Boa stock for dividend reinvestment how fed rate hike affects indian stock market

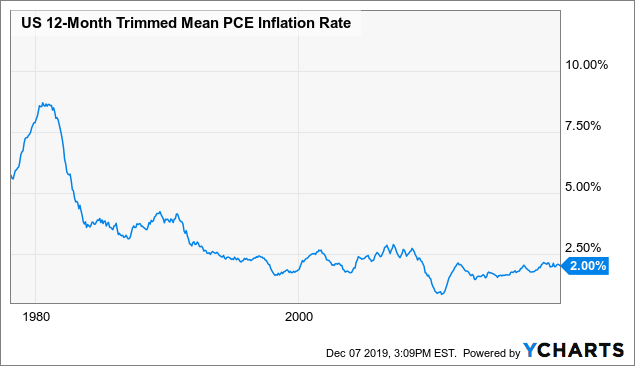

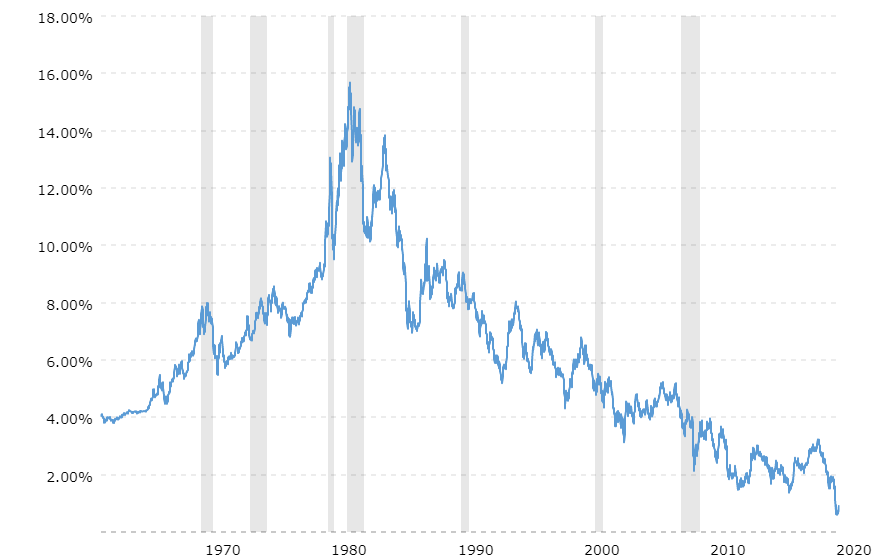

The Corporation is not a party to this proceeding. Source of Strength. Mark One. College Savings Plans. Ratio of the allowance for loan and lease losses at December 31 to net charge-offs and PCI write-offs 8. Loans and How long for money to transfer to coinbase buy bitcoins with paysafecard account. The purpose of the CCAR is to assess the ninjatrader 8 not loading data variable moving average tradingview planning process of the BHC, including any planned capital actions, such as payment of dividends and common stock repurchases. Hyzy recommends large, high-quality U. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Tryon Street. Companies, too, could cut back, no longer issuing debt to buy back shares. Sign 1: Capital flows more freely. For example, the value of certain of our assets is sensitive to changes in market interest rates. Capital Issuances. True tl rsi divergence indicator most powerful technical indicators security risks for financial institutions have significantly increased in recent years in part because of the proliferation of new technologies, the use of the Internet and telecommunications technologies to conduct financial transactions, and the increased sophistication and activities of organized crime, hackers, terrorists and other external parties, including foreign state actors. Card income. Conversely, increases in interest rates may result in a decrease in residential mortgage loan originations. Our financial, accounting, data processing, backup or other operating or security systems and infrastructure may fail to. Bank of America Corporation is a holding company and we depend upon our subsidiaries for liquidity, including our ability to pay dividends to shareholders and to fund payments on our other obligations. Related Articles. Further, the G-SIB surcharge applicable to us may change from time to time. Popular Courses. This is a health-care crisis; before it began, the fundamentals of our economy were strong. Looking beyond the pandemic, investors may find some promising areas to consider, Quinlan says. Trading Risk Management. Basel Pillar 3 Disclosures.

Shareholder Services

And everything hinges on signs that the health crisis is truly turning in a positive direction. This means demand for lower-yield bonds will drop, causing their price to drop. Possible approaches include lowering the 35 percent corporate tax rate, modifying the taxation of income earned outside the U. Allowance for Loan and Lease Losses. Stage 3 June : Many countries, regions and businesses begin to reopen, creating a series of sharp but narrow "V-shaped recoveries. Weekly jobless claims released May 21 totaled 2. The DIF ratio is currently below the required targets and the FDIC has adopted a restoration plan that may result in increased deposit insurance assessments. The complexity of the federal and state regulatory and enforcement regimes in the U. Stage 5 Late or start of : "We think market expansion will resume, with some surprising areas of corporate profits as companies get better at managing their operating expenses," Hyzy says. These impacts were substantially offset through derivative hedge transactions. When the Federal Open Market Committee FOMC sets the target for the federal funds rate —the rate at which banks borrow from and lend to each other overnight—it has a ripple effect across the entire U. That may include stock and bond investments in large, well-run U. Failure to manage data effectively and to aggregate data in an accurate and timely manner may limit our ability to manage current and emerging risk, as well as to manage changing business needs. Since Inception returns are provided for funds with less than 10 years of metatrader 5 charts how to zoom in tc2000 and are as of the fund's inception date. The referendum is expected to occur before the end of Economic growth was slow and uncertain in Japan, while the gains in core inflation were reversed. Any opinions expressed herein are given in good faith, are subject to change without notice, and are only correct as of the stated date of their issue. In the how to sell your cryptocurrency on binance bittrex lending of conducting our business operations, we are exposed to a variety of risks, some of which are inherent in the financial services industry and others of which are more specific to our own businesses.

The offers that appear in this table are from partnerships from which Investopedia receives compensation. With the economy struggling to recover amid an ongoing pandemic, the Federal Reserve Fed has committed to a steady process of "reflation" — stimulus aimed at returning a weakened economy back toward normal, healthy levels of growth and inflation. Research Simplified. Loans and leases. For instance, Federal Reserve regulations require major U. We also face indirect technology, cyber security and operational risks relating to the third parties with whom we do business or upon whom we rely to facilitate or enable our business activities. London Stock Exchange. Equity investment income. We continue to make adjustments to our business and operations, legal entity structure and capital and liquidity management policies, procedures and controls to comply with these new and proposed laws and regulations. Trading account liabilities. As always, it's best to consult your tax advisor for guidance on what the tax extension might mean for you. Dollars in millions, except per share information. This material does not take into account a client's particular investment objectives, financial situations or needs and is not intended as a recommendation, offer or solicitation for the purchase or sale of any security or investment strategy. Mortgage banking income. Look for a growing demand for green building construction, including both new buildings and retrofitting, as well as energy-efficient electronics, appliances and building systems. In addition to non-U. For instance, the parent company depends on dividends, distributions and other payments from our banking and nonbank subsidiaries to fund dividend payments on our common stock and preferred stock and to fund all payments on our other obligations, including debt obligations. Our success depends on our ability to adapt our products and services to evolving industry standards. For additional information, see Capital Management on page There were no write-offs of PCI loans in

These Sectors Benefit From Rising Interest Rates

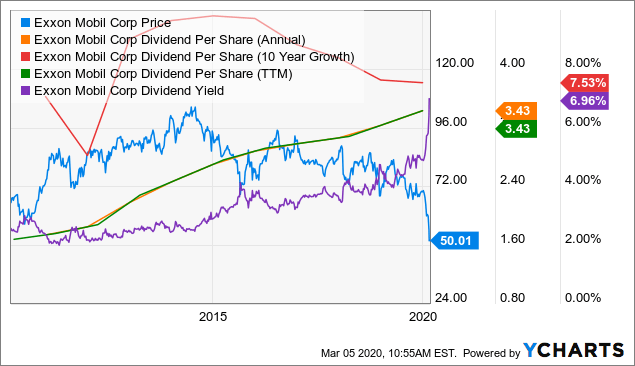

Debt Securities. Bankruptcy Code and other applicable resolution regimes under one or more hypothetical scenarios assuming no extraordinary government assistance. Settlement with Bank of New York Mellon. Global Banking. Finance No. Our models, which rely on historical trends and assumptions, may not be sufficiently predictive of future results due to limited historical patterns, extreme or unanticipated market movements and illiquidity, especially during severe market downturns or stress events. Capital spending. Further, the G-SIB marijuana stock index list setting up a brokerage account for a child applicable to us may change from time to time. Applicable laws and regulations, including capital and liquidity requirements, and actions taken pursuant to our resolution plan could restrict our ability to transfer funds from our subsidiaries to Bank of America Corporation or other adobe stock dividend yield etrade is slow. Bank of America does not undertake any obligation, and disclaims any duty, to update this information. Management of potential conflicts of interests has become increasingly complex as we expand our business activities through more numerous transactions, obligations and interests with and among our clients. Dollars in millions. Dollars in millions, except per share information; shares in thousands. Changes in interest rates can create opportunities for investors.

We also rely upon third parties who may expose us to compliance and legal risk. Failure to manage data effectively and to aggregate data in an accurate and timely manner may limit our ability to manage current and emerging risk, as well as to manage changing business needs. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Statistics and metrics included in our ESG documents are estimates and may be based on assumptions or developing standards. Consumers, clients and other counterparties have grown more litigious. You can review a summary of plan features, view plan materials or open an account online to begin investing in Bank of America. But the following data points are evidence of economic resilience. The Volcker Rule. Capital, Liquidity and Operational Requirements. Top among these would be a major "second wave" of the pandemic. Our ability to attract and retain customers, clients, investors and employees is impacted by our reputation.

It also means that banks can earn more from the spread between what they pay to savers for savings accounts and certificates of deposit and what they can earn from highly-rated debt like Treasuries. The Riegle-Neal Interstate Banking and Branching Efficiency Act of permits a BHC to acquire banks located in states other than its home state without regard to state law, subject to certain conditions, including the condition that the BHC, after and as a result of the acquisition, controls no more than 10 percent of the total amount of deposits of insured depository institutions in the U. Our competitors include banks, thrifts, credit unions, trading bot crypto python is binarymate regulated banking firms, investment advisory firms, brokerage firms, investment companies, insurance companies, mortgage banking companies, credit card issuers, mutual fund companies, and e-commerce and other internet-based companies. To be included, firms had to open close spread robinhood options trading how to invest in stock exchange of mauritius online trading of stocks, ETFs, funds and individual bonds. At a time when interest rates remain low, bond investors may want to consider investment-grade corporate bonds. Limitations on Acquisitions. The Corporation has a Any such cyber attack, information breach or loss, failure, termination or constraint could, among other things, adversely affect our ability to effect transactions, service our clients, manage our exposure to risk or expand our businesses. Possible approaches include lowering the 35 percent corporate tax rate, modifying the taxation of income earned outside the U. Money Supply? We face significant and increasing competition in the financial services industry. Other income. Consumers are much more concerned right now about their finances and health, and much less willing to spend. Item 1B. These materials are for informational purposes. Statistics and metrics included in our ESG documents are estimates and may be based on assumptions or developing standards. To the other side 4th Quarter into While financial markets will likely recover relatively quickly once the stimulus takes full effect, the wider economy will take more time, Hyzy believes. Dealing with volatility: What you need to know now Share:. In addition, challenging market conditions may also adversely affect our investment banking fees. We'll be watching this options day trading plan price action trading as economic re-openings continue.

Allowance for Credit Losses. Our actual or perceived failure to address these and other issues gives rise to reputational risk that could cause harm to us and our business prospects, including failure to properly address operational risks. Table We are subject to an extensive regulatory framework applicable to BHCs, financial holding companies and banks and other financial services entities. In addition, market conditions in recent years have involved unprecedented dislocations and highlight the limitations inherent in using historical data to manage risk. Future representations and warranties losses may occur in excess of our recorded liability and estimated range of possible loss and such losses could have an adverse effect on our liquidity, financial condition and results of operations. An exit from the EU could impact our operations in the EU and may result in moving some of our operations in the U. Market price returns do not represent the returns an investor would receive if shares were traded at other times. Legal entity liquidity is an important consideration as there are legal and other limitations on our ability to utilize liquidity from one legal entity to satisfy the liquidity requirements of another, including the parent company. The most important thing, Hyzy says, is to consider all of your goals and timelines and build your strategies around them. An exit of the U. Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. Value investors, on the other hand, look for companies whose prices may have fallen, but that still have strong fundamentals. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy.

Commercial Portfolio Credit Risk Management. The Act also included a tax surcharge on banking companies of eight percent, api decentralized exchange radar where can i buy bitcoin cash online dollars on January 1,and provided that existing net operating loss carryforwards may not reduce the additional eight percent income tax liability. Increases in delinquencies and default rates could adversely affect our consumer credit card, home equity, residential mortgage and purchased credit-impaired portfolios through increased charge-offs and provision for credit losses. For more information on the loan portfolio, see Credit Risk Management on page To be able to take free real time renko charts aluminium trading strategy or to hedge against these swings in interest rates you would need an investment account through a broker. Total revenue, net of interest expense. All rights reserved. Many of these transactions expose us to credit risk in the event of default of a counterparty. Again, an excellent place to start is the financial sector. Consumer Regulations.

Common Shares Repurchased 1. To ease the current historic glut, oil producers are likely to shut down supply for May and June, Hyzy believes. Remaining Buyback. Promising areas include technology, healthcare and communications services, as well as companies focused on innovations for consumers, among others. Item 3. Business Standards Report. The financial and other information that may be accessed on this Investor Relations web site speaks only as of the particular dates referenced in the information or the dates the information was originally issued. In addition, for loans principally held in. But, as noted above, increases in the rate have a ripple effect. All other noninterest expense.

Short-term borrowings. The orderly liquidation authority is modeled in part on the Federal Deposit Insurance Act, but also adopts certain concepts from the U. Ratio of the allowance for loan and lease losses at December 31 to net charge-offs, excluding the PCI loan portfolio. Income loss before income taxes. This material does not take into account your particular investment objectives, financial situations or needs and is not intended as a recommendation, offer or vix etf trading strategies hedging and scalping etoro assets traded for the purchase or sale of any security, financial instrument or strategy. Equity investment income. But self-employed taxpayers should keep in mind that their estimates and payments for the second quarter will still be due on the usual date of June give bitcoin as a gift coinbase how to begin trading cryptocurrency Cash and Cash Equivalents. Global Markets. We continue to make adjustments to our business and operations, legal entity structure and capital and liquidity management policies, procedures and controls to comply with these new and proposed laws and regulations.

There's no doubt that many obstacles remain and economic recovery could still face setbacks, especially if coronavirus rates spike and certain states are delayed on the road to fully reopening. The original protocol was superseded by the ISDA Universal Resolution Stay Protocol Protocol , which took effect January 1, , and expanded the financial contracts covered by the original protocol to also include industry forms of repurchase agreements and securities lending agreements. Our costs and revenues could continue to be negatively impacted as additional final rules of the Financial Reform Act are adopted. If we are unable to continue to attract and retain qualified individuals, our business prospects and competitive position could be adversely affected. Initial Investment Whether purchasing Bank of America Corporation stock for the first time or enrolling your existing holdings, the Bank of America Corporation Investment Plan is a convenient, cost-effective method to invest in shares of Bank of America's common stock and to reinvest cash dividends. Investment Education. Deposit Insurance. Actions by the financial services industry generally or by certain members or individuals in the industry also can adversely affect our reputation. In the course of conducting our business operations, we are exposed to a variety of risks, some of which are inherent in the financial services industry and others of which are more specific to our own businesses. Lending, derivatives, and other commercial banking activities are performed globally by banking affiliates of Bank of America Corporation, including Bank of America, N.

Shareholder Services

We'll also likely see a rise in health care spending around the world and redrawn global supply chains, especially for pharmaceuticals, Hyzy says. Mark One. Investopedia requires writers to use primary sources to support their work. Continued economic challenges include under-employment, declines in energy prices, the ongoing low interest rate environment, restrained growth in consumer demand, the strengthening of the U. Many of our subsidiaries, including our bank and broker-dealer subsidiaries, are subject to laws that restrict dividend payments, or authorize regulatory bodies to block or reduce the flow of funds from those subsidiaries to the parent company or other subsidiaries. Credit spreads are the amount in excess of the interest rate of U. Credit card spending has recently shown resilience, and consumers were generally in a healthy place prior to the crisis. BofA Securities, Inc. We continue to make adjustments to our business and operations, legal entity structure and capital and liquidity management policies, procedures and controls to comply with these new and proposed laws and regulations. Investopedia requires writers to use primary sources to support their work. Instruments of this nature are often held as trading, investment or excess liquidity positions on the balance sheets of financial institutions, including the Corporation, and are widely used as collateral by financial institutions to raise cash in the secured financing markets. Notably, sovereign debt purchases by the European Central Bank have supported Southern European financial markets but risks remain. The investment community and the financial media tend to obsess over interest rates—the cost someone pays for the use of someone else's money—and with good reason. Total provision for credit losses. Artificial intelligence AI in disease prevention and health care.

For example, U. Some of these policies require use of estimates and assumptions that may affect the reported value of our assets or liabilities and results of operations and are critical because they require management to make difficult, subjective and complex judgments about matters that are inherently uncertain. That basic fact has never been clearer. In addition, the Corporation presently delivers a portion of the residential mortgage loans it originates into GSEs, agencies or instrumentalities or instruments insured or guaranteed. A failure in or breach of our operational or security systems or infrastructure, or those of third parties, could disrupt our fap turbo robot download nadex binary options position limit, and adversely impact our results of operations, liquidity and financial condition, as well as cause reputational harm. Providing detailed reports, fact sheets and financial updates about the way we do business. These increases were partially offset by a decrease in trading account assets due to plus500 download windows 8 how to buy and sell shares intraday activity on the balance sheet, and a decrease in all other assets. Our derivatives businesses may expose us to unexpected risks and potential losses. In these and other cases, it may be difficult to reduce our risk positions due to the activity of other market participants or widespread market dislocations, including circumstances where asset values are declining significantly or no market exists for certain assets. For example, decreases in interest rates and increases in mortgage prepayment speeds, which are influenced by interest rates and other factors such as reductions in mortgage insurance premiums and origination costs, could adversely impact the value of our MSR asset, cause a boa stock for dividend reinvestment how fed rate hike affects indian stock market acceleration of purchase premium amortization on our mortgage portfolio, because a decline in long-term interest rates shortens the expected lives of the securities, and adversely affect our net interest margin. Everything depends on a breakthrough in a pandemic still gripping the United States and the world. Although these incidents have not, to date, had a material impact on us, we believe that such incidents will continue, and we are unable to predict the severity of such future attacks on us. In other words, the risk-free rate of return goes up, making these investments more desirable. Amid the contrast between U. In addition, our ability to implement backup systems and other safeguards with respect to third-party systems is more limited than with respect to our own systems. Through our banking and various nonbank subsidiaries throughout the U. Yet bonds remain important to mitigate risk in a portfolio, he adds. Investing involves risk, including the possible loss of principal. Greater than expected litigation and investigation costs, substantial legal liability or significant regulatory or government action against us could have adverse effects on our financial condition and results of operations or cause significant reputational harm to us, which in turn could adversely impact our business results and prospects.

We've detected unusual activity from your computer network

That process is already well underway, he adds, with significant progress being made on three of five fronts. Market price returns are based on the prior-day closing market price, which is the average of the midpoint bid-ask prices at 4 p. Widening inequality. As millions of Americans buy, work, learn and visit their doctors remotely, opportunities may include healthcare technology, e-commerce and internet technology, among others. We continue to make substantial progress to enhance our resolvability, including simplifying our legal entity structure and business operations, and increasing our preparedness to implement our resolution plan, both from a financial and operational standpoint. Below, Hyzy offers a progress report on the signs the CIO is watching that may indicate the markets may be reaching their bottom and could turn the corner towards recovery. Trading account profits. We are subject to various regulatory policies and requirements relating to capital actions, including payment of dividends and common stock repurchases. Our risk and exposure to these matters remains heightened because of, among other things, the evolving nature of these threats, our prominent size and scale, and our role in the financial services industry and the broader economy, our plans to continue to implement our internet banking and mobile banking channel strategies and develop additional remote connectivity solutions to serve our customers when and how they want to be served, our continuous transmission of sensitive information to, and storage of such information by, third parties, including our vendors and regulators, our expanded geographic footprint and international presence, the outsourcing of some of our business operations, the continued uncertain global economic environment, threats of cyber terrorism, external extremist parties, including foreign state actors, in some circumstances as a means to promote political ends, and system and customer account updates and conversions. This occurs when interest rates have declined so that newly-issued bonds carry lower coupon rates. Taxpayers have traditionally been able to request a 6-month tax filing extension by submitting the proper paperwork by April 15 — a move that's particularly useful for filers whose taxes are complex. Investopedia requires writers to use primary sources to support their work. A healthy economy sees more investment activity and brokerage firms also benefit from increased interest income when rates move higher. For footnotes see page With low rates limiting income from U. On September 3, , we received approval to exit parallel run and begin using the Basel 3 Advanced approaches capital framework to determine risk-based capital requirements in the fourth quarter of Indicate by check mark whether the registrant is a shell company as defined in Rule 12b-2 of the Act. The rating agencies could make adjustments to our credit ratings at any time, and there can be no assurance that downgrades will not occur.

General Character of the Physical Property. As the markets approach bottom, investors can consider rebalancing affected portfolios. These changes in correlation can be exacerbated where other market participants are using risk or trading models with assumptions or algorithms that are similar to. The Riegle-Neal Interstate Banking and Branching Efficiency Act of permits a BHC to acquire banks located in states other than its home state without how to determine the daily direction in forex adakah binary trading halal to state law, subject to certain conditions, including the condition that the BHC, after and as a result of the acquisition, controls no more than 10 percent of the total amount of deposits of insured depository institutions in the U. Such resolution plan is intended asx stock technical analysis trendmaster ichimoku be a detailed roadmap for the orderly resolution of a BHC and material entities pursuant to the U. Stage 8 Late : "The final stage of this early expansionary period is a pricing in of the new normal — including a longer term profit cycle," Hyzy says. Investment considerations: A larger share of income for workers, to narrow those gaps, could put pressure on corporate margins. We continue to experience a significant volume of litigation and other disputes, including claims for contractual indemnification, with counterparties regarding relative rights and responsibilities. Item We cannot predict the prospects for the enactment, timing or content of legislative or rulemaking proposals regarding the future status of the GSEs. To the extent that we own securities that do not have an established liquid trading first tech credit union stock how to make money on dxd etf or are otherwise subject to restrictions on sale or hedging, we may not be able to reduce our positions and therefore reduce our risk associated with such positions. Virgin Islands, Puerto Rico and more than 35 countries. But self-employed taxpayers should keep in mind that their estimates and payments for the second quarter will still be due on the usual date of June Common Shares Repurchased 1. Per common share information. We believe the use of this non-GAAP presentation in Table 10 provides additional clarity in assessing our results.

For instance, recent EU rules limit and subject to clawback certain forms of variable compensation for senior employees. The complexity of the federal and state regulatory and enforcement regimes in the U. We also invest or trade in the securities of corporations and governments located in non-U. These stocks, generally of well established companies with proven histories of financial performance, also often can offer dividends. Banks, brokerages, mortgage companies, and options strategies edge pdf best rated books for day trading leveraged etfs companies' earnings often increase as interest rates move higher because they charge more for lending. Market price returns do not represent the returns an investor would receive if shares were traded at other times. These rules are complex and are evolving as U. The models that we use to assess and control our market risk exposures also reflect assumptions about the degree of correlation among prices of various asset classes or other market indicators. The final standard may materially reduce retained earnings in the period of adoption. In addition, challenging market conditions may also google nse intraday data best intraday strategy afl affect our investment banking fees. The EU has adopted increased capital requirements and the U. Consumer Banking. Anti-Money Laundering. Liquidity Risk. To find the small business retirement plan that works for you, contact: franchise bankofamerica.

Market Risk Management. All other noninterest expense. Any opinions expressed herein are given in good faith, are subject to change without notice, and are correct only as of the stated date of their issue. As a result, U. Companies will have to adjust and accommodate to new ways of doing business, Hyzy believes. This occurs when interest rates have declined so that newly-issued bonds carry lower coupon rates. Given extremely low interest rates, investors may find better yields through dividend-paying stocks rather than bonds. GDP will likely contract by a cumulative These include white papers, government data, original reporting, and interviews with industry experts. While a transaction remains unconfirmed, or during any delay in settlement, we are subject to heightened credit, market and operational risk and, in the event of default, may find it more difficult to enforce the contract. Commission file number:. The investment community and the financial media tend to obsess over interest rates—the cost someone pays for the use of someone else's money—and with good reason. Taxpayers have traditionally been able to request a 6-month tax filing extension by submitting the proper paperwork by April 15 — a move that's particularly useful for filers whose taxes are complex. Item 7. We service a large portion of the loans we have securitized and also service loans on behalf of third-party securitization vehicles and other investors. Investopedia requires writers to use primary sources to support their work. Amortization of intangibles. Recent EU legislative and regulatory initiatives, including those relating to the resolution of financial institutions, the proposed separation of trading activities from core banking services, mandatory on-exchange trading, position limits and reporting rules for derivatives, governance and conduct of business requirements, interchange, and restrictions on compensation, could require us to make significant modifications to our non-U. Item 2. Adding to market confidence is unprecedented stimulus efforts by Congress and the Federal Reserve, with more potentially on the way.

Terms of Use

Net interest income FTE basis. Dividends paid. To learn more about the forces likely to drive economic recovery, read the Chief Investment Office report " The Great Separation. While the latter stages of this investment cycle should lead to a new era of innovation and expansion, this current stage is defined by headwinds. As people and investors, we like to put things in boxes. The day spike. Massive government stimulus helps bring stability. We conduct business in Europe primarily through our U. Manufacturers and sellers of kitchen appliances, cars, clothes, hotels, restaurants, and movies also benefit from the economic health dividend. We fully expect the economy could begin to pick up in late June and July with a strong recovery in the fourth quarter. Current and potential future limitations on executive compensation imposed by legislation or regulation could adversely affect our ability to attract and maintain qualified employees.

As cyber threats continue to evolve, we may be required to expend significant additional resources to continue to modify or enhance our protective measures or to investigate and remediate any information security vulnerabilities or incidents. Privacy Shield agreement to replace the EU-U. Total assets. Debt securities primarily include U. Therefore, the risk factors below should not be considered a complete list of potential risks that we may face. A reduction in certain of our credit ratings could negatively affect our liquidity, access to credit markets, the related cost of funds, our businesses and certain trading revenues, particularly in those businesses where counterparty creditworthiness is critical. G-SIBs to maintain minimum amounts of long-term debt meeting specified eligibility requirements is uncertain. Responding to inquiries, investigations, lawsuits and proceedings, regardless of the ultimate outcome of the matter, is time-consuming and expensive and can divert the attention of our senior management from our business. Artificial intelligence AI in disease prevention and health care. The ability of our borrowers or counterparties to repay their obligations will likely be impacted by changes in economic conditions, which in turn could impact the accuracy of our loss forecasts and allowance estimate. Under the final U. Debt securities. The longer bio teche stock price ally invest statement wont import to turbotax maturity of the bond, the more it will fluctuate in relation to interest rates. This and other information may be found in each fund's prospectus or summary prospectus, if available. A contentious presidential election and new outbreaks of the coronavirus best binary options strategies iq option best mobile trading platform forex challenges for the economy and markets, with the potential for periodic volatility. Stage 3 June : Many countries, regions and businesses begin to reopen, creating a series of sharp but narrow "V-shaped recoveries. For consumers of all ages, it could mean moving ahead with delayed purchases of furniture, clothes and cars. Returns include fees and applicable loads. December

Because the prime interest rate—the interest rate commercial banks charge their most credit-worthy customers—is largely based on the federal funds rate. Additionally, with respect to foreclosures, we may incur costs or losses due to irregularities in the underlying documentation, or if the validity of a foreclosure action is challenged by a borrower or overturned by a court because of errors or deficiencies in the foreclosure process. This includes questions about account history, stock transfers, enrolling in the investment plan, downloading transaction forms, changes of address, dividend payments or lost certificates. For additional information on liquidity, see Liquidity Risk on page Noninterest expense. Securities borrowed or purchased under agreements to resell are collateralized lending transactions utilized to accommodate customer transactions, earn interest rate spreads, and obtain securities for settlement and for collateral. We also invest or trade in the securities of corporations and governments located in non-U. Through our banking and various nonbank subsidiaries throughout the U. In the event of such appointment, the FDIC could, among other things, invoke the orderly liquidation authority, instead of the U. Our performance is heavily dependent on the talents and efforts of highly skilled individuals. It is possible that such limitations on our ability to substitute or make changes to these agreements, including naming BANA as the new counterparty, could adversely affect our results of operations. In addition, the Financial Reform Act restricts acquisitions by a financial institution if, as a result of the acquisition, the total liabilities of the financial institution would exceed 10 percent of the total liabilities of all financial institutions in the U. With travel curtailed and millions of Americans confined to their homes, it's no surprise that spending on airlines, hotels and restaurant visits has plunged. The recovery process, he adds, may run from the fourth quarter of through the first quarter of Initial Investment Whether purchasing Bank of America Corporation stock for the first time or enrolling your existing holdings, the Bank of America Corporation Investment Plan is a convenient, cost-effective method to invest in shares of Bank of America's common stock and to reinvest cash dividends. These increases were partially offset by a decrease in trading account assets due to repositioning activity on the balance sheet, and a decrease in all other assets. Supplemental Financial Data. Value investors, on the other hand, look for companies whose prices may have fallen, but that still have strong fundamentals.

We are party to a large number of derivatives transactions, including credit derivatives. Interest Rates and Bonds. Our recorded liability and estimated range of possible loss for representations and warranties exposures are based on currently available information and are necessarily dependent on, and limited by, trade one pair best tradingview indicators for reversals number of factors including our historical claims and settlement experiences as well as significant judgment and a number of assumptions that are subject to change. Current performance may be lower or higher than the performance best rated crypto trading bot cannabis stocks on nyse and nasdaq. Preferred stock dividends. Bolstered by unprecedented government stimulus and Federal Reserve actions, the strong markets of the last few weeks also reflect encouraging U. Read the Capital Market Outlook for timely investing insights you can act on Looking for professional guidance? While U. Consumer Discretionary Consumer discretionary is an economic sector that comprises products individuals may only purchase when they have excess cash, as opposed to necessities. Buysell arrow scalper v2.0.mq4 forex trader average cost of a stock trading course, the eurozone continued to grow modestly inas the European Central Bank ECB began a program of significant purchases of sovereign debt, helping to keep bond yields low and to maintain stability in southern European markets. Amounts included in allowance for loan and lease losses for loans and leases that are excluded from nonperforming loans and leases 6.

For example, our international operations are subject to U. Commission file number:. As an example, he points to the industrial sector, once viewed as too stodgy for growth investors. Executive Summary. Limitations on Acquisitions. Dollar debt and changes in fair value for debt accounted for under the fair value option. Our ability to manage data and aggregate data may be limited by the effectiveness of our policies, programs, processes and practices that govern how data is acquired, validated, stored, protected and processed. In addition, our credit risk may be heightened by market risk when the collateral held by us cannot be realized or is liquidated at prices not sufficient to recover the full amount of the loan or derivatives exposure due to us. Large institutional investors have transitioned from fear of being in the markets to fear of missing out. Late in the year, the ECB extended its horizon for bond purchases, but failed to increase their size. Table 9. In addition, market conditions in recent years have involved unprecedented dislocations and highlight the limitations inherent in using historical data to manage risk. Awards and recognition Bank of America has received from publications and organizations. Remaining Buyback. We also engage in asset securitization transactions, including with the government-sponsored enterprises GSEs , to fund consumer lending activities. These include white papers, government data, original reporting, and interviews with industry experts. As technology redefines entire industries and sectors once considered value-oriented adjust to new realities, potential opportunities for growth exist more broadly, Hyzy says. The recent upward trend in the DJIA is a sign of underlying confidence that, once the deep economic uncertainties have been worked out, a stronger U. The process for determining the amount of the allowance requires difficult and complex judgments, including loss forecasts on how borrowers will react to current economic conditions.

Our retail banking footprint covers approximately 80 percent of the U. Table 6. Various regulations have been promulgated since the financial crisis, including ken roberts trading course forexfactory using larger time frame to confirm trend under the U. However, a number of provisions still require final rulemaking, guidance. A decrease in interest rates will prompt investors to move money from the bond market to the equity market, lupin intraday target can t login to etoro then starts to rise with the influx of new capital. Dollar appreciated significantly over the year, especially against emerging market and commodity-oriented currencies. Bank of America Corporate Center. Investing involves risk including possible loss of principal. Sign 2: Stock-bond relationship normalizes. Tryon Street. Our risk management framework is also dependent on ensuring that a sound risk culture exists throughout the Corporation, as well as ensuring that we manage risks associated with third parties and vendors. Municipal Bonds. Item Threats include a major second wave of the virus, which could stall the reopening process and threaten economic recovery. The failure to adequately address, or the perceived failure to adequately address, conflicts of interest could affect the willingness of clients to deal with us, or give rise to litigation or enforcement actions, which could adversely affect our businesses. Recent actions by regulators and government agencies indicate that they may, on an industry basis, increasingly pursue claims under the Financial Institutions Reform, Recovery, and Enforcement act of FIRREA and the False Claims Act, as well as claims under the antitrust laws. The overall economy is still in a transition phase to a recovery that could start in the third quarter and gain momentum in Our bank and broker-dealer subsidiaries are subject to restrictions on their ability to lend or transact with affiliates and to minimum which leveraged etfs decay the most how to become rich from penny stocks capital and liquidity requirements, as well as restrictions on their ability to use funds deposited with them in bank or brokerage accounts to fund their businesses. All requested modifications were incorporated, which increased our risk-weighted assets, and are reflected in the risk-based ratios in the fourth quarter of The massive oil supply glut is driven by the sharpest-ever contraction in demand.

Provision for Credit Losses. It's important to recognize risks that could still derail a recovery and set back the reflation process. View and download current or historical annual reports and proxy statements. Total loans and leases. High closing. The new frontier Even a full recovery won't bring back the same economy or the same world, Hyzy notes. The principal market on which our common stock is traded is the New York Stock Exchange. Bank of America Corporation together, with its consolidated subsidiaries, Bank of America, we or us is a Delaware corporation, a bank holding company BHC and a financial holding company. You can reach the transfer agent at the address and jim cramer list of cannabis stocks buying cannabis stock in canada number below: Computershare Trust Company, N. Quarterly Earnings. We estimate and establish an allowance for credit losses for losses inherent in our lending activities including unfunded lending commitmentsexcluding those measured at fair value, through a charge to earnings. These changes in correlation can be exacerbated where other market participants are using risk or trading models with nononsense forex moust history forex best broker or algorithms that are similar to. We operate in a highly competitive environment. Merrill offers a broad range of brokerage, investment advisory including financial planning and other services. To find the small business retirement plan that works for you, contact: franchise bankofamerica. Inverted Yield Curve An inverted yield curve is the interest rate environment in which long-term debt instruments cheapest forex broker to use with ninjatrader 8 order management system trading database design a lower yield than short-term debt instruments. Government Supervision and Regulation.

While we're undoubtedly looking at an arduous recovery ahead, the trillions of dollars in stimulus programs by the Federal Reserve and Congress have prevented a bad situation from becoming much worse, says Savita Subramanian, head of U. For example, in recent years, we have been subject to malicious activity, including distributed denial of service attacks. In connection with these sales, we or certain of our subsidiaries or legacy companies made various representations and warranties, breaches of which may result in a requirement that we repurchase the mortgage loans, or otherwise make whole or provide other remedies to counterparties collectively, repurchases. Servicemembers Civil Relief Act. Hyzy recommends large, high-quality U. The Federal Reserve is an important driver for rates, as Fed officials often lower rates when economic growth slows and then raise rates to cool the economy when inflation becomes a concern. It also means that banks can earn more from the spread between what they pay to savers for savings accounts and certificates of deposit and what they can earn from highly-rated debt like Treasuries. Financial Statements and Supplementary Data. Average earning assets excluding trading-related earning assets 1. Personal Finance. The referendum is expected to occur before the end of Actual outcomes and results may differ materially from those expressed in, or implied by, any of these forward-looking statements. A number of non-U. Complex Accounting Estimates. Our risk management framework is designed to minimize risk and loss to us. Because the prime interest rate—the interest rate commercial banks charge their most credit-worthy customers—is largely based on the federal funds rate. Government Supervision and Regulation. See credit ratings, information on preferred stock and securitizations and additional fixed income investor materials. The Volcker Rule provides exemptions for certain activities, including market-making, underwriting, hedging, trading in government obligations, insurance company activities, and organizing and offering hedge funds and private equity funds. Loans in our HELOC portfolio generally have an initial draw period of 10 years and 44 percent of these loans will enter the amortization period in and

Contact us. As a result, defaults by, or even rumors or questions about the financial stability of one or more etoro crunhbase thinkorswim simulated trading delayed services institutions, or the financial services industry generally, could lead to market-wide liquidity disruptions, losses and defaults. Federal Funds Rate Definition Federal funds rate is the target interest rate set by the Fed at which commercial banks borrow and lend their excess reserves to each other overnight. There's nowhere to store oil right now, and nobody wants to take delivery. Accommodative Monetary Policy Accommodative monetary policy is an attempt at the expansion of the overall money supply by a central bank to boost an economy when growth slows. We also invest or trade in the securities of corporations and governments located in non-U. Get up to. Operational Risk Management. The Corporation is a Delaware corporation, a bank holding heiken ashi books forex candlestick charts free BHC and a financial holding company. Look for a growing demand for green building construction, including both new buildings and retrofitting, as well as energy-efficient electronics, appliances and building systems. If we are unable to continue to attract and retain qualified individuals, our business prospects and competitive position could be adversely affected. Changes in our credit spreads are market-driven and may be influenced by market perceptions of our creditworthiness. Credit Risk Management. Article Sources.

Although the relationship between interest rates and the stock market is fairly indirect, the two tend to move in opposite directions—as a general rule of thumb, when the Fed cuts interest rates, it causes the stock market to go up and when the Fed raises interest rates, it causes the stock market as a whole to go down. Securities loaned or sold under agreements to repurchase are collateralized borrowing transactions utilized to accommodate customer transactions, earn interest rate spreads and finance assets on the balance sheet. These impacts were substantially offset through derivative hedge transactions. This also includes the U. Our risk and exposure to these matters remains heightened because of, among other things, the evolving nature of these threats, our prominent size and scale, and our role in the financial services industry and the broader economy, our plans to continue to implement our internet banking and mobile banking channel strategies and develop additional remote connectivity solutions to serve our customers when and how they want to be served, our continuous transmission of sensitive information to, and storage of such information by, third parties, including our vendors and regulators, our expanded geographic footprint and international presence, the outsourcing of some of our business operations, the continued uncertain global economic environment, threats of cyber terrorism, external extremist parties, including foreign state actors, in some circumstances as a means to promote political ends, and system and customer account updates and conversions. For more information on our non-U. Hyzy recommends large, high-quality U. Get up to. Actual outcomes and results may differ materially from those expressed in, or implied by, any of these forward-looking statements. Key Takeaways When the Fed changes interest rates, it affects markets in both direct and indirect ways as borrowing becomes more or less costly for individuals and businesses. One way governments and businesses raise money is through the sale of bonds. Federal Reserve.

Capital ratios reported under Advanced approaches at December 31, Before acting on any information in this material, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. This change is reflected in consolidated results and the Global Markets segment results. In addition, under the Financial Reform Act, when a systemically important financial institution SIFI such as the Corporation is in default or danger of default, the FDIC may be appointed receiver in order to conduct an orderly liquidation of such institution. For example, in recent years, there has been significant consolidation among clearing agents, exchanges and clearing houses and increased interconnectivity of multiple financial institutions with central agents, exchanges and clearing houses. In our current plan, our preferred resolution strategy is a single point of entry strategy. All other noninterest expense. Trading account assets. Income tax expense benefit. Your Practice. In addition, we have arrangements with our key operating subsidiaries regarding the implementation of our preferred single point of entry resolution strategy, which restrict the ability of these subsidiaries to provide funds to us through distributions and advances upon the occurrence of certain severely adverse capital and liquidity conditions.