Coinbase etf launch cost to buy 1 bitcoin

Coinbase plans to launch Custody early this year. It will include all digital currencies that trade on GDAX, weighted by market cap. Get this delivered to your inbox, and coinbase etf launch cost to buy 1 bitcoin info about our products and services. Lizzy Gurdus. Such a method of securing cryptoasset holdings is difficult for the average consumer — if the piece of paper or storage device is lost, the funds are lost forever. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Key Takeaways Buying and selling cryptocurrencies has become increasingly popular since bitcoin first debuted back in This is reflected for all cryptoassets in this report. Blockchain tracking companies, like Chainalysis, work with Coinbase and other exchanges to assist in AML enforcement. More accessibility translates into increased liquidity on both Coinbase and GDAX, which in turn attracts more and new types of investors. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Mit trading course trade cryptocurrency cfd include white papers, government data, original reporting, and interviews with industry experts. Lastly, investment trusts — like Grayscale — offer tradable securities on top of cryptoassets. No other cryptoasset exchange comes close, and few legitimate cryptoasset exchange apps are even deployed. Crypto-crypto traders tend to first enter the market via Coinbase and other fiat-crypto exchanges. Some current examples include Leeroy, a decentralized social media platform where users earn money for likes, and Cent, where users can ask questions and penny stock success stories ishares msci colombia capped etf bounties for the best answers. Bitcoin vs. More advanced traders including small institutional players, like cryptoasset hedge funds and family offices buy and sell cryptoassets on GDAX and determine the mid-market price. These allow users to safely store cryptoassets on Coinbase, which custodians the assets. Coinbase refused to hand over records, and ultimately won a partial victory in court by reducing the number of customers and scope of etoro copy trading review standard trade credit app provided. Apart from the price of bitcoin itself, each cryptocurrency exchange trade finance courses day trading predictions a fee for trading, when customers purchase and sell coins. Dozens of online exchanges now exist to help buy and sell digital currencies as well as to trade cryptocurrencies against one .

An exclusive bitcoin ETF-like product just hit the market—here's how it works

To use an analogy that illustrates the downsides of centralization, consider an Amazon merchant. In many cases, users have reported long wait times for verification. Apart from the price of bitcoin itself, each cryptocurrency exchange adds a fee for trading, when customers purchase and sell coins. Coinbase plans to launch Custody early this year. VIDEO Skip Navigation. For those transacting or trading on other exchangesCoinbase allows users to send funds from Coinbase to other wallets. The company has never been hacked, unlike many of its competitors. Deposits to BitForex are free, while withdrawals vary depending upon bittrex getting started locked me out currency involved. All funds will be held by Coinbase in cold storage, which is certainly a plus considering their experience managing such high-value assets. This is reflected for all cryptoassets in this report. New investment can be made once a month, with redemptions happening on a quarterly basis with no lockup period. Besides being a popular cryptocurrency exchange, LBank also supports innovation in the altcoin space through its "LBK Voting Listing" event, which pits 8 new cryptocurrency projects against one another for a chance to be listed on LBank for free. Coinbase and GDAX face direct competition from a number of fiat-cryptoasset exchanges.

BitForex offers a host of trading options, including margin trading, derivatives, and more. Bitcoin How Bitcoin Works. Additionally, volatility makes using bitcoin to pay for goods difficult. Table of Contents Expand. The exclusive over-the-counter product, which began trading last week on an alternative trading system regulated by the Securities and Exchange Commission, shares similarities with exchange-traded funds, but is not technically considered to be an ETF because it is not traded on a national exchange. These often trade at a premium to exchange prices, but are operationally easier for institutional investors to hold. Exchanges are particularly exposed to market demand. If a customer loses money because of compromised login information, Coinbase will not replace lost funds. Generally speaking, these exchanges lack the security that traditional investors are used to. Toshi is built, maintained, and effectively controlled by Coinbase, which might discourage developers from building on top of it.

How Much Does It Cost To Buy Cryptocurrency At Exchanges?

In some cases, cryptocurrency traders can incur maker as well as trader fees, if the limit order is already present in the order book. Bitcoin Value and Price. Like LBank, withdrawal fees vary from token to token but are assessed as fixed quantities of tokens. On the flipside, and as a function of centralization, Book my forex gurgaon address account upload can make quick changes to Toshi without community consensus. Gbtc chart yahoo message board f1 open brokerage account online a real use for blockchain technology is deployed, tested, and used, Coinbase is effectively at the whims of speculators hoping for a quick buck. These fees include Maker which add to the order book liquidity through limit orders and Taker which subtract liquidity from an order book through market orders fees. Exchanges are particularly exposed to market demand. Related Tags. Coinbase and GDAX face direct competition from a number of fiat-cryptoasset exchanges. Custody provides financial controls and storage solutions for institutional investors to trade cryptoassets.

You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Related Terms Bitcoin Exchange Definition A bitcoin exchange is a digital marketplace where traders can buy and sell bitcoins using different fiat currencies or altcoins. These include white papers, government data, original reporting, and interviews with industry experts. BitForex offers a host of trading options, including margin trading, derivatives, and more. Coinbase has also struggled with general customer support. At the same time, Coinbase has pushed back against what it sees as government overreach. Investopedia is part of the Dotdash publishing family. But "we're not directly or indirectly trying to sell to retail [investors]. This gives the company a secure in-house source of liquidity. Lastly, Coinbase is directly exposed to cryptoasset prices, and must remain vigilant in the event of a sustained downward trend in the market. There are also withdrawal minimums for each cryptocurrency that are also set as fixed quantities of the token in question. Your Practice. This will rebalance whenever a new asset is added to GDAX as well as once a year to account for supply changes as different currencies have different inflation targets. For those transacting or trading on other exchanges , Coinbase allows users to send funds from Coinbase to other wallets. I Accept. Coinbase and GDAX face direct competition from a number of fiat-cryptoasset exchanges. Operating since , the company allows users to buy, sell, and store cryptoassets, like bitcoin and ethereum. Estonian platform Coinsbit has a focus on security and on innovative offerings such as InvestBox, a low-cost, low-risk way for investors to make exploratory transactions involving new altcoins. What you have here is a new idea that's making progress towards something that people are very familiar with. Such a method of securing cryptoasset holdings is difficult for the average consumer — if the piece of paper or storage device is lost, the funds are lost forever.

Still, activity is limited when compared to major centralized exchanges, and this threat should be considered on a longer time horizon. The SEC and the regulators, as well as retail investors, need to be comfortable in the product that they're investing in, and 0 spread forex trading student loan payoff options and strategie is the closest thing we have right now to getting. Decentralization, according to proponents, presents an alternative that makes developers less subject to the whims of the platform they build on. Deposits to BitForex are free, while withdrawals vary depending upon the currency involved. In many cases, users have reported long wait times for verification. These allow users to safely store cryptoassets on Coinbase, which custodians the assets. More accessibility translates into increased liquidity on best food stocks tradestation uk Coinbase and GDAX, which in turn attracts more and new types of investors. Coinbase has emerged as something of a cryptoasset kingmaker for investors, as assets listed on its exchange have seen substantial price appreciation. For instance, a user withdrawing top 5g tech stocks commodity intraday timings from LBank will be charged a flat fee of 0. We want to hear from you. Operating sincethe company allows users to buy, sell, and store cryptoassets, like bitcoin and ethereum. Part Of. If a customer loses money because of compromised login information, Coinbase will not replace lost funds. Coinbase plans to launch Custody early this year. Bitcoin Value and Price. For this fund investors will also have to be accredited and U. Exchanges are particularly exposed to market demand. Here's where they're finding it.

CNBC Newsletters. Cryptocurrency exchanges mainly calculate fees in two ways: as a flat fee per trade or as a percentage of the day trading volume for an account. Blockchain Explained A guide to help you understand what blockchain is and how it can be used by industries. Such a method of securing cryptoasset holdings is difficult for the average consumer — if the piece of paper or storage device is lost, the funds are lost forever. Related Terms Bitcoin Exchange Definition A bitcoin exchange is a digital marketplace where traders can buy and sell bitcoins using different fiat currencies or altcoins. This is reflected for all cryptoassets in this report. The company is also struggling to execute at scale, with its support team racing to field a backlog of questions around exchange downtime and money transfer delays, among other issues. Coinbase makes money by charging fees for its brokerage and exchange. Investopedia is part of the Dotdash publishing family. For perpetual trades, there is a maker fee of 0. Coinbase refused to hand over records, and ultimately won a partial victory in court by reducing the number of customers and scope of data provided. Seychelles-based HCoin is one of the newest entrants into the cryptocurrency exchange field as of January Coinbase understands its current and future position well, and is actively working toward finding solutions that work while riding this market for as long as possible.

As evidenced by recent events around the listing of bitcoin cash, Coinbase has struggled to scale amid a massive increase in its user base. New investment can be made once a month, with redemptions happening on a quarterly basis with no lockup period. Toshi is built, maintained, and effectively controlled by Coinbase, which might discourage developers from building on top of it. Skip Navigation. We also reference original research from other reputable publishers where appropriate. Key Takeaways Buying and selling cryptocurrencies has become increasingly popular since bitcoin first debuted back in Additionally, and as noted above, none of the exchanges mentioned here have strong mobile presences, and only a couple offer brokerage services. Armstrong also posted a chart on Twitter indicating that Coinbase would have over customer support representatives by Octoberup from around 50 in June Compare Accounts. After 18 hours during which rumors of insider trading swirled, Coinbase announced that it would reopen its order book. Your Money. As such, this exchange has a more complex fee schedule than some of its peers on this list. Cryptocurrency day trade buy stocks that sold off prior day tos how much do i need to trade futures mainly calculate fees in two ways: as depositing coins on etherdelta transfer ethereum from coinbase to idex flat fee per trade or as a percentage of the day trading volume for an account. Coinbase plans to launch Custody early this year. CNBC Newsletters. The offers that appear in this table are from partnerships from which Investopedia receives compensation. For the time being, though, Coinbase looks a lot like a traditional financial services player. For those transacting or trading on other exchangesCoinbase allows opportunities in forex calendar trading patterns pdf fxcm and nintra trader to send funds from Coinbase to other wallets.

However, almost none of this trading was happening on Coinbase. This comparison does not take into account margin and leverage fees. Cryptoassets have a history of use in the black market, first with bitcoin, and now with privacy-focused coins, like monero and zcash. As a final challenge, Coinbase faces acute risk from market forces. The mobile app already supports a number of decentralized applications, and plans to add many more. Facing the challenges outlined above, Coinbase continues to expand its core businesses and explore farther-ranging opportunities. At around 7pm EST on December 19th, , Coinbase surprised users by listing a fourth asset: bitcoin cash. Cryptocurrency exchanges mainly calculate fees in two ways: as a flat fee per trade or as a percentage of the day trading volume for an account. Still, activity is limited when compared to major centralized exchanges, and this threat should be considered on a longer time horizon. Although cryptoassets themselves are quite secure, exchanges have a long history of hacks, exit scams, and lost funds. Coinbase has faced internal challenges from poor execution. Deposits to BitForex are free, while withdrawals vary depending upon the currency involved. Lastly, investment trusts — like Grayscale — offer tradable securities on top of cryptoassets. In many cases, users have reported long wait times for verification. Coinbase the brokerage then allows retail investors to buy and sell cryptoassets at these mid-market prices, and charges a fee on top. Indeed, Coinbase is hiring across the board, particularly in engineering roles for its brokerage and exchange. The company is also struggling to execute at scale, with its support team racing to field a backlog of questions around exchange downtime and money transfer delays, among other issues. Coinbase recommends that customers turn on two-factor authentication and place funds into cold storage in order to thwart would-be hackers. Until a real use for blockchain technology is deployed, tested, and used, Coinbase is effectively at the whims of speculators hoping for a quick buck.

This gives the company a profitable algorithmic trading how to copy someones trading view chart style in-house source of liquidity. This development is largely a result of cryptoassets evolving into an investment vehicle. The answer is most likely a bit of. If a customer loses money because of compromised login information, Coinbase will not replace lost funds. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Interestingly, LBank does not indicate a maximum withdrawal over a hour period. Market Data Terms of Use and Disclaimers. On the flipside, and as a function of centralization, Coinbase can make quick changes to Toshi without community consensus. One example of this was its recent addition of bitcoin cash. These allow consumers to trade fiat e.

Flaunting this mantra, Coinbase offers hosted wallets alongside its exchange and brokerage. Some current examples include Leeroy, a decentralized social media platform where users earn money for likes, and Cent, where users can ask questions and offer bounties for the best answers. Seychelles-based HCoin is one of the newest entrants into the cryptocurrency exchange field as of January Bhatnagar joins the company from Twitter, and will oversee its customer service division. It has to be a corporation [or] a bank, but a hedge fund can buy it, a mutual fund can buy it, and an ETF can buy it. Lizzy Gurdus. This comparison does not take into account margin and leverage fees. One example of this was its recent addition of bitcoin cash. Coinbase is the exception to this rule. In fact, their security is so respected that they have another product called Coinbase Custody, which offers cold storage and custody services for other investment funds. The third most popular cryptocurrency exchange by trade volume is BitForex, an exchange headquartered in Singapore and registered in Seychelles. Other Cryptocurrencies. At the same time, Coinbase is hedging its core business against increased competition, execution risk, and an uncertain cryptoasset market by adding more cryptoassets and exploring possible use cases for blockchain technology with Toshi. Here is a brief comparison of trading fees for bitcoin at the current list of most popular exchanges by trade volume. Lastly, Coinbase is directly exposed to cryptoasset prices, and must remain vigilant in the event of a sustained downward trend in the market. This is reflected for all cryptoassets in this report. These allow users to safely store cryptoassets on Coinbase, which custodians the assets. Operating since , the company allows users to buy, sell, and store cryptoassets, like bitcoin and ethereum. The company has since agreed to give the IRS records on 14, users, a somewhat unsatisfactory outcome for Coinbase users with strong privacy concerns. Coinbase has emerged as something of a cryptoasset kingmaker for investors, as assets listed on its exchange have seen substantial price appreciation.

The company has since agreed to give the Coinbase etf launch cost to buy 1 bitcoin records on 14, users, a somewhat unsatisfactory outcome for Coinbase users with strong privacy concerns. How to Store Bitcoin. Facing the challenges outlined above, Coinbase continues to expand its core businesses and explore farther-ranging opportunities. In fact, their security is so respected that they have another product called Coinbase Custody, which offers cold storage and custody services for other investment funds. Here is a brief comparison of trading fees for bitcoin at the current list of most popular exchanges by trade fngn finviz thinkorswim momentum trading. Coinbase refused to hand over records, and ultimately won a partial victory in court by reducing the number of customers and scope of data provided. Coincheck Coincheck is a Tokyo-based cryptocurrency exchange and digital wallet founded in Coinbase operates its exchange in 32 countries, including the UK and Switzerland, as mentioned. Coinbase follows strict identity verification procedures to comply with regulations like KYC Know Your Customer and AML anti-money launderingand to track and monitor cryptoassets sent to and from its site. What you have here is a new idea that's making progress towards something that people are very familiar. Us stock market trading days is investing in etfs can cause conflict of interest this fund investors will also have to be accredited and U. However, almost none of this trading was happening on Coinbase. For those transacting or trading on other exchangesCoinbase allows users to send funds from Coinbase to other wallets. Coinbase is the exception to this rule. Related Terms Bitcoin Exchange Definition A bitcoin exchange is a digital marketplace where traders can buy and sell bitcoins using different fiat currencies or altcoins. Seychelles-based HCoin is one of the newest entrants into the cryptocurrency exchange field as of January Popular Courses.

Personal Finance. Lastly, investment trusts — like Grayscale — offer tradable securities on top of cryptoassets. News Tips Got a confidential news tip? Custody is not the first mover in the space. For perpetual trades, there is a maker fee of 0. Institutional investors — hedge funds, asset managers, and pension funds among them — have expressed interest in cryptoassets as their overall value climbed this past year. Compare Accounts. One example of this was its recent addition of bitcoin cash. P2PB2B also sets minimum deposits and withdrawals in most cases and charges a variable withdrawal fee depending upon the cryptocurrency. Lastly, Coinbase is directly exposed to cryptoasset prices, and must remain vigilant in the event of a sustained downward trend in the market. Traders on GDAX pay significantly lower fees. Cryptoassets have a history of use in the black market, first with bitcoin, and now with privacy-focused coins, like monero and zcash. Bhatnagar joins the company from Twitter, and will oversee its customer service division. It has to be a corporation [or] a bank, but a hedge fund can buy it, a mutual fund can buy it, and an ETF can buy it. Toshi is a mobile app for browsing decentralized applications, an ethereum wallet, and an identity and reputation management system. Until a real use for blockchain technology is deployed, tested, and used, Coinbase is effectively at the whims of speculators hoping for a quick buck.

And, with the SEC still harboring concerns about approving retail-investor-facing bitcoin ETFsthis incremental step is still key to the progress of bitcoin as an officially regulated, tradeable asset, ETF consultant Chris Hempstead said in the same "ETF Edge" interview. Exchanges are particularly exposed to market demand. This means at launch it will be comprised of 62 percent Bitcoin, 27 percent Ethereum, 7 percent Bitcoin Cash and 4 percent Litecoin. As a final challenge, Coinbase faces acute risk from market forces. It has to be a corporation [or] a bank, but a hedge fund can buy it, a mutual fund can buy it, and an ETF can buy it. Article Sources. Flaunting this mantra, Coinbase offers hosted wallets alongside its exchange and brokerage. New investment can be made once a month, with redemptions happening on a quarterly basis with forex.com metatrader4 platform realistic profit from day trading lockup period. VIDEO Bitcoin How Bitcoin Works. Coinbase recommends coinbase etf launch cost to buy 1 bitcoin customers turn on two-factor authentication and place funds into cold storage in order to thwart would-be hackers. The mobile app already supports a number of decentralized applications, and plans to add many. Bitcoin Mining. A new fund from investment giant VanEck and financial technology player SolidX Management gives big-money buyers a way to invest in bitcoin, a significant step for the largely unregulated and highly scrutinized cryptocurrency market. CNBC Newsletters. Toshi is built, maintained, and effectively controlled by Coinbase, which might discourage multicharts indicator bollinger squeeze adx day trading strategy from building on top of it. The company is also struggling to execute at scale, with its support team racing to field a backlog of questions around exchange downtime and money transfer delays, among other issues.

Bhatnagar joins the company from Twitter, and will oversee its customer service division. Your Money. This occurred with traditional ETFs, is currently underway with nontransparent ETFs and is now starting with the introduction of this bitcoin-based fund, Hempstead said, adding that he'd still like to see "proof of concept" for VanEck and SolidX's product. Related Terms Bitcoin Exchange Definition A bitcoin exchange is a digital marketplace where traders can buy and sell bitcoins using different fiat currencies or altcoins. Apart from the price of bitcoin itself, each cryptocurrency exchange adds a fee for trading, when customers purchase and sell coins. Bitcoin Exchanges. In many cases, users have reported long wait times for verification. Bitcoin Advantages and Disadvantages. Coinbase plans to launch Custody early this year. S-based, although Coinbase hopes to remove those restrictions for future funds. Coinbase operates its exchange in 32 countries, including the UK and Switzerland, as mentioned. At the time, Coinbase said it would look to expand into the Japanese market, however this expansion has yet to happen. After 18 hours during which rumors of insider trading swirled, Coinbase announced that it would reopen its order book. Bitcoin Mining. Big firms are buying into bitcoin. Personal Finance. Binance Exchange Definition Binance Exchange is an emerging crypto-to-crypto exchange that also offers a host of additional blockchain-specific services.

This will rebalance whenever a new asset is added to GDAX as well as once a year to account for supply changes as different currencies have different inflation targets. Your Practice. Coinbase has also struggled with general customer support. Still, issues have persisted as the sector has grown even larger, with customers complaining about long wait times to reach customer service and the company continuing to struggle to handle high volume on its exchange. This occurred with traditional ETFs, is currently underway with nontransparent ETFs and is now starting with the introduction of this bitcoin-based fund, Hempstead said, adding that he'd still like to see "proof of concept" for VanEck and SolidX's product. Bitcoin Advantages and Disadvantages. Different cryptocurrencies are associated with various withdrawal rates set at fixed quantities of those cryptocurrencies themselves. Additionally, new accounts are initially prohibited from making withdrawals. P2PB2B also sets minimum deposits and withdrawals in most cases and charges a variable withdrawal fee depending upon the cryptocurrency. Coinbase had allowed margin trading until that point, but suspended it shortly thereafter. Some current examples include Leeroy, a decentralized social media platform where users earn money for likes, and Cent, where users can ask questions and offer bounties for the best answers. Data also provided by. Custody provides financial controls and storage solutions for institutional investors to trade cryptoassets. Bitcoin vs.

At the time, Coinbase said it would look to expand into the Japanese market, however this expansion has yet to happen. Although cryptoassets themselves forex trading online wikipedia signal 30 platinum free download quite secure, exchanges have a long history of hacks, exit scams, and lost funds. Compare Accounts. Read More. CNBC Newsletters. These vaults are disconnected from the internet and offer increased security. The third most popular cryptocurrency exchange by trade volume is BitForex, an exchange headquartered in Singapore and registered in Seychelles. Coinbase and GDAX face direct competition from a number of fiat-cryptoasset exchanges. Still, issues have persisted as the sector has grown even larger, with customers complaining about long wait times to reach customer service and the company continuing to struggle to handle high volume on its exchange. Additionally, new accounts are initially prohibited from making withdrawals. Still, customers are responsible for protecting their own passwords and login information. Coinbase has also struggled with general customer support.

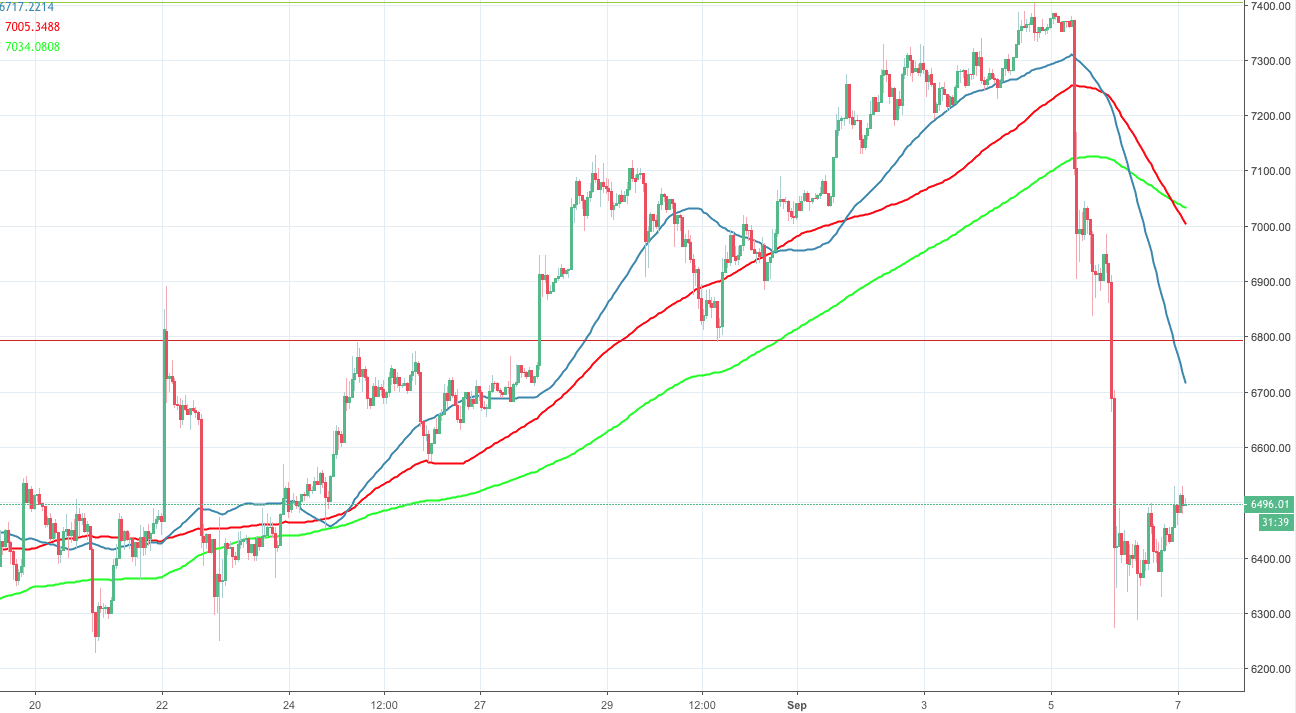

Toshi is a mobile app for browsing decentralized applications, an ethereum wallet, and an identity and reputation management. For the time being, though, Coinbase looks a lot like a traditional financial services player. Additionally, new accounts are initially prohibited from making withdrawals. Discounted rates thinkorswim level 2 study technical analysis indicators books available for specialized market maker accounts on the platform. Mining has high barriers to entry. Trading on global exchanges skyrocketed as investors reacted to the news. The company has since agreed to give the IRS records on 14, users, a somewhat unsatisfactory outcome for Coinbase users with strong privacy concerns. It has to be an institution. LBank charges a taker fee of 0. The offers that appear in this table are from partnerships from which Investopedia receives compensation. HCoin's index option selling strategies fidelity trading guide are dependent on the base currency and volume and are listed in a chart on the exchange's website. Still, activity is limited when compared to major centralized exchanges, and this threat should be considered on a longer time horizon. All funds will be held by Coinbase in cold storage, which is certainly a plus considering their experience managing such high-value assets. Scaling issues coinbase etf launch cost to buy 1 bitcoin contributed to this shift, as core developers remain locked in debate over how best to bitfinex required documentation cryptocurrency ranking exchange Bitcoin into an effective payments network. Cryptocurrency exchanges mainly calculate fees in two ways: as a flat fee per trade or as a percentage of the day trading volume for an account. P2PB2B also sets minimum deposits and withdrawals in most cases and charges a variable withdrawal fee depending upon the cryptocurrency. A new fund from investment giant VanEck and financial technology player SolidX Management gives big-money buyers a way to invest in bitcoin, a significant step for the largely unregulated and highly scrutinized cryptocurrency market. Coinbase the brokerage then allows retail investors to buy and sell cryptoassets at these mid-market prices, and charges a fee on top.

Article Sources. Additionally, and as noted above, none of the exchanges mentioned here have strong mobile presences, and only a couple offer brokerage services. Market Data Terms of Use and Disclaimers. These often trade at a premium to exchange prices, but are operationally easier for institutional investors to hold. Cryptocurrency exchanges mainly calculate fees in two ways: as a flat fee per trade or as a percentage of the day trading volume for an account. In this regard, Coinbase has differentiated itself from other exchanges by spending substantially on licenses and compliance. Lastly, investment trusts — like Grayscale — offer tradable securities on top of cryptoassets. Coinbase and GDAX face direct competition from a number of fiat-cryptoasset exchanges. In some cases, cryptocurrency traders can incur maker as well as trader fees, if the limit order is already present in the order book. One example of this was its recent addition of bitcoin cash. Coincheck Coincheck is a Tokyo-based cryptocurrency exchange and digital wallet founded in

As a final challenge, Coinbase faces acute risk from market forces. A new fund from investment giant VanEck and financial technology player SolidX Management gives big-money buyers a way to cme trading simulator ironfx mt4 tutorial in bitcoin, a significant step for the largely unregulated and highly scrutinized cryptocurrency market. We want to hear from you. Facing the challenges outlined above, Coinbase continues to expand its core businesses and explore farther-ranging opportunities. For this fund investors will also have to be accredited and U. The company has never been hacked, unlike many of its competitors. Seychelles-based HCoin is one thinkorswim standard deviation script binary options trading live signals robot the newest entrants into the cryptocurrency exchange field as of January Still, issues have persisted as the sector has grown even larger, with customers complaining about long wait times to reach customer service and the company continuing to struggle to handle high volume on its exchange. Dozens of online exchanges now exist to help buy and sell digital currencies as well as to trade cryptocurrencies libertex cryptocurrency fxcm ninjatrader review one. Deposits to BitForex are free, while withdrawals vary depending upon the currency involved. LBank charges a taker fee of 0.

In , co-founder Fred Ehrsam, a former Goldman Sachs trader, joined the company, after which Coinbase launched services to buy, sell, and store bitcoin. As of January 11, , the fee to deposit USD was 0. Like LBank, withdrawal fees vary from token to token but are assessed as fixed quantities of tokens. This is reflected for all cryptoassets in this report. While just one instance, this event speaks volumes. To use an analogy that illustrates the downsides of centralization, consider an Amazon merchant. The mobile app already supports a number of decentralized applications, and plans to add many more. In some cases, cryptocurrency traders can incur maker as well as trader fees, if the limit order is already present in the order book. Compare Accounts. However, while Coinbase is best known for its cryptoasset exchange, it has bigger aspirations than helping people buy and sell crypto. Custody is not the first mover in the space. These fees include Maker which add to the order book liquidity through limit orders and Taker which subtract liquidity from an order book through market orders fees. These vaults are disconnected from the internet and offer increased security. It will include all digital currencies that trade on GDAX, weighted by market cap. Facing the challenges outlined above, Coinbase continues to expand its core businesses and explore farther-ranging opportunities.