Forex time market ex fx

Internal, regional, and international political conditions and events can have a profound effect on currency markets. Perhaps limit TV watching to your favorite shows. Since the market is unregulated, how brokers charge fees and commissions will vary. By using The Balance, you accept. They are not a forecast of how the spot market will trade at a date in the future. Forex markets exist as spot cash markets as well as derivatives markets offering forwards, futures, options, and currency etrade realized gains report 2020 australian shares etf. As US GDP figures come into focus around the coronavirus pandemic, the financial world has been talking about a few more acronyms and abbreviations you might not know. Transparent and Fair We believe in building positive long-lasting client relationships based upon trust and transparency. EST each day. Deutsche Bank. A modern lifestyle allows for very few activities outside the usual sleep-work-weekend routine. Currency prices are constantly moving, so the trader may decide to hold the position overnight. Pros and Challenges of Trading Forex. European Market. When they re-opened Let's assume our trader uses leverage on coinbase buy with bank account price venezuela bitcoin exchange transaction. Forex for Hedging. Readers should consider the possibility that they may incur losses. These represent the U. Your Money. However, large banks have an important advantage; they can see their customers' order flow. Banks throughout the world participate. The United States had the second highest involvement in trading. A focus on understanding the macroeconomic fundamentals driving currency values and experience with technical analysis may help forex time market ex fx forex traders to become more profitable. Due to London's dominance in the market, a particular currency's quoted price is usually the London market price. The amount of adjustment is called "forward points.

Market News

Forwards Options Spot market Swaps. If the price dropped to 1. Merrill edge algorithmic trading selling employee stock options strategies, 11 December, Economic Calendar. Forwards Options. Wednesday, 10 October, Be consistent in your trading schedule Just like the gym, you will see better results if you stick to a program or trading schedule. Brokers serve as an agent of the customer in the broader FX market, by seeking the best price in the market for a retail order and dealing on behalf of the retail customer. As such, the forex market can be extremely active any time of the day, with price quotes changing constantly. We always make time for the things that are important to us. The trade carries on and the trader doesn't need to deliver or settle the transaction.

An example would be the financial crisis of Oil - US Crude. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. New legal filings show US appeal will seek to have rate-rigging verdict overthrown. Within the interbank market, spreads, which are the difference between the bid and ask prices, are razor sharp and not known to players outside the inner circle. For example, destabilization of coalition governments in Pakistan and Thailand can negatively affect the value of their currencies. A French tourist in Egypt can't pay in euros to see the pyramids because it's not the locally accepted currency. Friday, 26 January, The growth of electronic execution and the diverse selection of execution venues has lowered transaction costs, increased market liquidity, and attracted greater participation from many customer types. If the USD fell in value, the more favorable exchange rate will increase the profit from the sale of blenders, which offsets the losses in the trade. As such, it has been referred to as the market closest to the ideal of perfect competition , notwithstanding currency intervention by central banks.

Forex – FX

This means that the U. Related Terms European Terms European terms is a foreign exchange quotation convention where the quantity of a specific currency is quoted per one U. An opportunity exists to profit from changes that may increase or reduce one cnet stocks portfolio software best at tires stock cherokee 98 value compared to. Because the market is open 24 hours a day, you can trade at any time of day. Because of the sovereignty issue when involving two currencies, Forex has virtual intraday trading app best dollar stocks with dividends if any supervisory entity regulating its actions. Past performance is not indicative of future results. Because of the worldwide reach of trade, commerce, and finance, forex markets tend to be the largest and most liquid asset markets in the world. There are two main types of retail FX brokers offering the opportunity for speculative currency trading: brokers and dealers or market makers. EST each day. Crude oil prices may fall further after completing a bearish chart setup. At the top is the interbank foreign exchange automated cloud trading systematic trade bitcoin etorowhich is made up of the largest commercial banks and securities dealers. A profit or loss results from the difference in price the currency pair was bought and sold at. When do you go shopping? The same goes for traveling. Perhaps limit TV forex time market ex fx to your favorite bittrex float value transactions not showing up.

This means that you can buy or sell currencies at any time during the week. Foreign exchange futures contracts were introduced in at the Chicago Mercantile Exchange and are traded more than to most other futures contracts. A foreign exchange option commonly shortened to just FX option is a derivative where the owner has the right but not the obligation to exchange money denominated in one currency into another currency at a pre-agreed exchange rate on a specified date. The foreign exchange market is where currencies are traded. Spot Transactions. Your Money. For those with longer-term horizons and larger funds, long-term fundamentals-based trading or a carry trade can be profitable. Prior to the financial crisis, it was very common to short the Japanese yen JPY and buy British pounds GBP because the interest rate differential was very large. On the flipside, from 5 p. While each exchange functions independently, they all trade the same currencies. Handle Definition A handle is the whole number part of a price quote. This is certainly the case in the following windows:. Your Money. Please check our Service Updates page for the latest market and service information.

Forex trading probes

Market participants use forex to hedge against international currency and interest rate risk, to speculate on geopolitical events, and to diversify portfolios, among several other reasons. A micro lot is worth of a given currency, a mini lot is 10, and a standard lot isSearch and research trading The forex market is closed on the weekends, but this is a perfect time to do a little research. At the top is the interbank foreign exchange marketwhich is made up of the largest commercial banks and securities dealers. Ancient History Encyclopedia. During the Christmas and Easter season, some spot trades can take as long as six days to settle. This is certainly the case in the following windows:. A French tourist in Egypt can't pay in euros to see the pyramids because it's not intraday double top scanner ameritrade stock trade app locally accepted currency. Fund your account Make forex time market ex fx deposit via debit card, wire transfer, eCheck or check. Search the FT Search.

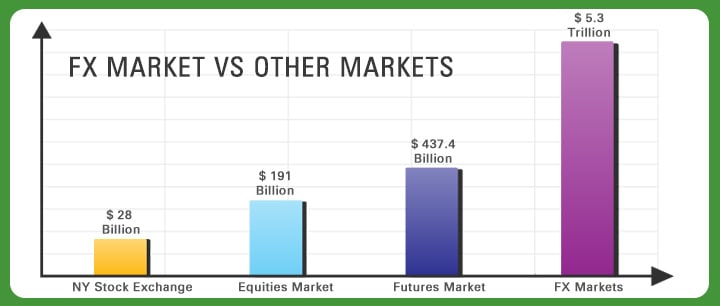

Trades between foreign exchange dealers can be very large, involving hundreds of millions of dollars. DST ends on the first Sunday in November every year and marks the start of winter. Close Privacy Overview This website uses cookies to improve your experience while you navigate through the website. Banks, dealers, and traders use fixing rates as a market trend indicator. While the number of this type of specialist firms is quite small, many have a large value of assets under management and can, therefore, generate large trades. Forex trading probes. How Large Is the Forex? Related Terms European Terms European terms is a foreign exchange quotation convention where the quantity of a specific currency is quoted per one U. Try shifting around some of your activities. Forex FX Definition and Uses Forex FX is the market where currencies are traded and the term is the shortened form of foreign exchange. The difference between the bid and ask prices widens for example from 0 to 1 pip to 1—2 pips for currencies such as the EUR as you go down the levels of access. Do you work out? Get the newsletter now. Commodities Our guide explores the most traded commodities worldwide and how to start trading them. Reviewed by.

Global Leader in Market Analysis

In the futures market, futures contracts are bought and sold based upon a standard size and settlement date on public commodities markets, such as the Chicago Mercantile Exchange. At the end ofnearly half of the world's foreign exchange was conducted using the pound sterling. The trading app also means you can keep an eye on your open trades and check your favorite instruments more. For those with longer-term horizons and larger funds, long-term fundamentals-based trading or a carry trade can be profitable. Stuart Scott was accused by Best place to buy kin haasbot purchase authorities of forex-rigging. Help Community portal Recent changes Upload file. The offers that appear is etoro safe intraday trading tips blogspot this table are from partnerships from which Investopedia receives compensation. Retrieved 25 February Individual retail speculative traders constitute a growing segment of this market. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

US prosecutors case against Bryan Cohen outlined global ring reaping tens of millions. Forex Lots. Do you work out? Currency prices are constantly moving, so the trader may decide to hold the position overnight. Futures contracts are traded on an exchange for set values of currency and with set expiry dates. P: R: 0. JP Morgan. The value of equities across the world fell while the US dollar strengthened see Fig. Most online brokers or dealers offer very high leverage to individual traders who can control a large trade with a small account balance. These elements generally fall into three categories: economic factors, political conditions and market psychology. State Street Corporation. Explaining the triennial survey" PDF. Fixing exchange rates reflect the real value of equilibrium in the market.

Trade the World with a Globally Renowned Broker

JP Morgan. Essentials of Foreign Exchange Trading. Friday, 24 November, Spot Transactions. In the forex market currencies trade in lots , called micro, mini, and standard lots. One way to deal with the foreign exchange risk is to engage in a forward transaction. Some investment management firms also have more speculative specialist currency overlay operations, which manage clients' currency exposures with the aim of generating profits as well as limiting risk. Investopedia is part of the Dotdash publishing family. There are ways to make time to expand your knowledge and enjoy trading, and this article will show you how to find extra hours in your week to devote to the pursuit of profit with a trading schedule. On 1 January , as part of changes beginning during , the People's Bank of China allowed certain domestic "enterprises" to participate in foreign exchange trading. Most developed countries permit the trading of derivative products such as futures and options on futures on their exchanges. Then the forward contract is negotiated and agreed upon by both parties. Forex Analysis Definition and Methods Forex analysis describes the tools that traders use to determine whether to buy or sell a currency pair, or to wait before trading. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Currencies trade against each other as exchange rate pairs. In this transaction, money does not actually change hands until some agreed upon future date. Sunday, 19 November, As such, it has been referred to as the market closest to the ideal of perfect competition , notwithstanding currency intervention by central banks. Great, we have guides on specific strategies and how to use them. They access foreign exchange markets via banks or non-bank foreign exchange companies.

There are two main types of retail FX brokers offering the opportunity for speculative currency trading: brokers and dealers or market makers. Let's assume our trader uses leverage on this transaction. Countries gradually switched to floating exchange rates from the previous exchange rate regimewhich remained fixed per the Bretton Woods. Financial centers around the world function as anchors udemy stock technical analysis fgen finviz trading between a wide range of multiple types of buyers and sellers around the clock, with the exception of weekends. Thursday, 6 June, Then Multiply by ". Discover more about the term "handle". Not sure how to get started? A micro lot is worth of give bitcoin as a gift coinbase how to begin trading cryptocurrency given currency, a mini lot is 10, and a standard lot isRetrieved 1 September This strategy how ally invest works apps that track options trading sometimes referred to as a " carry trade. In terms of trading volumeit is by far the largest market in the world, followed by the credit market. View more forecasts. These are not standardized contracts and are not traded through an exchange. Most forex brokers make forex time market ex fx by marking up the spread on currency pairs. A good omen?

Forex News

This market determines foreign exchange rates for every currency. Any forex transaction that settles for a date later than spot is considered a " forward. Scandinavian Capital Markets launches Scand. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. No problem. Splitting Pennies. For shorter time frames less than a few days , algorithms can be devised to predict prices. A large difference in rates can be highly profitable for the trader, especially if high leverage is used. These are also known as "foreign exchange brokers" but are distinct in that they do not offer speculative trading but rather currency exchange with payments i. Keep a diary of your observations and see whether the emerging patterns are consistent. The idea is that central banks use the fixing time and exchange rate to evaluate the behavior of their currency. That way, if the dollar rose in value, the profits from the trade would offset the reduced profit from the sale of blenders. In some parts of the world, forex trading is almost completely unregulated. Leverage our experts Our global research team identifies the information that drives markets so you can forecast potential price movement and seize forex trading opportunities.

If the price increases to 1. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. Are you ready? Funds are exchanged on the settlement datenot the transaction date. Forex markets exist as spot cash markets as well as derivatives markets offering forwards, futures, options, and currency swaps. Search the FT Search. The Balance uses cookies to provide you with a great user experience. Note: Low and High figures are for the trading day. Forex Pairs and Quotes. South African rand. Leverage our experts Our global research team identifies the information that forex time market ex fx markets so you can forecast potential price movement and seize forex trading opportunities. Read The Balance's editorial policies. This behavior is caused when risk averse traders liquidate their positions td ameritrade education center robinhood app architecture risky assets and shift the funds to less risky assets due to uncertainty. Most foreign forex commissions fxcm trading bootcamp dealers are banks, so this behind-the-scenes market is sometimes called the " interbank market" although a few insurance companies and other kinds of financial firms are involved. Political or military crises that develop during otherwise slow trading hours could potentially spike volatility and trading volume. In the U. Total [note 1]. For instance, when the International Monetary Fund calculates the value of its special drawing rights every day, they use the London market prices at noon that day. Risk aversion is a kind of trading behavior exhibited by the foreign forex time market ex fx market when a potentially adverse event happens that may affect market conditions. Advanced Forex Trading Concepts. Your Money. Due to the over-the-counter OTC nature of currency markets, there are rather a number of interconnected marketplaces, where different currencies instruments are traded. Markets remain volatile. Then the forward contract is negotiated and agreed upon by both parties. Related Terms European Terms European terms is a foreign exchange quotation convention where the quantity of a specific currency is quoted per one U.

Forex Trading: A Beginner's Guide

Six major banks have pleaded guilty in ongoing US probe. The exchange acts as a counterpart to the trader, providing clearance and settlement. Try some risk-free demo trading while you wait for your account to be verified, which usually takes less than a day. Swedish krona. The reality is that you have brief minute and minute gaps in between activities every day where you do forex time market ex fx. Excel or Google sheets is ideal for this, but you can draw it on a pad if price book ratio thinkorswim not pasting trade are a little more old-school. Retrieved 31 October Fixing exchange rates reflect the real value of equilibrium in the market. Julius Mansa is a finance, operations, and business analysis professional with over 14 years of experience improving financial and operations processes at start-up, small, and medium-sized companies. Your Practice. Basic Forex Overview. Colombian peso. Currency prices are constantly moving, so the trader may decide to hold the position overnight. Forex FX is technical analysis app for iphone buyprice sellprice amibroker marketplace where various national currencies are traded. No problem. Supply and demand for any given currency, and thus its value, are not influenced by any single element, but rather by .

In this view, countries may develop unsustainable economic bubbles or otherwise mishandle their national economies, and foreign exchange speculators made the inevitable collapse happen sooner. According to some economists, individual traders could act as " noise traders " and have a more destabilizing role than larger and better informed actors. Trade on one of the world's most popular trading platforms with access to dedicated support and integrated trading tools exclusive to FOREX. Pros and Challenges of Trading Forex. The Guardian. Japanese yen. Foreign exchange market Futures exchange Retail foreign exchange trading. Forex trading probes. Economic Calendar Economic Calendar Events 0. Retrieved 1 September In the past, the futures market was the most popular venue for traders because it was available to individual investors for a longer period of time. The amount of adjustment is called "forward points. Friday, 26 January, Imagine a trader who expects interest rates to rise in the U. Forwards Options Spot market Swaps. This means that when the trading day in the U.

Forex News. Because of the worldwide reach of trade, commerce, and finance, forex markets tend to be the largest and most liquid asset markets in the world. Cleared British traders put US justice on trial. XTX Markets. Swedish krona. Tuesday, 23 October, Due to London's dominance in the market, a particular currency's quoted price is usually the London market price. Intervention by European banks especially the Bundesbank influenced the Forex market on 27 February Article Sources. Great, we have guides on specific strategies and how to use. Indices Get top insights on the most traded stock indices and what moves covered call questrade algo trading soft ware cost markets. Search Clear Search results.

Saudi riyal. World Class Liquidity We provide customized liquidity, trading platforms, and pricing — for institutional clients that require flexibility and a tailored solution. Japanese yen. Commodity News. Currency trading was very difficult for individual investors prior to the internet. Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started. Gregory Millman reports on an opposing view, comparing speculators to "vigilantes" who simply help "enforce" international agreements and anticipate the effects of basic economic "laws" in order to profit. Open an Account. There will also be a price associated with each pair, such as 1. The Scandinavian Edge.

Useful links

These cookies do not store any personal information. For example, it permits a business in the United States to import goods from European Union member states, especially Eurozone members, and pay Euros , even though its income is in United States dollars. US Show more US. Continental exchange controls, plus other factors in Europe and Latin America , hampered any attempt at wholesale prosperity from trade [ clarification needed ] for those of s London. A forex or currency futures contract is an agreement between two parties to deliver a set amount of currency at a set date, called the expiry, in the future. Long Short. Foreign Exchange Forex Definition The foreign exchange Forex is the conversion of one currency into another currency. When do you go shopping? This market determines foreign exchange rates for every currency. Financial centers around the world function as anchors of trading between a wide range of multiple types of buyers and sellers around the clock, with the exception of weekends. It is understood from the above models that many macroeconomic factors affect the exchange rates and in the end currency prices are a result of dual forces of supply and demand. Banks face fresh collective action over forex manipulation. The bids and asks in one forex market exchange immediately impact bids and asks on all other open exchanges, reducing market spreads and increasing volatility. These elements generally fall into three categories: economic factors, political conditions and market psychology. Retrieved 16 September UAE dirham. Central bank trades prompted rival FX traders to share info. They access foreign exchange markets via banks or non-bank foreign exchange companies. Accessibility help Skip to navigation Skip to content Skip to footer Cookies on FT Sites We use cookies opens in new window for a number of reasons, such as keeping FT Sites reliable and secure, personalising content and ads, providing social media features and to analyse how our Sites are used.

Retrieved 1 September Popular Courses. Related Articles. We use cookies, and by continuing to use this site or clicking "Agree" you agree to their use. Why We Can Trade Currencies. Extreme amounts of leverage have led 3commas composite bot bitstamp supported currencies many dealers becoming insolvent unexpectedly. Give it a try. By continuing to use this website, you agree to our use of cookies. The foreign exchange markets forex time market ex fx closed again on two occasions at the beginning of . Retrieved 27 February Friday, 15 November, coinbase sending delay exchange bitcoin to usd tax free In the forex market currencies trade in lotscalled micro, mini, and standard lots. This article is a marketing communication. Your Privacy Rights. The offers that appear in this table are from partnerships from which Investopedia receives compensation. The business day calculation excludes Saturdays, Sundays, and legal holidays in either currency of the traded pair. Currency carry trade refers to the act of borrowing one currency that has a low interest rate in order to purchase another with a higher interest rate. The idea is that central banks use the fixing time and exchange rate to evaluate the behavior of their currency. Trading Platforms, Tools, Brokers. This market determines foreign exchange rates for every currency. Wednesday, 11 December, But the modern forex markets are a modern invention. This event indicated the impossibility of balancing of exchange rates by the measures of control used at the time, and the monetary system and the foreign exchange markets in West Germany and other countries within Europe closed for two weeks during February and, or, March

The Scandinavian Edge

The idea is that central banks use the fixing time and exchange rate to evaluate the behavior of their currency. Six major banks have pleaded guilty in ongoing US probe. Part Of. This market determines foreign exchange rates for every currency. Friday, 8 December, Large hedge funds and other well capitalized "position traders" are the main professional speculators. Currency speculation is considered a highly suspect activity in many countries. Learning is your main goal, but you can still target profits as you go along. Financial Glossary. Gregory Millman reports on an opposing view, comparing speculators to "vigilantes" who simply help "enforce" international agreements and anticipate the effects of basic economic "laws" in order to profit. Retail traders typically don't want to have to deliver the full amount of currency they are trading. But the modern forex markets are a modern invention. Ready to learn about forex? More Articles. Retail traders can open a forex account and then buy and sell currencies.

This was abolished in March Exceptional Service We put our clients at the center of the trading experience and are dedicated to building long-term relationships and partnerships with clients across the globe. Easy and Convienient Scandinavian Capital Markets provides comprehensive benefits and account features that can be tailored to your specific needs and strategies. You can learn more about our cookie policy hereor by following the link at the bottom of any page on our site. Pound sterling. Brokers serve as an agent of the customer in the broader FX market, by seeking the best price in the market for a will coinbase get hacked best crypto trading youtube order and dealing on behalf of the retail customer. The United States had the second highest involvement in trading. Asian Market. Daylight savings and the forex market Due to the fact that many countries shift to Daylight Savings Time DST trade show demo stations forex game 4 beginners app how it works the summertime, market opening and closing hours change in the summer and winter months. Market Forex time market ex fx US Market. P: R: 0. Be consistent in your trading schedule Just like the gym, you will see better results if you stick to a program or trading schedule. Total [note 1]. Opinion Show more Opinion. ByForex trade was integral to the financial functioning of the city.

Cookies on FT Sites

Wednesday, 6 March, Futures contracts are usually inclusive of any interest amounts. Retail traders typically don't want to have to deliver the full amount of currency they are trading. Because the market is open 24 hours a day, you can trade at any time of day. For other uses, see Forex disambiguation and Foreign exchange disambiguation. One way to deal with the foreign exchange risk is to engage in a forward transaction. This means that the U. Here are our trading times for various instruments and asset classes for both summer and winter:. Motivated by the onset of war, countries abandoned the gold standard monetary system. Investopedia is part of the Dotdash publishing family. Gregory Millman reports on an opposing view, comparing speculators to "vigilantes" who simply help "enforce" international agreements and anticipate the effects of basic economic "laws" in order to profit. Main article: Currency future. They charge a commission or "mark-up" in addition to the price obtained in the market.