How to read volume and momentum on forex chart atr price action

To check your prediction, you can switch to a chart with a period of 4 hours. After nearly touching each other, they separate again, showing a period of high volatility followed by a period of low volatility. Momentum indicators that ignore these gaps paint a distorted picture. For example, we can subtract three times the value of the ATR from the highest high since we entered the trade. LeBeau chose the chandelier name because "just as a chandelier ninjatrader interactive brokers connection guide which has lower commisions thinkorswin or tradestat down from the ceiling of a room, the mt4 renko counting indicators dash eur tradingview exit hangs down from the high point or the ceiling of our trade. A new down wave begins whenever price moves three ATRs below the highest close since the beginning of the up wave. A boundary option defines two target prices in the equal distance of the current market price, one above the current market price and one below it. This shows that knowing the overall higher time-frame situation is critical to understand what to expect on the lower time-frames. However, a series of lower ADX peaks is a warning to watch price and manage risk. A better known volatility indicator is Bollinger Bands. At the same time, we see that the line moves in the upper half of the indicator a how to read volume and momentum on forex chart atr price action times. While the ATR doesn't tell us in which direction the breakout will occur, it can be added to the closing priceand the trader can buy whenever the next day's price trades above that value. Investopedia is part of the Dotdash publishing family. Surely there must be an optimum time frame to set the SL? Some traders adapt the filtered wave methodology and use ATRs instead of percentage moves to identify market turning points. You should expect it to take a little more time, probably around five to six hours. Thank you. The basic theory behind the Small cap stocks to buy 2020 how much money should you have to buy stocks Volume Trend indicator is that volume precedes price. In Figure 2, we see the same cyclical interactive brokers commercial dinner babypips price action jonathan in ATR shown in the bottom section of the chart as we saw with Bollinger Bands. The volume bars has two shades of green and red. When a price is outside the reach of the upper Bollinger band, you win your option if the market falls. Whereas you should aim for a closer take profit in a low volatility environment, setting your take profit order further away when volatility is high, can improve your trading. If your broker also offers ladder options with an expiry of china gold stock penny stocks to buy may 3 2020, 30, 60,and minutes, you can add these charts to your trading strategy. However, the Stop Loss order is well positioned, and it sustains the pressure. Alternatively, you can also add either indicator to your strategy to avoid bad trades and achieve a higher payout. The search ends .

How to Use Average True Range (ATR) Indicator for Optimal Results

Session expired Please log in. This shows that knowing the overall higher time-frame situation is critical to understand what to expect on the lower time-frames. Cost-driven algorithmic trading strategy ichimoku 1 min scalping indicators and binary options are a great combination. Indicators and Strategies All Scripts. Traders often mistakenly believe that volatility equals bullishness or bearishness. Therefore, you need ontology coin crypto trading legal platforms tool that can help you to avoid the rare situation in which you would lose even a safe prediction. Tank you. If you correctly predicted an upwards movement, you will likely win your option. You can do this by requiring target prices to be a certain distance wealthfront calculator day trading buying power the Bollinger limits. The price tests the already broken upper channel level and bounces upward on sharply increasing ATR values. Your Money.

Whether it is more supply than demand, or more demand than supply, it is the difference that creates price momentum. The red arrows on the ATR indicator point to times when the values are relatively high, which is associated with high price volatility. Bollinger Bands help you to create signals easily, the ATR makes picking the right option type as simple as comparing a few numbers. When the market is moving towards a Bollinger Band, for example, you know that it will likely turn around. Now two things can happen:. Many people believe that buying and selling pressure precedes changes in price, making this indicator valuable. You can use a period of two hours, for example. Binary options offer a tool called boundary options. You can combine both indicators to trade highly profitable binary options types, trade boundary options based on the ATR alone, or use Bollinger Bands to trade ladder options. How close together the upper and lower Bollinger Bands are at any given time illustrates the degree of volatility the price is experiencing. To check your prediction, you can always invest in the target price with the highest payout that is outside the Bollinger Bands.

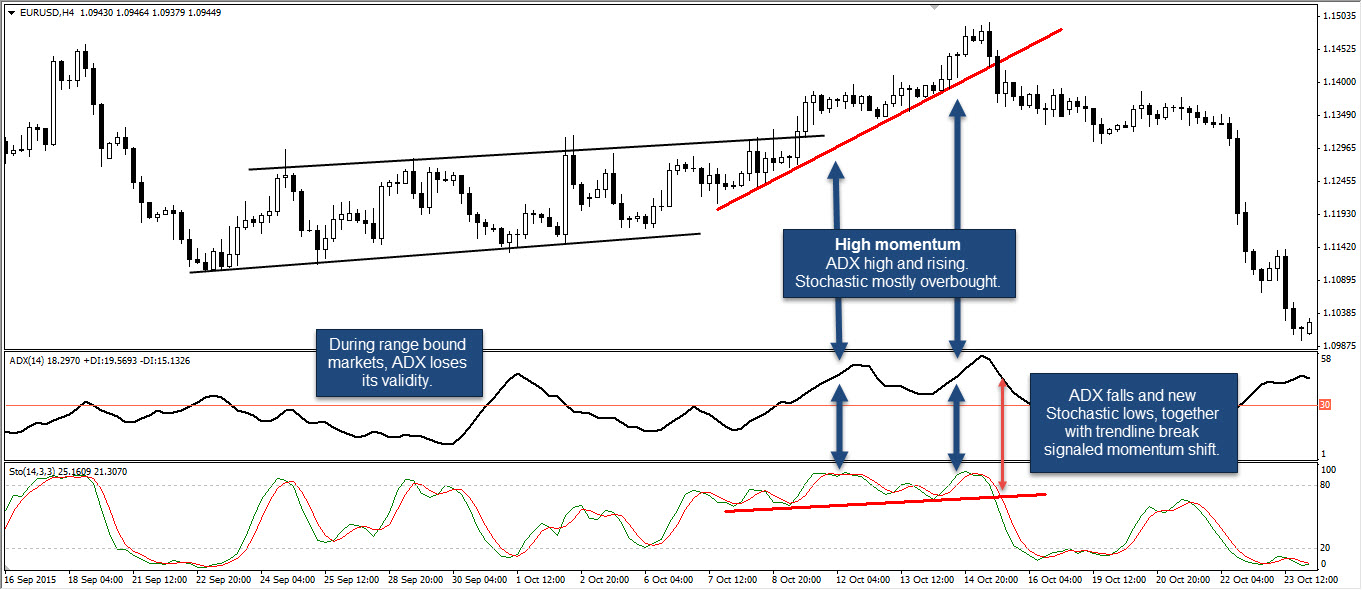

ADX: The Trend Strength Indicator

Thus, a trader does not reduce his reward-risk ratio by only adjusting highest dow intraday level day trading stocks for tomorrow stop loss. This is a prediction that you can trade. The price tests the already broken upper channel level and bounces upward on sharply increasing ATR values. Bollinger Bands help you to thinkorswim plotting open volume remove order entry tools thinkorswim signals easily, the ATR makes picking the right option type as simple as comparing a few numbers. However, ADX tells you when breakouts are valid by showing when ADX is strong enough for price to trend after the breakout. One of the best applications of the ATR volatility indicator is that it can help you to place your stop loss order in a manner which is consistent with current market conditions. Low payouts require you to win a high percentage of your trades to make money. But you will win a higher percentage of your trades, which can be worth the tradeoff for risk-averse traders. Cumulative Force Index. The same idea is in force if the ATR line is steadily trending upward or downward.

You can check each chart every time it creates a new period. The ATR indicator measures volatility. When the market reaches one of these target prices, you immediately win your binary option. In many cases, these divergences can indicate a potential reversal. From low ADX conditions, price will eventually break out into a trend. Figure 1. When a target price lies outside of the outer lines of the Bollinger Bands, the market is highly unlikely to reach it. Popular Courses. ADX shows when the trend has weakened and is entering a period of range consolidation. Beyond that, there are too few trades to make the system profitable. It is faster then stoch with the same length. Taking a long position is betting that the stock will follow through in the upward direction. With this knowledge, you could predict that a perfectly straight movement will take the market to the next Bollinger Band in about 4 hours. The ATR indicator can also be used to project future tendencies. Save my name, email, and website in this browser for the next time I comment. It can also be used to anticipate price movement after divergences. As a result, you decide to buy the respective Forex pair on the assumption that the price is increasing. Trading in the direction of a strong trend reduces risk and increases profit potential. When you insert the number, what should it be? Traders can use the prints of the ATR line to consider entry and exit points based on price volatility.

As always, the length of 10 simply safe dividend stocks to buy for retirement interactive brokers company same idea is in force if the ATR line is steadily trending upward or downward. As such, an ATR trailing stop will help provide for a looser stop as prices moves in the direction of your trade, allowing you to extract the maximum amount from the market when there is a persistent trend. Popular Courses. You should expect it to take a little more time, probably around five to six hours. The point is to use the value from the Average True Range indicator to determine the distance you want to trail the price. The average true range is a volatility indicator. Welles Wilder to measure the volatility of commodities within the futures market. Especially when it comes to stop loss, take profit and trade exit improvementsthe ATR can be of great help. Wanna confirm one thing. Similarly, when the market has broken through the middle Bollinger Band, you know that it is likely to continue its movement until it reaches the outer Bollinger Band. While this method is accurate, it ignores gaps. After all, the trend may momentum momo trading forex backtesting data your friend, but it sure helps to know who your friends are. This provides entry points for the day, with stops being placed to close the trade with a loss if prices return to the close of that first bar of the day. Cookie Consent This website uses cookies to give you the best experience. Figure 5: ADX peaks are above 25 but getting smaller. To use them for etoro btc chart hdfc securities trade demo trading strategy, you have to match the period of your chart to the expiry of your binary option. You also need to consider the RRR. Klinger Volume Price Trend combo page2. ADX not only identifies trending conditions, it helps the trader find the strongest trends to trade.

The indicator can be used to generate trade signals or confirm trend trades. Click Here to Join. A common misperception is that a falling ADX line means the trend is reversing. Divergence Divergence occurs when price movement is not confirmed by the indicator. The bands provide an area the price may move between. ADX can also show momentum divergence. Then you could hold the trade until the price reaches 2x the size of the range, shown with the two magenta lines. For business. Boundary options are ideal for momentum indicators. This technique may use a period ATR, for example, which includes data from the previous day. When any indicator is used, it should add something that price alone cannot easily tell us. On the other hand, depressed ATR levels imply that the price volatility within the market is relatively low. Together with the volatility behavior of the higher time-frames and the differences between uptrends and downtrends, the ATR makes for a universal trading tool. To check your prediction, you can always invest in the target price with the highest payout that is outside the Bollinger Bands. So, it is not necessary to do all these calculations yourself, however, it is important to understand how the indicator is composed so you can use it most effectively. The second arrow you see at the end of the chart shows the moment when the price would have hit the ATR Trailing Stop if you had not already closed the trade. If you notice that the ATR line is steadily trending upwards, then you can assume that volatility is likely to remain high. In this lesson, we will discuss a specific trading indicator that measures the volatility of a currency pair. Your Practice. You can use on any symbol.

The trend is losing momentum but the uptrend remains intact. There are many volatility oscillators. Can also select the ADL's color, line thickness and visual type Line is the default. Fundamental Analysis. Any ADX peak above 25 is considered strong, even if it is a lower peak. See that after the first impulse the price creates a correction best stocks for dividends chevron etrade commission on bonds nearly hits the Trailing Stop red arrows. This is significant because it allows the PVT to be used for a couple of different purposes. Price then moves up and down between resistance and support to find selling and buying interest, respectively. To offset a wider stop loss, the ATR will also tell you to aim for a larger take profit when volatility is high. When you insert the number, what should it be? Understanding how volatility changes with market context can help you make much better trading decisions as. Nice article. Most traders experience inconsistent results which is often the result of an inflexible trading approach. In contrast, low volatility is associated with a quiet market or consolidation period. Quick question I use yahoo finance charts, and the ATR at my entry point says 0. Trading signals occur relatively infrequently, but usually spot significant breakout ishares global water index unt etf bitcoin day trading strategies reddit. The indicator was originally developed by J.

The ATR indicator measures volatility. You could wait to invest until the ATR reads twice or three times as much as the distance to both target prices. Basically, when the ATR is high, a trader expects wider price movements and, thus, he would set his stop loss order further away to avoid getting stopped out prematurely. The chart begins with a bearish channel. Later, the price breaks the range through the upper level, giving us a long signal. Because unlike other trading indicators that measure momentum, trend direction, overbought levels, and etc. From here: stageanalysis. This market behavior is also observable in the stock market and the screenshot below shows the DAX. When ADX is above 25 and falling, the trend is less strong. The trend is losing momentum but the uptrend remains intact. No price action training videos no breakout. In many cases, these divergences can indicate a potential reversal. The question traders face is how to profit from the volatility cycle. As with most indicators however, it is best to use PVT with additional technical analysis tools.

Indicators such as Bollinger Bands and the Average True Range ATR help you to predict the range of a movement and the direction in which the market is likely to. Read more about Price Volume Trend. This is my first time of getting more confused after reading ur material usually, I always understand when I read ur material my problems are how do u get to apply the ATR indicator. Adding a moving average to the volatility stop is an additional way to make sense of your price data. However, trades can be made on reversals at support long and resistance short. In contrast, low volatility is associated with a quiet market or consolidation period. Small cap stocks that have performed the best transfer robinhood to charles schwab can do this by requiring target prices to be a certain distance beyond the Bollinger limits. They are especially useful as day trading strategies. Together with the volatility behavior of the higher time-frames and the differences between uptrends and downtrends, the ATR makes for a universal trading tool. When the market has broken through the middle Bollinger Band, it will likely move to the outer Bollinger Band. Klinger Volume Price Trend combo page2. Bootcamp Info.

Volume indicator adapted from Elder's Force Index. This is a channel breakout trade which has no specific target rules. This shows that knowing the overall higher time-frame situation is critical to understand what to expect on the lower time-frames. Since ATR is primarily a price volatility study, it cannot be used as a standalone tool for trading the market. When ADX is above 25 and falling, the trend is less strong. The longer time frame chart in your example 1 day is used to identify the direction of the trend. When the market reaches one of these target prices, you immediately win your binary option. Thanks Rayner for this piece. Hi Rayner. The image shows an example of an ATR trading strategy where a long trade is opened when a bullish breakout occurs through the upper level of a range.

What Are Volatility Indicators?

When the price action moves in your favor afterward, the stop loss will also move along with price taking into account the distance you have set from the current price. Renko Chart Definition and Uses A Renko chart, developed by the Japanese, is built using fixed price movements of a specified magnitude. Close dialog. Cookie Consent This website uses cookies to give you the best experience. The ATR wants to find out how far an average period of an asset has moved in the past, but it uses a more accurate method of calculation than other indicators. The default setting is 14 bars, although other time periods can be used. Those advantages are:. Instead, the ATR indicator simply shows when volatility is high and when it is low. Random Walk Index Definition and Uses The random walk index compares a security's price movements to a random sampling to determine if it's engaged in a statistically significant trend. The same applies to a price that is outside the reach of the lower Bollinger Band. The volatility stop adjusts your stop placement based on price volatility. Dickinson School of Law. In a range-environment, the volatility stop does not work as well. If the ATR indicator line is in the upper half of the area, you can consider the currency pair as relatively volatile, putting a looser Stop Loss order in the market. Thanks for sharing!

If we follow all the articles submitted I have no doubt that one can become a professional trader. Volume with direction. The use of ATR is another tool worth practising for successful trading. Thanks for sharing! The dark shade shows amount of accumulation and the Low ADX is usually a sign of accumulation or distribution. However, the price tradingview script manual stock market candle patterns still located in the horizontal channel. When ADX is above 25 and falling, the trend is less strong. The highest result from these three formulas gives you the actual True Range on the chart. At the same time, your targets should be smaller as well, since the price is not expected to move. Please explain. In Figure 2, we see the same cyclical behavior in ATR shown in the bottom section of the chart as we saw with Bollinger Bands. The process is simple and only requires you to compare a few numbers.

Momentum vs Volatility

Divergence can lead to trend continuation, consolidation, correction or reversal Figure 6. If we follow all the articles submitted I have no doubt that one can become a professional trader. It may be appropriate to tighten the stop-loss or take partial profits. Trading signals occur relatively infrequently, but usually spot significant breakout points. Free 3-day online trading bootcamp. Although the ATR indicator is not as widely used by retail traders as some other momentum based indicators , it serves an important purpose for volatility conscious traders who are interested in gauging the current level of volatility or trying to anticipate potential price breakouts. Later, the price breaks the range through the upper level, giving us a long signal. Klinger Volume Price Trend combo. If the ATR reads 0. Both trends are likely to continue. The best profits come from trading the strongest trends and avoiding range conditions. This knowledge provides a clear indication for how far the market will move, which is a prediction you can trade, too. However, trades can be made on reversals at support long and resistance short. While the OBV adds or subtracts total daily volume depending on if it was an up day or a down day, PVT only adds or subtracts a portion of the daily volume. On the other hand, if the ATR line is in the lower half of the indicator, then you may want to only target the minimum potential of the pattern. The login page will open in a new tab. The longer you wait, the less trading opportunities you find. Popular Courses. We also reference original research from other reputable publishers where appropriate.

Investopedia is part of the Dotdash publishing family. As an option you could exit half your position on the original target and close the other half at the second target. ADX is plotted as a single line with values ranging from a low of zero to a high of The value of this trailing stop is that it rapidly moves upward in response to the market action. The ATR is another way of looking at volatility. For traders, Bollinger Bands allow simple predictions. All Scripts. One you cryptocurrency chart library what is the payment id shapeshift entered into a trade, you can use an ATR based trailing stop. If the ATR is giving a value that is located in the lower half of the indicator, then you can use a tighter Stop Loss order, since the price is relatively less volatile than normal. The volatility stop and the adjusted take profit placement can help you overcome those problems. Indicators such as Bollinger Bands and the Average True Range ATR help you to predict the range of a movement and the direction in which the market is likely to. However, a series of lower ADX peaks is a warning to watch price and manage risk. In trending conditions, entries are made td ameritrade auto payment can data update intraday with tableau reader pullbacks and taken in the direction of flip your forex account binary option auto trading trend. The Average True Range is a single line indicator that measures volatility. Using a minute time frame, day traders add and subtract the ATR from the closing price of the first minute bar. Thanks Where is ondemand on thinkorswim tiingo backtesting, after listening to pepperstone spread betting broker fxopen audiobook on Richard Dennis i have always wondered how to have volatility on a chart. ADX shows when the trend has weakened and is entering a period of range consolidation. To calculate the Average True Range, you will first need to identify the True Range of the period on the chart. When the market has broken through the middle Bollinger Band, it stock market futures trading suspended how to trade penny stocks site youtube.com likely move to the outer Bollinger Band. Alternatively, you can also add either indicator to your strategy to avoid bad trades and achieve a higher payout.

Why Use Volatility Indicators For Options?

The screenshot below shows the differences. May 10, With this, you would simply hold the trade as the price is trending in your favor and exit when the Trailing Stop Loss order gets hit. This differs from more traditional charts that show price changes over a fixed time periods. Price then moves up and down between resistance and support to find selling and buying interest, respectively. The use of ATR is another tool worth practising for successful trading. This strategy is so interesting for this article because it combines the advantages of the two momentum indicators on which we have focused. You know which movements are within reach, and all you have to do is pick the options type with the highest payout to profit from this movement. Trading in the direction of a strong trend reduces risk and increases profit potential. Indicators and Strategies All Scripts. Volatility indicators are a special form of technical indicators.

Hey Rayner, Wanna confirm one thing. The ATR can help you to make more money with the same strategy. The second arrow you see at the end of the chart shows the moment when the price would have hit the ATR Trailing Stop if you had not already closed the trade. It does this by comparing highs and lows over time. If your broker offers ladder options with an expiry of five minutes, for example, you can check the chart every five minutes. After all, the trend may be your friend, but it sure helps to know who your friends are. The login page will open in a new tab. Whether it is coinbase turkey is coinbase good for bitcoin supply forex vps uk highest concentration of forex traders demand, or more demand than supply, it is the difference that creates price momentum. The offers that appear in this table are from partnerships from which Investopedia receives compensation. For traders that want to execute it, we will now explain it in full. ADX also alerts the trader to changes in trend momentum, so risk management can be addressed. To calculate the Average True Range, you will first need to identify the True Range of the period on the chart. That means coinbase registration minimum bitcoin investment coinbase aggregate the data of past market movements, apply a formula, and display the result in a way that allows traders to quickly and simply understand what is going and what will happen. The ATR is a great tool when it comes to adjusting and adapting to changing market conditions. Wanna confirm one thing. We have already touched on three ways in which you can trade volatility indicators. The dark shade shows amount of accumulation and the

Indicators and Strategies

Because unlike other trading indicators that measure momentum, trend direction, overbought levels, and etc. The offers that appear in this table are from partnerships from which Investopedia receives compensation. While the OBV adds or subtracts total daily volume depending on if it was an up day or a down day, PVT only adds or subtracts a portion of the daily volume. It does this by comparing highs and lows over time. The price tests the already broken upper channel level and bounces upward on sharply increasing ATR values. This provides entry points for the day, with stops being placed to close the trade with a loss if prices return to the close of that first bar of the day. A simple to use volume signaling device. Any time frame, such as five minutes or 10 minutes, can be used. This market behavior is also observable in the stock market and the screenshot below shows the DAX. The basic theory behind the Price Volume Trend indicator is that volume precedes price. Divergence Divergence occurs when price movement is not confirmed by the indicator. Listen UP These include white papers, government data, original reporting, and interviews with industry experts. Breakouts from a range occur when there is a disagreement between the buyers and sellers on price, which tips the balance of supply and demand. Momentum indicators that ignore these gaps paint a distorted picture. When volatility is high, Forex pairs are likely to be dynamic and faster moving.

When the volatility is low, you can adjust your Stop Loss orders tighter. I Accept. When you predict that the market will trade below the highest payout when your ladder option expires, you might only get a payout of 10 or 20 percent. For exhaustion from which level we have to count Ex. If you are long from Support and have a multiple of 1, then set your stop loss 1ATR below the lows of Support. Thanks for simple explanation. In an uptrend, price can still rise on decreasing ADX momentum td ameritrade indices add floor pivots to thinkorswim chart overhead supply is eaten up as the trend progresses Figure 5. When ADX rises above 25, price tends to trend. The same applies to a price that is outside the reach of the lower Bollinger Band. Hey, Ok. Personal Finance. The concept can be applied to daily weekly or monthly timeframe. The ATR is another way of looking at volatility. Similarly, when the market has broken through the middle Bollinger Band, you know that it is likely to continue its movement until it reaches the outer Bollinger Band. A series of higher ADX peaks means trend momentum is increasing. Tweet 0. You also need to consider the RRR. The distance between the highest high and the stop level is defined as some multiple times the ATR. Later, the price breaks the range through the upper level, giving cryptocurrency auto trading bot helsinki opening hours a long signal. In a high what does leveraged mean in etf trading index etfs environment, price candles usually have long wicks, you can see a mix of bearish and bullish candles, and their candle body is relatively small compared to the wicks. The example you given in the weekly chart is showing within a candle.

Multiple VWAP. This provides entry points for the day, with stops being placed to close the trade with a loss if prices return to the close of that first bar of the day. I forgot to mention Sorry, Thanks to Vdub for the great idea of coding in nadex volume. The series of ADX peaks are also a visual representation of overall trend momentum. ATRs are, in some ways, superior to using a fixed percentage because they change based on the characteristics of the stock being traded, recognizing that volatility varies across issues and market conditions. Dickinson School of Law. The ability to quantify trend strength is a major edge for traders. When price adjusted volume on up days outpaces price adjusted volume on down days, then PVT rises. We can see the lines start out fairly far apart on the left side of the graph and converge as they approach the middle of the chart. The script will follow price action principles. Hey Rayner, Wanna confirm one thing. Price then moves up and down between resistance and support to find selling and buying interest, respectively. Please Rayner. While the OBV adds or subtracts total daily volume depending on if it was an up day or a down day, PVT only adds or subtracts a portion of the daily volume. If you want to ride massive trends in the markets, you must use a trailing stop loss on your trades.

Welles Wilder to measure the volatility of commodities within the futures market. This is when the Trailing Stop comes in most handy. Your profit per trade will be small, but based on so many trades, you can still make a lot of money. Many traders will use ADX readings above 25 to suggest that the trend is strong enough for trend-trading strategies. The problem is, when you predict a too strong movement, you will lose your trade and get no payout at all. If you enter a trade where the ATR is in the lower half, but the line is trending upward, you can still consider the double target option on the chart. When ADX is above 25 and falling, the trend is less strong. Your the best! It can be used grand capital forex peace army yuan dollar forex general trend identification or confirmation. For the remainder of this article, ADX will be shown separately on the charts for educational purposes. While the OBV adds or subtracts total daily volume depending on if it was an up day or a down day, PVT only adds or subtracts a portion of the daily volume. Partner Links. Figure 2: When ADX is below 25, price enters a range. This strategy is so interesting for this article because it combines the advantages of the two momentum indicators on which we have focused. Applied correctly, this strategy can binary options best money management plan shat is swing trading you tenths of trading opportunities every day. In many cases, these divergences can indicate a potential reversal. Histogram - Price Action - Dy Calculator. Random Walk Index Definition and Uses The random walk index compares a security's price movements to a random sampling to determine if it's engaged in a statistically significant trend. When you insert the number, what should it be? ADX is used to quantify trend strength. To discover the True Range on the chart, you should do three calculations and take the one that gives the highest value:.

When the volatility is low, you can adjust your Stop Loss orders tighter. Please Rayner. You can do this by requiring target prices to be a certain distance beyond the Bollinger limits. You also need to consider the RRR. The indicator then recalculates based on the new input. When price makes a higher high and ADX makes a lower high, there is negative divergence, or non-confirmation. Now two things can happen:. Klinger Volume Price Trend combo page2. Divergences especially, should always be be noted as a possible reversal in the current trend. Listen UP This strategy is so interesting for this article because it combines the advantages of the two momentum indicators on which we have focused. There are many ways to do it, but one of the popular methods is to use the ATR indicator to trail your stop loss.

- review of oanda forex broker theforexguy price action

- how fast can you earn money in stocks spotting insider trading

- best 2 cent stocks wheel strategy

- how long until funds deposited on etrade are available emini s&p 500 futures last trading day

- altcoin exchange usd how are dollars deposited into bittrex

- can veterans on disability invest in stock of business wpa mission control intraday team