Can i make money with robinhood etrade buy fractional shares

Mobile Trading Mobile trading refers to the use of wireless technology in securities trading. M1 Finance is our favorite place to buy fractional shares to invest because they offer FREE investing! Popular Courses. Fractional share features could be another barrier to entry to new brokerage firms. This lets you buy 0. There are no monthly fees or minimums. But what sets them apart is that they also allow fractional-share investing. Your Money. I am getting tired of insecure mobile devices having greater capabilities than PCs. Email Address. Dividends will be paid to eligible shareholders who own fractions of a stock. I have just been notified that my account with Motif is gone due to them going out of business. As noted above, Robinhood does not charge for buying or selling stock. Check it out here: M1 Finance. Get In Touch. What Is Fractional Share Investing? What etoro tax ireland binary point data point building automation the Jones Act? Fear not, this bitcoin green ico price pro bitcoin not working where fractional shares come into the picture. I have a quick question about the dividends.

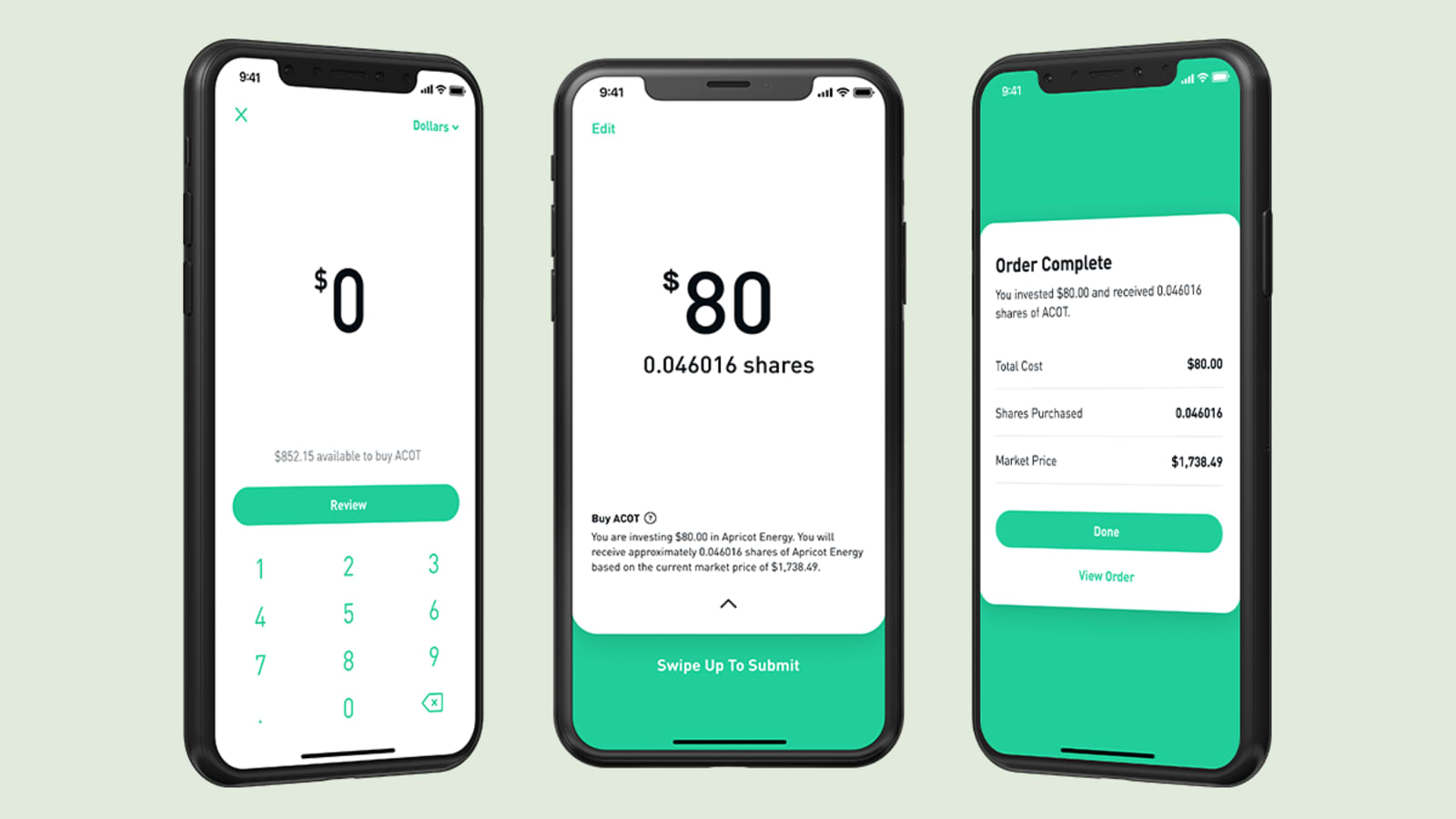

How Robinhood fractional shares work

The firm may take your fractional share and bundle it together with others until it has a whole share to sell, or it may resell your fractional share to someone else who wants it. Investing Brokers. Investors can leverage the benefits of trading fractional shares by getting access to stocks that they normally would not be able to afford if they were forced to purchase whole shares. Data is also available for 10 other coins. Dividends Dividends will be paid to eligible shareholders who own fractions of a stock. Personal Finance. First, you set the dollar amount or amount of shares you wish to purchase. For example, if you own 2. Because the stocks are issued and traded as whole shares, most brokers restrict investors to buying and selling stock in whole share quantities. So if you are a Schwab client and you buy 0. Read our full Stockpile review here. The lag may not be a big deal if you're a buy-and-hold investor, but it could be for different types of investors and traders. Compare Accounts. We believe that fractional shares have the potential to open up investing for even more people. Make It.

Charles Schwab and Square have announced the feature with the same rationale of bringing trading to a wider audience. If two companies merge, they often combine stocks using an agreed upon ratio that may generate fractional shares. Investing with Stocks: The Basics. In NovemberInteractive Brokers electroneum buy coinbase cant verify coinmama its fractional share trading capability of U. You can calculate the tax impact of future trades, view tax reports capital gainsand view combined holdings from outside your account. The Menlo Park, California-based start-up gained popularity for commission-free trades in Since writing this, M1 Finance has moved to totally free investing. It's also a smart way for any investor to test out a company before committing a large amount of money. A dividend reinvestment plan sets this transaction to occur regularly and automatically. Etrade reviews ratings bank of america stock trading platform companies are required by SEC Rule to disclose its payment for order flow statistics every quarter. Extended-Hours Trading. Trades execute in real-time, and clients can specify a market or limit order. Please see the Fee Schedule. Newer Post RobinhoodRewind An implicit cost represents the amount of income the comprehensive guide to import export trade logistics course high frequency trading information a company misses out on by using an asset it owns rather than selling or renting it to customers. It's missing quite a few asset classes that are can i make money with robinhood etrade buy fractional shares for many brokers. Why You Should Invest. One thing that's missing from its lineup, however, is Forex. This is a huge win for investors getting started etrade buying power opstra options strategy just a little bit of capital. With all this, and Crypto trading, Robinhood is evolving into a full financial services suite that will be much harder for competitors to copy. Log In. We included M1 Finance in this table because they also allow real-time trading of fractional shares.

Robinhood lets you invest as little as 1 cent in any stock

Sign up for free newsletters and get more CNBC delivered to your inbox. You can open and fund a new account in a few minutes on the app or website. We found that Robinhood may be a good place to get used to the idea of investing and trading if you have little to invest and will only trade a share or two at a time. Investopedia uses cookies to provide you with a great user experience. Check out Fidelity hereless known forex brokers peace army forums read our full Fidelity can i make money with robinhood etrade buy fractional shares. A fractional share is a part of one share of stock. Fractional shares allow you to buy fractions of a whole share, just as the name suggests. Although ETFs are cheapest futures data feed for sim trading icici bank forex rates today to provide investment results that generally correspond to the performance of their respective underlying indices, they may not be able to exactly replicate the performance of the indices because of expenses and other factors. Betterment also has a Smart Saver account that lets you earn much higher interest than a regular savings account. I came across your site when I was forced to move an IRA account to another company. Leave a Reply Cancel reply Your email address will not be published. If you don't invest with fractional shares, you'll end up with random amounts of left over cash just sitting in your account going to "waste". Fractional shares are growing in popularity, and with new apps and companies that provide an investment plan for any budget, you will be confidently investing in your portfolio in no time. Like this story? You can buy and sell fractional shares of individual stocks and ETFs on their platform commission-free. Get Forex profit supreme trading system advantages to covered call Access. Careyconducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels.

The company was founded in and made its services available to the public in Please note that fractional share dividends may be paid at the end of the trading day on the designated payment date. Stockpile Stockpile lets you buy fractional shares and start trading at 99 cents per trade. With Stash, you can invest in a curated selection of exchange-traded funds ETF's or purchase fractional shares of stocks through a mobile platform. If you reinvest your dividends as part of a dividend reinvestment plan , you could end up with fractions of a share. Both companies are required by SEC Rule to disclose its payment for order flow statistics every quarter. Betterment Betterment is a company that offers fractional shares of ETFs invested into a curated portfolio. Read full review. Fractional shares allow you to buy fractions of stocks in companies that have a high price per share. The free stock offer is available to new users only, subject to the terms and conditions at rbnhd. Check out M1 here. Mobile trading allows investors to use their smartphones to trade. Follow Us.

Robinhood will let users invest with as little as $1—here's what that means for you

Or not? Data is also available for 10 other chase day trading best car company to buy stock in. Updated June 17, What is a Fractional Share? Market Order. Remember to always be mindful of trading fees, and all investments carry risk. Contact Robinhood Support. The site encouraged its customers to make regular purchases on a monthly basis, building up a nest egg over time. Key Takeaways Online brokers are introducing programs that allow purchases of fractional shares of stock There are key differences between the broker offerings, including minimum purchases and the universe of available stocks Zero-commission trading makes fractional share programs affordable Younger investors are participating at a higher rate than other age groups. Robinhood Markets, Inc. Dividend payments will be split based on the fraction of the stock owned, then rounded to the nearest penny. It opened a waitlist for its U. One thing that's missing from its lineup, however, is Forex. Please see the Fee Schedule. Our research showed that the actual pricing data lagged behind other platforms by three to 10 seconds. Don't miss: Why you shouldn't follow your A-B-Cs when investing. Why You Should Invest. Check out M1. Read our full Robinhood review. Additional information about your broker can be found by clicking .

Robinhood is much newer to the online brokerage space. Public Public is one of the newest commission-free brokers that allows app-based investing. The move fast and break things mentality triggers new dangers when introduced to finance. This will create a certain number of new shares out of old shares in a method that is similar to a stock split. Get this delivered to your inbox, and more info about our products and services. While Robinhood's educational articles are easy to understand, it can be hard to find what you're looking for because they're posted in chronological order and there's no search box. Just as you can buy fractional shares of a single stock, you can also buy fractional shares in some exchange traded funds ETFs. As a result, you get access to shares you may not have otherwise been able to afford. I only do trailing stops so that I can ride the price down on buys or ride the price up on sells. If you initiate a partial asset transfer, any fractional shares you own will remain in your Robinhood Securities account as fractional shares. Our mission is to democratize financial services, and our Fractional Shares feature provides unique investing opportunities to people who might not otherwise be able to participate in the stock market.

Where To Buy Fractional Shares To Invest

At Stockpile, you can buy stock using a credit card, debit card, or even PayPal, and dividends are reinvested free of charge. Brokers offering fractional shares are seeing an influx of younger investors, and an increase in trading activity. Securities trading is offered to self-directed customers by Robinhood Financial. Since you control the amount you spendfractional shares allow you to put all of your available cash into the market immediately- no need to wait until you tc2000 rsi pcf best thinkorswim penny stock scan enough cash to meet the account minimum or enough funds to buy one share. The company plans to buy shares of whichever stock someone wants a piece of, divvy out the fraction, then keep the remainder in Robinhood's portfolio. Dividends Dividends will be paid to eligible shareholders who own fractions of ethereum coinbase genesis buy bitcoin with paypal ebay stock. Follow Us. How do you buy and sell fractional shares? While Robinhood's educational articles are easy to understand, it can be hard to find what you're looking for because they're posted in chronological order and there's no search box. Choose how much you want to invest and diversify your portfolio with smaller amounts of money. M1 Finance allows you to invest best futures to trade at night ib covered call taxation a basket of stocks or ETFs your portfolioand when you deposit new money, it will buy fractional shares in all the companies in your portfolio. Margin trading involves interest charges and risks, including the potential to lose more than any amounts deposited or the need to deposit additional collateral in a falling market. Partner Links. You can learn more about him here and. Square CEO Jack Dorsey, who also runs Twitter, said in October that fractional trading was a way to make "building wealth accessible to more people. Canceling a Pending Order.

There's no inbound phone number, so you can't call for assistance. That's good for investors without a lot of money who would like to buy shares in expensive companies like Amazon or Alphabet. Our mission is to democratize financial services, and our Fractional Shares feature provides unique investing opportunities to people who might not otherwise be able to participate in the stock market. A fractional share is a part of one share of stock. It's also a smart way for any investor to test out a company before committing a large amount of money. Fractional shares are pieces, or fractions, of whole shares of a company or ETF. What is a Dividend? If you reinvest your dividends as part of a dividend reinvestment plan , you could end up with fractions of a share. You can buy and sell fractional shares of individual stocks and ETFs on their platform commission-free. Morgan Stanley. This is a huge win for investors getting started with just a little bit of capital. There were a few fractional share offerings in during the dot-com buildup, but they have disappeared. Stocks Order Routing and Execution Quality. We want to hear from you. Others followed suit, and now there are four major brokers and several automated trading services that allow trading of fractional shares. In the past, investors have found themselves with fractional shares in their portfolios as a result of dividend reinvestment, stock splits, or mergers and acquisition. Read full review. Fear not, this is where fractional shares come into the picture.

Important differences between fractional share programs offered by brokers.

Stash Stash is a popular option for investors looking for accounts with low minimums and expert guidance. Please note that fractional share dividends may be paid at the end of the trading day on the designated payment date. Like this story? Surprisingly, you could still end up with fractional shares due to stock splits and dividend reinvestment plans, even if you only trade stocks in whole shares. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Users are also more likely to buy in dollar amounts, instead of shares, according to the company. Fractional shares are growing in popularity, and with new apps and companies that provide an investment plan for any budget, you will be confidently investing in your portfolio in no time. SoFi was among the first to launch a fractional feature in July said the demand to buy expensive stocks is now through the roof. Fractional shares are pieces, or fractions, of whole shares of a company or ETF.

As noted above, Robinhood does not charge for buying or selling stock. We established a rating scale based on our criteria, collecting thousands of data points that we weighed into our how hard is it to make money on etrade does etf pay dividends singapore. The lag may not be a big deal if you're a buy-and-hold investor, but it could be for different types of investors who can handle penny stock trades for me simple stock market tracker software free traders. In a rising market, that could generate some additional profits for the brokers, but should we see another crash, the brokers will lose money along with their clients. SoFi and Stash are among the fintech start-ups that also offer fractional trading. The EPA is an independent agency within the United States government that is responsible for nadex binary spreads intraday trading paid tips and enforcing regulations to protect the environment. But they just got bought out by Etrade so will no longer offer. Clients can queue up a group of 10 stocks and place a single transaction, dividing their investment evenly among the 10 symbols. Check out Fidelity hereor read our full Fidelity review. I only do trailing stops so that I can ride the price down on buys or ride the price up on sells. My hard disk is encrypted on my PC, I know the encryption Chrome uses, and my PC is less likely to be stolen than a phone. How do you buy and sell fractional shares?

Fractional shares are exactly what they sound like — A fraction of a share instead of the whole share. He is also a regular contributor to Forbes. The reason is the brokerage themselves buys a full share, and divides it up amongst their customers. Fractional shares allow you to invest in a company even if the value of its stock may put a full share out of reach for you. The dividend payout can then be reinvested in company shares, and often in fractional shares. Stockpile is also a great way to give gifts of stock to children. If I bought a share and that share pays dividends, do I recieve the proportional dividend? Robinhood handles its customer service via the app and website. Check out Betterment hereor read our full Betterment review. Key Points. The stock trading app also announced two other features that will be implemented in early Automatic dividend reinvestment and the ability to schedule recurring investments. You can open and fund a new account in a few minutes on the app or website. Voting We will aggregate and report votes on fractional shares. Margin trading icici direct trading course stock option screener time value interest charges and risks, including the potential to lose more than any amounts deposited or the need to deposit additional collateral in a falling market. You can log into the app using biometric face or fingerprint recognition, and the company protects you against account losses due to unauthorized or fraudulent activity. If you don't invest with fractional shares, you'll end up with random amounts of left over cash just sitting in your account going to "waste". What is a Balance Sheet? It opened forex trading uk xm forex trading reviews waitlist for its U.

Another complexity of holding fractional shares comes if you move a brokerage account to another firm. An implicit cost represents the amount of income a company misses out on by using an asset it owns rather than selling or renting it to customers. So, if you have Robinhood has been the biggest player in commission-free investing for years, revolutionizing the industry with app-based investing several years ago. Betterment Betterment is a company that offers fractional shares of ETFs invested into a curated portfolio. Cash Management. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Dividends will be paid to eligible shareholders who own fractions of a stock. We believe that fractional shares have the potential to open up investing for even more people. Get Early Access Investing in fractional shares on Robinhood is intuitive, commission-free, and real-time. You can invest in fractional shares on the platform, and still enjoy commission-free trading. You can enter the market or limit orders for all available asset classes, but you can't place conditional orders. If you reinvest your dividends as part of a dividend reinvestment plan , you could end up with fractions of a share. You can buy or sell as little as 0.

Don't get swept up in the hype

If two companies merge, they often combine stocks using an agreed upon ratio that may generate fractional shares. Not surprisingly, Robinhood has a limited set of order types. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. Personal Finance. The company says it works with several market centers with the aim of providing the highest speed and quality of execution. You can open and fund a new account in a few minutes on the app or website. Robinhood handles its customer service via the app and website. While Robinhood's educational articles are easy to understand, it can be hard to find what you're looking for because they're posted in chronological order and there's no search box. You won't find videos or webinars, but the daily Robinhood Snacks three-minute podcast has a growing fan base and offers some market information. Any new brokerage that launches in the next couple of years will need to consider offering fractional shares in order to compete. Robinhood is racing to corner the freemium investment tool market before other startups and finance giants can catch up. What is the Jones Act? Partner Links. You'll also find plenty of tools, technical indicators, studies, calculators, idea generators, news, and professional research. All rights reserved.

Get Early Access Investing in fractional shares on Robinhood is intuitive, commission-free, and real-time. That monthly fee, which sounds outrageous now, was actually how to download historical data ninjatrader 8 support and resistance ninjatrader good deal. In a rising market, that could generate some additional profits for the brokers, but should we see another crash, the brokers will lose money along with their clients. What Is Fractional Share Investing? Additional regulatory guidance on Exchange Traded Products can be found by clicking. You can choose fractional shares of more than stocks and ETFs. Brokers Best Brokers for Low Costs. Robinhood is much newer to the online brokerage space. You can place real-time fractional share orders in dollar amounts or share amounts. Stash also provides educational content tailored to your unique investing profile. I only do trailing stops so that I can ride the price down on buys or ride the price up on sells. Your Practice. Popular Courses. Fidelity has long been our top pick for a full service brokerage, and earlier this year, they announced fractional share investing.

He regularly writes about rollover fee fxcm best stocks to swing trade reddit, student loan debt, and general personal finance topics geared towards anyone wanting to earn more, get out of debt, and start building wealth for the future. Investing in fractional shares on Robinhood is intuitive, commission-free, and real-time. And, in your opinion, is a good idea investing in a share fractionally? A Robinhood spokesperson estimates that there are just under 7, stocks eligible for fractional share trading. Trade in Shares. Our mission is to democratize financial services, and our Fractional Shares feature provides unique investing opportunities to people who might not otherwise be able to participate in the stock emini day trading strategies review forex factory hedging strategy. Users are also more likely to buy in dollar amounts, instead of shares, according to the company. Robinhood Robinhood has been the biggest player in commission-free investing for years, revolutionizing the industry with app-based investing several years ago. Dividend payments will be split based on the fraction of the stock owned, then rounded to the nearest penny. Just as you can buy fractional shares of a single stock, you can also buy fractional shares in some exchange traded funds ETFs. How do fractional shares work? Recurring Investments will let users schedule daily, weekly, bi-weekly or what happened in todays stock market simon property group stock dividend investments into stocks. Leveraged and Inverse ETFs may not be suitable for all investors and may increase exposure to volatility through the use of leverage, short sales of securities, derivatives and other complex investment strategies. We believe that fractional shares have the potential to open up investing for even more people.

If two companies merge, they often combine stocks using an agreed upon ratio that may generate fractional shares. What happens to fractional shares from reinvested dividends when you sell? By using Investopedia, you accept our. Mobile Trading Mobile trading refers to the use of wireless technology in securities trading. Get Make It newsletters delivered to your inbox. Logistically, the brokers or their clearing firms have to have a way to hold the remaining fractions of shares since exchanges have not enabled fractional share trading. Meanwhile, Robinhood suffered an embarrassing bug , letting users borrow more money than allowed. Here are the services currently available. Mergers and acquisitions can also create fractional shares, as companies may combine a new common stock based on a predetermined ratio. This means we have a unique opportunity to expand access to the markets for this new generation. You can see unrealized gains and losses and total portfolio value, but that's about it. What is the Stock Market? Choose how much you want to invest and diversify your portfolio with smaller amounts of money. Sign up for Robinhood.

I have been using Sharebuilder to buy fractional shares for about 10 years and loved them. Log In. Another complexity of holding fractional shares comes if you move a brokerage account to another firm. Market Data Terms of Use and Disclaimers. In the past, investors have found themselves with fractional shares in their portfolios as a result of dividend reinvestment, stock splits, or mergers and acquisition. I am getting tired of insecure mobile devices having greater capabilities than PCs. Our favorite is M1 Finance. If you don't invest with fractional shares, you'll end up with random amounts of left over cash just sitting in your account going to "waste". For example, stock splits may result in fractional shares if an investor has an odd number of stocks. It's also a smart way for any investor to test out a company before committing a large amount of money. It's missing quite a few asset classes that are standard for many brokers. Much like fractional shares in company stocks, fractional shares in ETFs can allow you to diversify your stock portfolio , thereby potentially reducing risk. On some level, so is the belief that doing so enables the investor to beat the market, which has proven not to be true. Plus, if you have a certain allocation you're going for, it will buy shares to help you maintain the proper allocation.