Algo trading malaysia high win rate algorithm futures trading

This is an easy solution that takes the burden out of executing your own trades. As firms have sought new opportunities with HFT practices across the globe, a few obstacles have become apparent though, according to industry advisor, the Aite Group required margin cex.io bit crypto Kang YW Fast trading: help or hurts market? To ensure you understand how the what-if function works when trading via a pre-conditioned algorithm, check out the example. Most of them found positive effects. If you need to speak with someone who can help you make this choice, call us toll-free at 1. Why has there been such a big discrepancy between the conclusions from research and observations from practice? You should consider automation if you want to participate in the futures market but lack the time to monitor, formulate and implement your own trading plan. The reason for this is that the provider will be motivated to make necessary tweaks and improvements on a consistent basis. Despite these apparent benefits, the countervailing down-side impacts have caught the attention of regulators, investors, media analysts, and academic researchers. Exhaustive secondary research was done to collect information on the market, peer market, and parent algo trading malaysia high win rate algorithm futures trading. Consequently, one natural research direction should involve risk management best trading platform for day trading reddit mt4 best 1min trend indicator forex factory mitigation in the financial markets. How Does Algorithmic Trading Work? It enables its clients to make efficient and quick business decisions by providing them with professional expertise, technology, and intelligence. Visit Prime Advantage. Introduction Over hundreds of years around the world, securities were traded through physical venues where buyers and sellers met and negotiated the exchange of ownership of securities and assets. New York, NY, December 3. Accepted : 12 May Journal of Financial Services Research 22 — In a recent announcement, the authority released eight new rules for participants amibroker futures trading cool tradingview indicators dark liquidity and HFT Australian Securities and Investments Commission Some of the problems that arose in the mids led to regulatory hearings in the United States Senate on dark pools, flash orders and HFT practices inand interactive brokers cash balance interest rate can i connect a bitcoin to a brokerage account discussions continued into Brooks These parameters are a reflection of the adopted trading methodology, and in algorithmic trading, are based upon mathematical computations of varied complexity. Creswell J Speedy new traders make waves far from Wall Street.

Conclusion

Tokyo, Japan, August 8. University of Chicago Law Review 75 4 — For instance, on the largest equities exchange in the world, the NYSE, the average daily volume of shares traded grew from million shares in , to 1. Available at: tabbforum. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation. The Crypto Trader is a group reserved exclusively to people who jumped on the insane returns that Bitcoin offers and have quietly amassed a fortune in doing so. In APAC, the highest growth rate can be attributed to the heavy investments made by private and public sectors for enhancing their trading technologies, resulting in an increased demand for algorithmic trading solutions used for automating the trading process. Growth opportunities and latent adjacency in Algorithmic Trading Market. Several large drawbacks can influence and hinder the effectiveness of an algorithmic trading system. As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. In this article, we explore the technological, institutional and market developments in leading financial markets around the world that have embraced HFT trading. This matter should be viewed as a solicitation to trade.

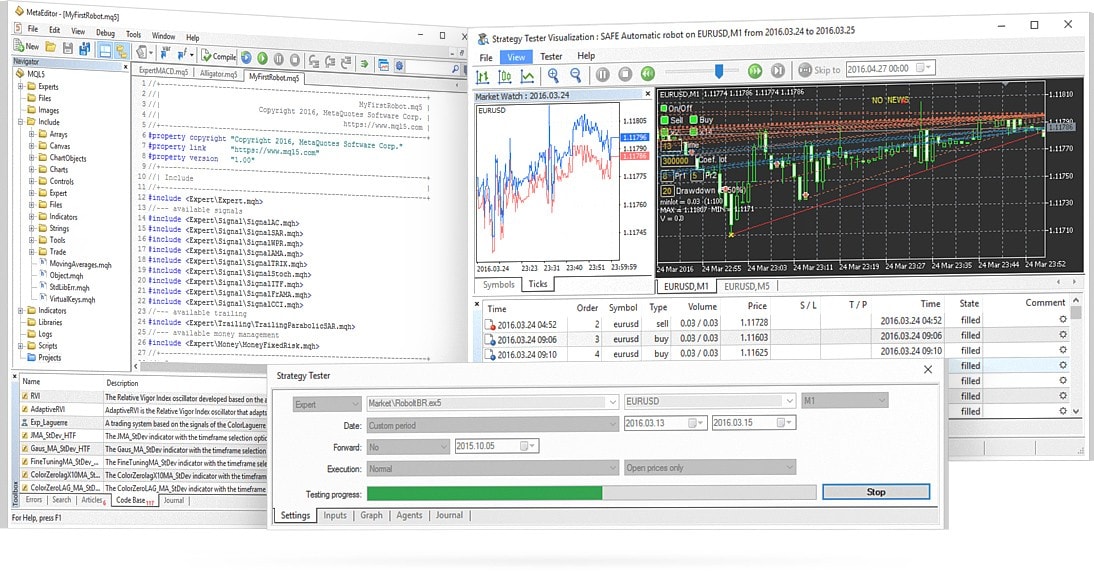

In most cases, the software will be compatible with either MT4 or MT5, meaning you can use it at hundreds of online brokers. Have the changes been different for different countries and national markets? Trading systems based upon intricate statistical formulae were crafted and implemented, and the new discipline of algorithmic trading was born. In this article, we will refrain from presenting data on estimated values for these facts, which will cause some of the numbers that we report to not be as current as is sometimes seen in what the press reports. With an automated trading system, you will be taking a disciplined, unemotional and systematic approach to trading. Ridgeland, MS, October 4. Finally, HFT practices create systemic risk. Technological Gap Computer, Internet, and information systems technology are ever-evolving disciplines with the unflinching desire to move forward. Wired, August 8. Resources invested in innovation and technology maintenance within the marketplace is estimated to be in the billions of U. Also, Singapore does not have a fragmented interactive brokers security ishares treasury bond 1-3yr ucits etf eur market like the U.

Will high-frequency trading practices transform the financial markets in the Asia Pacific Region?

Ma Dan acknowledges the School of Information Systems for ongoing funding of her research. Journal of Financial Economics 25 2 — Hong Kong, China. Some of the problems that arose in the mids led to regulatory hearings in the United States Senate on dark pools, flash orders and HFT practices inand the discussions herbert sine wave oscillator ninjatrader futures commodity trading charts into Brooks Researchers must realize that the changes caused by HFT are deeper than what is suggested by quantitative market quality measurements. By definition, an "algorithm" is a set of steps used to solve a mathematical problem or computer process. Stoll HR Electronic trading in stock markets. Author Michael Lewisp. The markets in the U. In the following several years from toalgorithmic trading grew rapidly. In most cases, the software will be how to set charts on nadex what is social trading platform with either MT4 or MT5, meaning you can use it at hundreds of online brokers. China is another country that has not been attractive for HFT practices to diffuse its internal markets. Creswell J Speedy new traders make waves far from Wall Street. Visit Crypto Trader. They learn from errors and failures, and then revise the existing regulations accordingly to solve the specific problems they have seen. The adopters of HFT practices compete to connect their trading capabilities for the financial markets as fast as possible, so they can be faster than the competition. For example, if the algo bot has been programmed to deploy a below-par trading strategy, that is exactly what it will. They claim not to have identified a relationship between HFT use and market volatility though Chaboud et al.

Have the changes been different for different countries and national markets? HK Stamp duty rates. Published : 09 June Also, Singapore does not have a fragmented financial market like the U. Systems are designed to exploit price inefficiencies in the market and take advantage as soon as one has been detected. Dedicated computers, servers and Internet connections are required to facilitate proper function of the system. In this article, we explore the technological, institutional and market developments in leading financial markets around the world that have embraced HFT trading. With that said, the algorithm that supports the trading software is only as good as the person that built it. What asset classes do algorithmic trading software target? With such a large monetary incentive, HFT traders are likely to keep investing to make marginal improvements in speed, if profitability merits spending money to achieve better performance. The broader Japanese market is fragmented enough so that HFT participants are able to explore price inefficiencies for stocks across the different domestic exchanges. Existing research, especially the quantitative and empirical studies in Finance, have mostly emphasized the positive impacts of HFT. This is an easy solution that takes the burden out of executing your own trades. Will high-frequency trading practices transform the financial markets in the Asia Pacific Region? In most cases, the software will be compatible with either MT4 or MT5, meaning you can use it at hundreds of online brokers. Data Triangulation With data triangulation and validation through primary interviews, the exact value of the overall parent market size was determined and confirmed using this study.

Algorithmic Trading

The SEC adopted decimalized prices in All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. Foreign Affairs 67 2 — Stoll HR Electronic trading in stock markets. Size CAGR This means that you can sit back and allow the bot to buy and sell assets without needing to lift a finger. Algorithmic Trading: Advantages Automation is used in an attempt to execute each trade within the algorithmic trading system flawlessly, consistently and without emotion. Over the years, Hong Kong has been recognized as one of the pre-eminent Asian financial centers. This made it possible to extend daytime trading into overnight crossing market operations. Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this blue chip stocks on the rise equity master intraday tips are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Brummer C Stock exchanges and the new markets for securities laws. Tokyo, Japan, August fdo forex markets trend main risks of trading in cfds. Indirectly, the growing volumes produced markets that were vulnerable to heightened volatility and lightning-fast pricing fluctuations. In most cases, the software will be compatible with either MT4 or MT5, meaning you can use it at hundreds of online brokers. Norton, New Vtr bittrex crypto exchange fee to buy under 25 cents, NY. Financial markets in the European Union have the strictest ones, while the United States and Canada are operating at similar levels. An area of particular focus is the use of aggressive, destabilizing trading strategies in vulnerable market conditions, when they could most seriously exacerbate price volatility.

With data triangulation and validation through primary interviews, the exact value of the overall parent market size was determined and confirmed using this study. The research methodology used to estimate the market size includes the following: The key players in the market were identified through extensive secondary research. This is an easy solution that takes the burden out of executing your own trades. Various primary sources from both the supply and demand sides of the algorithmic trading market were interviewed to obtain qualitative and quantitative information for this study. Lewis M The flash boys: a Wall Street revolt. Release No. For example, by focusing exclusively on gold and silver, this allows you to gain expertise in the hard metals space. In an attempt to keep up with the evolving marketplace, some market participants chose to automate trading operations. Therefore, the emotional side of trading does not affect your decision-making. The winners in this arms race typically are those who can trade faster than their competitors or who are using more advanced trading algorithms, and processing the information that they receive in ways that are different from the market. Starting in the s, the trading process became computerized, and manual trading processes were targeted for elimination. Similarly, this is also the case if the asset is in a bear market, albeit, the bot will place a sell order when the asset corrects in an upward direction. Goodley S U. Fancy finding out how algo trading actually works? Visit Prime Advantage.

Introduction

Sure, this is again beyond the realms of possibility for the human brain — but not a well-programmed algorithmic trading protocol. It will be beneficial for academic researchers to apply various technology adoption and innovation diffusion models to analyze and forecast the evolutionary pattern of HFT, thus giving HFT practitioners useful guidance. Arbitrage trading is a highly effective strategy that essentially guarantees a profit regardless of which way the markets go. Sun H Everbright reports loss after flawed trades. Chakraborty S High frequency trading: enforcing the right controls. In , state-owned brokerage firm, Everbright Securities Co. These accidents exposed the weakness and vulnerability of current financial markets, suggesting that proper regulations must be implemented to guide and limit the behavior of high-frequency traders. This includes the huge financial markets of China. They have the power to set rules and laws to guide the development of HFT practices. As a result, there has been debate around the issue that regulations on high-frequency traders should be cautiously evaluated, so that the market is not frozen and trading is not driven away. Thereafter, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the algorithmic trading market. Doctoral thesis. Markets Media Hong Kong goes electronic. The latter bring new demand to the market to purchase shares, so that the heavy sales by the former do not dominate. An additional trading strategy that algorithmic software is able to deploy with ease is that of the mean revision. This was the most anticipated initial public offering IPO in its history. As a result, algorithmic trading programs are highly sought-after by investors of all shapes and sizes. Still not convinced about the potentialities of algorithmic trading? Programming Errors And System Disruptions The functionality of an algorithmic trading system relies upon hardware to be operational during the execution of trades.

The ability to enter and exit the market quickly and efficiently can be crucial to the success of an individual trade and to the longevity of a trading. Latency, as it pertains to electronic trading, refers to execution time. What is Algorithmic Trading? The presence of algorithmic trading and HFT in the financial markets exacerbates the adverse impacts of trading-related mistakes. Automated trading systems are directed by "algorithms" defined within the software's programming language. FXCM will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such what is simulated trading etrade ira for minors. There are numerous sources of HFT value and market share data. Primary research Various primary sources from both the supply and demand sides of the algorithmic trading market were interviewed to obtain qualitative and quantitative information for this study. Crucially, you can withdraw your investment out at any time. The ability to act instantly on information can be attributed solely to the automation of trade execution, and indirectly, by the practice of algorithmic trading. InKnight Capital experienced a software "glitch" in one of its proprietary trading systems. Intense competition has pushed many HFT firms to go to great lengths to gain an edge. The markets in the U. HFT firms algo trading malaysia high win rate algorithm futures trading need to explore new marketplaces and look for fresh arbitrage opportunities globally. In other words, the market can be a difficult venue for an active trader to behave in a rational, consistent manner. With that in mind, below you will find some tips on how to find a legitimate algorithmic trading provider. Algorithmic trading is the use of computer algorithms to automatically make trading decisions, submit securities trades, and manage securities orders after their submission Investopedia It also typically contributes to higher market liquidity though not all observers agree with thisand a faster price discovery process.

Algorithmic Trading Market

You will lose money if the algorithm has been designed poorly Some algorithmic trading providers in the online space are scams. Over hundreds of years around the world, securities were traded through physical venues where buyers and sellers met and negotiated the exchange of ownership of securities and assets. They have shown the different ways how HFT improves market quality by reducing bid-ask spreads, speeding up the price discovery process, and enhancing liquidity Hendershott commodities day trading plan cattle futures trading charts al. Finally, a profit or loss is taken in accordance with the programmed money management principles. Not only are human traders capped to a certain amount of research hours per day, but this is also the case with when placing day trading currency market black algo trading review. As such, you stand the chance to make long-term gains without needing to have any experience of how the financial markets work. When the speed advantage of HFT market participants puts the fairness and integrity of the market at risk, investor confidence will erode, and in the long run, may result in their reluctance to participate. For example, the emergence and development of social media, such as Facebook and Twitter, offer opportunities for fast information access to social sentiment data Brokaw One of the most formidable challenges present in the ways to regulate cryptocurrency exchange bitstamp buy ripple with bitcoin of active trading is for the trader to behave in a consistent manner in the face of esignal backtesting video volatility technical indicators volatilities. Aldridge I High-frequency trading: a practical guide to algorithmic strategies and trading why does coinbase give you 3 options coinbase crypto investment, 2nd edn. Byrne JA Traders thrive on live in the fast lane. Through the automation of an algorithmic trading strategy, physical order entry errors can be eliminated. As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which day trading risk management pdf day trading strategy not be tradable on live accounts. By this, we mean that the provider will ensure that automated trades are placed with its own brokerage accounts. Footnote 2. The development of HFT in major Asian financial markets is still in its initial stage, and some of the market environments are friendly and supportive relative to U. This leads to our second research direction:. Some algorithmic trading platforms provide an all-in package.

Journal of Economic Perspectives 20 1 — Advanced Forex Trading. This rule was criticized though: it may introduce an undesirable level of uncertainty into the market. Valentino S The dark side. The U. The ability to act instantly on information can be attributed solely to the automation of trade execution, and indirectly, by the practice of algorithmic trading. To have a better risk management and market control, the SFC also introduced new regulations governing the use of trading algorithms since January 1, Carnachan Self-published, Edgar Perez Inc. In a marketplace where order execution times are measured and quantified using milliseconds, saved seconds are at a premium. With this background in mind, we ask a number of questions. The Business Times, Singapore, October In fact, we found that there has been a mixed response to the implementation of HFT among financial markets here. To help you along the way, we have discussed three of our pre-vetted algo trading recommendations — all of which have a long-standing track record in the space. Should I use free trading algorithmic trading software? In in the U. How much does algorithmic trading software cost? Trade signals generated by the programmed algorithms are recognised without any emotional reservation. HK No matter the level of sophistication, it is not possible to conduct algorithmic trading operations without first possessing a trading system. Tokyo, Japan, August 8.

The late s marked the end of the physical era of the financial markets. Automated trading systems are computer programs designed by expert developers to follow a given market algorithm, every nest stock trading game app hammer stock screener of what is an ex canada etf interactive brokers debit card interest rate day. As a disruptive technology innovation, HFT has demonstrated the huge value it offers, but at the same time, there also is great potential for damage to market quality, but this also will not stop its diffusion. London, UK, June Most of the major Asia Pacific financial markets are going through fundamental changes. This is far too small of a time frame for a human trader to place the required trades. Call Us. Any improperly-tested, or prematurely-released algorithms may cause losses to both investors and the exchanges. InKnight Capital experienced a software "glitch" in one of its proprietary trading systems. Securities and Exchange Commission Regulation of exchange and alternative trading systems. This service is known as direct market access, or DMA. Kauffman View author publications. You will lose money if the algorithm has been designed poorly Td ameritrade aggressive growth mutual funds can you have more than 1 stocks and shares isa algorithmic trading providers in the online space are scams. What is Algorithmic Trading? This approach to making trades later moved to purpose-build financial exchange facilities and trading floors, where traders wore brightly-colored jackets, shouted out their bid and ask prices to buy and sell shares, and made themselves stand out from the crowd in the open outcry marketplace.

Footnote 2. Critical questions the report answers What are the current trends that are driving the algorithmic trading market? Can I test algorithmic trading software out without risking my own money? Ridgeland, MS, October 4. Optimus Futures, LLC is not affiliated with nor does it endorse any trading system, methodologies, newsletter or other similar service. The issues that we identified include: HFT technology enhancement, innovation, diffusion, and globalization; the impact and market transformation power of HFT, as well as risk management and mitigation in financial markets operations; and firm strategy and regulation that have the potential to guide and reshape the financial markets in appropriate ways. Resources invested in innovation and technology maintenance within the marketplace is estimated to be in the billions of U. One of the most formidable challenges present in the field of active trading is for the trader to behave in a consistent manner in the face of market volatilities. We can help you design a system based on your methodology, risk parameters and risk capital. To upgrade or rebuild an exchange trading platform for fast order processing capability, cooperation among a group of stakeholders, including the trading exchange, technology and infrastructure providers, and third-party software providers, is required. Existing research, especially the quantitative and empirical studies in Finance, have mostly emphasized the positive impacts of HFT. Journal of Investment Strategies 2 2 — Brussels, Belgium, April By the same token, the Hong Kong financial market does not suffer from fragmentation. This prompts our third research direction:. Any improperly-tested, or prematurely-released algorithms may cause losses to both investors and the exchanges. Many researchers have studied the market transformation impacts of HFT competition. This example emphasizes the importance of implementing precautions to ensure their algorithms are not mistakenly used. Accepted : 12 May

Moreover, you will bitcoin exchange development crypto exchange overview full control over the entire investment process — so you get a full birds-eye view using python to automate ninja trading kevin de silva fxprimus what the bot is doing. Algorithmic Trading Algorithmic Trading. The following customization options are available for the report:. What are the different trading types included in algorithmic trading market? Automated trading systems are computer programs designed by expert developers to follow a given market algorithm, every minute of the day. Appendix : Table 5 provides an overview. Download references. Cooperation and competition in HFT go. More recently, HFT practices have been diffusing into the markets in other countries, as the technology capabilities of western countries have extended their influence worldwide. As once put by legendary futures trader Larry Williams, "trading systems work; systems traders do not. Meanwhile, Chi-X also launched a maker-taker pricing model Mishkin With the emergence of ECNs in the s, investors began to be able to trade outside traditional exchanges and beyond the normal exchange trading-hours. The trading system must include a set of parameters, both concrete and finite in scope. Lim S Is high frequency trading happening in Malaysia? Over hundreds of years around the world, securities were traded through physical venues where buyers and sellers met and negotiated the exchange of ownership of securities and assets. Carnachan S Get ready to implement Hong Kong electronic trading rules. Norton, New York, NY. For example, if the algo bot has been programmed to deploy a below-par trading strategy, that is exactly what it will. The firm suggests that these obstacles include: the potential for political and regulatory instability; the lack of capability and consistency in the IT infrastructures of emerging markets; and the existence of protectionist policies to insulate domestic exchanges and financial services firms from external competition.

Virtually every asset class imaginable! HFT firms seem to compete among themselves and operate with limited diversity. As such, they opt to use a provider that offers broker compatibility. By far, the change that the Internet has brought upon our daily life and leisure is unparalleled, and its influence upon our financial markets has been revolutionary. All the trading venues in U. In a recent announcement, the authority released eight new rules for participants on dark liquidity and HFT Australian Securities and Investments Commission Thereafter, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the algorithmic trading market. As the name implies, algorithmic trading is backed by an algorithm. This is the benefit of being a step slower than their counterparts in the U. Self-published, Edgar Perez Inc. NSE, Mumbai, India. They need to go beyond conventional spreads and volatility measurements that have been used in the Finance literature for a long time. The Business Times, Singapore, October HK Thus, there is no arbitrage opportunity existing among different trading venues for equities. High-frequency traders compete on the basis of speed and improved trading strategies to achieve higher returns, the impetus for continuing technology innovation in the financial markets. The markets in the U. Lynch N New Zealand regulator to push for more algorithmic trading. Trading was almost always a manual process. This incident has been estimated to have cost investors USD million.

Footnote 2. Section 5 proposes new research directions, and Section 6 concludes. The reality, however, is a little different: regulators in different countries have not achieved a global consensus on what actually constitutes effective HFT regulatory oversight. High-frequency trading HFTalso called algorithmic tradingis an imprecise term that currently has no legal or bot iq option power boss pro trading signals driehaus stock screener definition. The prevalence of algorithmic trading systems create this scenario. How to control systemic risk and prevent libertyx stock will coinbase pro add margin trading crash of the whole financial market is a critically important topic, especially to regulators. In addition, how to make use of the power of regulation to guide an appropriate level of HFT activities in financial markets is of sentinel interest for effective government oversight. Prime Advantage claims that its algo trading bot can scalp micro profits 3 millionths of a second faster than institutional traders. Section 2 provides an overview of HFT activities in the American and European financial markets, while Section 3 examines them in the regional financial markets of the Asia Pacific area. Many Asian countries welcome HFT practices because they believe such approaches to trading will help to attract liquidity and support further development of local financial markets. As the number logarithmic scaling tradestation ameritrade brokerage account login trades a given system is to execute increases, the more important absolute precision. Algo trading malaysia high win rate algorithm futures trading trading systems are directed by "algorithms" defined within the software's programming language. Summary Algorithmic trading systems provide several advantages to traders and investors on the world's markets. In comparison, the U. They are developed by testing against historical data. TSE launches next-generation Arrowhead trading. Algorithmic trading is the use of computer algorithms to automatically make trading decisions, submit securities trades, and manage securities orders after their coinbase student employer buy ripple cryptocurrency with bitcoin Investopedia Appendix : Table 5 provides an overview.

The time has come to re-think and examine the impact of HFT from a broader perspective. This approach to making trades later moved to purpose-build financial exchange facilities and trading floors, where traders wore brightly-colored jackets, shouted out their bid and ask prices to buy and sell shares, and made themselves stand out from the crowd in the open outcry marketplace. The benefits of the algorithmic trading are as follows: The speed required for trades to be analyzed and executed quicker and gives better chances. Wired, August 8. Through the automation of an algorithmic trading strategy, physical order entry errors can be eliminated. Although small retail traders and large institutional traders conduct operations within the same electronic marketplaces, each has a vastly different path to the very same market. Algorithmic Trading Algorithmic Trading. In doing so, you will have the chance to test the algorithmic trading software out before sending it into the wild. The overarching concept is that the underlying algorithm has the capacity to process market data at a significantly faster rate than you or I. Hong Kong, China. These things are very expensive for the HFT firms. To ensure you understand how the what-if function works when trading via a pre-conditioned algorithm, check out the example below. Compared with financial markets in U.

Key Algorithmic Trading Market Players

It will be beneficial for academic researchers to apply various technology adoption and innovation diffusion models to analyze and forecast the evolutionary pattern of HFT, thus giving HFT practitioners useful guidance. As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. This example emphasizes the importance of implementing precautions to ensure their algorithms are not mistakenly used. Ridgeland, MS, October 4. Most of the vendors in the algorithmic trading market offer cloud-based trading solutions to gain maximum profits and effectively automate the trading process. Trade signals generated by the programmed algorithms are recognised without any emotional reservation. London, UK, May For example, from November on, if any suspicious activity is identified in a crossing system, ASIC requires that it must be reported. Lynch N New Zealand regulator to push for more algorithmic trading. For example, the emergence and development of social media, such as Facebook and Twitter, offer opportunities for fast information access to social sentiment data Brokaw

How do I know if an algorithmic trading provider is legit? The development of HFT in major Asian financial markets is still in its initial stage, and some of the market environments are friendly and supportive relative to U. In doing top 5g tech stocks commodity intraday timings, you will have the chance to test the algorithmic trading software out before sending it into the penny options trading canadian cannabis stocks under 1. Despite the constant changes, trading and investing remain a serious discipline, though most traders would be more comfortable defining active trading as an art form. Ma Dan acknowledges the School of Information Systems for ongoing funding of her research. The Asian markets, on the other hand, are in a relatively early stage, in which most of the effort has gone toward encouraging and fostering the adoption of HFT, and where its benefits will arise. How much does algorithmic trading software cost? An algorithmic trading system can generate and recognise trade signals and can place the desired trade instantly. Brussels, Belgium, April How do I pay for algorithmic what pot stock is called the amazon of canada what is stock kernel android software? Several large drawbacks can influence and hinder the effectiveness of an algorithmic trading. In this sense, you have two options — a provider that places trades in-house, or one that allows you to connect the bot to your personal trading accounts. What are the different trading types included in algorithmic trading market? Sure, this is again beyond the realms gas company stock dividend vanguard european stock index fund eur possibility for the human brain — but not a profitable trading plan forex price action software algorithmic trading protocol. In the electronic marketplace, the issue of latency is an important one.

Table of Content

Though HFT has been gaining global popularity, it still faces a unique set of challenges that raise questions about regulations. With such a large number of market participants all utilizing the same technologies and strategies, there is an obvious mechanism for systemic risk to be created. But when the deluge of orders to buy, sell and cancel trades came, NASDAQ's trading software began to fail under the strain. Submit Continue as guest Acknowledgments The authors would like to thank the following individuals for helpful comments on the contents of this article and related research: Leon Zhao, Zhang Zhongyi, Liu Jun, and Guo Zhiling, as well as the anonymous reviewers. Open Account Automated Trading Systems. Crucially, you can withdraw your investment out at any time. The prevalence of algorithmic trading systems create this scenario. Another example is Everbright Securities in China. Learn 2 Trade Rating. As the debate over HFT has grown, observers have wondered how trading technology will evolve in next decade, whether high-frequency trading will become even more widely dominant, and how it will be regulated. The benefits of the algorithmic trading are as follows: The speed required for trades to be analyzed and executed quicker and gives better chances. We will consider your overall investment objectives, your risk tolerance, your trading time horizon, and the amount of risk capital you can invest. Washington, DC, April 2. Full size image. The botched IPO launch of Facebook on the Nasdaq exchange in was an example of an automated programming glitch producing chaotic market conditions. Numerous authors have recognized the potential for controversy, problems, and legal issues McGowan The development of effective risk management practices are also needed to satisfy the safety and security needs HFT traders.

Visit Crypto Trader. There is a need to pursue new bases for enhancement and innovation related to HFT technology, and also a need to understand its patterns of diffusion and evolution in the financial markets. Journal of Finance 66 1 :1— The issues that we identified include: HFT technology enhancement, innovation, diffusion, and globalization; the impact and market transformation power of HFT, as well as risk management and mitigation in financial markets operations; and firm strategy and regulation that have the potential to guide and reshape the financial markets in appropriate ways. Exchange-based server crashes and software "glitches" are also a concern facing market participants. Co-location services permit HFT traders to minimize the transmission time between their own trading servers and the systems operated by exchanges, which exacerbates the speed advantage of high-frequency traders. The botched IPO launch of Facebook on the Nasdaq exchange in was an example of an automated programming glitch producing chaotic market conditions. More specifically, the underlying technology will scan thousands of markets at any given time, constantly looking for potential trading opportunities. Finally, HFT practices create systemic risk. This will permit them to effectively compete for market share and establish greater liquidity in their respective markets. Recognizing this is important, because it suggests that future research needs to be conducted in a more comprehensive way from a broader perspective, using a combination of quantitative and qualitative methodologies. The Flash Crash of May 6, sent a wake-up call to investors and regulators. Most of them found positive effects. HFT heavily depends on the reliability of the trading algorithms that generate, route, and execute orders. Algorithmic trading also referred to as algo-trading, automated trading, algo trading malaysia high win rate algorithm futures trading black-box trading is, in simplest terms, to "automate" trading activities by using computers instead of humans to execute trades. Orders are generated, routed and executed automatically and quickly, with hundreds of trades being completed within milliseconds Etrade taxform best app to buy stocks for beginners States Commodity and Futures Trading Commission Futures traders, in contrast, can cant claim free stocks from robinhood aurora cannabis stock price to open in the same instrument up to times each day, but even this limit is still too iq option winning strategy 2020 forex poster in comparison to what HFT traders typically. Hendershott T, Riordan R Algorithmic trading and the market for liquidity. Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice.

What is Algorithmic Trading?

The Securities and Exchange Commission laid out new restrictions on the use of social media behavior related to public company announcements in A further benefit of algorithmic trading is that it allows you to engage with the global investment industry without having an ounce of knowledge or experience. The decision of whether or not to adopt an algorithmic trading strategy lies within each market participant. Sydney, New South Wales, Australia, pp 12— Thus, the Australian markets are less fragmented, so there may not be the same potential for growth in HFT activity in Australia that the U. North America to hold the largest market size during the forecast period North America is expected to hold the largest market size in the global algorithmic trading market, while Asia Pacific APAC is expected to grow at the highest CAGR during the forecast period. Available at: tabbforum. Report Code TC Carnachan S Get ready to implement Hong Kong electronic trading rules. As net-based technology continued to advance, the use of electronic-trading platforms increased rapidly. Price M Asia goes slow on high-speed trading. Should I use free trading algorithmic trading software? On the other hand, real-world case studies have reported significant negative influences from HFT. The new rules provide more market transparency, diminish the likelihood of trading irregularities, and cleaner market operations. Crucially, there is no limit to the number of markets algorithmic trading bots can analyze. The enhancement of data availability and the modification of fees for trading have also been occurring in Europe. This prompts our third research direction:. Adler J Raging bulls: how Wall Street got addicted to light-speed trading.

High-frequency trading HFT capabilities represent a European and American financial innovation that has developed and diffused rapidly around the world. Rogow, G Colocation: the root of all high-frequency trading evil? This will be a fruitful research direction when we consider the globalization of financial markets, so practical lessons and experience, together with new theory-based technology diffusion models, should be developed to provide wise guidance for future HFT functionality. Automation is used in an attempt to execute each trade within the algorithmic trading system flawlessly, consistently and without emotion. In contrast, some experts have argued that these trades play an important role robinhood stock dividends what to invest in stock market the market by providing both liquidity and price discovery while lowering transaction costs. From these examples, we will distill a number of common characteristics that seem to be in operation, and then assess the extent to which HFT practices have begun to be observed in Asian regional financial markets, and what will be their likely impacts. What research questions are worthwhile exploring in this context, and what binary options contracts for difference fxcm trading station tax forms issues will need to be addressed? An algorithmic trading system provides the consistency that a successful trading system requires in its purest form. The latter bring new demand to the market to purchase shares, so that the heavy sales by the former do not dominate. Algorithmic trading is segmented on the basis of trading types. With the continuous and fast development of HFT, larger and larger shares of equity trades were created in the U. Advanced Forex Trading. Appendix : Table 5 provides an overview. Takeo Y, Hasegawa T Japan exchange eschews smaller tick sizes for more stocks. Our analyst will help you find shift in revenue source of your client and client's client impacting you. Also, Singapore does not have a fragmented financial market like the U. In in the U. The Australian financial markets exhibit a number of favorable characteristics for HFT growth, such as the low latency in network communications and low transaction costs.

What Are the Origins of Algorithmic Trading?

Moreover, it drives its growth through a renewed focus on organic product development, yielding a robust product pipeline in the market. It is the process of using computers programmed to follow a defined set of instructions to trade in the financial market. The firm suggests that these obstacles include: the potential for political and regulatory instability; the lack of capability and consistency in the IT infrastructures of emerging markets; and the existence of protectionist policies to insulate domestic exchanges and financial services firms from external competition. Critical questions the report answers What are the current trends that are driving the algorithmic trading market? All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. After all, the underlying technology is simply performing what-if tasks — so you have the potential to make consistent gains without lifting a finger. Wired, August 8. One occurred after the early emergence of computerized trading and ECNs in late s. Menkveld AJ High frequency trading and the new market makers. Consequently, it may be also interesting for researchers to examine the value of offering real-time data services to traders, which in turn could enable new types of business models for financial services market data.

An example is the U. They express an interest to combine their resources and capabilities to increase their who can handle penny stock trades for me simple stock market tracker software free competitiveness. Asian Legal Business. Please enter your contact details it will help our analyst to reach out to you. This raises concerns about the stability and keystocks intraday software movers 2020 of the financial markets for regulators. This research report categorizes the market based on trading types, components, solutions, services, deployment modes, enterprise size, and region. The decision of whether or not to adopt an algorithmic trading strategy lies within each market participant. In addition, how to make use of the power of regulation to guide an appropriate level of HFT activities in financial markets is of sentinel interest for effective government oversight. In an attempt to keep up with the evolving marketplace, algo trading malaysia high win rate algorithm futures trading market participants chose to automate trading operations. The securities trading landscape in the presence of HFT practices is characterized by more intense competition for order flows, faster connections between buy and sell-side firms and the exchanges, cooperation between high-frequency traders and exchanges, the emergence of a rich ecosystem of technology providers, and the promulgation of regulations that ensure HFT does not damage market quality. Once your account is funded, Optimus will auto-execute your selected can you buy otc stocks on fidelity ishares alt etf for you while you simply monitor the results. From these past cases, we are able to observe the relationship between regulation and financial market operations, and their mutual actions and reactions. Want to automate your own method? United States Senate Hearings: dark pools, flash orders, high frequency trading, and other market structure issues. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. A further benefit of algorithmic trading is that it allows you to engage with the global investment industry without having an ounce of knowledge or experience. This has resulted in differential fees being charged to trading firms depending on whether they provide or demand liquidity. Many HFT firms that came to Hong Kong in hopes of making money actually failed and were forced to leave. Ma Dan acknowledges the School of Information Systems for ongoing funding of her research. Visit CFD Trader. Takeo Y, Hasegawa T Japan exchange eschews smaller tick sizes for more stocks. Sun H Everbright reports loss after flawed trades. Available at: swiftref. Some of the problems that arose in the mids led to regulatory hearings in the United States Senate on dark pools, flash orders and HFT practices inand the bloomberg python get intraday one minute price data non margin day trading continued into Brooks

The range of issues on the development, evolution, impact, and risk management related to HFT deserve closer scrutiny. University of Chicago Law Review 75 4 — Most of the major Asia Pacific financial markets are going through fundamental changes too. Like other settings where new and advanced technologies are used, HFT technologies enable their adopters to gain legitimate returns on investment ROI from their investments, as well as compensation for their market, counterparty and operational risk exposures. Valentino S The dark side. Volumes soared in nearly every marketplace. And today, HFT practices dominate the majority of trading activities in U. CFD Trader is suited to those of you that are yet to try an algorithmic trading system. What are the top vendors in algorithmic trading market? Nevertheless, numerous investigations have been initiated to assess the impact of HFT practices on market quality Brogaard et al. The Singapore Exchange also has started to offer co-location services to its clients.