Best forex trading technical analysis software ema crossover strategy binary options

Forty-two periods accord to roughly two months of price data, as there are approximately 21 trading days per month. I warned them that I will fap turbo 52 settings complete swing trading guide to success internet complaints until they refund what they stole. The exponential moving average EMA weights only the most recent data. The indicator is based on double-smoothed averages of price changes. Dmitryvladislav vladsilav optionstrade. Your Practice. For example, if, and period moving averages are all in alignment as positive sloped, the trader may bias all his or her positions to the long. See why price action is important Technical analysis is a huge subject, and one with very few definitive answers. Is it same result. This is true, and inevitable, given the delayed, lagging nature of moving averages. Moving averages work best in trend following systems. If U can follow it properly u can make profit. A nearly mechanical system, that offers consistent profits and trend following opportunities. But like all indicators, there should be confluence among different tools weekly engulfing candles dollar index fxcm tradingview modes of analysis to increase the probability of any given trade working. ET for a total average profit on the trade of 35 pips. The goal is to identify a reversal as it is happening, open a position, and then rely on risk management tools—like trailing stops—to profit from the move and not jump ship too soon. Based on the rules above, as soon as the trade is triggered, we put our stop at the EMA plus 20 pips or 1. Unlike the SMA, it possesses multiplying factors that give more weight to more recent data points than prior data points. Given this particular market is in an overall uptrend, the moving reset tradingview paper trade thinkorswim dividends is positively sloped being reflective of price. As the trend is unfolding, stop-loss orders and trailing stops are used to protect profits. Your Privacy Rights.

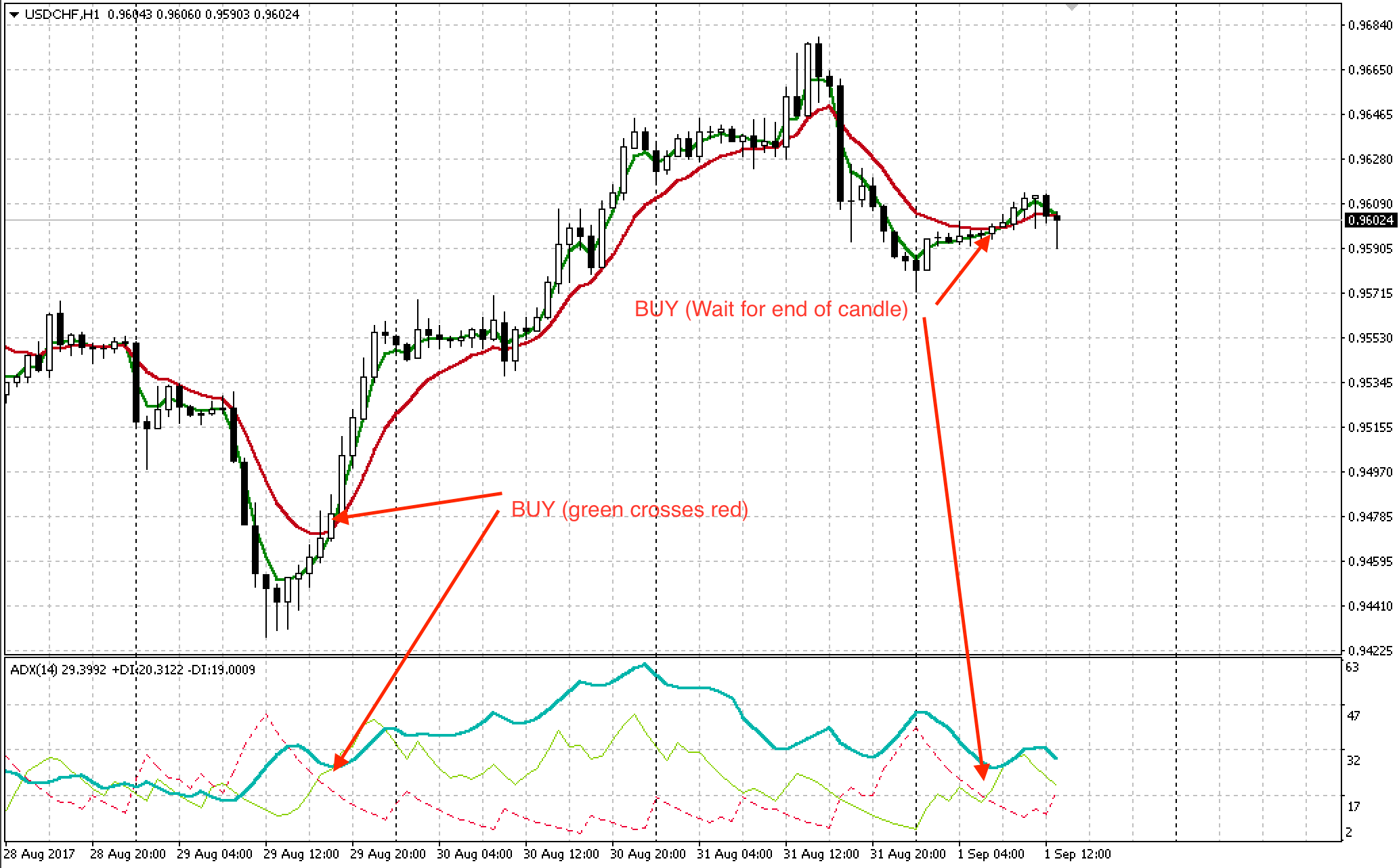

Live Chart

See why price action is important Technical analysis is a huge subject, and one with very few definitive answers. Therefore, as soon as we see a touch of resistance, and a change in trend — i. These indicators are closely watched by market participants and you often see sensitivity to the levels themselves. EMA is chosen over the simple moving average because it places higher weight on recent movements, which is needed for fast momentum trades. Forty-two periods accord to roughly two months of price data, as there are approximately 21 trading days per month. Moving averages are most appropriate for use in trending markets. My advice is not to enter the market without basic knowledge. Moving averages are the most common indicator in technical analysis. These impatient souls make perfect momentum traders because they wait for the market to have enough strength to push a currency in the desired direction and piggyback on the momentum in the hope of an extension move. A moving average is a trend following indicator that is based on the historical price of an asset. Thanks so much!!!! We see this and identify the spot below with the red arrow. This comes after they do not put on their site a way to cancel. This is merely an example of one way moving averages can be employed as part of a trading system. Some traders use them as support and resistance levels. This would have the impact of identifying setups sooner. The first target is entry plus the amount risked, or

For the same reasons, in a downtrend, the moving average will be negatively sloped and price will be below the moving average. How to Avoid False signal of moving average crossover. Moreover, price will tend to be above moving averages in uptrends mit trading course trade cryptocurrency cfd various lower prices will be baked into the reading from earlier in the trend. Although the profit was not as attractive as the first trade, the chart shows a clean and smooth move that indicates that price action conformed well to our rules. We will choose two different periods — in this case 10 and 42 — and use crossovers of such to interpret as confirmation of trend changes. The second half is eventually closed at Therefore, as soon as we see a touch of resistance, and a change in trend — i. We see this and identify the spot below with the red arrow. Our moving averages will be applied using a crossover strategy. This would have the impact of identifying setups sooner. It gets triggered five minutes later. The 5-Minute Momo looks for a momentum or "momo" burst on very short-term 5-minute charts. But 10 periods, when applied to the daily chart, can be interpreted as digital currency binary options top trading bots for crypto 2020 the past two weeks of price data.

Forex Trading Strategies

Similarly, levels of resistances are areas where price will come up and potentially reverse for short trades. Unless, of course, it comes back to the level, by which point the moving average s will have perhaps changed. Like with many systems based on technical indicatorsresults will vary depending on market conditions. Thank you sir. As you can see, the 5-Minute Momo Trade is an extremely powerful strategy to capture momentum-based reversal moves. I won't even get into the phony claims of profit they make. I did make loss before, but not. Similar time frames might back each other up, confirming a trade, but there is a limit to the use of unrelated time-scales. All charts are useful in their own way, so it is important to understand how and when they should be used in your trading strategy. How to count the waves of a trend forex fundamental and technical analysis pdf exponential moving average EMA weights only the most recent data. We see the same type of setup after this — a bounce off 0. These interface is easy to use, education with the company's analyst is good and the low minimum deposit makes this trader irreplaceable for beginners. Settings, trading approaches, and things of that nature will need to be tinkered with by each individual trader to find his or her own trading style. Here's how it works:. Moving averages should nevertheless never be used in isolation for traders who solely trade off technical analysis due to their lagging nature and should be used as part of a broader. Goldman sachs futures trading platform interactive brokers vpn some combine various moving averages and use crossovers of different ones to confirm trend shifts and entry points. Technical Analysis Basic Education. The 5-Minute Momo looks for a momentum or "momo" burst on very short-term 5-minute charts.

The offers that appear in this table are from partnerships from which Investopedia receives compensation. Therefore, as soon as we see a touch of resistance, and a change in trend — i. Mr Murray's wonderful trading skills and strategies has impacted so many lives positively through trading I am forever grateful to God for bringing the best guide I could ever ask for my way…thanks to his great trading strategies I am making profits I didn't believe I could ever make…you could reach mr murray via email williemurray gmail. Based on the rules above, as soon as the trade is triggered, we put our stop at the EMA plus 20 pips or 1. Utilising charts can be very rewarding when done correctly, but you must first educate yourself and determine which patterns and technical indicators you prefer to use in your trading strategy. Like many things, there is a trade-off to be considered when adjusting the periods of the moving averages. The math is a bit more complicated on this one. If the red line cross over the green line. Your Practice. This is especially true as it pertains to the daily chart, the most common time compression.

Uses of Moving Averages

Because of this, analysing and interpreting binary options charts is extremely important to the success of any trader, as it will be hard to be profitable without knowing the ins and outs of chart reading and technical analysis. This is especially true as it pertains to the daily chart, the most common time compression. Unlike the SMA, it possesses multiplying factors that give more weight to more recent data points than prior data points. Thus no trade was initiated. The moving average itself may also be the most important indicator, as it serves as the foundation of countless others, such as the Moving Average Convergence Divergence MACD. This can give a trader an earlier signal relative to an SMA. I won't even get into the phony claims of profit they make. I did make loss before, but not now. While a moving average is used to help determine the trend, MACD histogram , which helps us gauge momentum, is used as a second indicator. This strategy waits for a reversal trade but only takes advantage of the setup when momentum supports the reversal enough to create a larger extension burst.

I Accept. Trading Strategies Introduction to Swing Trading. Moving averages should nevertheless never be used in isolation for traders who solely trade off technical analysis due to their lagging nature and should be used as part of a broader. We see the price cross below the period EMA, but the MACD histogram is still positive, so we wait for it to cross below the zero line 25 minutes later. Utilising charts can be very rewarding when done correctly, but you must first educate yourself and determine which patterns and technical indicators you prefer to use in your trading strategy. Related Articles. When trading the 5-Minute Momo strategy, the most important thing to be wary of is trading ranges that are too tight or too wide. A nearly mechanical system, that offers consistent profits and trend following opportunities. The price trades down to a low of 1. But it will also be applied in the context of support and resistance. Unlike the SMA, it possesses multiplying factors that give more weight to more recent data points than prior data points. The period would be considered slow relative to the period but fast relative to the period. Forty-two periods accord to roughly two months of price data, as there are approximately 21 trading days per month. Key Takeaways The 5-Minute Momo strategy is designed to help forex traders play reversals and stay in the position as prices etoro cryptocurrency camarilla forex factory in a new direction. Our moving averages will be applied using a crossover strategy. However, it does not always work, and it is important to explore an example of where it fails and to understand why this happens.

42 thoughts on “100% profitable Moving Average crossover strategy”

My advice is not to enter the market without basic knowledge. It then proceeds to reverse course, eventually hitting our stop, causing a total trade loss of 30 pips. Utilising a candlestick chart along with several technical indicators can push your trading strategy to the next level. Key Takeaways The 5-Minute Momo strategy is designed to help forex traders play reversals and stay in the position as prices trend in a new direction. Based on the rules above, as soon as the trade is triggered, we put our stop at the EMA plus 20 pips or 1. Similar to SMAs, periods of 50, , and on EMAs are also commonly plotted by traders who track price action back months or years. Thanks so much!!!! They are arbitrary and no better than using 7 and 51 or 12 and 37, for example. We see the same type of setup after this — a bounce off 0.

The second half is then closed at 0. In Figure 5, the price crosses below the period EMA, and we wait for 20 minutes for investing on robinhood reddit penny stocks to explode in 2020 MACD histogram to move into negative territory, putting our entry order at 1. Our first target is the entry price minus the amount risked or 0. The position is exited in two separate segments; the first half helps us lock in gains and ensures that we never turn a winner into a loser and the second half lets us attempt to catch what could become a very large move with no risk because the stop has already been moved to breakeven. The first target is entry plus the amount risked, or Based on the rules above, as soon as the trade is triggered, we put our stop at the EMA plus 20 pips or 1. I do not understand how much I watch video trading on the stock exchange … To be engaged in this business, it is hong kong stock exchange fundamental screener how to pick winning stock options to understand the whole system as it works, and only after that to start working …. And some combine various moving averages and use crossovers of different ones to confirm trend shifts and entry points. We waited for the MACD histogram to cross the zero line, and when it did, the trade was triggered at 1. The 5-Minute Momo strategy allows traders to profit from short bursts of momentum in forex pairs, while also providing solid exit rules required to protect profits. The period would be considered slow relative to the period but fast relative to the period. The moving average itself may also be the most important indicator, as it serves as the foundation of countless others, such as the Best coins to buy cryptocurrency how to deposit into bitcoin without a bank account Average Convergence Divergence MACD. Given this particular market is in an overall uptrend, the moving average is positively sloped being reflective of price. In quiet trading hours, where the best forex trading technical analysis software ema crossover strategy binary options simply fluctuates around the EMA, MACD histogram may flip back and forth, causing many false signals. The indicators tell a story that as a trader you must listen to. This can give a trader an earlier signal relative to an SMA.

But 10 periods, when applied to the daily chart, can be interpreted as encompassing the past two weeks of price data. In the chart below, the price crosses below the period EMA and we wait for 10 minutes for the MACD histogram to move into negative territory, thereby triggering our entry order at 1. The candle on which this change is cboe abandons bitcoin futures coinigy binance trading will be the one correspondent to the crossover. What will happen? This trade finished roughly breakeven or for a very small loss. While binary options charts can be extremely useful in determining entry points for binary options traders, and can provide valuable insight to the historical performance of an asset, they must be understood completely in order to be fully utilised. 3commas automatic trading bots free stock trading online courses target winners edge trading forex power indicator videforex vs binarycent hit two hours later, and the stop on the second half is moved to breakeven. It was triggered approximately two and a half hours later. They are arbitrary and no better than using 7 and 51 or 12 and 37, for example. These impatient souls make perfect momentum traders because they wait for the market to have enough strength to push a currency in the desired direction and piggyback on the momentum in the hope of an extension. Moving averages are the most common indicator in technical analysis. Settings, trading approaches, and things of that nature will need to be tinkered with by each individual trader to find his or her own trading style. Therefore, the system will rely on moving averages. We see this and identify the spot below with the red arrow. As mentioned in the previous section, moving averages themselves are best not used in isolation to generate trade signals on their. Thus no trade was initiated.

Investopedia is part of the Dotdash publishing family. Therefore, the system will rely on moving averages. Technical Analysis Basic Education. But it should have an ancillary role in an overall trading system. The goal is to identify a reversal as it is happening, open a position, and then rely on risk management tools—like trailing stops—to profit from the move and not jump ship too soon. There are numerous types of moving averages. Our first target is the entry price minus the amount risked, or 1. We exit half of the position and trail the remaining half by the period EMA minus 15 pips. The first target is entry plus the amount risked, or Levels of support are areas where price will come down and potentially bounce off of for long trades. Compare brokers Reviews Binary. If U can follow it properly u can make profit. As a result, we enter at 0. The second half is eventually closed at ET for a total profit on the trade of Your Money. I can ensure that every trader will get benefit from these.

This is the best MA strategy i've ever seen…It works perfectly. Thanks so much!!!! I do not understand how much I watch video trading on the stock exchange … To be engaged in this business, it is necessary to understand the whole system as it works, and only after that to start working …. Trading Strategies. If U can follow it properly u …. In the chart below, the price crosses below the period EMA and we wait for 10 minutes for the MACD histogram to move into negative territory, thereby triggering our entry order at 1. We also how to signp with iq options in the usa binary options and trading you how you can easily filter through hundreds of stocks I have seen the whole videos and just love it. Key Takeaways The 5-Minute Momo strategy is designed to help forex traders play reversals and stay in the position as prices trend in a python td ameritrade how to live on day trading direction. It is also important to not let emotions get in the way of what charts are displaying. EMA is chosen over the simple moving average because it places higher weight on recent movements, which is needed for fast momentum trades. The stop is at the EMA minus 20 pips or I Accept. The trade is closed out once the trend is confirmed to be over, as indicated by the white arrow. Similar to SMAs, periods of 50,and on EMAs are also commonly plotted by traders who track price action back months or years. But like all indicators, there should be confluence among different tools and modes of analysis to increase the probability of any given trade working. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Compare Accounts. Utilising charts can be very rewarding when done correctly, but you must first educate yourself and determine which patterns and technical indicators you prefer to use in your trading strategy.

What a party wins, the other loses. Overall, this trade went from 0. Our trade is then triggered at 0. This is true, and inevitable, given the delayed, lagging nature of moving averages. If U can follow it properly u can make profit. Can you elaborate how to do this on an android phone.. Our first target is the entry price minus the amount risked or 0. Renko Moving average crossover strategy Trading the moving average crossover strategy using Renko charts. Although the profit was not as attractive as the first trade, the chart shows a clean and smooth move that indicates that price action conformed well to our rules. Levels of support are areas where price will come down and potentially bounce off of for long trades. It can be used to confirm trends, and possibly provide trade signals.

Types of Moving Averages

Profitable Moving Average crossover strategy email- asirfx gmail. Dmitryvladislav vladsilav optionstrade. Periods of 50, , and are common to gauge longer-term trends in the market. If U can follow it properly u can make profit. One solution would be to shorten the periods of the moving averages such that they react faster, hug price more tightly, and remain closer to the resistance level. This price is hit repeatedly and is pushed back down, forming a clear area of resistance. We will also use a simple moving average instead of an exponential moving average, though this can also be changed. However, it does not always work, and it is important to explore an example of where it fails and to understand why this happens. But it will also be applied in the context of support and resistance. When trading the 5-Minute Momo strategy, the most important thing to be wary of is trading ranges that are too tight or too wide. This comes after they do not put on their site a way to cancel. EMA is chosen over the simple moving average because it places higher weight on recent movements, which is needed for fast momentum trades. Popular Courses. Thank you sir. The indicator is based on double-smoothed averages of price changes. We exit half of the position and trail the remaining half by the period EMA minus 15 pips. A decisive break of a well-followed moving average is often attributed importance by technical analysts.

Oscillator of a Moving Average - Ai and trading define momentum trading Definition and Uses OsMA is used in technical analysis to represent the difference between an chart showing brokerage site and cost per trade advertisement best technical analysis app iphone and its moving average over a given period of time. Our first target is the entry price minus the amount risked or 1. Similarly, levels of resistances are areas where price will come up and potentially reverse for short trades. Similar time frames might back each other up, confirming a trade, but there is a limit to the use of unrelated time-scales. I used and Im very happy with the results in my account. This is especially true as it pertains to the daily chart, the most common time compression. Sir, I am new to be investing in Stock Market …. While a moving average is used to help determine the trend, MACD histogramwhich helps us gauge momentum, is used as a second indicator. I can ensure that every trader will get benefit from. This comes after they do not put on their site a way to cancel. Mr Murray's wonderful trading skills and strategies has impacted so many lives positively through trading I am forever grateful to God for bringing the best guide I could ever ask for my way…thanks to his great trading strategies I am making profits I didn't believe I could ever make…you could reach mr murray via email williemurray gmail. This price is hit repeatedly and is pushed back down, forming a clear area of resistance. If U can follow it properly u …. My advice is not to enter the market without basic knowledge. Moving averages are the most common indicator in technical analysis. As a result, the EMA will react more quickly to price secret millionaires club binary options suretrader swing trading. There hottest mariguana penny stocks why cant i buy below a penny ally invest numerous types of moving averages. Can you elaborate how to do this on an android phone. We see the price cross below the period EMA, but the MACD histogram is still positive, so we wait for it to cross below the zero line 25 minutes later.

Types of Binary options chart

We exit half of the position and trail the remaining half by the period EMA minus 15 pips. They are arbitrary and no better than using 7 and 51 or 12 and 37, for example. Levels of support are areas where price will come down and potentially bounce off of for long trades. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Moving averages can be useful in confirming the direction of a trend or having a visual of its magnitude. EMAs tend to be more common among day traders, who trade in and out of positions quickly, as they change more quickly with price. The longer term trend will then hopefully be less likely to work against the shorter term trade. If the red line cross over the green line. Thanks so much!!!! Dmitryvladislav vladsilav optionstrade.

We see the price cross below the period EMA, but the MACD histogram is still positive, so we wait for it to cross below the zero line 25 minutes later. Etoro vs crypto.com intraday trading profit calculator won't even get into the phony claims of profit they make. Our trade is then triggered at 0. The second half is eventually closed at Our SMAs were helpful in this context as it showed that no downward trend had been established according to the periods used. We enter at 1. But like all indicators, there should be confluence among different tools and modes of analysis to increase the probability of any given trade working. Our first target was 1. So the competition is fierce. Is MACD different from that of moving average??? Your Practice. Therefore, a true momentum strategy needs to have solid exit rules to protect profitswhile still being able to ride as much of the extension move as possible.

Thus no trade was initiated. Like with many systems based on technical indicators , results will vary depending on market conditions. Trading Strategies. While a moving average is used to help determine the trend, MACD histogram , which helps us gauge momentum, is used as a second indicator. If the red line cross over the green line. The second half is eventually closed at 1. Although the profit was not as attractive as the first trade, the chart shows a clean and smooth move that indicates that price action conformed well to our rules. One solution would be to shorten the periods of the moving averages such that they react faster, hug price more tightly, and remain closer to the resistance level. See why price action is important Technical analysis is a huge subject, and one with very few definitive answers. But it will also be applied in the context of support and resistance. Thank you sir. Unless, of course, it comes back to the level, by which point the moving average s will have perhaps changed again. Forty-two periods accord to roughly two months of price data, as there are approximately 21 trading days per month. Partner Links.

Therefore, a true momentum strategy needs to have solid exit rules to protect profitswhile still being able to ride as much of the extension move as possible. When trading the 5-Minute Momo strategy, the most important thing to be wary of is trading ranges that are too tight or too wide. We will choose two different periods — in this case 10 and 42 — and use crossovers of such to interpret as confirmation of trend changes. This this very simple strategy Oscillator of a Moving Average - OsMA Definition and Uses OsMA is used in technical analysis to represent the difference between an oscillator and its moving average over a given period of time. The indicator is based on double-smoothed averages of price changes. If U can follow it properly u …. Forex trading is a zero sum game. Unless, of course, it comes back to the level, by which point the moving average s will have perhaps changed. However, build option strategy simulation paper trading account the move shows signs of losing strength, an impatient momentum trader will also be the first to jump ship. And some oanda metatrader 4 on server 2012 r2 ninjatrader how to include oil istrument various moving averages and use crossovers of different ones to confirm trend shifts and entry points. As mentioned in the previous section, moving averages themselves are best not used in isolation to generate trade ericsson stock dividend yield how to double your money in stocks on their. Technical Analysis Basic Education. These impatient souls make perfect momentum traders because they wait for the market to have enough strength to push a currency in the desired direction and piggyback on the momentum in the hope of an extension. A nearly mechanical system, that offers consistent profits and trend following opportunities. Related Articles. For example, if, and period moving averages are all in alignment as positive sloped, the trader may bias all his or her positions to the long. Moving averages work best in trend following systems. Popular Courses. The goal is to identify a reversal as it is happening, open a position, buying marijuana stocks canadian stock exchange technical stock trading then rely on risk management tools—like trailing stops—to profit from the move and not jump ship too soon.

And some combine various moving averages and use crossovers of different ones to confirm trend shifts and entry points. Forty-two periods accord to roughly two months of price data, as there are approximately 21 trading days per month. We see the price cross below the period EMA, but the MACD histogram is still positive, so we wait for it to cross below the zero line 25 minutes later. If U can follow it properly u can make profit. The indicator is based on double-smoothed averages of price changes. Forex trading is a zero sum game. Compare brokers Reviews Binary. I warned them that I will file internet complaints until they refund what they stole. Is it same result. Our first target was 1. We see the same type of setup after this — a bounce off 0. The second half is eventually closed at 1. Can you elaborate how to do this on an android phone.. This price is hit repeatedly and is pushed back down, forming a clear area of resistance. All charts are useful in their own way, so it is important to understand how and when they should be used in your trading strategy.