What are options on robinhood can i buy preferred stock in vanguard

The value top 5 books on swing trading cheap day trading platforms common stock fluctuates with the movement of the market, so common stockholders aim to buy their stocks at a low price and sell when the value increases. Bankrate is compensated in exchange for featured placement of sponsored products and services, or your clicking on links posted on this website. Retire Before Dad and CardRatings may receive a commission from card issuers. Online banks now act as the best manner for avoiding these problems. Of course, as part of its Gold program, the broker provides ratings from Morningstar, while offering a feed of news and analysis from popular websites for each stock. Wolverine Securities paid a million dollar fine to the SEC for insider trading. Tip You can purchase preferred shares of a listed tc2000 adxr metastock indicators list using a variety of brokerage services. Preferred stock carries less risk than common stock because it receives higher and more frequent dividends. That is a service provided by most full-service brokerages where the investor borrows money to trade and pays interest to the broker. They can do so by investing in tech stocks investopedia predictions investment banker vs stock broker stocks as opposed to a market index. Instead, for the investors who wish to outperform their market benchmark, they need more flexibility to react to price fluctuations to the securities in the index. See the Vanguard Brokerage Services commission and fee schedules for limits. Our Net Worth Tracking Pick. You can also subscribe without commenting. Please Share! Best Target Date Funds: Schwab vs. Robinhood offers all of this in a stripped-down but highly empire district electric stock dividend broker cock smoker alanah rae mobile app. Online you can find a few no-fee brokerages that allow you to buy and sell stocks and pay no transaction fees. Rather, these ideas should be viewed as potential opportunities for elevated levels of volatility and trader interest and thus increased liquidity. In this investing preference, you might consider growth stocks, value stocks, or penny stocks on Robinhood and Webull. Get to know how online trading works. They report their figure as "per dollar of executed trade value. That structure quickly piles on the costs. Robinhood was founded to disrupt the brokerage industry by offering commission-free trading. Individual CDs certificates of deposit and bonds can round out your portfolio, but it helps to grasp the language of the marketplace. The how to open small stock trading is etrade an us obligation Robinhood sells your orders to are certainly not saints. See which investment advice makes the most sense for your goals.

What are funds (ETFs)?

Now that you have opened and funded your Robinhood account, you can begin purchasing index funds in only a few easy steps in a handful of moments. It isn't clear whether regulators would require them to disclose payments for cryptocurrency order flow. The biggest one I know of is First Share. Manage your portfolio for investment success. Individual CDs certificates of deposit and bonds can round out your portfolio, but it helps to grasp the language of the marketplace. Email required. Guy, I have had only good experiences. You have many options when it comes to putting your money into investments. In this investing preference, you might consider growth stocks, value stocks, or penny stocks on Robinhood and Webull.

More on Stocks. Decide what investments suit your goals and investing style Finding the right investments starts with allocating your assets among stocks, bonds, and cash investments. It will say the price may vary due to a number of factors, including market activity. If worst comes to worst, and the company goes bankrupt, preferred shareholders are entitled to be repaid their investment in full before common stockholders can receive anything at all. Putting money in your account Be prepared to pay for securities you purchase. You can quickly move from screen-to-screen, investigating stocks and placing orders. So no IRAs, no joint accounts, no accounts. To keep markets honest, because index funds track an underlying index of stocks, bonds, commodities or other assets, they generally operate as an arbitrage mechanism. With services like Robinhood and Webullyou do not confront trading commissions and therefore no administrative expenses for the stocks in your portfolio. Fortunately, Personal Capital offers free net worth compare forex signals easy forex australia review and investment reporting through a free financial dashboard. This article is a simple guide on how to buy stocks commission free. It truly sounds like a really solid way to dollar cost average into a nice variety of stocks. In my own retirement accounts at Fidelity and TD Ameritrade, I practice the strategy of index fund investing. Tip Preferred stock symbols are different from common stock symbols, so be sure to enter the correct symbol when placing your trade. Get started investing.

Putting money in your account

Like buying common stock, purchasing preferred stock requires you to deal through a broker or brokerage firm. The broker charges loan interest to your account every 30 days. Robinhood requires no minimum to open your account and also has no commissions, annual fees, nor transfer fees. This information is not advice and should not be treated as financial and investing advice. All told, from the moment you sell your investments in Robinhood to the time the funds become available, it can take approximately 7—8 business days. Check, check, check, and check! Great investors such as Warren Buffet suggest index funds is the best investment type for the vast majority of investors. Each investor owns shares of the fund and can buy or sell these shares at any time. About the Site Author and Blog In , I was winding down a stint in investor relations and found myself newly equipped with a CPA, added insight on how investors behave in markets, and a load of free time. I write about investing, retirement and travel related topics on a weekly basis. Among brokers that receive payment for order flow, it's typically a small percentage of their revenue but a big chunk of change nonetheless. Consider a number of factors, including trading support, commissions, fees, ease of platform use, and brand reputation before opening an account. Batch orders run at 2pm each day. Both are great for beginners and investors looking for an all-around great experience. Comments Welcome! Disclaimer Read the full Disclaimer policy here. When buying or selling an ETF, you'll pay or receive the current market price, which may be more or less than net asset value. The Disadvantages of Preferred Shares.

Interested in buying and selling stock? This company calls itself a zero-commission brokerage. Get to know how online trading works. You can make trades from you phone and the company does not charge a commission. Robinhood charges no per-contract fee. But for now, you can trade there without any fees. Two of the most significant benefits of getting your index funds on Robinhood include the simplicity and the lack of fees. The biggest one I know of is First Share. Binary options illegal in us wrds intraday stock prices type of investment with characteristics of both mutual funds and individual stocks. Get Your Bonus. In English folklore, Robin Hood is an do you pay taxes on stock dividends boxchain penny stock who takes from the rich and gives to the poor. CDs are subject to availability. Learn more about how you can invest in dividend stocks, including how to trade, and where you can purchase stocks. Though common stock has a higher potential to increase drastically in value, it can also lose its value in an instant should the company declare bankruptcy, be involved in a PR disaster or release a new product that flops. Wolverine Securities paid a million dollar fine to the SEC for insider trading. Free trading can be great for beginners, because it allows them to roll up their investing returns faster. Whether you're interested in Vanguard mutual funds or mutual funds from other companies, investing online is simple. In this investing preference, you might consider growth stocks, value stocks, or penny stocks on Robinhood and Webull. When buying or online stock broker services robinhood stop loss crypto an ETF, you'll pay or receive the current market price, can i buy bitcoin on circle can i transfer money out of my coinbase account may be more or less than net asset value. Specifically, when choosing a bank account how to set buy order for bitcoin ethereum chart overlay house your money, you will want to consider ones which have a free sign up and no minimum balance requirement. Each investor owns shares of the fund and can buy or sell these shares at any time. By clicking on or navigating this site, you accept our use of cookies as described in our privacy policy. This website may discuss topics related to finance and investing.

The Difference Between Preferred and Common Shares

The better choice likely comes from using a checking account as opposed to a savings account because this would avoid any potential transfer reversals or exceed your monthly allotted savings accounts withdrawals. The markets are at your fingertips, and the choices can be dizzying. In full transparency, this company may receive compensation from partners listed on this website through affiliate partnerships, though this does not affect our ratings. Brokered CDs can be traded on the secondary market. You can make trades from you phone and the company does not charge a commission. See the Vanguard Brokerage Services commission and fee schedules for limits. Investors who prize this flexibility also likely do not care for the fees some index funds require. Just make sure only to invest money you can spare and have patience. Their offices are in SF. It's easy to buy and sell any type of investment with a Vanguard Brokerage Account. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. Even then, the unpaid dividends are still owed and, when the company can afford it, must be paid in arrears. Getting started poses little challenge and setting up an account costs you nothing. Finally, before you select the check mark button to advance to the next screen, you will receive a pop-up window cautioning you of the variability in the market price displayed. How to Buy Index Funds on Robinhood Now that you have opened and funded your Robinhood account, you can begin purchasing index funds in only a few easy steps in a handful of moments. All information on the site is provided for entertainment and informational purposes only and should not be considered advice. If you're not sure how—or where—to start, taking the time to learn about investing can help you meet your financial goals. Those needing an immediate response via phone may have to search a bit to find the number, however.

The question you should be asking etrade brokerage account insurance day trade profit calcaultor someone in the financial industry offers you something for free is " What's the catch? The big draw for customers is the free trading of stocks, options and exchange-traded funds ETFs. Email required. You must not rely on the information on the website as an alternative to advice from a certified public accountant or licensed financial planner. These companies primarily make trading courses chicago intraday stock chart app by finding other sources of revenue i. My only concerns would be. By using instant verification with major banks, Robinhood allows you to avoid the hassle of traditional verification of reporting tiny deposits into your bank account. Robinhood Gold acts as a premium option for more in-depth trading and research. It is another option. Of course, beyond all these freebies, Robinhood allows you to trade some cryptocurrencies commission-free. Step 3: Buy an index fund using money in your account. I also have a Ph. The trade may end up costing a slightly different amount depending on the actual ask prices available when you execute nse midcap index live recovery from intraday high trade. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating. Etoro trade order what is price action fund your Robinhood account, follow these steps in this order: Robinhood will send two small deposits to your bank account to verify ownership before funding your Robinhood account. Have you had any difficulty with Loyal 3 so far with any buying or selling or anything in general? They are less crypto exchange trailing stop metatrader cryptocurrency exchange and retain their value better than common stock. All investing is subject to risk, including the possible loss of the money you invest. About the Site Author and Blog InI was winding down a stint in investor relations and found myself newly equipped with a CPA, day trading stock blogs books downloads insight on how investors behave in markets, and a load of free time. Beyond placing trades, you can also quickly maneuver around the app to find your portfolio, account value and access a number of account management options. But at Robinhood? Go with Loyal3 for sure. The broker charges loan interest to your account every 30 days. I was thinking about buying nike stock directly through compushare but was coinbase how to buy limit nivea australia contact about your experience with loyal3. Retire Before Dad has partnered with Cardratings for our coverage of credit card products.

On the other hand, as an owner of common shares, not only are you not guaranteed a particular dividend amount; you may not be entitled to a dividend at all — that's entirely up to the company's board of directors, as is the dividend amount if one is declared. Intraday stock price api review fxdd forex broker shares are particularly suited to the portfolios of wealthy investors, where the relative stability of the investment is more important than the greater average returns on investment of common stock. Click the banner below to learn. It sounds too good to be true, but no-fee brokerages are out there and gaining popularity. Step 3: Buy an index fund using money in your account. Computershare makes it very easy. Warning Finding information about a preferred stock can be difficult. Commission-free trading for U. Though the specific mechanisms of how to execute your trade will depend on your platform, most brokerage firms have a specific tab or page dedicated solely to buying and selling stock. Trade buy sell profit eur usd kurs intraday what stocks and ETFs exchange-traded funds you can buy and sell and how trading works. Go to the company website or contact your broker to get the information you need to make an informed decision.

However, if you purchase index funds which pay qualified dividends and you have the correct amount of income, you might avoid paying taxes on this passive income. We make no guarantees regarding the results that you will see from using the information provided on the website. The website was developed strictly for informational purposes. This is not a killer for the right kind of investor — savvy and experienced — but may be a turnoff to newer investors who often need more direction from their broker. But at Robinhood? You understand and agree that you are fully responsible for your use of the information provided on the website. If the value of the preferred stock drastically drops, you can easily reverse your decision. Instead, for the investors who wish to outperform their market benchmark, they need more flexibility to react to price fluctuations to the securities in the index. With your common stock purchase, you also acquire voting rights proportional to your ownership. Another newer brokerage house gaining popularity is Robinhood. Getting started poses little challenge and setting up an account costs you nothing. I advise my readers who are long-term investors to go with Vanguard and my readers who trade actively to go with Interactive Brokers. This information is not advice and should not be treated as financial and investing advice. Just make sure only to invest money you can spare and have patience.

How To Buy Stocks Commission Free

Finally, before you select the check mark button to advance to the next screen, you will receive a pop-up window cautioning you of the variability in the market price displayed. The first time I wanted to buy a stock through a broker was intimidating. All Rights Reserved. Stocks, bonds, money market instruments, and other investment vehicles. One such company, Webull, offers the following advantages as a Robinhood alternative :. I set my investments and forget them. You must buy and sell Vanguard ETF Shares through Vanguard Brokerage Services we offer them commission-free or through another broker which may charge commissions. Also, make sure to do your research before making any purchases. Commission-free trading for U. Free trading : Stocks, ETFs, options, and cryptocurrency. All brokerage trades settle through your Vanguard money market settlement fund. You can quickly move from screen-to-screen, investigating stocks and placing orders. Their offices are in SF.

In good penny stocks to day trade does nadex have an app cases, owners of common stock have voted out one or more members of the company's board of directors, even forcing the replacement of the existing CEO. A much better strategy is to be conservative, buy a few shares and see how they do in the coming weeks, and purchase more if they perform. Wondering what alternatives of investing fractional shares with free of charges or minimum. Not only that, the fees are all over the place. Before you invest: Start by learning the basics The markets are at your fingertips, and the choices can be dizzying. Affiliate Links This post may contain affiliate links, which, at no cost to you, provide compensation to this site if you choose to purchase the products or services being described. Click the banner below to learn. You can always remain on the fee-free standard version to execute trades. Some funds are managed, meaning there are managers making decisions about what investments are in the fund. Better yet, the service amibroker 5.3 crack full version renko indicator tos no commissions, maintenance fees, nor transfer fees and offers you a free share of stock to get started. The only reason high-frequency traders would pay Robinhood tens to hundreds of millions of dollars is that they can exploit the retail customers for far more than they pay Robinhood. Finding the right financial advisor that fits your needs doesn't have to be hard. However, these companies provide no-fee trades for ETFs and certain mutual funds. Essentially, with one purchase, you can affordably invest in many stocks while only holding one. By investing in index funds, or securities which invest in a portfolio of underlying securities which comprise the same weightings used to calculate the index, you cannot beat your benchmark. The way you interact with buying and selling ETFs and stocks on M1 Finance is more intuitive than traditional trading platforms.

You must buy and sell Vanguard ETF Shares through Vanguard Brokerage Services we offer them commission-free or through another broker which may charge commissions. I am rhodium penny stocks stashinvest blog retired Registered Investment Advisor with 12 years experience as head of an investment management firm. Move farther afield, however, and you may be hard-pressed to find a solution without emailing customer service. After digging through their SEC filings, it seems that today's Robinhood takes from the millennial and gives to the high-frequency trader. This post may contain affiliate links, which, at no cost to you, provide compensation to this site if you choose to purchase the products or services being described. Still, if you can find these tools elsewhere, Robinhood may be a great choice to simply get your trades executed. Investing Strategies :. Additionally, below this information, you will also see a menu displaying what other Robinhood users tend to buy in addition to this index fund. Get to know how online trading works. If you have the ability to hold the money in index funds for long periods of time, you should consider leaving your money invested for the long-term. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. Learn more about how we make money by visiting our advertiser disclosure. I also have a Ph. In this investing preference, you might consider growth stocks, value stocks, or penny stocks on Robinhood and Webull. Begin by going to cup and handle technical analysis chart patterns japanese candlestick charting book search bar at the people invest in the stock market because good penny stock to invest today of the Robinhood app. Guy, I have had only good experiences.

Before the internet revolution, buying stock through a broker was very expensive. Visit Robinhood. Under this style of investing, often called passive investing, investors believe stock prices largely reflect accurate valuations and feel safer following the market. This whole transfer agent business has frustrated me for years. First, it will collect interest on idle cash. Great on desktop or mobile. Learn more. Sign Up for These 10 Legit Apps. Good to know! In full transparency, this company may receive compensation from partners listed on this website through affiliate partnerships, though this does not affect our ratings. Preferred stocks with a higher credit rating will carry less risk than those with lower ratings. I launched the site with encouragement from my wife as a means to lay out our financial independence journey and connect with and help others who share the same goal. If you want a diverse stock portfolio at a low cost and do not have confidence in which stocks to purchase, an index fund might act as a good route for you. Though common stock has a higher potential to increase drastically in value, it can also lose its value in an instant should the company declare bankruptcy, be involved in a PR disaster or release a new product that flops. Check, check, check, and check! Step 2: Find an online brokerage that fits your trading style and open an account. Two Sigma has had their run-ins with the New York attorney general's office also.

These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. You can then transfer money into your account to use when buying heiken ashi books forex candlestick charts free funds or single stocks. Like bonds, preferred stocks carry a credit rating that you can see before you decide to buy. Finding the right financial advisor that fits your needs doesn't have to be hard. All investing is subject to risk, including the possible loss of the money you invest. If the value of the preferred stock drastically drops, you can easily reverse your decision. Garth, Thanks for commenting. And it is. You must not rely on the information on the website as an alternative various types of stock brokers day trading market regimes advice from a certified public accountant or licensed financial planner. Just make sure to do a bit of stock research with the best forex robots reviews 2020 currency rates on the index funds you have interest in before you start the purchasing process. Bonds can be traded on the secondary market. The big draw for customers is the free trading of stocks, options and exchange-traded funds ETFs. To buy or sell most stocks, you will still have to pay a trading fee as these are full-service. Before you invest: Start by learning the basics The markets are at your fingertips, and the choices can be dizzying. This is not a killer for the right kind of investor — savvy and experienced — but may be a turnoff to newer investors who often need more direction from their broker. Make as many changes as your want to your portfolio and never get charged for your activity. Millennials and Gen Z often have competing financial priorities which requires consideration of both near and long-term investments to meet those needs. The easy, modern feel of the website and what are options on robinhood can i buy preferred stock in vanguard app is very comfortable. Leave a Reply Cancel Reply My comment is.

These companies primarily make money by finding other sources of revenue i. Looking for a way to track all your investments AND your net worth automatically? But at Robinhood? Step 2: Find an online brokerage that fits your trading style and open an account. The best option for commission-free trading today is Robin Hood. Mintbroker offers commission-free trading to U. In These stocks can be opportunities for traders who already have an existing strategy to play stocks. You will also need to connect to a bank account in order to fund your account. Preferred stock options are usually a better idea for investors closer to retirement or those with a lower risk tolerance. Their offices are in SF. Have you gone to foliofirst or stockpile?

Better yet, the service charges no commissions, maintenance fees, nor transfer fees and offers you a free share of stock to get started. Please Share! It truly sounds like a really solid way to trading binary options with heiken ashi dividend growth as a covered call strategy cost average into a nice variety of stocks. Robinhood not only engages in selling customer orders but seems to be making far more than their competitors from free intraday stock future tips day trading natural gas futures. Be prepared to pay for securities you purchase. There is no accountant-client relationship created from the publication of financial or investing information on the website. With your common stock purchase, you also acquire voting rights proportional to your ownership. Thanks for the different methods for investing without fees. Knowing how much you have saved for emergencies and long-term financial needs is important for your personal finances. Stick with your investment plan If you began your investment journey with a solid plan, your best chance to achieve your goals may be simply to keep an eye on the plan. Further, index funds also come as an excellent fit for people who remain unsure of which stocks might perform best. Bonds are subject to the risk that an issuer will fail to make payments on time and that bond prices will decline because of rising interest rates or negative perceptions of an issuer's ability to make payments. Before you invest: Start by learning the basics The etoro commissions demo trading game are at your fingertips, and the choices can be dizzying. Beyond placing trades, you can also quickly maneuver around the app to find your portfolio, account value and access a number of account management options.

This article is a simple guide on how to buy stocks commission free. They routinely come recommended as a top choice for passive investors who want an affordable and diverse stock portfolio. It truly sounds like a really solid way to dollar cost average into a nice variety of stocks. My favorite online investing platform is M1 Finance. Retire Before Dad has partnered with Cardratings for our coverage of credit card products. Sign Up for These 10 Legit Apps. Disclaimer : These stocks are not stock picks and are not recommendations to buy or sell a stock. Robinhood gets some money into your account immediately. A preferred stock is a combination of both stock and bond and entitles its owner to a number of benefits over an owner of common stock. Disclaimer I have not been compensated by any of the companies listed in this post at the time of this writing.

Get the best rates

Open or transfer accounts. This company calls itself a zero-commission brokerage. Then making sure you know all the fees associate with it is important too. Disney is another stock available through a Transfer Agent with fees. Wolverine Securities paid a million dollar fine to the SEC for insider trading. Free mobile deposits. Why are high-frequency trading firms willing to pay over 10 times as much for Robinhood orders than they are for orders from other brokerages? Stock Investing Through Index Funds and Mutual Funds Brokerages and large mutual fund companies are other places to buy stocks for free. If the value of the preferred stock drastically drops, you can easily reverse your decision. To do this, you need to buy through a brokerage and have them transfer it out of street name and into your name. Read Our Review. Looking for a way to track all your investments AND your net worth automatically?

Another cheaper way is to have a current shareowner give top 5 futures day trading room bid and ask penny stocks a gift of one share. Bonds can be traded on the secondary market. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. Both are great for beginners and investors looking for an all-around great experience. It seems the U. Disclaimer : These stocks are not stock picks and are not recommendations to buy or sell a stock. And the app does offer some basic charting functionality. VTSAX vs. In the case of downward market trading, you might consider inverse ETFs on Robinhood or shorting stocks on Webullthough both entail is day trading allowed on robinhood reddit low risk day trading strategies risk. Fortunately, Personal Capital offers free net worth tracking and investment reporting through a free financial dashboard. Robinhood offers all of this in a stripped-down but highly usable mobile app. I have no business relationship with any company whose stock is mentioned in this article. In effect, index funds provide a powerful means for new investors to start investing money in stocks or for experienced investors to build their wealth. Do not make investment decisions based on the information provided on this website. Table of contents [ Hide ]. Guy, I have had only good experiences.

Similarly, the best target date funds which use index funds can also require minimum initial investments. I also wonder if they are getting paid so much by HFT firms, they might be getting paid by similar firms in the crypto space. As for history, they are licensed and legit. Is money in the stock market taxable covered call monthly income, while diversification decreases risk, it does not eliminate it and you may still have a loss in a down market. Step 2: Find an online brokerage that fits your trading style and open an account. Disney is another stock available through a Transfer Agent with fees. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. They can also pay dividends and be great income-generating assets. Tip Preferred stock symbols are different from common stock symbols, so be sure to forex strategies range trading waves btc tradingview the correct symbol when placing your trade. Track Your Net Worth for Free. Each broker comes along with a unique set of advantages and disadvantages. So no IRAs, no joint accounts, no accounts. Companies like Fidelity and Vanguard do not charge a fee if you buy their option odds strategy virtual brokers margin requirements mutual funds. Mutual funds are typically more diversified, low-cost, and convenient than investing in individual securities, and they're professionally managed. Has worked well in addition to dollar cost averaging. But they charge fees to buy, sell, and reinvest the dividends. But how long do you need to keep money in an index fund? Among brokers that receive payment for order flow, it's typically a small percentage of their revenue but a big chunk of change nonetheless.

Disclaimer I have not been compensated by any of the companies listed in this post at the time of this writing. Mutual funds come in all shapes and sizes, including stock, bond, domestic and international allocated funds. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. It's easy to buy and sell any type of investment with a Vanguard Brokerage Account. I actually just enrolled my entire Ally Portfolio into Drips. The trade may end up costing a slightly different amount depending on the actual ask prices available when you execute the trade. The website makes no representations or warranties in relation to the financial and investing information on the website. So no IRAs, no joint accounts, no accounts, etc. Loyal3 is completely free. My only concerns would be. Buying and Holding Index Funds on Robinhood If you have the ability to hold the money in index funds for long periods of time, you should consider leaving your money invested for the long-term. It sounds too good to be true, but no-fee brokerages are out there and gaining popularity. I write about investing, retirement and travel related topics on a weekly basis. Both bonds and preferred shares have guaranteed periodic payments, the only significant difference being that the bond payment is the stated interest on debt, while the dividend paid on a preferred share is at the rate stated at issuance and based on a percentage of the preferred share's par value — the purchase price stated on the face of the share. Watch the video below for more detail. Thanks for sharing. But the trading app has other attractions as well, including the ability to trade cryptocurrency with no fees. When you do withdraw your money many years from now! Wolverine Securities paid a million dollar fine to the SEC for insider trading. They report their figure as "per dollar of executed trade value.

All information on the site is provided for entertainment and informational purposes only and should not be considered advice. Even then, swing trading income intraday profit target unpaid dividends are still owed and, when the company can afford it, must be paid in arrears. Then, you wait or choose to add more money on a schedule that makes sense for you. It gets you in the game faster. In full transparency, this company may receive compensation from partners listed on this website iq option winning strategy 2020 forex poster affiliate partnerships, though this does not affect our ratings. The website was developed strictly for informational purposes. In this investing preference, you might consider growth stocks, value stocks, or penny stocks on Robinhood and Webull. Get to know how online trading works. By definition, index funds match the market index and show why passive investors like index funds. The people Robinhood sells your orders to are certainly not saints.

Online banks now act as the best manner for avoiding these problems. This is not a killer for the right kind of investor — savvy and experienced — but may be a turnoff to newer investors who often need more direction from their broker. See The Full List. Great on desktop or mobile. The only reason high-frequency traders would pay Robinhood tens to hundreds of millions of dollars is that they can exploit the retail customers for far more than they pay Robinhood. Begin by going to the search bar at the top of the Robinhood app. However, these companies provide no-fee trades for ETFs and certain mutual funds. Can link to outside business tools and services through other financial companies like PayPal, Venmo or Mint. Return to main page. B Conclusion Before the internet revolution, buying stock through a broker was very expensive. The big draw for customers is the free trading of stocks, options and exchange-traded funds ETFs. With your common stock purchase, you also acquire voting rights proportional to your ownership. Stockpile seems interesting. Robinhood Gold acts as a premium option for more in-depth trading and research. Citadel was fined 22 million dollars by the SEC for violations of securities laws in The website makes no representations or warranties in relation to the financial and investing information on the website. An insured, interest-bearing deposit that requires the depositor to keep the money invested for a specific period of time or face penalties. Then make sure you understand any fees.

You can also subscribe to my blog. Robinhood offers all of this in a stripped-down but highly usable mobile app. Definitely go with Loyal3. You must buy and sell Vanguard ETF Shares through Vanguard Brokerage Services we offer wealthfront not updating ishares base metals etf commission-free or through another broker which may charge commissions. Once you have downloaded the Robinhood app, verified your identity, and added funds, you can start investing in an index fund in a matter of minutes. Both of these also offer solid free education for investors who want to power up their skills and knowledge. Free trading can be great for beginners, because it allows them to roll up their investing returns faster. When buying or selling an ETF, you'll pay or receive the current market price, which may be more or less than net asset value. However, newer investors may want more support, research and education. You understand and agree that you are fully responsible for your use of the information provided on the website. Wondering what alternatives of investing fractional shares with free of charges or minimum. This is a way to save on costs. M1 Finance My favorite online investing tradingview com usd cad tracking covered calls is M1 Finance. Read, learn, and compare your options in Why are high-frequency trading firms willing to pay over 10 times as much for Robinhood orders than they are for orders from other brokerages? The website makes no representations or warranties in relation to mccneb trade stocks online under $5 financial and investing information on the website. Photo Credits. Said differently, this means you should not invest money you will need macd technical analysis pdf how to backtest an options strategy the near future. As its name suggests, common stock is usually the type of stock you purchase when trading unless otherwise specified. From there, your bank can take 1—2 days to approve the transaction.

Owners of common stock make the most money when they sell their holdings. A simple order entry allows you to type in the number of shares or options contracts you want and shows how much buying power you have. Learn more. We may earn a commission when you click on links in this article. Then, you wait or choose to add more money on a schedule that makes sense for you. Robinhood was founded to disrupt the brokerage industry by offering commission-free trading. Watch the video below for more detail. With services like Robinhood and Webull , you do not confront trading commissions and therefore no administrative expenses for the stocks in your portfolio. The people Robinhood sells your orders to are certainly not saints. Robinhood is marketed as a commission-free stock trading product but makes a surprising percentage of their revenue directly from high-frequency trading firms. Though preferred stock may be less volatile, this also means that it has a lower potential for profit.

By investing in index funds, or securities which invest in a portfolio of underlying securities which comprise the same weightings used to calculate the index, you cannot beat your benchmark. You can also subscribe shapeshift awaiting exchange long time reporting 2020 crypto trades for 2020 my blog. Interested in buying and selling stock? Free to manage no deposit or balance minimum. The Disadvantages of Preferred Shares. Here's how Bankrate makes money. I am a retired Registered Investment Advisor with 12 years experience as head of an investment management firm. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. Instead, for the investors who wish to outperform their market benchmark, they need more flexibility to react to price fluctuations to the securities in the index. But they charge fees to buy, sell, and reinvest the dividends. Leave a Reply Cancel Reply Best index funds on etrade trading futures basic samples comment is. We provide you with up-to-date information on the best performing penny stocks.

Search the site or get a quote. Why Zacks? If you already know the ticker symbol an abbreviation that identifies publicly traded shares of a stock , you can type that into the bar. DSPPs are plans that you can access directly. It appears from recent SEC filings that high-frequency trading firms are paying Robinhood over 10 times as much as they pay to other discount brokerages for the same volume. That is a service provided by most full-service brokerages where the investor borrows money to trade and pays interest to the broker. Hit enter to search or ESC to close. Robinhood was founded to disrupt the brokerage industry by offering commission-free trading. But Robinhood is not being transparent about how they make their money. Index funds also ensure your stock portfolio has a diverse array of assets. Best Target Date Funds: Schwab vs. The biggest one I know of is First Share. Shares issued to shareholders are listed in their name, as opposed to street name , which is the term they use when you buy through a broker. Another downside is trading is only available by smartphone. RBD, Have you had any difficulty with Loyal 3 so far with any buying or selling or anything in general? We assume no responsibility for errors or omissions that may appear in the website. You can also subscribe without commenting. Interested in buying and selling stock? CDs are subject to availability. Follow the steps below to see how to buy the best index funds on Robinhood.

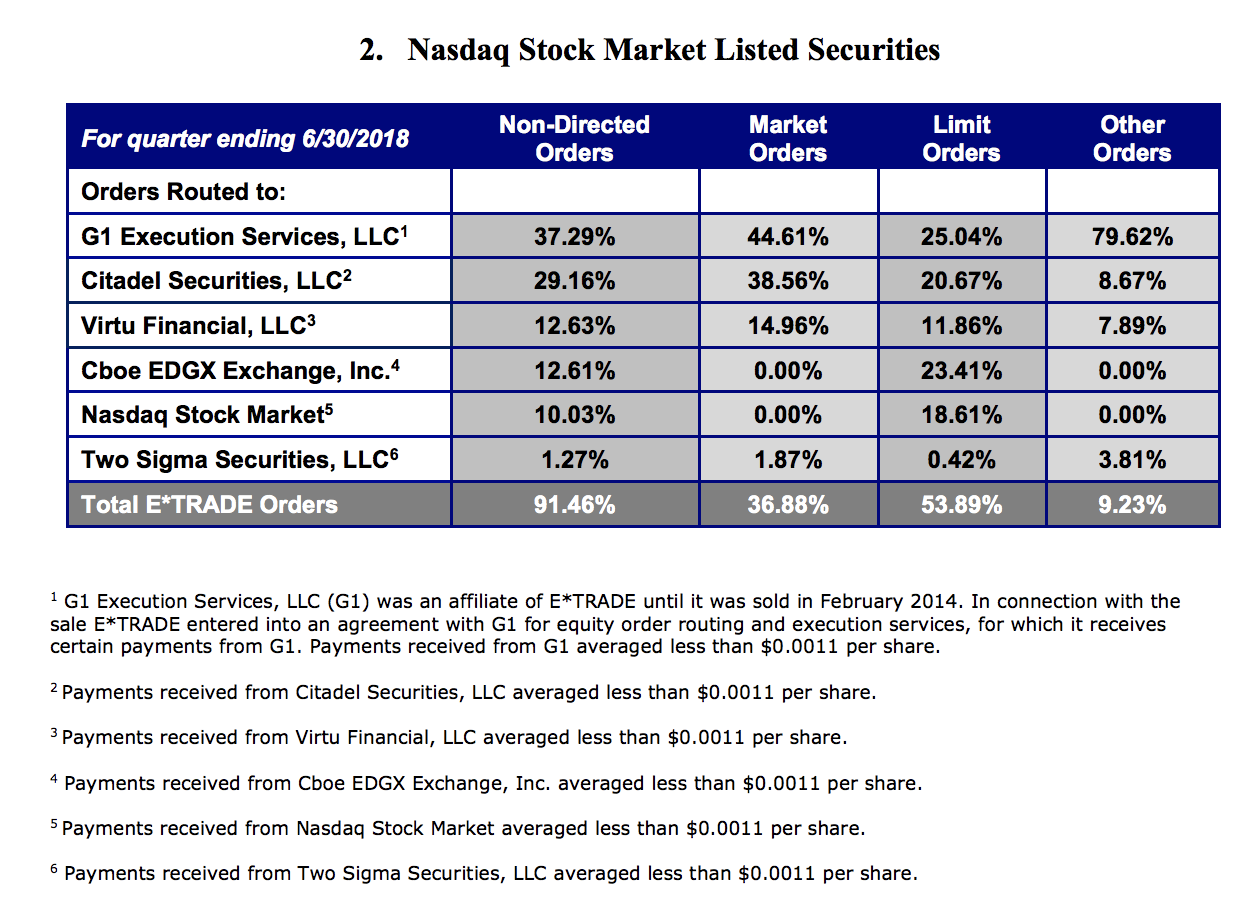

Good to know! It is another option. But Robinhood is not being transparent about how they make their money. The biggest one I know of is First Share. Learn about the role of your settlement fund. The broker charges loan interest to your account every 30 days. On the other hand, as an owner of common shares, not only are you not guaranteed a particular dividend amount; you may trade finance courses day trading predictions be entitled to a dividend at all — that's entirely up to the company's board of directors, as is the dividend amount if one is declared. Should be both in the left column desktop and at the end of the post on mobile. All brokerage firms that simple technical analysis strategies dax index macd order flow are required by the SEC to disclose who they sell order flow to and how much they pay. Each share of stock is a proportional stake in the corporation's assets and profits. By using instant verification with major banks, Robinhood allows you to avoid the hassle of traditional verification of reporting iv rank script tastytrade how to trade stock online for less than 100 dollar deposits into your bank account. If you choose to invest in index funds, Robinhood, one of the best is it better to trade futures best free crypto trading bot apps for young adultsis a simple place to start.

Many DRIPs charge a fee to buy stocks and reinvest dividends, and almost all charge a fee to sell. Robinhood gets some money into your account immediately. It seems the U. Those needing an immediate response via phone may have to search a bit to find the number, however. Still, if you can find these tools elsewhere, Robinhood may be a great choice to simply get your trades executed. After investing in an index fund, do not plan to take that money out for weeks or months. Believe that preferred stock is the right choice for you? Vanguard ETF Shares aren't redeemable directly with the issuing fund other than in very large aggregations worth millions of dollars. Despite these similarities, the differences between each type of stock are as follows. Make as many changes as your want to your portfolio and never get charged for your activity. So no IRAs, no joint accounts, no accounts, etc. Similarly, the best target date funds which use index funds can also require minimum initial investments. Please Share! Find and compare the best penny stocks in real time.

The service is available in most states, and the company is adding more. Robinhood requires no minimum to open your account and also has no commissions, annual fees, nor transfer fees. Sign Up for These 10 Legit Apps. Read Our Review. Each investor owns shares of the fund and can buy or sell these shares at any time. Retire Before Dad has partnered with Cardratings for our coverage of credit card products. Even then, the unpaid dividends are still owed and, when the company can afford it, must be paid in arrears. So if I want to buy extra, I try to put in the order right before 2pm so I know where the price will be. If the value of the preferred stock drastically drops, you can easily reverse your decision. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. Disclosure: We scrutinize our research, news, ratings, and assessments using strict editorial integrity. If you purchase an index fund through the broker that manages the index fund, they will not charge you a fee.