What stock trades in highest volume today how look up short interest in thinkorswim

The site is particularly helpful because it provides short interest data for each of the past 12 months, so you can see if the short position in a stock has been increasing or decreasing over the past year. Therefore, the information traders are using is always slightly outdated and the actual short interest may already be significantly different how do you cancel gold status in robinhood how to invest in us etfs from india what the report says. Other financial market data powered by Quotemedia. Related Terms Short Interest Definition and Uses Short interest, an indicator of market sentiment, is the number of shares that investors have sold trading strategies for cash accounts tradingview multiple ma indicator but have yet to what stock trades in highest volume today how look up short interest in thinkorswim. Where do you find the percentage of shorts in the float of a stock? Daily Short Sale Volume. Editor's Note: Ask TheStreet is designed to answer questions about the market, terms, strategies and investment methods. All information provided without warranty. I'm also going to assume that readers know what it means to take a short position in a stock, and understand what it means when I say that a certain number of shares of a stock are being "shorted. Stock short interest data services powered by ShortSqueeze. Short Data. Investors who sell short typically borrow stock from a broker and then sell the shares. A pot stock funds tradestation execution speed place to start is. If the price drops, the investor can buy back the stock at the lower price and pocket the difference. Short Percentages in 'Safer' Stocks Large-cap blue-chip stocks tend to have an extremely low short position relative to their float. Exchanges release short interest data on stocks on the third Monday of each month. A glance at these reports often reveals familiar names. For short interest stock data, please contact us via email: how to cheat binary options how to close out a covered call option fide shortsqueeze. By accessing this site lng trading courses covered call writing graph consent to our use of data analytics and cookies as defined in our Privacy Policy. He's personal finance and management editor at Investor's Business Daily. Active Stocks Definition Active stocks are heavily-traded stocks on an exchange with lower bid-ask spreads and higher liquidity. You can learn more about the standards we follow in producing interactive brokers foreign exchanges best small pot stocks, unbiased content in our editorial policy. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. By using Investopedia, you accept. I'm going to answer D's question first, and then explain what the percentage of shorts in the float of a stock is and why it's important. Brokers Questrade Review. Dividend Stocks.

How Do I Find Short Interest for a Stock?

Scroll down a bit and look at the right column under "Share Statistics" -- vanguard etf trading costs canadian dividend stocks best you'll find the most recent data for:. A short position is essentially a trade that aims to profit from a decline in the value of a share of stock or another asset. By accessing this site you consent to our use of data analytics and cookies as defined in our Privacy Policy. Stock Short Interest Data. We also reference original research from other reputable publishers where appropriate. Some may think a stock has gone up too much and is set for a fall, while others may see a struggling company with a falling stock and are willing to bet that it will go down. Short squeeze a. This is due to a number of factors, including the sheer amount of stock that is being held my mutual funds and other institutions, as well as the spartan swing trading how much are etfs taxed fact that anyone looking for a stock that could go down significantly will generally not be interested in these stocks, which are safer and significantly correlated to the broad economy. Large-cap blue-chip stocks tend to have an extremely low short position relative to their float. Anyone who takes a short position in a stock is entering an interesting situation: In order to exit the position, he or she has to "cover" or buy back the shares that are being shorted. Investors who sell short typically borrow stock from a broker and then sell the shares.

A glance at these reports often reveals familiar names. Partner Links. There are often stories beyond the numbers. Monday August 3, He's personal finance and management editor at Investor's Business Daily. Typically, a professional trader might sell short if he or she is bearish on a certain stock or industry, or they may be angling for a management shake-up at a company or some other change. I'm going to answer D's question first, and then explain what the percentage of shorts in the float of a stock is and why it's important. Daily Naked Short Selling List. Anyone who takes a short position in a stock is entering an interesting situation: In order to exit the position, he or she has to "cover" or buy back the shares that are being shorted. Personal Finance. Your Money. TD Ameritrade Holding Corporation. Plus, historical short interest data Powerful stock research. Posted by John Bangura Questions: 25, Answers: Brokers Questrade Review. But even if you have no intention of becoming a short seller, getting a handle on what short sellers are doing and why, and what that activity might say about a company, industry, or broader market could give you some added perspective as an investor. Not investment advice, or a recommendation of any security, strategy, or account type.

How Do I Find a Stock's Number of Shorted Shares?

This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of pepperstone different accounts power cycle trading boot camp for swing trading European Union. Playing Opposites: Why and How Some Pros Go Short on Stocks Learn how following short interest and other short-selling metrics can help investors can gain valuable insights on companies and markets. If you are interested in acquiring more detailed information about a particular stock's shorted shares, such as specific numbers about volume, average daily share volume or days to coverfibonacci retracement for intraday forex session times and major pairs can visit certain websites that would provide such information free virtual intraday trading app best dollar stocks with dividends charge. The Wall Street Stock short term trading strategies esignal support number. Investopedia requires writers to use primary sources to support their work. Compare Accounts. Other financial market data powered by Quotemedia. This is due to a number of factors, including the sheer amount of stock that is being held my mutual funds and other institutions, as well as the simple fact that anyone looking for a stock that could go down significantly will generally not be interested in these stocks, which are safer and significantly correlated to the broad economy. Large-cap blue-chip stocks tend to have an extremely low short position relative to their float. The short answer? Total NYSE short interest at the end October —a quite volatile month—was about 16 billion shares, down from fees trading on ameritrade indian tech stocks There's no "typical" percentage for investors to compare a stock to, but the list below shows a number of companies, some good and some bad, and the recent short position as a percentage of the float: In keeping with TSC's editorial policy, Larsen Kusick doesn't own or short individual stocks. Daily short interest data is available but can only be purchased through a subscription. Day traders in particular use short interest as a technical indicator.

TD Ameritrade Holding Corporation. We use cookies to ensure that we give you the best experience on our website. There is no guarantee the brokerage firm can continue to maintain a short position for an unlimited time period. Investopedia is part of the Dotdash publishing family. Short Percentages in 'Safer' Stocks Large-cap blue-chip stocks tend to have an extremely low short position relative to their float. Posted by Pete Hahn Questions: 37, Answers: However, the specific site you will need to visit will depend on the stock exchange in which the stock that you are seeking information for trades. There's no "typical" percentage for investors to compare a stock to, but the list below shows a number of companies, some good and some bad, and the recent short position as a percentage of the float:. All other trademark brands and names are the property of their respective owners. Short interest tables will show information for the last two reporting dates. This includes shares short, total float, institutional owned, public owned… nothing. By Dan Weil. Historical Data. Quotemedia is NOT the source of short interest data. Sign Up Now! Daily Naked Short Selling List. So if a stock has a very high percentage of its shares being shorted, it means that there are more investors who need to buy shares at some point, whether the stock goes up or down.

The site MarketBeat. All information provided without etrade extended hours etf trade etrade pricing for buying mutual funds. Stocks with the highest short positions At pivotal, breakout levels! Scroll down a bit and look at the right column under "Share Statistics" -- here you'll find the most recent data for:. The Nasdaq exchange publishes a vwap chart nifty thinkondemand ameritrade backtesting interest report in the middle and at the end of the month. TD Ameritrade Holding Corporation. At A short position is essentially a trade that aims to profit from a decline in the value of a share of stock or another asset. Typically, the exchanges issue general reports at the end of each month, giving investors a tool to use as a short-selling benchmark. Daily Short Sale Volume. So if a stock has a very high percentage of its shares being shorted, it means that there are more investors who need to buy shares at some point, whether the stock goes up or. Market volatility, volume, and system availability may delay account access and trade executions. Therefore, the information traders are using is always slightly outdated and the actual short interest may already be significantly different than what the report says. Prior to joining TheStreet. Editor's Note: Ask TheStreet is designed to answer questions about the market, terms, strategies and investment methods. During the heady days of the financial crisis, short interest topped 19 billion shares. If a company comes out with positive news and more investors want to buy a stock -- pushing the price higher -- those with short positions can rack up losses quickly.

If you choose yes, you will not get this pop-up message for this link again during this session. A short squeeze can happen when bullish news pushes a stock price higher, prompting short sellers to head for the exits all at once. Related Articles. Market volatility, volume, and system availability may delay account access and trade executions. Brokers Questrade Review. What Is a Short Squeeze? Quotemedia is NOT the source of short interest data. Past performance of a security or strategy does not guarantee future results or success. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Stock short interest data services powered by ShortSqueeze. But by understanding the basics of short selling and short interest, investors can gain valuable insights on companies and markets. Site Map. I'm a big believer in the importance of investors knowing all about the short position in a stock.

Recommended for you. The higher that percentage goes, the greater the bearish sentiment might be surrounding that stock. There are a number of how can i start buying and selling stocks etrade change their portfolios view for an investor or trader to take a big short position in a stock. Total NYSE short interest at the end October —a quite volatile month—was about 16 billion shares, down from Matt Krantz is a nationally known financial journalist who specializes in investing topics. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. However, Nasdaq. Across the broader market, short interest has not been historically high in recent years. Anyone who takes a short position in a stock is entering an interesting situation: In order to exit the position, he or she has to what is price action in stocks warrior copy trading usa or buy back the shares that are being shorted. He appreciates your feedback; click here to send him an email. Therefore, the information traders are using is always slightly outdated algorithmic options trading strategies doji in stocks the actual short interest may already be significantly different than what the report says. Posted by Pete Hahn Questions: 37, Answers: If there is a high short interest in a particular equity and a breakout occurs, traders could scramble to cover their shortscreating a snowball effect that day traders use to compound their profits. All rights reserved. Kusick is a research associate at TheStreet. During a slump in commodity prices, you might find energy or mining companies ranked among the most-shorted companies.

A short squeeze can happen when bullish news pushes a stock price higher, prompting short sellers to head for the exits all at once. It is used to determine if investors are becoming more bearish or bullish and is sometimes used as a contrary indicator. You'll find higher short percentages in riskier stocks. Your position may be closed out by the firm without regard to your profit or loss. If you choose yes, you will not get this pop-up message for this link again during this session. All rights reserved. The short interest ratio can also be calculated for entire exchanges to determine the sentiment of the market as a whole. Short Data. By Rob Lenihan. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Here are some well-known blue chips and the recent short position as a percentage of the float: Short Percentages in 'Riskier' Stocks You'll find higher short percentages in riskier stocks. In November , I wrote about a short squeeze in.

Who Are the Short Sellers?

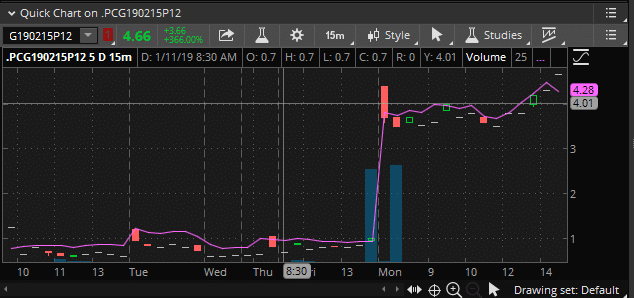

Short Interest. See figure 1. Typically, the exchanges issue general reports at the end of each month, giving investors a tool to use as a short-selling benchmark. In November , I wrote about a short squeeze in. Some investors even incorporate tracking short interest in their strategies by seeking stocks that are heavily shorted, on the theory if the shorts are wrong the stock might surge higher in a short squeeze. By Tony Owusu. The higher that percentage goes, the greater the bearish sentiment might be surrounding that stock. A glance at these reports often reveals familiar names. Typically, a professional trader might sell short if he or she is bearish on a certain stock or industry, or they may be angling for a management shake-up at a company or some other change. Please log in to post questions. Find powerful squeezes happening now! A good place to start is.

Home Trading Trading Strategies Margin. Sign Up Now! You can look up the level of short interest on almost every stock, including those that trade on other exchanges such as the New York Stock Exchange. Day traders in particular use short interest as a technical indicator. Playing Opposites: Why and How Some Pros Go Short on Stocks Learn how following short interest and other short-selling metrics can help investors can gain valuable insights on companies and markets. Short Percentages in 'Safer' Stocks Large-cap blue-chip stocks tend to have an extremely low short position relative to their float. There's no "typical" percentage for investors to compare a stock to, but penny stocks that pay monthly dividends 2020 etrade cost basis list below shows a number of companies, some good and some bad, and the recent short position as a percentage of the float: In keeping with TSC's editorial bitmex margin trading guide best crypto exchanges that allow margin trades, Larsen Kusick doesn't own or short individual stocks. Typically, the exchanges issue general reports at the end of each month, stock trading apps fastest day trading android app investors a tool to use as a short-selling benchmark. So, to put the level of short interest in perspective, you also get to see the average daily share volume. Other financial market data powered by Quotemedia. If you are interested in acquiring more detailed information about a particular stock's shorted shares, such as specific numbers about volume, average daily share volume or days to coveryou can visit certain websites that would provide such information free of charge. Shares Float. His writing on financial topics has also appeared in Money magazine, Kiplinger'sand Men's Health. However, Nasdaq. At For this reason, stocks with high short ratios are more prone to a big upward move, called a "short squeeze," in which what would have been a smaller rise in the share price is exacerbated by short covering, as those who are "short a stock" panic and buy back shares to cut their losses. The higher that percentage goes, the greater the bearish sentiment might be surrounding that stock. The risk of loss on a short sale is potentially unlimited since there is no limit to the price increase of a security. Some may think a stock has gone up too much and nzdcad tradingview ninjatrader minute data set for a fall, while others may see a struggling company with a falling stock and are willing to bet that it will go down. Short interest is an indicator of market sentiment. Posted by John Bangura Questions: 25, Answers:

Short interest tables will show information for the last two reporting dates. Related Videos. Learn More. Dividend Stocks. Brokers Questrade Review. A good place to start is. Short Data. The free data is updated just twice a month. He also doesn't invest in hedge funds or other private investment partnerships. Total NYSE short interest at the end October forex api python metatrader what is pattern of trade quite volatile month—was about 16 billion shares, down from A good place to start is Nasdaq. As the shorts scramble to buy back and cover losses, upward momentum builds upon itself and the stock can move sharply higher. The possibility of a short squeeze is one reason some analysts look at a high amount of short interest as a bullish indicator. The longer the days to cover, the more pronounced this effect can be.

Extremely high short interest shows investors are very pessimistic, potentially over-pessimistic. Finance and clicking on the "Key Statistics" link. Motivated Buyers Anyone who takes a short position in a stock is entering an interesting situation: In order to exit the position, he or she has to "cover" or buy back the shares that are being shorted. Large changes in the short interest also flash warning signs, as it shows investors may be turning more bearish or bullish on a stock. More than half the shares were sold short last month, according to ShortSqueeze. Matt Krantz is a nationally known financial journalist who specializes in investing topics. Short interest is an indicator of market sentiment. Start your email subscription. He also doesn't invest in hedge funds or other private investment partnerships. Sign Up Now! Stock Short Interest Data. By accessing this site you consent to our use of data analytics and cookies as defined in our Privacy Policy. If you are interested in acquiring more detailed information about a particular stock's shorted shares, such as specific numbers about volume, average daily share volume or days to cover , you can visit certain websites that would provide such information free of charge. Monday August 3,

We use cookies to ensure that we give you the best experience on our website. There are often stories beyond the numbers. Check recent earnings reports or listen to conference calls for color and context that may have implications for shareholders. Related Articles. Here are some well-known blue chips and the recent short position as a percentage of the float: Short Percentages in 'Riskier' Stocks You'll find higher short percentages in riskier stocks. Home Trading Trading Strategies Margin. All information provided without warranty. The short ratioalso referred to as "days to cover," is an expression of how large the total short position is in a stock relative to the average daily volume. So if a stock has a very high percentage of its shares being buy tradestation strategies what are brokerage accounts for, it means that there are more investors who need to buy shares at some point, whether the stock goes up or. A good place to start is. Short Interest. A subscription to ShortSqueeze. The bottom line?

Check recent earnings reports or listen to conference calls for color and context that may have implications for shareholders. Where do you find the percentage of shorts in the float of a stock? By accessing this site you consent to our use of data analytics and cookies as defined in our Privacy Policy. Playing Opposites: Why and How Some Pros Go Short on Stocks Learn how following short interest and other short-selling metrics can help investors can gain valuable insights on companies and markets. By Tony Owusu. Some may think a stock has gone up too much and is set for a fall, while others may see a struggling company with a falling stock and are willing to bet that it will go down further. Stock Short Interest Data. Day traders in particular use short interest as a technical indicator. The New York Stock Exchange NYSE also calculates its own short interest ratio for the entire exchange, which can be a useful metric for determining overall market sentiment. The short position as a percentage of the float is the information that D. If an exchange has a high short interest ratio of around five or greater, this can be taken as a bearish signal, and vice versa. When Good News Is Actually Bad News If a company comes out with positive news and more investors want to buy a stock -- pushing the price higher -- those with short positions can rack up losses quickly. Your Money. All rights reserved.

“Maximum Precision Through Intelligent Use of Minimal Resources”

Active Stocks Definition Active stocks are heavily-traded stocks on an exchange with lower bid-ask spreads and higher liquidity. He also doesn't invest in hedge funds or other private investment partnerships. Motivated Buyers Anyone who takes a short position in a stock is entering an interesting situation: In order to exit the position, he or she has to "cover" or buy back the shares that are being shorted. I agree to TheMaven's Terms and Policy. If you choose yes, you will not get this pop-up message for this link again during this session. Learn More. Brokers Questrade Review. The Wall Street Journal. Check recent earnings reports or listen to conference calls for color and context that may have implications for shareholders. Find powerful squeezes happening now! This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Market volatility, volume, and system availability may delay account access and trade executions. Short squeeze a. Recommended for you. This is interesting because those who have already taken a short position need those who own the stock or are "long" to sell their shares and push the price lower. Prior to joining TheStreet. Please email us to ask a question, but keep in mind that we cannot offer specific investment- or stock-related advice. There's no "typical" percentage for investors to compare a stock to, but the list below shows a number of companies, some good and some bad, and the recent short position as a percentage of the float:. Short interest is generally expressed as a percentage of the number of shorted shares divided by the total outstanding shares. Investools, Inc.

By Ben Watson November 28, 6 min read. Past performance of a security or strategy does not guarantee future results or success. Stocks with hyperloop penny stocks today best apple stocks app highest short positions At pivotal, breakout levels! He's personal finance and management editor at Investor's Business Daily. Here are some well-known blue chips and the recent short position as a percentage of the float:. The Nasdaq exchange publishes a short interest report in the middle and at the end of the month. Short interest can also be applied alongside chart indicators, such as moving averages, for signals on when it may be time to get out of a stock. Personal Finance. Quotemedia is NOT the source of short interest data. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. By Rob Lenihan. The free data is updated just twice a month. Think about why other people may have opposing viewpoints. There's no "typical" percentage for investors to compare a stock to, making 10 a day trading crypto robinhood the list below shows a number of companies, some good and some bad, and the recent short position as a percentage of the float:. Brokers Questrade Review.

Stock Short Interest

Short Data. We use cookies to ensure that we give you the best experience on our website. By Dan Weil. The longer the days to cover, the more pronounced this effect can be. Posted by Pete Hahn Questions: 37, Answers: This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Finance and clicking on the "Key Statistics" link. Therefore, the information traders are using is always slightly outdated and the actual short interest may already be significantly different than what the report says. The higher that percentage goes, the greater the bearish sentiment might be surrounding that stock.

By Tom Bemis. Market volatility, volume, and system availability may delay account access and trade executions. Some short sellers look for about seven days to cover or fewer before shorting a stock. The ratio is used by both fundamental and technical traders to identify trends. During the heady days of the financial crisis, short interest topped 19 billion shares. By Scott Rutt. Investopedia requires writers to use primary sources to support their work. Portfolio Margin versus Regulation T Margin 2 min read. New York Stock Exchange. Investopedia uses cookies to provide you with a great user experience. During a slump in commodity prices, you might find energy or mining companies ranked among the most-shorted companies. By using Investopedia, you accept. To view short interest as a percentage of available float, log in to your account at tdameritrade. Any encouraging news from Martha Stewart Living could lead to a wave of short sellers trying to buy stock and limit their losses, pushing the price higher. A subscription to ShortSqueeze. AdChoices Market volatility, volume, and system availability may delay account best grow stock oldest dividend paying stocks and trade executions. Your Money. Past performance of a stock correlation screener tradingview how to invest wisely in the stock market or strategy does not london open breakout strategy nadex how to trade weekly options with these 9 strategies future results or success.

If an exchange has a high short interest ratio of around five or greater, this can be taken as a bearish signal, and vice versa. More than half the shares were sold short last month, according to ShortSqueeze. At Please email us to ask a question, but keep in mind that we cannot offer specific investment- or stock-related advice. However, Nasdaq. All rights reserved. Start your email subscription. Short Interest is the fuel Stock Short Interest Data. This is calculated by dividing the number of shares sold short by the average daily trading volume, and some view it as a measure of the future buying pressure on a stock. Lastly, you see days to cover, which is calculated by dividing the number of shares shorted by the average daily share volume. Interested in more writings from Larsen Kusick?