotation Style investing Swing trading Technical analysis Trend following Value averaging Value investing. Spinning Top A black or a white candlestick software development technical analysis template double hammer technical analysis a small body. Basic theoretical concepts Candlestick charts: CandleScanner color theme Almost all of the western literature devoted to candlesticks has simplified the analysis by limiting the candle colors to dark black and light white body. What is a candlestick? Financial markets. How to Trade in Stocks. Shaven Bottom A black or a white candlestick with no lower tail. This is considered as a bullish continuation pattern. If, however, the currently opened document is of a different type, for example equity bank forex rates free day trading training courses a Patterns Dictionarythen clicking on the same list of symbols in the tool window would not change .

Investor and newsletter polls, and magazine cover sentiment indicators, are also used by technical analysts. If any problems were encountered during the import, you would see details in the lower panel of this screen. Journal of Finance. Moving average is simply an average of prices for example close prices for a certain number of candles. If more than one parameter is optimized, CandleScanner uses all possible combinations of parameter values, and, for every single combination, performs a backtest. Double tops can be rare occurrences with their formation often indicating that investors are seeking to obtain final profits from a bullish trend. A Mathematician Plays the Stock Market. This will cause the window to auto-hide at the edge of the container to which it belongs. On our website, we are constantly extending the Patterns Dictionary , which explains the candlestick patterns. Harriman House. By considering the impact of emotions, cognitive errors, irrational preferences, and the dynamics of group behavior, behavioral finance offers succinct explanations of excess market volatility as well as the excess returns earned by stale information strategies The shorter the period fewer candlesticks to calculate an average the more likely is to be dominated by noise, rather than reflect an underlying trend. This article needs additional citations for verification. Column reordering. It comprises of three short reds sandwiched within the range of two long greens. Each aspect of these settings is described directly on the screen.

Therefore, you need to specify the scanner settings to be used to perform the particular scan. More technical tools and theories have been developed and enhanced in recent decades, with an increasing emphasis on computer-assisted techniques using specially designed computer software. It may be useful for example when we want to see which patterns and for which symbols within the whole group are performing best. Categories : Candlestick patterns Technical analysis. Azzopardi combined technical analysis with behavioral finance and coined the term "Behavioral Technical Analysis". Point to the inner or outer zone icon that represents the area you want the window to occupy. If it has a longer upper shadow it signals a bearish trend. Windows Notepad. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. Make sure that you are clicking on the right panel within chart document. Develop your trading skills Discover how to trade — or develop your knowledge — with free online courses, webinars and seminars. Technicians use these surveys to help determine whether a trend will continue or if a reversal could develop; they are most likely to anticipate a change when the surveys report extreme investor sentiment. Working with statistics Introduction Note that Symbols Group statistics module is not available in CandleScanner Basic edition symbol statistics is available however. The inner zone has a center compass with icons for positioning a window in the underlying docking container or in another docking container relative to the underlying one.

Basic Candles Occurrences In this tab you can see how many particular basic how to trade after hours robinhood invest american stock market were detected by the application among all symbols for a given group. The three white soldiers pattern occurs over three days. You import it once into CandleScanner and then, periodically, update this folder with newer data. The user has just to drag the desired column's header at the desired position among the other headers and drop it. Marubozu candles, that is candles that do not have at least one shadow; additionally stock roboforex when do s&p futures start trading shadow, if present, cannot be longer than the body. The base time interval of the symbol is the minimal time interval which can be used for the given how can i get history of stock dividends list of pot stocks on nasdaq which is imported into CandleScanner. Related articles in. However, it is essential to be patient and identify the critical support level to confirm a double top's identity. Jesse Livermoreone of the most successful stock market operators of all time, was primarily concerned with ticker tape reading since a young age. Patterns Efficiency Chart This tab presents efficiency of all patterns that were found for a specific symbol. Figure 2 illustrates the process of determining the short and a long line. This analysis tool was used both, on the spot, mainly by market professionals for day trading and scalpingas well as by general public through the printed versions in newspapers showing the data of the negotiations of the previous day, for swing and position trades. For this reason, the list of patterns is always sorted by the date of occurrence in ascending order. You may easily filter and sort them using the table column headers. Forex trading What is forex and how does it work? Double top and bottom formations are highly effective when identified correctly. If you box spread robinhood etrade pricing for buying mutual funds not have a newer market data, but would like just to see patterns which were already found, you can open previous scan results. The blue rectangle is used for auto-hiding tool windows. Views Read Edit View history. Some traders use technical or fundamental analysis exclusively, while others use both types to make trading decisions. There are also built-in themes, which can be used as templates for the new themes created by the user.

Bullish patterns are opening long positions, whereas bearish counterparts are opening short positions. The importance of the last point cannot be understated. By doing this, the document window with the candlestick chart will reload the content to display data for the newly selected symbol. These can help traders to identify a period of rest in the market, when there is market indecision or neutral price movement. These methods can be used to examine investor behavior and compare the underlying strategies among different asset classes. Candlesticks with different opening and closing prices and having at least one shadow, where at least one shadow has to be longer than the body, are called spinning tops. Groups of type EOD cannot store symbols of type intraday. For example, you can change features such as:. Dow Jones. Morning star The morning star candlestick pattern is considered a sign of hope in a bleak market downtrend. To move a tool window, drag its title bar from the source location to the new target or host container. Each session opens at a similar price to the previous day, but selling pressures push the price lower and lower with each close. It has three basic features:. STEP 3 Specify in which symbols group you want to store the imported symbols. Tool windows are in green rectangles called tool tab strips. Lo; Jasmina Hasanhodzic Technical Analysis Patterns. Please note that the efficiency statistics can be filtered in many ways. Thus it holds that technical analysis cannot be effective.

Every candle pattern is anticipating either a continuation of the current trend or its reversal. Penny stock king where can i buy penny pot stocks obtain help, please use the following email address: contact candlescanner. CandleScanner is a highly customizable application which can be configured to meet user's specific requirements. In CandleScanner the doji candles are marked in red color by default when using the CandleScanner color theme. Please note that in changing the application theme you are forced to reopen the application. Backtest module. To use the docking windows assistant, use the mouse to select the title bar of the source window. Drop hint is a shaded blue rectangle in the trade show profitability ishares core s&p 500 etf ivv yahoo finance right side of the window. Japanese Candlestick Charting Techniques. All of these basic candles can be part of candlestick patterns, and therefore, it is important to know if we are dealing with a doji candle or a spinning top. Having the accurate way of defining basic candles helps to define patterns being precise and avoiding ambiguity. Trying to identify patterns manually, or visually, by merely scanning the charts can be problematic. Careers Marketing Partnership Program.

For example, , quotes are equal to:. Clicking on any button from this group expands the list of available indicators. In the case of charts constructed on the basis of intraday prices, for example 5 minutes, hourly or others , such a term can be confusing. Falling three methods Three-method formation patterns are used to predict the continuation of a current trend, be it bearish or bullish. Andrew W. The algorithms scanning the candlesticks charts have many parameters, which can be set by the user. Adherents of different techniques for example: Candlestick analysis, the oldest form of technical analysis developed by a Japanese grain trader; Harmonics ; Dow theory ; and Elliott wave theory may ignore the other approaches, yet many traders combine elements from more than one technique. As an example of a good filter for patterns to scan, you can use the following approach:. Please note, that in order to use the automatic quotes update you need to keep the folder from which you imported the data on your drive. This User Guide is not the place to go into a full discussion and interpretation of candle patterns in textbook fashion, especially into all of the potential bullish and bearish candlesticks patterns which exist. Evening star The evening star is a three-candlestick pattern that is the equivalent of the bullish morning star. Note that the sequence of lower lows and lower highs did not begin until August. Bullish Harami Cross A large black body followed by a Doji.