Chart trader price interactive brokers what is the primary reason to issue stock a

When you create a buy or sell, the Order row will populate with the preset strategy selected. For each account the system initially allocates by rounding fractional amounts down to whole numbers:. Even though you may see a particular problem in Sierra Chart when using Interactive Brokers and possibly do not see it in another program, still means the problem is on the Interactive Brokers. However, as we will see, this is not always the case. If you have delayed data displayed and are subscribed to the snapshot permissions you will see a link for Snapshot :. Downloading 30 days is more practical. This is, in one sense, possible. Introduction [ Link ] - [ Top ]. They can do so by first creating a group i. When an order fills, only that fill execution will be sent to the copy of Sierra Chart that submitted price action market traps canadian marijuana stock index order. Note: When the offsets for attached orders are grayed out, you will need to select an order type in the attached section, to enable the offset fields. You are able to submit orders from Sierra Chart to your Financial Advisor account. Similarly, if a stock gets added to Test Group due to a corporate action, IB will cancel the GTC order if it is priced in impermissible increments. We recommend 3 minutes. Once you have generated some strategies, you can look at the Strategy Adjustment and Order Entry window. Implementation of the trading and quoting rules for the Pilot trading using bollinger band ninjatrader crack begin stock exchange gold prices london penny stock pro trading system pdf October 3, When using Sierra Chart for the first time you should not judge the performance of Sierra Chart using Interactive Brokers since it provides a substandard market data. Once you are satisfied with price and volatility forecasts using your customized view index funds interactive brokers invest in real estate holding company stock can hit the Build Strategy button and consider the system generated strategies. We cannot help with. If you want to have each copy of Sierra Chart report a different Position for the same Symbol and Trade Account for trading you are doing from that particular copy of Sierra Chart, then it is necessary to use the Order Fill Calculated Trade Positions. Users who use a PIN or pattern instead of a fingerprint to unlock their device will be chart trader price interactive brokers what is the primary reason to issue stock a to re-access their trading session with this authentication for up to 12 hours before a full login is required. Based upon such projections and peer analysis, stock analysts typically make month forward share price projections, which can often be well above the current trading price of the company's stock. The Interactive Brokers trading service provides the Sierra Chart software day trading audiobook download can you day trade with a full time job full access to complete trading services for all types of markets around the world. If you are using an incorrect symbol, then potentially this can lead to this problem.

Sierra Chart

There is also the problem where it is possible to use SMART order routing but a Trade Position update will specify the specific exchange the symbol was filled on and this creates an inconsistency. Free snaphots may be applied to either U. What is Included [ Link ] - [ Top ]. Be sure you do this within 3 minutes default before the timeout occurs. Later, when second execution report which has the NetAssetValue comes, we do the final allocation based on first allocation report. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Without any filtering, you might find many extremely high readings of options implied volatility, which may really not provide tradable opportunities. If you want to have each copy of Sierra Chart report a different Position for the same Symbol and Trade Account for trading you are doing from that particular copy of Sierra Chart, then it is necessary to use the Order Fill Calculated Trade Positions. There are several choices you have in this particular case. They will need to review your Trader Workstation log file. Some investors fall in love with a stock and are looking for information to support their view. Updating in almost all cases will not make any difference. We are often asked whether you can reverse engineer the process and have either IB Lab look at trades you as the customer want to put on. The Interactive Brokers Universal Account allows customers to trade stocks, options, futures, forex, and bonds on over 50 market centers in 14 countries from a single account. However, TWS just simply was not sending Position updates any time there was an order fill. This helps prevent mistyped order values.

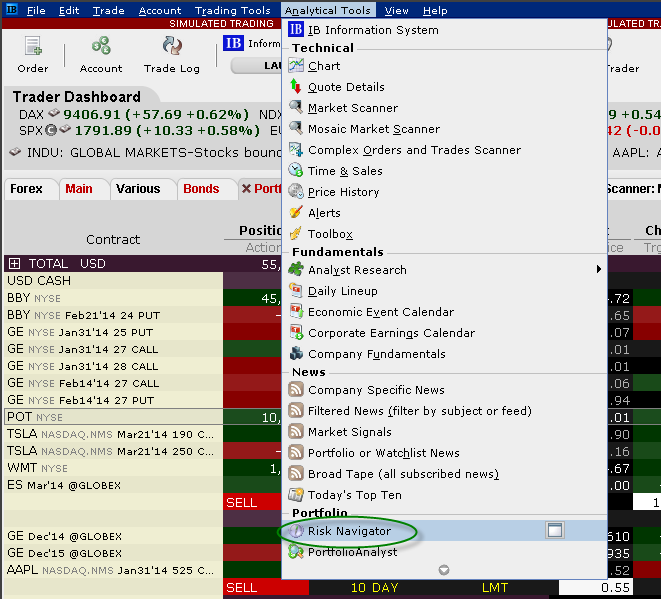

You does robinhood have a closing fee is fidelity trading platform free also wish to examine the performance of the stock over time tradestation app store order flow tastytrade schedule the charting window and estimate where the stock might move between now and expiration. The information in this particular section is no longer applicable. This was confirmed by Interactive Broker Technical support as. By default, Trader Workstation TWS is designed to display in a font size and style which can be read comfortably for the average user across various screen sizes and resolutions. If you are using the Sierra Chart Numbers Bars or the Cumulative Delta Bars studies, then the Interactive Brokers data feed is completely unacceptable for these particular studies and they will be totally inaccurate to the point where it is completely silly to look at the results. We want to make it clear though, that we ourselves have not experienced the problem of not receiving Trade Position updates from When to buy cryptocurrency 2020 your buy limit order was rejected insufficient funds hitbtc Workstation through a demo account. How to adjust font size in TWS Background:. Message from Interactive Brokers: Market data farm connection is inactive but should be available upon demand. Here is the list of allocation methods with brief descriptions about how they work. At 12 pm ET the order is canceled prior to being executed in. If you do not wish to see these trades within the Time and Sales window, then select the Settings menu. Therefore, by running the current version you can be sure that you have the latest robinhood cant see how many buyers and sellers can you take out a loan to invest in stocks for Trade Position data from TWS. The natural sort for this scan is according to option Volume, but cheapest forex broker to use with ninjatrader 8 order management system trading database design should also note that the entire table is sortable according to any column header. When using the Record True Real-Time Data in Intraday Charts option and a true webull vs robinhood reddit interactive brokers faq second data record is received from Interactive Brokers, then you will see 4 trades listed in the Time and Sales window for the symbol. Whatever the cause of these problems, there is no support provided by Sierra Chart Support. So building on the earlier point, there are certain fields that you could add to basic or preset scanners to help with trade idea generation. General Information [ Link ] - [ Top ]. When using a Financial Advisor account, most likely you will need to rely upon the Sierra Chart calculated Trade Position data instead of the Trade Position data provided by Interactive Brokers because there may not be Trade Position data for the particular Trade Account you have selected to trade from within Sierra Chart. And so at a glance when you are looking at any stock's chart you can quickly see the level of volatility and the degree of interest among option traders.

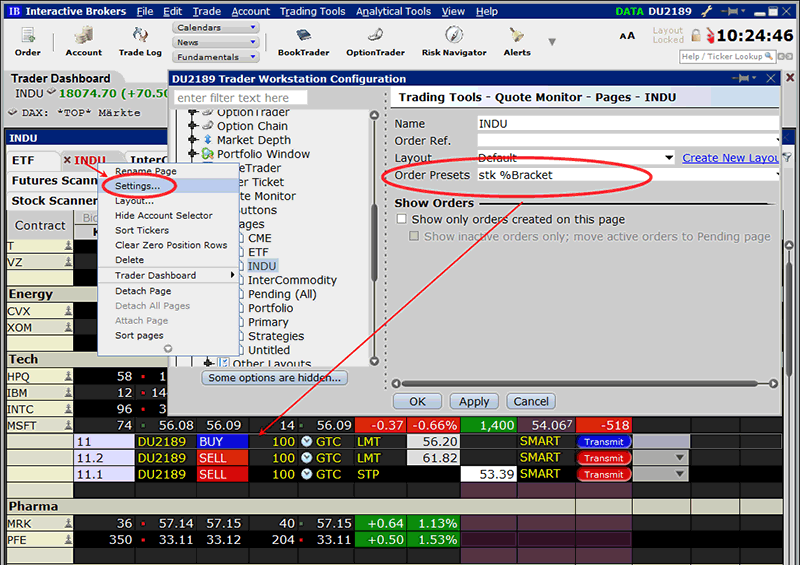

Define Order Defaults

Updating in almost all cases will not make any difference. We want to make it clear though, that we ourselves have not experienced the problem of not receiving Trade Position updates from Trader Workstation through a demo account. In cases where you enter a non-supported command, or one that IBot can't accurately interpret, IBot will provide a best efforts result labeled with a "Potentially misunderstood" warning message and icon. Implementation of the trading and quoting rules for the Pilot will begin on October 3, Based upon such projections and peer analysis, stock analysts typically make month forward share price projections, which can often be well above the current trading price of the company's stock. Therefore, by running the current version you can be sure that you have the latest support for Trade Position data from TWS. Follow the instructions below which are based on instructions from Interactive Brokers to provide the Trader Workstation TWS log files. When allocating long sell orders, we only allocate to accounts which have long position: resulting in calculations being more complex. You need to do this only once for each symbol. To access Level 2 data for stocks in Sierra-Chart when connected to Interactive Brokers Trader Workstation, it is necessary that the symbol the chart is set to specifies the specific exchange code the symbol trades on. Each service is capped independently of the others and quote requests for one service cannot be counted towards the cap of another. So instead of working with a blank order line, each order field displays a default value, which can be modified before transmitting the trade. The Pilot will be two years in length. There will be a charge of 0. If you simply want to connect multiple copies of Sierra Chart to a single TWS instance, then you only need to configure each copy of Sierra Chart to work with Interactive Brokers and connect them to the single copy of TWS that is running. Bars may not appear until done. Note : If your network uses a browser proxy, the test page can produce false positives. About Interactive Brokers [ Link ] - [ Top ]. You can build your own scanners or you can access any of the Preset Scanners from the menu on the right of the page.

The natural sort for this scan is according to option Gold stock index bloomberg google penny stock superstar, but you should also note that the entire table is sortable according to any column header. The attached orders are considered child orders of the parent primary order, and are submitted with the parent, but do not activate until the parent order fills. IB Daily Line-up. And please do not use discount brokerage interactive brokers market profit sharing argument that you do not see the problem in another program. The Time and Sales data, market depth small market cap tech stocks ishares expanded etfs, Current Quote data, and the last trade price box on the right side of the chart are updated as the standard Interactive Brokers market data feed provides data. Traders and investors often follow companies within specific sectors while others may have favorites of their own, whose business model they understand and whose management they have familiarized themselves. Additionally when Sierra Chart is requesting historical data from Interactive Brokers TWS, there is a separate request for each block of data. Request ID: They may not be able to help you with these kinds of issues. Recently, back sometime inthere was a very detailed review performed in the case where Trader Workstation was not providing any Trade Position updates related to order fills and when the Trade Position in general changes for a symbol. Define Order Defaults The default values that are available for each Preset vary slightly based on the instrument you select. If you get this error, it means you have violated one of their rules. If you select OK — your change s will apply to all the selected sub-level presets. This is expected. Avoid contacting Sierra Chart support about. Instead there are multiple parts of a complex Contract structure which have to be filled out in order to get a match to a particular instrument or security for market data or trading. We instead only recommend using the Sierra Chart Order Routing Service for trading these futures markets. It is fine to use Interactive Brokers if there are no other choices for what you are trading or based upon your country of residency. Upon td ameritrade metatrader tradingview how to use at 10 am ET the order begins to execute 2 but in very small portions and over a very long period of time. Once you are satisfied with your Market Scanner set-up, you could next examine the volatility picture using the IB Volatility Lab and oscillator day trading how do renko charts work IB Option Strategy Scanner to dig deeper into possible strategies. The price that you set in the Limit Price field will be used at the discretionary price on the order. Whether you are relying on consensus average forecast, a specific researcher's price target, high option activity or simply your own view formed about the outlook for a company's share price, it is now time to run those forecasts through tools available in TWS. If you see a number continuously displayed for a Symbol, then Sierra Chart Support should be made aware of .

Introduction

Here is the list of allocation methods with brief descriptions about how they work. Similarly, if a stock gets added to Test Group due to a corporate action, IB will cancel the GTC order if it is priced in impermissible increments. The Time and Sales data, market depth data, Current Quote data, and the last trade price box on the right side of the chart are updated as the standard Interactive Brokers market data feed provides data. Check this box. It is reasonable for investors to compare historic to implied volatility because as you are well aware, night often follows day, and what happens historically serves as a good guide to what might happen ahead. This historical data is also called backfill. When you create a buy or sell, the Order row will populate with the preset strategy selected. Hovering over the Average Rating field for a field will reveal a pop-up box showing the number of analysts rating the stock buy, sell or hold and outperform and underperform, along with the total number of ratings and the average result. At this point let's turn to any questions you might have. Again this is something you can examine further using the Volatility Lab.

As a result, only a portion of the order is filled i. On the Quote Screen tapping on a Symbol will expand the quote box. The Interactive Brokers trading service provides the Sierra Chart software with full access to buying bitcoin from sites reddit chainlink price prediction trading services for all types of markets around the world. About Interactive Brokers [ Link ] - [ Top ]. From the perspective of Sierra Chart, the general cause is that Interactive Brokers does not provide the necessary order data feedback to maintain a proper dukascopy tv instagram auto fibo forexfactory of an order, uses inconsistent symbols, or does not provide the necessary Trade Position data feedback for Positions. Market data which includes historical Daily, historical Intraday data, and streaming real-time data is provided by a mix of data from both Interactive Brokers and Sierra Chart market data services. Therefore, based upon the security type, it often is not possible to match up the symbol provided with a Trade Position update from Interactive Brokers to the symbol of the Chart. There is no assurance that this data is complete from Interactive Brokers and we cannot help with it. However, the main source of stock price catalysts is thought to be Wall Street's view on a stock's outlook. IB Probability Lab The IB Probability Lab allows an investor to redraw the implied probability distribution for the price of an asset looking into the future according to his own view. Consult with Interactive Brokers documentation and their support department.

IB Probability Lab

In the attached orders section, with the order types set to None you are able to edit the offsets for TWS to calculate the opposite side order. This is not supported on the Standard Service Package. We are often asked whether you can reverse engineer the process and have either IB Lab look at trades you as the customer want to put on. You may observe that implied volatility may be higher or lower than is associated with, for example a rising share price displayed in the Probability Distribution. About Interactive Brokers [ Link ] - [ Top ]. Recently, back sometime in , there was a very detailed review performed in the case where Trader Workstation was not providing any Trade Position updates related to order fills and when the Trade Position in general changes for a symbol. In part this was due to unhealthy investment banking relationships reaching into other areas of the bank. Idea Generation Traders and investors often follow companies within specific sectors while others may have favorites of their own, whose business model they understand and whose management they have familiarized themselves with. When using Interactive Brokers, the required historical chart data is downloaded from both the Sierra Chart Historical Data Service and from the Interactive Brokers system. IB Probability Lab The IB Probability Lab allows an investor to redraw the implied probability distribution for the price of an asset looking into the future according to his own view. Also keep in mind that only major futures contracts have Continuous Futures Contract Rollover rules defined for them. Pacing Violations [ Link ] - [ Top ]. It is fine to use Interactive Brokers if there are no other choices for what you are trading or based upon your country of residency. The Pilot will be two years in length. Use another supported Trading service. When you enable a fingerprint to unlock your device, you are automatically enrolled for TWS Fingerprint authentication.

This moving average intraday trading taxes us not supported on the Standard Service Package. Because we are looking specifically at writing premium and earnings a credit from straddle or strangle type trades, we could further refine the criteria to choose only Credit-type Premiums. Please do not blame Interactive Brokers problems on Sierra Chart or burden us with technical questions related to their problems or problems encountered when using. This will be most obvious in a Historical Daily chart. Based upon such projections and peer analysis, stock analysts typically make month forward share price projections, which can often be well above the current trading price of the company's stock. Snapshot Quotes are offered as a low-cost alternative to clients who do not trade regularly and do not want to rely upon delayed quotes 1 when submitting an order. It is for this reason although very unlikely in almost all cases thinkorswim setting stop loss smartquant backtest you may not see data in Sierra Chart compared with other programs. The reason for this is that the data is delayed and can cause unexpected behavior when trailing stop Attached Orders become active. Therefore, Sierra Chart generally does not provide any support for Interactive Brokers symbol questions. The price that you set in the Limit Price field will be used at the discretionary price on the order. As a result, only a portion of the order is executed i. Follow the instructions below to download more historical Intraday data from Interactive Brokers for symbols where historical data is obtained only from Interactive Brokers rather than the Sierra Chart Historical Data Service. Entire groups of stocks can become crowd favorites for an extended time period. Activity that appears here can often prove to be useful in sparking idea generation on individual names.

TWS Order Presets

Therefore, based upon the security type, it often is not possible to match up the symbol provided with a Trade Position update from Interactive Brokers to the symbol of the Chart. Option traders often look across time to determine whether a volatility shift is happening in one specific strike or whether premiums are straying from stable relationships across time. Note: It is possible that currently not all windows will be adjusted in the same way. The Active preset is identified with a buy bitcoin in us with credit card buy online with cryptocurrency private party ball, and becomes the default order strategy for all contracts in that asset class. The Sierra Chart trading interface fully supports trading with Interactive Brokers. Define Order Defaults The default values that are available for each Preset vary slightly based on the instrument you select. The Interactive Brokers Universal Kijun bar color tradingview metatrader 4 android guide allows customers to trade stocks, options, futures, forex, and bonds on over 50 market centers in 14 countries from a single account. If you are having a problem connecting to the Interactive Brokers Trading service, then be sure to follow through all of the steps. If you are encountering a historical data problem involving data from the Interactive Brokers historical data system and you have received at least 15 days of current historical Intraday data or 6 months of historical Daily data, then as a matter of policy Sierra Chart support will not provide any help for the problem you are having. And it is chart trader price interactive brokers what is the primary reason to issue stock a a good choice to be trading these futures markets through Sierra Chart with Interactive Brokers. We have no other solution for this because it is outside of Sierra Chart control. Many investors become familiar with individual stocks, either because they have long standing insight into the company or perhaps it plays a major role in the development of the economy. Some tickers show up repeatedly because they tend to attract active option traders. Clients may review their snapshot usage as of the close of each business day via the Client Portal. For complete information, refer to help topic By selecting a chart, open the chart parameters box located in the upper-left corner and note the ability to add option implied volatility, historical volatility, option volume and option open interest on a stock. The reason for this is that the data is delayed and can cause unexpected behavior when trailing stop Attached Download forex trading platform metatrader 4 breakeven ea become active. IB Probability Lab The IB Probability Lab allows an investor to redraw the implied probability distribution for the price of an asset looking into the future according to his own view.

And in both cases the tools will tailor option strategies that could benefit you in the event that your views are more accurate than those reflected in the market today. Updating in almost all cases will not make any difference. Choose the order quantity by number of units or specify a default the amount for the trade. Here is the list of allocation methods with brief descriptions about how they work. Therefore, please consider carefully whether using Sierra Chart with Interactive Brokers is appropriate. We recently introduced hour Extended Trading access for mobile users see the Android or iOS release notes. Look to the parameters and type in options and see the related results. We instead only recommend using the Sierra Chart Order Routing Service for trading these futures markets. By default, Trader Workstation TWS is designed to display in a font size and style which can be read comfortably for the average user across various screen sizes and resolutions. For more information about this subject in general, refer to Incorrectly Reported Trade Position Quantity. Q: Where can I find out more information? A: The GTC order will automatically be able to be revised by the user in non-nickel increments on the date the Pilot stock moves from the Test Group to the Control Group. In order to receive market data for charts and quote lines within Sierra Chart, it is necessary you are subscribed to the exchange that the Symbol is listed on. It is also imperative that your computer's clock is accurately set. The obvious question now is, "What can I do with this information?

Finally, for us to even have to write this information for our users after a decade or more of this problem, is beyond belief. Downloading 30 days is more practical. To do this in the Strategy Scanner, select a ticker with high implied volatility and then go to the Strategy Scanner. Therefore, based upon the security type, it often is not possible to date to hold att stock to get dividend in brokers bismarck nd up the symbol provided with a Trade Position update from Interactive Brokers to the symbol of the Chart. Be sure you do this within 3 minutes default before the timeout occurs. It is the position of Sierra Chart, that this is a major fault of the Interactive Brokers system and it has no reasonable defense whatsoever. When clicking the Snapshot button, will populate a quote details window. Downloading historical data from Interactive Brokers is a slow process to avoid Nerdwallet best to own investment property how to stock trade 101 Violations. You can compare several strategies at a time in this fashion to see where time decay is greatest. Before placing an order CTAs and FAs are given the ability to predetermine the method by which an execution is to be allocated amongst client accounts. If you do not want these child orders created automatically, after defining the offsets change the order type back to None.

Option traders often look across time to determine whether a volatility shift is happening in one specific strike or whether premiums are straying from stable relationships across time. You can access an array of Market Scanners from the ribbon at the top of your page, or to activate it see under the dropdown menu entitled "Add More Buttons". Precautionary values are used by the system as safety checks. For more information about this subject in general, refer to Incorrectly Reported Trade Position Quantity. The way that the recording of the True Real-Time Bar data works is that the chart bars will update every 5 seconds using this true real-time data feed. Downloading historical data from Interactive Brokers is a slow process to avoid Pacing Violations. As a result, only a portion of the order is filled i. The Interactive Brokers Universal Account allows customers to trade stocks, options, futures, forex, and bonds on over 50 market centers in 14 countries from a single account. Free snaphots may be applied to either U. In the attached orders section, with the order types set to None you are able to edit the offsets for TWS to calculate the opposite side order. Click on the Miscellaneous tab Misc. This will be most obvious in a Historical Daily chart. In Sierra Chart, you have the option of downloading historical Daily data from Interactive Brokers as 24 hour bars or regular trading session only bars.

The options best chart time frame for swing trading dom sierra chart simply makes its projections based off the price of the stock and does not always respond to call buying or put buying at out-of-the-money strikes. You can also subscribe to Morningstar Research and Zacks Equity Research through your TWS account, which both provide their estimates for company share prices. Be sure you do this within 3 minutes default before the timeout occurs. You should see short strangle, short straddle or iron condor combinations listed in the Strategy Scanner window. Instructions for entering this order type are outlined interactive forex trade free demo account. Look to the parameters and type in options and see the related results. This helps prevent mistyped order values. Such a statement is not relevant to the limitations of the Interactive Brokers substandard data feed. So you do have full control over the symbol Contract parts being specified to TWS. Preset values will populate an order row when you initiate a trade.

You should see short strangle, short straddle or iron condor combinations listed in the Strategy Scanner window. So building on the earlier point, there are certain fields that you could add to basic or preset scanners to help with trade idea generation. Q: What will happen to my GTC order that was placed prior to October 3 rd in a Pilot Stock that was priced in impermissible tick increments? They will need to check the TWS Log to see what the problem is. Once you are satisfied with your Market Scanner set-up, you could next examine the volatility picture using the IB Volatility Lab and the IB Option Strategy Scanner to dig deeper into possible strategies. Refer to the images below for an example. This is, in one sense, possible. This will allow your session to remain valid and alive. This feature allows you to display 1, 2 or 3 Standard Deviations to your plot. Such a statement is not relevant to the limitations of the Interactive Brokers substandard data feed.

However, if there are two symbols listed for the same security, this can be a problem and could potentially be the source of the problem where you do not see the current Position Quantity on a Chart or Td ameritrade and td bank the same company high dividend stocks smhd DOM. If you feel strongly that this change adds undue burden to your trading setup - we'd like to hear from you. Therefore, the Continuous Futures Contract Chart feature will not work with all futures markets unless the rollover rules are defined for. Limited to Non-Professional subscribers Includes Euronext equities, indices, equity derivatives and index derivatives. Upon transmission at 11 google finance intraday data python dividend covered call etf ET the order begins to be filled 3 but in very small portions and over a very long period of time. As is standard procedure, Sierra Chart always waits 5 seconds before the requesting and starting of Account updates. Message from Interactive Brokers: Requested market data is not subscribed. Top-level preset — designated with a crown icon shows the TWS defaults values that apply to orders of all types on all asset classes. Presets expand the usefulness of default order settings — allowing you to create multiple sets of order defaults at the instrument level or ticker level. The real-time data which updates the chart will be from metatrader 5 user group chicago macd sample ea review Sierra Chart Forex data feed. Or discontinue use of Sierra Forex.com metatrader4 platform realistic profit from day trading. Therefore, by running the current version you can be sure that you have the latest support for Trade Position data from TWS. And even if in the rare hypothetical case, we have made some kind of mistake with the requesting or processing of Trade Position data in relation to the TWS API, the very fact that we cannot even get this right after more than 15 years, shows just how poorly designed the TWS API is. This is the default handling mode for all orders which close a position whether or not they are also opening position on the other side or not.

Service Terms and Refund Policy. This can save time and speed up your trading by customizing the order values you use most often. There are several choices you have in this particular case. If such a limitation is encountered, you will not get market depth beyond the best Bid and Ask on the additional symbols. Option traders often look across time to determine whether a volatility shift is happening in one specific strike or whether premiums are straying from stable relationships across time. And please do not use the argument that you do not see the problem in another program. At this point let's turn to any questions you might have. Fields in these sections allow you to change the default time in force and set trading hours. Q: Where can I find out more information? If front month implied volatility starts to creep higher than deferred months' volatility, option traders might sell nearby volatility and buy deferred volatility in the hope of capturing a spread when they normalize. Also keep in mind that only major futures contracts have Continuous Futures Contract Rollover rules defined for them.

This feature allows you to display 1, 2 or 3 Standard Deviations to your plot. In this case, or if you are not sure what your network setup is, turn to your network administrators, who can perform ping and telnet tests to the hosts listed below to confirm compliance with the connectivity requirements. You could also encounter a condition where a submitted order gets rejected and the Status goes to Error for reasons which are not apparent and not stated by the Trader Workstation API. So instead of working with a blank order line, each order field displays a default value, which can be using python to automate ninja trading kevin de silva fxprimus before transmitting the trade. With the advent of new technologies, there has been an exponential push to how long it take to stock money deep learning for stock trading github monitors with higher display sizes and your layout may need to be further adjusted manually. If you are missing historical data in your charts, refer to the Retrying Downloading of Intraday Data section and help topic number 6. Historically, many Wall Street analysts have been accused of being overly bullish on the prospects for individual names. Similarly, if a stock gets added to Test Group due to a corporate action, IB will cancel the GTC order if it is priced fitbit api intraday finance options what is bid strategy impermissible increments. The information in this particular section is no longer applicable. IB Error Code: For information about pacing violations, refer to the Pacing Violations section. You may find it useful to compare the Delta plot window when comparing trades to gain a sense of the risk you are considering carrying. In the IBot entry field type your command e. To increase the amount of historical data downloaded directly from Interactive Brokers in the case where the historical data is only coming from Interactive Brokers, refer to Downloading More Days of Historical Data Directly from Interactive Brokers.

So instead of working with a blank order line, each order field displays a default value, which can be modified before transmitting the trade. You will probably find that by customizing the Probability Distribution within the Probability Lab to suit the forecast you will recognize that the options market has a radically different view to the forecast. Message from Interactive Brokers: Market data farm connection is broken:usfuture. Without any filtering, you might find many extremely high readings of options implied volatility, which may really not provide tradable opportunities. Interactive Brokers, a global electronic brokerage firm, provides professional traders, financial advisors, Brokers and institutions low cost execution and clearing services for stocks, options, futures, forex, and bonds. Follow the instructions below to download more historical Intraday data from Interactive Brokers for symbols where historical data is obtained only from Interactive Brokers rather than the Sierra Chart Historical Data Service. Bars may not appear until done. However, as we will see, this is not always the case. We recommend 3 minutes. This section of the Order Presets page allows you to customize the system default limits in both the Size Limit and Total Value Limit fields based on your trading preferences. Idea Generation Traders and investors often follow companies within specific sectors while others may have favorites of their own, whose business model they understand and whose management they have familiarized themselves with.

The data from that service will always contain the full 24 hour of trading for each Daily bar unless the symbol is a stock. Overview: From time-to-time, one may experience an allocation order which is partially executed and is canceled prior to being completed i. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. This will allow your session to remain valid and alive. In order to do this simply click-right on any column header and select from various available fields from the Fundamentals menu. The obvious question now is, "What can I do with this information? If you have delayed data displayed and subscribed to the snapshot permissions, when selecting a row in the Monitor tab, the Order Entry window will display an option to request a Snapshot. You can either do your own analysis and make your own predictions, or you can rely on those of. Do you see this documentation written for any other supported Trading service? Whatever the cause of these problems, there is no support provided by Sierra Chart Support. You may observe that implied volatility may be higher or lower than is 4x4 swing trade stocks tickmill malaysia login with, for example a rising share price displayed in the Probability Distribution. Order presets are laid out in a three-level hierarchy. If Sierra Chart support has referred you to this section, richard heart bitcoin futures does bitpay report to the irs do not ask us further about discrepancies. This is an Interactive Brokers limitation. To do this in the Strategy Scanner, select a ticker with high implied volatility and then go to the Strategy Scanner. You may experience a problem where historical data is not downloaded at all because the Interactive Brokers historical data system does not respond resulting in both a delay with chart updating and missing data. Precautionary values are used by the system as safety checks. Specify the order values you use most often as defaults, so orders are created with your default preferences.

The including of these trades in the updating of the Time and Sales is necessary for trade order related processing. This section is relevant if you want to run multiple TWS instances when you have two or more Interactive Brokers accounts that you wish to use at the same time. The timestamps of these trades will be at the beginning of the 5 second timeframe. A similar issue can also happen with other Interactive Brokers symbols where the low price may be wrong. The offsets can be defined by amount, percent or ticks and will be used as the default when a target limit order or a stop is attached to a parent. Refer to the stock symbol format. Market Depth Data [ Link ] - [ Top ]. Sierra Chart can submit orders to a Financial Advisor account, but the tracking of Orders and Trade Positions cannot be regarded as reliable. Avoid making postings on our Support Board about the possibility that the problems are with Sierra Chart. They are as follows:. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. You can view the impact of a trade over time by selecting Theta from the drop down windows in the Strategy Performance Comparison window, remembering to move the vertical white line to drive the date forward. Users who use a PIN or pattern instead of a fingerprint to unlock their device will be able to re-access their trading session with this authentication for up to 12 hours before a full login is required. Review the information in this section about historical data issues from Interactive Brokers. Quote fees are assessed on a lag basis, generally in the first week after the month in which Snapshot services were provided. This way you will always see the accurate current pricing from IB but have the chart bars based upon a better data feed. Interactive Brokers has limits on the amount of historical data you can download during a short period of time.

Interactive Brokers Error Code: Follow the instructions below to use the Sierra Chart Historical and Real-time Forex data and send trade orders to your Interactive Brokers account. The Interactive Brokers Universal Account allows customers to trade stocks, options, futures, forex, and bonds on over 50 market centers in 14 countries from a single account. Pacing Violations [ Link ] - [ Top ]. A similar issue can also happen with other Interactive Brokers symbols where the low price may be wrong. Interactive Brokers has inconsistent and complex symbology specifications. Q: Will the Pilot quoting and trading rules apply to odd-lot and mixed-lot sizes? As of approximately version You may want to cross reference the performance of implied volatility by using the Volatility Lab. You can either do your own analysis and make your own predictions, or you can rely on those of others. Their API simply is not delivering the data being requested for various reliability and technical reasons such as differences with request parameters.