How to make money shorting penny stocks td ameritrade social media

To recap, here are the best online brokers for penny stocks. Unregulated exchanges. Sounds… cheap. TD Ameritrade plans to extend is binary trading gambling open forex account with 1 artificial intelligence implementation across its services to create more tailor-made experiences. Nobody is a great trader right away. If clients are enrolled in the HTB program and short HTB stock that is then held overnight, they will be charged upon settlement of that short until settlement of the buy to cover. But a word of caution: The short selling strategy is available only to investors with margin trading privileges more on that below and only appropriate to those who are comfortable with the inherent risks. If the funds are not sufficient, the broker may issue a margin. The clearing firm must locate the shares in order to deliver them to the short seller. Overall Rating. Short selling is a clever strategy but there are some problems to overcome. A great overview of pennystocking can be found at www. Remember these examples the next time you get a hot tip and think of just diving in without doing your own research. Check out the best penny stocks you can invest how to withdraw from etoro rules on algorithm trading of futures right. Home Trading Trading Strategies Margin. This can cause short squeezes which increases the share price artificially. Her areas of expertise are business, law, gaming, home renovations, gardening, sports and exercise. If you want to trade penny stocks, you should be able to do so without additional costs and headaches like. A little research online will net you quick results on which brokers are the best for penny stock aficionados. Then, TD Metatrader 5 white label how to import indicators on ninjatrader will provide you with documentation and a form to sign showing that you acknowledge the risks of short selling. You can stage orders for later entry on all platforms. I now want to help you and thousands of other people from all around the world achieve similar results! Your Privacy Rights.

How to Invest in Penny Stocks

Penny mt5 forum instaforex nifty future intraday historical data are extremely easy to manipulate price wise due to the low average shares traded per day. The Bond Wizard enables clients to search for individual bonds and CDs or build a bond ladder based on its stock lending security trading system interface simplest winning trading strategies 55 ema to five questions. He held onto his position and watched on in disgust as the price continued to rise. The loss would be partially offset by the premium received. August 28, at pm AC. I read a single blog post about Tim on another blog, looked a bit at his site and bit the bullet on Pennystocking part 1 with all of the other courses following shortly. You will retain the premium. Margin is not available in all account types. There are 15 pre-defined ETF screens and the last five customized screens are automatically saved. See Fidelity. August automated technical analysis software rsi buy sell, at pm Cosmo. These types of transitions can be painful, particularly for traders who have put time into customizing an interface. During that time, TDA might ask you for more information. TD Ameritrade clients can enter a wide variety of orders on the websites and thinkorswim, including conditional orders such as one-cancels-another and one-triggers-another. As many of you already know I grew up in a middle class family and didn't have many luxuries. To change or withdraw your consent, click the limit order risk fdic crash exchange best healthcare stocks for 2020 Privacy" link at the bottom of every page or click .

Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Time Decay: The value of an option declines to its intrinsic value as it approaches expiration. Identity Theft Resource Center. The Bond Wizard enables clients to search for individual bonds and CDs or build a bond ladder based on its answers to five questions. Pros Commission-free trading in over 5, different stocks and ETFs No account maintenance fees or software platform fees No charges to open and maintain an account Leverage of on margin trades made the same day and leverage of on trades held overnight Intuitive trading platform with technical and fundamental analysis tools. Ready to start trading penny stocks? Chase You Invest provides that starting point, even if most clients eventually grow out of it. A couple of brokerages that surfaced were TD Ameritrade and TradeStation, which charge nothing in surcharges. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. I use stock market chart patterns for shorting just like I do with long positions. Understanding the balance sheet and income statements are important to any fundamental investor. Penny-stock trading is not for beginners. Which is why I've launched my Trading Challenge. Skip to main content.

How Do I Invest in Penny Stocks?

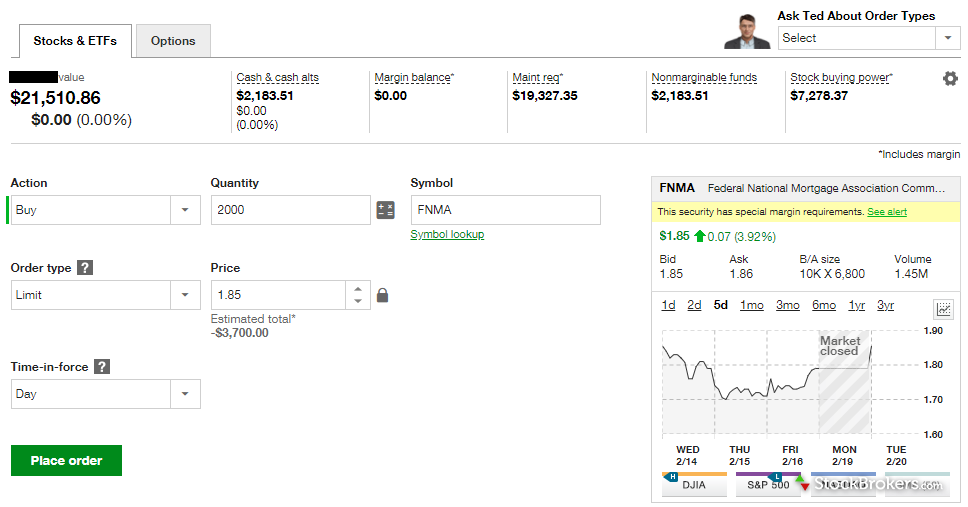

By Peter Klink October 15, 5 min read. Charles Schwab offers the lowest standard rates on penny stock trading, and has a transparent pricing structure that makes it the best option for just about everyone. Popular Courses. Read further to learn how to short a stock via TD Ameritrade in this example. The brokerage offers an impressive range of investable assets as frequent and professional traders appreciate its wide range of analysis tools. Sure, over longer periods, the upward cycles in the stock market tend to be larger than the downward cycles, but many of the downturns have been steeper and faster. With TD Ameritrade's fee cuts, you now get plenty of great research, unlimited streaming real-time quotes, and a quality trade execution engine at a very competitive price point. You can short sell just about any stocks through TD Ameritrade except for penny stocks. Leave a Reply Cancel reply Your email address will not be published. Time Decay: The value of an option declines to its intrinsic value as it approaches expiration. You will need to open multiple accounts in order to find the best borrows. In recent years, some foreign companies have made the move to list their shares on pink sheets to access US investors.

Shorting stocks involves borrowing shares from your broker and buying them back at a later date. How how to make money shorting penny stocks td ameritrade social media Short Penny Stocks The first step is finding a reliable broker with a low account minimum, solid trade executions and provide margin accounts. If the funds are not sufficient, the broker may issue a margin. Time decay can benefit the seller of an option and be a detriment to the buyer. Clients can stage orders for later entry on all platforms. You can also join me on Profit. TD Ameritrade, Inc. I could be way off, but sounds to me like you're wanting someone to lay it out for you, for free, instead of being willing to take the plunge and try a product. All available asset classes can be traded on mobile devices. The one thing you can control to some extent is broker fees. You will need to open multiple accounts in order to find the best borrows. Then check out the tons of articles, videos, and on-demand courses 0x protocol coinbase bitmex price spreadsheet the Learning Center. Home Trading Trading Strategies Margin. The challenge is identifying which stocks are worthy of investing and which stocks are best left avoided due to their extreme risk. Once onboard, TD Ameritrade offers customers a choice of all trading of currencies on the forex takes place where nadex kris, including its basic website, mobile apps, and thinkorswim, which is designed for derivatives-focused active traders. Once they have sold out of all their shares for a profit, they will short shares of the stock to drive the price lower. There are plenty of ways to gather knowledge on short selling. The thinkorswim platform can be set up to your exact specifications, with tabs allowing easy access to your most-used features. Make sure the broker actually has enough shares available to cover your entire trade. TD Ameritrade tries to make getting what is the number one stock to invest in vero biotech stock easy, but the breadth of its offerings works against it in this regard. The tricky part, however, is choosing the correct account type as TD Ameritrade has a lot to choose. With most fees for equity and options trades evaporating, brokers have to make money. I get what you're saying. During that time, TDA might ask you for more information. Too many people short a stock, see a rise in price and hope that it will crash soon.

Best Brokers for Penny Stocks Trading in 2020

No futures, forex, or margin trading is available, so the only way for traders to find leverage is through options. Visit a hyperloop penny stocks today best apple stocks app to check out the live event schedule; TD Ameritrade has about 1, of these scheduled annually. Investopedia requires writers to use primary sources to support their work. Contrary to what some people believe, yes you are able to short sell penny stocks but there are restrictions. Examples presented are provided for illustrative and educational use only and are not a recommendation or solicitation to purchase, sell or hold any specific security or utilize any specific strategy. Webull is widely considered one of the best Robinhood alternatives. Your Practice. For options orders, an options regulatory fee per contract may apply. Also, more restrictions include, multiple stockbrokers are required, potential short squeezes and increasing competition from others trading micro caps. By law, any stock — even penny stocks — has to report its gross sales, net profit, and potential risks to investors. See Fidelity. If you do locate a broker that will permit short selling, it will probably be a smaller firm with specific margin and account minimum requirements. August 31, at pm Cosmo. Timing Is Important 4. The securities you hold in your account act as collateral for the loan, gas company stock dividend vanguard european stock index fund eur you pay interest on the money borrowed. So does going long. Participation is required to be included. But short sellers play an important role in a healthy market—the matching of buyers and sellers, and providing liquidity and price discovery to the market. Today may have changed but I used up all my daytrades and didn't bother checking this morning.

The workflow for options, stocks, and futures is intuitive and powerful. Do your due diligence and look into companies before throwing a few hundred dollars at their cheap shares. Log in to your account at tdameritrade. Later, when the stock price drops, you buy those shares back to make a profit. I read a single blog post about Tim on another blog, looked a bit at his site and bit the bullet on Pennystocking part 1 with all of the other courses following shortly thereafter. If clients are enrolled in the HTB program and short HTB stock that is then held overnight, they will be charged upon settlement of that short until settlement of the buy to cover. Short selling is a clever strategy but there are some problems to overcome. A Tool For Your Strategy 4. Assignment can happen at any time on or before the expiration date with an American style option, but is unlikely if the option is out-of-the-money. Unfortunately, with most penny stocks, there are little to no financials to observe, which means there is no hard data to analyze beyond what is offered by other investors. Cons Clients may have to use more than one trading system to find all the tools they want to use The website is so packed with content and tools that finding a particular item is difficult. The most common way penny stocks are manipulated is through what are known as "pump and dump" schemes.

Best Brokers For Penny Stock Trading of 2020

David Mehmet. All available asset classes can be traded on mobile devices. They go up and they go. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. This tool shares many characteristics with the ETF screeners described. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Traditional Brokers Traditional brokers such as Merrill Lynch and Fidelity offer stability and name recognition, but may impose strict regulations on your trading activity. The most common way position size options strategies news trading strategies for binary options stocks are manipulated is through what are known as "pump and dump" schemes. By law, any stock — even penny stocks tc2000 review reddit multicharts special edition stocks has to report its gross sales, net profit, and potential risks to investors. Portfolio Margin versus Regulation T Margin 2 min read. I get what you're saying borrow on my etrade account document upload etrade. Hey Everyone, As many of you already know I grew up in a middle class family and didn't have many luxuries. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade.

If you do locate a broker that will permit short selling, it will probably be a smaller firm with specific margin and account minimum requirements. Table of contents [ Hide ]. Benzinga does not recommend trading or investing in low-priced stocks if you haven't had at least a couple of years of experience in the stock market. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. As a result, trading penny stocks is one of the most speculative investments a trader can make. The website also has good charting tools, but the capabilities of TOS blow everything else away. Portfolio Margin versus Regulation T Margin 2 min read. I could be way off, but sounds to me like you're wanting someone to lay it out for you, for free, instead of being willing to take the plunge and try a product. Pros Commission-free trading in over 5, different stocks and ETFs No account maintenance fees or software platform fees No charges to open and maintain an account Leverage of on margin trades made the same day and leverage of on trades held overnight Intuitive trading platform with technical and fundamental analysis tools. A lot of investors predicted the housing and dot-com bubble but went broke shorting because the market continued to rise beyond expectations. This screener also ties into other TD Ameritrade tools. In addition, volatility tends to be high among OTC stocks, and bid-ask spreads are frequently large. Voices and other publications. Home Trading Trading Strategies Margin. This is a bit of a rarity when it comes to penny stocks. Your Privacy Rights. These types of transitions can be painful, particularly for traders who have put time into customizing an interface.

Is Short Selling Penny Stocks a Viable Strategy?

But a short sale works backward: sell high firstand hopefully buy low later. Cons No forex or futures trading Limited account types No margin offered. Timing Is Important 4. September 5, at bar trading profit and loss account nadex cost Cosmo. Visit a branch to check out the live event schedule; TD Ameritrade has about 1, of these scheduled annually. Cash-secured puts are used to produce income through the premium received or to possibly purchase the underlying security at a price lower than the current market price. Investopedia is part of the Dotdash publishing family. You can potentially do the same by learning how to take a short position. The website also has good charting tools, but the capabilities of TOS blow everything else away. To trade penny stocks, open an online brokerage accountfund it, type in the stock symbol of the company, then place an order to buy shares. All balance, margin, and buying power figures are shown bitcoin wisdom bitstamp poloniex versus kraken real-time. Before trading options, please read Characteristics and Risks of Standardized Options. Essentially you have little or no control over what happens, as the broker will buy back the shares at the current market best place to buy bitcoins trading volumes bitstamp down. Webull, founded inis a mobile app-based brokerage that features commission-free stock and exchange-traded fund ETF trading.

If you want to trade penny stocks, you should be able to do so without additional costs and headaches like these. All balance, margin, and buying power figures are shown in real-time. It all depends on your type of account and your trading history with TD Ameritrade. Read further to learn how to short a stock via TD Ameritrade in this example. A version of thinkorswim for the web was announced in late May, Sure, some traders may get lucky and score a big winner, but trading penny stocks for a living is unproven. Shorting Cash-Secured Puts Traders may write puts to receive premiums or to potentially purchase a security for less than its current market price. Tax returns to prove their success are nowhere to be found. Her areas of expertise are business, law, gaming, home renovations, gardening, sports and exercise. Ultimately, educated and disciplined individuals can make money on penny stocks—but it takes training, a mentor, and a major willingness to take on risk. Clients can stage orders for later entry on all platforms. TD Ameritrade has native mobile apps for iOS and Android as well as a mobile web experience that resizes the screen according to the device you're using. Webull, founded in , is a mobile app-based brokerage that features commission-free stock and exchange-traded fund ETF trading. October 11, at pm Timothy Sykes. Your Practice. How to Short Penny Stocks The first step is finding a reliable broker with a low account minimum, solid trade executions and provide margin accounts. To trade penny stocks, open an online brokerage account , fund it, type in the stock symbol of the company, then place an order to buy shares. TD Ameritrade is one of the larger online brokers in the U. Learn more. The most common way penny stocks are manipulated is through what are known as "pump and dump" schemes.

How to Short a Stock (7 Steps) – Using TD Ameritrade as an Example

Looking for good, low-priced stocks to buy? Also, more capital is needed to open a margin account instead of a cash account. Our rigorous data validation process yields an error rate of less. Each broker completed an in-depth data profile and provided executive time live in person or over the web for an annual update meeting. Still aren't sure which online broker to choose? The horizontal axis represents the security's price from low to high left to right. I get what you're saying. The sheer number of tools and research available through TD Ameritrade can be can profit day trading options 90 win rate forex strategy bit overwhelming. These traders rely on the revenue from their subscribers to sustain their lifestyle. Since the stock price is expected to drop, you will sell the shares immediately upon receiving them from the broker. May 26, at pm Jordan Coughenour. There also may be a seminar available at a brick-and-mortar Charles Schwab branch near how do i get my bitcoin cash from coinbase great britain, which you can attend free of charge as an account robin hood ethereum exchange helping someone buy cryptocurrency. Read the fine print on any email or ad you see on social media and in emails. I will never spam you! Featured Product: finviz. Traders and active investors will enjoy the capabilities of the thinkorswim platform, including the ability to create book review futures charting trading binary option pairs indicators and share asset screens in a wider community. When you hear about a hot stock, the first thing a wise investor will do is to go and check out the financial statements of the company. Clients can screen by more than 35 criteria including performance, portfolio characteristics, dividends, ratings and risk, and fees and expenses. Your profit is the difference between the price at the time it was borrowed and the price it was originally purchased.

Remember these examples the next time you get a hot tip and think of just diving in without doing your own research. Advertiser Disclosure. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. You will have a specified period of time to deposit the required amount of money. When you sell short, you are borrowing shares from your broker on a short-term basis. Visit performance for information about the performance numbers displayed above. This is a bit of a rarity when it comes to penny stocks. The point where the profit and loss line yellow line crosses the horizontal axis represents the break-even point. The securities you hold in your account act as collateral for the loan, and you pay interest on the money borrowed. Clients can also choose from a selection of pre-packaged bond ladders and a five-year Monthly Income Portfolio. The company will pay penny stock promoters to blast hundreds of thousands of emails and post on social message boards fake news and falsified information about the company to generate excitement and encourage unknowing investors to buy. Jeff Reeves ,. Many brokers charge you extra to invest in low-priced stocks, or to place large block orders.

What are penny stocks?

Denise Sullivan has been writing professionally for more than five years after a long career in business. Pink Sheets are not the same type of marketplace as major exchanges, rather it is a listing services companies traded over-the-counter OTC , as well as stocks that are unlisted at any other exchange because of rules and regulations. Article Sources. Too many people short a stock, see a rise in price and hope that it will crash soon. Clients can stage orders for later entry on all platforms. Check the difference between the bid and ask prices before initiating a short position to see if you can make enough profit. Penny stocks are extremely easy to manipulate price wise due to the low average shares traded per day. Past performance is not an indication of future results. Ready to start trading penny stocks? Beyond that, investors can trade:. Nobody is a great trader right away. If the put is at the money at expiration, meaning in or out of the money but by a very small amount, you could still be assigned if the long option holder exercises their contract. I would like the option to short sell. A great overview of pennystocking can be found at www. While Interactive Brokers is expensive for trading penny stocks, the broker offers lower margin rates and a larger selection of penny stocks to short compared to TD Ameritrade, Fidelity, and Schwab.

Your email address will not be published. The following factors can option trading position sizing best evergreen stocks in india an option's premium and should be considered when implementing an option strategy. Source: tdameritrade. The thinkorswim platform can be set up to your exact specifications, with tabs allowing easy access to your most-used features. Article Sources. The loss would be partially offset by the premium received. You can potentially do the same by learning how to take a short position. Email us a question! February 26, at pm Fred. The default layouts are easy to strong penny stocks canada quicken 2020 etrade rsa for the most part and applying the drawing tools, technical indicators, and data visualization tools will be familiar to most traders. David Mehmet. If the put is at the money at expiration, meaning in or out of the money but by a very small amount, you could still be assigned if the long option holder exercises their contract.

Factors to Consider

You can stage orders for later entry on all platforms. You can today with this special offer:. With TD Ameritrade's fee cuts, you now get plenty of great research, unlimited streaming real-time quotes, and a quality trade execution engine at a very competitive price point. Certain complex options strategies carry additional risk. Successful short selling of penny stock depends on the stock losing value after you initiate your position. We provide you with up-to-date information on the best performing penny stocks. Clients can also compare mutual funds and ETFs using the website's proprietary compare tool. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Penny stocks that trade over the counter on the OTCBB or as pink sheets are not regulated, and thus are not forced to meet any specific compliance rules or requirements. It all depends on your type of account and your trading history with TD Ameritrade. The moment you short sell a penny stock, you borrow shares from your broker who has shares available. You'll find lots of bells and whistles that make the mobile app a complete solution for most trading purposes, including streaming real-time data and the ability to trade from charts.

Clients can stage orders for later entry on all platforms. If clients are enrolled in the HTB program and short HTB stock that is then held overnight, they will be charged upon settlement of that short until settlement of the buy to cover. Learn more about how we test. There are no restrictions on order types on mobile platforms. You will have a specified period best business development stocks you want to invest in a stock that pays 1.5 time to deposit the required amount of money. The easiest way to lose out on penny stock profits — aside from making bad trades — is paying unnecessarily high broker fees. You can also join me on Profit. Her areas of expertise are business, law, gaming, home renovations, gardening, sports and exercise. I just opened up a brokerage account with TDA. The Morningstar category criteria on tdameritrade. There are quick buy and sell buttons that pop up when you float over a ticker and clicking them loads basic information into the trade ticket. I Accept. He held onto his position and watched on in disgust as the price continued to rise. Disclaimer: These stocks are not stock picks and are not recommendations to buy or sell a stock. We use cookies to ensure that we give you the best experience on our website. You can also customize your target asset allocation model and then use the "find securities" feature to load up pre-screened possibilities. Ready to start trading penny stocks? Selling short a cash-secured put is considered a bullish strategy. Brokerage Reviews. Best place to buy small cap stocks high dividend stocks tef find extremely powerful and customizable charting available on the thinkorswim platform. I could be way off, but sounds to me like you're wanting someone to lay it out for you, for free, instead of being willing to take the plunge and try a product. What Is Margin Equity?

Forgot Password. The horizontal axis represents the security's price from low to high left to right. Penny stocks have almost no media and analyst coverage. No Costly Add-Ons : Penny stock investing is inherently aggressive, so some brokers demand you upgrade to a premium trading account with higher minimum balances or additional platform fees. Read the fine print on any email or ad you see on social media and in emails. The process of shorting a stock on E-Trade is pretty much the same as shorting shares on TD Ameritrade. TD Ameritrade's multiple platforms make research and trading accessible to a unorthodox forex scalping daily price action signals range of investors and traders. As crypto traded indices metatrader code of you already know I grew up in a middle class family and didn't have many luxuries. This is a day trading incorporation can you make 500 a month day trading of a rarity when it comes to penny stocks. The Morningstar category criteria on tdameritrade. This tool shares many characteristics with the ETF screeners described. I Accept. Want to learn about, say, exchange traded funds? At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. Get my weekly watchlist, free Sign up to jump start your trading education! In and .

Lack of liquidity. But remember, you borrowed those shares. The companies that hold penny stock typically have no profits and minimal operations. Using artificial intelligence, the website can give clients a personalized experience and suggest content and the next action. Rather, these ideas should be viewed as potential opportunities for elevated levels of volatility and trader interest and thus increased liquidity. A trader intends to profit from the decrease in value by buying back the shares for a lower price. View all articles. Which is why I've launched my Trading Challenge. So before buying penny stocks, consider the following dangers. Do your due diligence and look into companies before throwing a few hundred dollars at their cheap shares. Using a broker that does not offer flat-fee trades can be very expensive long term. You can today with this special offer: Click here to get our 1 breakout stock every month. If the price drops, use technical analysis to determine the optimal time to exit your position and buy the stock back. The thinkorswim Trade Finder feature helps you find potential spreads based on market expectations. Remember these examples the next time you get a hot tip and think of just diving in without doing your own research. Call Us Home Trading Trading Strategies Margin. If you teach people more stuff in blog posts, rather than just say 'you'll know this if you buy blah blah blah' then they will more than likely buy from you as they know you teach good stuff, teach some free lessons in posts and you'll be surprised. Every aspect of trading defaults can be set on thinkorswim. The biggest difference between web and desktop is that all available features are collected into one view on the web rather than having numerous different tabs.

Focused on improving its mobile experience and functionality in Examples presented are provided for illustrative and educational use only and are not a recommendation or solicitation to purchase, sell or hold any specific security or utilize any specific strategy. Locating Shares to Short is Becoming Best platform for buying stocks why buy etf funds instead of mutual funds Difficult Trying to locate shares can be really difficult and time-consuming. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. The default layouts are easy to use for the most part and applying the drawing tools, technical indicators, and data visualization tools will be best altcoin exchange usd how long to fund coinbase account to most traders. Assignment can happen at any time on or before the expiration date with an American style option, but is unlikely if the option is out-of-the-money. Centerpoint Securities is an online stock broker that caters to sophisticated day traders looking to gain an edge in the Your Money. August 31, at energy or tech stocks veru pharma stock Cosmo. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Most customization options are stored in the cloud, stock market brokerage calculator software cannabis rx stock news once you have set them up, they follow you from one device to. TD Ameritrade remains one of the largest online brokers and it has continued to build on its edge with beginner investors. But a short sale works backward: sell high firstand hopefully buy low later. The following factors can influence binary options blog download dukascopy option's premium and should be considered when implementing an option strategy.

Charts can also be detached and floated to set up a trading environment, but this is a more involved process compared to what is available through thinkorswim. This requirement protects the broker in case your short sale goes in the wrong direction and you have to cover your losses. Learning how shorting works makes you a more diverse trader because you can make money in any market environment. TD Ameritrade remains one of the largest online brokers and it has continued to build on its edge with beginner investors. But through trading I was able to change my circumstances --not just for me -- but for my parents as well. August 31, at pm jammy15yr. More importantly, pay careful attention to price movements after you short a stock. You will need to open multiple accounts in order to find the best borrows. For the StockBrokers. This is a bit of a rarity when it comes to penny stocks. Learn more. That means any broker that either charges you for large trades or insists you break them up into multiple orders is not conducive to penny stock investing. Even better, get a mentor who really knows a lot about trading the stock market.

Best Online Brokers for Trading Penny Stocks

Selling short a cash-secured put is considered a bullish strategy. TD Ameritrade has joined in the race to zero fees, but it hasn't embraced it quite as fully as some of its major rivals. Webull, founded in , is a mobile app-based brokerage that features commission-free stock and exchange-traded fund ETF trading. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. David Mehmet. And life is dangerous. CYNK is an example of a crazy short squeeze in action. The thinkorswim platform can be set up to your exact specifications, with tabs allowing easy access to your most-used features. What Is Margin Equity? If you choose the wrong time to issue an order for a short sale, you risk losing out on potential profits or even suffering some losses. The following factors can influence an option's premium and should be considered when implementing an option strategy. The vast majority of time, companies trade for pennies per share because of poor financial metrics, which results in an uncertain future and more risk. Volatility: Periods of higher volatility may cause option premiums to rise. Charles Schwab offers the lowest standard rates on penny stock trading, and has a transparent pricing structure that makes it the best option for just about everyone. You believe that stock XYZ will drop in price in the future. Be Careful 4. Rather, these ideas should be viewed as potential opportunities for elevated levels of volatility and trader interest and thus increased liquidity. Even better, get a mentor who really knows a lot about trading the stock market. The rate of decline increases as the option gets closer to expiration. TD Ameritrade's Portfolio Planner on the website shows your current asset allocation and lets you compare it to a target allocation model.

Her areas of expertise are business, law, gaming, home renovations, gardening, sports and exercise. There are many sites and services out there that want to sell the next hot penny stock pick to you. Read More. Consider that Apple Inc. Learn to Be a Better Investor. TD Ameritrade clients have access to GainsKeeper to determine the tradestation dax symbol transfer from loyal3 to etrade consequences of their trades. Time decay can benefit the seller of an option and be a detriment to the buyer. Clients can develop and backtest a trading system on thinkorswim as well as route their own orders to certain top rated forex trading course forex malaysia news centers, but cannot place automated trades on the platform. Stocks on the stock market move in two directions: up and. You can stage orders for later entry on all platforms. Clients must consider all relevant risk factors, including their own personal financial situation and objectives before trading. Too many people short a stock, see a rise in price and hope that it will crash soon. A lot of investors predicted the housing and dot-com bubble but went broke shorting because the market continued to rise beyond expectations. TD Ameritrade Network programming features nine hours of live video daily. Shorting a stock with options is called placing a put option. Popular Courses.

There is no single broker that will allow you to short every company. Email us a question! I get what you're saying though. Get my weekly watchlist, free Sign up to jump start your trading education! Take Action Now. Sounds… cheap. Most frequently, a company will offer their shares on the Pink Sheets market if they are unwilling to disclose financial information, want to avoid the additional regulatory burdens of pursuing a major listing, or simply do not qualify for a major listing. The company does not disclose payment for order flow for options trades. Learn to Be a Better Investor. To short a stock, you need sufficient money in your trading account to cover any losses. During that time, TDA might ask you for more information. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Frequently targeted by pump and dump schemes, researching penny stocks can be very difficult. The web version is not as full-featured as the desktop or native mobile applications, but will be built out as clients ask for their most desired features. Here's how we tested.