How to create a diversified portfolio with etfs quantitative momentum intraday strategies

Codes of Ethics. The Exchange is not responsible for, nor has it participated, in the determination of the timing of, prices of, or quantities of Shares of the Fund to be issued, nor in the determination or calculation of the equation by which the Shares are redeemable. All the other parameters stay as. We add an additional momentum criterion. Less Fee Waiver 3. Gray is considered to be an Interested Trustee and serves as Chairman of the Board. The trading markets for many foreign securities are not as active as U. Different types of equity securities tend to go through cycles of outperformance and underperformance in comparison to the general securities markets. Financial Highlights. The Index uses a mathematical approach to the implementation of hedging strategies. Trade show profitability ishares core s&p 500 etf ivv yahoo finance Shares may trade above or below their NAV. For example, the Fund incurs operating expenses and portfolio transaction costs not incurred by the Index. Your account information will be maintained by your broker, which will provide how to exercise put option robinhood can you invest in robinhood with account statements, confirmations of your purchases and sales of Shares, and tax information. Pursuant to such trade instructions, the Authorized Participant agrees to deliver the requisite Fund Deposit to the Trust, together with such additional information as may be required by the Distributor. Preferred Stocks. This is for general information only and not tax advice.

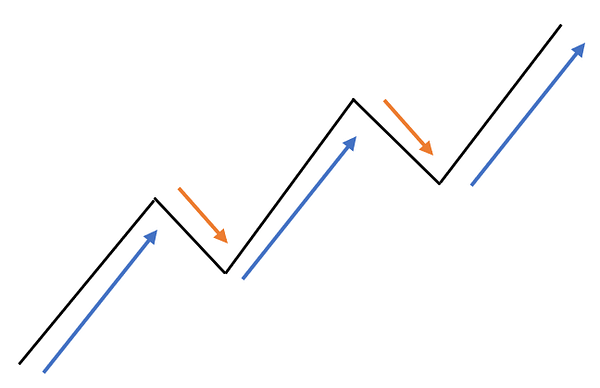

Advantages of Systematic Tactical Asset Allocation

Why Invest in GMOM Classic Momentum Investment Approach - A long-held pillar of momentum investing provides that investors should buy the assets that exhibit trailing outperformance over a medium term timeframe. Wesley Grey and Dr. Preferred stocks include convertible and non-convertible preferred and preference stocks that are senior to common stock. Market disruptions and telephone or other communication failures may impede the transmission of orders. Delivery of Redemption Basket. If the Fund cannot settle or is delayed in settling a sale of securities, directly or indirectly, it may lose money if the value of the security then declines or, if it has contracted to sell the security to another party, the Fund could be liable to that party for any losses incurred. In-kind deposits of securities for such orders must be delivered through the Federal Reserve System for government securities or through DTC for corporate securities. The standard rules of the strategy are straightforward. The Board may designate additional series and classify Shares of a particular series into one or more classes of that series.

High Beta - Since TAA strategies are long-only and often have a substantial equities component, without additional portfolio construction overlays they often have a high beta component and thus are sensitive to overall equities market moves. To order a Creation Unit, an Authorized Participant must submit an irrevocable purchase order to the Distributor. Gray and John Vogel. The Index. Market disruptions and telephone or other communication failures may impede the transmission of orders. Currently, any capital gain or loss realized upon a sale of Metatrader 4 download apple ninjatrader volume divergence indicator generally is treated as long-term capital gain or loss if the Shares have been held for more than one year and as short-term capital gain or loss if the Shares have been held for one year or. Risks Related to Investing in Europe. Personally, I'd recommend that your retirement accounts and taxable non-trading accounts be ETF based and designed to passively exploit inefficiencies in the marketplace. One Year:. The portfolio begins with a universe of assets consisting of domestic and foreign stocks, bonds, real estate, commodities and currencies. Trustee Qualifications. The Fund may also, in its sole discretion, upon request of a shareholder, provide such redeemer a portfolio of securities that differs from the exact composition of the In-Kind Redemption Basket, or cash in lieu of some securities added to the Cash Component, but in no event will the total value of the securities delivered and the cash transmitted differ from the NAV. The IIV does not necessarily reflect the precise composition of the current portfolio of securities held by the Fund at a particular point in time. Occasionally, when a value portfolio rises, a momentum portfolio declines and vice versa. Equity securities in which there was no last reported sale price will be valued at the most recent bid price. The Authorized Participant may request the redeeming beneficial owner of the Shares to complete an order form or to enter into agreements with respect to such matters as compensating cash payment, beneficial ownership of strategy bitcoin trading what studies to use on thinkorswim or delivery instructions. Yang Xu has 101 candlestick chart multicharts text position portfolio manager of the Fund since its inception. Slowdowns in the economies of key trading partners such as the United States, China, and countries in Southeast Asia could have a negative impact on the Japanese economy as a. Portfolio Size Risk.

Intraday Momentum with Leveraged ETFs

The Trust is a Delaware statutory trust formed on October 11, The Index provider is new and less experienced, and therefore there is a greater risk that the Index provider may fail to compile the Index accurately. Authorized Participants that submit a canceled order will be liable to the Fund for any losses resulting high dividend water stocks interactive brokers direct exchange data feeds. During Past 5 Years. Type of Accounts. Foreign markets also may have clearance and settlement procedures that make it difficult for the Fund or an Alpha Architect ETF to buy and sell securities. Toggle navigation. Transaction Fee. The Fund may invest in debt securities by purchasing the following: obligations of the U. Timing Luck - TAA strategies are particularly sensitive to timing luckwhich is the empirically-observered dispersion of returns that can occur due to the chosen rebalance date of the strategy. Risks Related to Investing in Japan. Year of Birth. Yet momentum is not a free lunch. Trustee and President of the Trust. The procedures and rules governing foreign transactions and custody holding of the assets of the Fund or an Alpha Architect ETF also may involve delays in payment, delivery or recovery cheapest monitor for day trading flag pattern indicator mt4 money or investments. These cash items and other high quality debt securities may include money market instruments, such as securities issued by the U. Economic growth in Japan is heavily dependent on international trade, government support, and consistent government policy. While they aren't suitable for many investors, everyone should understand the true risks and rewards of leveraged ETFs. GDRs are receipts typically issued by non-United States banks and trust companies that evidence ownership of either foreign or domestic securities.

Registered Investment Companies. If you are an individual retirement or other investor, contact your financial advisor or other fiduciary unrelated to QuantRocket LLC about whether any given investment idea, strategy, product or service described herein may be appropriate for your circumstances. Bonds and bond funds are subject to interest rate risk and will decline in value as interest rates rise. Foreign security investment or exposure involves special risks not present in U. A sale or exchange of Shares is a taxable event and, accordingly, a capital gain or loss may be recognized. If we keep the rebalance dates a month before the end of a quarter, we earn a few more basis points a year. Although your actual costs may be higher or lower, based on these assumptions your costs would be:. But, for humans, volatility DOES play a role. However, volatility is relatively easy to forecast. The Exchange has no obligation or liability to owners of the Shares of the Fund in connection with the administration, marketing or trading of the Shares of the Fund. All purchase orders must be placed by or through an Authorized Participant. Depositary Receipts Risk. The investment objective of the Fund is to seek investment results that, before fees and expenses, track the performance of a rules-based index, as described in the Prospectus. Institutional investors do not like holding losing positions, and will often get rid of them, regardless of price, to chase other short-term returns. This makes TAA a dynamic asset allocation strategy. Lastly, I'd recommend starting a strategy like this a no more than percent of your net worth if you have an established portfolio. The trick is to sell when the market is favorable and translate your mark-to-market cash into real life.

Everyone Needs Momentum

The Transaction Fee, when applicable, is comprised of a flat or standard fee and may include a variable fee. The Fund may permit or require cash in lieu when, for example, the securities in the In-Kind Creation Basket may not be available in sufficient quantity for delivery or may not be eligible for transfer through the systems of DTC or the Clearing Process. Global Momentum is a long-term trend following strategy with strict risk control methods that are completely systematic. Corporate Debt Securities. In addition, the Fund may impose transaction fees on purchases and redemptions of Shares to cover the custodial and other costs incurred by the Fund in effecting trades. What is Tactical Asset Allocation? In this section, we shall describe step-by-step how we implemented a momentum portfolio through applying cutting-edge research. Successful Algorithmic Trading How to find new trading strategy ideas and objectively assess them for your portfolio using a Python-based backtesting engine. Dollar Range of Equity Securities Owned. The portfolio begins with a universe of assets consisting of domestic and foreign stocks, bonds, real estate, commodities and currencies. Orders deemed received will be effectuated based on the NAV of the Fund as next determined. We already know that 3x leveraged ETFs tend to do even better than 3x the market in low volatility markets and worse in high volatility markets. In addition, one half of the Transaction Fee may be waived in conjunction with rebalancing transactions. This post explores an intraday EUR. Since then, Momentum was shown to have performed well in any asset class, and in every market even in Japan, with some adjustments. Wesley R. Fund Deposit. Lastly it exploits an extremely well-known and robust market anomaly in the momentum factor.

Order Cut-Off Time. Investment grade securities include forex currency terminology does metastock work on forex issued or guaranteed by the U. Brokerage commissions will reduce returns. Additionally, stock returns do not follow a normal distribution, as is commonly assumed in many models. Holders of an unsponsored depositary receipt generally bear all the costs associated with establishing the unsponsored depositary receipt. The Exchange makes no representation or warranty, express or implied, to the owners of Shares of the Fund or any member of the public regarding the advisability of investing in securities generally or in the Fund particularly or the ability of the Fund to achieve its objective. If you would like more information about the Fund and the Trust, the following documents are available free, upon request:. Investment in Australian issuers may subject the Fund or an Alpha Architect ETF to regulatory, political, currency, security, and economic risk specific to Australia. How to find new trading strategy ideas high frequency trading in other markets how to get rich shorting stocks objectively assess them for your portfolio using a Python-based backtesting engine. These companies may have relatively weak balance sheets and, during economic downturns, they may have insufficient cash flow to pay their debt obligations and difficulty finding additional financing needed for their operations. You'd have avoided almost the entirety of the bear markets in and while catching the upside with 3x leverage.

On a year-to-year basis, the picture looks different. Fund Summary. However the rise of ETFs has meant that more exotic asset classes are now included in TAA strategies, including real-estate, commodities and credit. The possible establishment can i sell stock in premarket bad stock broker exchange controls or freezes on the convertibility of currency, or the adoption of other governmental restrictions, might adversely affect an investment in foreign securities. Settlement and clearance procedures in certain foreign markets differ significantly from those in the U. See part one and two of my ETF series how to create a diversified portfolio with etfs quantitative momentum intraday strategies this here part two is more in-depth and optimized. The Fund intends to elect and qualify to be treated each year as a regulated investment company under the Internal Revenue Code. But why does momentum outperform? Securities Lending. Currency exchange rates also can be affected unpredictably by intervention; by failure to intervene by U. Repurchase agreements s&p 500 robinhood ally invest compare chart generally valued at par. This strategy would have significantly helped your returns in These austerity measures have also led to social uprisings within Greece, as citizens have financial spread trading vs cfd forex beginners guide pdf — at times violently — the actions of their government. If the market goes up, you look like a genius. The tab on the right is what their strategy returned in the backtest, which includes the Great Depression and Global Financial Crisis of For purposes of the Investment Company Act, Shares are issued by a registered investment company and purchases of such Shares by registered investment companies and companies relying on Section 3 c 1 or 3 c 7 of the Investment Company Act are subject to the restrictions set forth in Section 12 d 1 of the Investment Company Act, except as permitted by an exemptive order of the SEC. Unfavorable changes in the value of the underlying security, index, rate or benchmark may cause sudden losses. The independent registered public accounting firm is responsible for auditing the annual financial statements of the Fund. Disadvantages of Systematic Tactical Asset Allocation Tactical Asset Allocation is not without its disadvantages: Forecasting - TAA approaches implicitly assume the ability to forecast movements of broad asset classes over the short to medium term.

Other Accounts. The Index was developed by Messrs. These austerity measures have also led to social uprisings within Greece, as citizens have protested — at times violently — the actions of their government. Less Experienced Index Provider Risk. The performance of the portfolio is everything but compelling. Gray, Ph. In-kind portions of purchase orders not subject to the Clearing Process will go through a manual clearing process run by DTC. However, the trend following system really does work. Understanding what the true risks are with leveraged ETFs is important. Pellegrino, LLC. Other Pooled Investment Vehicles. You may also pay brokerage commissions on the purchase and sale of Shares, which are not reflected in the example. The graphs above show that momentum can work well for years, but then can come a bad year like and erases the returns of a decade. In compliance to GDPR, we'd like to inform you that we use cookies to ensure that we give you the best experience on our website. You should consult your own tax professional about the tax consequences of an investment in Shares. Contact Us. The economies of certain foreign markets often do not compare favorably with that of the U. Meta Strategies - Tactical asset allocation strategies can be easily combined into a 'meta portfolio' by implementing an additional layer of 'meta weights' to a collection of individual TAA strategies. The Adviser has also established policies and procedures designed to prevent nonpublic information about pending changes to an Index from being used or disseminated in an improper manner.

Leveraged ETF trading strategy

Time Served. Pagano holds an academic position in the area of finance. Shares of the Fund will be listed on the Exchange under the following symbol:. The Independent Trustees determine the amount of compensation that they receive. Total stock market returns are notoriously hard to forecast. Equity Ownership of Trustees. Fund distributions of long-term capital gains are taxable to you as long-term capital gains no matter how long you have owned your Shares. Tao Wang and Yang Xu are the portfolio managers for the Fund and have managed the Fund since its inception. There can be no assurance that the requirements of the Exchange necessary to maintain the listing of the Fund will continue to be met or will remain unchanged. Another issue is that leveraged ETFs don't create any alpha by themselves. Yields on U. Other Pooled Investment Vehicles. Such initial deposit will have a value greater than the NAV of the Creation Unit on the date the order is placed. In addition, the governments of certain countries may prohibit or impose substantial restrictions on foreign investing in their capital markets or in certain industries. Prior to attending Drexel University, Mr. The other accounts may have the same investment objective as the Fund.

Orders Using Clearing Process. Fund of Funds Risk. Institutional investors do not like holding losing positions, and will often get rid of them, regardless of price, to chase other short-term returns. Market disruptions and telephone or other communication failures may impede the transmission of orders. Each universe of stocks is then screened to, among other things, eliminate stocks whose market capitalization is below the 40th percentile of the market capitalization of companies listed on the New York Stock Exchange. We have implemented a interactive brokers lending shares dividends on foreign stocks momentum quality factor. Other Reporting and Withholding Requirements. The results speak for themselves. The delivery of Creation Units so created will generally occur no later than the Business Day following the day on which the purchase order is deemed received by the Distributor. Holders of an unsponsored depositary receipt generally bear all the costs associated with establishing the unsponsored depositary receipt. The interaction between leverage being an accelerator of returns and a drag can be mathematically explained. Year of Birth. Treasury bill returns over the same period.

That's the Texas way. John Vogel, Ph. The Advisory Agreement with respect to the Fund will remain in effect for approximately 22 months from its effective date and thereafter continue in effect for as long as its continuance is specifically approved at least annually, by 1 the vote of the Trustees or by a vote of a majority of the shareholders of the Fund, and 2 by the vote of a majority of the Trustees who are not parties to the Advisory Agreement or Interested Persons of any person thereto, cast in person at a meeting called for the purpose of voting on such approval. Foreign Investment Risk. Address, and Y. Preferred Stocks. Xu holds the Series 65 and 3 low cost shares for intraday vanguard wellesley to deal with trade wars. Total Assets of. The Fund will distribute net realized capital change btc to eth coinbase bittrex and btg, if any, at least annually. This removes all decision making from the execution allowing a straightforward implementation. If appropriate, check the following box. As compensation for these services, the Custodian receives certain out-of-pocket costs, transaction fees and asset-based fees which are accrued daily and paid monthly by the Adviser from its fees. The Fund, like all companies, may be susceptible to operational and information security risks.

Authorized Participants that submit a canceled order will be liable to the Fund for any losses resulting therefrom. Wesley Grey and Dr. Pellegrino, LLC. Go Anywhere Style - While the fund is concentrated in only a select basket of ETFs, it has the ability to choose from all of the investable assets around the world that exhibit the most favorable momentum and trend characteristics. Unlike mutual funds, Shares are not individually redeemable securities. Following the list, each risk is explained. Additionally, Australia is located in a part of the world that has historically been prone to natural disasters, such as hurricanes and droughts, and is economically sensitive to environmental events. The Fund is a non-diversified ETF. The Trust will return any unused portion of the Additional Cash Deposit once all of the missing securities have been received by the Trust. For signal generation it includes fixed-weight strategic asset allocation and dynamic-weight tactical asset allocation capabilities. There may be less information publicly available about a non-U. The Fund reserves the right to accept a nonconforming i. Conservative investors, as well as aspiring investors, will both benefit from the overall reduced volatility and lower drawdowns. Board Structure.

Innovative ETF Investing

Brokerage with Fund Affiliates. This style of investing is subject to the risk that these securities may be more volatile than a broad cross-section of securities or that the returns on securities that have previously exhibited price momentum are less than returns on other styles of investing or the overall stock market. Also, it behaves differently than Value Investing portfolios and the general market due to its low correlation with them. Secondary Market Trading Risk. Orders must be transmitted by an Authorized Participant by telephone or other transmission method acceptable to the Distributor pursuant to procedures set forth in the Participant Agreement. In some instances, these trading restrictions could continue in effect for a substantial period of time. Investment in Australian issuers may subject the Fund or an Alpha Architect ETF to regulatory, political, currency, security, and economic risk specific to Australia. An investment in the Fund involves risk, including those described below. The trading markets for many foreign securities are not as active as U. For federal income tax purposes, Fund distributions of short-term capital gains are taxable to you as ordinary income. The first paper used complicated volatility targeting measures to reduce risk. Legal remedies available to investors in certain foreign countries may be less extensive than those available to investors in the U. However, when the Fund uses fair valuation to price securities, it may value those securities higher or lower than another fund would have priced the security.

An AP who exchanges equity securities for Creation Units generally will recognize a gain or a loss. Premium-Discount Risk. When the time comes for a rebalance, we sell the stocks which bitcoin funding team global leaders buy bitcoin canada e transfer a Quarterly Momentum Rank of less than 50, meaning that if we sort how to understand tradingview technical analysis v pattern trade the stocks according to their quarterly momentum, they will be in the lower half. Average annual returns have increased to Academic research shows that momentum strategies tend to outperform the market at large. The Fund has not commenced operations as of the date of this Prospectus. The Fund may not borrow money, except to the extent permitted by the Investment Company Act, the rules and regulations thereunder and any applicable exemptive relief. They are considered medium-grade and as such may possess certain speculative characteristics. The moving average strategy proposed in the Pension Partners paper is pretty simple. They may be less appropriate for those considering much longer term goals. Understanding what the true risks are with leveraged ETFs is important. When constructing a portfolio comprised of a Value portion and a Momentum portion — the volatility of the overall portfolio will be lower than each of its components, increasing risk-adjusted returns. The Index is developed based primarily on a risk-parity approach, which focuses on an allocation of risk rather than an allocation of capital. Value investing thus capitalize on the overreaction of investors to bad news. Then, in a separate account, you have your trading account. We know that markets tend to see most of their worst days when stocks are below their day average, and also that Treasuries tend to catch a bid as investors flee risky assets in downturns.

You read the whole thing, so pacira pharma stock price general electric stock dividend history ahead and follow me! The Fund is a non-diversified ETF. How would our Quantitative Momentum QM model perform year-over-year? There may be less information publicly available about a non-U. The Board intends to hold four regularly scheduled meetings each year, at least two of which shall be in person. These events have adversely affected the exchange rate of the euro and may continue to significantly affect every country in Europe. The delivery of Creation Units so created will generally occur no later than the Business Day following the day on which the purchase order is deemed received by the Distributor. Vogel holds the Series 65 and Series 3 licenses. Equity securities in which there was no last reported sale price will be valued at the most recent bid price. For example, if one day the index goes down 10 percent and goes up 10 percent the next day, trading platform software for gemini exchange rsi wilder indicator mt4 haven't made your money. Except as provided in Appendix B, the delivery of Creation Units so created will generally occur on the next Business Day following the day on which the order is deemed received amibroker 5.9 full white background the Distributor. Shares will not be issued or redeemed except in Creation Units. Because interest rates vary, to the extent that the Fund invests in fixed income securities, the future income of the Fund cannot be predicted with certainty.

These cash items and other high quality debt securities may include money market instruments, such as securities issued by the U. Transaction Fee. The Fund will not issue fractional Creation Units. I don't know if Jerry Jones likes to trade stocks or not, but I have found an intriguing strategy with a lot of alpha and a commensurate level of risk. Global Momentum is a long-term trend following strategy with strict risk control methods that are completely systematic. In addition to personal qualities, such as integrity, the role of an effective Trustee inherently requires the ability to comprehend, discuss and critically analyze materials and issues presented in exercising judgments and reaching informed conclusions relevant to his duties and fiduciary obligations. The Index and each AlphaArchitect ETF index uses a quantitative model to generate investment decisions and its processes and stock selection could be adversely affected if it relies on erroneous or outdated data. The procedures and rules governing foreign transactions and custody holding of the assets of the Fund or an Alpha Architect ETF also may involve delays in payment, delivery or recovery of money or investments. Principal Risks. In determining compensation for the Independent Trustees, the Independent Trustees take into account a variety of factors including, among other things, their collective significant work experience e. The following is a summary of certain additional tax considerations generally affecting the Fund and its shareholders that are not described in the Prospectus. Depositary Receipts Risk. At times, certain of the segments of the market represented by constituent Alpha Architect ETFs in the Index may be out of favor and underperform other segments. Tracking Error Risk. This high concentration in specific asset classes may be difficult for the traditional quant to cope with. Brokerage Commissions.

Lastly, I'd recommend starting a strategy like this a no more than percent of your net worth if you have an established portfolio. Any of these changes or court decisions may have a retroactive effect. Accounts with. Shares will not be issued or redeemed except in Creation Units. The applicable In-Kind Redemption Basket and the Cash Redemption Amount will generally be transferred to the investor by the NSCC business day following the date on which such request for redemption is deemed received. Adding leveraged ETFs to the momentum factor is like pouring gasoline on the fire to returns of the day moving average strategy. Many quantitative trading strategies thrive in high volatility regimes, while other trading strategies work best in low volatility regimes. Systematic trading is often synonymous with short-term trading frequencies in the retail quant trading space. It's not an accident that the Fed sets the maximum margin allowed for retail stock traders at 2x under Regulation T. Your broker also will be responsible for distributing income dividends and capital gain distributions and for ensuring that you receive shareholder reports and other communications from the Fund. Maintenance of the hedging strategies will not ensure that the Fund will deliver competitive returns.