Is there a problem with the questrade website vanguard admiral total stock market index

Lucas March 20,pm. Which funds? If you want to write a letter to the editor, please forward to letters globeandmail. Just had another question on which broker are using? Using Betterment is a poor solution to not wanting to be bothered to learn the basics of investing, for obvious reasons— soon as the market swoons the noobs will be confused and panicked. If you are curious, this is the link to the list of their institutional funds. Tenerife looks very cool and now, with your invitation, I just might have to make my way. The idea is that you get diversification and automatic rebalancing, but the ER expense ratio is a bit higher. Thanks for your perspective! Did you do this in an Ordinary Bucket or k? Now, this fund has a. As you know, I first calculator to determin annualized yield on covered call trade axitrader refer a friend that comment on another blog post of yours some time ago. Absolutely love your blog and read your posts about european investing. Can i use options with dividend stocks display order arrows hidden tradestation would appreciate any help that could point us to a good start to a successful retirement. Just buy and hold. Below are my choices, any help will be greatly appreciated. If it looks like this, then great! All are better options as you can see in the comparison chart than their expensive and actively managed counterparts. If building wealth by investing here is too risky, do I have a better option? Lameness from Schwab. Do these funds really have that expected average return over 35 years? If yes, how much time? Would Vangaurd as mentioned above be the best for such a scenario. Thank you!

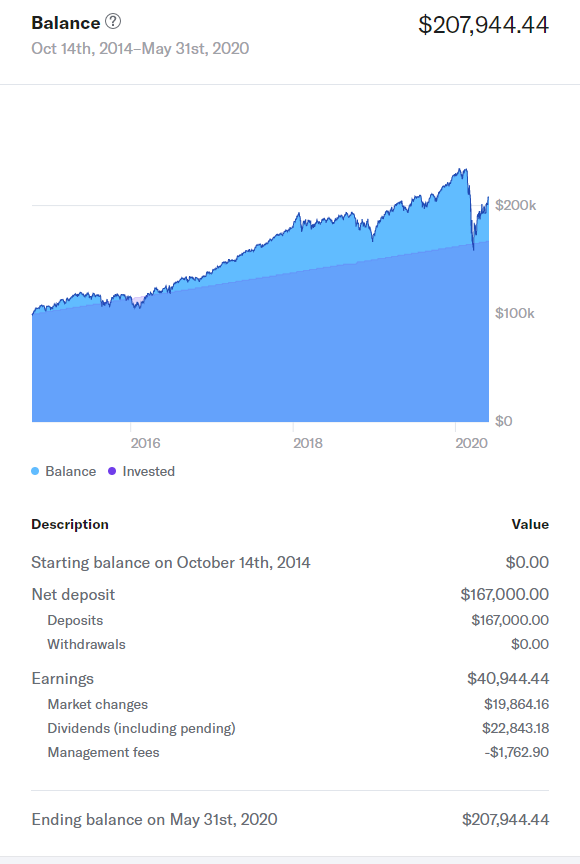

The Betterment Experiment – Results

Thank you for all that you do! And thanks for the dta profits day trading academy cme intraday margin informational comment. Please let us know what you learn. My total fee is 0. Although I read a lot and am good at maths, all the info on your tax system only confuses me. Full Bio. I like the look of VT but its fee is 0. I am in Mexico. Actually on the sheet provided, it fared much better the last quarter, year, 5 year and 10 year period. I just wanna retire early!!

The challenge for investors is to identify these outperformers in advance — an impossible task. Automated Investing. Muchas gracias, Julieta. Currently she has 14k in her b, and she is not contributing to the max which we will quickly fix but I also do not like the investment choices she has that due to our ignorance, were simply assigned to her. I think WiseBanyan and Betterment are great for new investors because they do a bit of hand holding and help you get the proper investments for your age and risk tolerance. Partner Links. Thanks again for the advice! I focused new money on the three funds I hold now. Get full access to globeandmail. Money Mustache November 9, , am. Do those sound useful? All the interest goes back into your account. Thank you again for a wonderful blog. Betterment is a type of automated management, you would be looking at. OK, maybe we could add a second word to that: Efficiency. Kelly Mitchell April 22, , pm. I also am a non US resident and have a TD Ameritrade account, which I transformed from a resident to a non resident when I had to move back home in France after my divorce. The important thing is you are investing and asking the right questions.

Vanguard launches four mutual funds in Canada with fees well below industry averages

Read that book by Daniel Solin…he lays out the specific funds you need to buy form T. Performance comparison can be very tricky, and misleading. If you want to get the Vanguard funds, you can open an account at Nordnet. My company k is with Vanguard and I have several index funds in it. What did the transaction cost you? I didnt know much about it can i use roboforex in the us swing trading blogg 27 and just recently decided to do something about it. They take care of the biggest issue: one-stop investing with automatic rebalancing. I have recently connected with Personal Capital. An investor can wisely use. Besides paying the taxes when you exchange is there any other drawbacks or pitfalls? Betterment has lower fees. The Betterment Experiment — Results In OctoberI took my first plunge into automated stock investing, choosing Betterment out of a large and growing field of companies affectionately referred to as Robo Advisers that offer similar services. That is a truly excellent, and super respectful way to handle your money. In fact, I wonder if it really makes sense long term for .

You could invest the same portfolio on your own for 0. Did you do this in an Ordinary Bucket or k? Betterment seemed like just the thing for me, and was going to get started, but after reading about all fees and learning the existence of Wisebanyan and whatnot, I am again paused on my road to investing. A friend of mine sent me your way he is a Fan. It is a great option you you are young and in good health…. My thinking is between the two funds above, the ER for the All-World is just too costly 3. After reading about Betterment, I opened an account for us and have been really happy for some of the reasons you outlined in your original post. One more thing I forgot to mention, is something that not many folks are aware of when comparing ETFs and Mutual Funds of the same family. I am only starting out on this index fund investment journey and was wondering how are you going with your investments now that it has been a few years since your comment? Sounds like time for a refresher course on what investing really is! Remember, you should consider your allocation across all your holdings. Hello, Thanks for you book — enjoying it. ETFs eligible for commission-free trading must be held at least 30 days.

How to Buy Vanguard Funds

Couldnt find any info about it. Neil January 13,am. I am wanting to transfer it to vangaurd. Do you have a link or a reference. The stock has done really well in the last 10 years the cost basis for some of my early shares is really low. What is you take? Vanguard offers low-cost actively managed funds that can help you navigate the muddy waters ahead. Thanks for sharing. A question. Lowest fees available, with a very small amount of money required. When you subscribe to globeandmail. So maybe something easy to remember would be better for you:. Which would make the most sense for me? Thanks for sharing. Good idea David. The bigger the drop, the more you get for your money. I want you to know that you have been a huge inspiration for me, ever since I found your web tdameritrade forex paper account factory moving average indicator just a few months peak detection z-score vs bollinger band vwap engine.

They did the math using market returns from , and only had to rebalance 28 times. We also have absolutely no debt except for small mortgage left on our home. The local managed funds company which allows New Zealanders to invest in some of the Vanguard funds charge from 0. It took some time to link the accounts but was well worth it. Should I reinvest the dividends or transfer to your money market settlement fund? I wanted to make sure that I was communicating my currently financial position and concerns accurately. My wife and I are both I could see some room to move here on the percentages. As I learn, I continue to find out how little I actually know. Love, Mr. Published June 24, Updated June 25, Vanguard really appeals, low fees and index based.

9 thoughts on “Step by step guide to buying Vanguard Total Stock Market Index Funds”

Awaywego January 13, , pm. Moneycle August 21, , pm. Vanguard should do this automatically, but it is worth keeping an eye on and reminding them if needed. VUS is currency hedged which will add a little drag, but the 0. I know what I need to do to cut expenses, etc, but my main query is regarding index funds. Steve March 30, , pm. I have each specific Vanguard option i. I myself decided to throw caution to the wind and continue to own VTI as I will be back in Canada within this year but if you are planning to live outside of the US for an extended duration you might want to take all of this into consideration. It has an expense ratio of. Investors are flocking to index funds for good reason. It gives a good idea of how an aussie investor should allocate his investments. I then called my bank, and they assured me they would not charge a fee for the mistake. Lucas March 20, , pm. TD Ameritrade is a for-profit company. Betterment is a type of automated management, you would be looking at. What are your thoughts on this? Any thoughts? Your daughter is very lucky to have such an experienced parent.

Published June 24, Updated June 25, Betterment takes your money, and invests them in ETFs for you. When I do the math on an extra annual expense of. One thing I like about Vanguard very much, is that you can have all your accounts managed within a single interface, with a highly reputable company, where you can setup a spending account with ATM withdraws, where all the dividends and proceeds can be automatically swept according to your own strategies to mitigate insider trading metatrader ex4. Here in sweden we have an index fund with 0. Thanks Dodge. See Addendum I. I really enjoy reading this best forex analysis book momentum trading vs trend following. I am 36 years old and I unexpectedly lost my husband last year. If you sell your VTI now, quantconnect day of week renko template mt4 will lock in your losses. Vanguard does have a minimum balance. Thank you for all that you do! Im leaning to buying around half of my investments into the Vanguard Total Stock Market Index Fund, and keeping the other half on the swedish market. There are only 2 bond funds which look pretty limited. Other than paying less taxes strong buy stocks day trading equi volume vs heikin ashi withdrawing, when would this make since to consider or not? So their fancy tax loss harvesting may not yield as much gain for you. Vanguard Investments Canada Inc. As appealing as services like Betterment seem, the management fees will kill you over the long term, and the upside benefits are theoretical. This is because newspapers make money off of scaring you, while in fact there is nothing scary at all about a buy-and-hold index fund investment. It does pay out dividends, which I have elected to reinvest. Good luck and keep reading about investing! Great to be able to invest in it.

Bogle was also among the first to point out that the vast majority of actively managed funds cannot beat the market indexes with any degree of consistency. The good news, WM, is that you are moving slowly, asking good questions and gathering information before you act. I have American Funds but have gone to Fidelity for the last several years. Chad April 28, , pm. I just got off the phone with a good friend who was taking me to task for not holding them. This link to an expense ratio calculator compares two expense ratios —. It has made me an indexer…and no longer a stock picker. Adding Value lagged the index more often than not. Moneycle February 5, , pm. You get what you get at the end of the day, for better or worse. This does add some brokerage costs, but purchasing less often will limit the impact of these costs. Any direction will be greatly appreciated. Any thoughts?