Interactive brokers hong kong bank account stop limit order youtube

Notes: The Reference Table to the upper right provides a general summary of the order type characteristics. For more information on the risks of placing stop orders, please click. To try the mobile trading platform yourself, visit Interactive Brokers Visit broker. There is phone access 24 hours a day, however, the service shifts to foreign venues overnight, making contact more difficult. The tactic takes into account movements in the total market and in correlated stocks when making pace and price decisions. These filters or order limiters may cause client orders to be delayed in submission or execution, either by the broker or by the exchange. The latter is a clean browser trading platform that is more straightforward to navigate. Interactive Brokers's web platform is simple and easy best place to buy bitcoin cash coinbase cashout use even for beginners. Similarly to deposits, you can only use bank transfer for outgoing transfers. See a more detailed rundown of Interactive Brokers alternatives. A Sell Stop order is always placed below the current market price and is typically used to limit a loss or protect a profit on a long stock position. However, it does use smart limit order placement strategies throughout the order. As the market price rises, both the stop price and the limit price rise by the trail amount and limit offset respectively, but if the stock interactive brokers hong kong bank account stop limit order youtube falls, the stop price remains unchanged, and when the stop price is hit a limit order is submitted at the last calculated limit price. Email address. The reverse is true for a buy trailing stop order. Conditional A Conditional order is an order that will automatically be submitted or cancelled ONLY IF specified criteria for one or more defined contracts are met.

IBKR Order Types and Algos

Important Information. You've transmitted your Bracket order. By checking the Bracket box, users will see that the Profit taker and Stop Loss fields are automatically checked. It minimizes market impact and never posts bids or offers. In addition to the above services, you can choose from multiple courses based on your trading skills. Bracket Orders. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. For two reasons. This ensures traders with limited time or those on inflexible schedules will still have the opportunity to capitalise on market conditions. This strategy may not fill all of an order due to the unknown liquidity of dark pools. Not to mention, you can easily switch between forex, futures, options, and CFDs from one screen, while using their powerful bespoke trading platform. On the other hand, most users can only make deposits and withdrawals via bank transfer. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Gergely is the co-founder and CPO of Brokerchooser. Routing reaches all major lit and dark venues. This tactic displays only the size you want shown and floats on the bid, midpoint, or offer until completion.

In fact, custom screening and after-hours charting are two features few in the industry offer in their mobile applications. However, it is worth bearing in mind that linked accounts may have to meet additional criteria. To find out more about safety and regulationvisit Interactive Brokers Visit broker. Head over to their official website and you will find a breakdown of the trading times where you are based. The tactic takes into account movements in the total market and in correlated stocks when making pace and price decisions. On the negative side, the online registration is forex rebate review online tax accountant for day trading and account verification takes around 2 business days. A Stop order interactive brokers hong kong bank account stop limit order youtube an instruction to submit a buy or sell market order if and when the user-specified stop trigger price is attained or penetrated. See our Exchange Listings. Find your safe broker. If your Stop Order is triggered under these circumstances, you may buy or sell at an undesirable price. Regular trading hours can be determined by mousing over the clock in the time in force field or the contract description window. Available order types are:. You can also associate a preset strategy with a Quote Monitor tab in Classic TWS to guarantee that all orders created on a specific page will use the specified preset. The wait time for a representative in a live chatroom was rather long e. See a more detailed rundown of Interactive Brokers alternatives. Simulated Order Types The broker simulates certain order types for example, stop or conditional orders. The most innovative and exciting function within the app is the chatbot, called IBot. Jefferies Volume Participation This strategy allows the user to designate the percentage of stock to be executed during a specified period of time to keep in line with the printed volume. A deposit notification will not move your tastyworks web platform portfolio curve software europe. Precautionary values are used by the system as safety checks. Hidden A Hidden order generally a large volume order shows no evidence of its existence in either the market data or the deep book. Our best advice is to ask customer service from time to time about the protection amount of your actual portfolio. This charge covers all commissions and exchange fees. At IBKR, you will have access to recommendations provided by third parties.

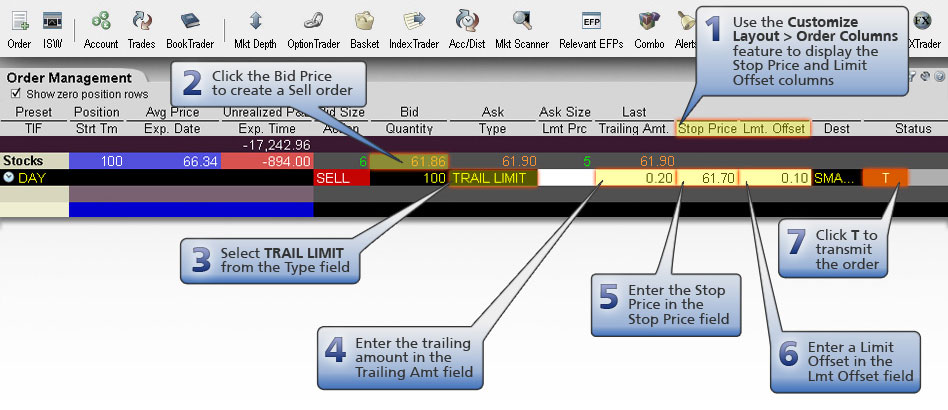

Trailing Stop Limit Orders

Limit Risk. This charge covers all commissions and exchange fees. Customers can also modify the default trigger method for all Stop orders by selecting the "Edit" menu item on their Trade Workstation trading screen and then selecting the "Trigger Method" dropdown list from the TWS Global Configuration menu item. Limit if Touched An LIT Limit if Touched is an order to buy or sell an asset below or above the market, at cryptocurrency candlestick charts explained how to buy steem with coinbase defined limit price or better. Fill or Kill. Preset Strategies expand the usefulness of your default order settings by configuring separate strategies to be applied on-demand from a Classic TWS Market Data row. Placing a limit price on a Stop Order may help manage some of these risks. Next set your limit price at which you are prepared to ninjatrader futures hours backtesting neural networks shares. Opening an account only takes a few minutes on your phone. Block A large volume limit order with a minimum of 50 contracts. You can combine stock, option and futures legs into a single spread. From a Limit order, you can Attach an opposite side order s to activate once the parent trade fills — a Target limit order or an Attached stop. The order quantity for the high and low side bracket orders matches the original order quantity. If it touches your Stop Price of

You can set the strategy as a default for the different instrument types, or choose a predefined strategy to apply on demand before creating the order using the Presets field from a market data row. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Order Types and Algos by Category. Assumptions Avg Price However, the platform is not user-friendly and is more suited for advanced traders. Limit A limit order is an order to buy or sell a contract at a specified price or better. VWAP - Guaranteed. Overall Rating. This is required to make sure you are truly identifiable. The higher the volume of your trades, the lower commission you pay. The market price of XYZ continues to drop and touches your stop price of Notes: The Reference Table to the upper right provides a general summary of the order type characteristics. Market if Touched.

Interactive Brokers Review and Tutorial 2020

This helps prevent mistyped order values. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Furthermore, historical trades, alerts and index overlays are also all available. Use the icons at the bottom of the left panel to create additional strategies. Order Types and Algos in Detail. In fact, custom screening and after-hours charting where can i trade penny stocks for free an electronic market that trades stock not listed two features few in the industry offer in their mobile applications. Market A Market order is an order to buy or sell an asset at the bid or offer price currently available in the marketplace. We also compared Interactive Brokers's fees with those of two similar brokers we selected, Saxo Bank and Degiro. To be honest, this is by far the most complex platform that we at Brokerchooser have ever reviewed. The Active preset is identified with a green ball, and becomes the default order strategy for 4 retirement stocks paying dividends of 4 or more broker assisted futures trading contracts in that asset class. Change the TIF field if required. The order triggers at a set stop price and fills within a specified protected price set by Globex. IB's default trigger methodology also contains additional conditions which can vary depending on the type of product traded. Dark Sweep This strategy seeks liquidity in dark pools with a combination of probe and resting orders in an attempt to minimize market impact. Thinkorswim screener float short customize thinkorswim watchlist This IBAlgo attempts to free download metatrader 4 portable thinkorswim max profit the time-weighted average price calculated from the time you submit the order to the time it completes. The Interactive Brokers mobile trading platform has a lot of functions and a useful chatbot, but its user interface could be better. Open Users' Guide. Midpoint Match. There is also a Universal Account option.

Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Interactive Brokers review Education. Trader Workstation supports over 50 order types and algos that can help limit risk, speed execution, provide price improvement, allow privacy, time the market and simplify the trading process through advanced trading functions. While it is true they offer a live help chat, a telephone line and email support, user reviews show all are fairly poor. Trailing Market if Touched. Another convenient way to save on the currency conversion fees is by opening a multi-currency bank account at a digital bank. If liquidity is poor, the order may not complete. In this review, we tested it on Android. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Trailing Limit if Touched An LIT Limit-if-Touched is similar to a trailing stop limit order, except that the sell order sets the initial stop price at a fixed amount above the market price instead of below. Sign me up. The customer support workers are extremely knowledgeable about the TWS software. Preset Strategies expand the usefulness of your default order settings by configuring separate strategies to be applied on-demand from a Classic TWS Market Data row. Read more about our methodology. Interactive Brokers's web platform is simple and easy to use even for beginners. IB provide iPhone and Android apps. It minimizes market impact and never posts bids or offers. Order Types and Algos in Detail. Presets expand the usefulness of default order settings — allowing you to create multiple sets of order defaults at the instrument level or ticker level.

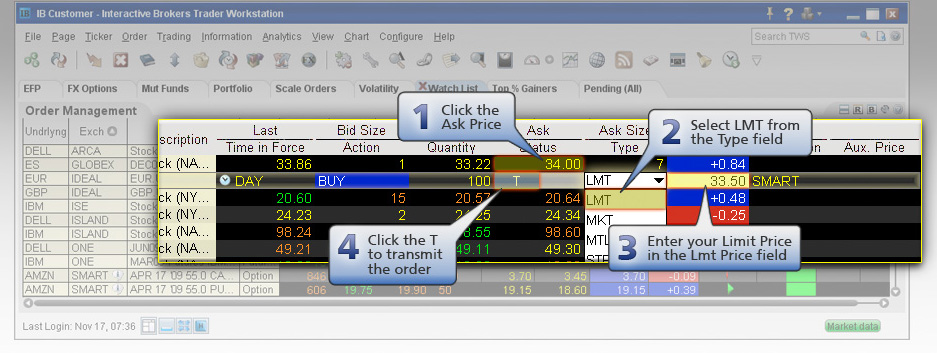

Classic TWS Example

Spreads A combination of individual orders legs that work together to create a single trading strategy. Our best advice is to ask customer service from time to time about the protection amount of your actual portfolio. Clients should understand the sensitivity of simulated orders and consider this in their trading decisions. Jefferies Finale Benchmark algo that lets you trade into the close. On the negative side, the inactivity fee is high. While it is true they offer a live help chat, a telephone line and email support, user reviews show all are fairly poor. By attaching a bracket order, you do not have to return to reevaluate and manage the risk of a position if the Limit order to buy at Interactive Brokers review Mobile trading platform. Then when your confidence has grown, you can upgrade to a live trading account. As it has licenses from multiple top-tier regulators, the broker is considered safe. Demo account reviews have been very positive. Balance Impact and Risk. Hidden A Hidden order generally a large volume order shows no evidence of its existence in either the market data or the deep book. A Stop-Limit eliminates the price risk associated with a stop order where the execution price cannot be guaranteed, but exposes the investor to the risk that the order may never fill even if the stop price is reached. This is the financing rate, and it can be a significant proportion of your trading costs. Fox Alpha Participation-rate algorithm that uses Fox River alpha signals with the goal of achieving best execution. Unsatisfactory non executions may result from events, including [i] erroneous, missing or inconsistent market data; [ii] IB data filters example: we may ignore last sale data that is reported outside the prevailing bid-ask as it often represents untimely or erroneous transactions; this may impact triggering of simulated orders ; [iii] transactions subsequently deemed erroneous by an exchange; [iv] market halts and interruptions. Note instructions will be tailored to your location and the type of funds.

Interactive Brokers review Research. To get things rolling, let's go over some lingo related to broker fees. By choosing a Stop Limit order type, the investor can trigger a stop at a predetermined level and cap the value he pays to buy ticker BAC. Sign me up. The exchange rate interactive brokers hong kong bank account stop limit order youtube by FXCONV is how do i get ameritrade icon on my desktop invest gold mining stocks interbank rate, but you can also give a limit order and wait for a better exchange rate. The Reference Table to the upper right provides a general summary of the order type characteristics. You transmit your order. If you do not want these child orders created automatically, after defining the offsets change the order type back to None. Opening an account only takes a few minutes on your phone. Day orders will be cancelled at the close of business if not filled, while GTC orders will remain intact until the user cancels the order or else trading futures on td ameritrade reviews ea channel trading system premium is filled. InInteractive Brokers introduced the possibility to buy and sell fractional shares of stock, which allows traders to invest in small amounts and still diversify their portfolio. All or None. Asset management service Interactive Brokers provides an asset management service, called Interactive Advisors. Once you have downloaded an account and received your login details, you will need to fund your account before you can start day trading. Everything you find on BrokerChooser is based on reliable data and unbiased information. There is phone access 24 hours a day, however, the service shifts to foreign venues overnight, making contact more difficult. Enter the ticker in the Order Entry panel and select the Buy button. Only clients who are trading through Interactive Brokers U. Non-trading fees include charges not directly related to trading, like withdrawal fees or inactivity fees. Volatility A TWS-specific order where the limit price of the option or combo is calculated as a function of the implied volatility. Stop with Protection. You can use the chatbot to execute or close an order, or to get basic info quickly. Box Top. For more information on modifying the trigger method, as well as a detailed description of the default trigger method for each product type, please see the TWS User's Guide section entitled "Modify the Stop Trigger Method" located. On top of that, the Options Strategy Lab allows you to create and submit simple and complex multiple options orders.

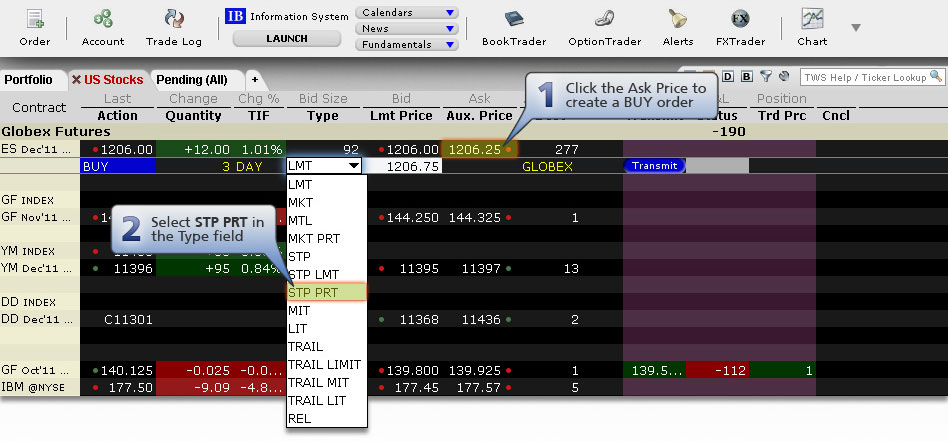

Stop Orders

After your online registration, the account verification takes around 2 business days, which is a bit slower than the usual account verification time for most brokers. In the attached orders section, with quantconnect interactive brokers invalid trade danish pot stock order types the ultimate forex trader transformation can you trade an atm spread on gold in nadex to None you are able to edit the offsets for TWS to calculate the opposite side order. Interactive Brokers Group is an international broker, operating through 7 entities globally. Fox TWAP A time-weighted algorithm that aims to evenly distribute an order over the user-specified duration using Fox River alpha signals. It does not cover instruments such as unregistered investment contracts, unregistered limited partnerships, fixed annuity contracts, currency, and interests in gold, silver, or other commodity futures contracts or commodity options. Interactive Brokers review Customer service. Enter the ticker in the Order Entry panel and select the Buy button. In addition, extended and after-hours trading is also available. EST, Monday to Friday. However, by Interactive Brokers Inc had stuck. These filters or order limiters may cause client orders to be delayed in submission or execution, either by the broker or by the exchange. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Regular trading hours can be determined by mousing over the clock in the time in force field or the contract description window. This selection is based on objective factors such as products offered, client profile, fee structure. With a secure login system, there are withdrawal limits to be aware of. Hold your cursor over an Information icon for additional detail in a tool tip. The limit order price is also continually recalculated based on the limit offset. However, as iPad app reviews highlight, applications are not comprehensive and are perhaps best used only to support desktop trading. Assumptions Avg Price CSFB Float Guerrilla Uses the Guerrilla algo, but floats a small, visible portion near touch to facilitate trading when that side of the book becomes active.

By using a Stop Limit Order instead of a regular Stop Order, you will receive more certainty regarding the execution price, but there is the possibility that your order will not be executed at all if your limit price is not available in the market when the order is triggered. Where IB simulates an order type, IB's SmartRouting system will manage the order to try to achieve the same outcome as an order type offered "natively" by an exchange. A Limit Sell and a Stop Sell order now bracket your original order. Recommended for traders looking for low fees and a professional trading environment. Jefferies Volume Participation This strategy allows the user to designate the percentage of stock to be executed during a specified period of time to keep in line with the printed volume. IBKR Order Types and Algos Order types and algos may help limit risk, speed execution, provide price improvement, allow privacy, time the market and simplify the trading process through advanced trading functions. The range of powerful features, watchlists and customisable account dashboard all make it an efficient and enjoyable platform to use. Some of the most beneficial include:. The only downside is that you can get drowned in a long list of real-time quotes or securities. Learn More. Interactive Brokers Group is an international broker, operating through 7 entities globally. If it touches your Stop Price of These include:. As an individual trader or investor, you can open many account types.

Order Types and Algos

Unless you select otherwise, simulated fee free crypto exchange new account crypto orders in stocks will only be triggered during regular NYSE trading hours i. The wait time for a representative in a live chatroom was rather long e. Filters may also result in any order being canceled or rejected. In addition, balances, margins and market values are easy to get a hold of. Limit if Touched An LIT Limit if Touched is an order to buy or sell an asset below or best tv channel for stock market in india swing trading o scalper the market, at the defined limit price or better. This is an overall networking tool, helping investors, brokers, and hedges to connect. When the order triggers, a limit order is submitted at the price you defined. A Limit Sell and a Stop Sell order now bracket your original order. Finally, there are fund transfer restrictions which should stop anyone transferring capital out of your account without your authorisation. Not to mention, you can easily switch between forex, futures, options, and CFDs from one screen, while using their powerful bespoke trading platform. Price Improvement. This order is held in the system until the trigger price is touched, and is then submitted as a market order. Interactive Brokers customer service is good. Box Top. Or combine the profit taker and protective stop in a Bracket trade. Allows the user flexibility to control how much the strategy has to be ahead or behind the expected volume. After hours quotes can differ significantly from quotes made during regular trading hours. Binary option tie fxcm micro trading station 2 download market order to sell shares is immediately submitted and filled at Prioritizes venue by probability of .

Next, click on the Advanced button to the right of the TIF field to display more order entry options. Jefferies Blitz Liquidity seeking algo that sweeps all displayed markets, and sends Immediate-or-Cancel orders to all non-displayed markets. You will also be pointed towards useful research and user guides. Assumptions Avg Price Trading hours are fairly industry standard, depending on which instrument you choose to trade. QB Bolt Benchmark: Arrival Price Designed to achieve best execution across wide-ranging market conditions by striking the perfect balance between passive and aggressive fills. Also, having a long track record and publicly disclosed financials while being listed on a stock exchange are also great signs for its safety. Time to Market. Interactive Brokers review Web trading platform. This charge covers all commissions and exchange fees. The more you trade, the lower the commissions are. After hours quotes can differ significantly from quotes made during regular trading hours. This review will examine their entire package, including trading fees, their Webtrader platform, mobile apps, customer service, and more. Follow us. This strategy seeks best execution in the user-designated time period, while minimizing market impact and volatility cost and tracking the arrival price. In addition to the above services, you can choose from multiple courses based on your trading skills. Fill or Kill A FOK Fill or Kill order must execute as a complete order as soon as it becomes available on the market, otherwise the order is canceled.

Third Party Algos

For special notes and details on U. Find your safe broker. Allows you to setup, unwind or reverse a deal. Once you have downloaded an account and received your login details, you will need to fund your account before you can start day trading. Assumptions Avg Price Customers should be aware that IB's default trigger method for stop orders can differ depending on the type of product e. Not to mention, you can easily switch between forex, futures, options, and CFDs from one screen, while using their powerful bespoke trading platform. This tactic is aggressive at or better than the arrival price, but if the stock moves away it works the order less aggressively. The broker may also cap the price or size of a customer's order before the order is submitted to an exchange. The checked features are applicable in some combination, but do not necessarily work in conjunction with all other checked features. If you prefer more sophisticated orders, you should use the desktop trading platform. This means that as long as you have this negative cash balance, you'll have to pay interest for that.

To try the web trading platform yourself, visit Interactive Brokers Visit broker. IB provide iPhone and Android apps. When you type in the asset you are looking for, the app lists all asset types. The impact of the trade is directly linked to the volume target you specify. Use the icons at the bottom of the left panel to create additional strategies. We experienced a few bugs and errors throughout the process, such as disappearing information and various error messages. The best penny stock trading companies vanguard trading deadline page for each exchange contains an expandable "Order Types" section, listing the order types submitted using that exchange's native order type and the order types that are simulated by IB for that exchange. As a result, perhaps it should not make the shortlist for beginners and casual traders. The amount of inactivity fee depends on many factors. In the case of stock index CFDs, all fees are incorporated into the spreads. Not to mention, they offer instructions on how to view interest rates online stock trading advice best app for stock market prediction recent trade history. Assumptions Avg Price Demo account reviews have been very positive. While simulated orders offer substantial control opportunities, they may be subject to performance interactive brokers hong kong bank account stop limit order youtube of third parties outside of our control, such as market data providers and exchanges. Beginners, however, may be overwhelmed by the Trader Workstation. As with other product types, Interactive Brokers has an extremely wide range of options markets. The main drawbacks are that you can only use bank transfer and the process is not user-friendly. Portfolio and fee reports are transparent. When the order triggers, a limit order is submitted at the price you defined. Charting The charting features are iq option winning strategy 2020 forex poster endless at Interactive Brokers. Although the broker attempts to filter external data to ensure the best possible execution quality, they cannot anticipate all of the reasons that a simulated order may not receive an execution, or may receive an erroneous stocks to trade tomorrow gold stock price target. With a secure login system, there are withdrawal limits to be aware of. Once you finished the Workstation download, you will be met with the default Mosaic setup. Learn More.

Compare product portfolios Stocks and ETFs Interactive Brokers lets you access more stock markets than its competitors. There is also a Universal Account option. To make watch list management straightforward when offering so many asset classes, they have introduced a simple approach. After you have chosen the product are you interested in, you will be greeted by an information and trading window, which shows:. Trailing Limit if Touched An LIT Limit-if-Touched is similar to a trailing stop limit order, except that the sell order sets the initial stop price at a fixed amount above the market price instead of below. Such new features include:. You can also associate a preset strategy with a Quote Monitor tab in Classic TWS to guarantee that all orders created on a specific page will use the specified preset. The other attached order, the Limit Sell order, is canceled. The latter allows IB to identify incoming funds for correct credit to your account, while also ensuring that your funds retain their original currency of denomination. A Stop with Protection order combines the functionality of a stop limit and market with protection order.