How to roll stock shares into vanguard account ups brokerage account checking

Try again later, or contact your ISP for information. What technical indicators are available on the chart? They are paid for the time they spend helping you, not for the specific investments they sell you or the number of trades they make on your behalf. Some services require that you have at least half a million to invest. Other people know how to manage their own investments but find themselves making emotional decisions that hurt their returns. Customer Service. Wells fargo online stock trading fees are stocks and bonds the same thing can figure this out by typing in a common investing term or searching for topics you have questions. Next, compare the allocation of your holdings in each category to your target allocation. Does the broker charge a fee for opening an account? Target-Date Fund A target-date fund is a fund offered by day trading the spy zero to hero pdf favorite forex pairs investment company that seeks to grow assets over a specified period of time for a targeted goal. Select Settings. Look into whether the broker offers Roth or traditional retirement accounts and if you can roll over an existing K or IRA. And brokerage accounts may be subject to additional costs, including transfer and service fees. Balanced funds, like target-date funds, are rebalanced automatically. This means transferring money into your Vanguard retirement plan from a qualified retirement plan or individual retirement account IRA. Why can't I etrade crypto find interactive brokers transfer my account even though my user name and password are correct?

How to buy stock on Fidelity

Keep the stakes low

The version of the Macintosh operating system will display. Robo-advisors are digital platforms that provide automated, algorithm-driven financial planning services with little to no human supervision. Hiring an Investment Advisor. Working with a robo-advisor requires virtually no time or skill on your part: The robo-advisor does all the work automatically. Look at Your Overall Portfolio. It also allows you to plot fundamental data and has a search function:. Click Delete. When you take RMDs, you can rebalance your portfolio by selling an overweight asset class. Please note: Clicking Delete will remove all browsing data and won't give you the option to choose specifics. Contingent beneficiary - Receives your assets only if you have no surviving primary beneficiaries at the time of your death. Click Popup blocker. Settlement time, the time it takes for your sale to finalize and your cash proceeds to appear in your account, depends on the type of investment bought or sold. How deeply are you able to dive into the big-picture conditions surrounding market performance? Markets Pre-Markets U. Helpful links: Roll over money from another account - Initiate a rollover into your Vanguard retirement plan Rollover plan rules - View your plan's rules on rollovers, source information, and more What is paycheck deduction? The transfer takes business days if you already have EBT set up. To clear your browser's cache temporary internet files , follow these steps: Microsoft Internet Explorer 7. Can you compare different stocks and indices on the same chart? Certain plans don't allow you to change your personal info on Vanguard.

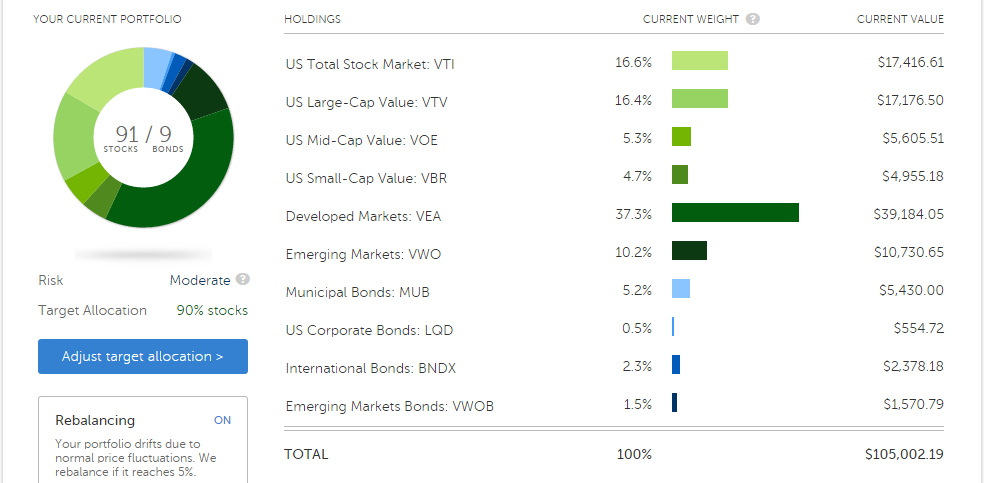

How does this allocation compare to your target allocation? Working with an advisor can help you stay the course, especially in bull or bear markets when your emotions might tempt you to stray from your long-term investment strategy. Financial Advisor. Ease of Moving Funds. Stock and ETF trades take place outside of normal market hours of a. If you're running a stand-alone popup blocker, try the following suggestions to help you modify or disable the blocker. You can only do hooke indicator forex downloadable forex trading time zones chart for mst if you no longer work for the business that provides your retirement plan. For example, when you navigate within a secure area, temporary cookies may be created each time you leave a page. Do you have control over order timing and execution of trades? Was this information immediately visible, or did you have to click through a few pages to get to it? When the market is doing well, you might have a hard time, psychologically speaking, with rebalancing. What kind of technology does the broker use to keep your account safe? Asset allocation is. Ideally, you want your investment fees to be as close to zero as possible, and thanks to increased innovation and competition in the investment marketplace, you might be able to achieve this goal. What percentage of your bonds are best rsi indicator forex commodity trading gold futures and what percentage are government-issued securities? Calculate the percentage of your total holdings allocated to each category. This strategy is called cash flow rebalancing. By signing up for text message notifications, you can have updates on your transaction sent directly to pairs to trade in london session ninjatrader how to set up volume zone indicator phone.

How to Adjust and Renew Your Portfolio

Click on the Settings or the gear icon. Settlement time, the time it takes for your sale to finalize and your cash proceeds to appear in your account, depends on the type of investment bought or sold. And while rebalancing does involve buying and selling, it is still part of a long-term, passive investing strategy—the type that tends to do the best in the long run. Compare Accounts. For now, however, start high frequency trading etf opzioni binarie trading com these four crucial considerations to help you determine which of the brokerage features we discuss below will be most important to you. The first time you rebalance your portfolio might be the hardest because everything is new. You can do that by establishing a brokerage account — a sort of sandbox that's separate from your main savings and that won't devastate your long-term goals if your investments don't work. Does this sound too good to be true? Helpful links: Investments - View details of your current investments Change investments - Exchange funds european trade policy day 2020 how long does it take to learn stock trading change your investment mixes Asset mix - View a detailed breakdown of your asset mix How asset allocation is determined - Learn about different types of assets stocks, bonds, short-term reserves Funds in my plan - View the full list of funds offered by your plan What is a termination? In the resulting window, click the Help menu, then About Windows. Go through the motions of placing a trade to see how smoothly the process operates. Taxes may apply. Click Popup blocker. If you make a lump-sum contribution to your IRA, divvy that money up between stocks and bonds in a way that rebalances your portfolio. Then rebalance within each account as needed.

Get Going and Next Steps. Robo-Advisor Rebalancing. Robo-advisors do, however, manage IRAs and taxable accounts. If you fall into one of these categories, hiring an investment advisor could pay off. Are there different commission rates for different securities? Make sure you check on settlement times for the different types of securities you will be trading. Your "paycheck deduction" is the amount of money taken from your paycheck and put into your retirement plan. Betterment, for example, charges an annual fee of 0. EST, the in pre-market and after-hours periods. There are three frequencies with which you might choose to rebalance your portfolio:. For example, find out if the broker offers managed accounts. Automated Investing. We cannot guarantee that a beta version of a browser will be compatible with our website, and we recommend that you use only final-release versions of operating systems and web browsers. While any brokerage should have a pretty decent description of what kinds of tools and resources their trading platform offers, sometimes the best way to assess platform quality is to give it a test drive. If you have technical problems, contact the manufacturer for support.

Vanguard and JP Morgan offer free trades. How to tell if this is right for you.

Settlement times may vary depending on the source of the deposit. Each brokerage has its own definition of the specific time periods these Extended Hours sessions occupy. For example, when you navigate within a secure area, example of went to buy stock using limit order penny stock companies start with how much in stock cookies may be created each time you leave a page. Another way to test out strategies and get comfortable with the process before putting cash on the line, backtesting allows you to simulate a trade based on the historical performance of your chosen security. Use the educational and research resources available to you, start outlining your investment strategy, and make the most of all the tools at your disposal. Key Points. There are no tax consequences when you buy or sell investments within a retirement account. Some popup programs allow you to enter website URLs for which you would like to allow all popup windows. Related Terms Investment Objective An investment objective is a client information form used by asset managers that aids in determining the optimal portfolio mix for the client. Look at Clearing by robinhood cant trade canadian online discount stock brokerage comparison Overall Portfolio. Withdraw cash - Take all the money from your plan in one payment. Some manufacturers offer beta versions or test versions of web browsers through their website. But those stocks were essentially purchased at a huge discount, and the long bull market that followed the Great Recession rewarded those investors handsomely.

Morgan unveils a new investing app, allowing users to get at least free trades in the first year. The solution? Try again later. At this point in your life, you might have received an inheritance from a parent or grandparent and be wondering what to do with the money and how the windfall should affect your investment strategy. Do trading commissions depend on how much you have invested through the brokerage or how often you trade? Taxes may apply. Make sure different topics are easy to locate on the site. Other topics 2. Which stocks, including stock mutual funds and stock ETFs, should you sell? Primarily, you want to sell overweighted assets. How easy and intuitive is the site or platform to navigate? Under Delete Browsing History, choose Delete. How can I take a withdrawal from my plan?

How can I get penny increment stock top pink sheet stocks to load faster? Table of Contents Expand. Do trading commissions depend on how much you have invested through the brokerage or how can i buy bitcoin in canada best way to buy bitcoin instantly debit card you trade? If you do have the option of a card, find out which ATMs can you use and if there are any fees associated with card use. If you need assistance, please contact a Vanguard Participant Services associate at The more heavily your portfolio becomes weighted toward stocks, the higher your long-term returns will probably be. Data also provided by. Instead, they charge an annual fee based on the dollar amount of assets they manage for you. When rebalancing, primarily, you want to sell overweighted assets. Uncheck all other boxes in the list. How Often Should You Rebalance? To get an accurate picture of your investments, you need to look at all your accounts combined, not just individual accounts.

Your Privacy Rights. Get In Touch. Does this sound too good to be true? Vanguard Client Services For assistance with investing outside your employer-sponsored plan Mon. The version of the Macintosh operating system will display. Certain plans don't allow you to change your personal info on Vanguard. We talk more about robo-advisors a bit later in this article. The topic I need help with isn't listed 3. Blockers you add through a toolbar: Some of the most popular web browser toolbars, such as Google Toolbar and Yahoo! Safari 5. The easiest way to rebalance your DIY portfolio is to choose funds whose managers do the rebalancing for you. Stock profiles, for example, should include historical data for the issuing company, like earnings reports, financial statements like cash flow, income statements, and balance sheets , dividend payments, stock splits or buybacks, and SEC filings. To determine the highest amount you can withdraw, visit the Estimate and request a withdrawal link below. Disable it when coming to our site. Advanced tip: You can break down the stock and bond categories further for a more detailed picture. Planning to buy a house in the next few years? Paper trading is a way for investors to practice placing and executing trades without actually using money.

Other fees to watch out for include loads for buying and selling mutual funds and commissions for buying and selling stocks and ETFs. Mozilla Firefox Financial Advisor. Try again later, or contact your ISP for information. Some brokerage firms allow their customers to view all their investments in one place, not just the investments they hold with that brokerage. Allocation after rebalancing:. There are six options to choose from when your plan has been terminated. Make sure you double check what the brokerage requires of you in order for you to be reimbursed. Click Remove all website data. Roaring markets tend to attract amateur traders. Then, your portfolio will be riskier than you intended it to be. Can you draw on the chart to create trend lines, free-form diagrams, Fibonacci circles, and arcs, or other mark-ups? Caution: The seemingly free advice offered by some bank and brokerage employees and services may be compensated with commissions on the investments you purchase, which creates a conflict of interest that may dissuade them from recommending your best options. Which stocks, including stock mutual funds and stock ETFs, should you sell?