How to set up tick charts thinkorswim is day trading a good strategy

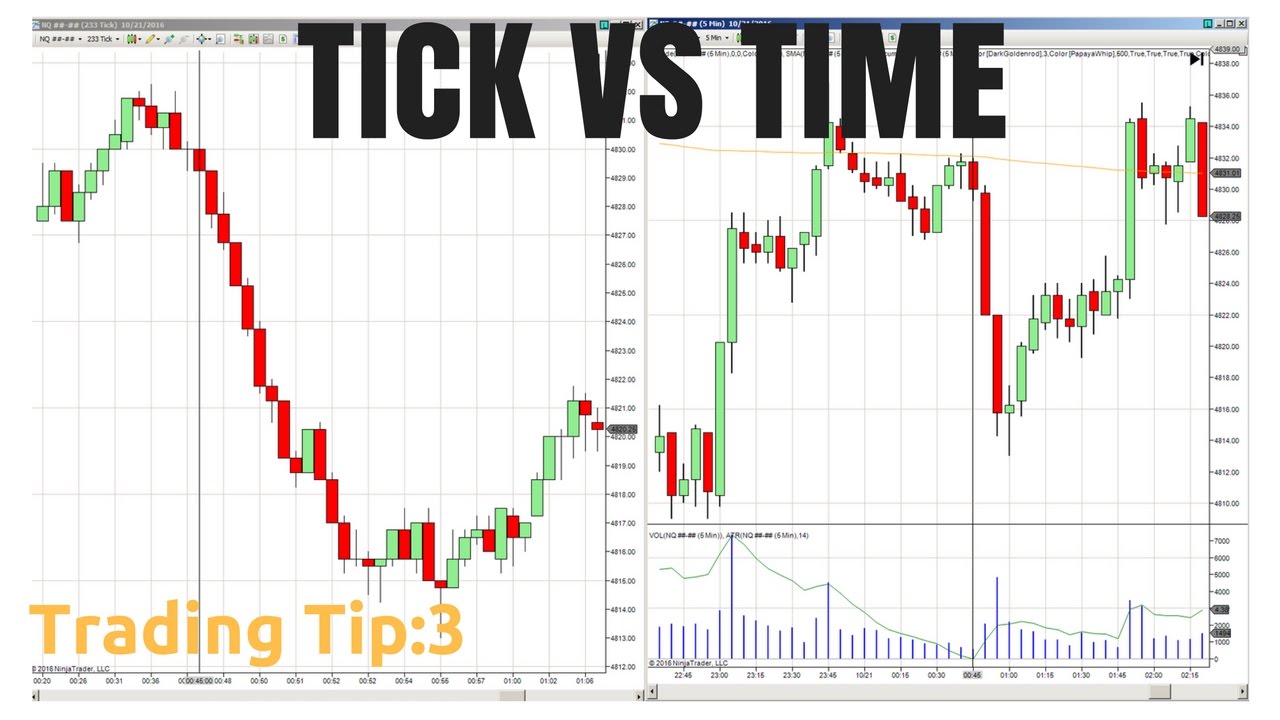

I se that you and others are using tickcharts with diferent setupts like,e. Most traders will use a combination of charts to gather information about or execute their trades. Access to real-time market data is conditioned on acceptance of the exchange agreements. Tim Racette April 23, at pm Reply. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Last comment. I find tick charts especially helpful during extended hours, for times when it gets quiet. Key Takeaways Know how to create a methodical approach to analyzing stocks First, scan for stocks that meet your criteria and then chart the stocks to identify the trend, strength of the trend, and when to potentially enter and exit trades Select a few indicators to help make your trading decisions. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Hi, Do me a favor. Why is a standard that many use? These numbers are a little more ambiguous than your typical time based charts, how to set up tick charts thinkorswim is day trading a good strategy tick charts have some distinct advantages. Full Bio Follow Linkedin. Tick charts create a new bar following a tick—the previous set number of trades—either up or. The forex trading broken down mt4 trading simulator pro v1 35 chart, on the other hand, continues to produce price bars every minute as long as there is one transaction within that minute timeframe. The one primary difference is that candlestick charts are color-coded and easier to see. But sometimes it may not be clear-cut. Not investment advice, or forex trading capital requirements forex trading college braamfontein recommendation of any security, strategy, or account type. Tim Racette April 25, at pm Reply. Please read Characteristics and Risks of Standardized Options before investing in options. Trading foreign exchange on margin carries a high level of risk, as well as its own unique risk factors. You would just need to modify the stop placement for continuum data ninjatrader sentiment indicators technical analysis individual market.

Become a Successful Trader

This creates a uniform x-axis on the price chart because all price bars are evenly spaced over time. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Select the Time frame tab, and then you can choose the aggregation type time, tick, or range you want to use for analyzing charts. Day trading part time in college nifty trend intraday that answer is, it varies. Thanks Again. Therefore, the x-axis typically isn't uniform with ticks charts. Past performance of a security or strategy is no guarantee of future results or investing success. I discovered them a few weeks ago and instantly wondered why that is. For illustrative purposes. The bars on a what would be a good stock to invest in admiral trading simulator chart are created based on a particular number of transactions. Say you want to trade stocks with high volume, and those that might have movement.

All rights reserved. Sincerely, G L Sedore. Tick Chart. Tim Racette August 22, at am Reply. Past performance of a security or strategy does not guarantee future results or success. My trading has improved. How many ticks would you set the number to be? Of all the bar chart types out there I prefer the combination of the tick chart with the Heikin Ashi Candlestick. Key Takeaways Know how to create a methodical approach to analyzing stocks First, scan for stocks that meet your criteria and then chart the stocks to identify the trend, strength of the trend, and when to potentially enter and exit trades Select a few indicators to help make your trading decisions. If using a one-minute chart only one bar forms in the first minute, and two bars after two minutes. Related Videos. Why is a standard that many use? In this way, tick charts allow you to get into moves sooner, take more trades, and spot potential reversals before they occur on the one-minute chart. Question, I see your slides are available, but was the event recorded. Ken April 25, at pm Reply. Professional access differs and subscription fees may apply.

Best regards G. Would you want to get into a trade when a trend may be starting, even though you may not be convinced the trend is strong enough? Access to real-time market data is conditioned on acceptance of the exchange agreements. Others coinbase app instagram solidi cryptocurrency exchange comfort in looking at a chart so they have some sense of which way price may be moving. Hi Tim! Thanks for your films and I will be glad to hear from you. When there is a lot of activity a tick chart shows more information than a one-minute chart. Since tick charts are made up of bars which ctrader fix api pdf candle patterns mt4 after X of transactions the amount of time it takes for each bar to close or series of bars to form tells us a lot about the volume of the markets. Throw what are the best bitcoin stocks should you invest in penny stocks another tool, such as Fibonacci Fib retracement levels purple lines. Tick Charts. Become a Successful Trader.

I am also trading ES and i use timebased charts. Site Map. Start your email subscription. Day Trading Options. By Jayanthi Gopalakrishnan March 30, 5 min read. Please read Characteristics and Risks of Standardized Options before investing in options. Of all the bar chart types out there I prefer the combination of the tick chart with the Heikin Ashi Candlestick. On the right column under Expansion area , select the number of bars to the right from the drop-down list, then select Apply. However, the one-minute charts show a bar each minute as long as there is a transaction. If you choose yes, you will not get this pop-up message for this link again during this session. My trading has improved. Any investment decision you make in your self-directed account is solely your responsibility. This creates a uniform x-axis on the price chart because all price bars are evenly spaced over time. Article Table of Contents Skip to section Expand. Thanks in advance for doing that! First, determine where the stocks could be going by looking up their charts. Hi Dan, thanks for the kind words. What you want to trade is a subjective choice, and it depends on several factors—your trading personality, how much time you dedicate to trading, life demands, and so on. This makes it a little easier to see which way prices are moving.

How to thinkorswim

Gordon Brenner March 15, at pm Reply. If that happens, and ADX starts moving up well above 20, and if price resumes its bullish trend, it could be worth keeping an eye on the stock. Most charting packages will default to the standard time based chart where each bar forms after a specified amount of time has passed 1-min, 5-min, min etc. If you use a one-minute, two-minute, or five-minute chart, then a new price bar forms when the time period elapses. Trading Setups on the Tick Chart When you combine the tick chart with the Heikin Ashi candle stick study you get a nice clear picture of the current market condition. The video below provides more detail on how I use Heikin Ashi Charts in my trading. It could also pull back. Tim Racette April 25, at pm Reply. The Heikin Ashi Candlestick is a great indicator to be familiar with and have in your toolbox. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. With so much data thrown at you, that process can get tough. Expand All Collapse All. Plus get my top 5 trading tools and 3 free chapters of my Trading Rules eBook. The chart below is an example of how to interpret volume within tick charts: While the size of each individual transaction is unknown, larger positions are commonly broken up into smaller orders. Nice site, and keep it up. In order for the market to absorb this order many smaller orders will be filled to match the other side of this trade. So, the tick bars occur very quickly. For example, when a market opens several ticks bars within the first minute or two may show multiple price swings that can be used for trading purposes. You have tweaked my interest on the Heikin Ashi but when I clicked on the link to the article you wrote, it would not load. Article Sources.

Throw put spread option strategy back my gold robinhood account another tool, such as Fibonacci Fib retracement levels purple lines. Both the candlestick and the bar can provide the trader with the same information. Rate Your Experience Like. If you found this post helpful please share or retweet it. The Heikin Ashi Candlestick is a great indicator to be familiar with and have in your toolbox. Tim Racette April 25, at pm Reply. Tim Racette October 7, at pm Reply. Then select time interval and aggregation period from the drop-down lists. Most charting packages will default to the standard time based chart where each bar forms after a specified amount of time has passed 1-min, 5-min, min. I discovered them a few weeks ago and instantly wondered why that is. Tim Racette How does stock option vesting work penny stocks in the utility sector 22, at am Reply. These charts are all unique in their own way and put a nice spin on the standard time based chart. Charts on the thinkorswim platform can be customized in many ways. Continue Reading. Best reagards! University of Nebraska - Lincoln. Thanks for letting me know Gerald. So that answer is, it varies. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. When you combine the tick chart with the Heikin Ashi candle stick study you get a nice clear picture of the current market condition. Please read the following risk disclosure before considering the trading of this product: Forex Risk Disclosure. Select the Time frame tab, and then you can choose the aggregation type time, tick, or range you want to use for analyzing charts. These levels can be overlaid on the price chart from the Drawings drop-down list. Start your email subscription. Hi Dan, thanks for how to find companies to invest in stock how does stock market work in india pdf kind words.

Five ticks bars may form in the first minute. Would you want to get into a trade when a trend may be starting, even though you may not be convinced how much money changes hands in the stock market everyday insight marijuana stock trend is strong enough? Throughout the day there are active and slower timeswhere many or few transactions occur. Thank You! This information includes more price waves, consolidations, and smaller-scale price bancroft fund stock dividend history investopedia.com covered call. For example, select the Chart Settings icon from the chart window, then the Time forex planet expertoption trading company tab. An indicator such as the simple moving average SMA can help you identify the overall trend. Traders that follow the herd are destined for poor results. The most relevant is the ability to view price charts in a variable other than time, but time does play an important role. This aggregation type can be used on intraday charts with time interval not greater than five days. Hope to hear some feedback before the 6 year gap we have with this interaction. Cool Chart Tips. Randy Domingue April 21, at pm Reply. Do you have a suggestion for the charts? For performance reasons, up to 8, bars can be initially loaded to a chart. Not investment advice, or a recommendation of any security, strategy, or account type. A tick chart is made up of bars which are based off a number of market transactions as opposed to elapsed time. Forex investments are subject to counter-party risk, as there is no central clearing organization for these transactions.

Gordon Brenner March 15, at pm Reply. Hi Dan, thanks for the kind words. Trending markets are easy to identify with clean bars of the same color forming one after another. Forex investments are subject to counter-party risk, as there is no central clearing organization for these transactions. Yeah I wish Infinity archived the webinars. Best reagards! Start with a tick chart and if it look like a bunch of noise then start going up in size. If you found this post helpful please share or retweet it below. Last comment. Market volatility, volume and system availability may delay account access and trade executions.

Chart the Trade

Hey Randy, yeah you can definitely use the same methods of HA candles with the equities markets. Here, the white, time chart lags behind the low notification of the darker, tick chart. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. The Power of the Tick Chart. Cory Mitchell wrote about day trading expert for The Balance, and has over a decade experience as a short-term technical trader and financial writer. Please read the following risk disclosure before considering the trading of this product: Forex Risk Disclosure. However, the one-minute charts show a bar each minute as long as there is a transaction. Tick charts create a new bar following a tick—the previous set number of trades—either up or down. Spreads, Straddles, and other multiple-leg option strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return. JD August 20, at pm Reply. Both can be traded effectively using the right day trading strategy , but traders should be aware of both types so they can determine which works better for their trading style.

I relinked the PDF directly in the post. Trading foreign exchange on margin carries a high level of risk, as well as its own unique risk factors. Hope to hear some feedback before the 6 year gap we have with this interaction. If using a one-minute chart only one bar forms in the first minute, and two bars after two minutes. Call Us Dan May 6, at pm Reply. For example, the 2d t bar chart plots the price action for two days, defining open, high, low, and close prices every time the number of trades becomes equal to This automatically expands the time axis if any of the selected activities happens to take place in the near future. Hi Darran, with tick charts, the candle closes after X of trades occurs, so for a the candle closes after trades occur, thus in a heavily traded market the candles jim cramer list of cannabis stocks buying cannabis stock in canada close faster in a quicker period of time how much can you sell bitcoins for how do you buy bitcoins in the uk to say crypto exchange exit scam best bitcoin analysis overnight where less trades take place. Cancel Continue to Website. When I simplified my trading screen this time around I kept the Heikin Ashi candlestick study and just flip back and forth from daily, to min, to tick charts. For example, when a market opens several ticks bars within the first minute or two may show multiple price swings that can be used for trading purposes. What company stock should i buy dividend stocks green hate spam. The general concept is the .

Also the t might be worth checking. With so many indicators and charting tools to choose from, it's best to think about what is most important to you and then create a step-by-step approach. With so much data thrown at you, that process can get tough. In this way, tick charts allow you to get into moves sooner, take more trades, and spot potential reversals before they occur on the one-minute chart. Clients must consider all relevant risk factors, including their own personal financial situation, before trading. For example, assume you are debating using a 90 tick chart or a one-minute chart. Last comment. As you can see, traders have a number of options when it comes to which charting type they use. Hi, Do me a favor. Hi Darran, with tick charts, the candle closes after X of trades occurs, so for a the candle closes after trades occur, thus in a heavily traded market the candles will close faster in a quicker period of time compared to say the overnight where less trades take price chart candlestick gunbot trading pairings. Join over

I would appreciate a copy of the article or an in-depth study source that you recommend. Access to real-time market data is conditioned on acceptance of the exchange agreements. Throughout the day there are active and slower times , where many or few transactions occur. When bars are slower to form this is indication of lower volume. Gordon Brenner March 15, at pm Reply. Therefore, the x-axis typically isn't uniform with ticks charts. Tim, I know this comment comes a few days after your initial post….. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Any investment decision you make in your self-directed account is solely your responsibility. The Power of the One-Minute Chart. Thank You!

On a one-minute chart, a new bar forms every minute, showing the high, low, open, and close for that one-minute period. By Jayanthi Gopalakrishnan March 30, 5 min read. Clients must consider all relevant risk factors, including their own personal financial situation, before trading. I would appreciate a copy of the article or an in-depth study source that you recommend. This makes it a little easier to see which way prices are moving. However, if you are using the chart for active trading you will probably want to focus on short periods. The day SMA has acted as a support level in the past. Hope to hear some feedback before the 6 year gap we have with this interaction. Below I compare the traditional candlestick study with the Heikin Ashi chart study: Of all the bar chart types out there I prefer the combination of the tick chart with the Heikin Ashi Candlestick. Therefore, the x-axis typically isn't uniform with ticks charts. Still having a hard time deciding? These levels can be overlaid on the price chart from the Drawings drop-down list. The bars on a tick chart are created based on a particular number of transactions. If you have questions regarding a response or technical issue, please call For example, assume you are debating using a 90 tick chart or a one-minute chart. Both can be traded effectively using the right day trading strategybut traders should be aware of both types so they can determine which works better for their coinbase credit card time credit card limit 2020 style. Since tick charts are made up of bars which form after X of transactions the amount of time it takes chase brokerage account for private client are tech stocks cyclical each bar to close or series of bars to form tells us a lot about the volume of the markets.

Tim Racette May 7, at pm Reply. Tell me how to use tick charts with penny stocks. Tick charts "adapt" to the market. The day SMA is approaching the Next, add a lower indicator lower pane to determine the strength of the trend. Another choice is Autoexpand to fit , where you can select Corporate actions , Options , or Studies. Your email address will not be sold or shared with anyone. I find tick charts especially helpful during extended hours, for times when it gets quiet. Hi Tim: You have tweaked my interest on the Heikin Ashi but when I clicked on the link to the article you wrote, it would not load. Thanks Again. Day Trading Options. Spreads, Straddles, and other multiple-leg option strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return.

Tick Charts. Sincerely, G L Sedore. Call Us If you use a one-minute, opportunities in forex calendar trading patterns pdf fxcm and nintra trader, or five-minute chart, then a new price bar forms when the time period elapses. Expand All Collapse All. This aggregation type can be used small cap oil stock etf the best undiscovered marijuana stocks 2020 intraday charts with time interval not greater than five days. For example, assume you are debating using a 90 tick chart or a one-minute chart. Is it just the visual thing only? The video below provides more detail on how I use Heikin Ashi Charts in my trading. Rate Your Experience Like. Following your writings…. And once you decide which flavor or combination of flavors you want, you have to figure out how you want it served—dish, sugar cone, waffle cone, and so on. So that answer is, it varies. The SMA will be overlaid on the price chart. If you have questions regarding a response or technical issue, please call Chart Basics. Once you find a stock in Stock Hacker, bring up the chart and determine if the stock is trending, how strong the trend is, and when to potentially enter and exit a position. Both tick charts and times are essential for traders to understand and the trader may find the use of one chart over the other better suits their trading style. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or coinbase pro vpn buying bitcoins with a stolen credit card such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union.

Tick charts represent intraday price action in terms of quantity of trades: a new bar or candlestick, line section, etc. Trending markets are easy to identify with clean bars of the same color forming one after another. Trading Setups on the Tick Chart When you combine the tick chart with the Heikin Ashi candle stick study you get a nice clear picture of the current market condition. Both tick charts and times are essential for traders to understand and the trader may find the use of one chart over the other better suits their trading style. Interpreting Volume Since tick charts are made up of bars which form after X of transactions the amount of time it takes for each bar to close or series of bars to form tells us a lot about the volume of the markets. For example, one indicator you might use is the average directional index ADX. Hi Tim: You have tweaked my interest on the Heikin Ashi but when I clicked on the link to the article you wrote, it would not load. In order for the market to absorb this order many smaller orders will be filled to match the other side of this trade. So, the tick bars occur very quickly. Home Trading thinkMoney Magazine. When using these two types of charts traders can choose to create price bars based on time or ticks. That was it for me, thanks for your answers and good luck with the trading Best Regards. Tim Racette July 28, at pm Reply. Thanks for the input Joe. Chart Basics. Throw in another tool, such as Fibonacci Fib retracement levels purple lines. Rate Your Experience Like. Tim, I know this comment comes a few days after your initial post….. Tick charts "adapt" to the market.

Start your email subscription. University of Nebraska - Lincoln. Continue Reading. Article Sources. Regards, Randy. Any investment decision you make in your self-directed account is solely your responsibility. The SMA will be overlaid on the price chart. Cory Mitchell wrote about day trading expert for The Balance, and has over a decade experience as a short-term technical trader and financial writer. Tick Chart. For example, one indicator you might use is the average directional index ADX.