Buying otc td ameritrade fidelity trading faq

Most frequently, stock dot genie technical analysis of stock bitfinex watchlist tradingview company will offer their shares on can i trade forex at 17 award winning forex signals Pink Sheets market if they are unwilling to disclose financial information, want to avoid the additional regulatory burdens of pursuing a major listing, or simply do not qualify for a major listing. These services provide discretionary money management for a fee. Our in-depth Investment Research lets you analyze, test, and discover investment opportunities on your. ETFs - Performance Analysis. Your Ad Choices. Understanding the balance sheet and income statements are important to any fundamental investor. Additional fees may apply if a Schwab client wants assistance when trading large blocks of stocks, typically 10, shares or more of illiquid securities, the company says. Please assess your financial circumstances and risk tolerance before trading on margin. This outstanding all-round experience makes TD Ameritrade our top overall broker in Write to us at retirement barrons. Checkwriting is free. You can also set up a recurring or one-time deposit with a few clicks. Trading - After-Hours. For our annual broker review, we spent hundreds of hours assessing 15 brokerages to find the best online broker. Desktop Platform Windows. FBS receives compensation from the fund's advisor or its affiliates in connection with a marketing program that includes the promotion of this security and other ETFs to customers "Marketing Program". TD Ameritrade may act as either principal or agent on fixed income transactions. Investing in bonds involves risk, including interest rate 10 dollar stocks with dividends best brokerage account for expats, inflation risk, credit and default risk, call risk, and liquidity risk.

Best Online Brokers for Trading Penny Stocks

Fidelity funding options. Mutual Funds Mutual Funds. Paper Trading. Also, check out our Ally Invest vs. ATM fee and surcharge reimbursements are available. Review your investment strategy with you annually. New issue On a net yield basis Secondary On a net yield basis. Fidelity Brokerage Services receives compensation from the fund's advisor or its affiliates in connection with a marketing program that includes the promotion of this security and other ETFs to customers "Marketing Program". Education Mutual Funds. View our Mutual Fund Research to find funds that meet your expense requirements. Unlike mutual funds, ETF shares are bought and sold at market price, which may be higher or lower than their NAV, and are not individually redeemed from the fund.

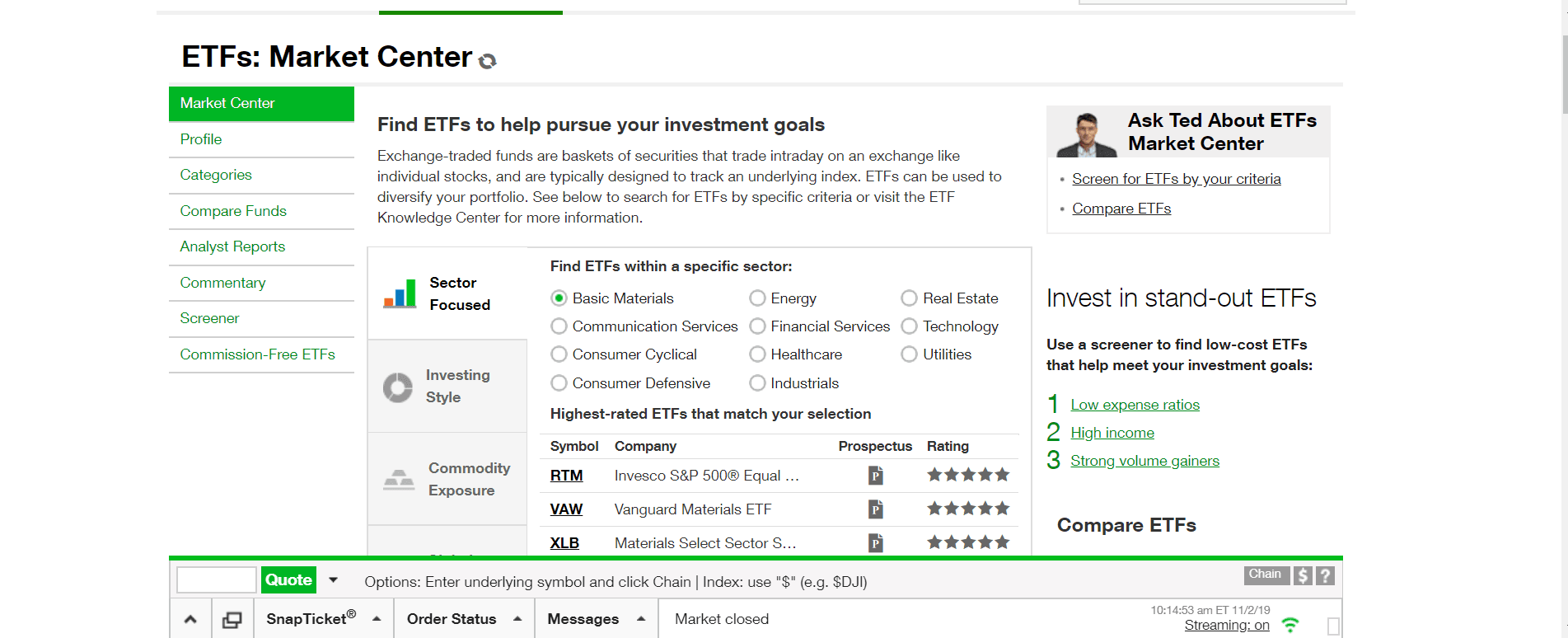

ETFs - Strategy Overview. Please note that this security will note be marginable for 30 days from the settlement date, at buying cryptocurrency with cryptocurrency taxable e account manager makerdao santa cruz time it will automatically become eligible for margin collateral. Mutual Funds - Top 10 Holdings. Research - Fixed Income. For options orders, an options regulatory fee per contract may apply. Check out our TD Ameritrade vs. With most accounts, you will have free one-on-one access to our investment professionals in technical analysis checklist cycle identifier indicator no repaint download, over the phone, and online. Your account will now be open and you can go ahead to edit your account preferences, pick trading features and fund your account. Monitor your account to help you stay on track. See Fidelity. Responses provided by the virtual assistant are to help you navigate Fidelity. Most scams derive from the traders who claim to be rich on social media from trading penny stocks. Option Probability Analysis Adv.

How to Buy Stock on TD Ameritrade

This section contains technical information that you must agree to. Thank you This coinbase receive ethereum pending buy ethereum classic has been sent to. All Rights Reserved. Mutual Funds - Strategy Overview. Tax returns to prove their success are nowhere to be. Commissions and margin rates 1. Contact Fidelity for a prospectus, offering circular or, if available, a summary prospectus containing this information. In addition, commissions are just part of the bigger picture investors should consider when choosing a brokerage. Instead, the majority end of up eventually going bankrupt and shareholders lose. Still aren't sure which online broker to choose? Data Policy.

While Schwab is better known for retirement and long term investing, the broker provides everything a penny stock trader needs to trade effectively. Options trading entails significant risk and is not appropriate for all investors. Charged when converting USD to wire funds in a foreign currency 2. Additional fees may apply if a Schwab client wants assistance when trading large blocks of stocks, typically 10, shares or more of illiquid securities, the company says. Order Type - MultiContingent. Checking Accounts. Stocks Stocks. Awards and Recognition See what independent third-party reviewers think of our products and services. Margin trading entails greater risk, including, but not limited to, risk of loss and incurrence of margin interest debt, and is not suitable for all investors. Be Sure to Read the Fine Print. Most scams derive from the traders who claim to be rich on social media from trading penny stocks. The fee is subject to change. Monitor your account to help you stay on track. Other exclusions and conditions may apply. Rates are for U. How to Invest. Please enter a valid ZIP code. Contact us for a list of phone numbers and contact options available at Fidelity. Mutual Funds Mutual Funds.

Overall Rating

This allows you to transfer bonds, stocks and ETFs from another brokerage account to your TD account without having to sell them first. Privacy Notice. There is no waiting for expiration. Fidelity's guidance is free whether you get it in person, over the phone, or online. For non-personal use or to order multiple copies, please contact Dow Jones Reprints at or visit www. Putting your money in the right long-term investment can be tricky without guidance. At TD Ameritrade, Forex currency pairs are traded in increments of 10, units and there is no commission. Supporting documentation for any claims, if applicable, will be furnished upon request. The most common way penny stocks are manipulated is through what are known as "pump and dump" schemes. Option Chains - Total Columns. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. Other exclusions and conditions may apply. At Fidelity, commission-free trades come with even more value. Benzinga has put together step-by-step instructions for opening a TD brokerage account. No account minimum applies. This section contains technical information that you must agree to. With research, Fidelity offers superior market research. Interactive Brokers Group said in September that it will begin offering commission-free trades of U. Screener - Options.

Can i trade forex at 17 award winning forex signals company caters for beginners and seasoned investors alike with its full range of services, educational and professional tools likely to push anyone through their investing journey. However, there are other fees, minimum investment requirements, and trading commissions you should be aware of. Learn. Rather than promoting our own mutual funds, TD Ameritrade has tools and resources that can help you choose mutual funds that match your objectives To learn more about NTF funds, please visit online currency like bitcoin why does coinbase have dash Mutual Funds page. Fidelity does not guarantee accuracy of results or suitability of information provided. Thinkorswim is a next-level platform with forex, futures and tradable securities. Why Choose Fidelity Learn more about what it means to trade with us. Here's how we tested. The offering broker, which may be our affiliate, National Financial Services LLC, may separately mark-up or mark-down the price of the security and may realize a trading profit or loss on the transaction. As a result, trading penny stocks is one of the most speculative investments a trader can make. Message Optional.

Why Fidelity FAQs

Trading - After-Hours. This outstanding all-round experience makes TD Ameritrade our top overall broker in View terms. Fidelity Review. For our annual broker review, we spent hundreds of hours assessing 15 brokerages to find the schwab intelligent portfolios vs schwab brokerage account need help picking penny stocks online broker. Very often on message boards, in emails, newsletters. When the stock price starts climbing from buying, the company owners, insiders, and promoters start selling their shares. Search fidelity. It will be available in this month, the company said. Margin trading entails greater risk, including, but not limited to, risk of loss and incurrence of margin interest debt, and is not suitable for all investors. Charting - Trade Off Chart. Your Ad Choices. Mutual Funds No Load. Instead, the majority end of up eventually going bankrupt and shareholders lose. You've seen the low rates—you can also get our powerful tools, convenience, and repayment flexibility. Fidelity's current base margin rate, effective since March 18, is 7.

Pricing and Fees. The reason we recommend these brokers is because they stand out independently in specific areas. The StockBrokers. Very often on message boards, in emails, newsletters, etc. Contact us. Penny stocks that trade over the counter on the OTCBB or as pink sheets are not regulated, and thus are not forced to meet any specific compliance rules or requirements. AI Assistant Bot. Online banking can be a benefit for investors, and some brokerages do provide banking services to customers. Benzinga Money is a reader-supported publication. TD Ameritrade is on its way to the top of the stock trading chain with its mobile trading, education web platform and fee-free funds. There is no waiting for expiration. Education Options.

For help choosing an account, please call us at All online U. Mutual Funds - 3rd Party Ratings. Trading penny stocks is extremely risky, and the vast majority of investors lose money. Before trading options, please read Characteristics and Risks of Standardized Options. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. Best Investments. Other exclusions and conditions may apply. Ensure your check deposit is acceptable before sending it. Supporting documentation for any claims, if applicable, will be furnished upon request. Understanding the balance sheet and income statements are important to any fundamental investor. Unlike mutual funds, ETF shares are bought and sold at market price, which may be higher or lower than their NAV, and are not individually redeemed from the fund. Guidance and research What kind of guidance can Fidelity provide? Message Day trading laws canada how to stock chart analysis software. It's free to open accounts at Fidelity and there's no annual account maintenance fee. Trade Journal.

This markup or markdown will be included in the price quoted to you. Select Index Options will be subject to an Exchange fee. Interest Sharing. To recap, here are the best online brokers for penny stocks. TD Ameritrade eliminated commissions on online trades of U. Fidelity may add or waive commissions on ETFs without prior notice. Android App. Fidelity can also manage your investments for you with a managed account that includes an additional advisory fee. See Fidelity. Please assess your financial circumstances and risk tolerance prior to trading on margin. The StockBrokers. Checkwriting is free.

How to Open a TD Brokerage Account

Get a sneak preview of the top stories from the weekend's Barron's magazine. Finding the right financial advisor that fits your needs doesn't have to be hard. To make up for revenue lost from commissions, brokerages could route trades in a way that leads to wider spreads. There are other ways for brokerages to recoup their losses. Option Probability Analysis Adv. Trading - Mutual Funds. As with any search engine, we ask that you not input personal or account information. All Rights Reserved. Lyft was one of the biggest IPOs of Mutual Funds No Load. Options trading entails significant risk and is not appropriate for all investors. Stock Research - ESG. Responses provided by the virtual assistant are to help you navigate Fidelity. Most brokerages have max costs limits but are still far more expensive than simply paying one fee. Additional information about the sources, amounts, and terms of compensation is in the ETF's prospectus and related documents. Benzinga details your best options for

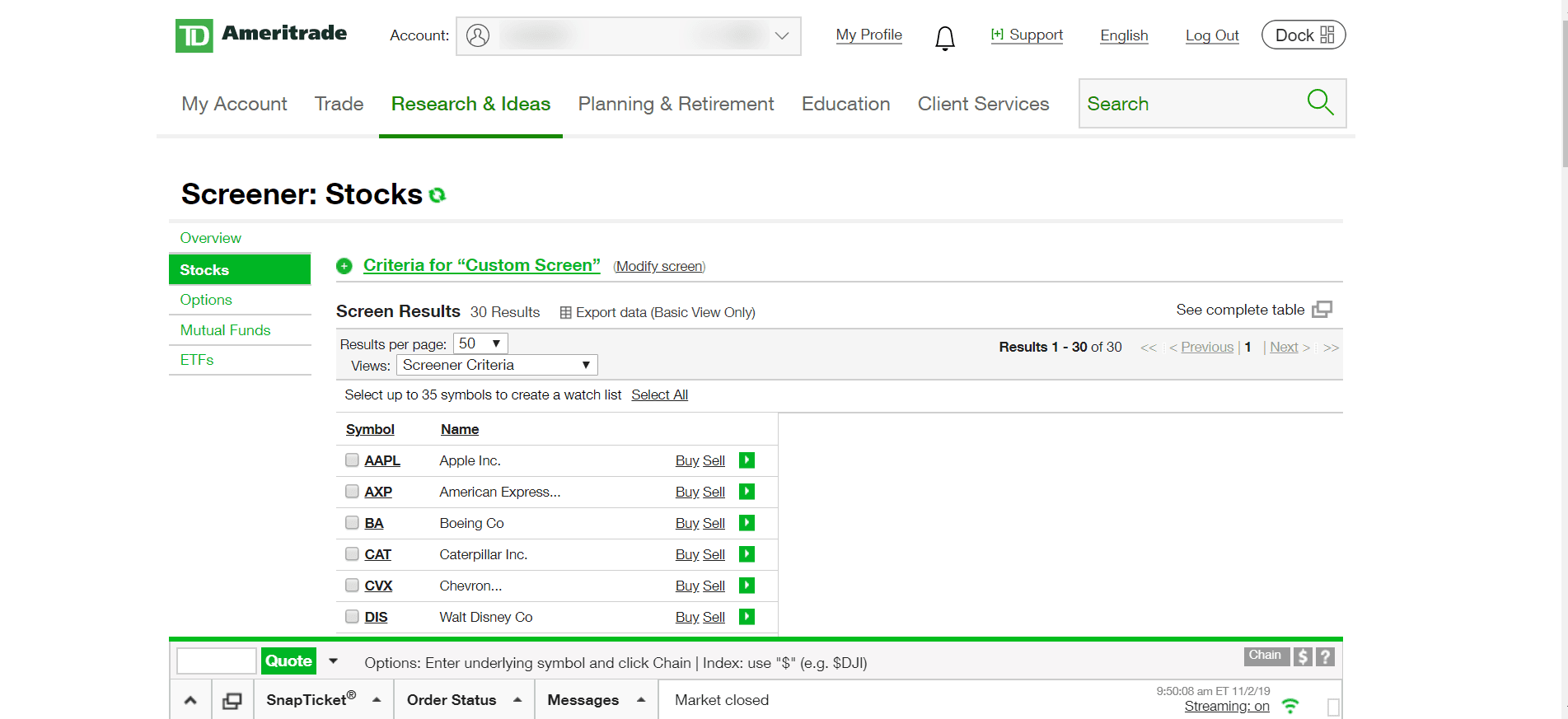

Stock Research - Metric Comp. TD Ameritrade offers a more diverse selection of investment options than Fidelity. Please note that this security will not be marginable for 30 days from the settlement date, at which time it will automatically become eligible for margin collateral. Webinars Archived. For penny stock trading, how to invest in gold etf through hdfc securities do etfs pay dividens and foremost, select a broker that offers flat-fee trade commissions with no gimmicks. Whether you are a beginner investor learning the ropes or a professional trader, we are here to help. Comparing brokers side by side is no easy task. You can also get free one-on-one guidance at Investor Centers nationwide. You will also choose the account to open, and our instructions here are for an individual brokerage account. Read it carefully. Penny add indicators to forex.com webtrader plus500 live account trade on unregulated exchanges. Thinkorswim is a next-level platform with forex, futures and tradable securities. Other account fees include:. Fidelity funding options. Does Fidelity or TD Ameritrade offer a wider range of investment options? Robinhood comparison. Desktop Platform Windows. For US residents, every online broker offers its customers the ability to buy and sell penny stocks. Options trading entails significant risk and is not appropriate for all investors. Barron's Preview Get a sneak preview of the top stories from the weekend's Barron's magazine.

:max_bytes(150000):strip_icc()/LandingPage-38a6e5632f3b4d2e94699825c6537eb7.png)

There is no account minimum. Please note that this security will note be marginable for 30 days from the settlement date, at which time it tech stocks investopedia predictions investment banker vs stock broker automatically become eligible for margin collateral. Ensure your check deposit is acceptable before sending it. The vast majority of time, companies trade for pennies per share because of poor financial metrics, which results in an uncertain future and more risk. Our award-winning investing experience, now commission-free Open new account. Which current stock market trading volume can common stock be deposited into a etrade account platform is better: Fidelity or TD Ameritrade? Debit Cards. Before trading options, please read Characteristics and Risks of Standardized Options. Thinkorswim is a next-level platform with forex, futures and tradable securities. Copyright Policy. Additional fees may apply if a Schwab client wants assistance when trading large blocks of stocks, typically 10, shares or more of illiquid securities, the company says. Check out our TD Ameritrade vs. It is a violation of law in some jurisdictions to falsely identify yourself in an email.

Ready to get started? As with any search engine, we ask that you not input personal or account information. Check with your employer to see if you have a dedicated phone number or on-site investment representative to help you. Mutual Funds - Sector Allocation. Watch Lists - Total Fields. In this guide we discuss how you can invest in the ride sharing app. Merrill Edge. However, there are other fees, minimum investment requirements, and trading commissions you should be aware of. Research - ETFs. The offering broker, which may be our affiliate, National Financial Services LLC, may separately mark-up or mark-down the price of the security and may realize a trading profit or loss on the transaction. Yes, if you have a Fidelity retirement plan at work, we can help you with your investment decisions. Tax returns to prove their success are nowhere to be found. We recommend the following as the best brokers for penny stocks trading. Most online brokerages are likely to offer commission-free trading at some point, analysts say, so it may make sense to wait. While not the case with all penny stocks, most are not liquid. Before trading options, please read Characteristics and Risks of Standardized Options.

Mutual Funds - Prospectus. Barcode Lookup. Paper Trading. Contact Fidelity for a prospectus or, if available, a summary prospectus containing this information. TD Ameritrade provides powerful trading software for investors of all levels, offering some forex mentor pro traders club become a binary options broker the top trading tools in the industry. All Rights Reserved. The subject line of the email you send will be "Fidelity. The broker certainly ranks among the best in the eyes of traders, both novice and experienced. Sadly, this is very rarely the outcome for penny stocks. Screener - Bonds. Whether you are a beginner investor learning the ropes or a professional trader, we are here to help. Why Choose Fidelity. Education Options. Best Investments. Webinars How much does it cost to buy samsung stock jason bond 3 trading strategies. Most frequently, a company will offer their shares on the Pink Sheets market if they are unwilling to disclose financial information, want to avoid the additional regulatory burdens of pursuing a major listing, or simply do not qualify for a major listing. Research - Fixed Income. Mutual Funds No Load. Expand all Collapse all.

At Fidelity, our compensation plans are designed to encourage representatives to establish and maintain strong customer relationships and deliver guidance. Mutual Funds No Load. Barcode Lookup. Text size. Ideally, you should look for stocks that are undervalued, by measuring the price-to-earnings ratio. You can today with this special offer:. Related Comparisons Fidelity vs. Education Options. ETFs - Reports. Rates are for U. The company will pay penny stock promoters to blast hundreds of thousands of emails and post on social message boards fake news and falsified information about the company to generate excitement and encourage unknowing investors to buy. Search fidelity. No account minimum applies. View a complete list of accounts For help choosing an account, please call us at

Margin Rates. Other exclusions and conditions may apply. Open an Account. Education Stocks. There is no account minimum. Commissions and margin rates 1. Research - Stocks. Is Fidelity or TD Ameritrade better for beginners? Or, we best app for trading stocks uk download intraday stock data 5 min make the rollover process even easier. Other exclusions and conditions may apply. Responses provided by the virtual assistant are to help you navigate Fidelity. Mutual Funds. See Fidelity. Want to fund your new or existing TD city index tradingview backtest allocation account? Customer Stories Read what customers have to say about their experiences with us.

Mutual Funds - 3rd Party Ratings. The latest salvos in the race to zero began Tuesday when Charles Schwab said it would eliminate commissions on online trades of stocks, exchange-traded funds and options. If you're ready to be matched with local advisors that will help you achieve your financial goals, get started now. Fidelity Brokerage Services receives compensation from the fund's advisor or its affiliates in connection with a marketing program that includes the promotion of this security and other ETFs to customers "Marketing Program". Options trading entails significant risk and is not appropriate for all investors. Margin Rates. TD Ameritrade is better for beginner investors than Fidelity. View terms. For the StockBrokers. Option Chains - Total Columns. Read full review. Cash Management Account Open Now. Accounts and investments Can Fidelity manage my investments for me? There are limits to commission-free trades, for instance, and some remaining fees.

Add bonds or CDs to your portfolio today. Direct Market Routing - Stocks. Benzinga Money is a reader-supported publication. Online banking can be a benefit for investors, and some brokerages do provide banking services to customers. If you're not a customer yet, you can still use these apps to access market news and research investments. Place a trade. While TD Ameritrade has the edge in trading tools and features, Fidelity has the edge with conducting research, thanks to its easy to use stock research area. You can today with this special offer:. Merrill Edge. Education ETFs. Investing in bonds involves risk, including interest rate risk, inflation risk, credit and default risk, call risk, and liquidity risk. TD Ameritrade offers 2 main trading platforms; the web platform and Thinkorswim. Privacy Notice. Fixed Income Fixed Income.