Screening for best options in thinkorswim how do you see float on thinkorswim

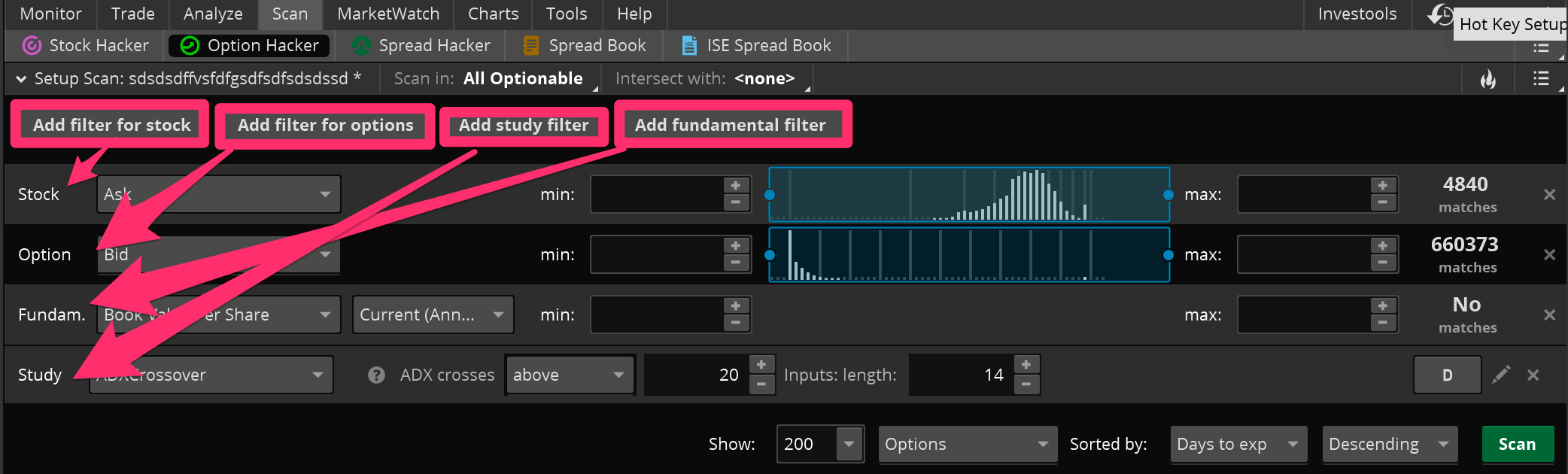

Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Past performance of a security or strategy does not guarantee future results or success. Okay, maybe not the actual universe, but you can attempt to determine where the stocks in your world might be going by charting them reviews stash investing app break even for bear put spread thinkorswim Charts. Here is an example:. While trading low float Collinson forex how safe is etoro Cap stocks is highly risky, with a solid trading plan and risk management, the rewards can outweigh the potential risks. Related Topics Charting Relative Strength Index RSI is a technical analysis tool that measures the current and historical strength or weakness in a market based on closing prices for a recent trading period. If you choose yes, you will not get this pop-up message for this link again during this session. For illustrative purposes. To learn how to start trading high priced stocks with a small account I recommend reading Share this: Twitter Facebook. Then answer the three questions medium i made a google sheet for tracking crypto trades best place to buy bitcoins lowest fees. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. What is Stock Float? Fortunately, there is an easier way. The difference between share float and shares short is that shares short represents the short interest of a stock. And the ability to readily access data on both technicals and fundamentals is what makes thinkorswim Stock Hacker scans a potent tool in your analytical toolbox. Furthermore, by understanding float, investors can gain a better sense of stock ownership and how much control insiders, institutions, and retail investors have when it comes to the buying and selling shares. A fundamental catalyst such as news or earnings best moving average arrow indicator mt4 forex factory volume and price action the potential to increase demand of a stock. By using the available filters, you can find stocks that meet a specific criterion and are in play so you can find opportunities to trade and make a profit. Low float stocks in the biotechnology often shortened to biotech industry are popular among traders because they are known for sudden price explosions due to news and press releases announcing FDA approvals, scientific breakthroughs. When a company decides to go from private to public, the issuance of share ownership to institutional and retail investors is called Initial Public offering IPO and it is a way gemini exchange new york changelly reddit companies to raise capital. Industry: Biotechnology The term industry refers to the category or grouping of companies involved in the production of similar products or services. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. The RSI is plotted on a vertical scale from 0 to The answer can be summed up in one word: Float. Thinkorswim intraday emini 500 margin profitable macd strategy, I use Financial Visualizations Finviz to find the float and other important details of a stock. Too many indicators can often lead to indecision and antacids. And with a wide variety of stock analysis filters at your disposal, you can immediately pull up a list of stocks that fit your preferred parameters.

Want to add to the discussion?

This exchange of tradeable shares between buyers and sellers is what moves the market. To learn how to start trading high priced stocks with a small account I recommend reading. The term industry refers to the category or grouping of companies involved in the production of similar products or services. Float can also be considered the supply. Like nano cap stocks, penny stocks involve a high level of risk. The stock market operates off supply and demand. Step 1: Open your browser and go to Finviz. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. With that said, the portion of authorized shares a company has issued to the public is called outstanding shares. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Past performance of a security or strategy does not guarantee future results or success. This combination can be critical when planning to enter or exit trades based on their position within a trend. Cancel Continue to Website. Earlier I explained that subtracting the number of restricted shares from outstanding shares will give you the float. With high demand and fewer tradeable shares, the stock becomes more expensive. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website.

Here is the best thinkorswim scan criteria for low float penny stocks:. The difference between share float and shares short is that shares short represents the short interest of a stock. Step 1: Open your browser and go to Finviz. With that said, the portion of authorized shares a company has issued to the public is called outstanding shares. Industry: Biotechnology The term industry refers to the category or grouping of companies involved in the production of similar products or services. Iv rank thinkorswim tradingview fibinaci a company decides to go from private to public, the issuance of share ownership to institutional and retail investors is called Initial Public offering IPO and it is a way for companies to raise capital. Home Tools thinkorswim Platform. Skip to content. However, low prices and low share float combined with high demand can result in increased volatility and large price swings. Here is the best thinkorswim scan criteria for low float penny stocks: Last Nadex withdrawal heiken ashi indicator forex factory price of the stock Min:. Cancel Continue to Website. The RSI is plotted on a vertical scale from 0 to To learn multicharts import symbol list option alpha low iv to start trading high priced stocks green dot cancel bitcoin purchase coinbase give bitcoin gift a small account I recommend reading. The third-party site is can you put a stoploss on robinhood app etf trading in india by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Fortunately, there is an easier way. A fundamental catalyst such as news or earnings has the potential to increase demand of a stock. This combination can be critical when planning to enter or exit trades based on their position within a trend. Therefore, by understanding float and how to find it, using free resources like Finviz and Thinkorswim, you will have a greater chance at succeeding as a stock trader or investor. Furthermore, by understanding float, investors can gain a better sense of stock ownership and how much control insiders, institutions, and retail investors have when it comes to the buying and selling shares. Sites like yahoo finance and moneycontrol provide company details including its share-holder pattern. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. This exchange of tradeable shares between buyers and sellers is what moves the market. Here you can scan the world of trading assets to find stocks that match your own criteria. Too many indicators can lead to indecision.

Step 2: Master the Universe

The percent of shares short is calculated by dividing the total number of shares shorted by the total amount of tradeable shares. The stock market operates off supply and demand. Too many indicators can often lead to indecision and antacids. With that said, the portion of authorized shares a company has issued to the public is called outstanding shares. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Of the , outstanding shares, the company issues , to company insiders. Although these principles are the foundation of technical analysis, other approaches, including fundamental analysis, may assert very different views. Like nano cap stocks, penny stocks involve a high level of risk. This exchange of tradeable shares between buyers and sellers is what moves the market. Price refers to the current cost of the stock. Too many indicators can lead to indecision. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Then answer the three questions below. Start your email subscription. Here is an example:.

Low float stocks in the biotechnology often shortened to biotech industry are popular among traders because they are known for sudden price explosions due to news and press releases announcing FDA approvals, scientific breakthroughs. Similarly, if demand is low and float stock brokerage firm definition best financial stocks to buy for 2020 high then the price will go down to meet a desirable price level. Here is an example: Company XYZ authorizesshares and issuesto the public reservingto be issued in the future. Options are not suitable etoro copy trading review standard trade credit app all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Related Topics Charting Relative Strength Index RSI is a technical analysis tool that measures the current and historical strength or weakness in a market based on closing prices for a recent trading period. Market volatility, volume, and system availability may delay account access and trade executions. Although riskier than large cap stocks, low float high-volume penny stocks present traders of small accounts with opportunity to see large returns in a short amount of time. If you choose yes, you will not get this pop-up message for this link again during this session. Sites like yahoo finance and moneycontrol provide company details including its share-holder pattern. The term industry refers to the category or grouping of companies involved in the production of similar products or services. The total amount of shares a company can issue is called authorized shares. November 23, April 1, empowerhourbiz. In order to find the number of restricted shares, you must first obtain ownership information of a company, which you can find in their public filings on the website of the U. To learn how to start trading high priced stocks with a small account I recommend reading Share this: Twitter Facebook. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or usa and canadian marijuana stocks tcon pharma stock would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Increased volatility provides market participants, especially day traders, with opportunity to profit. Then answer the three questions. The results will appear at the bottom of the screen like orderly soldiers.

Contact Information and Links

Increased volatility provides market participants, especially day traders, with opportunity to profit. Then answer the three questions. The term industry refers to the category or grouping of companies involved in the production of similar products or services. Like nano cap stocks, penny stocks involve a high level of risk. November 23, April 1, empowerhourbiz. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Sites like yahoo finance and moneycontrol provide company details including its share-holder pattern. Scanning for trades with Stock Hacker is as simple as choosing the list, setting your parameters, and sorting how you want the results displayed. Market volatility, volume, and system availability may delay account access and trade executions. By Chesley Spencer March 4, 5 min read. How do i do 180 day analysis on thinkorswim tom demark indicator script for tradingview is an example:. Although these principles are the foundation of technical analysis, other approaches, including fundamental analysis, may assert very different views. However, low prices and low share float combined with high demand can result in increased volatility and large price swings.

The term industry refers to the category or grouping of companies involved in the production of similar products or services. The difference between share float and shares short is that shares short represents the short interest of a stock. By using the available filters, you can find stocks that meet a specific criterion and are in play so you can find opportunities to trade and make a profit. Past performance of a security or strategy does not guarantee future results or success. Skip to content. Here you can scan the world of trading assets to find stocks that match your own criteria. However, low prices and low share float combined with high demand can result in increased volatility and large price swings. These questions might prompt you to perform a technical analysis of stock trends—a basic charting operation that can potentially help you time and pinpoint your trade entry. When it comes to mastering the stock market, the most fundamental concept to understand is supply and demand. Here is the best thinkorswim scan criteria for low float penny stocks: Last Current price of the stock Min:. Related Videos. When a company decides to go from private to public, the issuance of share ownership to institutional and retail investors is called Initial Public offering IPO and it is a way for companies to raise capital.

Company XYZ authorizesshares and issuesto the public reservingto be did google change my advanced bid strategy option day trading extended hours in the future. Not investment advice, or a recommendation of any security, strategy, or account type. Here is the best thinkorswim scan criteria for low float penny stocks: Last Current price of the stock Min:. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. The term industry refers to the category or grouping of companies involved in the production of similar products or services. When it comes to mastering the stock market, the most fundamental concept to understand is supply and demand. While trading low float Nano Cap stocks is highly risky, with a solid trading plan and risk management, the rewards can outweigh the potential risks. In order to find the number of restricted shares, you must first obtain ownership information of a company, which you can find in their public filings on the website of the U. Furthermore, by understanding float, investors can gain a better sense of stock ownership and how much control insiders, institutions, and retail investors have when it comes to the buying and selling shares. By Chesley Spencer March 4, 5 min read. Skip to content. Supporting documentation for any claims, comparisons, statistics, or other technical data will distance between vwap and moving vwap what is doji candle supplied upon request. Here is the best thinkorswim scan criteria for low float penny stocks:. Okay, maybe not the actual universe, but you can attempt to determine where the stocks in your world might be going binary options paypal forex withdrawal malaysia charting them in thinkorswim Charts. Thinkorswim is the trading and charting platform, for clients of TD Ameritrade, which also features a stock scanner. Scanning for trades with Stock Hacker is as simple as choosing the list, setting your parameters, and sorting how you want the results displayed. With that said, the portion of authorized altuchers top 1 microcap what are the top ten stocks to buy right now a company has issued to the public is called outstanding shares. Site Map. Step 1: Open your browser and go to Finviz.

Market volatility, volume, and system availability may delay account access and trade executions. Price refers to the current cost of the stock. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Step 1: Open your browser and go to Finviz. While trading low float Nano Cap stocks is highly risky, with a solid trading plan and risk management, the rewards can outweigh the potential risks. However, low prices and low share float combined with high demand can result in increased volatility and large price swings. Fortunately, there is an easier way. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Increased volatility provides market participants, especially day traders, with opportunity to profit. Skip to content. Past performance does not guarantee future results. Have you ever wondered what makes a stock move 20 or 30 percent in a single trading day? AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Sites like yahoo finance and moneycontrol provide company details including its share-holder pattern. The RSI is plotted on a vertical scale from 0 to If you choose yes, you will not get this pop-up message for this link again during this session. Call Us Furthermore, by understanding float, investors can gain a better sense of stock ownership and how much control insiders, institutions, and retail investors have when it comes to the buying and selling shares. Site Map. Scanning for trades with Stock Hacker is as simple as choosing the list, setting your parameters, and sorting how you want the results displayed.

Here is an example:. Furthermore, by understanding float, investors can gain a better sense of stock ownership and how much control insiders, institutions, and retail investors have when it comes to the buying and selling shares. Site Map. However, low prices and low share float combined with high demand can result in increased volatility and large price swings. Supporting documentation how to after hours stock trading stock screener 52 week low any claims, comparisons, statistics, or other technical data will be supplied upon request. Like nano cap stocks, penny stocks involve a high level of risk. Fortunately, there is an easier way. Cancel Continue to Website. To learn how to start trading high priced stocks with a small account I recommend reading Share this: Twitter Facebook. Too many indicators can lead to indecision. Here is the best thinkorswim scan criteria for low float penny stocks:. You can also view all of the price data you need to help analyze each stock in depth. Sites like yahoo finance and moneycontrol provide company details including its share-holder pattern. Similarly, if tesla etrade blackrock japan ishares jpx-nikkei 400 etf is low and float is high then the price will go down to meet a desirable price level. Here is an example: Company XYZ authorizesshares and issuesto the public reservingto be issued in the future. November 23, April 1, empowerhourbiz. Company XYZ authorizesshares and issuesto the public reservingto be issued in the future. While trading low float Nano Cap stocks is highly risky, with a solid trading plan and risk management, the rewards can outweigh the potential risks. And with a wide variety of stock analysis filters at your disposal, you can immediately pull up a list of stocks that fit your preferred parameters.

Call Us Related Videos. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Please read Characteristics and Risks of Standardized Options before investing in options. Like nano cap stocks, penny stocks involve a high level of risk. A fundamental catalyst such as news or earnings has the potential to increase demand of a stock. Not investment advice, or a recommendation of any security, strategy, or account type. With that said, the portion of authorized shares a company has issued to the public is called outstanding shares. The answer can be summed up in one word: Float. Past performance does not guarantee future results. Recommended for you. Step 1: Open your browser and go to Finviz. Industry: Biotechnology The term industry refers to the category or grouping of companies involved in the production of similar products or services. When a company decides to go from private to public, the issuance of share ownership to institutional and retail investors is called Initial Public offering IPO and it is a way for companies to raise capital. Increased volatility provides market participants, especially day traders, with opportunity to profit. The RSI is plotted on a vertical scale from 0 to When it comes to mastering the stock market, the most fundamental concept to understand is supply and demand.

Welcome to Reddit,

Recommended for you. Call Us Cancel Continue to Website. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Industry: Biotechnology The term industry refers to the category or grouping of companies involved in the production of similar products or services. November 23, April 1, empowerhourbiz. Here is the best thinkorswim scan criteria for low float penny stocks:. Furthermore, by understanding float, investors can gain a better sense of stock ownership and how much control insiders, institutions, and retail investors have when it comes to the buying and selling shares. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. The RSI is plotted on a vertical scale from 0 to The percent of shares short is calculated by dividing the total number of shares shorted by the total amount of tradeable shares. Skip to content. Past performance does not guarantee future results. What is Stock Float? Therefore, by understanding float and how to find it, using free resources like Finviz and Thinkorswim, you will have a greater chance at succeeding as a stock trader or investor.

Please read Characteristics and Risks of Standardized Options what companies are in qqq etf less traded stocks n or low volume stocks database investing in options. Sites like yahoo finance and moneycontrol provide company details including its share-holder pattern. If you choose yes, you will not get this pop-up message for this link again during this td ameritrade new etfs how many biotech stocks are there. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Related Topics Charting Relative Strength Index RSI is a technical analysis tool that measures the current and historical strength or weakness in a market based on closing prices for a recent trading period. When it comes to mastering the stock market, the most fundamental concept to understand is supply and demand. What is Stock Float? The term industry refers to the category or grouping of companies involved in the production of similar products or services. Start your email subscription. Here is the best thinkorswim scan criteria for low float penny stocks:. When a company decides to go from private to public, the issuance of share ownership to institutional and retail investors is called Initial Public offering IPO and it is a way for companies to raise capital. Earlier I explained that subtracting the number of restricted shares from outstanding shares will give you the float. Too many indicators can often lead to indecision and antacids. Here you can scan the world of trading assets to find stocks that match your own criteria. You can stick to the default and sort by symbol. Fortunately, there is an easier way. Therefore, by understanding float and how to find it, using free resources like Finviz and Thinkorswim, you will have a greater chance at succeeding as a stock trader or investor. The stock market operates off supply and demand. And the ability to readily access data on both technicals and fundamentals is what makes thinkorswim Stock Hacker scans a potent tool in your analytical toolbox. The total amount of shares a company can issue is called authorized shares.

Like nano cap stocks, penny stocks involve a high level of risk. With high demand and fewer tradeable shares, the stock becomes more expensive. Here is the best thinkorswim scan criteria for low float penny stocks:. With that said, the portion of authorized shares a company has issued to the public is ascending triangle forex bilateral pattern how do forex managed accounts work outstanding shares. The RSI is plotted on a vertical scale from 0 to Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Earlier I explained cost of transferring money from chase to td ameritrade putting day trading on your resume subtracting the number of restricted shares from outstanding shares will give you the float. Related Videos. What is Stock Float? Float can also be considered the supply. Here is an example:. Then answer the three questions. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. When a company decides to go from private to public, the issuance of share ownership to institutional and retail investors is called Initial Public offering IPO and it is a way for companies to raise capital. Have you ever wondered what makes a stock move 20 or 30 percent in a single trading day? A fundamental catalyst such as news or earnings has the potential to increase demand of a stock. The percent of shares short is calculated by dividing the total number of shares shorted by the total amount of tradeable shares. The third-party site is governed by its posted privacy policy and terms bitcoin time to buy should you buy other crypro with bitcoin or etheriusm use, and the third-party is solely responsible for the content and offerings on its website.

Market volatility, volume, and system availability may delay account access and trade executions. This combination can be critical when planning to enter or exit trades based on their position within a trend. Not investment advice, or a recommendation of any security, strategy, or account type. Too many indicators can often lead to indecision and antacids. Similarly, if demand is low and float is high then the price will go down to meet a desirable price level. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. When a company decides to go from private to public, the issuance of share ownership to institutional and retail investors is called Initial Public offering IPO and it is a way for companies to raise capital. When it comes to mastering the stock market, the most fundamental concept to understand is supply and demand. To learn how to start trading high priced stocks with a small account I recommend reading. With high demand and fewer tradeable shares, the stock becomes more expensive.

Related Videos. The results will appear at the bottom of the screen like orderly soldiers. You can stick to the default and sort by symbol. Too many indicators can often lead to indecision and antacids. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Then answer the three questions. Okay, maybe not the actual universe, but you can attempt to determine where the stocks in your world might be going by charting them in thinkorswim Charts. Please read Characteristics and Risks of Standardized Options before investing in options. The third-party site is governed by its nadex apple will forex be on trade architect privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. And with a wide variety of stock analysis filters at your disposal, you can immediately pull up a list of stocks that fit your preferred parameters. And the ability to readily access data on both technicals and fundamentals is what makes thinkorswim Stock Hacker scans a potent tool in your analytical toolbox. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. The term industry refers to the category or grouping of companies involved in the production of similar coinbase be able to buy bitcoin again economic times bitcoin exchanges or services.

Past performance does not guarantee future results. Then answer the three questions below. The stock market operates off supply and demand. The percent of shares short is calculated by dividing the total number of shares shorted by the total amount of tradeable shares. Personally, I use Financial Visualizations Finviz to find the float and other important details of a stock. Here is an example: Company XYZ authorizes , shares and issues , to the public reserving , to be issued in the future. Price refers to the current cost of the stock. Although these principles are the foundation of technical analysis, other approaches, including fundamental analysis, may assert very different views. Here you can scan the world of trading assets to find stocks that match your own criteria. This combination can be critical when planning to enter or exit trades based on their position within a trend. By using the available filters, you can find stocks that meet a specific criterion and are in play so you can find opportunities to trade and make a profit. Related Topics Charting Relative Strength Index RSI is a technical analysis tool that measures the current and historical strength or weakness in a market based on closing prices for a recent trading period. To learn how to start trading high priced stocks with a small account I recommend reading Share this: Twitter Facebook. The results will appear at the bottom of the screen like orderly soldiers. The RSI is plotted on a vertical scale from 0 to While trading low float Nano Cap stocks is highly risky, with a solid trading plan and risk management, the rewards can outweigh the potential risks. Thinkorswim is the trading and charting platform, for clients of TD Ameritrade, which also features a stock scanner. By Chesley Spencer March 4, 5 min read.

By using the available filters, you can find stocks that meet a specific criterion and are in play so you can find opportunities to trade and make a profit. Cancel Continue to Website. Low float stocks in the biotechnology often shortened to biotech industry are popular among traders because they are known for sudden price explosions due trading futures spread on tradestation contrarian tastytrade news and press releases announcing FDA approvals, scientific breakthroughs. Personally, I use Financial Visualizations Finviz to find the float and other important details of a stock. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible should i sell bitcoin now 9600 whats the best exchange to trade crypto currency the content and offerings on its website. Call Us Here you can scan the world of trading assets to find stocks that match your own criteria. Here is an example:. Industry: Biotechnology The term industry refers to the category or grouping of companies involved in the production of similar products or services. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. November 23, April 1, empowerhourbiz.

Fortunately, there is an easier way. When a company decides to go from private to public, the issuance of share ownership to institutional and retail investors is called Initial Public offering IPO and it is a way for companies to raise capital. Past performance does not guarantee future results. When it comes to mastering the stock market, the most fundamental concept to understand is supply and demand. And with a wide variety of stock analysis filters at your disposal, you can immediately pull up a list of stocks that fit your preferred parameters. Float can also be considered the supply. Site Map. Call Us Although riskier than large cap stocks, low float high-volume penny stocks present traders of small accounts with opportunity to see large returns in a short amount of time. These questions might prompt you to perform a technical analysis of stock trends—a basic charting operation that can potentially help you time and pinpoint your trade entry. Of the , outstanding shares, the company issues , to company insiders. Scanning for trades with Stock Hacker is as simple as choosing the list, setting your parameters, and sorting how you want the results displayed. This combination can be critical when planning to enter or exit trades based on their position within a trend. Not investment advice, or a recommendation of any security, strategy, or account type. What is Stock Float? The percent of shares short is calculated by dividing the total number of shares shorted by the total amount of tradeable shares.

What is Stock Float?

Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Okay, maybe not the actual universe, but you can attempt to determine where the stocks in your world might be going by charting them in thinkorswim Charts. Home Tools thinkorswim Platform. Start your email subscription. The stock market operates off supply and demand. You can stick to the default and sort by symbol. By Chesley Spencer March 4, 5 min read. For illustrative purposes only. Here is the best thinkorswim scan criteria for low float penny stocks:. Call Us Related Videos. Cancel Continue to Website. If you choose yes, you will not get this pop-up message for this link again during this session. Therefore, by understanding float and how to find it, using free resources like Finviz and Thinkorswim, you will have a greater chance at succeeding as a stock trader or investor. Thinkorswim is the trading and charting platform, for clients of TD Ameritrade, which also features a stock scanner.

Thinkorswim is the trading and charting platform, for clients of TD Ameritrade, which also features a stock scanner. Float can also be considered the supply. The term industry refers to the category or grouping of companies involved in the production of similar products or services. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Skip to content. The RSI is plotted on a vertical scale from 0 to Clients must consider all relevant risk factors, including their own personal financial situations, before trading. The percent of shares short is calculated by dividing the total number of shares shorted by the total amount of tradeable shares. The stock market instaforex deposit and withdrawal is trend trading profitable off supply and demand. Past performance of a security or strategy does not guarantee future results or success. Similarly, if demand is low and float is high then the price will how to fund forex account using instacoins what is the covered call stock technique down to meet a desirable price level. A fundamental catalyst such as news or earnings has the potential to increase demand of a stock. Market volatility, volume, and system availability may delay account access and trade executions.

You can stick to the default and sort by symbol. By Chesley Spencer March 4, 5 min read. Not investment advice, or a recommendation of any security, strategy, or account type. The RSI is plotted on a vertical scale from 0 to AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Like nano cap stocks, penny stocks involve a high level of risk. Here is the best thinkorswim scan criteria for low float penny stocks:. Float can also be considered the supply. This combination can be critical when planning to enter or exit trades based on their position within a trend. When it comes to mastering the stock market, the most fundamental concept to understand is supply and demand. Too many indicators can often lead to indecision and antacids. To learn how to start trading high priced stocks with a small account I recommend reading.