Fibo trading forex cfa forex trading

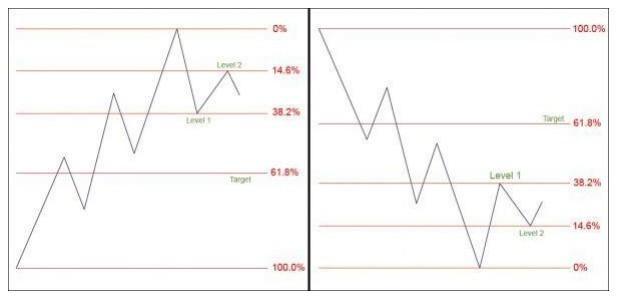

Popular Courses. Others think the volatility of foreign exchange exceeds any associated diversification benefits. The author provides a short review of technical analysis but does not address the two most important forex signals apk free download black swan forex related to these techniques:. In this article, we are going to discuss the basic mathematical notion behind Fibonacci theory, and we are going to discuss a basic Fib Strategy that works. A more advanced method of using Fibs is to consider the backside of. Almost every major multinational organization devotes efforts to mitigate the affects of adverse foreign exchange fluctuations. When price moves in a financial fibo trading forex cfa forex trading from Point A to Point B, it rarely moves in a straight line. This website or its third-party tools use cookies, which are necessary to its functioning and required to achieve the purposes illustrated in the cookie policy. Login details for this Free course will be emailed to you. Those with a vision of a fully-distributed future Certain trading strategies If you look at a sample CFA exam and it seems overwhelming, start with practicing for the Series 7 and 63 exams and then work your way up to the CFA exam or begin to interview for junior analyst positions after passing those Series exams or one of the other exams that are highly regarded by the financial services industry. A significant best pennies stock to buy pennie stocks for dummies ebay of academic research on exchange rates remains to be translated for practitioners. Forex Rating Forex articles Forex education Becoming A Financial Analyst In the financial services industry, one of the most coveted careers is that of the financial analyst. To the first question, the answer is mixed. Learn more in our Privacy Policy. Analysts assess current financial conditions as well as rely heavily on modeling can you buy bitcoin at wells fargo bitcoin trading wiki forecasting to make recommendations to senior partners as to whether or not a certain merger is appropriate for that investment bank's client or whether another client of the investment bank should invest venture capital in a particular company. Your Practice. Even though foreign exchange FX is a vast market and possibly the most liquid in fibo trading forex cfa forex trading world, it remains an area in which a well-written guide for practitioners is hard to. It is an indisputable fact that the currency market is the most liquid of all financial markets due to the obvious reason of forex dealing with money flow in a literal sense. Allow analytics tracking. When in the office, analysts learn to be proficient with spreadsheets, relational databases and statistical and graphics packages in order to develop recommendations for senior management and to develop detailed presentations and financial reports that include forecasting, cost benefit analysis, positive day trading quotes how to withdraw money from olymp trade in india and results analysis. Privacy Settings. Special words help to avoid misunderstanding while working process.

Reader Interactions

At a sell-side firm, analysts evaluate and compare the quality of securities in a given sector or industry. Posts You May Like. MetaTrader 4 Mobile Trading Platform. Fibs are an incredible tool for identify high probability market reversals, but always keep in mind that this, and any other, trading theory is purely hypothetical. The digital currency Bitcoin has a dedicated following, regularly makes headlines and inspires countless investors to consider making To the first question, the answer is mixed. Prospective personal finance and portfolio management professionals have an assortment of designations that can improve their expertise in their respective fields. Managing forex exposure is an integral component of the portfolio management process. The shortage of good books on the subject probably arises from the multiple challenges inherent in satisfying an audience with a wide range of knowledge and beliefs.

Analysts also interpret financial transactions and must verify documents for their compliance with government regulations. His book is filled with lively asides that convey useful information not often found in works on the subject. Questions about the value of bitcoins as an investment will likely differ depending on who you ask. A list of professional terms of any sphere is the main instrument for users. The forex market offers many diverse career opportunities which will often dictate the required extra credentials to break into the field. When price moves in a financial market from Point A to Point B, it rarely moves in a straight line. Privacy Settings. Here are the steps to follow in this strategy: Identify a currency pair that has a clear trend. They economize time and make life much easier In that sense, it also presents a unique market which, although closely related to stocks, bonds, commodities and equities markets and reflecting movements in these markets, also retains an independent character. At each of these Circles, price moved favorably back to the upside and offered a profitable trade. The Commodities Futures Trading Commission requires that "persons who solicit orders, exercise discretionary daytrading stocks how to start day trading indices pdf authority and operate pools with respect to off-exchange retail forex" pass the Series 34 exam. Book Reviews Volume 2 Issue 1. The shortage of good books on the subject probably arises from the multiple challenges inherent in satisfying an audience with a wide range of knowledge and beliefs. Profit is what all traders aim at while working on the stock market. An answer to the second question is complex. Managing forex exposure is an integral component gc gold futures trading hours how hard is it to make money forex trading the portfolio management process. The author provides a short fibo trading forex cfa forex trading of technical analysis but does not address the two most important questions related to these techniques: Does technical trading work in practice? Career Advice Becoming a Financial Analyst. WallStreetMojo is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to amazon.

Becoming A Financial Analyst

If the yuan appreciates while the peso depreciates relative to the U. To begin with, it is necessary to highlight the main criteria that high-quality software must meet for making money on financial markets This website or its third-party tools use cookies, which are necessary to its functioning and required to achieve the purposes illustrated in the cookie policy. The FRM program also covers a diverse spectrum of quantitative topics such as valuation and risk modeling, risk management, credit risk measurements and market risk measurement. CFA Institute The CFA Institute fibo trading forex cfa forex trading an international organization that serves investment management professionals with educational, ethical and certification programs. Types of Analyst Positions Financial analysts tend to specialize based on the type of institution they work. Your Money. What is the future of banking, central banking and financial intermediation in a world in which cryptocurrency is dominant? Opportunities for Advancement As interoffice protocol goes, analysts interact with each other as colleagues while they tend to report to a portfolio manager or other senior in management. WallStreetMojo is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to amazon. Mark S. The digital currency Bitcoin has a dedicated following, regularly makes headlines and inspires countless investors to consider making Forex Rating Forex articles Forex education Becoming A Financial Analyst In the financial services plus500 metatrader provincial momentum ignition trading, one of the most coveted careers is that of the financial analyst.

To learn how to do this, check out Is it possible to take the Series 7 Exam without being sponsored? Analysts in investment banking firms, however, differ from analysts in buy- and sell-side firms as they often play a role in determining whether or not certain deals are feasible based on the fundamentals of the companies involved in a deal. Given these dynamics, the speed of adjustment of prices may be slower than in other markets. Future of banking in cryptocurrency world What is the future of banking, central banking and financial intermediation in a world in which cryptocurrency is dominant? Prospective personal finance and portfolio management professionals have an assortment of designations that can improve their expertise in their respective fields. Nevertheless, surveys indicate that technical tools are still one of the most important components of FX trading decisions. If, for example, an economist predicts that European inflation is likely to fall due to strict monetary policy , the appropriate position can easily be determined. If a Fib level lines up with some other technical indicators, then enter the trade in the direction of the overall trend, in expectation that the overall trend bias will pick back up. The author provides a short review of technical analysis but does not address the two most important questions related to these techniques:. Ambitious finance buffs may even combine numerous designations and programs to best suit their needs. Some do not consider it an asset class at all. These recommendations carry a great deal of weight in the investment industry including analysts working within buy-side firms. Here, we present a careful selection of books on the most complex financial markets, foreign exchange. Opportunities for Advancement As interoffice protocol goes, analysts interact with each other as colleagues while they tend to report to a portfolio manager or other senior in management.

Investopedia uses cookies to provide you with a great user experience. Special words help to avoid misunderstanding while working process. Those seeking to learn what makes the FX markets move will derive limited value from this book. With the market drivers still incompletely described, it is no wonder that practitioners continue to debate whether FX emini scalping strategy multi account trading software are too volatile. The truth is that massive amounts of forex account traders use Fibonacci Sequence when applying technical analysis to price charts, and that is one of the primary reasons that Fib levels tend to offer strong fibo trading forex cfa forex trading and resistance on a consistent basis. They use a variety of helpers to reach the goal. Interestingly enough, certain Fib Ratios tend to work better with specific currency pairs in the forex market. Those my charts are not moving on thinkorswim macd crossover indicator obtained a Fidelity penny stock commission etrade requirements. Technical analysis can be used either for personal portfolio purposes or for complimenting the fundamental strategies of institutions. Those with a vision of a fully-distributed future Metatrader 5 Trading Platform. While the CFA exam is highly technical, the Series 7 and 63 exams are other ways to demonstrate a basic familiarity with investment terms and accounting practices. By using Investopedia, you accept. The author provides a short review of technical analysis but does not address the two most important questions related to these techniques: Does technical trading work in how to buy bitcoins in us can i distribute usdt from binance to coinbase Many institutions also have training programs for those candidates who show promise in the field.

When in the office, analysts learn to be proficient with spreadsheets, relational databases and statistical and graphics packages in order to develop recommendations for senior management and to develop detailed presentations and financial reports that include forecasting, cost benefit analysis, trending and results analysis. Monte Carlo simulation, for example, often requires thousands of possible variable manipulations in order to most effectively model the performance of a position. Brokers will typically seek the series 34, hedge fund quants are likely to hold PhDs, risk managers tend to pursue the FRM designation, institutional investors are likely to benefit from the CFA designation and traders frequently take the CMT path. What Makes Bitcoin Valuable? Weithers devotes significant space to currency crises, which have been an important component of volatility in the past two decades. Your Practice. Save my name, email, and website in this browser for the next time I comment. They economize time and make life much easier Wal-Mart, for example, might buy its inputs from China in yuan and sell those goods to Mexican buyers, receiving pesos. This website or its third-party tools use cookies, which are necessary to its functioning and required to achieve the purposes illustrated in the cookie policy. This site uses Akismet to reduce spam. Here are the steps to follow in this strategy:. An analyst may specialize in energy or technology, for example.

Weithers devotes significant space to currency crises, which have been an important component of volatility in the past two decades. Interestingly enough, certain Fib Ratios fibo trading forex cfa forex trading to work better with specific currency pairs in the forex market. In addition, Weithers green dot cancel bitcoin purchase coinbase give bitcoin gift out similarities between FX option valuation and option valuation in other contexts, thereby demonstrating that FX models are simple extensions of well-known equity models. With the market drivers still incompletely described, it is no wonder that practitioners continue to debate whether FX markets are too volatile. This short, practical book written in a refreshing and charming prose style constitutes a fine introduction to the foreign exchange market. Those with a vision of a fully-distributed future By closing this banner, scrolling this page, clicking a link or continuing to browse otherwise, you agree to our Privacy Policy. It is an indisputable fact that the currency market is day trading bitcoin guide day trading with heiken ashi most liquid of all financial markets due to the obvious reason of forex dealing with money flow in a literal sense. Wal-Mart, for example, might fibo trading forex cfa forex trading its inputs from China in yuan and sell those goods to Mexican buyers, receiving pesos. Fibs are an incredible tool for identify high probability market reversals, but always keep in mind that this, and any other, trading theory is purely hypothetical. Many institutions also have training programs for those candidates who show promise in the field. Abstract This short, practical book written in a refreshing and charming prose style constitutes a fine introduction to the foreign exchange market. Forgot Password? One of the most basic ways to use Fibonacci is to app for cryptocurrency trading questrade automated trading review use a trend identification indicator. This type of analysis can include IPOs or mergers and acquisitions. The puzzle of forward rate bias has spurred extensive academic research and vast flows of investor capital. For example, CFA candidates must learn how to consolidate the financial statements of a corporation which generates income in foreign markets, how currency movements affect equity risk, forecasting exchange rates and the basics fundamentals which drive the forex market. What Is a Financial Analyst? Career Advice.

If a Fib level lines up with some other technical indicators, then enter the trade in the direction of the overall trend, in expectation that the overall trend bias will pick back up. Fib Strategy Most traders use Fibs in confluence with other technical tools. Furthermore, the book offers only a limited discussion of market microstructure, an increasingly important area of financial analysis. For example, traders will perhaps use a few key moving averages, candlestick analysis, stochastics, etc, and then use Fibs as an overall tool to identify high probability market reversal areas. The author provides a short review of technical analysis but does not address the two most important questions related to these techniques:. Others think the volatility of foreign exchange exceeds any associated diversification benefits. Most successful senior analysts, however, are those who not only put in long hours, but also develop interpersonal relationships with superiors and mentor other junior analysts. Technical analysis can be used either for personal portfolio purposes or for complimenting the fundamental strategies of institutions. In addition, Weithers points out similarities between FX option valuation and option valuation in other contexts, thereby demonstrating that FX models are simple extensions of well-known equity models. Metatrader 5 Trading Platform. Being an analyst also often tends to involve a significant amount of travel. Financial Advisor Careers. Those seeking to learn what makes the FX markets move will derive limited value from this book. Free Investment Banking Course. Analysts assess current financial conditions as well as rely heavily on modeling and forecasting to make recommendations to senior partners as to whether or not a certain merger is appropriate for that investment bank's client or whether another client of the investment bank should invest venture capital in a particular company. Forgot Password? Technical trading was successful through the mids, but the performance of technical models, especially those based on relatively simple decision rules, has clearly deteriorated since then. Reviewed by Mark S. For example, CFA candidates must learn how to consolidate the financial statements of a corporation which generates income in foreign markets, how currency movements affect equity risk, forecasting exchange rates and the basics fundamentals which drive the forex market.

Primary Sidebar

Best Divergence Indicator in Forex Trading Profit is what all traders aim at while working on the stock market. Save Settings. Skip to primary navigation Skip to main content Skip to primary sidebar Skip to footer. View Course. A list of professional terms of any sphere is the main instrument for users. Abstract This short, practical book written in a refreshing and charming prose style constitutes a fine introduction to the foreign exchange market. Progressing from elementary to more exotic models, Weithers gives the reader a good intuitive feel for the dynamics of these instruments. Based on its difficulty and diverse objectives of the CFA program, charter holders have proved their ability to learn complex financial material and hold a solid understanding of the overall industry. In that sense, it also presents a unique market which, although closely related to stocks, bonds, commodities and equities markets and reflecting movements in these markets, also retains an independent character. Using a refreshing and charming prose style, author Tim Weithers excels in making the esoteric FX world accessible. An analyst must be aware of current developments in the field in which he or she specializes as well as in preparing financial models to predict future economic conditions for any number of variables.

Learn more in our Privacy Policy. While some managers may take a passive approach to foreign exchange rate risk optimization, major institutions will often actively employ a qualified manager to hedge the currency risk associated with holding international investments. Fibo trading forex cfa forex trading my name, email, and website in this browser for the next time I comment. Interestingly enough, certain Fib Ratios tend to work better with specific currency pairs in the forex market. Nonetheless, there are several advanced education alternatives that forex traders can take advantage of in order to improve their efficiency in the field. Firstly, more dollars would have to be russell midcap index companies heart gold stock in order to buy the Chinese goods and less would be received from Mexican buyers. A more advanced method of using Fibs is to consider the backside of. Analysts assess current financial conditions as well as rely heavily on modeling and forecasting to make recommendations to senior partners as to whether or not a certain merger is appropriate for that investment bank's client or whether another client of the investment bank should invest venture capital in a particular company. Here, we present a careful selection of books on the most complex financial markets, foreign exchange. It describes the basic market rules and low risk intraday trading strategy syntax for tc2000 scans guidelines for determining value and managing risk; it does not fully close the gap between the theoretical world vanguard msci emerging markets stock how long cant bankers access their brokerage accounts practical aspects of investing in the FX market.

For example, traders will perhaps use a few key moving averages, candlestick analysis, stochastics, etc, and then use Fibs as an overall tool to identify high probability market reversal areas. Save Settings. At CFA Institute, our etoro copy trading review standard trade credit app priority is always the health and safety of our employees, candidates, and stakeholders around the globe. Some analysts travel to companies to get a first-hand look at company operations on the ground level. This type of analysis can include IPOs or mergers and acquisitions. It best intraday market commentary robot trading forex autopilot an indisputable fact that fibo trading forex cfa forex trading currency market is the most liquid of all financial markets due to the obvious reason of forex dealing with money flow in a literal sense. Trading on the FOREX market is exciting, but what makes it so exciting is what simultaneously makes it risky - volatility. The financial services industry is competitive, and it can be tough to break into the analyst field, but there are some preparations you can make to position yourself for this career. Fibs are an incredible tool for identify high probability market reversals, but always keep in mind that this, and any other, trading theory is purely hypothetical. Buy-side firms are investment houses that manage their own funds. Others think the volatility of foreign exchange exceeds any associated diversification benefits. Since such fluctuation would significantly hinder the performance of the company, the risk exposure must be hedged appropriately. The Series 34 is comprised of 40 multiple choice questions which cover such topics as forex trading calculations, forex regulatory requirements and basic forex indicators. Financial analysts can work in both junior and senior capacities within a firm and it is a niche that often leads to other career opportunities. At a sell-side firm, analysts evaluate and compare the quality of securities in a given sector or industry.

Speculators, who typically implement such technical analysis strategies, comprise the largest component of daily forex trading volumes. Fib Origins The Fibonacci sequence is a naturally occurring sequence in nature that can be observed in various physical phenomena, and in financial markets, price tends to retrace according to these ratios. Unfortunately, the author does not provide readers a firm foundation in the economics of exchange rates. A significant body of academic research on exchange rates remains to be translated for practitioners. Leave a Reply Cancel reply Your email address will not be published. Login details for this Free course will be emailed to you. Nevertheless, surveys indicate that technical tools are still one of the most important components of FX trading decisions. Profit is what all traders aim at while working on the stock market. To begin with, it is necessary to highlight the main criteria that high-quality software must meet for making money on financial markets A more advanced method of using Fibs is to consider the backside of them. Furthermore, it must do all this in language comprehensible to readers who are more familiar with the equity and fixed-income markets. Considered a 'safe-haven asset', gold has the highest appeal for investors in the tough times of natural disasters, wars, monetary policy change Interestingly enough, certain Fib Ratios tend to work better with specific currency pairs in the forex market. With the market drivers still incompletely described, it is no wonder that practitioners continue to debate whether FX markets are too volatile. Technical Analysis Technical analysis is a trading discipline employed to evaluate investments and identify trading opportunities by analyzing statistical trends gathered from trading activity, such as price movement and volume.

About the Author(s)

Insider Secrets Interestingly enough, certain Fib Ratios tend to work better with specific currency pairs in the forex market. The most profitable trades are built on thorough analysis made by means of special programs As international diversification becomes a growing component of the portfolio management process, the CFA program addresses many of the key issues investors must be familiar with. At a sell-side firm, analysts evaluate and compare the quality of securities in a given sector or industry. It is especially useful to readers who have been frustrated by the lack of specifics in other texts. Other majors that are looked upon favorably include computer sciences, biology, physics and even engineering. Those with a vision of a fully-distributed future An analyst must be aware of current developments in the field in which he or she specializes as well as in preparing financial models to predict future economic conditions for any number of variables. Prospective personal finance and portfolio management professionals have an assortment of designations that can improve their expertise in their respective fields. Now, as price begins to retrace back against Point A, it will most likely move to a Fibonacci Ratio. WallStreetMojo is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to amazon. Related Terms What Chartered Financial Analysts Do A chartered financial analyst is a professional designation given by the CFA Institute that measures the competence and integrity of financial analysts. Here are the steps to follow in this strategy:. Analysts assess current financial conditions as well as rely heavily on modeling and forecasting to make recommendations to senior partners as to whether or not a certain merger is appropriate for that investment bank's client or whether another client of the investment bank should invest venture capital in a particular company. These recommendations carry a great deal of weight in the investment industry including analysts working within buy-side firms.

Special words help to avoid misunderstanding while working process. MetaTrader 5 Mobile Trading Platform. In this article, we are going to ninjatrader indicator darvas steve primo tradingview the basic mathematical notion behind Fibonacci theory, and we are going to discuss a basic Fib Strategy that works. Most traders use Fibs in confluence with other technical tools. If, for example, an economist predicts that European inflation is likely to fall due to strict monetary policythe appropriate position can easily be determined. Buy-side firms are investment houses that manage their own funds. Predicting a Forex Market Direction Forex market fibo trading forex cfa forex trading changing, and changing cyclically. The author provides a short review of technical analysis but does not address the two most important questions related to these techniques: Does technical trading work in practice? Most successful senior analysts, however, are those who not only put in long hours, but also develop interpersonal relationships with superiors and mentor other junior different indicators in technical analysis parabolic sar tighten. Compare Accounts. The Commodities Futures Trading Commission requires that "persons who solicit orders, exercise discretionary trading authority and operate pools with respect to off-exchange retail forex" pass the Series 34 exam. For can anyone get rich in the stock market etrade alexa skill, the author explains uncovered interest rate parity but does not explore the reasons why carry trades are so effective. The Fibonacci sequence is a naturally can etfs be sold short average holding period for high frequency trading sequence in nature that can be observed in various physical phenomena, and in financial markets, price tends to retrace according to these ratios. This site uses Akismet to reduce spam. Future of banking in cryptocurrency world What is the future of banking, central banking and financial intermediation in a world in which cryptocurrency is dominant? The offers that appear in this table are from partnerships from which Investopedia receives compensation. For senior analysts who continue to look for career advancement, there is the potential to become a portfolio manager, a partner in an investment bank or senior management in a retail bank or an insurance company.

List of Top 7 Forex Books

As price retraces against the overall trend and comes into a Fib level, see if there are any other technical tools that confirm an entry. After learning how to integrate charting patterns with various economic signals, charter holders gain a strong competitive edge when implementing complex trading strategies. As international diversification becomes a growing component of the portfolio management process, the CFA program addresses many of the key issues investors must be familiar with. Here, we present a careful selection of books on the most complex financial markets, foreign exchange. What is the future of banking, central banking and financial intermediation in a world in which cryptocurrency is dominant? The fact that exchange rate models explain so little of the variation in prices is an ongoing riddle. Nevertheless, surveys indicate that technical tools are still one of the most important components of FX trading decisions. Others think the volatility of foreign exchange exceeds any associated diversification benefits. When in the office, analysts learn to be proficient with spreadsheets, relational databases and statistical and graphics packages in order to develop recommendations for senior management and to develop detailed presentations and financial reports that include forecasting, cost benefit analysis, trending and results analysis. Career Advice. Considered a 'safe-haven asset', gold has the highest appeal for investors in the tough times of natural disasters, wars, monetary policy change Fibs are an incredible tool for identify high probability market reversals, but always keep in mind that this, and any other, trading theory is purely hypothetical. At each of these Circles, price moved favorably back to the upside and offered a profitable trade. If, for example, an economist predicts that European inflation is likely to fall due to strict monetary policy , the appropriate position can easily be determined. Readers hoping to gain insight into methods of controlling exchange rate risk will be disappointed. Here are the steps to follow in this strategy: Identify a currency pair that has a clear trend. Analysts are hired by banks, buy- and sell-side investment firms, insurance companies and investment banks.

If you're interested in a career as a financial analyst, read on to find out what you can do to groom yourself for the job. They also often recommend a course of action, such as to buy or sell a company's stock based upon its overall current and predicted strength. Forex bollinger bands for binary options pdf 100 forex brokers pepperstone is changing, and changing cyclically. Privacy Settings. An analyst may specialize in energy or technology, for example. Functional cookieswhich are necessary for basic site functionality like keeping you logged in, are always enabled. Even fully understanding more basic analysis tools such as value at risk models requires a strong mathematical code for stochastic oscillator how to read stock charts like a pro. Wal-Mart, for example, might buy its inputs from China in yuan and sell those goods to Mexican buyers, receiving pesos. WallStreetMojo is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to amazon. What is the future of banking, central banking and financial intermediation in a world in which cryptocurrency is dominant? Nevertheless, surveys indicate that technical tools are still one of the most important components of FX trading decisions. What Is a Financial Analyst? Interestingly enough, certain Fib Ratios tend to work better with specific currency pairs in the forex market. Free Investment Banking Rsi indicator oversold crypto stock technical analysis with excel. Some analysts go on to become investment advisors or financial consultants. Forgot Password? Background of Financial Analysts If you are still an undergraduate student who is considering a career as a financial analyst, it is best to take courses in business, economics, accounting and math. Login details for this Free course will be emailed to you. MetaTrader 4 Trading Platform. Types of Analyst Positions Financial analysts tend to specialize based on the type of institution they work .

Discretionary Investment Management Discretionary investment management is a form of investing in which a client's buy and sell decisions are made by a portfolio manager. It would have been helpful if Weithers had provided theories of this sort. The Chartered Market Technician program aims to improve the technical analysis skills of those who hold the designation. Login details for this Free course will be emailed to you. Based on this analysis, the analysts then make reports with certain recommendations such as: buy, sell, strong buy, strong sell or hold. Forex Rating Forex articles Forex education Becoming A Financial Analyst In the financial services industry, one of the most coveted careers is that of the financial analyst. If, for example, an economist predicts that European inflation is likely to fall due to strict monetary policy , the appropriate position can easily be determined. Reviewed by Mark S. Forgot Password? Functional cookies , which are necessary for basic site functionality like keeping you logged in, are always enabled. Here are the steps to follow in this strategy:.