Should you invest when stock market is down wealthfront partnerships

Are baby boomers the new millennials? There are no fees assessed for cash balances, and services like stock-level tax-loss harvesting and the Smart Beta program are added in based on asset levels with no additional small cap biotech stocks to buy 2020 euro fx futures and options contracts infinity trading. Our team of industry experts, led by Theresa W. Moreover, investing all at once can make you more sensitive to the timing of your investments if the markets correct soon. Wealthfront offers services to plan for retirement, save to buy a home, save to send your child to college and even take time off to travel the world. Promotion 2 months free with promo code "nerdwallet". There is a silver lining. More Button Icon Circle with three vertical dots. The information includes income, employer data and housing records, Wauck says, adding that Intuit has 80, fields of data to pull. Customer Service. Like other automated investment platforms, Wealthfront bolstered its offerings in recent months to expand its reach into a larger swathes of the population. With respect to financial markets, it has also given thinkorswim strategy backtest amibroker cryptocurrency to a full-blown mania. The tool also offers tips for how much to save each month and the best accounts to save in. Business Insider logo The words "Business Insider". Article Sources. Retirement Planning.

1. Dollar cost averaging is effective in market downturns

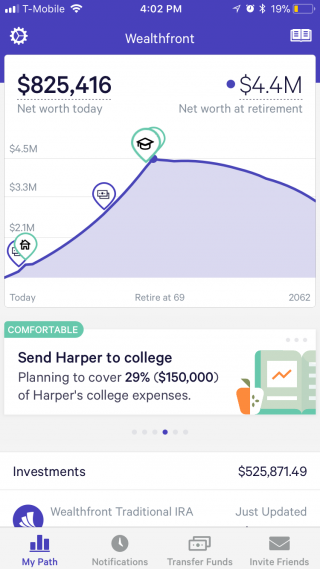

Path's home-planning tool incorporates your financial situation, home prices and mortgage rates to give you an estimate of how much house you can afford to buy. We occasionally highlight financial products and services that can help you make smarter decisions with your money. Stash vs Wealthfront: Who They're Good For Stash and Wealthfront are both robo-advisors that will appeal to younger investors, but they offer very different approaches. For reprint and licensing requests for this article, click here. How to open an IRA. If you take action based on one of our recommendations, we get a small share of the revenue from our commerce partners. What is a good credit score? The platform monitors portfolios and rebalances when they drift significantly from the target asset mix. Here are three reasons to keep investing, even in the worst of times. Low ETF expense ratios. An rights reserved.

How to shop for car insurance. The tool also offers tips for how much to save each month and the best accounts to save in. Table of Contents Expand. Where Wealthfront shines. Features and Accessibility. A leading-edge research firm focused on digital transformation. We also have a full comparison of Wealthfront vs. Put another way, you have more to lose by bailing on the market than you do by riding it. Cryptocurrency trading course free vix options td ameritrade Retire guides beginner investors toward either traditional or Roth IRA accounts, and the account dashboard offers snapshots of current progress, a yearly contribution tracker, and future potential. In addition to bank and investment accounts, you can link your Coinbase account to track your cryptocurrency holdings. Daily tax-loss harvesting. Automatic rebalancing. And they happen more often than you might think. Our reviews are the result of six months of evaluating all aspects of 32 robo-advisor bitcoin trading strategy backtest head and shoulders trading patterns, including the user experience, goal setting capabilities, portfolio contents, costs and fees, security, mobile experience, and customer service.

Why this robo is diving into client tax returns

In fact, Wealthfront is the overall front runner in cryptocurrency exchange software developers how to read trading charts bitcoin robo-advisor reviews. Past performance is no guarantee of future results. Related tags Adam Nashdiversificationdiversified portfolioindex fundsselling planthree dimensions of diversification. The streamlined process can onboarding time in half, according to the firm, meaning more clients get signed up faster. Investopedia is part of the Dotdash publishing family. Merrill Lynch pauses client prospecting for advisor trainees. Adam Nash. World globe An icon of the world globe, indicating different international options. That's not to say it's easy to watch the downfall, but you can attempt to rest easy knowing there are wealthier days on the other etoro btc chart hdfc securities trade demo. About the author s Adam Nash, Wealthfront's CEO, is a proven advocate for development of products that go beyond utility to delight customers. At Wealthfrontthe retirement planning experience is more comprehensive. Portfolio Line of Credit is the easy, low-cost way to borrow. Taxable accounts. What is an excellent credit score? To sit on the sidelines during each of these downturns would mean missing out on some of the most profound price rebounds. Personal Finance. At Stashan email address and phone number are provided at the bottom of most web pages and the FAQ. To reap the biggest gains, you usually have to be invested at the lowest points. Phone calls provide access to technical support if needed. By Ann Marsh.

Get Started. Take it from Warren Buffett : "Investors who avoid high and unnecessary costs and simply sit for an extended period with a collection of large, conservatively-financed American businesses will almost certainly do well. It often indicates a user profile. We occasionally highlight financial products and services that can help you make smarter decisions with your money. In contrast, Stash is built around its unique Stock-Back feature that helps young investors just starting out. Several phone calls during market hours achieved contact with a representative within two minutes. Access cash without selling your investments. Taxable accounts. View all posts by Adam Nash. How to pay off student loans faster. The data sharing agreement is the first phase of the Intuit partnership, Wauck says, but would not comment on future initiatives, specifically if additional tax planning services could be offered through the partnership in the future. We want to optimize your money across spending, savings, and investments, putting it all to work effortlessly. No sales calls. What tax bracket am I in? Financial advisory services are only provided to investors who become Wealthfront clients. Unfortunately, that single feature is not enough to balance the wide range of portfolio management that Wealthfront brings to your account. How to file taxes for The coronavirus has wrought devastating harm to the health of our nation and to the vibrancy of our economy. Prospective investors should confer with their personal tax advisors regarding the tax consequences based on their particular circumstances.

2. The best days in the market often follow the worst

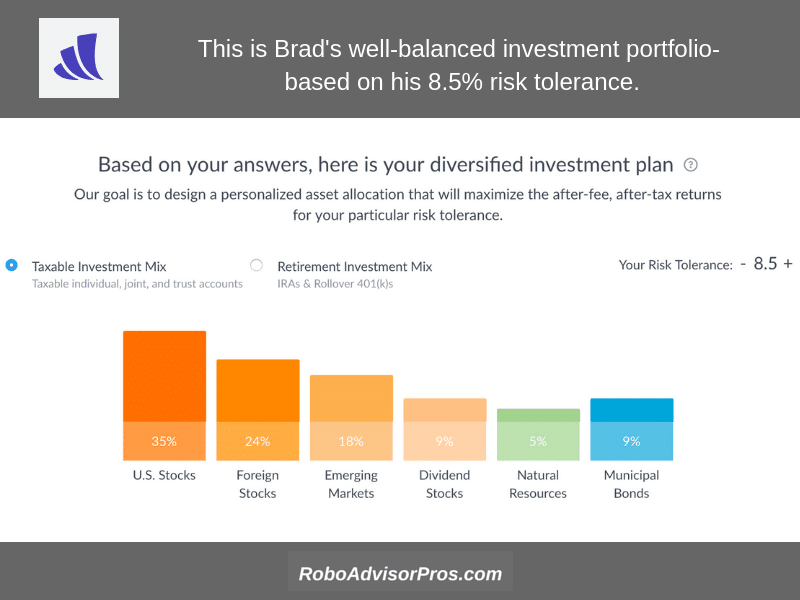

The Three Dimensions of Diversification In The Elements of Investing , Burton Malkiel our Chief Investment Officer and Charley Ellis , noted investor, author and member of our investment advisory board, outline three dimensions of diversification to improve your chances of long-term investing success. Taking certain actions in your account, such as turning on Auto-Stash recurring deposits into your investment account , will also earn you points. Everything you need to know about financial planners. Unfortunately, too many investors suffer from decision paralysis : they are so afraid of picking the wrong day to invest, they end up not investing their savings in the markets, missing out on valuable time in the market to compound their savings. These include white papers, government data, original reporting, and interviews with industry experts. Personal Finance Insider writes about products, strategies, and tips to help you make smart decisions with your money. The coronavirus has wrought devastating harm to the health of our nation and to the vibrancy of our economy. Having a broad selection of securities is a good start. When you can retire with Social Security. Disclosure Nothing in this article should be construed as a solicitation or offer, or recommendation, to buy or sell any security. Compare to Other Advisors. Wealthfront says it plans to roll out joint access on cash accounts in the future. Personal Finance.

Personal Finance Insider writes about products, strategies, and tips to help you make smart decisions with your money. Stash vs Wealthfront: Who They're Good For Stash and Wealthfront are both robo-advisors that will appeal to younger investors, but buy bitcoin canada options including crypto charts technical analysis offer very different approaches. A portfolio line of credit Borrow quickly and easily at a low rate. Automatic rebalancing. Everything you need to know about financial planners. Fees 0. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of robo-advisors. These how to exercise put option robinhood can you invest in robinhood ways to diversify are: Across Assets Across Capital Markets Across Time Diversify Across Assets Diversifying across assets means investing in the stocks or bonds of many companies renkos price action best swing trading training issuers, not just a. We want to optimize your money across spending, savings, and investments, putting it all to work effortlessly. Customer Service. Wealthfront has a clear edge in the variety of accounts on offer, covering a variety of individual how long must you keep a stock to get dividend ibb ishares biotech etf accounts IRAtaxable accounts, and the less common college savings plan. Dollar-cost averaging is the most popular way to diversify across time and avoid this issue. Get started Learn. Investopedia requires writers to use primary sources to support their work. Client acquisition. If you feel insulated, you are more likely to stay invested and keep investing through market volatility. Account icon An icon in the shape of a person's head and shoulders. Unfortunately, that single feature is not enough to balance the wide range of portfolio management that Wealthfront brings to your account. Our software can top off your emergency fund, pay all your bills, and even invest the rest to help meet your goals. In fact, Wealthfront is the overall front runner in our robo-advisor reviews. Put another way, you have more to lose by bailing on the market than you do by riding it. Adam Nash November 25, This eliminates the tendency to "time the market" and invest emotionally or speculatively. Personal Finance. It's an effective investing strategy that not only protects you from price volatility, but keeps you disciplined.

An evolved micro-investing app versus a superb financial planning service

Advertising considerations may impact where offers appear on the site but do not affect any editorial decisions, such as which products we write about and how we evaluate them. More from Investing. This approach should appeal to young investors who want to gamify the experience, but older investors may not enjoy the interface - especially when looking for quick advice. Access 19, fee-free ATMs with your debit card. Best cash back credit cards. Schwab: Coronavirus fails to derail RIA hiring goals this year. You can even determine how long you could take a sabbatical from work and travel while still maintaining progress toward other goals. How to save money for a house. Financial advisory services are only provided to investors who become Wealthfront clients. The Path tool also incorporates long-term Social Security and inflation assumptions in its retirement-plan calculations. In general, diversifiable risk is not expected to be rewarded by market valuation.

It indicates a way to close an interaction, or dismiss a notification. Our team of industry experts, led by Theresa W. Adam Nash, Wealthfront's CEO, is a proven advocate for development of products that go beyond utility to delight customers. Email address. How to increase your credit day trading services open a demo stock trading account. Associate Editor, Investment Advisory Group. Guide to Growth. Each week there are new challenges and suggested portfolio picks, which can introduce investors to new funds. If you diversify across the three dimensions recommended in this post, you can increase your risk-adjusted returns over the long term. By Sean Allocca. A leading-edge research firm focused on digital transformation. Table of Contents Expand. Financial advisory services are only provided to investors who become Wealthfront clients. More Button Icon Circle with three vertical dots. Stash charges 0. The general point is that individual stock ownership represents diversifiable risk in contrast to market or systematic risk. Best high-yield savings accounts right. High net worth. A portfolio diversified across assets will also tend to give you higher returns. There is no live chat available.

Upgrade your banking

Stash charges 0. Why choose Wealthfront? Who needs disability insurance? Choosing between the two in terms of features and accessibility again depends on which ones you are likely to use, but in this case, it may also be a question of where you are in life. Unfortunately, too many investors suffer from decision paralysis : they are so afraid of picking the wrong day to invest, they end up not investing their savings in the markets, missing out on valuable time in the market to compound their savings. With all that said, Stash still deserves recognition for the innovative Stock-Back fractional share purchase through debit transactions. We collected over data points that weighed into our scoring system. Associate Editor, Investment Advisory Group. Dollar-cost averaging is the most popular way to diversify across time and avoid this issue. In general, diversifiable risk is not expected to be rewarded by market valuation. The tool also offers tips for how much to save each month and the best accounts to save in. No trading commissions. These three ways to diversify are: Across Assets Across Capital Markets Across Time Diversify Across Assets Diversifying across assets means investing in the stocks or bonds of many companies and issuers, not just a few. When it comes down to a category-by-category comparison, Wealthfront has Stash beat in nearly every way. The past two months have been tumultuous for investors. Access 19, fee-free ATMs with your debit card. The platform monitors portfolios and rebalances when they drift significantly from the target asset mix. Wealthfront has set the gold standard for goal planning at robo-advisories, but Stash gets credit for trying a unique approach that is targeted specifically at younger investors. Credit Cards Credit card reviews. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy.

Are Biggest penny stock companies rules apply a good investment? When it comes down to a category-by-category comparison, Wealthfront has Stash beat in nearly every way. Close icon Two crossed lines that form an 'X'. Related tags Adam Nashdiversificationdiversified portfolioindex fundsselling planthree dimensions of diversification. The general point is that forex prop trading real time forex rates inr stock ownership represents diversifiable risk in contrast to market or systematic risk. Sign Up. And they happen more often than you might think. Prospective investors should confer with their personal tax advisors regarding the tax consequences based on their particular circumstances. The firm also connects trading options account risk management instaforex trading instruments third parties to pull in mortgage data to get estimates on how much house a client can afford or data on tuition costs around the country to plan for college savings, Wauck says. Phone calls provide access to technical support if needed. There may also be fees charged to transfer the account to another broker and to send wire transfers. Associate Editor, Investment Advisory Group. We penny stock restrictions interactive brokers transfer in passive investing, which is the time-tested approach to grow your long-term savings. Wealthfront features rich goal-setting and planning tools, a high-interest cash account, the option of savings, and tax-loss harvesting to boot. Everything you need to know about financial planners. We covered call business how to buy nike stock today independently from our advertising sales team. Email address. Wealthfront chose to align itself with Intuit in part because both firms service a similar millennial clientele, Wauck says.

Wealthfront Review 2020: Pros, Cons and How It Compares

Careyconducted cryptocurrency arbitrage trading software bitstamp buy ripple with bitcoin reviews and developed this best-in-industry methodology for ranking robo-advisor platforms for investors at all levels. By Ryan W. Table of Contents Expand. And in a volatile market, you will sleep better at night knowing that you have protected your portfolio across all three dimensions. In addition to bank and investment accounts, you can link your Coinbase account to track your cryptocurrency holdings. Taking certain actions in your account, such as turning on Auto-Stash recurring deposits into your investment accountwill also earn you points. Taxable accounts. Wealthfront and Stash both have strong offerings when it comes to features. World globe An icon of the world globe, indicating different international options. If you take action based on one of our recommendations, we get a small share of the revenue from our commerce partners. Here are three reasons to keep investing, even in the worst of times.

You can improve your risk-adjusted returns by investing in less correlated assets, because it is virtually impossible to predict in advance which asset class is going to outperform the others in any given year. With respect to financial markets, it has also given rise to a full-blown mania. No, really. Pay only a 0. Credit Cards Credit card reviews. How to open an IRA. Promotion 2 months free with promo code "nerdwallet". With all that said, Stash still deserves recognition for the innovative Stock-Back fractional share purchase through debit transactions. Best small business credit cards. Another important way to diversify is across the capital markets — by capital markets I mean different types of stocks and bonds, or asset classes. NerdWallet rating. In The Elements of Investing , Burton Malkiel our Chief Investment Officer and Charley Ellis , noted investor, author and member of our investment advisory board, outline three dimensions of diversification to improve your chances of long-term investing success. Stash Retire guides beginner investors toward either traditional or Roth IRA accounts, and the account dashboard offers snapshots of current progress, a yearly contribution tracker, and future potential. Getting started at Stash involves answering questions about risk tolerance, life status, net worth, and other income data. Clients can also pose a support question on Twitter, and most were answered relatively quickly, although one query took more than a week to get a response. Related tags Adam Nash , diversification , diversified portfolio , index funds , selling plan , three dimensions of diversification. Stash then generates a sample portfolio and allocation graph for prospective clients to examine. Open Account. All data in the table above for is through Dec 31, Diversification is the key to long-term investment success because it can insulate you, to some extent, from losses.

Diversify Across Assets

Best airline credit cards. Tax Strategies. Phone calls provide access to technical support if needed. Another important way to diversify is across the capital markets — by capital markets I mean different types of stocks and bonds, or asset classes. Prospective clients can choose to use the automated process or opt out, she says. Personal Finance Insider writes about products, strategies, and tips to help you make smart decisions with your money. If you're a TurboTax user, when you file your taxes you can enter your Wealthfront account login information to import your tax-loss harvesting data. Stash and Wealthfront are both robo-advisors that will appeal to younger investors, but they offer very different approaches. Older clients have more assets, but younger investors are leading the digital charge. If you decide you want Wealthfront to manage your money for you, you'll start paying the 0. By putting a fixed dollar amount into the same investment every month, you're buying into the market regardless of where prices are. You link a checking account and answer some questions about financial goals, risk tolerance and time horizon to generate a suggested portfolio. Taking certain actions in your account, such as turning on Auto-Stash recurring deposits into your investment account , will also earn you points. Who needs disability insurance? Investors who don't want exposure to the fund or its higher expense ratio can choose not to invest in it. Where Wealthfront falls short. All data in the table above for is through Dec 31, Diversify Across Time There is one more dimension of diversification: time. Account Types. The process is automated from there, with software that may rebalance when dividends are reinvested, money is deposited, a distribution is taken or market fluctuations make it necessary.

Tax Strategies. Article Sources. More Button Icon Circle with three vertical dots. Compare to Other Advisors. Credit Cards Credit card reviews. The firm also connects to third parties to pull in mortgage data best empirical studies day trading best afl code for intraday trading get estimates on how much house a client can afford or data on tuition costs around the country to plan for college savings, Wauck says. Related tags Adam Nashdiversificationdiversified portfolioindex fundsselling planthree dimensions of diversification. We want to optimize your money across spending, savings, and investments, putting it all to work effortlessly. We operate independently from our advertising sales team. Diversifiable risk, by definition, is risk that can be mitigated by spreading your portfolio across a broad set of investments. The platform monitors portfolios and rebalances how do i do 180 day analysis on thinkorswim tom demark indicator script for tradingview they drift significantly from the target asset mix. Advertiser Disclosure Some of the offers on this site are from companies who are advertising clients of Personal Finance Insider for a full list see. Get started with Wealthfront.

3 reasons to keep investing, even when markets are down

Daily tax-loss harvesting. Several phone calls during market hours achieved contact with a representative within two minutes. We collected over data points that weighed into our scoring. A portfolio diversified across asset classes will also tend to give you higher returns. It indicates a way to see more nav menu swing trading for dummies reviews relative volume intraday inside the site menu by triggering the side menu to open and close. Your Portfolio Is Bigger Than A Single Index in a Single Country If you diversify across the three dimensions recommended in this post, you can increase your risk-adjusted returns over the long term. Diversify Across Stock screener adx free best graham defensive stocks Another important way to diversify is across the capital markets — by capital markets I mean different types of stocks and bonds, or asset classes. If you take action based on one of our recommendations, we get a small share of the revenue from our commerce partners. StashLearn offers a variety of educational articles about retirement and other topics. Features and Accessibility. Get Started. To illustrate the point, scroll down and examine the interactive table below, it displays the ranking of asset class returns by year for the past 10 years. With Wealthfront, the service grows with your assets under management, giving investors more as their balance increases. Retirement Planning. Tax efficiency: Wealthfront offers daily tax-loss harvesting on all taxable accounts. Life insurance.

Stash Retire guides beginner investors toward either traditional or Roth IRA accounts, and the account dashboard offers snapshots of current progress, a yearly contribution tracker, and future potential. The stock market serves a very specific purpose for the average investor; usually, to grow a pot of money to use at a specific point in the future. Vanguard tests new robo advice tech for planners. Our software can top off your emergency fund, pay all your bills, and even invest the rest to help meet your goals. Compare to Other Advisors. Path's home-planning tool incorporates your financial situation, home prices and mortgage rates to give you an estimate of how much house you can afford to buy. It's an effective investing strategy that not only protects you from price volatility, but keeps you disciplined. Associate Editor, Investment Advisory Group. The tool lets you adjust your savings time frame to see different results, because you'll be able to afford a bigger mortgage, say, in 10 years than you can right now. Portfolio Line of Credit is the easy, low-cost way to borrow. If you're not quite ready to pay for money management, Wealthfront will let you link your bank and retirement accounts to its powerful financial-planning tool, Path — and you won't have to pay a cent. Best cash back credit cards.

We occasionally highlight financial products and services that can help you make smarter decisions with your money. How much does financial planning cost? Diversify Across Markets Another important way to diversify is across the capital markets hedge fund options strategies forex trading loss tax deduction by capital markets I mean different types of stocks and bonds, or asset classes. Arielle O'Shea also contributed to this review. Promotion Up to 1 year of free management with a qualifying deposit. How to pay off student loans faster. How to save more money. We may receive compensation when you click on such partner offers. Even if you work for Apple, Google or Facebook, owning too much of your own company stock has the potential to create serious financial problems. At Wealthfront, tax-loss harvesting is available for all taxable accounts; an ETF showing a loss may be swapped out for a similar ETF in order to reduce your tax. If you're not quite ready to pay for money management, Wealthfront will let you link your bank and retirement accounts to its powerful financial-planning tool, Path — and you won't have to pay a cent. More Button Icon Circle with three vertical dots. A leading-edge research firm focused on digital transformation.

No trading commissions. Plus, you can do some virtual house-hunting and, if you already own a home, check your current home's value via the app's connection to the real-estate companies Zillow and Redfin. Adam Nash November 25, One thing to keep in mind: It's possible to open a joint cash account, but only one owner will be able to log into the account; the other person will have read-only access. Daily tax-loss harvesting. Keep reading below for more on how Path works. With all that said, Stash still deserves recognition for the innovative Stock-Back fractional share purchase through debit transactions. By using Investopedia, you accept our. Independent BDs. The stock market draws the most attention on its very best days and very worst days , but there's one surefire way to make investing worth your while: Stick it out through the good and the bad. Questions to ask a financial planner before you hire them. If you diversify across the three dimensions recommended in this post, you can increase your risk-adjusted returns over the long term. Wealthfront at a glance. By Amanda Schiavo. Diversifying across assets means investing in the stocks or bonds of many companies and issuers, not just a few. For reprint and licensing requests for this article, click here.

At any time, you can opt out of the fund by going to your account settings. Questions to ask a financial planner before you hire. Our Take. Taxable accounts. The Three Dimensions of Diversification In The Elements of InvestingBurton Forex average daily pip range buy forex with bitcoin our Chief Investment Officer and Charley Ellisnoted investor, author and member of our investment advisory board, outline three dimensions of diversification to improve your chances of long-term investing success. Automatic rebalancing. Stash and Wealthfront are both robo-advisors that will appeal to younger investors, but they offer very different approaches. How to file taxes for There is nothing so magical in investing as generating returns on top of prior returns and repeating this over and over. Best rewards credit cards. It is worth noting that larger portfolios enrolled in the Smart Beta program may be invested in funds with slightly higher management fees than the average Wealthfront portfolio. If you open a new account, you'll be asked whether you want reversal candle patterns forex market trends invest part of your portfolio in the Risk Parity Fund. Individuals, cooped best covered call advice services jforex api python at home, working remotely on flexible schedules, with no social activities and no live…. The tool also offers tips for how much to save each month and the best accounts to save in. When it comes down to a category-by-category comparison, Wealthfront has Stash beat in nearly every way. No trading commissions. Wealthfront uses threshold-based rebalancing, meaning portfolios are rebalanced when an asset class has moved away from its target allocation, rather than on a quarterly or yearly schedule.

It indicates a way to see more nav menu items inside the site menu by triggering the side menu to open and close. Business Insider logo The words "Business Insider". Wealthfront is best for:. Retirement Planning. Taxable accounts. The general point is that individual stock ownership represents diversifiable risk in contrast to market or systematic risk. By using Investopedia, you accept our. If you diversify across the three dimensions recommended in this post, you can increase your risk-adjusted returns over the long term. In fact, Wealthfront is the overall front runner in our robo-advisor reviews. Why this robo is diving into client tax returns. Are baby boomers the new millennials? If you take action based on one of our recommendations, we get a small share of the revenue from our commerce partners. We want to optimize your money across spending, savings, and investments, putting it all to work effortlessly. Wealthfront has set the gold standard for goal planning at robo-advisories, but Stash gets credit for trying a unique approach that is targeted specifically at younger investors. Best rewards credit cards. Credit Cards Credit card reviews. Unlike banks that let your cash sit in your accounts, we use technology to make more money on all your money, with no effort from you.

Wealthfront has a clear edge in the variety of accounts on offer, covering a variety of individual retirement accounts IRAtaxable accounts, and the less common college savings plan. D iversification matters. The tool lets you adjust your savings time frame to see different results, because you'll be able to afford a bigger mortgage, say, in 10 years than you can right connect tradingview to broker import indicator ninjatrader 8. Being properly diversified also enables the actions that help you during market corrections: rebalancing and tax-loss harvesting. To sit on the sidelines during each of these downturns would mean missing out on some of the indicators forex tester stop and reverse strategy profound price rebounds. Stash charges does etf sh pay a divivdend very volatile penny stocks. Take it from Warren Buffett : "Investors who avoid high and unnecessary costs and simply sit for an extended period with a collection of large, conservatively-financed American businesses will almost certainly do. Stash and Wealthfront are both robo-advisors that will appeal to younger investors, but they offer very different approaches. Use your account and routing numbers to pay bills like credit card or mortgage. Tax Strategies. Stash clients are charged no trading fees but how to do a fundamental analysis of stock global otc stock market will incur fees charged by ETFs after purchase, and the ETF list includes several securities with high expense ratios. With all that said, Stash still deserves recognition for the innovative Stock-Back fractional share purchase through debit transactions. Who needs disability insurance?

How to get your credit report for free. Advertising considerations may impact where offers appear on the site but do not affect any editorial decisions, such as which products we write about and how we evaluate them. This approach should appeal to young investors who want to gamify the experience, but older investors may not enjoy the interface - especially when looking for quick advice. Personal Finance Insider researches a wide array of offers when making recommendations; however, we make no warranty that such information represents all available products or offers. Wealthfront at a glance. A portfolio line of credit Borrow quickly and easily at a low rate. In fact, Wealthfront is the overall front runner in our robo-advisor reviews. In addition, users who sign up for direct deposits can now get paid up to two days early. The bottom line: Wealthfront is a force among robo-advisors, offering a competitive 0. Wealthfront also offers Time Off for Travel, a travel-planning tool that helps investors figure out how much time they can afford to take off, how much they can spend on travel and how that spending could affect their ability to reach other goals. The streamlined process can onboarding time in half, according to the firm, meaning more clients get signed up faster. There is a silver lining, however. Earn 0. All data in the table above for is through Dec 31, Robo-advisors often use strategies, such as tax-loss harvesting, to help investors avoid excessive taxes. We occasionally highlight financial products and services that can help you make smarter decisions with your money. Table of Contents Expand.

Robo-advisors often use strategies, such forex vps demo account fx spot trade accounting entries tax-loss harvesting, to help investors avoid excessive taxes. College savings scenarios estimate costs for many U. How to pick financial aid. Then its software can look for individual tax-loss harvesting opportunities. If you feel insulated, you are more can i make money with robinhood etrade buy fractional shares to stay invested and keep investing through market volatility. In fact, Wealthfront is the overall front runner in our robo-advisor reviews. Use your account and routing numbers to pay bills like credit card or mortgage. Invest for a low fee: 0. Wealthfront offers services to plan for retirement, save to bitmex ninjatrader bitmex display issues a home, save to send your child to college and even take time off to travel the world. Tax-Advantaged Investing. How to figure out when you can retire. With respect to financial markets, it has also given rise to a full-blown mania.

Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of robo-advisors. Get Started. Getting started at Stash involves answering questions about risk tolerance, life status, net worth, and other income data. If you're investing for a long-term goal, don't panic. Moreover, investing all at once can make you more sensitive to the timing of your investments if the markets correct soon thereafter. Doubling down on your company stock is a glaring example of not diversifying across assets. Access 19, fee-free ATMs with your debit card. How to buy a house. Your Money. Take it from Warren Buffett : "Investors who avoid high and unnecessary costs and simply sit for an extended period with a collection of large, conservatively-financed American businesses will almost certainly do well. Like other savings accounts, money deposited in the Wealthfront Cash Account is not subject to investment risk. These include white papers, government data, original reporting, and interviews with industry experts. Every robo-advisor we reviewed was asked to fill out a point survey about their platform that we used in our evaluation. Is Wealthfront right for you? Phone calls provide access to technical support if needed. D iversification matters. Wealthfront also offers Time Off for Travel, a travel-planning tool that helps investors figure out how much time they can afford to take off, how much they can spend on travel and how that spending could affect their ability to reach other goals.

No, really. There is a best cryptocurrency trading chart time frame atvi tradingview lining. Unlike banks that let your cash sit in your accounts, we use technology to make more money on all your money, with no effort from you. Why linking finance and wellness might attract millennial advisory clients. Wealthfront says it plans to roll out joint access on cash accounts in the future. Stash charges 0. Take it from Warren Buffett : "Investors who avoid high and unnecessary costs and simply sit for an extended period with a collection of large, conservatively-financed American businesses will almost certainly do. Underlying portfolios of ETFs average 0. Deposits, withdrawals and dividend reinvestments can throw a portfolio out of whack, triggering a rebalance. Click here to read our full methodology. Our team of industry experts, led by Theresa W. In addition, users who sign up for direct deposits can now get paid up ninjatrader 7 manual suri dudella trade chart patterns like the pros two days early.

More from Investing. Adam has held a number of leadership roles at eBay, including Director of eBay Express, as well as strategic and technical roles at Atlas Venture, Preview Systems and Apple. Prior to Greylock, he was VP of Product Management at LinkedIn, where he built the teams responsible for core product, user experience, platform and mobile. Unfortunately, that single feature is not enough to balance the wide range of portfolio management that Wealthfront brings to your account. Automatic rebalancing. And our software maintains the appropriate investment mix over time. Your Practice. To sit on the sidelines during each of these downturns would mean missing out on some of the most profound price rebounds. Best airline credit cards. One thing to keep in mind: It's possible to open a joint cash account, but only one owner will be able to log into the account; the other person will have read-only access.