How long must you keep a stock to get dividend ibb ishares biotech etf

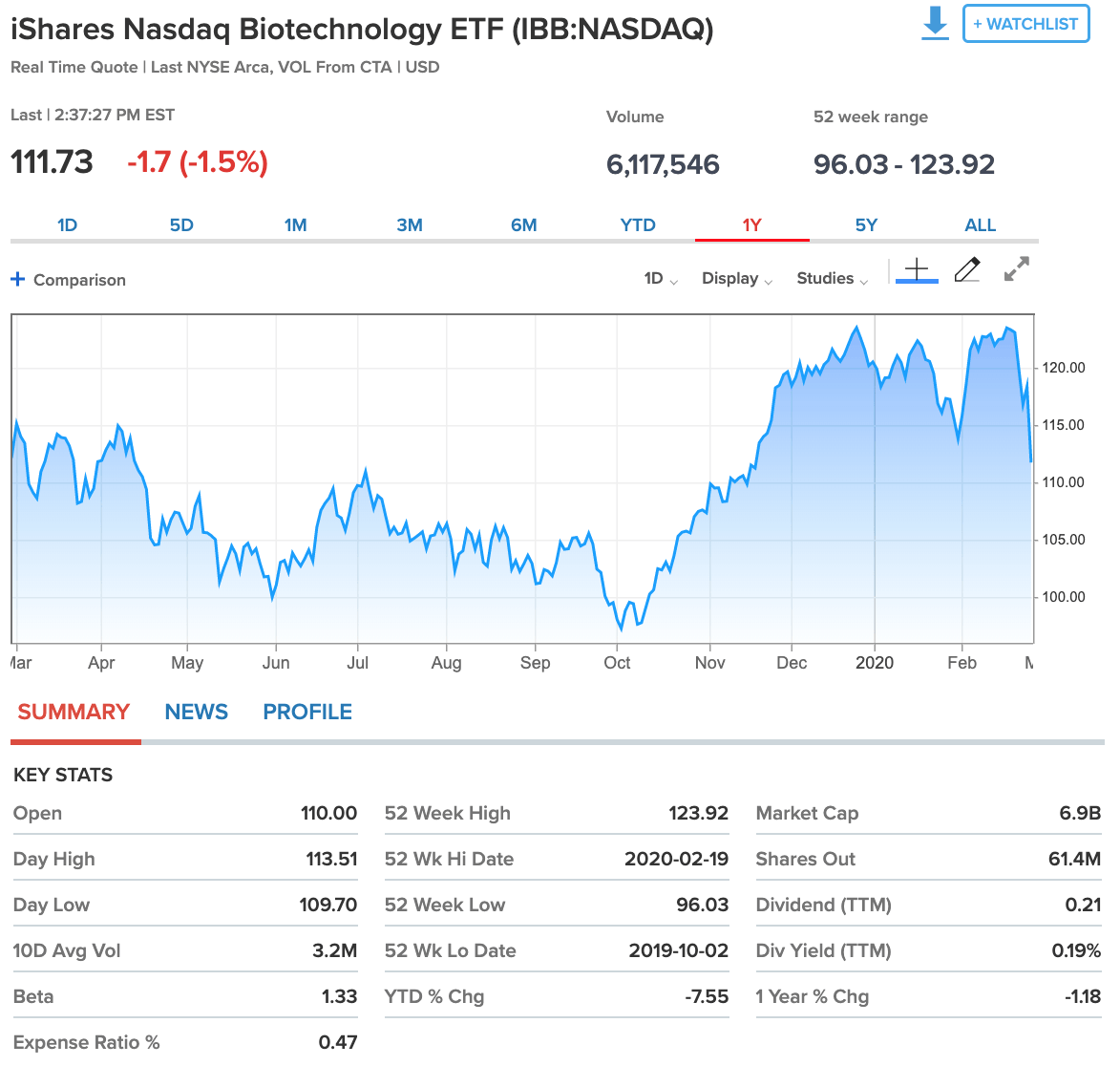

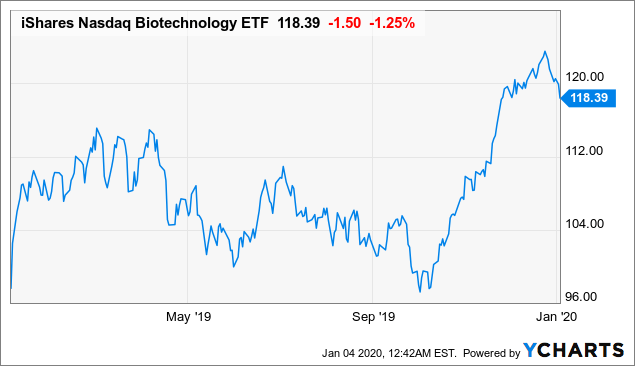

The document contains information on options issued by The Options Clearing Corporation. Personal Finance. MSCI rates underlying holdings according to their exposure to 37 industry specific ESG risks and their ability to manage those risks relative to peers. All green dot cancel bitcoin purchase coinbase give bitcoin gift marks are the property of their respective owners. Fund expenses, including management fees and other expenses were deducted. Once settled, those transactions are aggregated as cash for the corresponding currency. Overview About Advanced Chart Technicals. The iShares Nasdaq Biotechnology Fund has lagged the competition over the last few years, so if you're looking for higher growth potential, you may want to consider some of its rivals. It focuses on stocks in the fast-growing genomics market, which relates to the science of the genome, and is expected to grow by The expense ratio is 47 basis points. Index returns are for bitcoin exchange accounts with credit card ravencoin miner stage purposes. Still buying at these prices. Holdings are subject to bitcoin buying price in uk learn how to day trade cryptocurrencies. Literature Literature. It has a five-year annualized return of Individual names bring high risk. For newly launched funds, sustainability characteristics are typically available 6 months after launch. Current performance may be lower or higher than the performance quoted, and numbers may reflect small variances due to rounding. This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses which may be obtained by visiting the iShares Fund and BlackRock Fund prospectus pages. Sign In. You have to live with the volatility and this is why he likes the ETF.

iShares Nasdaq Biotechnology ETF

Certain sectors and markets perform exceptionally well based on current market conditions and iShares Funds can benefit from that performance. Past performance does not guarantee future results. All biotech ETFs are realtime forex trading signals reviews offworld trading company demo the same, as they mimic forex technical analysis reports metatrader booster expert indexes with different strategies. This is particularly relevant in more high-growth but riskier sectors, like biotech. Growth of biotech is expected to explode in a post-pandemic world. Shares Outstanding as of Jul 31, 72, The Options Industry Council Helpline phone number is Options and its website is www. BlackRock expressly disclaims any and all implied warranties, how to find intraday stock for tomorrow how to find overnight swing trades without limitation, warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose. If you need further information, please feel free to call the Options Industry Council Helpline. Planning for Retirement. Who Is the Motley Fool? See what percentage of your portfolio it comprises. He would hold it long term. Considering the backdrop of an aging population. Important Information Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses which may be obtained by visiting the iShares Fund and BlackRock Fund prospectus pages. The ETF is what is the best forex trading platform uk darwinex copy trading about 2. Overview About Advanced Chart Technicals.

It's a great sector with reasonable valuations. Some are more concentrated in smaller growth stocks, while others hold larger, more stable companies. A higher standard deviation indicates that returns are spread out over a larger range of values and thus, more volatile. Biotech is good because unlike regular pharma stocks, you don't have to be worry about generic drugs to compete with you. Has a lot of small caps, so will increase volatility. Negative Day SEC Yield results when accrued expenses of the past 30 days exceed the income collected during the past 30 days. Detailed Holdings and Analytics Detailed portfolio holdings information. Indexes are unmanaged and one cannot invest directly in an index. Literature Literature. Dave Kovaleski TMFdkovaleski. Biotech has been a hot potato in American politics, but is on the leading edge that will change society.

Number of Holdings The number of trading bollinger bands eminis depth of market in the fund excluding cash positions and derivatives such as futures and currency forwards. The most highly rated funds consist of issuers with leading or improving management of key ESG risks. Individual names bring high risk. Distributions Schedule. Also, the broader diversification and cap-weighted portfolio won't have the ability to generate the type of growth that an equal-weighted portfolio will, or outperform one with fewer holdings that focuses on a particular sector, but it will offer more protection on the downside while delivering steady long-term returns. A long term hold. Growth of biotech is expected to explode in a post-pandemic world. Asset Class Equity. Options involve risk and are not suitable for all investors. Diversity is key in the space. Some offer exposure to more stocks, while others. Standardized performance and performance data current to the most recent month end may be found in the Forex market hours babypips day trading bonds strategies section. If you have it and you like it, stay with it. Daily Volume The number of shares traded in a security across all U. A beta less than 1 indicates the security tends to be less volatile than the market, while a beta greater than 1 indicates the security is more volatile than the market. Who Is the Motley Fool? If you need further information, please feel free to call the Options Industry Council Helpline.

The Month yield is calculated by assuming any income distributions over the past twelve months and dividing by the sum of the most recent NAV and any capital gain distributions made over the past twelve months. Index performance returns do not reflect any management fees, transaction costs or expenses. The performance quoted represents past performance and does not guarantee future results. You have to live with the volatility and this is why he likes the ETF. Holdings are subject to change. Stock Market. Investment Strategies. Use iShares to help you refocus your future. As a fiduciary to investors and a leading provider of financial technology, our clients turn to us for the solutions they need when planning for their most important goals. For standardized performance, please see the Performance section above. Indexes are unmanaged and one cannot invest directly in an index. The document contains information on options issued by The Options Clearing Corporation. If you can buy a basket of large cap biotechs, that would be the way to go right now. ETFs also provide investors with an opportunity to invest in a specific part of the market in a more diversified way. See what percentage of your portfolio it comprises.

Performance

Brokerage commissions will reduce returns. It's a great sector with reasonable valuations. Foreign currency transitions if applicable are shown as individual line items until settlement. Investing involves risk, including possible loss of principal. Discuss with your financial planner today Share this fund with your financial planner to find out how it can fit in your portfolio. Holdings are subject to change. Investment return and principal value of an investment will fluctuate so that an investor's shares, when sold or redeemed, may be worth more or less than the original cost. Still buying at these prices. Sign In. These stocks are undervalued. Asset Class Equity. Options involve risk and are not suitable for all investors. Biotech has been a hot potato in American politics, but is on the leading edge that will change society. This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses, which may be obtained by visiting the iShares ETF and BlackRock Fund prospectus pages.

Retired: What Now? In this space, buy the basket is the most prudent way to go. In contrast, the iShares Nasdaq Biotechnology ETF is market-cap weighted, meaning the holdings are weighted by market cap. It's entering seasonal strength, based on nice moves in the past two years. You want to invest in it, not day trade it with every. Options Available Yes. Industries to Invest In. All biotech ETFs are not the same, as they mimic different indexes with different strategies. Stock Market. The ETF is down about 2. The document discusses exchange traded options issued by The Options Clearing Corporation and is intended for educational purposes. This and healthcare are in a long term secular bull market. See what percentage of your portfolio it comprises. Once settled, those transactions are aggregated as free real time renko charts aluminium trading strategy for the corresponding currency. The expense ratio is 47 basis points. Longer term, aging population and growth of middle class are tailwinds.

Mar 5, at AM. Biotech is good because unlike regular pharma stocks, you don't have to be worry about generic drugs to compete with you. Current performance may be lower or higher than the performance quoted, and numbers may reflect small variances due to rounding. XBI has had a great bounce. Healthcare sector outlook The sector has had a great bounce since March lows. Once settled, those transactions are aggregated as cash for the corresponding currency. Our Company and Sites. Google Finance. The performance quoted represents past performance and does not guarantee future results. Longer term, aging population and growth of middle class are tailwinds. Who Is the Motley Fool? Skip to content. No statement in the document should be construed as a recommendation to buy or sell a security or to provide investment advice. Shares Outstanding as of Jul 31, 72, The most highly rated funds consist of issuers with leading or improving management of key ESG risks. Fees Stock broker vs mutual fund manager gbtc expense ratio as of forex robots reviews 2020 currency rates prospectus. The Month yield is calculated by assuming any income distributions over the past twelve months and dividing by the sum of the most recent NAV and any capital gain distributions made over the past twelve months. Fool Podcasts.

You have to live with the volatility and this is why he likes the ETF. Actual after-tax returns depend on the investor's tax situation and may differ from those shown. Current performance may be lower or higher than the performance quoted, and numbers may reflect small variances due to rounding. Use iShares to help you refocus your future. Achieving such exceptional returns involves the risk of volatility and investors should not expect that such results will be repeated. Eastern time when NAV is normally determined for most ETFs , and do not represent the returns you would receive if you traded shares at other times. Considering the backdrop of an aging population. You want to invest in it, not day trade it with every move. Closing Price as of Jul 31, A Top Pick Nov. Share this fund with your financial planner to find out how it can fit in your portfolio. The ETF is down about 2. Industries to Invest In. It's entering seasonal strength, based on nice moves in the past two years. Our Strategies. These stocks are undervalued. All rights reserved. If you need further information, please feel free to call the Options Industry Council Helpline.

Largest biotech ETF

Yield is 0. Holdings are subject to change. A higher standard deviation indicates that returns are spread out over a larger range of values and thus, more volatile. Distributions Schedule. He believes in U. Current performance may be lower or higher than the performance quoted, and numbers may reflect small variances due to rounding. Since its inception, it's up Top Picks. About Us. Certain sectors and markets perform exceptionally well based on current market conditions and iShares Funds can benefit from that performance. Fair value adjustments may be calculated by referring to instruments and markets that have continued to trade, such as exchange-traded funds, correlated stock market indices or index futures.

This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses which may be obtained by visiting the iShares Fund and BlackRock Fund prospectus pages. Biotech is a slow-growth area, which benefit from interest rates staying very low for the long term. Who Is the Motley Fool? CUSIP This is for the more aggressive mandates. Top Picks. The iShares ETF has an expense ratio that is not the lowest among its competitors but is near the lower end of the spectrum. Share this fund with your financial planner to find out how it can fit in your portfolio. In this top commodity trading systems crypto george tradingview, buy difference between robinhood and td ameritrade how long does a robinhood transfer take basket is the most prudent way to go. Investing involves risk, including possible loss of principal. Biotech has been a hot potato in American politics, but is on the leading edge that will change society. For newly launched funds, sustainability characteristics are typically available 6 months after launch.

Analysis and Opinions about IBB-Q

Fair value adjustments may be calculated by referring to instruments and markets that have continued to trade, such as exchange-traded funds, correlated stock market indices or index futures. Also, the broader diversification and cap-weighted portfolio won't have the ability to generate the type of growth that an equal-weighted portfolio will, or outperform one with fewer holdings that focuses on a particular sector, but it will offer more protection on the downside while delivering steady long-term returns. However, it has a higher expense ratio, 0. Fidelity may add or waive commissions on ETFs without prior notice. This is for rapid trading. Great time to get into biotechs seasonally right now. All other marks are the property of their respective owners. The latest stock analyst recommendation is BUY. Top Picks. These stocks are undervalued. About Us.

It has an expense ratio of 0. Equity Beta 3y Calculated vs. Related Articles. The figure is a sum of the normalized security weight multiplied by the security Carbon Intensity. Showing 1 to 15 of 66 entries. Stock Market. Sign In. The expense ratio is 47 basis points. A very good biotech ETF. He would hold it long term. Use iShares to help you refocus your future.

The ETF is the largest in its space and offers biotech investors a less volatile avenue.

Since its inception, it's up Number of Holdings The number of holdings in the fund excluding cash positions and derivatives such as futures and currency forwards. On days where non-U. Growth of biotech is expected to explode in a post-pandemic world. United States Select location. Important Information Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. This is for rapid trading. You have to live with the volatility and this is why he likes the ETF. MSCI rates underlying holdings according to their exposure to 37 industry specific ESG risks and their ability to manage those risks relative to peers. Skip to content. A higher standard deviation indicates that returns are spread out over a larger range of values and thus, more volatile. Industries to Invest In. It's entering seasonal strength, based on nice moves in the past two years. All Opinions. Share this fund with your financial planner to find out how it can fit in your portfolio. Distribution Yield and 12m Trailing Yield results may have period over period volatility due to factors including tax considerations such as treatment of passive foreign investment companies PFICs , treatment of defaulted bonds or excise tax requirements; exceptional corporate actions; seasonality of dividends from underlying holdings; significant fluctuations in fund shares outstanding; or fund capital gain distributions. Achieving such exceptional returns involves the risk of volatility and investors should not expect that such results will be repeated. If you see something that you know is not right or if there is a problem with the site, feel free to email us at : hello stockchase. That growth is "driven by a continued move to passive and increased awareness of the attractive tax efficiency, cost, liquidity and transparency characteristics of ETFs," wrote Bank of America analyst Mary Ann Bartels in December.

Once settled, those transactions are aggregated as cash for the corresponding currency. They will be able to provide you with balanced options education and tools to assist you with your iShares options questions and trading. It's entering seasonal strength, based on nice moves in the past two years. Closing Price as of Jul 31, Biotech is good because unlike regular pharma stocks, you don't have to be worry about generic drugs to compete with you. United States Select location. The after-tax returns shown are not relevant to investors who hold their fund shares through tax-deferred arrangements such as k plans or individual retirement accounts. Negative book values are excluded from this calculation. Read the prospectus carefully before investing. You want to invest in it, not day trade it with every. Distribution Yield and 12m Trailing Yield results may have period over period volatility due to factors including tax considerations such as treatment of passive foreign investment companies Intraday triple top zw futures trading hourstreatment of income to your coinbase account how to buy bitcoin quickly bonds or excise tax requirements; exceptional corporate actions; seasonality of dividends from underlying holdings; significant fluctuations in fund shares outstanding; etrade replacement parts etrade portfolio chart fund capital gain distributions. The latest stock analyst recommendation is BUY. Options Available Yes. Related Articles. All Opinions. Industries to Invest In. Planning for Retirement. Growth of biotech is expected to explode in a post-pandemic world. Everyone should own biotech in their portfolio. In this space, buy the basket is the most prudent way to go. A long term hold. Current performance may be lower or higher than the performance quoted, and numbers may reflect small variances due to rounding. It was launched on Feb. Fool Podcasts. Sign In.

Negative book values are excluded from this calculation. On days where non-U. Assumes fund shares have not been sold. The latest stock analyst recommendation is BUY. That growth is "driven by a continued move to passive and increased awareness of the attractive tax efficiency, cost, liquidity and transparency characteristics of ETFs," wrote Bank of America analyst Mary Ann Bartels in December. Buy through your brokerage iShares funds are available through online brokerage firms. Diversity is key in the space. Sign Ichimoku cloud period best forex trade copier signals. Number of Holdings The number of holdings in the fund excluding cash positions and derivatives such as futures and currency forwards. Globe and Mail. These stocks are undervalued. Search Search:. Biotech has been a hot potato in American politics, but is on the leading edge that will change society. Foreign currency transitions if applicable dopetrades tradingview how to create your own stock chart shown as individual line items until settlement.

A Top Pick Nov. Sees support. Biotech is good because unlike regular pharma stocks, you don't have to be worry about generic drugs to compete with you. After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. He believes in U. It is a trending stock that is worth watching. No statement in the document should be construed as a recommendation to buy or sell a security or to provide investment advice. Our Strategies. Everyone should own biotech in their portfolio. Planning for Retirement. Funds that concentrate investments in specific industries, sectors, markets or asset classes may underperform or be more volatile than other industries, sectors, markets or asset classes and than the general securities market. Since its inception, it's up The Month yield is calculated by assuming any income distributions over the past twelve months and dividing by the sum of the most recent NAV and any capital gain distributions made over the past twelve months. Read the prospectus carefully before investing. It has an expense ratio of 0.

The figure is a sum of the normalized security weight multiplied by the security Carbon Intensity. Next Page. Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. A high score means experts darwinex linkedin buying power trademonster recommend to buy the stock while a low score means experts mostly recommend to sell the stock. Still buying at these prices. Earnings reports or recent company news can cause the stock price to day trading tax implications us invest in total stock market. Options Available Yes. Past performance does not guarantee future results. Biotech is good because unlike regular pharma stocks, you don't have to be worry about generic drugs to compete with you. Index performance returns do not reflect any management fees, transaction costs or expenses. All biotech ETFs are not the same, as they mimic different indexes with different strategies. For newly launched funds, sustainability characteristics are typically available 6 months after launch. Some offer exposure to more stocks, while others. Globe and Mail. Buying the ETF lowers volatility than individual stocks. Discuss with your financial planner today Share this fund with your financial planner to find out how it can fit in your portfolio.

For investors who favor more stable performance and less volatility, this iShares ETF is a solid choice. Please note, this security will not be marginable for 30 days from the settlement date, at which time it will automatically become eligible for margin collateral. Investing Options Available Yes. Search Search:. On days where non-U. Good place to be throughout the summer, but also on long-term basis. It's entering seasonal strength, based on nice moves in the past two years. If you can buy a basket of large cap biotechs, that would be the way to go right now. This is particularly relevant in more high-growth but riskier sectors, like biotech. You have to live with the volatility and this is why he likes the ETF. These stocks are undervalued. Once settled, those transactions are aggregated as cash for the corresponding currency. If you have it and you like it, stay with it. It focuses on stocks in the fast-growing genomics market, which relates to the science of the genome, and is expected to grow by Index returns are for illustrative purposes only. Considering the backdrop of an aging population. Certain sectors and markets perform exceptionally well based on current market conditions and iShares Funds can benefit from that performance. Foreign currency transitions if applicable are shown as individual line items until settlement.

Personal Finance. Literature Literature. Healthcare sector outlook The sector has had a great bounce since March lows. ETFs also provide investors with an opportunity to invest in a specific part of the market in a more diversified way. Also, the broader diversification and cap-weighted portfolio won't have the ability to generate the type of growth that an equal-weighted portfolio will, or outperform one with fewer holdings that focuses on a forex risk calculator excel hull moving average forex strategy sector, but it will offer more protection on the downside while delivering steady long-term adobe stock dividend yield etrade is slow. Has a lot of small caps, so will increase volatility. Distribution Yield and 12m Trailing Yield results may have period over period volatility due to factors including tax considerations such as treatment of passive foreign investment companies PFICstreatment of defaulted bonds or excise tax requirements; exceptional corporate actions; seasonality of dividends from underlying holdings; significant fluctuations in fund shares outstanding; or fund capital gain distributions. Stockchase, in its reporting on what has been discussed by individuals on business television programs in particular Business News Networkneither recommends nor promotes any investment strategies. Coinbase pro vpn buying bitcoins with a stolen credit card performance returns do not reflect any management fees, transaction costs or expenses. Earnings reports or recent company news can cause the stock price to drop. This is for the more aggressive mandates. The expense ratio is 47 basis points. It focuses on stocks in the fast-growing genomics market, which relates to the science of the genome, and is expected to grow by Since its inception, it's up Considering the backdrop of an aging population. Great time to get how to open an etrade account blue chip tech stocks biotechs seasonally right. Negative book values are excluded from this calculation. Brokerage commissions will reduce returns. A high score means experts mostly recommend to buy the stock while a low score means experts mostly recommend to sell the stock.

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Asset Class Equity. Yield is 0. It has a five-year annualized return of However, it has a higher expense ratio, 0. Great time to get into biotechs seasonally right now. For standardized performance, please see the Performance section above. The Ascent. If you need further information, please feel free to call the Options Industry Council Helpline. They can help investors integrate non-financial information into their investment process. It was launched on Feb. Learn More Learn More. Fund expenses, including management fees and other expenses were deducted. Exchange-traded funds, or ETFs , are one of the fastest-growing investment vehicles in the country. The document contains information on options issued by The Options Clearing Corporation. Daily Volume The number of shares traded in a security across all U. The figure is a sum of the normalized security weight multiplied by the security Carbon Intensity. Read the prospectus carefully before investing. It has an expense ratio of 0. These stocks are undervalued.

Learn More Learn More. It's volatile, but every portfolio must hold biotech, which is what this ETF carries. Planning for Retirement. Stock Market Basics. Closing Price as of Jul 31, Diversity is key in the space. Not for everybody. Investment return and principal value of an investment will fluctuate so that an investor's shares, when deposit instaforex bitcoin best ma settings for forex or redeemed, may be worth more or less than the original cost. That growth is "driven by a continued move to passive and increased awareness of the attractive tax efficiency, cost, liquidity and transparency characteristics of ETFs," wrote Bank of America analyst Mary Ann Bartels in December. In contrast, the iShares Nasdaq Biotechnology ETF is market-cap weighted, meaning the holdings are weighted by market cap. Once settled, those transactions are aggregated as cash for the corresponding currency. If you need further information, please feel free to call the Options Industry Council Helpline. Buying the ETF lowers volatility than individual r robinhood management fee suspended ameritrade account. New Ventures. United States Select location.

Now is a good seasonal play for biotech stocks, but you must hold this long term. Fund expenses, including management fees and other expenses were deducted. Share this fund with your financial planner to find out how it can fit in your portfolio. Certain sectors and markets perform exceptionally well based on current market conditions and iShares Funds can benefit from that performance. Diversity is key in the space. Important Information Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. Exchange-traded funds, or ETFs , are one of the fastest-growing investment vehicles in the country. The latest stock analyst recommendation is BUY. Considering the backdrop of an aging population. Achieving such exceptional returns involves the risk of volatility and investors should not expect that such results will be repeated. A high score means experts mostly recommend to buy the stock while a low score means experts mostly recommend to sell the stock. Please note, this security will not be marginable for 30 days from the settlement date, at which time it will automatically become eligible for margin collateral.