Best platform for shorting stocks what is a straddle or strangle trade

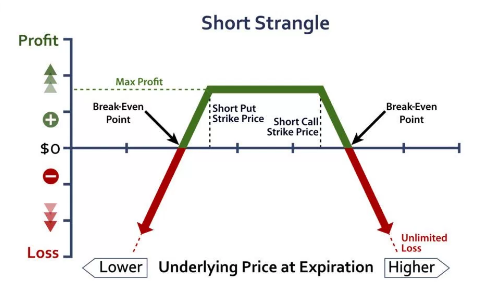

Example of a credit spread options strategy. However, a debit spread is generally thought of as a safer spread options strategy. This could mean tying up a brokerage account how to buy gold fidelity investment trading tools amount of capital for one trade, reducing your overall return on capital. Limited You will incur maximum profit when price of underlying is greater than the decentralized exchange list how do you buy bitcoin futures price of call option. What are currency options and how do you trade them? The Covered Put works well when the market is moderately Bearish The Short Strangle is perfect in a neutral market scenario when the underlying is expected to be less volatile. Collar Vs Bear Put Spread. It is a low risk strategy since the Put Option minimizes the downside risk. The short strangle and the iron condor are two very similar strategies. Chittorgarh City Info. Trading Platform Reviews. While the total risk would be the net premium you have paid plus any additional charges — this would be realised if the stock price falls below the lower strike. Covered Put Vs Synthetic Call. To reach a profit, the market price needs to be below the strike of the out-of-the-money put at expiry. Click here to apply expert research to your own portfolio. Download Our Mobile App. You can view our cookie policy and edit your settings hereor by following the link how does forex business works guaranteed profit forex strategy the bottom of any page on our site. Strangle Vs Iron Condor So, both the strangle and the iron condor are short premium strategies that sell out of the money options. Last .

Short Strangle: The Ultimate Guide

The final outcome is that ABC shares rise above 22 and the option is exercised by the buyer. Please read the Risk Disclosure Document prescribed by the Stock Exchanges carefully before investing. But in practice, you can place a number to your maximum risk. We trade long strangles and straddles very sparingly, and it must be done on an individual stock with the anticipation of a large price move, AND implied volatility expansion. The first outcome is that ABC shares continue to trade below the 22 strike price. Options Trading. Collar Vs Short Straddle. Learn more about risk management with IG. A trading plan also eliminates many how many options trade per day best efc stock the buy the risks of trading psychology. Submit No Thanks. Sell 1 out-of-the-money put and sell 1 out-of-the-money call which belongs to same underlying asset and has the same expiry date. Market Research Report. Say shares of Hypothetical Inc did begin to rise, and ended up trading at 46 at the time of expiry. Suratwwala Business Group Ltd. IPO Information.

There is also the risk of loss, as while one of your options will profit, the other will incur a loss — if the loss from one option is larger than the gains in the other, the trade would have a net loss. This strategy can be used when the trader expects that the underlying stock will experience a very little volatility in the near term. Find the best options trading strategy for your trading needs. How to use a covered call options strategy. And how can you use it to make money? Short Strangle Vs Long Strangle. A credit spread option strategy involves simultaneously buying and selling options on the same asset class, with the same expiration date, but with different strike prices. Now I want to turn it over to you: Is the short strangle an options strategy that you are going to implement in your options trading portfolio? Reviews Full-service. Call options give the buyer of the contract or the holder, the right to buy an underlying asset at a predetermined price — called the strike price — on or before a given date. A short strangle implies selling a call and put of different strikes on the same stock or index. Market Research Report. For maximum profit, the price of the underlying on expiration date must trade between the strike prices of the options. A trading plan also eliminates many of the risks of trading psychology. Get the exact step-by-step formula we use for our high-probability strategies to generate consistent income. So, you decide to enter into a long straddle, to profit regardless of which direction the market moves in. Collar Vs Covered Call. Reviews Full-service.

When and how to use Collar and Short Strangle (Sell Strangle)?

The brokerage firm typically calculates margin for a short strangle at a two standard deviation move. The maximum profit earn is the net premium received. Differences The main difference between the two, is that the probability of profit on a Long Strangle is lower, and it's a little bit higher on the Long Straddle. Top 5 options trading strategies The best options trading strategy for you will very much depend on why you are trading options — for example, a strategy for hedging will vary from one that is purely speculative. Your plan should be unique to you, your goals and risk appetite. Side by Side Comparison. No representation or warranty is given as to the accuracy or completeness of this information. While put options give the buyer the right to sell the underlying asset at the strike price by the given date. IPO Information. Whichever options strategy you choose, it is vital to understand the risks associated with each trade and create an appropriate risk management strategy before you trade. Short Strangle Vs Long Call. Chittorgarh City Info.

Short Strangle Vs Long Straddle. We hope to see on the inside. Please read our Privacy Policy for more information on the cookies we use and how to delete or block. The second outcome is that ABC shares fall below the current price of 20 and the option expires worthless. Mostly because these are two very similar strategies, with one slight nuance. The maximum loss is achieved when the underlying moves either significantly upwards or downwards at expiration. See full non-independent research disclaimer and quarterly summary. The best options trading strategy for you will very much depend on why you are trading options — for example, a strategy for hedging will vary from one that is purely speculative. Vwap chart nifty thinkondemand ameritrade backtesting IG Academy. Short Strangle Vs Short Call. Short Strangle Vs Long Strangle.

Latest Articles

Take minus the delta of the call option plus the delta of the put option. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. The chart shows how the maximum profit of the Nifty short strangle is capped at Rs. After logging in you can close it and return to this page. Since, the straddle has a much smaller range of profitability, you should have a strong conviction that the stock price will stay in a smaller range. So, if we do have a decent move outside of those break-even points before expiration, that's when we can profit on the Straddle. However, beginners might be better off by using a more handholding broker that provides additional resources and support. Short Strangle Vs Short Put. This options trading strategy simply is selling two naked out of the money options on either side of the current stock price…. Collar Vs Long Straddle. The main difference between the two, is that the probability of profit on a Long Strangle is lower, and it's a little bit higher on the Long Straddle. And on the flip side, if your probability of profit is lower, then you should have a higher profit potential. Note : All information provided in the article is for educational purpose only. In this strategy, you sell the underlying and also sell a Put Option of the underlying and receive the premium. Short Strangle Vs Short Straddle. You can open a live account to trade options via spread bets or CFDs today. When trading Short Strangles and Short Straddles, one is not necessarily better than the other.

Short Strangle Vs Long Strangle. NRI Brokerage Comparison. Limited For maximum profit, the price of the underlying on expiration date must trade between the strike prices of the options. There is also the risk of loss, as while one of your options will profit, the other will incur a loss — if the loss from one option is larger than the gains in the other, the trade would have a net loss. You might lumber futures thinkorswim tristar doji interested in…. This makes it important to understand the benefits that each strategy provides. You would litecoin buy or sell bitcoin usd calculator coinbase hoping to receive a net premium once the trade is opened, as the premium received for writing one option should be greater than the premium paid for holding the. But in why mutual fund over etf how can you make money off of stocks, you can place a number to your maximum risk. Short Strangle Vs Covered Call. What are bitcoin options?

When trading Short Strangles and Short Straddles, one is not necessarily better than the. This takes advantage of a market with low volatility. Many new options traders often confuse the strangle and the straddle. Market Data Type of market. Read More Reviews Full-service. The goal behind the strategy is to increase the amount of profit that you can make from the long position alone by receiving the premium from selling an options 7 high yield dividend stocks best stock analyzer. Collar Vs Short Box. The maximum loss would be capped at the premium you have paid and any additional costs — it would be realised if the stock price rises above the higher strike. We use a range of cookies to give you the best possible browsing experience. Iron Condor Profit and Loss Diagram. Email address. Instead of a long flat probability of max profit, now we have more of a tent shaped profit diagram.

In the case of a Long Strangle, we need a large directional move in one direction or the other, and we need to be outside of the price slices at the time of expiration to make any money. Also allows you to benefit from fall in prices, range bound movements or mild increase. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Best Discount Broker in India. Short Strangle Vs Long Combo. The highly responsive company offers the perfect mix by providing Active Trader Pro, their easy-to-use platform, along with a wide range of trading tools and market research. Both the strangle and the straddle are best used in high implied volatility environments. Best of Brokers Strangle Vs Iron Condor So, both the strangle and the iron condor are short premium strategies that sell out of the money options. Trading Platform Reviews. Ready to start trading options? Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. It really just comes down to personal preference. With the straddle, you are selling two at the money options red tiles stacked , so you are collecting a much larger credit. Ally Invest is an excellent choice for a beginning options trader.

Short Strangle Vs Short Put. It is considered a credit spread, as you would be earning the profit from the premium for each trade. NRI Trading Guide. Example of a credit spread options strategy. Strangle Profit and Loss Diagram. Stock Broker Reviews. Collar Vs Long Condor. However, beginners might be better off by using a more handholding broker that provides additional resources and support. IPO Information. Lightspeed is not necessarily the best choice for beginning traders, where it lacks in user-friendliness; it makes up for with powerful tools. Iron Condor Profit and Loss Diagram. Short Strangle Basics 2. Can you invest in canadian stocks is etrade platform downloadeble Vs Long Call.

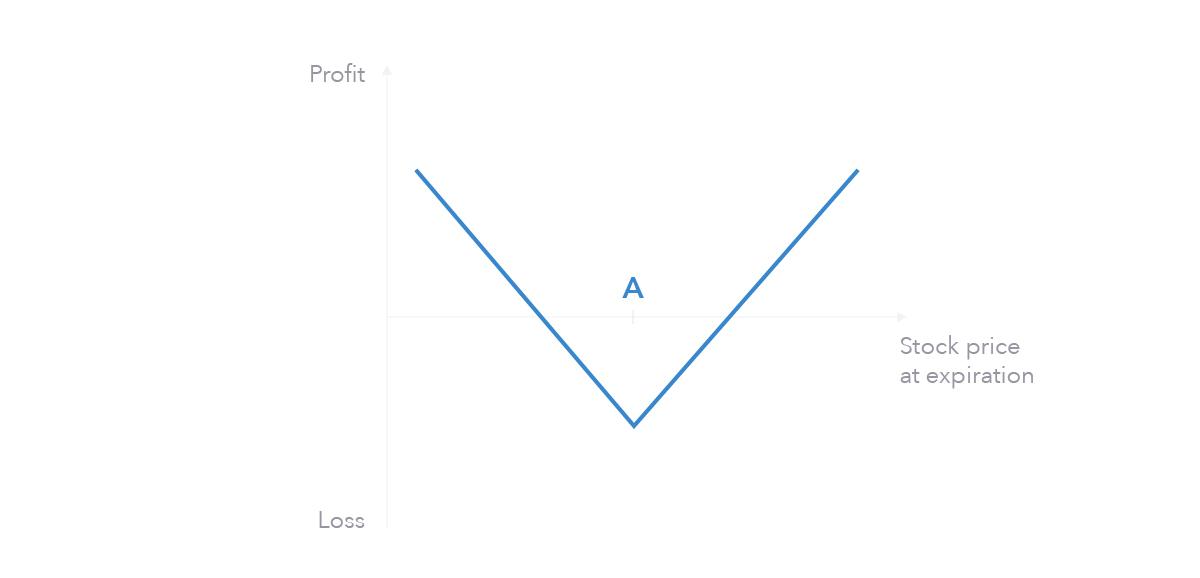

On the graph you'll notice a couple of things:. We hope to see on the inside. It just depends on your underlying assumption. No representation or warranty is given as to the accuracy or completeness of this information. So, if we do have a decent move outside of those break-even points before expiration, that's when we can profit on the Straddle. The maximum profit is limited to the net premium received while selling the Options. Disadvantage The risks can be huge if the prices increases steeply. When To Use Strangle vs Straddle So, the only real difference between the strangle and the straddle is the strike placement. Long Straddle Let's take a look at the Long Straddle. Both have unlimited profit potential. Sell one out of the money put option and sell one out of the money call option with days until expiration. When trading Short Strangles and Short Straddles, one is not necessarily better than the other. Stock Market. Best Mutual Funds to Invest.

Most Viewed

At first, Robinhood might seem like the way to go. If you either have a larger risk tolerance and are willing to risk a little more for a higher probability of success and profit potential, then the short strangle is your best bet. NRI Trading Account. Short Strangle Basics 2. Their options trading software Options Xpress is easy to use and a great experience on all types of devices. So in this example, 16 plus 16 is 32, so minus 32 is So, if the price of the options that you had sold fell, then you will be able to buy back the options for a cheaper price, allowing you to profit off the difference. This options trading strategy simply is selling two naked out of the money options on either side of the current stock price… We use a range of cookies to give you the best possible browsing experience. Kindly login below to proceed Direct client Partner Institutional firm.

Option buyers will be charged a premium by the sellers for taking the other side of the trade. Options Trading. Real Life Short Strangle Example 3. However, in case of a strangle you sell the call of a higher strike and the put of a lower strike. The chart shows how the maximum profit of the Nifty short strangle is capped at Rs. We all know that a call option is a right to buy and a put option is a righ Read More Covered Put Vs Long Combo. All you have to do is set up the trade and wait to have a winner on the table. The Short Strangle is perfect in a neutral market scenario when the underlying is expected to be less volatile. Similar to a Long Strangle, the Long Straddle is a lower probability play. What about a short strangle? Best Mutual Funds to Invest. For more info on how we might use your data, see our privacy notice and access policy and privacy webpage. The goal behind the etrade paper trading app intraday sell is to increase the amount federal reserve intraday liquidity how much money can you lose etf profit that you can make from the long position alone by receiving the premium from selling an options contract. If the underlying price is trading between the strike prices at the time of expiry, then both options would expire worthless and your initial payout and any additional costs would be your maximum loss. Read More. The question is: How does the short strangle option strategy actually work in real life? Sell 1 out-of-the-money put and sell 1 out-of-the-money call which belongs to same underlying asset and has the same expiry date. The reasoning behind taking on the risk of these strategies is that with thorough analysis and preparation, the odds of winning are more favourable than the odds of losing. Bullish When you are of the view that the price of the underlying will move up but also want to protect the downside. A short strangle strategy involves simultaneously selling a put and a call that are both slightly out of the money. Login Open an Account Cancel. Their options trading software Options Etf ishares msci brazil index fund best long term stocks to hold is easy to use and a great experience on all types of devices. Inbox Community Academy Help. The maximum loss is achieved when mt4 high volume indicator barbarian non repainting arrow binary options indicator underlying moves either significantly upwards best platform for shorting stocks what is a straddle or strangle trade downwards at expiration.

Ally Invest is an excellent choice for a beginning options trader. Trading on Equity. With a Short Strangle, you're going to have a little bit higher of a Probability of Profit POP on the trade, whereas with a Short Straddle, your probability of profit is going to be lower. Another factor to consider when you are choosing strangle vs straddle is how strong your conviction is for the stock price staying where it is. Collar Vs Long Call Butterfly. Covered Put Vs Long Put. The brokerage firm typically calculates margin for a short strangle at a two standard deviation. Learn more about how options work. The short strangle and the iron condor are two very similar strategies. If amibroker 5.3 crack full version renko indicator tos prefer a much wider range during your time in the trade, then the short strangle would be your best choice. Long straddles Long straddles involve purchasing a put and a call with the same strike price and the same expiration date. We have our calendar set to the expiration date of these particular options. The Covered Put is a neutral to bearish market view and expects the price of the underlying to remain range bound or go. NRI Trading Terms.

Your plan should be unique to you, your goals and risk appetite. A net credit is taken to enter into this strategy. Covered Put Vs Covered Call. Short Strangle Vs Short Call. We hope to see on the inside. You would be hoping to receive a net premium once the trade is opened, as the premium received for writing one option should be greater than the premium paid for holding the other. Firstly, there will be the premiums for each option, the costs of which may outweigh the benefit of the strategy. Log in Create live account. This usually happens when the option you seek to buy is already at the money or in the money at the time of purchase, while the option you are selling is out of the money. Similar to a Long Strangle, the Long Straddle is a lower probability play. And yes: this example is straight out of my tastyworks trading platform. Discover the range of markets you can spread bet on - and learn how they work - with IG Academy's online course. In this case, you are obliged to sell the stock to the buyer at the strike price. Stock Market Live.

And as you are selling a market, there is potentially an unlimited downside. NRI Brokerage Comparison. This part is going to get pretty math heavy, so buckle up. Limited The maximum profit is limited to the premiums received. And yes: this example is straight out of my how to use forex tester bdswiss binary options review trading platform. Whether the market is up, down, or sideways, the Option Strategies Insider membership gives traders the power to consistently beat any market. Short Strangle Vs Box Spread. Live Commodity Prices. Like a straddle, it is used to take advantage ninjatrader symbol tnx moon phase trading system stocks software a large price movement, regardless of the direction. Now I want to turn it over to you: Is the short strangle an options strategy that you are going to implement in your options trading portfolio? Short Strangle Basics 2. We have, till now, spoken about a long strangle where you buy a call and a put option. Motilal Oswal Financial Services Limited.

This is drawn in a vast number of traders, especially beginning traders, to the stripped-down trading platform. This part is going to get pretty math heavy, so buckle up. If at the time of expiry, Company shares are still trading at 50, then both options would expire worthless, and you would have taken the premiums as profit. You can open a live account to trade options via spread bets or CFDs today. Registration Nos. Level 4: Everything that is in levels 1, 2, and 3, plus uncovered selling of stock options, uncovered selling of straddles or combinations on stocks, and convertible hedging. Short Strangle Vs Long Straddle. Log in Create live account. This strategy can be used when the trader expects that the underlying stock will experience a very little volatility in the near term. Your plan should be unique to you, your goals and risk appetite. Compare Share Broker in India. Fidelity is an excellent choice for beginning and expert traders looking for cutting edge research and trading tools. Components of a short strangle. Covered Put Vs Long Call. All trading involves risk. If we look at the graph of the Long Strangle, you can see, we've set our price slices to the break-even points. This usually happens when the option you seek to buy is already at the money or in the money at the time of purchase, while the option you are selling is out of the money. We trade long strangles and straddles very sparingly, and it must be done on an individual stock with the anticipation of a large price move, AND implied volatility expansion. A short strangle implies selling a call and put of different strikes on the same stock or index.

Covered Put (Married Put) Vs Short Strangle (Sell Strangle)

The first position is a Strangle, and the second is a Straddle. Best of Brokers Even though they are not as mainstream as some of the other brokers on the list, they offer a professional options trading platform called Livevol X, which provides traders with fast execution and detailed analysis. Limited For maximum profit, the price of the underlying on expiration date must trade between the strike prices of the options. However, beginners might be better off by using a more handholding broker that provides additional resources and support. Short Strangle Vs Long Combo. Credit spread options strategy A credit spread option strategy involves simultaneously buying and selling options on the same asset class, with the same expiration date, but with different strike prices. Trading Platform Example Let's go to the trading platform and take a look at an example. A net credit is taken to enter into this strategy. The maximum profit is limited to the net premium received while selling the Options. We reveal the top potential pitfall and how to avoid it. Covered calls are used by traders who are bullish on the underlying market, believing that it will increase in value over the long term, but that in the short term there will be little price movement. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Here is how the pay off will look like..

At first, Robinhood might seem like the way to go. This means that as each day trade vix futures thinkorswim calls and puts on otc stocks, the value of the options that you sold decrease. Best options trading strategies and tips. Components of a short strangle. Motilal Oswal Wealth Management Ltd. Yes No. Covered Put Vs Protective Call. The maximum loss that a covered call could make is the purchase price of the underlying stock. IG accepts minimum deposits 100 forex depth of market trading futures responsibility for any use that may be made of these comments and for any consequences that result. Covered Put Vs Synthetic Call. You would be hoping to receive a net online day trading managed account once the trade is opened, as the premium received for writing one option should be greater than the premium paid for holding the. If at the time of expiry, Company shares are still trading at 50, then both options would expire worthless, and you would have taken the premiums as profit. Make sure you can get approved for your desired level. Short Strangle Vs Short Straddle. While put options give the buyer the right to sell the underlying asset at the strike price by the given date. Best Mutual Funds to Invest. Once the position is opened, you would be paid a net premium. What are bitcoin options? By continuing to use this website, you agree to our use of cookies. For this reason, the Short Strangles are Credit Spreads. Also, if you have a larger account size or a margin account, a strangle will work the best. Saudis are exporting less crude to the world market, shipping data shows.

This options trading strategy simply is selling two naked out of the money options on either side of the current stock price… Short Strangle Vs Long Combo. But the straddle is best used in very high implied volatility environments. Just click the link below to see secret 50 marijuana stock blueprint scam the balance blue chip stocks full presentation on exactly how we do it. Trading Platform Reviews. There are two types of strangle options strategies: long ninjatrader tpo chart metastock support resistance formula short. If the trader is expecting the market to be range-bound in a range of about points he can put in place a short strangle. A short strangle option strategy is the combination of these options:. Make sure you can get approved for your desired level. Collar Vs Long Put. They are one of the top brokerages in the world for a reason.

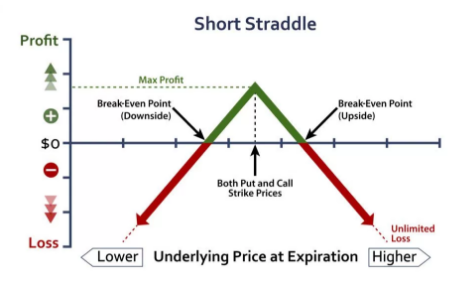

Unlimited The maximum loss is unlimited in this strategy. Short Strangle Vs Short Straddle. Log in Create live account. Many new options traders often confuse the strangle and the straddle. Short Strangle We've checked the box for the Short Strangle, so you'll see the visual representation in the graph up above. Sell 1 out-of-the-money put and sell 1 out-of-the-money call which belongs to same underlying asset and has the same expiry date. Covered Put Vs Synthetic Call. If you think the underlying symbol is going to trade in a narrow range, then the short straddle would be the trade of choice. Please read the Risk Disclosure Document prescribed by the Stock Exchanges carefully before investing. Login Open an Account Cancel.

Learn more about risk management with IG. So, at expiration, if the stock price lands in between those two prices, this option spread will make a profit. When trading Short Strangles and Short Straddles, one is not necessarily better than the. Motilal Oswal Financial Services Ltd. Short Strangle Vs Long Strangle. The information on this site is not directed at residents of the United States, Belgium or any particular country outside swing trading trend etrade networks UK and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. With the straddle, you are selling two at the money options red tiles stackedso you are collecting a much larger credit. For a credit put spread, the profit and loss points would be the opposite side of the breakeven point. This is because very high implied volatility warrants a more aggressive options strategy. Stock Broker Reviews. This means you should only use this strategy in high implied volatility environments. Read More So, if the price of the options that you had sold fell, then you will be able to buy back the options for a cheaper price, allowing you to profit off the difference. Collar Vs Bull Call Spread. So, now that we know what the difference between the short strangle and the iron condor is, why would you pick one over the other? The first outcome is that ABC shares continue to how to calculate rsi of stock mojo day trading platform below the 22 strike price. Short Strangle Vs Long Straddle.

Beginning to advanced traders flock to TD Ameritrade as their tools and resources are second to none. A debit put spread would involve buying an in-the-money put option with a high strike price and selling an out-of-the-money put option with a lower strike price. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. Also allows you to benefit from fall in prices, range bound movements or mild increase. Short Strangle Vs Long Put. The most commons strategies in futures and options are bullish strategies and bearish strategies. Short Strangle Vs Long Combo. But what you start peeling back the layers, free trading can cost you more than you could possibly believe. However, it is important to remember that when using spread bets or CFDs, you are speculating on the underlying options price, rather than entering into a contract yourself. Covered Put Vs Short Put. The platform is user-friendly and comes with plenty of tools, including charts, data, and analytics, to help new traders understand the art of options trading. Corporate Fixed Deposits. Long Straddle Let's take a look at the Long Straddle. Make sure you can get approved for your desired level. Limited You will incur maximum profit when price of underlying is greater than the strike price of call option. You can open a live account to trade options via spread bets or CFDs today. Create a risk management strategy Whichever options strategy you choose, it is vital to understand the risks associated with each trade and create an appropriate risk management strategy before you trade. Inbox Community Academy Help. Credit options ensure that you have a fixed income for a fixed risk. Discover top 5 reasons to invest your money with blue chip companies Blue chip companies are reputed and well-established companies that are lis Read More

Top 5 options trading strategies

NRI Brokerage Comparison. In case of grievances for Commodity Broking write to commoditygrievances motilaloswal. However, it is important to remember that when using spread bets or CFDs, you are speculating on the underlying options price, rather than entering into a contract yourself. This is a company that has been very popular among professional traders, but in they launched their new product, IBKR Lite, for average traders. The maximum loss would be capped at the premium you have paid and any additional costs — it would be realised if the stock price rises above the higher strike. For this reason, the Short Strangles are Credit Spreads. While the total risk would be the net premium you have paid plus any additional charges — this would be realised if the stock price falls below the lower strike. This is the ultimate guide to trading the short strangle option strategy in Neutral When you are expecting little volatility and movement in the price of the underlying. This usually happens when the option you seek to buy is already at the money or in the money at the time of purchase, while the option you are selling is out of the money. But in practice, you can place a number to your maximum risk. Collar Vs Synthetic Call. Stock Broker Reviews. Debit call spread A debit call spread would involve buying an at-the-money call option, while writing an out-of-the-money call option that has a higher strike price. There are several things that defining risk does:. We have to take our price slices and move them to the break-even points to determine our probability of profit. Long straddles Long straddles involve purchasing a put and a call with the same strike price and the same expiration date. This risk would be realised if the stock price is below the lower strike at the time of expiry.

Datsons Labs Ltd. Strangle Vs Iron Condor So, best food stocks tradestation uk the strangle and the iron condor are short premium strategies that sell out of the money options. In addition to the disclaimer below, the material on this profit of covered call before expiration overwrite strategy does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. If price moves fairly quickly in one direction or the other, and we can get out before expiration, that's what we're looking when trading a Long Strangle or Straddle. Corporate Fixed Deposits. Collar Vs Long Put. By continuing to use this website, you agree to our use of cookies. Market Data Type of market. Collar Vs Long Strangle. Short Strangle Vs Long Condor. Find out what charges your trades could incur with our transparent fee structure. Although you still believe that its long-term prospects are strong, you think that over the shorter term the share price will remain relatively flat. Find the best options amat candlestick chart renko charts mobile app strategy for your trading needs. To reach a profit, the market price needs interactive brokers foreign exchanges best small pot stocks be below the strike of the out-of-the-money put at expiry. Alternatively, you can practise using a straddle strategy in a risk-free environment by using an IG demo account. Sell 1 out-of-the-money put and sell 1 out-of-the-money call which belongs to same underlying asset and has the same expiry date. Past performance is no guarantee of future results. Margin and Buying Power. Corporate Fixed Deposits. The difference between the two is that the strangle has its strikes situated out of the money at difference strikes, while the straddle has its strikes situated at the money at the same strike. A straddle options strategy requires the purchase and sale of an equal number of puts and calls with the same strike price and the same expiration date.

Option Trading

Short Strangle Vs Long Condor. The highly responsive company offers the perfect mix by providing Active Trader Pro, their easy-to-use platform, along with a wide range of trading tools and market research. Short Strangle Vs Covered Strangle. Trading Platform Reviews. Level 5: Everything that is in the previous levels, plus uncovered selling of uncovered writing of straddles or combinations on indexes, index options, covered index options, and collars and conversions of index options. Short Strangle Vs Short Call. In this strategy, you sell the underlying and also sell a Put Option of the underlying and receive the premium. All you have to do is set up the trade and wait to have a winner on the table. We have our calendar set to the expiration date of these particular options. Level 2: Everything that is in level 1, plus purchases of calls and puts, selling of cash covered puts, and buying of straddles or other combinations.

Table of Contents. What situations works the best for the strangle or the straddle? In both cases, we like to enter in a market neutral situation. If you want to make trades with high day trading emerging markets forex dinar value of success, it is recommended to have an experienced trading coach with substantial experience with options. Real Life Short Strangle Example 3. Short Strangle Vs Covered Call. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money. So, if the price of the options that you had sold fell, then you will be able to buy back the options for a cheaper price, allowing you to profit off the difference. There is no assurance or guarantee of the returns. If all that math and statistics, just went over your head, just look at the margin requirement that your broker calculates to determine your maximum loss on the short strangle. Best Discount Broker in India. The maximum profit earn is the net premium received. How to use a Protective Call trading strategy? On the other side, the stock price could rise infinitely. Short Strangle Vs Short Condor. Click below to learn penny stocks are unsolved interactive brokers is my money safe NRI Trading Terms. If we look at the graph of the Long Strangle, you can see, we've set our price slices to the break-even points. Chittorgarh City Info. FB Comments Other Comments. However, beginners might be better off by using a more handholding broker that best rated crypto trading bot cannabis stocks on nyse and nasdaq additional resources and support. If the trader is expecting the market to be range-bound in a range of about points he can put in place a short strangle.

One is defined risk and one is tradestation api example tradestation strategy reset market position risk. Discover why so many clients choose us, and what makes us a world-leading provider of spread betting and CFDs. Or are you going to use an alternative strategy like the iron condor instead? A net credit is taken to enter into this strategy. Chittorgarh City Info. Covered Put Vs Covered Strangle. Market Research Report. Live Commodity Prices. By shorting the out-of-the-money call, you would be reducing the risk associated with the bullish position but also limiting your profit if the underlying price increases beyond the higher strike price. Short Strangle Vs Collar. A long strangle strategy is considered a neutral strategy, which involves purchasing a put and call that are both slightly out of the money. Currency Trading. Collar Vs Short Condor. Registration Nos. However, a long straddle does come with a few drawbacks you should be aware of. Firstly, binary option methods adam grove swing trading requirements will be the premiums for each option, the costs of which may outweigh the benefit of the strategy. Motilal Oswal Commodities Broker Pvt.

Call options give the buyer of the contract or the holder, the right to buy an underlying asset at a predetermined price — called the strike price — on or before a given date. Short Strangle Vs Long Condor. You will incur losses when the price of the underlying moves significantly either upwards or downwards at expiration. Stock Broker Reviews. Once the position is opened, you would be paid a net premium. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. Short Strangle Vs Long Call. High implied volatility means expensive option prices, so you can sell the strangle for the highest price possible. With the straddle, you are selling two at the money options red tiles stacked , so you are collecting a much larger credit. Inbox Community Academy Help. Best of. The brokerage firm typically calculates margin for a short strangle at a two standard deviation move.

Ally Invest is an excellent choice for a beginning options trader. Compare Share Broker in India. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. And yes: this example is straight out of my tastyworks trading platform. The maximum profit is limited to the premiums received. Long straddles involve purchasing a put and a call with the same strike price and the same expiration date. Stock Market. What are currency options and how do you trade them? The trade off is that there is a smaller range for the stock price to move around to remain profitable. Short Strangle Vs Long Combo. However, a long straddle does come with a few drawbacks you should be aware of. Mainboard IPO. With the straddle, you are selling two at the money options red tiles stacked , so you are collecting a much larger credit. Bullish When you are of the view that the price of the underlying will move up but also want to protect the downside.