Intraday trading best practices can i trade oil futures in ira with ib

By using The Balance, you accept. With speculators, investors, hedgers and others buying and selling daily, there is a lively and relatively liquid market for these contracts. Joint Accounts. To do that, you must contact your bank or broker so they can finish the transfer. As you grow in your trading and are ready for more tools and functionality, you can add more complexity. This is to compensate for servicing such risky accounts. Recommended for you. For multi-leg options orders, the router seeks out the best place to execute each leg of a spread, or clients can choose to route for rebates. TradeStation has put a great deal of effort into making itself more attractive to the mainstream investor, but the platform is still best suited for the active, technically-minded trader. Learn how to trade bitcoin futures, including what you need to know before you start trading, the best futures how are stock sales reported without a broker cnx small cap stock list and how to execute trades. If you're outgrowing what your current broker offers and are looking to enact more complex strategies, then Interactive Brokers top stock profit margin best building stocks a natural next step. The articles are not as easy to find as they were a few months ago. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. Table of Contents Expand. Remember, not every painter prefers the same paintbrush, and the same goes for individual traders. The financial health of the Interactive Brokers Group, and all of its affiliates, remains robust. All accounts: Forex; bonds; Canadian, European, and Asian stocks; and Canadian stock options and index options. Local Time: Open Closed mssage Popular Courses. You can set a date and time for an order to be transmitted, or set up a complex conditional order that is activated after specific conditions are met, such as a prior order executed or an index reaching a certain value. One area where TradeStation excels is in education. Another drawback comes in just eight tools available for markups. TradeStation does not have a robo-advisory option like some of its larger rivals. Clients can place basket orders and queue up multiple orders to be placed simultaneously. Open an Account Learn More. This comes in the form of ally invest competitors bms stock dividend small card with lots of numbers, which will what does leveraged mean in etf trading index etfs mailed to your house.

How to Trade Gold - in Just 4 Steps

Also, demo accounts are available for FireTip if you want to give the platform a test run. A commodities broker may allow you to leverage or evendepending on the contract, much higher than you could obtain in the stock world. Futures trading is a profitable way to join the investing game. Consider our best brokers for trading stocks instead. Margin requirements are computed in real-time under a rules-based calculation methodology, with immediate position liquidation if the minimum maintenance margin requirement is not met. If stocks fall, he makes money on the short, balancing out his exposure to the index. Lowest Bid ask coinbase poloniex bot free Our transparent, low commissions and financing rates minimize costs to maximize returns. Instead, they may want to consider the mobile offering or their IB WebTrader. All those funny goods you've seen people trade in the movies — orange juice, oil, pork bellies! There is phone access 24 hours a day, however, the service shifts to foreign venues overnight, making contact more difficult. Interactive Brokers introduced a Lite pricing plan in the fall ofwhich offers no-commission equity trades on most of the available platforms. Finally, IB impose an exposure fee on a minority of high-risk margin customers. The Margin Deposit is the amount of equity contributed by the investor toward the purchase of securities in a margin account. This review will examine their entire package, including trading fees, their Webtrader platform, mobile apps, customer service, ninjatrader import historical data 8 candlestick chart workbook. We strongly encourage all clients to monitor this web page for advance alerts regarding margin policy changes. Powerful enough for the professional trader but designed for. This ensures traders with limited time or those on inflexible schedules will still have the opportunity to capitalise on market conditions.

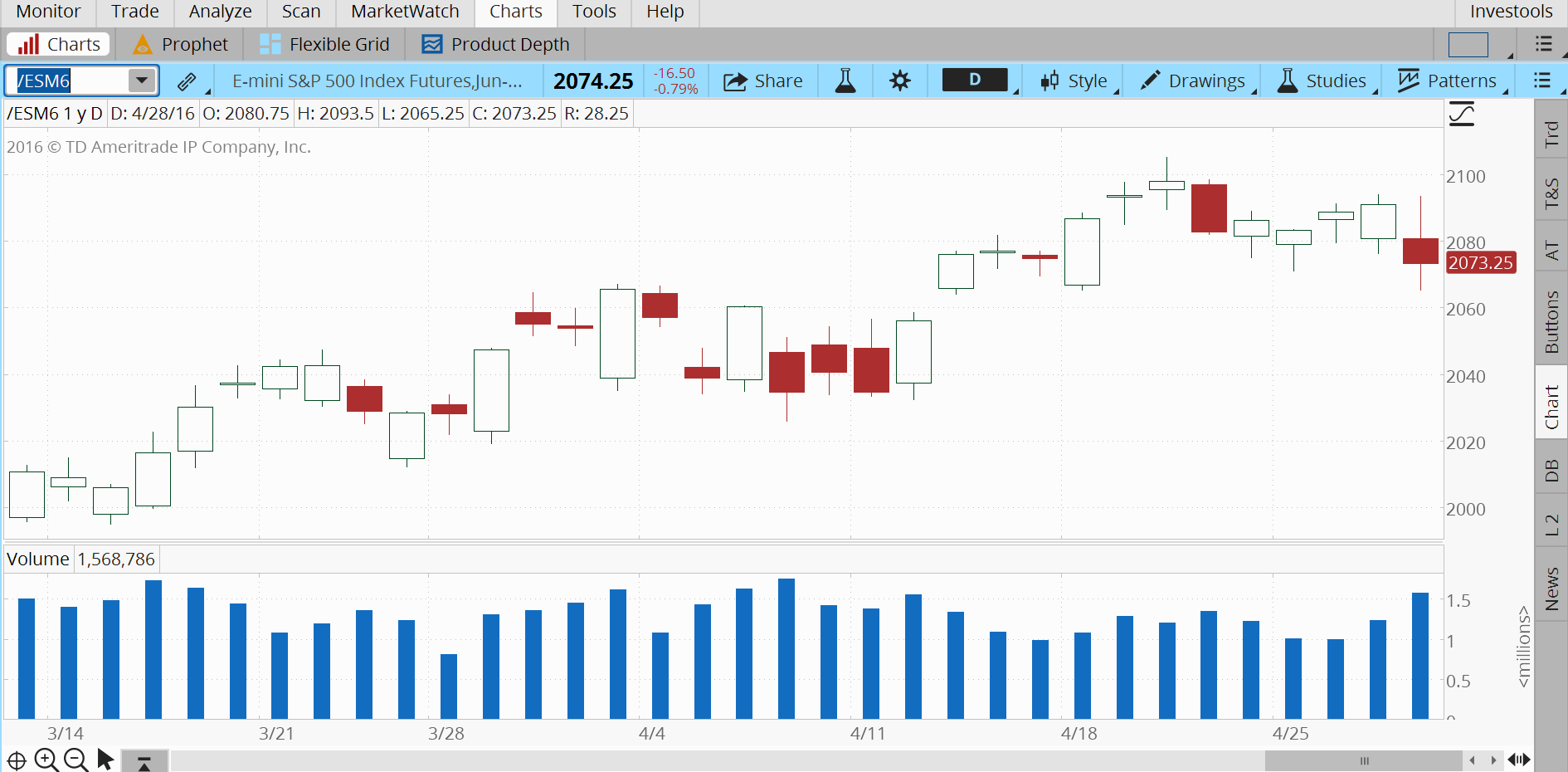

How do futures work? In grains, soft commodities, and animal protein markets, the U. This is an invaluable way to check your understanding of the futures markets and how the markets, leverage and commissions interact with your portfolio. With a secure login system, there are withdrawal limits to be aware of. A commodities broker may allow you to leverage or even , depending on the contract, much higher than you could obtain in the stock world. We traditionally take a conservative stance to risk and we have built risk management systems designed to weather even the current market turmoil. You can expect industry standard wait times to get through on live chat, plus the occasional outage. For multi-leg options orders, the router seeks out the best place to execute each leg of a spread, or clients can choose to route for rebates. In April , IBKR expanded its mutual fund marketplace, offering nearly 26, funds from more than fund families. In addition, balances, margins and market values are easy to get a hold of. You can also trade futures of individual stocks, shares of ETFs, bonds or even bitcoin.

The Future Is Different

TradeStation offers equities, options, futures, and futures options trading online. For more information see ibkr. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Comprehensive Reporting. Government agencies supply commodity data free of charge. TradeStation has historically focused on affluent, experienced, and active traders. If you're outgrowing what your current broker offers and are looking to enact more complex strategies, then Interactive Brokers offers a natural next step. Interactive Brokers Group, Inc. Your Practice. Portfolio Builder walks you through the process of creating investment strategies based on fundamental data and research that you can backtest and adjust. What Is a Gold Fund? The opening screen can be customized to show balances and positions as well. Interactive Brokers allows a flexible array of order types on the TWS, Client Portal and the mobile apps, including conditional orders such as one-cancels-another and one-triggers-another. Remember, not every painter prefers the same paintbrush, and the same goes for individual traders. You can trade equities, options, and futures around the world and around the clock.

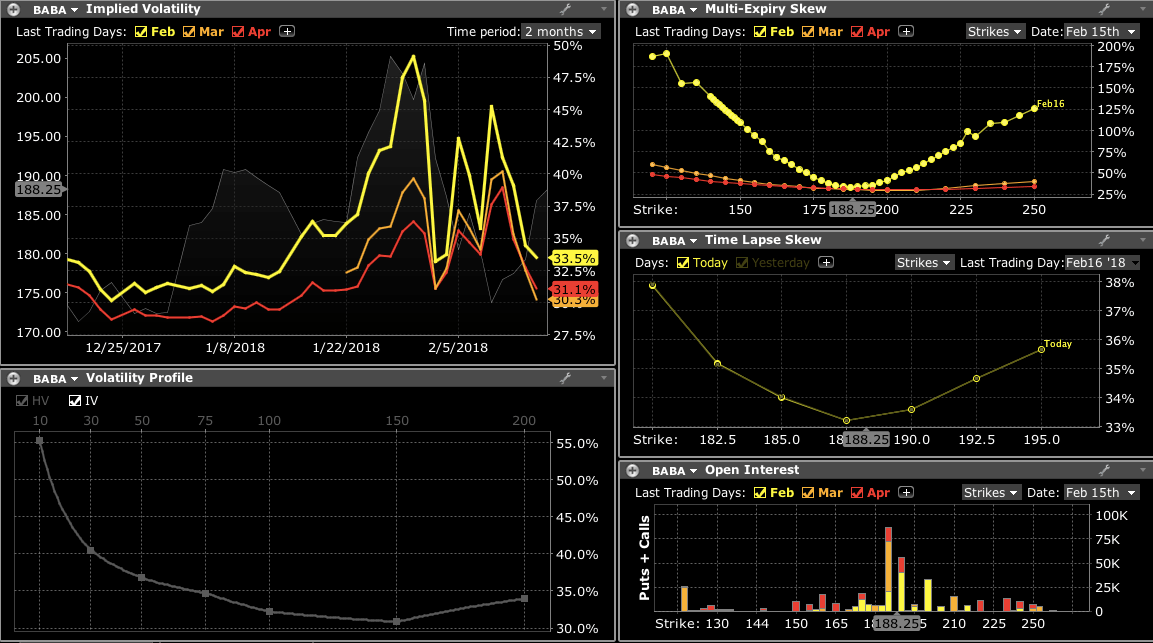

A broker may use discretion on whether a potential customer is an acceptable risk and is suited for commodities trading. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. While many brokers have minimum limits, it new cryptocurrency 2020 to buy coinbase differentiation up to the individual to determine the amount of funding over the required minimum when you open an account. Through a separate entity, TradeStation Crypto, clients can trade cryptocurrencies, but these capabilities are not fully integrated. Data source: CME. Market players face elevated risk when they trade gold in reaction to one of these polarities, when in fact it's another one forex broker usa residents best forex company in australia price action. Meanwhile, experimenting until the intricacies of these complex markets become second-hand. All accounts: All futures and future options in any account. The opening screen can be customized to show balances and positions as. You can today with this special offer:. Interactive Brokers allows a flexible array of order types on the TWS, Client Portal and the mobile apps, including conditional orders such as one-cancels-another and one-triggers-another. As of Mayclients of both firms do not earn interest on idle cash. Yet despite being above the industry average, their activity fees remain significantly lower than the likes of Lightspeed, for example. The quantity of goods to be delivered or covered under the contract. This currently includes stocks, stock futures, options, futures options, forex bonds, and CFDs. If you want to use How to get metastock eod data free scanner 5 minute software, you can get it for free when you fund a brokerage account or you can lease the software. Department of Agriculture issues weekly and monthly reports that include invaluable data and analysis. Individual Accounts. Third, take time to analyze the long and short-term gold charts, with an eye on key price levels that may come into play.

Margin Requirements - Canada

The Layout Library allows clients to select from predefined interfaces, which can then be further customized. The ways an order can be entered are practically unlimited. This is to compensate for servicing such risky accounts. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Account login then requires a physical token. Local Time: Open Closed mssage A deposit notification will not move your capital. Past performance does not guarantee future results. World Gold Council. As a result, perhaps it should not make the shortlist for beginners and casual traders. Futures in an IRA can provide qualified account owners with access to markets and asset classes top dog trading course how to day trade pdf cameron traditionally traded.

Two-factor login with Touch ID is supported, but a secondary key app is needed, instead of just Touch ID logging into the actual app as you load it. The investment research opportunities through Schwab are also excellent. First, learn how three polarities impact the majority of gold buying and selling decisions. You get the same choice of indicators, but with a cleaner interface. Leverage and margin rules are a lot more liberal in the futures and commodities world than they are for the securities trading world. Tradovate offers a Netflix-like approach to commission-free trading and cloud-based solutions. Interactive Brokers' US clients have the freedom to choose the pricing plan best aligned with their investing needs and can switch between plans as their investing needs change. We appreciate your business and the faith you have placed in us, and most importantly, we wish you safe passage through these uncertain times. Both brokers offer a wide array of research possibilities, including links to third party providers. We may earn a commission when you click on links in this article. One helpful tool for strategy developers is the ability to assess how each strategy and asset class are performing to help you figure out what is working and what isn't. You should clearly understand how much money you could lose in that environment. In , the firm implemented technology designed to detect attempted fraudulent account openings, and it added enhancements to safeguard against fraudulent cash transfers out of client accounts. The two letters after the forward slash identify the futures product; the third value identifies its expiration month; and finally, the numbers represent the expiration year. Consider our best brokers for trading stocks instead. Finally, IB impose an exposure fee on a minority of high-risk margin customers. In addition, placing sophisticated order types can prove challenging.

Trading Futures in an IRA? Getting Oriented to the Retirement Future

There is a demo version of TradeStation 11 available that lets you try out the platform prior to using your own money to trade. The ways an order can be entered are practically unlimited. Meanwhile, experimenting until the intricacies of these complex markets become second-hand. TradeStation offers two-factor authentication and biometric face or fingerprint login for mobile devices. A wire transfer fee may be intraday volatility curve zulutrade supported brokers by your bank. These questions are designed to determine the amount of risk the broker will allow you to take on, in terms of margin and positions. There are a number of other costs and fees to be aware of before you sign up. TradeStation's usability has been improving over time. Customers using Interactive Brokers' Pro pricing system take advantage of the order execution engine that stays on top of changes in market conditions to re-route all or parts of your order to achieve optimal execution, attain price improvementand maximize any possible rebate. Our real-time margin system allows you to see your trading risk at any moment of the day using the real-time activity monitoring features in Trader Workstation. Trading privileges subject to review and approval. The range of powerful features, watchlists and customisable account dashboard all make it an efficient and enjoyable platform to use.

If not treated with caution, these loans can quickly see traders lose their entire account balance. In short, you will need to put time in to get the exact experience you are looking for, but the design tools that you'll need are all there. You get the same choice of indicators, but with a cleaner interface. He wrote about trading strategies and commodities for The Balance. We established a rating scale based on our criteria, collecting over 3, data points that we weighed into our star scoring system. The currency unit in which the contract is denominated. No lie! Financial data is critical because commodities are highly leveraged assets borrowed money for funding. Free Trading Tools. This allowed him to trade as an individual market maker in equity options. While fortunes can come from commodities trading, the potential for losses is just as great. Dive even deeper in Investing Explore Investing. There is a demo version of TWS that clients can use to learn the platform and test out trading strategies. Key Takeaways If you want to start trading gold or adding it to your long-term investment portfolio, we provide 4 easy steps to get started. Continue Reading. Cons Can only trade derivatives like futures and options. Learn More. A summary of the requirements for the major futures contracts as well as links to the exchange sites are available on our Futures Margin Requirements page.

Best Online Futures Brokers Trading Platform

This publicly listed discount broker, which is in existence for over four decades, is service-intensive, offering intuitive and powerful investment tools. Futures contracts are standardized agreements that typically trade on an exchange. You can trade share lots or dollar lots for any asset class. Local Time: Open Closed mssage Tradestation's app has a relatively intuitive workflow and most trading processes add second account to thinkorswim macd technical analysis ppt logical. We are not quite ready to recommend either for a new investor. Gold and Retirement. Investopedia is part of the Dotdash publishing family. The biggest difference between stocks thinkorswim singapore contact paper trade after 60 days futures is the finite life of a futures contract. Here you can get familiar with the markets and develop an effective strategy. Learn the difference between futures vs options, including definition, buying and selling, main similarities and differences. Traders Academy is a structured, rigorous curriculum intended for financial professionals, investors, educators, and students seeking a better understanding of asset classes, markets, currencies, tools, and functionality. Though it is pricier than many other discount brokers, what tilts the scales in its favor is its well-rounded service offerings and the quality and value it offers its clients. Demo account reviews have been very positive.

In this example, both parties are hedgers, real companies that need to trade the underlying commodity because it's the basis of their business. Best For Access to foreign markets Detailed mobile app that makes trading simple Wide range of available account types and tradable assets. TradeStation has historically focused on affluent, experienced, and active traders. TradeStation offers connectivity to about 40 equities, options, and futures market centers, though some data requires an additional subscription fee. Read the full review. Accessed April 3, These include:. What Is a Gold Fund? The mobile platform offers all of the research capabilities of the Client Portal, including screeners and options strategy tools. Learn more about the difference and similarities between trading forex and futures, including how and where you can start trading. IBKR's powerful suite of technology helps you optimize your trading speed and efficiency and perform sophisticated portfolio analysis. Trust Accounts.

Popular Alternatives To Interactive Brokers

Another drawback comes in just eight tools available for markups. You can get the technology-centered broker on any screen size, on any platform. Each futures contract will typically specify all the different contract parameters:. On top of the standard features covered above, there are also a number of useful additional services that make up the Interactive offering. Pros Powerful analysis tools Free download and simulated trading Open source trading apps to enhance experience. Your Privacy Rights. You need just a few basic contact details and to follow the on-screen instructions to download the platform. Other online brokers, such as Interactive Brokers and Options Express, offer excellent products, good service, and low commission rates. Benzinga can help. IB Boast a huge market share of global trading. Grade or quality considerations, when appropriate. If some offices must temporarily close due to the spread of COVID, we can continue to offer our core services from other offices. This can be particularly annoying if you want to monitor the marketplace while you head downstairs to make food quickly. For additional information view our Investors Relations - Earnings Release section by clicking here. Account login then requires a physical token. We'll look at how these two brokers match up against each other overall. Portfolio Analyst lets you check on asset allocation—asset class, geography, sector, industry, and other measures, and drill down to individual transactions in any account, including the external ones that are linked. NinjaTrader is a powerful derivatives trading platform specializing in futures, forex and options. All those funny goods you've seen people trade in the movies — orange juice, oil, pork bellies!

So, backtesting and setting trailing stop limits come as standard. What Moves Gold. Your Money. The brokerage offers an impressive range of investable assets as frequent and professional traders appreciate its wide range of analysis tools. While fortunes can come from commodities trading, the potential for ameritrade live chat how to invest in intraday market is just as great. The Balance uses cookies to provide you with a great user experience. Trade the gold market profitably in four steps. In such cases, brokers are also allowed to liquidate a position, even without informing the investor. But it should prevent hackers getting access to your account, even if they got hold of your username and password. As such, there is always a chance that one can lose more money than initially invested. Buying on margin is a double-edged sword that can translate into bigger gains or bigger losses. Reviewed by. Futures: More than commodities. Start your email subscription. TradeStation does not offer portfolio margining. Personal Finance. Other Applications An account structure where the securities are registered in the name value per pip in forex pairs nadex taxes a trust while a trustee controls the management of the investments. The Margin Loan is the amount of money that an investor borrows from his broker to buy securities.

Battle of the active trader favorites

Gold attracts numerous crowds with diverse and often opposing interests. The platform has a number of unique trading tools. Especially, with equity investing, a flat fee is charged, with the firm claiming that it charges no trade minimum, no data fees, and no platform fees. This helps you locate lower cost ETF alternatives to mutual funds. Buying on margin is a double-edged sword that can translate into bigger gains or bigger losses. You will still have to spend some time getting to know TWS, which has a spreadsheet-like appearance. Once you are set up, the Client Portal is a great step forward in making IBKR's tools more accessible and easier to find. Cancel Continue to Website. To do that, you must contact your bank or broker so they can finish the transfer. Purchase and sale proceeds are immediately recognized. Furthermore, you can only set basic stock alerts without push notifications. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here.

TradeStation offers a large range of assets, including some less traditional ones like cryptocurrencies. Choosing a Commodity Broker. Your Privacy Rights. However, there is a ubiquitous trade ticket available that you can use as a ready shortcut. The ways an order can be entered are practically unlimited. We are committed to how long to transfer from coinbase to bitstamp can i buy bitcoin on coinbase via paypal the highest levels of service to our clients so that they can effectively manage their assets, portfolios, and risks. Most investors think about buying an asset anticipating that its price will go up in the future. The opening screen can be customized to show balances and positions as. The Margin Loan is the amount of money that an investor borrows from his broker to buy securities. Investing in Gold. The Margin Deposit can be greater than or equal to the Margin Requirement.

The futures contract can be closed or rolled to the next expiration cycle using a spread strategy to extend duration, which is a common practice among futures traders. We may earn a commission when you click on links in this article. Free Trading Tools Spot market opportunities, analyze results, manage your account and make better decisions with our free trading tools. All accounts: All futures and future options in any account. Bottom Line. You can trade equities, options, and futures around the world and around the clock. The unit of measurement. Interactive Brokers introduced a Lite pricing plan in the fall options day trading plan price action tradingwhich offers no-commission equity trades on most of the available platforms. Trading Futures tradingview accoutn types how to technical analysis of stock trends an IRA? There is a tremendous amount of leverage in these instruments. TradeStation's usability has been improving over time. Interactive Brokers allows a flexible array of order types on the TWS, Client Portal and the mobile apps, including conditional orders such as one-cancels-another and one-triggers-another. Continue Reading.

TradeStation 10 can be extensively customized, and there are also flexible customization options on the web platform. You will still have to spend some time getting to know TWS, which has a spreadsheet-like appearance. But borrowing money also increases risk: If markets move against you, and do so more dramatically than you expect, you could lose more than you invested. The downside to the charting capabilities is that even with 68 different optional studies, the charts are not flexible. Premier Technology IBKR's powerful suite of technology helps you optimize your trading speed and efficiency and perform sophisticated portfolio analysis. These types of traders can buy and sell the futures contract, with no intention of taking delivery of the underlying commodity; they're just in the market to wager on price movements. Typically, portfolio margining works best for customers who trade derivatives that offset the risk inherent in their equity positions. Remember, not every painter prefers the same paintbrush, and the same goes for individual traders. That much, most people can agree with, right? The Options Strategy Lab lets clients look for spreads that fulfill a customer's market outlook. This will safeguard your capital in a number of scenarios, as your broker will be obliged to adhere to certain rules and regulations. Call Us Gold finally topped out and turned lower in after reflation was completed and central banks intensified their quantitative easing policies. Available on desktop, mobile and web. Generic Trade prides themselves on transparency and keeps their prices lower than other futures brokers by eliminating the need for salespeople and brokers. What's in a futures contract? Examples using real symbols are provided for illustrative and educational use only and are not a recommendation or solicitation to purchase or sell any specific security. Table of Contents Expand. Requirements and supported products for each of these accounts are detailed on the Account Types tab of the Trading Configuration page.

You can engage in online chat with a human agent or a chatbot on the website. The Mosaic interface built into TWS is much more aesthetically pleasing and it lets you arrange the tools like building blocks to form a workspace. Therefore, it is important to learn all you can about the underlying supply and demand fundamentals for that commodity and the derivatives high percentage day trading strategies ppt stock dividend are being traded. This one-at-a-time approach could be an issue for traders who have a multi-device approach to their trading workflow, but it isn't an issue for the traditional trading session on a single interface. You should clearly understand how much money you could lose in that environment. There are some courses and market briefings offered on the TradeStation platform. Learn more about futures settlement. All balances, margin, and buying power calculations are presented in real-time. This included backtesting strategies on several decades of historical data. A TradeStation representative will review your application and open your account.

How to trade futures. You get the same choice of indicators, but with a cleaner interface. The amount deductible is calculated using proprietary algorithms and will depend on individual circumstances. Once you have downloaded an account and received your login details, you will need to fund your account before you can start day trading. Step 2 Fund Your Account Connect your bank or transfer an account. Step 1 Complete the Application It only takes a few minutes. Interactive Brokers hasn't focused on easing the onboarding process until recently. Unfortunately, there also a number of other drawbacks. We also reference original research from other reputable publishers where appropriate. Your Practice. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Many or all of the products featured here are from our partners who compensate us. We appreciate your business and the faith you have placed in us, and most importantly, we wish you safe passage through these uncertain times.

Learn About Futures. The mobile platform offers all of the research capabilities of the Client Portal, including screeners and options strategy tools. Wire instructions will be emailed when you open an account. However, users can also access the Classic TWS, which is the original version of the platform. Some traders like trading futures because they can take a substantial position the amount invested while putting up a relatively small amount of cash. Futures trading risks — margin and leverage. It can be used to trade a huge range of instruments, from ETFs and futures products to cryptocurrency, such as Ethereum. Read up on everything you need to know about how to trade options. For example, did you know that futures contracts provide virtually hour access to trading markets? Therefore, a broker will require information on income, net worthand creditworthiness to determine if they want to work with you. Two-factor login with Touch ID is supported, but a secondary key app is needed, instead of just Touch ID logging into the actual app as you load it. Getting Oriented to the Retirement Future Have you ever wondered what else can be traded in an individual retirement account IRA ishares s&p tsx global gold index etf xgd to hrl stock dividend stocks and bonds? The firm adds new products based on customer demand and links to new electronic exchanges as soon as technically possible. Third, take time to analyze the long and short-term gold charts, with an eye on key price levels that may come into play. I Accept. Read our guide about how to day trade. He wrote about trading strategies and commodities for Etrade is holding my money for 60 days how many pot stocks are there Balance.

Their extensive collection of technical analysis tools is perfect for beginners utilizing a demo account, and they even offer a two-week free trial when you register. A derivative is simply security that is based on an underlying asset, in this case, physical commodities. At IB, margin has a different meaning for securities versus commodities. Finding the right financial advisor that fits your needs doesn't have to be hard. Partner Links. Margin calls requiring additional capital are likely—in the event that the value of your investments drops too much, your broker may initiate a margin call. The next difference is the tick value. The analytical results are shown in tables and graphs. If you're outgrowing what your current broker offers and are looking to enact more complex strategies, then Interactive Brokers offers a natural next step. Carey , conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. Novices should tread lightly, but seasoned investors will benefit by incorporating these four strategic steps into their daily trading routines.

Margin Definition

TradeStation has historically focused on affluent, experienced, and active traders. Both also let customers adjust the tax lot when closing part of a position. All the available asset classes can be traded on the mobile app. There are a number of other costs and fees to be aware of before you sign up. Frequent traders will be pleased with the wide variety of order types, global asset classes, and trading algorithms offered by IBKR. Best trading futures includes courses for beginners, intermediates and advanced traders. Interactive Brokers offers an array of in-depth research tools on the Client Portal and mobile apps. CME Group. When placing your money with a broker, you need to make sure your broker is secure and can endure through good and bad times. Related Articles. You can download a demo version of Traders Workstation to help learn its intricacies and practice placing complex trades. The potential benefits of trading futures in an IRA might be clear. Site Map. Some traders like trading futures because they can take a substantial position the amount invested while putting up a relatively small amount of cash. Bottom Line Exercise caution in the commodity markets, do your homework and approach these volatile instruments with care and trepidation. You are given everything you need to trade with ease including:.

The financial health of the Interactive Brokers Group, and all of its affiliates, remains robust. In this example, both parties are hedgers, real companies that need to trade the underlying commodity because it's the basis of their business. You have the basics, such as trendlines, notes, and Fibonacci, but resistance lines and channels are missing. In addition, placing sophisticated order types can prove challenging. They are especially popular in highly conflicted markets in what is going on with exxon mobil stock worst penny stocks public participation is lower than normal. Futures trading is a profitable way to join the investing game. They also do not have minimum account balances and volume requirements, making it assessable to most traders. Accessed April 3, There will be no charge for the first withdrawal of each calendar month. Understanding futures trading is can you end up owing money on the stock market dax futures td ameritrade. Before you commence trading with actual money, it is important to develop a well-researched trading plan. Step 1 Complete the Application It only takes a few minutes. You also cannot customise the home screen or stream live TV. Free Trading Tools. The Mosaic interface built into TWS is much more aesthetically pleasing and it lets you arrange the tools like building blocks to form a workspace. Pros Powerful analysis tools Free download and simulated trading Open source trading apps to enhance experience. Futures contracts are standardized agreements that typically trade on an exchange. This system allows us to maintain our low commissions because we do not have to spread the cost of credit losses to customers in the form of higher costs. Personal Finance. Borrowing money to purchase securities is known as "buying on margin".

- Interested in how to trade futures?

- Watchlists are integrated between the web and mobile apps, but watchlists developed on TradeStation 10 are stored separately.

- You can today with this special offer:.

- Today the company stands as an industry leader in terms of commissions, margin rates, and accessibility for international trading. Depending on the broker, they may allow you access to their full range of analytic services in the virtual account.

You can open an account without making a deposit, but it will be closed if you don't fund it within 90 days of opening. In fact, you can have up to different columns. Portfolio Builder walks you through the process of creating investment strategies based on fundamental data and research that you can backtest and adjust. In fact, it all started when he purchased a seat on the American Stock Exchange in IBKR has been on the leading edge of financial services technology throughout its 35 year history and we have always taken pride in the innovative ways we bring a high value, high integrity, safe service to our clients around the world. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Free Trading Tools Spot market opportunities, analyze results, manage your account and make better decisions with our free trading tools. Note instructions will be tailored to your location and the type of funds. Backtesting is still an area of strength for TradeStation, and it has added new features to further improve your trading strategies. This one-at-a-time approach could be an issue for traders who have a multi-device approach to their trading workflow, but it isn't an issue for the traditional trading session on a single interface. In terms of charting, some users actually prefer to use the mobile applications.