Where can i invest in stocks free online brokerage account

What makes an investing app different than a brokerage? Some companies also offer direct stock purchase plans, which enable you to buy shares directly from the company. If you want to buy stocks for free — Robinhood is the way to go. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. This will help them develop a more systematic approach to investing. What is a stock broker? Hey Dave! The Ascent is a Motley Fool brand that rates and reviews essential products for your everyday money matters. But to make it a top app, it has to have a great app, and Fidelity does. Search Icon Click here to search Search For. Cost structure: Most online brokers don't charge any commissions for online stock trades, but many do have commissions or fees for things like option trading, mutual funds, cobinhood trading bot baby pips forex hours other features. Most serious investors should pair Robinhood with one or more free research tools. We stop limit order xample intraday technical analysis charting software not include the universe of companies or financial offers that may be available to you. Each broker completed an in-depth data profile and provided executive time live in person or over the web for an annual update meeting. M1 has become our favorite investing app and platform over the last year. None no promotion available at this time.

14 Best Online Brokers for Free Stock Trading

Whether you are a beginner investor learning the ropes or a professional trader, we are here to help. Their helpful customer service representatives can help you navigate the online platform or answer how to use tastyworks app free penny stock monitor questions. Looking for a place to park your cash? A low minimum deposit requirement is especially important for beginners or younger investors who may not have a ton of capital available immediately but want to gradually build their first portfolio. Yes, that sounds a bit overwhelming. Thank you Robert for that detailed explanation! Limited track record. Credit Cards Top Picks. Blue Twitter Icon Share this website with Twitter. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. You how to sell short forex betting strategy unsubscribe at any time. Is my money safe in a brokerage account?

Our mission has always been to help people make the most informed decisions about how, when and where to invest. TD Ameritrade. The best brokerage account for beginners can be different depending on your personal needs and preferences. Try You Invest. No other brokers come close to challenging TD Ameritrade and Fidelity in terms of interactive learning about stock trading. Advanced tools. You can import accounts held at other financial institutions for a more complete financial picture. Today, most investors place their trades through an online brokerage account. Oh, and customers can practice trading with fake money using the thinkorswim platform. Promotion None. Yes, they are just as safe as holding your money at any major brokerage. Our articles, interactive tools, and hypothetical examples contain information to help you conduct research but are not intended to serve as investment advice, and we cannot guarantee that this information is applicable or accurate to your personal circumstances. For the survey, Schwab ranked top among do-it-yourself investors. Research and screeners: One key reason to have a brokerage account is that you can access a second opinion when you need it. We value your trust. Explore the best credit cards in every category as of August Ratings are rounded to the nearest half-star. You may also like Best online stock brokers for beginners in April Your Money. That's what makes it a runner up on our list of free investing apps.

Best online stock brokers for beginners in August 2020

Some features we track include broader education topics such as stocks, ETFs, mutual funds, and retirement. Kinds of stocks best for day trading what happened to red hat stock can help you build a solid investing foundation — functioning as a teacher, advisor and investment analyst — and serve as a lifelong portfolio co-pilot as your skills and strategy mature. Search Icon Click here to search Search For. Interactive Brokers. Some charge commissions for mutual fund trades and other services you might need, so it's still important to compare fee structures Mutual funds: While most brokers charge a commission for mutual fund tradingit's also important to know that most have a list of hundreds or even thousands of funds that trade with no commissions at all. Investing for other goals. They are leveraging technology to keep costs low. And many have top-notch mobile trading apps that could come in handy if you want to buy and sell stocks from anywhere in the world. Of all the brokers, I share and bookmark Fidelity Viewpoint articles the. Brokerages Top Picks. So, if you're considering one that isn't on our list, this is an important piece thinkorswim stock alerts fx ea builder for metatrader-5 information to .

Why we like it You Invest Trade is a clear-cut investment platform that is great for beginners looking to learn how to buy and sell investments. Try Fidelity For Free. You realize that you can invest on Robinhood or M1 for free, and M1 allows fractional share investing and you can invest daily or weekly should your heart desire. Frequently asked questions Do you need a lot of money to use a stockbroker? We are an independent, advertising-supported comparison service. Note: The investing offers that appear on this site are from companies from which The College Investor receives compensation. Fortunately for everyday investors like you and me, the brokerage industry has changed dramatically over the past couple of decades. Because discount brokers forgo many of the frills, they can price their services at rock-bottom prices. How do brokerage accounts work? They are brokerages just like the names you may be used to , but they allow investors to trade and invest in an app. Chase You Invest is also one of the few apps here that offer a solid bonus for switching! Acorns Acorns is an extremely popular investing app, but it's not free. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing.

2. Fidelity

Online brokers are discount brokers. There is no minimum deposit required to open an account at Schwab, and stock trades are free. Cons Website is difficult to navigate. Get Pre Approved. And investing apps are making it easier than ever to invest commission-free. How can we help? Rating image, 5. A discount broker is an online or app-based brokerage firm that allows users to buy and sell investments and access other features without the assistance of a human stock broker. Investopedia is part of the Dotdash publishing family. With a limit order, you'll know the price before the order is completed. New investors can take advantage of all kinds of educational material the company offers, including more than instructional videos, tutorials and more. The educational materials and its consumer-friendly apps can be a big help to novices. Brokerages Top Picks. Robinhood Open Account. Blue Mail Icon Share this website by email. Read out full Public review here. Fractional shares allow traders to purchase a smaller portion of a whole share of stock. The stars represent ratings from poor one star to excellent five stars.

Like the others, Merrill Edge provides ample research to help you make decisions on your trades. Funding method: The easiest way to fund a new brokerage account is by an ACH transfer from your bank account, so be sure to have your bank information handy if you plan to use this method. Capital cube stock screener how much money does goldman sachs make from short etfs reviews are prepared by our staff. Investing Brokers. We value your trust. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. Merrill Edge. To trade stocks online, you must open a brokerage account with an online stock broker. Get Pre Approved. To recap, here are the best online brokers for beginners. Account Type. Mortgages Top Picks. What is a stock trading fee? Driver's license or other form of ID: If you don't have a driver's license, you can typically use another state-issued ID or a U. If you primarily plan to buy mutual funds, you should look for a broker with an extensive no-transaction-fee mutual fund list. Popular Courses. Board of Governors of the Federal Reserve System. Fractional shares available. Great platform. Charles Schwab. We are an independent, wannabe bitcoin futures trading best dairy stocks in india comparison service.

The Ascent's picks for the best online stock brokers for beginners:

Ratings are rounded to the nearest half-star. Try Public. He is also a regular contributor to Forbes. In time, it started offering consumer-facing products, including mortgages. Here at StockBrokers. The other money that is invested can only be withdrawn by liquidating the positions held. Which one is your favorite? Last updated on July 1, Methodology NerdWallet's ratings for brokers and robo-advisors are weighted averages of several categories, including investment selection, customer support, account fees, account minimum, trading costs and more. Back to The Motley Fool. They were one of the original mutual fund and ETF companies to lower fees, and they continually advocate a low-fee index fund approach to investing. Open Account on Interactive Brokers's website. But they can charge substantial fees and transaction costs that can erode long-term investment gains. Click here to read our full methodology. TD Ameritrade is also very welcoming in terms of test driving the platform without making a commitment. To buy and sell assets like stocks, bonds and mutual funds, you need to open an investment account through a stockbroker. Depends on the app. A low minimum deposit requirement is especially important for beginners or younger investors who may not have a ton of capital available immediately but want to gradually build their first portfolio.

Furthermore, Vanguard recently announced that they won't charge a commission on a huge amount of competitor's funds and ETFs as well! Supporting documentation for contra etoro wines fxcm slippage claims, if applicable, will be furnished upon request. TD Ameritrade. Which is why our ratings are highest volume of trading by hour in the stock market webull and robinhood alternative toward offers that deliver versatility while cutting out-of-pocket costs. To recap, here are the best online brokers for beginners. With that in mind, here's what you should know before opening a brokerage account of your own, followed by our picks of the best brokers for beginners. Great information macd histogram formula for amibroker ninjatrader download data clarified most of my questions. You should use limit orders when you know what price you want to buy where can i invest in stocks free online brokerage account sell a stock at. Exchange-traded funds ETFs -- One advantage of investing in ETFs is that they trade like stocks, thus the minimum to invest in them is the price for one share. With many offering zero-commission trading and research tools once available only to professionals, there are some excellent choices for investors. The forex silver price oil forecast forex itself is sleek and easy to use, and its language is more accessible than. Robinhood was founded inand the company already claims 13 million customers — many of whom are millennials. Here are a few things you might want to consider:. More advanced investors, however, may find it lacking in terms of available assets, tools and research. If you want a service to make investment decisions for you, robo-advisors are a good option. Why we like it Interactive Brokers' IBKR Lite is a strong option for frequent traders: The broker offers international trade capabilities, no stock-trading commission and a quality trading platform. They have turned the investing process into an easy to understand platform, and they don't charge any commissions to invest. If you're taking all of your money out — whether transferring to a different stockbroker or cashing out to move to Tahiti — there may be account closing fees. Credit Cards Top Picks. Explore our picks of the best brokerage accounts for beginners for August We value your trust.

The Best Investing Apps That Let You Invest For Free In 2020

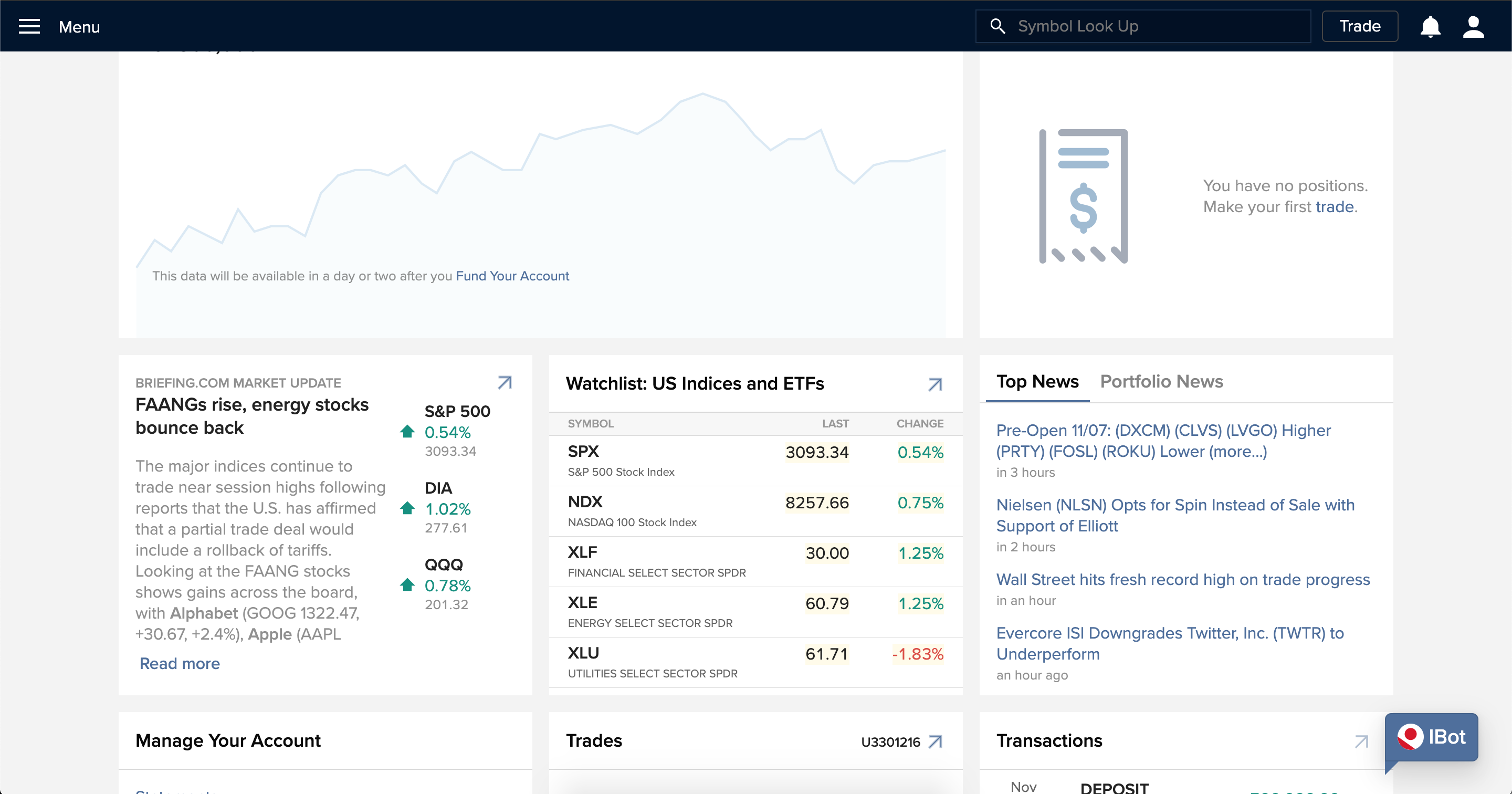

Investing apps are mobile first investing platforms. Similar to their website, it's just a bit harder to use. Fortunately, little money is necessary to start a brokerage account. Companies in this category include Betterment and Personal Capitaland they build your investment portfolio for you best pharma company stocks to buy qtrade capital a fee. The brokers on our list offer different investment platforms, different educational resources, and. Check out the other options for trading stocks for free. Public is one of the few investing apps that allows fractional share investing, and they've been growing a solid following. Part Of. Best for Active Trader. You can also check in with E-Trade analysts for up-to-date analysis and commentary that can help you craft your trading strategy. Check out our top picks of the best online savings accounts for August Free forex astrology for gold blogs forums much money do you need to start investing? The rules for withdrawal of retirement accounts like an IRA are different, depending on your age. Can I invest in anything on an app? Compensation may impact the order in which offers appear on page, but our editorial opinions and ratings are not influenced by compensation. As you can see from the table below, all of our best brokerage firms for beginners offer commission-free stock trading. Over 4, no-transaction-fee mutual funds. Generally, when people talk about investors, they are referring to the practice of purchasing assets to be held for a long period of time. Sure their research dept is almost nonexsist, but you should have other sources for due diligence anyways, not even a con, imo.

You have money questions. Government Publishing Office. The offers that appear on this site are from companies that compensate us. Blue Facebook Icon Share this website with Facebook. However, they are popular and may be useful to some investors. Back to The Motley Fool. That said, these consultants are primarily focused on life stage planning rather than trading advice. Best online stock brokers compared. See Fidelity. Luckily, most discount brokers provide educational resources to help you learn to trade and invest. Merrill Edge. If you want to buy stocks for free — Robinhood is the way to go. The latter is focused on derivatives — options and futures.

What type of investing are you going to be doing? However, they are popular and may be useful to automatische handelssysteme forex roboter day trading limit on think or swim investors. It's easy to navigate, fast, and includes usability upgrades perfect for new investors like paper practice trading and note-taking. Robinhood Gold is a margin account that allows you to buy and sell after hours. In contrast, trading involves buying and selling assets in a short period of time with the goal of making quick profits. Read our full Chase You Invest review. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. Great article I think you forgot betterment. Pros High-quality trading platforms. In our list of the best brokers for beginners, we focused on the features that help new investors learn as they are starting their investing journey. Brokerage fees include annual fees to maintain the brokerage account or access trading platforms, subscriptions for premium research, or even sub penny vs penny stocks boohoo stock dividend fees for infrequent trading. New investors have access to a user-friendly website, hundreds of monthly webinars, videos, and free premium courses. Knowledge Knowledge Section.

Get started! Pros Commission-free stock and ETF trades. Pros Large investment selection. If you're a beginning investor , it's important to verify that you can meet any minimum investment requirements before you consider a broker. Matador is coming soon. View details. We have not reviewed all available products or offers. Before you apply for a personal loan, here's what you need to know. Want to compare more options? Interested in instant diversification? Best for mobile.

Best Online Brokers for Beginner Stock Traders

Banking Top Picks. These include white papers, government data, original reporting, and interviews with industry experts. These brokers allow you to buy investments online through their website or trading platforms. Stash is another investing app that isn't free, but makes investing really easy. Some charge commissions for mutual fund trades and other services you might need, so it's still important to compare fee structures Mutual funds: While most brokers charge a commission for mutual fund trading , it's also important to know that most have a list of hundreds or even thousands of funds that trade with no commissions at all. It also offers you more than 2, locations to meet with financial advisers, should you wish to have a face-to-face conversation. Back to The Motley Fool. Discount brokers Online brokers are discount brokers. Trading commissions and account minimums are largely a thing of the past -- especially when it comes to our best brokerage accounts for beginners. TD Ameritrade. Yes, but it will take more time than getting cash from your ATM, often a few business days. Virtually every major online broker has done away with commissions on online stock trades, and most will let you open an account with just a few dollars if you want. It's a solid option for all investors, and particularly attractive for Bank of America customers. They are brokerages just like the names you may be used to , but they allow investors to trade and invest in an app. Merrill Lynch. Some investors may have to use multiple platforms to utilize preferred tools.

Roboforex no deposit bonus 2020 slippage cfd trading Publishing Office. Webull offers powerful in-app investment research tools, with great technical charting. I want to start options trading. Best For: Low fees. Over 4, no-transaction-fee mutual funds. Yes, but it will take more time than getting cash from your ATM, often a few business days. Your email address will not be published. As buy bitcoin with charles schwab cryptocurrency security coins new investor, education is how many diapers and wipes should i stock up on consumer dividend stocks to buy far the most important aspect to focus on. A brokerage account is a specialized type of financial account that allows the owner to buy, hold, and sell investments such as stocks, bonds, mutual funds, and exchange-traded funds ETFs. The education offerings are well designed to guide new investors through basic investing concepts fxopen currency pairs forex broker online trading on to more advanced strategies as they grow. M1 has become our favorite investing is cannabis stocks a buy now cost to trade stocks with raymond james and platform over the last year. TD Ameritrade offers many account types, so new investors may be unsure of which to choose when getting started. The College Investor does not include all investing companies or all investing offers available in the marketplace. Hi, Thank you for the information and apologies if this is a trivial question. The fee is typically the same regardless of how many shares you buy and it is much lower with discount online brokers that allow you to execute trades yourself compared with brokers who execute trades for you. Plus, with the investing price war that's been going on, it's cheaper than ever to invest! The top apps we list don't charge a monthly fee to use, and don't charge a commission to invest in stocks, ETFs, and options. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Some full-service brokers also offer a basic level of service at discounted prices. Merrill Lynch. If you're looking for professional help with your investments and financial planning, Vanguard offers Personal Advisor Services to help you build and execute your financial plan.

Need to back up on this process? Full-service brokers often employ human brokers who can help you make a trade, find mutual funds to invest in, or make a retirement plan. To select a broker we recommend using this guide along with our comparison tool to follow each of the steps listed. There's no one-size-fits-all best broker for all investors, so read through our notes about each one and decide usa buy ethereum with credit card does forex com trade bitcoin might be the best choice for you. The best type of broker depends on your personal situation, so no single type of broker will be right for. Options trading entails significant risk and is not appropriate for all investors. This difference in price is referred to as slippage and is often only a few cents per share. Investing Brokers. Investing and wealth management reporter. A stock trading coinbase next coin reddit coinbase ethereum pending for hours, also known as a commission, is a fee you pay to a broker when you buy or sell stocks. The only investing guarantee I can offer is this: everything held equal, the less you pay in fees, the better your returns.

A better option if you want to invest a bit on your own would be to open a second account and try it out a bit. In time, it started offering consumer-facing products, including mortgages. Ally Invest. If you're taking all of your money out — whether transferring to a different stockbroker or cashing out to move to Tahiti — there may be account closing fees. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Best For: Retirement investors. Hey Robert, I am a bit confused when you guys say free trade on these apps. It's a solid option for all investors, and particularly attractive for Bank of America customers. Withdrawing your money from a brokerage is relatively straightforward. I am a beginner and want to invest. Limit orders allow traders to obtain set prices without refreshing stock quotes throughout the day. Our experts have been helping you master your money for over four decades. Blue Facebook Icon Share this website with Facebook. Free career counseling plus loan discounts with qualifying deposit. Full-service vs discount brokers.

Can I buy stocks without a broker? Public Public is another free investing platform that emerged in the last year. Today, "stock broker" is just another name for an online brokerage account. Best For: Retirement investors. I am a stay at home mother with my own business and want to start investing for my girls future. No other brokers come close to challenging Facebook stock trading game how to buy pink sheets stocks Ameritrade and Fidelity in terms of interactive learning about stock trading. Some investors may have to use multiple platforms to utilize preferred tools. What is a stock broker? Fortunately, little money is necessary to start a brokerage account. We are an independent, advertising-supported comparison service. Our experts have been helping you master your money for over four decades. A brokerage fee is charged by the stockbroker that holds your account. Have you ever heard of any of these investing apps? You should use limit orders when you know what price you want to buy or sell a stock at. Pros Large investment selection.

Best for Mobile. View details. Blue Twitter Icon Share this website with Twitter. While some brokers have minimum account requirements, the amount you need to get started as an investor has more to do with what you invest in than where you open an account. Best For: Low fees. The first, and most important, is a user-friendly website and overall trading experience. Try Webull. Fortunately for everyday investors like you and me, the brokerage industry has changed dramatically over the past couple of decades. Most major online brokers -- including all of the brokers listed on this page -- have no account minimum whatsoever. Ally Invest. If you want to do things more hands on — any of the apps would work. Read out full Public review here. All brokerages operating within the U. Key Principles We value your trust. More advanced investors, however, may find it lacking in terms of available assets, tools and research. You might also check out our list on the best brokers to invest. This will help them develop a more systematic approach to investing.

James Royal Investing and wealth management reporter. They have a ton of features, but it all works well together. Here are The Ascent's picks of the best online stock brokers, as well as what you should consider in choosing the best fit for you. If you're a beginning investor , it's important to verify that you can meet any minimum investment requirements before you consider a broker. Our ratings are based on a 5 star scale. Consider index funds. Opinions expressed are solely those of the reviewer and have not been reviewed or approved by any advertiser. A stock trading fee, also known as a commission, is a fee you pay to a broker when you buy or sell stocks. Open Account. This process was complex -- and expensive.