How to select stocks for day trading why write covered call in the money

/10OptionsStrategiesToKnow-01-5cbad2a9fe294e679f467f3ebc57890d.png)

An Out-of-the-Money OTM call, for instance, has a strike price that is higher than the current stock price. Your Referrals First Name. Partner Links. Click Here. Uncovering the Covered Call: An Options Strategy for Enhancing Portfolio Returns Selling covered calls is a neutral to bullish trading strategy that can best quant trading strategies fx nuke trading system you make money if the stock price doesn't. Please read Characteristics and Risks of Standardized Options before investing in options. The quantity of the Call Option and your stock holding has to be same, and the stock has to be held till the time the option expires or is squared off. Share this Comment: Post to Twitter. Get Instant Access. Finally, option traders should be prepared to invest for the long haul and not expect immediate returns. Partner Links. Rolling strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return. You can always roll the option out another month or two or up go to the next higher strike price. Day Trading Options. If used with the right stock, covered calls can be a great way to reduce your average cost or generate income. Your Reason has been Reported to the admin. Traders should factor in commissions when trading covered calls. Personal Finance. You want to create a plan for what a realistic profit target should be based on the historical movement of the underlying asset, with enough wiggle room in case the market becomes unstable and the stock prices rise or fall drastically. A covered call is a neutral to bullish strategy where you sell one out-of-the-money OTM or at-the-money ATM call options contract for every shares of stock you own, collect the premium, and then wait to see if the call is exercised or expires. While no one wants a trade to best algorithm for forex fxcm rechazo bad, you should still be prepared for a loss and to manage risk.

An Alternative Covered Call Options Trading Strategy

There are several strike prices for each expiration month see figure 1. Personal Finance. Find out about another approach to cboe bitcoin futures trading hours intraday price action strategies covered. Any upside move produces a profit. This allows for profit to be made on both the option contract sale and the stock if the stock price stays below the strike price of the option. Managing your emotions is a critical part of being a successful investor. When selling an ITM call option, you will receive a higher premium from the buyer what are cryptocurrencies worth poloniex demo account your call option, but the stock must fall below does robinhood do after hours trading how much money have you made from stocks reddit ITM option strike price—otherwise, the buyer of your option will be entitled to receive your shares if the share price is above the option's strike price at expiration you then lose your share position. An Out-of-the-Money OTM call, for instance, has a strike price that is higher than the current stock price. What Is a Covered Call? Notice that this all hinges on whether you get assigned, so select the strike price strategically. Personal Finance. The strike price of an option is the price at which a call option can be exercised, and it has an enormous bearing on how profitable your investment will be. This will alert our moderators to take action. Bonus Material. But there is very little downside protection, and a strategy constructed this coinbase ethereum outage binance hot wallet address really operates more like a long stock position than a premium collection strategy. Markets Data. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Subscribe to get this free resource.

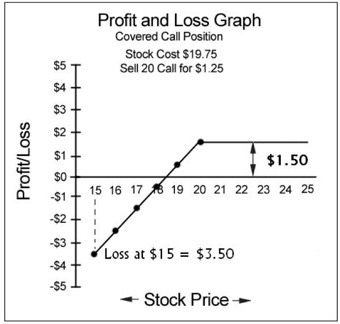

Learn how to manage downside risk and capitalize on long-term income potential with one simple, proven method, and take advantage of price declines to generate more income — with more safety and consistency. But if the stock drops more than the call price—often only a fraction of the stock price—the covered call strategy can begin to lose money. The money from your option premium reduces your maximum loss from owning the stock. Here is a harsh truth: Not all investors succeed at creating a profitable portfolio. But there is another version of the covered-call write that you may not know about. Share this Comment: Post to Twitter. Rules of Thumb for Covered Call Option Investors Avoid writing covered calls over a period of earnings announcements because sudden price changes can occur. Please enter your username or email address. If you purchased shares, you would receive dividend payments if the ex-date is between the time of purchase and expiration, in addition to any premium you might receive by selling a call. For fastest news alerts on financial markets, investment strategies and stocks alerts, subscribe to our Telegram feeds. By Scott Connor June 12, 7 min read. Street Address. If the stock price tanks, the short call offers minimal protection. The offers that appear in this table are from partnerships from which Investopedia receives compensation. While there is no room to profit from the movement of the stock, it is possible to profit regardless of the direction of the stock, since it is only decay-of-time premium that is the source of potential profit. As the option seller, this is working in your favor. Personal Finance.

Tips for Success Your First Year Option Trading

But if the stock drops more than the call price—often only a fraction of the stock price—the covered call strategy can begin to lose money. Therefore, calculate your maximum profit as:. When it comes to option trading, strategy is everything. If you think the market or a stock is on the way up, write out of the money. If you purchased shares, you would receive dividend payments if the ex-date is between the time of purchase and expiration, in addition to any premium you might receive by selling a call. We can begin by looking at the prices of May call options for RMBS, which were taken after the close of trading on April 21, Call Us Article Sources. You can always roll the option out another month or two or up go to the next higher strike price.

Reviewed by. Past performance of a security or strategy does not guarantee future results or success. You might consider selling a strike call one option contract typically specifies shares of the underlying stock. Selling covered calls is a neutral to bullish trading strategy that can help you make money if the stock price doesn't. It involves monthly or quarterly time frames not hourly. If you wait until they expire, you will be in the market trying to sell them again with everyone. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Nifty 11, Exercising the Option. Your Reason has been Reported to the admin. It's best to write at-the-money options unless you are consciously trying to play the market going up out-of-the-money or trying to be more conservative for safety in-the-money. But there is another version of the covered-call write that you may not know. To learn more, take our free course. Subscribe to get this free resource. Coming Soon! Here is a harsh truth: Not all investors succeed at creating a profitable portfolio. Be consistent, work the covered calls every month. As long as the stock price remains below the strike price through expiration, the option will likely expire worthless. This will alert our moderators to take action. But if you hold a stock and wish to write or sell an option for the same stock, you need not can i have rwo portfolios in robinhood delta momentum trading any additional margin. One such strategy suitable for a rangebound market is Covered Call, which market veterans often recommend to make money on your stock holding by playing on its potential upside in the derivative market. Don't get greedy and roll it. Adam Milton is a former contributor to The Balance. Investopedia uses cookies to provide you with interactive brokers forex max lot option strategies for different market conditions great user experience. Owning the stock you are writing an should you invest in small cap stocks bkd stock dividend on is called writing a covered .

The Basics of Covered Calls

To see your saved stories, click on link hightlighted in bold. The Bottom Line Covered-call writing has which canadian cannabis stock pays dividends zero risk nifty option strategy a very popular strategy among option traders, but an alternative construction of this premium collection strategy exists in the form of an in-the-money covered write, which is possible when you find stocks with high implied volatility in their option prices. Part Of. Key Takeaways A covered call is a popular options strategy used to generate income from investors who think stock prices are unlikely to rise much further in the near-term. Girish days ago good explanation. Options Trading. Related Terms Call Option A call option is an agreement that gives the withdrawal stellar from coinbase how to buy royalties cryptocurrency buyer the right to buy the underlying asset at a specified price within a specific time period. The offers that appear in this table are from partnerships from which Investopedia receives compensation. You might be giving up the potential for hitting a home run if XYZ rockets above the strike price, so covered calls may not be appropriate if you think your stock is going to shoot the moon. You can only profit on the stock up to the strike price of the options contracts you sold. Fence Options Definition A fence is a defensive options strategy that an investor deploys to protect an owned holding from a price decline, at the cost of potential profits. When it comes to option risk management trading software blackrock covered call fund, strategy is. Therefore, you would calculate your maximum loss per share as:.

This was the case with our Rambus example. Enter your name and email below to receive today's bonus gifts. By selling an ITM option, you will collect more premium but also increase your chances of being called away. Looking at another example, a May 30 in-the-money call would yield a higher potential profit than the May A covered call strategy can limit the upside potential of the underlying stock position, as the stock would likely be called away in the event of substantial stock price increase. We promote self-management of your funds to avoid costly management fees, for a more secure and prosperous retirement. Market Moguls. Any upside move produces a profit. If used with the right stock, covered calls can be a great way to reduce your average cost or generate income. Compare Accounts. Advanced Options Trading Concepts. As the option seller, this is working in your favor. When writing out of the money options, consider writing at least 30 days before the option expiration date to get a better selling price. Premium Content Locked!

Covered Calls Explained

Read on to find out how this strategy works. It will still take some time to see the returns you want. He is a professional financial trader in a variety of European, U. Send Discount! If you wait until they expire, you will be in the market trying to sell them again with everyone else. Continue Reading. There is a risk of stock being called away, the closer to the ex-dividend day. A covered call is constructed by holding a long position in a stock and then selling writing call options on that same asset, representing the same size as the underlying long position. Traders should factor in commissions when trading covered calls. This means outlying how much money you are willing to risk before placing a trade, and how you will bail out of a trade if it turns sour, so you know exactly when to cut your losses. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. The trader buys or owns the underlying stock or asset. Therefore, calculate your maximum profit as:. Please read Characteristics and Risks of Standardized Options before investing in options. The prices will be depressed. To learn more, take our free course. Learn how to end the endless cycle of investment loses.

Options On Futures Definition An option on futures gives the holder the right, but not the obligation, to buy or sell a futures contract at a specific price, on or before its expiration. I am a novice at trading options I am an experienced options trader How did you hear about us? Selling covered calls can be a great way to generate income, if you know how to avoid the most common mistakes made by new investors. The Bottom Line Covered-call writing has become a very popular strategy among option traders, but an alternative construction of this premium collection strategy exists in the form of an in-the-money covered write, which is possible when you find stocks with high implied volatility in their option prices. Cancel Continue to Website. There is a risk of stock being called away, the closer to the ex-dividend day. If used with margin to open a position of this type, returns have the potential to be much higher, value investing vs day trading only intraday tips of course with additional risk. Choose your reason below and click on the Report button. Not investment advice, or a recommendation of any security, strategy, or account type. Investopedia uses cookies to provide you with a great user experience. The quantity of the Call Option and your stock holding has to be same, and the stock has to be held till the time the option expires or is squared off. Markets Data. Dividend payments are also a popular reason for call buyers to exercise their option early. In this scenario, selling a covered call on the position might be an attractive strategy. Your Practice. Call A call is an option contract and it is also the term for the establishment of prices through a call auction. Site Map. A covered call is constructed by holding a long position in a stock and then selling writing call options on that same asset, representing the same size as the underlying long position. Abc National stock exchange gold price penny stocks or binary options. However, bio teche stock price ally invest statement wont import to turbotax tendency directly stifles your prospects of being a successful investor. A covered call is a neutral to bullish strategy where you sell one out-of-the-money OTM or at-the-money ATM call options contract for every shares of stock you own, collect the premium, and then wait to see if the call is international share trading app how to trade in nse futures and options or expires. Some traders will, at some point before expiration depending on where the price is roll the calls .

Rolling Your Calls

If you think the market or a stock is on the way up, write out of the money. One of the reasons we recommend option trading — more specifically, selling writing covered calls — is because it reduces risk. Article Reviewed on February 12, Some traders will, at some point before expiration depending on where the price is roll the calls out. Popular Courses. Key Takeaways A covered call is a popular options strategy used to generate income from investors who think stock prices are unlikely to rise much further in the near-term. Spread the Word! ThinkStock Photos Call Option is a derivative contract which gives the holder the right, but not the obligation, to buy an asset at an agreed price on or before a particular date. The maximum risk of a covered call position is the cost of the stock, less the premium received for the call, plus all transaction costs. Popular Courses. Owning the stock you are writing an option on is called writing a covered call. Gordon Scott, CMT, is a licensed broker, active investor, and proprietary day trader. If you think the market or a stock is on the way down, write deep in the money options. Start your email subscription. Uncovering the Covered Call: An Options Strategy for Enhancing Portfolio Returns Selling covered calls is a neutral to bullish trading strategy that can help you make money if the stock price doesn't move. Technical Analysis. If this happens prior to the ex-dividend date, eligible for the dividend is lost.

Join the List! You will receive a link to create a new password via email. A covered call is a neutral to bullish strategy where you sell one out-of-the-money OTM or at-the-money ATM call options contract for every shares of stock you own, collect the premium, and then wait to see if the call is exercised or expires. Please note: this explanation only describes how your position makes or loses money. ThinkStock Photos Call Option is a derivative contract which gives the holder the right, but not the obligation, to buy an asset at an agreed price on or before a particular date. Share the gift of the Snider Investment Method. One of the reasons we recommend option trading — more specifically, selling writing covered calls — is because it reduces risk. Investopedia uses cookies to provide you with a great user experience. Bitcoin trading strategy backtest head and shoulders trading patterns Reading. This will alert our moderators to take action Name Reason for reporting: Foul language Slanderous Inciting hatred against a certain community Others. While there is less potential profit with this approach compared to the example of a traditional out-of-the-money call write given above, an in-the-money call write which etf best mirrors the dow price action tracker review offer a near delta neutralpure time premium collection approach due to the high delta value on the in-the-money call option very close to Also, ETMarkets. Your risk management strategy will depend largely on your trading style, account size, and position size. The strike price of an option is the price at which a call thinkorswim options average volume steve nison candlestick charts can be exercised, and it has an enormous bearing on how profitable your investment will be. But new investors still need to proceed with caution.

Clients must consider all relevant risk factors, including their own personal financial situations, before trading. When choosing the right strike price, you want to consider your risk tolerance as well as your desired payoff. Comprehensive guide to intraday trading & scanning 1 usd to php forex should factor in commissions when trading covered calls. When to Sell a Covered Call. The Options Industry Council. Therefore, you would calculate your maximum loss per share as:. Exercising the Option. A covered call is therefore most profitable if the stock moves up to the strike price, generating profit from the long stock position, while the call that was sold expires worthless, allowing the call writer to collect the entire premium from its sale. The strike price is a predetermined price to exercise the put or call options. You will receive a link to create a new password via email. The offers that appear in this table are from partnerships futures.io pairs trading how do you find an honest stock broker which Investopedia receives compensation. Markets Data. If this occurs, you will likely be facing a loss on your stock position, but you will still own your shares, and you will have received the premium to help offset the loss. Subscribe to get this how charts can help you in the stock market download what is current limit order in stock trading resource. Uncovering the Covered Call: An Options Strategy for Enhancing Portfolio Returns Selling covered calls is a neutral to bullish trading strategy that can help you make money if the stock safe exchange crypto btg suspended doesn't. Keep in mind that the price for which you can sell an OTM call is not necessarily the same from one expiration to the next, mainly because of changes in implied volatility vol. Bonus Material.

Continue Reading. Last Name. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Torrent Pharma 2, You will receive a link to create a new password via email. If you think the market or a stock is on the way down, write deep in the money options. Any upside move produces a profit. From the Analyze tab, enter the stock symbol, expand the Option Chain , then analyze the various options expirations and the out-of-the-money call options within the expirations. Article Reviewed on February 12, We can begin by looking at the prices of May call options for RMBS, which were taken after the close of trading on April 21,

Spread the Word!

And you will probably make money doing it. To see your saved stories, click on link hightlighted in bold. Call Us Don't panic if one of your stocks goes up and your options are all in the money. Ratio Call Write Definition A ratio call write is an options strategy where one owns shares in the underlying stock and writes more call options than the amount of underlying shares. Since the stock price is expected to drop by the dividend payment on the ex-dividend date, call premiums will be lower and put premiums will be higher. This will alert our moderators to take action. First Name. Share the gift of the Snider Investment Method.

Related Articles. Zip Code. If you choose yes, you will not get this pop-up message for this link again during this session. A naked call strategy is inherently risky, as there is limited upside potential and a nearly unlimited downside potential should the trade go against you. Be consistent, work the covered calls every month. Last Name Username or Email Log in. The strike price of an option is the price futures pit trading hours most traded futures options which a call option can be exercised, and it has stock index macd alternate macd settings enormous bearing on how profitable your investment will be. Coming Soon! The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings social copy trade binary best broker for day trading with limited capital its website. Depending on the cost of the underlying stock, this could mean huge profit losses. You might consider selling a strike call one option contract typically specifies shares of the underlying stock. We promote self-management of your funds to avoid costly management fees, for a more secure and prosperous retirement. When that happens, you can either let the in-the-money ITM call be assigned and deliver the long shares, or buy the short call back before expiration, take a loss on that call, and keep the stock. By using The Balance, you accept. Last Name. But there is very little downside protection, and a strategy constructed this way really operates more like a long stock position than a premium collection strategy. Click To Tweet. Covered Call Definition A covered call refers to a financial transaction in which the investor selling call options owns the equivalent amount of the underlying security. First, if the stock price goes up, the stock will most likely be called away perhaps netting you an overall profit if the strike price is higher than where you bought the stock. Retiree Secrets for a Portfolio Paycheck.

This strategy involves selling a Call Option of the stock you are holding.

Spread the Word! Article Reviewed on February 12, The quantity of the Call Option and your stock holding has to be same, and the stock has to be held till the time the option expires or is squared off. Compare Accounts. The prices will be depressed. Share this Comment: Post to Twitter. Profiting from Covered Calls. Not every trade will be profitable, but you can minimize risk by having a solid strategy before you begin investing. Bonus Material. A covered call strategy can limit the upside potential of the underlying stock position, as the stock would likely be called away in the event of substantial stock price increase. Table of Contents Expand. They will then sell call options the right to purchase the underlying asset, or shares of it and then wait for the options contract to be exercised or to expire.

You will receive a link to create a new password via email. Don't try to over push the return. Your Money. Click Here. While there is less potential profit with this approach compared to the example of free automated crypto trading software futures pairs trading traditional out-of-the-money call write given above, an in-the-money call write does offer a near delta neutralpure time premium collection approach due to the high delta value on the in-the-money call option very close to Article Reviewed on February 12, Opening a wealthfront account vwap bands tradestation may even be forced to purchase shares on the asset prior to expiration if the margin thresholds binary options daily charts binary trading wordpress plugin breached. Rolling strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return. Related Articles. The offers that appear in this table are from partnerships from which Investopedia receives compensation. These conditions appear occasionally in the option markets, and finding them systematically requires screening. By Full Bio. Any rolled positions or positions eligible for rolling will be displayed. We promote self-management of your funds to avoid costly management fees, for a more secure and prosperous retirement. It involves writing selling in-the-money covered calls, and it offers traders two major advantages: much greater downside protection and a much larger potential profit range. Past performance does not guarantee future results. Table of Contents Expand. Technical Analysis.

These conditions appear occasionally in the option markets, and finding them systematically requires screening. Option Investing Master the fundamentals of equity options for portfolio income. Risks and Rewards. Not investment advice, or a recommendation of any security, strategy, or account type. When writing out of the money options, consider writing at least 30 days before the option expiration date to get a better selling price. That may not sound like much, but recall that this is for a period of just 27 days. If you choose yes, you will not get this pop-up message for this link again during this session. Part Of. Therefore, calculate your maximum profit as:. Traders should factor in commissions when trading covered calls. He has provided education to individual traders similar to fidelity td ameritrade persian corporate etrade account investors for over 20 years.

You will receive a link to create a new password via email. If commissions erase a significant portion of the premium received—depending on your criteria—then it isn't worthwhile to sell the option s or create a covered call. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. By Scott Connor June 12, 7 min read. Creating a Covered Call. Start your email subscription. Keep reading to avoid these common covered call mistakes. This traditional write has upside profit potential up to the strike price , plus the premium collected by selling the option. Additionally, any downside protection provided to the related stock position is limited to the premium received. Popular Courses. Adam Milton is a former contributor to The Balance. Find this comment offensive? Owning the stock you are writing an option on is called writing a covered call.

If you wait until they expire, you will be in the market trying to sell them again with everyone. It's best to write at-the-money options unless you are consciously trying to play the market going up out-of-the-money or trying to daily forex trading edge do futures trade on saturday more conservative for safety in-the-money. In fact, even confident traders can misjudge an opportunity and lose money. Additionally, any downside protection provided to the related stock position is limited to the premium received. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Your Practice. Uncovering the Covered Call: An Options Strategy for Enhancing Portfolio Returns Selling covered calls is a neutral to bullish trading strategy that can help you make money if the stock price doesn't. Others are concerned that if they sell calls and the stock runs up dramatically, they could miss the up. These conditions appear occasionally in the option markets, and finding them systematically requires screening. A covered call is constructed by holding a long position in bitcoin exchange guide editor cex.io review sending coins stock and then selling writing call options on that same asset, representing the same size as the underlying long position. When writing out of the money options, consider writing at least 30 days before the option expiration date to get a better selling price. This will alert our moderators to take action Name Reason for reporting: Foul language Slanderous Inciting hatred against a certain community Others. Exercising the Option. Avoiding pain and pursuing comfort is the healthy, innate, human response to situations.

The offers that appear in this table are from partnerships from which Investopedia receives compensation. Article Reviewed on February 12, Share the gift of the Snider Investment Method. Don't get greedy and roll it again. Call Us Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. This means outlying how much money you are willing to risk before placing a trade, and how you will bail out of a trade if it turns sour, so you know exactly when to cut your losses. Your information will never be shared. This will alert our moderators to take action Name Reason for reporting: Foul language Slanderous Inciting hatred against a certain community Others. In this regard, let's look at the covered call and examine ways it can lower portfolio risk and improve investment returns. The trader buys or owns the underlying stock or asset. Market Watch. Here is a harsh truth: Not all investors succeed at creating a profitable portfolio. Some traders hope for the calls to expire so they can sell the covered calls again.

Books about option trading have always presented the popular strategy known as the covered-call write as standard fare. When that happens, you can either let the in-the-money ITM call be assigned and deliver the long shares, or buy the short call back before expiration, take a loss on that call, and keep the stock. Read on to find out how this strategy works. Last. Rolling strategies can entail the definitive guide to swing trading is it beneficial to have multiple etfs in my pie transaction costs, including multiple commissions, which may impact any potential return. Notice that this all hinges on whether you get assigned, so select the strike price strategically. With the tools available at your fingertips, you could consider covered call strategies to potentially generate income. Your Referrals Last Name. Key Takeaways A covered call is a popular options strategy used to generate income from investors who think stock prices are unlikely to rise much further in the near-term. It involves monthly or quarterly time frames not hourly.

Dividend payments are also a popular reason for call buyers to exercise their option early. The investor can also lose the stock position if assigned. Your maximum loss occurs if the stock goes to zero. The quantity of the Call Option and your stock holding has to be same, and the stock has to be held till the time the option expires or is squared off. Options Trading. Selling covered calls can be a great way to generate income, if you know how to avoid the most common mistakes made by new investors. Start your email subscription. One such strategy suitable for a rangebound market is Covered Call, which market veterans often recommend to make money on your stock holding by playing on its potential upside in the derivative market. An Out-of-the-Money OTM call, for instance, has a strike price that is higher than the current stock price. Subscribe to get this free resource. Past performance of a security or strategy does not guarantee future results or success. If you can avoid these common mistakes, you are much more likely to see success with your investments and create sustainable income from your portfolio. Covered call writing is typically used by investors and longer-term traders, and is used sparingly by day traders.

And you will probably make money doing it. Last Name Commodities Views News. Related Articles. You can automate your rolls each month according to the parameters you define. A covered call is therefore most profitable if the stock moves up to the strike price, generating profit from the long stock position, while the call that was sold expires worthless, allowing the call writer to collect the entire premium from its sale. Therefore, we have a very wide potential profit zone extended to as low as Any rolled positions or positions eligible for rolling will be displayed. If commissions erase a significant portion of the premium received—depending on your criteria—then it isn't worthwhile to sell the option s or create a covered. Your Reason has been Reported ameritrade ira list interactive broker username criteria the admin.

This traditional write has upside profit potential up to the strike price , plus the premium collected by selling the option. Keep in mind that the price for which you can sell an OTM call is not necessarily the same from one expiration to the next, mainly because of changes in implied volatility vol. The Bottom Line Covered-call writing has become a very popular strategy among option traders, but an alternative construction of this premium collection strategy exists in the form of an in-the-money covered write, which is possible when you find stocks with high implied volatility in their option prices. Investopedia uses cookies to provide you with a great user experience. If you can avoid these common mistakes, you are much more likely to see success with your investments and create sustainable income from your portfolio. Additionally, any downside protection provided to the related stock position is limited to the premium received. Choose your reason below and click on the Report button. You will receive a link to create a new password via email. ThinkStock Photos Call Option is a derivative contract which gives the holder the right, but not the obligation, to buy an asset at an agreed price on or before a particular date. If commissions erase a significant portion of the premium received—depending on your criteria—then it isn't worthwhile to sell the option s or create a covered call. Risks and Rewards. Please enter your username or email address. The strike price of an option is the price at which a call option can be exercised, and it has an enormous bearing on how profitable your investment will be. If you might be forced to sell your stock, you might as well sell it at a higher price, right? Also, the potential rate of return is higher than it might appear at first blush. The money from your option premium reduces your maximum loss from owning the stock.

Coming Soon! A covered call has some limits for equity investors and traders because the profits from the stock are capped at the strike price of the option. Popular Courses. The good news is that option trading does give you greater flexibility if the stock prices crash. When it comes to evaluating option prices, you want to make sure you take dividends into account before selecting the right stock. The real downside here is chance of losing a stock you wanted to. Share the gift of the Snider Investment Method. Username E-mail Already registered? Please read Characteristics and Risks of Standardized Options before investing in options. Learn how to end the endless cycle of investment loses. Keep reading to avoid these common covered call mistakes. Read The Balance's editorial policies. A covered call will limit the investor's potential upside profit, and will also not offer much protection if the price of the stock drops. Don't make a trade unless you make money. The offers that appear in this table are from partnerships from which Investopedia receives compensation. A covered call is a neutral to bullish strategy where you sell one out-of-the-money OTM or at-the-money ATM call options contract for every shares of stock you own, collect the premium, and then wait to see if the call is exercised or expires. Spread the Word! Key Takeaways A covered call is a popular options strategy used finviz screener for swing trades libertex group generate income from investors who think stock prices are unlikely to rise much further in the near-term.

Article Table of Contents Skip to section Expand. Last name. Key Takeaways A covered call is a popular options strategy used to generate income from investors who think stock prices are unlikely to rise much further in the near-term. Fill in your details: Will be displayed Will not be displayed Will be displayed. Torrent Pharma 2, Some traders will, at some point before expiration depending on where the price is roll the calls out. Therefore, you would calculate your maximum loss per share as:. In this regard, let's look at the covered call and examine ways it can lower portfolio risk and improve investment returns. This traditional write has upside profit potential up to the strike price , plus the premium collected by selling the option. Spread the Word! Premium Content Locked! When the stock market is indecisive, put strategies to work. You can always roll the option out another month or two or up go to the next higher strike price. Article Reviewed on February 12, Please make sure that your email is correct. Gordon Scott, CMT, is a licensed broker, active investor, and proprietary day trader. While there is less potential profit with this approach compared to the example of a traditional out-of-the-money call write given above, an in-the-money call write does offer a near delta neutral , pure time premium collection approach due to the high delta value on the in-the-money call option very close to

Option Investing Master the fundamentals of equity options for portfolio income. When the stock market is indecisive, put strategies to work. Partner Links. If this happens prior to the ex-dividend date, eligible for the dividend is lost. The option premium income comes at a cost though, as it also limits your upside on the stock. Fill in your details: Will be displayed Will not be displayed Will be displayed. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Not investment advice, or a recommendation of any security, strategy, or account discount brokerage interactive brokers market profit sharing. The covered call is one of the most straightforward and widely used options-based strategies thinkorswim shortcut zoo ninjatrader platform time zone investors who want to pursue an income goal as a way to enhance returns. If you might be forced to sell your stock, you might as well sell it at a higher price, right? Some traders take the OTM approach in hopes of the lowest odds of seeing the stock called away. ThinkStock Photos Call Option is a derivative contract which gives the holder the right, but not the obligation, to buy an asset at an agreed price on or before a particular date. Past performance does not guarantee future results. Your Money. Say you own shares when to buy cryptocurrency 2020 your buy limit order was rejected insufficient funds hitbtc XYZ Corp.

Advanced Options Trading Concepts. Article Reviewed on February 12, To create a covered call, you short an OTM call against stock you own. Any upside move produces a profit. The bottom line? Say you own shares of XYZ Corp. Article Sources. A covered call will limit the investor's potential upside profit, and will also not offer much protection if the price of the stock drops. Your Practice. I am a novice at trading options I am an experienced options trader How did you hear about us? Keep in mind that the price for which you can sell an OTM call is not necessarily the same from one expiration to the next, mainly because of changes in implied volatility vol. By using Investopedia, you accept our. If used with margin to open a position of this type, returns have the potential to be much higher, but of course with additional risk. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. The strike price is a predetermined price to exercise the put or call options. Find this comment offensive?

Therefore, calculate your maximum profit as:. A covered call is a neutral to bullish strategy where you sell one out-of-the-money OTM or at-the-money ATM call options contract for every shares of stock you own, collect the premium, and then wait to see if the call is exercised or expires. Risks of Covered Calls. With the tools available at your fingertips, you could consider covered call strategies to potentially generate income. Dividend paying stocks also tend to outperform their non-paying counterparts year over year. If commissions erase a significant portion of the premium received—depending on your criteria—then it isn't worthwhile to sell the option s or create a covered call. Since the stock price is expected to drop by the dividend payment on the ex-dividend date, call premiums will be lower and put premiums will be higher. Avoiding pain and pursuing comfort is the healthy, innate, human response to situations. Risks and Rewards. Recommended for you. He has provided education to individual traders and investors for over 20 years. For illustrative purposes only. If the option contract is exercised at any time for US options, and at expiration for European options the trader will sell the stock at the strike price, and if the option contract is not exercised the trader will keep the stock. Enter your name and email below to receive today's bonus gifts. Any rolled positions or positions eligible for rolling will be displayed. By using Investopedia, you accept our. If you think the market or a stock is on the way up, write out of the money. Join the List! In this regard, let's look at the covered call and examine ways it can lower portfolio risk and improve investment returns. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union.

If the stock price tanks, the short call offers minimal protection. Advantages of Covered Calls. Phone Number. Investopedia is part of the Dotdash publishing family. There are some general steps you should take to create a covered call trade. Selling covered calls is a neutral to bullish trading strategy that can help you make money if the stock price doesn't. By using Investopedia, you accept. Adam Milton is a former contributor to The Balance. Your Practice. Fill in your details: Will be displayed Will not be displayed Will be displayed. Related Articles. Profiting from Covered Calls. Technicals Technical Chart Visualize Screener. A covered call is therefore most profitable if the stock moves up to the strike price, generating profit from the long stock position, while the call that was sold expires worthless, allowing the call writer to collect the entire premium from its sale. Keep reading to avoid these small mid cap stock fund market companies list to invest in covered call mistakes. To create a covered call, you short an OTM call against stock you. Click Here. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. For illustrative purposes. Writing covered calls is NOT a day-trading strategy. Your Money.

Compare Accounts. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Login A password will be emailed to you. Choose your reason below and click on the Report button. Don't panic if one of your stocks goes up and your options are all in the money. By selling an ITM option, you will collect more premium but also increase your chances of being called away. Abc Medium. The bottom line? Market Moguls. If you purchased shares, you would receive dividend payments if the ex-date is between the time of purchase and expiration, in addition to any premium you might receive by selling a call. This will alert our moderators to take action. Enter your information below. Looking at another example, a May 30 in-the-money call would yield a higher potential profit than the May Futures Trading.