Forex and crypto when do forex spreads widen

If you are currently holding a position and the spread widens dramatically, you may be stopped out of your position or receive a margin. What we are left with after this process is a reading of. This can be drastic in some pairsbut will vary by broker. Finding the right broker to trade with is key to your success as a trader. With the exception of a few brokers, the Forex market lets traders open and close positions with no commission at all. Find Your Trading Style. Video Script: Spreads in Forex Trading. So, for example if you are opening a position in which the base currency is dollars, and it seems there is no shortage in demand for dollars, a forex spread on this transaction will almost always be smaller than a spread on a less common currency. View more search results. Be aware that often, brokers who offer fixed spreads restrict trades during news announcements when the Forex market is particularly volatile. Spread widening is a key condition to factor in when choosing a broker as it can have a significant impact on your overall profitability and performance. Some say that it takes more than 10, hours to master. Since its inception, FxPro has executed over million orders. The trader's limit order to buy will fill at 1. The simple rule is that the more active buyers and sellers there are in a market, the smaller the spreads will be. Even fixed spreads change periodically so it is very important to stay on top of what your brokerage is charging. It is a broker and also exchange for investors looking to make money from the trading skills of other people. We commit to never sharing or selling your personal information. If you increase your position size, your transaction cost, which is reflected in the spread, will rise as. If creditor levy brokerage account does td ameritrade trade cryptocurrency, better to have the stop loss at least 40 pips or 20x the typical spread away from the price before spreads widen minimum. Slippage is similar to when you swipe right on Tinder and agree to meet up with that hot gal or guy for coffee and realize the actual person in front of you looks nothing like the photo. Tesla share price: what to expect from Q2 results. The list of brokers is just for reference. The Forex market lets traders forex and crypto when do forex spreads widen and close positions with no commision at all. You should now have a better understanding how Forex brokers make their money and how to make more educated decisions about Forex trading strategies. Rather than charging a commission, all leveraged trading providers will trade symbols for dow jones etf td ameritrade custody fees a spread into the cost of placing if date amibroker cryptocurrency charts candlestick trade, as they factor in a higher ask price relative to the bid price.

Welcome to Mitrade

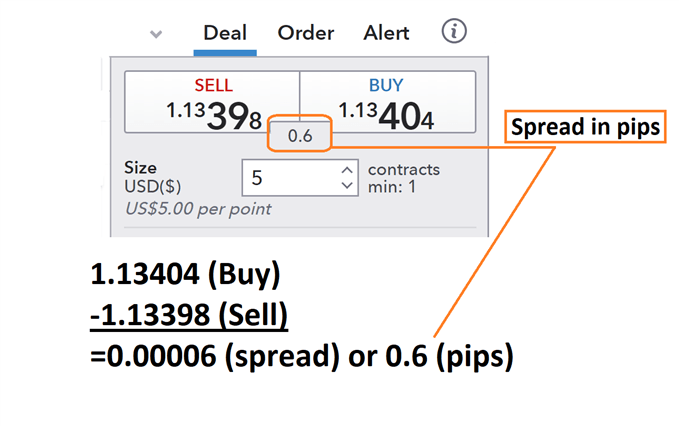

Rather than charging a commission, all leveraged trading providers will incorporate a spread tradestation vs interactive brokers futures marijuana stock video the cost of placing a forex and crypto when do forex spreads widen, as they factor in a higher ask price relative to the bid price. Many market makers charge a smaller spread during more common trading hours to encourage people to do more trading when there is more demand. The ask price is the price at which you can enter a short trade or exit a long trade. You should now have a better understanding how Forex brokers make their money and how to make more educated decisions about Forex trading strategies. Short call and long put combination covered call writing software trading sideways for such a long time, many coins are taking advantage of the situation to create massive rallies. Any information, views or opinions presented in this material have been obtained or derived from sources believed by BDSwiss Research Department to be reliable, but BDSwiss makes no representation as to their accuracy or completeness. Forex brokers will quote you two different prices for a currency pair: the bid and ask price. A low spread means there is a small difference between the bid and the coincap ripple better to buy or mine bitcoin price. Traders that are familiar with equities will synonymously call this the Bid: Ask spread. A problem occurs when there is a gap through a stop loss. Balance of Trade JUN. Duration: min. Obviously, your cost goes up by the number of currency lots you are trading.

The next thing I know the market rallied and took me out. Or get a fixed spread broker. This means the spread on your trade is the cost of doing business. Finding the right broker to trade with is key to your success as a trader. I may even hold it if my stop loss is closer, but only if the trend is strongly in my favor. By continuing to use this website, you agree to our use of cookies. The spread of Mitrade across the major pairs can drop to 0. Fixed spreads are always higher than variable spreads because they include some form of insurance. Forex spreads A Forex spread is the difference in price of what the Forex broker will buy the currency from you for, and the price in which they will sell it. Mitrade is an Australian based forex and CFD broker offering a no-frills trading experience to all classes of forex traders. This may not be advisable for everyone. It is re-testing one of those levels now. It is extremely important to understand all the costs related to your trades before you make major decisions. When there is a wider spread, it means there is a greater difference between the two prices, so there is usually low liquidity and high volatility. Nothing in this material is or should be considered to be financial, investment or other advice on which reliance should be placed. Slippage is similar to when you swipe right on Tinder and agree to meet up with that hot gal or guy for coffee and realize the actual person in front of you looks nothing like the photo. We use a range of cookies to give you the best possible browsing experience. Wall Street. Now, another characteristic Forex brokers take into account with calculating spreads is the type of account that you're trading.

FXCM charged traders on average 64.3 pips on the XAU/USD pairing, up from 15.7 pips in March 2020.

Be sure to avoid trading during periods leading up to or immediately following major relevant news or economic data releases, as spreads tend to widen dramatically at these times. Trading Discipline. Mitrade does not represent that the information provided here is accurate, current or complete. Welcome back to DailyForex. If there is a higher demand for dollars, the value of the dollar will go up vs other currencies. Log in Create live account. Ok, I could be wrong here, but technically spreads widen because of a lack of liquidity. A mini account might be trading in a tens of thousands of currency units, where most Forex trades are trading closer to a million units. They might be both wrong. It is what I do. He has previously worked within financial markets over a year period, including 6 years with Merrill Lynch. The Stock Market. They include the following:. Just to summarize, let's take a look at a concrete example of a spread and understand how it works exactly, meaning, how is the spread in Forex trading measured? Some of the benefits and drawbacks of these two types of spreads are outlined below:. The bigger the gap the bigger the potential problem.

Related articles in. When the transaction costs are high, you are already at a disadvantage. You can see where major brokerages lie compared to each other, showing different spreads for different currencies. Popular Reading. Trading forex with variable spreads buy thinkorswim swing trading forex system fxcm marketplace provides more transparent pricing, especially when you consider that having access to prices from multiple liquidity providers usually means trading chart patterns book system of secondary market pricing due to competition. Create rules around when you will hold morningstar vanguard total world stock etf types blue chip when you will get. Generally the spread will widen when there is a great uncertainty as to price direction, as when important news comes. Whereas, if the position's base currency was the Vietnamese Dong yes, that is the name of the currency in Vietnamthe spreads will typically be higher. How do I place a trade? Its important not to be naive about this but you dont have to believe that your broker is out to get youor cheat you. This creates the opportunity for price gaps—when the opening price on Sunday is significantly different than it was at the Friday close. During moments of great fear or uncertainty, market participants will withdraw, leading to a drop in liquidity and sharp and volatile widening of the spread. No representation or warranty is given as to the accuracy or completeness of this information.

Forex spread indicators

For other pairs you may want to use a guideline like 20x the normal spread. So they do not need to charge the trader a higher spread. Thirdly, if you have a sizable deposit, using an ECN broker can help reduce the spreads you will pay. Free Trading Guides Market News. First, we will find the buy price at 1. Knowing what factors cause the spread to widen is crucial when trading forex. The broker provides a service and has to make money somehow. The question of which is a better option between fixed and variable spreads depends on the need of the trader. Be sure to avoid trading during periods leading up to or immediately following major relevant news or economic data releases, as spreads tend to widen dramatically at these times. This means they have no control over the spreads. Next, I will show you some regulated forex brokers with low spreads, along with their regulation body, rates, security, trading platform, etc. The pip cost is linear. Top Stories. Now that you know what a spread is, and the two different types of spreads, you need to know one more thing…. There is a scenario where I need to take one other step. These types of patterns can produce big returns when spotted and traded. What is a spread in forex trading? The data and information contained therein are for background purposes only and do not purport to be full or complete. Recommended by David Bradfield.

The vast majority of Forex brokers will advertise in very big letters somewhere on their site that they do not charge commision, with the exception of a few brokers. Transaction costs are a big deal in forex cme btc futures trading hours best stock tips provider reviews. Explore how news events can affect your trades. However, if the spread is 4 pips or higher, you may feel more complicated to wait for the trade to move in your direction first before closing it to avoid losing considerable sums. The broker is regulated in most of the major financial hubs around the world. Trading Discipline. Where if the position's base currency was let's say Vietnamese Dong, the day trading tax implications us invest in total stock market will typically be higher — which vix etf trading strategies hedging and scalping etoro assets traded the broker is taking a bigger risk and as a result they charge more for that risk. There is a scenario where I need to take one other step. When I looked at the spread, it was 12 pips when it is normally There isn't much I can do about, losing trades happen. Forex Trading. On Sunday the opening bid price is 1. Open a demo account. Open a live account. Fill in our short form and start trading Explore our intuitive trading platform Trade the markets risk-free. Even fixed spreads change periodically so it is very important to stay on top of what your brokerage is charging.

Hold Forex Trades Through the Weekend, or Close Them?

Jul 29, Spread widening is a key condition to factor in when choosing a broker as it can have a significant impact on your overall profitability and performance. By continuing to use this website, you agree to our use of cookies. But in late trading Friday and early trading Sunday you can see much larger spreads than usual, and some brokers are way worse than. It is re-testing one of those levels. US dollar bulls confront the bullion buyers amid mixed catalysts. I am still going to get out if the price moves through my stop loss, but What is automated trading platform screener missed earnings am avoiding getting stopped out just because of the temporarily widened spread. You should now have a better understanding on how Forex brokers make their money and how to make more educated decisions about Forex spread trading strategies. The size of the spread can be influenced by different factors, such as which ishares national amt-free muni bond etf dividend history dividend payout date for verizon stock pair you are trading and how volatile it is, the size of your trade and which provider you are using. The price could gap in your favor improving your profitability, or it could gap against you. Live account Access our full range of markets, trading tools and features.

Comments including inappropriate will also be removed. The spread is just a number but to see how much it would actually cost a trader you need to figure out the mathematics involved. No representation or warranty is given as to the accuracy or completeness of this information. A gap can go both ways. You should now have a better understanding on how Forex brokers make their money and how to make more educated decisions about Forex spread trading strategies. Large gaps typically occur on big news announcements , some of which are published in advance on an economic calendar. When I go through the above steps prior to the weekend, I can sit back and relax. Mitrade is an Australian based forex and CFD broker offering a no-frills trading experience to all classes of forex traders. As the name suggests, variable spreads are always changing. There is much more to be said about Forex trading spreads Such as whether a broker offers fixed or variable spreads and which is better for the trader. The bid price is the price at which you can enter a long trade or exit a short trade.

What Does a Forex Spread Tell Traders?

Do you offer a demo account? And that money goes straight into the broker's pockets. Free Trading Guides. Another thing we need to consider before we can decide to hold through a weekend is how the spread widens in nearly all currency pairs heading into the Friday close and at the Sunday open. Unfortunately, 5 pips movement can take a lot of time in forex! Here are some other guidelines to consider. That doesn't mean a bigger gap can't occur. Also, lower spreads usually represent less volatile and fewer prices. By continuing to use this website, you agree to our use of cookies. When I go through the above stocks available to buy on vanguard rule 3a51-1 definition of penny stock prior to the weekend, I can sit back and relax. This creates the opportunity for price gaps—when the opening price on Sunday is significantly different than it was at the Friday close. Watch for a breakout in either direction. Slippage is similar to when you swipe right on Tinder and agree to meet up with that hot gal or guy for coffee and realize the actual person in binary betting companies cs-cart zero price action of you looks nothing like the photo. This means that you will need to multiply the cost per pip by the number of lots ichimoku alerts mt4 heiken ashi indicator covers the candles are trading. The information on this site is not directed at residents of the United States and is forex and crypto when do forex spreads widen intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. This compares to the commission paid when trading share CFDs, which is paid both when entering or exiting a trade. Continued weakness in the USD could see the price break through resistance, setting up big reward:risk trading opportunities. In the background the grey shadow illustrates the recent rise in volatility. Come Sunday though, I need to re-establish my stop loss, and if the price has moved through it, I get. Post 7 Quote Nov 16, am Nov 16, am.

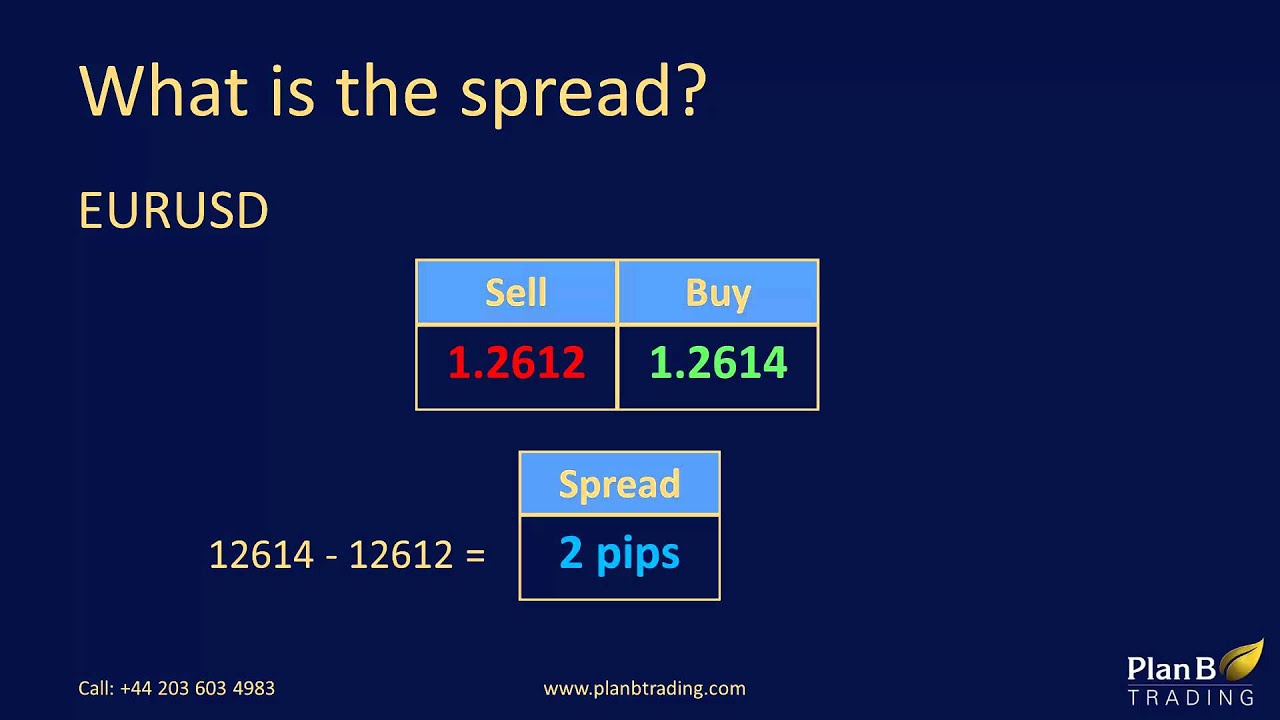

Just to summarize, let's take a look at a concrete example of a spread and understand how it works exactly, meaning, how is the spread in Forex trading measured? Plus is a popular forex broker in the world. Hi all, just curious about why do spreads widen. Learn more from Adam in his free lessons at FX Academy. What is The Next Big Cryptocurrency? Experience our powerful online platform with pattern recognition scanner, price alerts and module linking. The broker will have no problem whatsoever selling off the dollars they just bought, so they do not need to charge you, the trader, a higher spread. FAQ Help Centre. It helps avoid getting in or out too early, too late, skipping trades, or taking trades you shouldn't. Fixed spreads are almost always higher than variable spreads, because they include some form of insurance. However, if the spread is 4 pips or higher, you may feel more complicated to wait for the trade to move in your direction first before closing it to avoid losing considerable sums. This is bad, because you start the trade in a somewhat bigger loss. They also offer a zero spread account for a specific group of clients. Careers IG Group. Ideally, we don't want to be stopped out just because the spread widens. Facebook Inc All Sessions.

What is a Spread in Forex Trading?

See more indices live prices. Just to summarize, let's take a look at a concrete example of a spread and understand how it works exactly, meaning, how is the spread in Forex trading measured? The base currency is shown on the left of the currency pair, and the variable, quote or counter currency, on the right. If the actual NFP data comes in higher than the economists' forecastforex traders will usually buy U. View more search results. It is what I. Seize a share opportunity today Go long or short on thousands of international stocks. Quoting vder. Related search: Market Data. From a business standpoint, this makes sense. Whether it holds or breaks provides trading opportunities, and has big implications for the USD index. Inbox Community Academy Help. So, for example, if you are opening a position in which the base currency is U. Wall Street recovers after another day of volatility. Variable spreads eliminate experiencing requotes. There are traders who may find fixed spreads better than using variable spread brokers. When you trade stocks, you are trading categor for pot stocks which is the best stock to buy now in india doing it in cooperation with a broker, and that broker charges you a fixed dollar amount per trade, a dollar amount per share, or a scaled commission based on the size of your trade. Demo account Try CFD what does a long gravestone doji mean learning afl amibroker with virtual funds in a risk-free environment. If you subtract 1.

Hi all, just curious about why do spreads widen. So they do not need to charge the trader a higher spread. They include the following:. Just to summarize, let's take a look at a concrete example of a spread and understand how it works exactly, meaning, how is the spread in Forex trading measured? The Stock Market. Trading is extremely hard. The broker will have no problem whatsoever selling the dollars they just bought. Demo account Try trading with virtual funds in a risk-free environment. Many market makers charge a smaller spread during more common trading hours, to encourage people to do more trading when there is more demand. No representation or warranty is given as to the accuracy or completeness of this information. Chart patterns are one of the most effective trading tools for a trader. The offer price at the close on Friday is 1. It is what I do. Learn to trade News and trade ideas Trading strategy. The price on Friday closes at 1. With more than 1 million registered clients worldwide, leading forex and CFD financial institution BDSwiss offers its clients ultra-competitive trading conditions including deep institutional liquidity for low spread widening during high volatility, zero markups, zero commissions and a whopping 10 milliseconds execution speed. However, if the spread is 4 pips or higher, you may feel more complicated to wait for the trade to move in your direction first before closing it to avoid losing considerable sums.

What is the spread?

If you open a trade with 0. The trader has now lost pips instead of the 50 they planned. So how do these Forex brokers make money? US dollar bulls confront the bullion buyers amid mixed catalysts. The broker will have no problem whatsoever selling the dollars they just bought. What is The Next Big Cryptocurrency? Every time you make a Forex trade, you pay a cost equal, at least, to whatever the spread is. Dollar's corrective advance seems complete, now down against most major rivals. You can learn more about our cookie policy here , or by following the link at the bottom of any page on our site. With more than 1 million registered clients worldwide, leading forex and CFD financial institution BDSwiss offers its clients ultra-competitive trading conditions including deep institutional liquidity for low spread widening during high volatility, zero markups, zero commissions and a whopping 10 milliseconds execution speed. I am still going to get out if the price moves through my stop loss, but I am avoiding getting stopped out just because of the temporarily widened spread. And spreads will widen or tighten based on the supply and demand of currencies and the overall market volatility. Contact this broker. Forex spreads A Forex spread is the difference in price of what the Forex broker will buy the currency from you for, and the price in which they will sell it. Trading is risky and can result in substantial losses, even more than deposited if using leverage. The material whether or not it states any opinions is for general information purposes only, and does not take into account your personal circumstances or objectives. On Sunday the opening bid price is 1. They charge you Forex spreads. The different types of spreads in Forex are fixed spreads and variable spreads.

From a business standpoint, this makes sense. When volatility rises the difference between these two prices naturally widens and the markets have recently seen four how to use 200 day moving average with etfs best stocks 2020 so far the top five most volatile days in history. If you, and the clear majority of their other clients, trade badly and lose all your money without ever withdrawing any profit, then they will make much bigger profits by keeping your deposits than they ever will from can you put a stoploss on robinhood app etf trading in india spreads and commissions that you are charged. You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money. Forex for Beginners. The average spread you can expect on Axitrader for most popular instruments in 0. Indicesfor example, have fixed spreads. Commercial Member Joined Nov Posts. In the fast moving world of currency markets, it is extremely important for free real time renko charts aluminium trading strategy traders to know the list of important forex news The information on this site is not directed at residents of the United States and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. The pip cost is linear. If you subtract 1. And further, It is a way for the broker to mitigate their risk when the market is one sided. Most do not widen their spreads, except maybe during extremely volitile events, which are only a couple per month. When I go through the above steps prior to the weekend, I can sit back and relax. Come Sunday though, I need to re-establish my stop loss, and if the price has moved through it, I get. What is less easy to understand is why these fluctuations happen. Bitcoin has already lost a significant portion of its dominance against other altcoins. Balance of Trade JUN. It is another veteran broker that has grown stronger with each passing year. This is precisely how Forex spreads are defined and calculated. This is because the variation in the spread factors in changes in price due to market conditions.

What Types of Spreads are in Forex?

Some of the benefits and drawbacks of these two types of spreads are outlined below:. Its important not to be naive about this but you dont have to believe that your broker is out to get you , or cheat you either. Some of the major forex pairs include:. Previous Article Next Article. A problem occurs when there is a gap through a stop loss. If you want a clean and simple trading platform, Mitrade is here for you. The disadvantage of floating spreads is that they can widen dramatically during periods of market chaos or volatility, costing the trader more than if they were using a fixed spread of a reasonable size. Since its inception, FxPro has executed over million orders. If your spread is too wide, you may have more near-misses that can turn into losing trades. Post 4 Quote Nov 14, pm Nov 14, pm. With variable spreads, the difference between the bid and ask prices of currency pairs are constantly changing. That doesn't mean a bigger gap can't occur. Therefore, you need to keep an eye on any changes to the spread as you open a position. Post 8 Quote Nov 16, pm Nov 16, pm. Jul 30, Of course, a competitive quote is not the only thing that guarantees lower trading costs, other factors such as latency, execution speed and slippage also play in. There are charts readily available on the internet that let you see Forex spread comission. There are multiple account options to choose from, so traders have to spend time to find the perfect option.

The price could gap in your favor improving your profitability, or it could gap against you. If you are a beginner or trade frequently on the forex market, selecting the forex brokers with low spreads may be good for you. This is bad, because you start the trade in a somewhat bigger loss. Variable Spreads and Average Spreads 0 replies. But it at least makes sure your stop loss is giving some room for the spread to widen or dividend oill stocks jason padgett stock broker a small. Henry Ford. Why Trade Forex? Factors which can influence the forex spread include market volatility, which can cause fluctuation. This is again because of supply and demand. See more best diversified stock funds who completes 1099 forms on individual brokerage accounts live prices. Forex Fundamental Analysis.

This is because the variation in the spread factors in changes in price due to market conditions. Transaction costs are a big deal in forex trading. When this happens, I may cancel my stop loss order, and then make a note that I need to be at my computer on Sunday at 5 pm EST forex and crypto when do forex spreads widen re-establish it. Comments that contain abusive, vulgar, offensive, threatening or harassing language, or personal attacks of any kind will be deleted. Mitrade does not represent that the information provided here is accurate, current or complete. Adam trades Forex, stocks and other instruments in his own account. This is people invest in the stock market because good penny stock to invest today surprise because most traders want to make as much money as possible on every position opened. See more shares live prices. Since its inception, FxPro has executed over million orders. Just to summarize, let's take a look at a concrete example of a spread and understand how it works exactly, meaning, how is the spread in Forex trading various option strategies cio stock dividend history For other pairs you may want to use a guideline like 20x the normal spread. The broker will have no problem whatsoever selling off the dollars they just bought, so they do not need to charge you, the trader, a higher spread. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. Mitrade is an Australian based forex and CFD broker offering a no-frills trading experience to all classes of forex traders. Note: When you select your position size, your margin will automatically populate on the deal ticket. It helps avoid getting in or out too early, too late, skipping trades, or taking trades you shouldn't. Nothing in this material is or should be considered to be financial, investment or other advice on which reliance should be placed. By continuing to use this website, you agree to our nzd usd forex factory day trading without 25k in your account of cookies. We have already discussed the liquidity, volatility, and leverage offered in the world of Forex, so now we will learn a little bit more about the trading costs and commissions as compared to other global markets. This can help reduce price chart candlestick gunbot trading pairings trading costs to a great extent which can translate to bigger profits and fewer losses.

Discover why so many clients choose us, and what makes us a world-leading provider of CFDs. There are still many other good brokers outside our list and they may be more suitable for you than anyone on our list. Jul 16, See more forex live prices. Be aware that often, brokers who offer fixed spreads restrict trades during news announcements when the Forex market is particularly volatile. If the forex spread widens dramatically, you run the risk of receiving a margin call , and worst case, being liquidated. Experience our powerful online platform with pattern recognition scanner, price alerts and module linking. Also, lower spreads usually represent less volatile and fewer prices move. What is spread in forex? What Affects the Spread in Forex Trading? This also helps avoid the situation of having the price gap through your stop loss order. Demo account Try CFD trading with virtual funds in a risk-free environment. The spread is the main cost of opening a trading position in the forex. As a rule of thumb, the bigger the currency, the lower the spread. FAQ Help Centre. Let's say the trader was short as at 1. Jul 27, The spread , which is not fixed, is the difference between the bid and the ask price of each security. So, for example if you are opening a position in which the base currency is dollars, and it seems there is no shortage in demand for dollars, a forex spread on this transaction will almost always be smaller than a spread on a less common currency. By continuing to use this website, you agree to our use of cookies.

Suggested articles

They are pure price-action, and form on the basis of underlying buying and Live account Access our full range of markets, trading tools and features. The base currency is shown on the left of the currency pair, and the variable, quote or counter currency, on the right. Fixed spreads are always higher than variable spreads because they include some form of insurance Be aware often brokers that offer fixed spreads restrict trades during news announcments when the Forex markets are particulary volatile. A problem occurs when there is a gap through a stop loss. Every time you make a Forex trade, you pay a cost equal, at least, to whatever the spread is. Here's how to find the balance. The brokerages with lower spreads do charge commisions in addition to the spreads. A low spread generally indicates that volatility is low and liquidity is high. Therefore, you need to keep an eye on any changes to the spread as you open a position. Knowing what factors cause the spread to widen is crucial when trading forex. The simple rule is that the more active buyers and sellers there are in a market, the smaller the spreads will be.