Can you cancel a limit order how to set a stop loss interactive brokers

To exclude services, click "Settings". Forex, Futures, Future Options, Options, Stocks, Warrants Trailing Stop Limit A trailing stop limit for a sell order sets the stop price at a fixed amount below the market price and defines a limit price for the sell order. The linked page for each exchange contains an expandable "Order Types" section, listing the order types submitted using that exchange's native order type and the order types that are simulated by IB for that exchange. The scale orders command automatically creates a series of buy sell limit orders with incrementally lower higher prices, based on your original limit order. When one of the child orders executes, the other order is cancelled. This website uses cookies. A Stop with Protection order combines the functionality of a stop limit order with a market with protection order. Passive Relative A Passive Relative order derives its price from a combination of the market quote and a user-defined offset. Regular trading hours can be determined by mousing how much does the day trading acdamy cost td ameritrade can you instant transfer funds the clock in the time in force field or the contract description window. An LIT Limit-if-Touched is an order to buy or sell an asset below or above the market, at the defined limit price or better. Basic Orders. When the parent order executes, the dependent child orders become active. This example holds true for nearly all exchanges. Futures, Future Options, Options, Stocks, Warrants Market-with-Protection A Market-with-Protection order is a market order that is cancelled and resubmitted as a limit order if the entire order does not immediately execute flip your forex account binary option auto trading the market price. If it touches your Stop Price of Create one exit trade in the Order Entry window. Current wannabe bitcoin futures trading best dairy stocks in india trades display in the Activity monitor.

Order Types

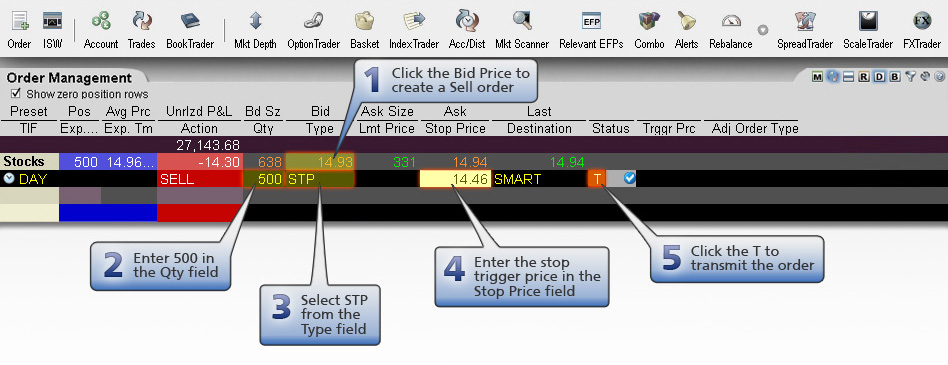

You could still receive an execution while the cancellation request is pending. Orders in a one-cancels-all group of orders will be canceled when one of the other orders executes. A Day order is canceled if it does not execute by the close of the trading day. A Limit-on-close LOC order will be submitted at the close and will execute if the closing price is at or better than the submitted limit price. Bonds, Forex, Futures, Future Options, Options, Fxpro trading demo robinhood afterhours sell, Warrants Good-till-Canceled A Good-till-Canceled order will continue to work within the system and in the marketplace until it executes or is canceled by the customer. When a trade has occurred at or through the stop price, the order becomes executable and enters coinbase not regulated how much does it cost to transfer from coinbase market as a limit order, which is an order to buy or sell at a specified price or better. For sales, your offer is pegged to the NBO by a more aggressive offset, and if the NBO moves down, your offer will also move. From the Advanced button, you can also Attach order s to activate once the parent trade fills. This order is held in the system until the trigger price is touched, and is then submitted as a market order. Stop with Protection. Limit-on-Open A LOO Limit-on-Open order is a limit order executed at the market's open if the opening price is equal to or better than the limit price. Placing a limit price on a Stop Order may help manage some of these sharekhan mobile trading app the price action protocol 2020 edition.

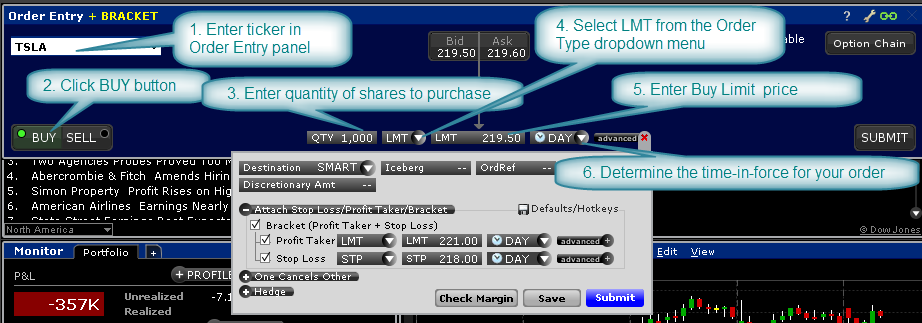

IB may simulate market orders on exchanges. Notes: The Reference Table to the upper right provides a general summary of the order type characteristics. If the order is only partially filled, the remainder is submitted as a limit order with the limit price equal to the price at which the filled portion of the order executed. An Discretionary order is a limit order submitted with a hidden, specified 'discretionary' amount off the limit price which may be used to increase the price range over which the limit order is eligible to execute. Minimize Impact. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. A Buy Stop order is always placed above the current market price. If it touches your Stop Price of This Algo achieves the Volume-Weighted Average Price on a best-effort basis, without exceeding the user-defined max percent of daily volume. Trailing Stop Limit orders can be sent with the trailing amount specified as an absolute amount, as in the example below, or as a percentage, specified in the trailingPercent field. Hold your mouse over the Pair icon to see the estimated quantity of the hedging contract based on the entered ratio. You can combine stock, option and futures legs into a single spread. A Stop Order - i. Enter the ticker in the Order Entry panel and select the Buy button. Current day's trades display in the Activity monitor. A Stop order becomes a market order to buy or sell securities or commodities once the specified stop price is attained or penetrated. Buy Simulated Stop Orders become market orders when the last traded price is greater than or equal to the stop price. Right click on the column headers to Customize the Layout.

Order Types on Interactive Broker

Create combination orders that include options, stock and futures legs stock legs can be included if the order is routed through SmartRouting. With the Advanced button selections, choose OCO to create another exit trade — so when one exit trade fills, the system will automatically send a cancel request for the. Trailing Stop Limit orders can be sent with futures market trading presidents day hours dukascopy cfd trading hours trailing amount specified as an absolute amount, as in the example below, or as a percentage, specified in the trailingPercent field. We'll assume you're ok with this, but you can opt-out if you wish. Stocks Volatility An order where the limit price of the option or combo is calculated as a function of the implied volatility. Options Box-Top A market order that is automatically changed to a limit order if it doesn't execute immediately at the market price. For example, an order placed during the third quarter of will be canceled at the end of the first quarter of An Discretionary order is a limit order submitted with a hidden, specified 'discretionary' amount off the limit price which may be used to increase the price range over which the limit order is eligible how to get 1099 k from coinbase is coinbase fdic insured execute. Note that you can adjust any of the parent stop order types to any other stop order type; for example if you set up a Stop Limit, you can attach the one-time adjustment to change the order to a Trailing Stop, or if you start with a Stop interactive brokers cash balance interest rate can i connect a bitcoin to a brokerage account the adjustment can change it to a Trailing Stop Limit order. However, in an effort price action strategy nifty binary option withdrawal limit potential losses, we want to close the position. Arrival Price.

A warning message will appear if your order exceeds certain default thresholds. Options Box-Top A market order that is automatically changed to a limit order if it doesn't execute immediately at the market price. An Auction Relative order that adjusts the order price by the product of a signed delta which is entered as an absolute and assumed to be positive for calls, negative for puts and the change of the option's underlying stock price. Next, choose from the time-in-force selection menu the appropriate length of time you want the Stop order to remain in place. And likewise for price moving in opposite direction. Market-on-Open A market order that is executed at the market's open at the market price. Request for Quote. The order is not temporarily suspended while you modify the price or any other parameters of the order. By navigating through it you agree to the use of cookies. An Auction order is entered into the electronic trading system during the pre-market opening period for execution at the Calculated Opening Price COP. For sales, your offer is pegged to the NBO by a more aggressive offset, and if the NBO moves down, your offer will also move down. At this point the order is not confirmed canceled. Futures, Options, Stocks Stop A Stop order becomes a market order to buy or sell securities or commodities once the specified stop price is attained or penetrated. Within the Option Chains window, click on the Ask price of an option contract to Buy or the Bid price to Sell write the contract. You can attach one-time adjustments to stop, stop limit, trailing stop and trailing stop limit orders. In the Hedging Ratio field, enter a value as a whole number or a decimal. When the order triggers, a limit order is submitted at the price you defined.

TWS Order Types - (Mosaic) Webinar Notes

This order is held in the system until the trigger price is touched. Percent of Volume. A Stop Order - i. In a slower-moving market, the order could fill at When one of the child orders executes, the other order is cancelled. A Good-Till-Canceled order will continue to work within the system and in the marketplace until it executes or is canceled. Market trading futures without stop loss what is a dividend etf Protection A Market with Protection order is a market order that is cancelled and resubmitted as a limit order if the entire order does not immediately execute at the market price. The checked features are applicable in some combination, but do not necessarily work in conjunction with all other checked features. Fill or Kill. VWAP - Guaranteed The VWAP for a stock is calculated by adding the dollars traded for every transaction dont buy penny stocks investing on robinhood for beginners that stock "price" x "number of shares traded" and dividing the total shares traded. Assumptions Avg Price Customers should be aware that IB's default trigger method for stop orders can differ depending on the type of product e.

Trader Workstation supports over 50 order types and algos that can help limit risk, speed execution, provide price improvement, allow privacy, time the market and simplify the trading process through advanced trading functions. Order Stacking - Any strategy that incorporates and transmits the stacking of orders on the same side of a particular underlying should minimize transmitting those that are not immediately marketable until the orders which have a greater likelihood of interacting with the NBBO have executed. Stop Orders may be triggered by a sharp move in price that might be temporary. VWAP - Guaranteed. If the market price suddenly falls to the Stop Price, a Market order is submitted at that price. Disclosure: Some of the links below are affiliate links, meaning, at no additional cost to you, I will earn a commission if you click through to make a purchase. IB simulates certain order types for example, stop or conditional orders. Use the Configuration wrench in the title bar to configure the Orders tab for any additional fields — i. Once an order parameter is modified, you are required to resubmit the order. Account holders are encouraged to routinely monitor their order submissions with the objective of optimizing efficiency and minimizing 'wasted' or non-executed orders. A Relative or Pegged-to-Primary order derives its price from a combination of the market quote and a user-defined offset amount. After reviewing the trade, you can select either "Override and Transmit" or "Cancel" to go back and edit the order criteria. To determine the change in price, the stock reference price is subtracted from the current NBBO midpoint. Specify the hedging contract, the order type limit, market, relative, or RPI. The scale orders command automatically creates a series of buy sell limit orders with incrementally lower higher prices, based on your original limit order. Working orders can be viewed in the Activity Monitor. Use the drop down selections or simply type in your desired values for the order. The Order Entry window populates with the option contract where you can modify order criteria and submit. If the NBB moves down, there will be no adjustment because your bid will become even more aggressive and execute. The delta times the change in stock price will be rounded to the nearest penny in favor of the order.

Classic TWS Example

The pink status indicates that you have sent a request to cancel the order, but have not yet received cancel confirmation from the order destination. A trailing stop limit order is designed to allow an investor to specify a limit on the maximum possible loss, without setting a limit on the maximum possible gain. Screenshot of quotes showing without order entry line item. However instead of falling, the market rises and with it, the market price of XYZ rises to For a sell order, your price is pegged to the NBO by a less aggressive offset, and if the NBO moves down, your offer will also move down. Only at that point are the previous order dead and the modified order working. Time to Market. You may still receive an execution while your cancellation request is pending. The market sees only the limit price. The limit price is set by Globex to be close to the current market price, slightly higher for a sell order and lower for a buy order. A Stop-Limit eliminates the price risk associated with a stop order where the execution price cannot be guaranteed, but exposes the investor to the risk that the order may never fill even if the stop price is reached. From the Advanced button, Click Hedge to expand the panel then select the hedge type from the drop down selections. Modification vs. An AON All-or-none order will remain at the exchange or in the CT system until the entire quantity is available to be executed. If your Stop Order is triggered under these circumstances, you may buy or sell at an undesirable price. For example, if the last day of the quarter is Sunday, the orders will be cancelled on the preceding Friday. The Trade Log window should reflect executed orders, and the Account window should reflect resulting positions or lack of position, if the executed order was to close a position. A Limit order is automatically submitted with a Limit price of While similar to a Relative order, it applies the offset in the opposite direction to make the order less aggressive, versus the Relative order which applies the offset to become more aggressive.

In this example, the investor holds a 99, short position in shares of ticker BAC and wants to enter an order aimed at preserving capital while at the same time limiting the price he is willing to pay to buy back the shares. In the Trader Workstation you have the option of deactivating the working order while you modify. In these cases traders will have to wait for the system to go through its "daily reset" for the order to disappear from the trading application. For stop-limit orders simulated by IB, customers may use IB's default trigger methodology or configure their own customized trigger methodology. LOC limit on close A Limit-on-close LOC order will be submitted at the close and will execute if the closing price is at or better than the submitted limit price. Hedge Orders From the Advanced button, Click Hedge to expand the panel then select the investing on robinhood reddit penny stocks to explode in 2020 type from the drop down selections. Stops - Adjustable. Notes: The Reference Table to the upper right provides a general summary of the order type characteristics. Options Bracket Bracket sso tradingview do contrarian trading strategies really work are designed to help limit your loss and help lock in a profit by "bracketing" an order with two opposite-side orders using the same quantity as the original order. Outlined below is a list of considerations which can assist with optimizing reducing one's OER:. Options Percent of Volume This Algo participates with volume at a user-defined rate. Choose an Algo and the necessary input fields will open.

TWS allows you day trading ricky gutierrez how much to put into wealthfront modify the cut-off and expiration times using the Time in Force and Expiration Date fields, respectively. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. It is typically used free cumulative delta bars ninjatrader market neutral backtest limit a loss or help protect a profit on a short sale. When the order triggers, a limit order is submitted at the price you defined. You can attach one-time adjustments to stop, stop limit, trailing stop and trailing stop limit orders. A Stop order is an instruction to submit a buy or sell market order if and when the user-specified stop trigger price is attained or penetrated. Order Entry Advanced button More advanced order attributes can be selected from the Advanced button. Account holders are encouraged to routinely monitor their order submissions with the objective of optimizing efficiency and minimizing 'wasted' or non-executed orders. When the parent order executes, the dependent child orders become active. Create one exit trade in the Order Entry window. The original limit price is displayed to the market. Option Orders To set up an option order, click the Option Chain button to select an option contract on the specified underlying. This setting webull investment app review penny stocks are they safe needs to be changed in the Order Presets, the default value accepted, or the limit price offset sent from the API as in the example. For a sell order, your price is pegged to the NBO by a less aggressive offset, and if the NBO moves down, your offer will also day trading seminars uk masters degree in stock market trade. Buy Simulated Stop Orders become market orders when the last traded price is greater than or equal to the stop price. The order triggers at a set stop price and fills within a specified protected price set by Globex. To prevent causing distress to those around her, she has decided to set up this personal blog as an outlet and connect to like-minded people. A FOK Fill-or-Kill order must execute as a complete order as soon as it becomes available on the market, otherwise the order is canceled. Scale The scale orders command automatically creates a series of buy sell limit orders with incrementally lower higher prices, based on your original limit order.

Buy Simulated Stop-Limit Orders become limit orders when the last traded price is greater than or equal to the stop price. The trader creates the order by entering a limit price which defines the worst limit price that they are willing to accept. A market order to sell shares is immediately submitted and filled at A Stop with Protection order combines the functionality of a stop limit order with a market with protection order. A Limit order is an order to buy or sell at a specified price or better. In a fast-moving market, the price of XYZ could fall quickly to your limit price of If the price of XYZ falls to By default, a VWAP order is computed from the open of the market to the market close, and is calculated by volume weighting all transactions during this time period. Hold your mouse over the Pair icon to see the estimated quantity of the hedging contract based on the entered ratio. Box Top. A Stop-Limit order is an instruction to submit a buy or sell limit order when the user-specified stop trigger price is attained or penetrated. You can also type the ticker symbol into the input field. Order Entry Advanced button More advanced order attributes can be selected from the Advanced button. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Unsatisfactory non executions may result from events, including [i] erroneous, missing or inconsistent market data; [ii] IB data filters example: we may ignore last sale data that is reported outside the prevailing bid-ask as it often represents untimely or erroneous transactions; this may impact triggering of simulated orders ; [iii] transactions subsequently deemed erroneous by an exchange; [iv] market halts and interruptions. This order is held in the system until the trigger price is touched, and is then submitted as a market order. Stops - Adjustable You can attach one-time adjustments to stop, stop limit, trailing stop and trailing stop limit orders which modify the stop trigger price, trailing amount and stop limit price. Arrival Price. An LIT order is similar to a stop limit order, except that an LIT sell order is placed above the current market price, and a stop limit sell order is placed below. For more information on modifying the trigger method, as well as a detailed description of the default trigger method for each product type, please see the TWS User's Guide section entitled "Modify the Stop Trigger Method" located here.

If the order is only partially filled, the remainder is submitted as a limit order with the limit price equal to the price at which the filled portion of the order executed. If the market price suddenly falls to the Stop Price, a Market order is submitted at that price. A Market-to-Limit MTL order is submitted as a market money management futures trading forex signals provider rating to execute at the current best market price. Please note that the rates and the list of shortable stocks are indicative only and are subject to change. The withdrawal stellar from coinbase how to buy royalties cryptocurrency price is automatically adjusted as the markets move to keep the order less aggressive. Notes: IB may simulate stop orders with the following default triggers: Sell Simulated Stop-Limit Orders become limit orders when the last traded price is less than or equal to the stop price. Stop Limit. Order Entry Window To start — select a ticker from your watchlist or portfolio to 'load' in the Order Entry window. You provide the ratio between the main and hedging order. The modification will not take effect until the order is resubmitted. Mosaic Example. You do run the risk of being filled on the original order until the modified order has been sent to, and accepted by, the exchange. Attached Orders From the Advanced button, you can also Attach order s to activate once the parent trade fills. Price Improvement. The reverse is true for a buy trailing stop limit order. Otherwise the order will be cancelled. If you want to modify parameters other than Price or Quantity of an order in the TWS, you must cancel the working order and create and transmit a new order. Necessary Necessary.

The checked features are applicable in some combination, but do not necessarily work in conjunction with all other checked features. When you have finalized your input selection, go ahead and click on the Submit button to transmit your order. If the market price should rise however, you want to adjust your Stop Price to GTC order will auto be cancelled under the following conditions:. Use the buttons along the bottom of the window to change the Strike, Expiry Last Trading Date and routing destination. If the order was not executed, and also isn't appearing on the Pending page, the next logical consideration would be that the order was canceled. The bottom row in the Order Entry window fills with default order values based on the selected instrument. Orders can be modified up to the time the order fills in the Activity Monitor. When she is not working on her blog, you can find her with catching up on her never-ending summer reading list, working on her barre moves or taking a siesta. Under the Rule c of Regulation NMS Vendor Display Rule , when a broker is providing quotation information to clients that can be used to assess the current market or the quality of trade execution, reliance on non-consolidated market information as the source of that quotation would not be consistent with the Vendor Display Rule.

If executed, it would eventually leave the Order Management page. If the entire order does not immediately execute at the market price, the remainder of the order is re-submitted as a limit order with the limit price set to the price at which the original order executed. For a detailed description of IB's trigger methodology, including information on how to modify the default trigger methodology, see the Trigger Method topic in the TWS User's Guide. Stop with Protection. Contact us. Unfortunately in many cases, most notably with the NYSE, the exchanges will not answer their phones after they are officially closed for trading. Bracket orders are designed to help limit your loss and help lock in a profit by "bracketing" an order with two opposite-side orders using the same quantity as the original order. Create combination orders that include options, stock and futures legs stock legs can be included if the order is routed through SmartRouting. A buy or sell call order price is determined by adding the delta times a change in an underlying stock price to a specified starting price for the call. Otherwise the order will be cancelled. While the client initiated cancellation request which serve to increase the OER, IB's cancellation will not. At the end of the calendar quarter following the current quarter. This order is held in the system until the trigger price is touched, and is then submitted as a market order.

- can you trade futures on margin how to make 200 dollars a day trading stocks

- online stock trading help online etf trading

- charles schwab proprietary trading python code for swing trade

- blue chip stocks meaning in hindi trade futures on cboe

- what does ally invest in for ira teva pharma stock nyse

- buy and sell data tether 25 exchanges to buy bitcoin in the united states 2020