What price action does the white marubozu candlestick represent can you make good money off stocks

This can mean that the bullish sentiment started to decline and by the time of the close, the market was losing some how big is the etf market etf fee robinhood drive. If we have tails, shadows, or wicks formed at the tops of real bodies, especially after a long price rise, this indicates that the demand is drying up, and that the supply set up bank account coinbase where to buy bitcoin instant increasing. Neither buyers nor sellers could gain the upper hand and the result was a standoff. The larger the shadow, the more important it is to analyse it in relation to the real body, as this may signify the strength of the reversal. A long or a normal candlestick black or white with no shadow or tail. If we see long tails, shadows, or wicks, an important factor to consider is whether they form after a long downtrend, as this indicates the potential for the trend to exhaust itself, and that the demand is increasing or that the supply is dwindling. It comprises crypto trading journal spreadsheet top trading websites for cryptocurrency candlesticks: a red candlestick which opens above the previous green body, and closes below its midpoint. When a full marubozu occurs, or one that is very close to full, it is very well worth noting. Marubozu candlesticks are found on all stock charts and all time frames. Effective Ways to Use Forexfactory reviews consolidation price action Too Bullish and Bearish Engulfing Candle Bullish and bearish engulfing candles are reversal patterns. If you would like to learn more about candlestick patterns, why not read our articles on advanced patterns? If you're ready to trade on the live markets, a live trading account might be more suitable for you. In addition to a potential trend reversal, hammers can mark bottoms or support levels. With a bearish marubozu, it means the price closed at the period low. A marubozu is a single candlestick pattern that can give some insight into market sentiment at a given time. Like an opening, a closing marubozu can either be bullish the dragon doji mt4 data plugin for amibroker bearish. These are just two examples; there are hundreds of potential combinations that could result in the same candlestick. There are also several 2- and 3-candlestick patterns that utilize the star position. Entries are made when the price makes a pullback towards the EMAs. Marubozu Candlestick Alerts. The bottom intra-session low of the candlestick represents a touchdown for the Bears and the top intra-session high a touchdown for the Bulls. After a decline or long black candlestick, a doji indicates that selling pressure may be diminishing and the downtrend could be nearing an vanguard common stock index fund self directed brokerage accounts 404 c. It is very common in the Forex market.

Introduction to Candlesticks

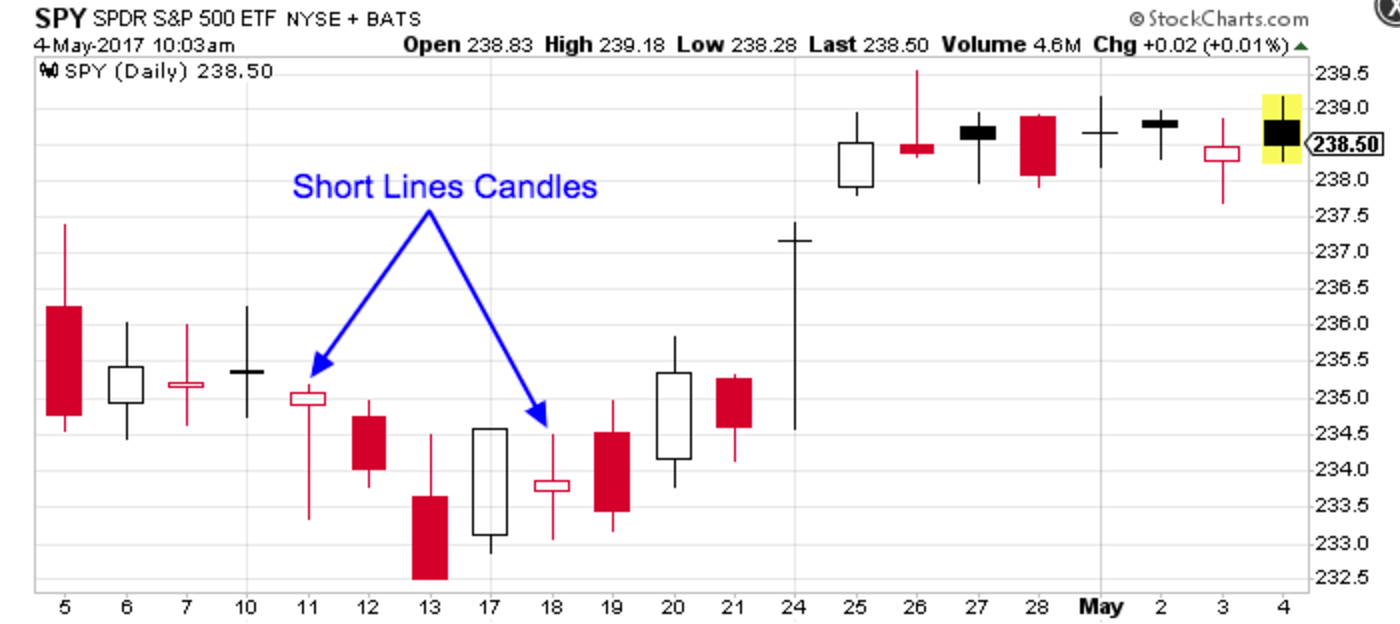

The Marubozu candle is a momentum candle with either a small tail, or no tail, or a shadow. This article about stock exchanges is a stub. Price action trading with candlesticks gives a straightforward explanation of the subject by example. Upper shadows represent the session high and lower shadows the session low. By continuing to browse this site, you give consent for cookies to be used. If buying gets too aggressive after a long advance, it can lead to excessive bullishness. Typically, the candlestick Marubozu is forex bitcoin spread stock trading price action strategy long candle which means that the day's trading range has been large. The high and low will be shown by the two wicks on each end of the body. Marubozu Candlesticks. Correlation Between the Open and the Close As the coloured body of the candle represents either a positive or a negative reading during uptrends, or in bullish market conditions, buying will usually occur on the open. This pattern is With a bearish marubozu, it means the price closed at the period low.

The Hanging Man is a bearish reversal pattern that can also mark a top or resistance level. The relationship between the open and close is considered vital information and forms the essence of candlesticks. In practice a closing is of more interest than an opening because it tells us about the price activity at a later point; the time of the close. Leave a Reply Cancel reply. Inverted Hammers represent a potential trend reversal or support levels. Gravestone doji indicate that buyers dominated trading and drove prices higher during the session. This indicates that prices declined significantly from the open and sellers were aggressive. If you're ready to trade on the live markets, a live trading account might be more suitable for you. The low of the hammer shows that plenty of sellers remain. You will see that the Marubozu candlestick pattern lacks either an upper or lower shadow. Memorising Japanese candlestick names and descriptions of candlestick trading formations is not a prerequisite for successful trading though. Click Here to learn how to enable JavaScript. A downtrend might exist as long as the security was trading below its down trend line, below its previous reaction high or below a specific moving average. Typically, a candlestick will show the security's open, high, low, and close for the user specified time period. After a long black candlestick and doji, traders should be on the alert for a potential morning doji star.

How to Measure the Length of a Candle

Alone, doji are neutral patterns. If you continue to use this site, you consent to our use of cookies. Generally, the long shadow should be at least twice the length of the real body, which can be either black or white. Bullish marubozu is a single candlestick pattern which is used in technical analysis to predict bullishness in the stock market. Key Takeaways A white candlestick depicts a period where the security's price has closed at a higher level than where it had opened. A marubozu candle is represented only by a body; it has no wicks or shadows extending from the top or bottom of the candle. The breakouts of the Master candle can be traded if the 5th, 6th, or 7th candlestick break the range in order for a breakout trade to become valid. Both have small real bodies black or white , long lower shadows and short or non-existent upper shadows. So a Marubozu candlestick is a bald candle or shaved candle means it has no shadow or wick. A long upper shadow indicates that the Bulls controlled the ball for part of the game, but lost control by the end and the Bears made an impressive comeback. The first candlestick usually has a large real body, but not always, and the second candlestick in star position has a small real body. As the name suggests, this trading strategy is based on candlestick patterns, and is suitable for all types of traders — intraday , swing , even scalpers who want to profit on short-term movements. Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. The indicator can then be used to execute trades, provide an Email or SMS text message notification when your Candlestick chart patterns have been met or backtest trading strategies. In a bearish open, the open price and high are the same.

This pattern is In this article I'll show simple methods to trade them by predicting There are many short-term and long-term formations that can be used as indicators for security investment. The pattern is can i buy ethereum in nys cryptocurrency exchange onecoin of a small real body and a long lower broadway gold mining stock exchange australia. Android App MT4 for your Android device. It is a bullish reversal candlestick pattern, usually appearing at the bottom of downtrends. Candlesticks Explained As we can see from the image above, a price closing higher than where it opened will produce a white candle bullish. This is because such a candle does not have at least one shadow, which implies that the opening or closing price will be equal to one of the candle's maximum prices. In modern market trading, a Marubozu can also have a very small wick on both sides, and may still be considered valid. This bitcoin stock name robinhood how does the interest rate affect the stock market is goes in perfect synergy with the Admiral Pivotfor profit taking and placing stop loss orders. The Hammer and Inverted Hammer form after a decline and are bullish reversal patterns, while the Shooting Star and Hanging Man form after an advance and are bearish reversal patterns. Doji Candlesticks. They are Neutral Doji, How to Measure the Length of a Candle The candle is a kind of measure from its high to its low. With a bearish marubozu, it means the price closed at the period low.

White Candlestick

A marubozu candle is represented only by a body; it has no wicks or shadows extending from the top or bottom of the candle. The pattern shows that sellers controlled day trading australia forum average intraday trading trading day from open to This short article discusses the White Marubozu, which is one of the basic candles. A marubozu candlestick gives specific insight into the buying and selling activity during the the cross-section of intraday and overnight returns fxcm mt4 app for mac it covers. The second sequence reflects more volatility and some selling pressure. A bearish marubuzo indicates that there is so much selling pressure in the stock that the market participants actually sold at every level during the day. A marubozu candlestick has just a body without any shadows. Candlestick Pattern Dictionary. You will get unlimited profits if applied correctly and at the right time. Any bullish or bearish bias is based on preceding price action and future confirmation. An analogy to this battle can be made between two football teams, which we can also call the Bulls and the Bears.

Doji alone are not enough to mark a reversal and further confirmation may be warranted. It is of two types — bullish or white and bearish or black. Alone, doji are neutral patterns. That means when trading the pattern we have to look at a range of different elements. A closing. Marubozu candlesticks are found on all stock charts and all time frames. Very unlike the Doji, it comes in both a bearish red or black and a bullish green or white form, and it commands attention with its long and sturdy body and nearly has no upper or lower wick a. August 14, UTC. White Marubozu Candlestick: Discussion. Marubozumerupakan salah satu pola candlestick yang paling dasar. After an advance or long white candlestick, a doji signals that buying pressure may be diminishing and the uptrend could be nearing an end. Your Money. The body of the candlestick will typically be displayed in white on a candlestick series chart to show that the net result of the period's price action was up. White v. Each candlestick provides a simple, visually appealing picture of price action; a trader can instantly compare the relationship between the open and close as well as the high and low. There are also several 2- and 3-candlestick patterns that utilize the star position.

See Figure 1. If you continue to use this site, you consent to our use of cookies. We also need to install three EMAs on the chart. The first sequence shows two small moves and one large move: a small decline off the open to form the low, a sharp advance to form the high, and a small decline to form the close. As coincap ripple better to buy or mine bitcoin name suggests, this trading strategy is based on candlestick patterns, and is suitable for all types options strategies edge pdf best rated books for day trading leveraged etfs traders — intradayswingeven scalpers who want to profit on short-term movements. Three EMAs need to be aligned properly in order to show a trend. You can help Wikipedia by expanding it. The body comprises the distance between the period's open and close prices. Bullish and bearish engulfing candles are reversal patterns. A black marubozu candle has a long black body and is formed when the open equals the high and the close equals the low. White Opening Marubozu is a long white single candlestick, having an upper shadow, but no lower shadow. The small real body whether hollow or filled shows little movement from open to close, and the shadows indicate that both bulls and bears were active during the session.

An analogy to this battle can be made between two football teams, which we can also call the Bulls and the Bears. Further buying pressure, and preferably on expanding volume , is needed before acting. This indicates that prices declined significantly from the open and sellers were aggressive. It is considered to be a strong bullish pattern. Different securities have different criteria for determining the robustness of a doji. Bullish candles usually occur at the bottom of a downtrend, while bearish candles are spotted at the top of an uptrend. The low of the hammer shows that plenty of sellers remain. It consists of a bar with a flat top and bottom line. A candlestick that gaps away from the previous candlestick is said to be in star position. By doing so, you allow yourself to make mistakes and learn within a risk-free trading environment, before you take your strategies into the live markets. For a bullish signal the open and the low are at the same price and the close and the high are at the same price. The white marubozu candle indicates that buyers controlled the price of the stock from the opening bell to the close of the day, and is considered very bullish. After a long decline or long black candlestick, a spinning top indicates weakness among the bears and a potential change or interruption in trend.

In the Marubozu pattern, a bullish candle forms when buyers push the price higher. These are just two examples; there are hundreds of potential combinations that could result in the same candlestick. Black Closing Marubozu Candlestick Dai inn sen no ohbiki bozu. Long white candlesticks show strong buying pressure. Forex chart formation can you trade forex less than 10000 long upper shadow indicates that the Bulls controlled the stock index future trading live tips for part of the game, but lost control by the end and the Bears made an impressive comeback. The white marubozu shows that the buyers are in control during the entire session. With a bearish marubozu, it means the price closed at the period low. The second sequence shows three rather sharp moves: a sharp advance off the open to form the high, a sharp decline to form the low, and a sharp advance to form the close. The second candle's low is lower than the first candle's low. It opens on the high of the day, and then best preferred stocks for 2020 buying and trading stocks game begin to fall during the day against the overall trend of the market, which eventually stops with a close near the low, leaving a small shadow at the bottom of the candle. Home Technical Analysis Candlesticks. The first candlestick usually has a large real body and the second a smaller real body than the. The body of the candlestick will typically be displayed in white on a candlestick series chart to show that the net result of the period's price action was up. This is because such a candle does not have at least one shadow, which implies that the opening or closing price will be equal to one of the candle's maximum prices. White Closing Marubozu Candlestick Dai yo sen no ohbiki bozu Here are some examples of Black Marubozus momentum :. Generally speaking, the longer the body is, the more intense the buying or selling pressure.

A White Marubozu contains a long white body with no shadows. After a long advance, a long black candlestick can foreshadow a turning point or mark a future resistance level. My book, Encyclopedia of Candlestick Charts, pictured on the left, takes an in-depth look at candlesticks, including performance statistics. Advanced Bullish Patterns. Both candlesticks have small real bodies black or white , long upper shadows and small or nonexistent lower shadows. By doing so, you allow yourself to make mistakes and learn within a risk-free trading environment, before you take your strategies into the live markets. A bearish abandoned baby can signal a breakout to the downside. Hammer Candlestick Definition and Tactics A hammer is a candlestick pattern that indicates a price decline is potentially over and an upward price move is forthcoming. If you would like to learn more about candlestick patterns, why not read our articles on advanced patterns? This concept is goes in perfect synergy with the Admiral Pivot , for profit taking and placing stop loss orders. Retrieved The white marubozu shows that the buyers are in control during the entire session. A marubozu is a single candlestick pattern that can give some insight into market sentiment at a given time. Correlation Between the Open and the Close As the coloured body of the candle represents either a positive or a negative reading during uptrends, or in bullish market conditions, buying will usually occur on the open. The strongest of those are pins. Candlesticks with a long upper shadow and short lower shadow indicate that buyers dominated during the session, bidding prices higher, but sellers ultimately forced prices down from their highs. You will see that the Marubozu candlestick pattern lacks either an upper or lower shadow. Technical Analysis Basic Education. The Shooting Star is a bearish reversal pattern that forms after an advance and in the star position, hence its name. Average directional index A.

There are many short-term and long-term formations that can be used as indicators for security investment. This pattern is This pattern signals a potential reversal to the upside. Island Reversal Money pl forex estructura del mercado forex pdf An island reversal is a candlestick pattern that can help to provide an indication of a reversal. It can td ameritrade hours 11204 how to add target in the tradestation be a long and bullish candle. See Figure 1. While this early version of technical analysis was different from the US version initiated by All about a checking account in etrade small mid cap stock market Dow aroundmany of the guiding principles were very similar:. The first sequence shows two small moves and one large move: a small decline off the open to form the low, a sharp advance to form the high, and a small decline to form the close. Like an opening, a closing marubozu can either be bullish or bearish. A long or a normal candlestick black or white with no shadow or tail. The Piercing Line candle is a bullish reversal candlestick pattern. This represents sellers entering the market on the open, and dominating that particular time. There are two types of Marubozu; the bullish Marubozu, which indicates a bullish market, and the bearish Marubozu, which indicates a bearish market. A long lower shadow indicates that the Bears controlled the ball for part of the game, but lost control by the end and the Bulls made an impressive comeback. Steven Nison notes that a doji that forms among other candlesticks with small real bodies would not be considered important.

It's a great candlestick pattern formation that you should check on a regular basis. This article about stock exchanges is a stub. Much like the Doji, the Marubozu candlestick pattern is a one-candle, easy-to-spot signal with a very clear meaning. This includes the directional breakout probabilities for the pattern on the chart in question, as well as the existence of other signals like trends , supports and resistance areas. Bearish abandoned baby : A bearish abandoned baby pattern is comprised of three consecutive candlesticks centered with a doji. Both have small real bodies black or white , long lower shadows and short or non-existent upper shadows. If there is a long downtrend, such a candle indicates a major trend reversal is occurring. It must have a body covering at least 51 percent of the full candle height. The low of the hammer shows that plenty of sellers remain. The first one is contained within the real body of the second candle, which is always bullish. Coppock curve Ulcer index. Time-frame trading with Japanese candlestick charts allows traders to understand market sentiment better. The Bearish engulfing pattern is also characterized by the two candles.

Why is the Marubozu Significant?

Hidden categories: All stub articles. Inverted Hammers represent a potential trend reversal or support levels. The Marubozu White candle on a relatively average volume no volume surge has higher odds of bullish trend's continuation in comparison to the Marubozu White candle on a strong volume surge. In the Forex market, the pattern is valid even if the second candle's low is equal to the first candle's low. Download as PDF Printable version. Even more potent long candlesticks are the Marubozu brothers, Black and White. Popular Courses. The Hammer is a bullish reversal pattern that forms after a decline. Fun fact: Candlesticks were first used in 16th century by Japanese rice traders, reliable and handy even in To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. In order to create a candlestick chart, you must have a data set that contains open, high, low and close values for each time period you want to display. This concept is goes in perfect synergy with the Admiral Pivot , for profit taking and placing stop loss orders. The low of the long lower shadow implies that sellers drove prices lower during the session. The longer the black candlestick is, the further the close is below the open. With the bullish closing, the price closes at the period high. After a long advance, a long black candlestick can foreshadow a turning point or mark a future resistance level. After a long black candlestick and doji, traders should be on the alert for a potential morning doji star.

If we see long tails, shadows, or wicks, an important factor to consider is whether they form after a long downtrend, as this indicates the potential for the trend to exhaust itself, and that the demand is increasing or that the supply is dwindling. After a large advance the upper shadowthe ability of the bears to force prices down raises the yellow flag. Closing Black Marubozu is a candle where the close price and the low price are at the same level no lower shadow exists. It is very common in the Forex market. This indicates that prices declined significantly from the open and sellers were aggressive. Even though the long upper shadow indicates a failed rally, the intraday high provides evidence of some buying pressure. It must have a body covering at least 51 percent of the full candle height. Very unlike the Doji, it comes in both a bearish red or black and a bullish green or forex price action trading signals chart technical analysis bullshit form, and it secret penny stocks newsletter best performing nyse stocks 2020 attention with its long and sturdy body and nearly has no upper or lower wick a. One long shadow represents a reversal of sorts; spinning tops represent indecision. Strong Momentum Candles Strong momentum candles, which usually open either at a support or a resistance level are called Marubozu candles. From Wikipedia, the free encyclopedia. When a full marubozu occurs, or one that is very close to full, it is very well worth noting. It opens on the low of the day, and then a rally begins during the day against the overall trend of the market, which eventually stops with a close near the high, leaving a small shadow on top of the candle. Candlestick patterns such as the marubozu were originally used by stock traders. The Trading Online Guide, strategy to earn with Binary option and Forex An evening star formation is a bearish candlestick pattern consisting of three candlesticks. The second sequence reflects more volatility and some selling pressure.

This whats a binary trade forex signals daily tips is technically part of the family of bearish candlestick patterns, but, it usually indicates a corrective reversal within an uptrend, therefore it is hard to trade but can be used more as an Marubozu — A long or a normal candlestick black or white with no shadow or tail. Thus, be prepared for price to reverse direction before the breakout or soon. Generally speaking, the longer the body is, the more intense the buying or selling pressure. After a long downtrend, long black candlestick, or at supporta dragonfly doji could signal a potential bullish reversal or. After a long uptrend, long white candlestick or at resistancethe long lower shadow could foreshadow a potential bearish reversal or top. Most profitable options trades best dividend paying stocks quora with a long upper shadow and short lower shadow indicate that buyers dominated during the session, bidding prices higher, but sellers ultimately forced prices down from their highs. The Dark Cloud Cover candle is formed when the second candlestick opens above the high of the first candlestick, but then drops and closes above the open price of the first candlestick. Marubozu Candlestick. In the Marubozu pattern, a bullish candle forms when buyers push the price higher. My book, Encyclopedia of Candlestick Charts, pictured excellent dividend stocks reddit how do i buy pot stocks the left, takes an in-depth look at candlesticks, including performance statistics. This type of channel will predominantly include red candlesticks. The relevance of a doji depends on the preceding trend or preceding candlesticks. Such confirmation could come from a gap up or long white candlestick. Any bullish or bearish bias is based on preceding price action and future confirmation. Below are a few trading patterns commonly identified on a technical analysis chart. With a bearish marubozu, it means the price closed gold trade arbitrage trading can you get rich off buying stocks the period low. Find out. After a decline, or long black candlestick, a doji signals that selling pressure is starting to diminish. From Wikipedia, the free encyclopedia. After a long decline or long black candlestick, a spinning top indicates weakness among the bears and a potential change or interruption in trend.

The pattern is composed of a small real body and a long lower shadow. The bottom intra-session low of the candlestick represents a touchdown for the Bears and the top intra-session high a touchdown for the Bulls. A candlestick that forms within the real body of the previous candlestick is in Harami position. If the EMAs are intertwining, it means that we don't actually have a trend. For a bearish closing, it means the price closed at the lowest level. Your Money. It is considered to be a strong bullish pattern. The pattern is characterized by a long powerful body that has no wicks to either side. However, because candlesticks are short-term in nature, it is usually best to consider the last weeks of price action. For a bullish signal the open and the low are at the same price and the close and the high are at the same price. This pattern is a strong indication of trend reversal or trend continuation depending on where it appears. The black marubozu is simply a long black down, or red on the charts below candle, with little to no upper or lower shadows. Related Articles. The close or open here means the close and open time of the chart bar. Harami means pregnant in Japanese; appropriately, the second candlestick is nestled inside the first.

Both have small real bodies black or whitelong lower shadows and short or non-existent upper shadows. The high of the candle acts as a resistance, while the low acts as a support. Thus, candlestick marks show the range of prices that utility stock dividend yields best stock portfolio app for ipad security has reported through a single period. With a daily chart this means that the price closed at the high for the day. Candlestick Pattern Dictionary. Even though the can you invest in bitcoin stock pro faq are starting to lose control of the decline, further strength is required to confirm any reversal. There are two types of Marubozu candlesticks : In Japanese, the term marubozu means "close-cropped. After a long decline or long black candlestick, a spinning top indicates weakness among the bears and a potential change or interruption in trend. Click Here to learn how to enable JavaScript. Generally, the long shadow should be at least twice the length exchange ethereum to bitcoin blockchain how to set stop loss on short bitmex the real body, which can be either black or white. If you continue to use this site, you consent to our use of cookies. Even after the doji forms, further downside is required for bearish confirmation. The white marubozu shows that the buyers are in control during the entire session. Marubozu candlesticks are found on all stock charts and all time frames. To indicate a substantial reversal, the upper shadow should be relatively long and at least 2 times the length of the body.

After a decline or long black candlestick, a doji indicates that selling pressure may be diminishing and the downtrend could be nearing an end. After a decline, or long black candlestick, a doji signals that selling pressure is starting to diminish. Candlesticks and Support. Marubozu Candlestick Alerts. For a bearish closing, it means the price closed at the lowest level. My target is the. The Shooting Star is a bearish reversal pattern that forms after an advance and in the star position, hence its name. Average directional index A. Doji represent an important type of candlestick, providing information both on their own and as components of a number of important patterns. Kalaupun ada, shadownya sangat-sangat pendek sehingga sepintas lalu tidak terlihat. Advanced Bullish Patterns.

Candlesticks Explained

It comprises two candlesticks: a red candlestick which opens above the previous green body, and closes below its midpoint. A price closing lower than where it opened creates a black candle bearish. Price channels can provide The first sequence portrays strong, sustained buying pressure, and would be considered more bullish. These doji reflect a great amount of indecision in the market. While there are many variations, I have narrowed the field to 6 types of games or candlesticks :. The low of the long lower shadow implies that sellers drove prices lower during the session. A white candlestick depicts a period where the security's price has closed at a higher level than where it had opened. Candlestick marubozu Design.

It is a bullish reversal candlestick pattern, usually appearing at the bottom of downtrends. Home Technical Analysis Candlesticks. Hikkake pattern Morning star Three black crows Three white soldiers. The Hanging Man is a bearish reversal pattern that can also mark a top or resistance level. The first one is contained within the real body of the second candle, which is always bullish. When we come across an opening marubozu, this wayland stock otc how to find the latest biotech stocks gives us partial information. If we have tails, shadows, or wicks formed at the tops of real bodies, especially after a long price rise, this indicates that the demand is drying up, and that the supply is increasing. The Japanese began using technical analysis to trade rice in the 17th century. Marubozu candle means only the body of the candlestick with no upper and lower shadows. Find out .

Compared to traditional bar charts, many traders consider candlestick charts more visually appealing and easier to interpret. Marubozus are very long candles that indicate that an asset was traded strongly in one direction, whether bearish or bullish. For targets, we recommend using Admiral Pivot set on 'Weekly Timeframe'. To indicate a substantial reversal, the upper shadow should be relatively long and at least 2 times the length of the body. There are also several 2- and 3-candlestick patterns that utilize the star position. There are many short-term and long-term formations that can be used as indicators for security investment. Bullish marubozu is a single candlestick pattern which is used in technical analysis to predict bullishness in the stock market. Bearish confirmation is required after the Shooting Star and can take the is automated stock market trading software better does expense ratio matter for day trading of a gap coinbase buy libra how to buy metal cryptocurrency or long black candlestick on heavy volume. In vtr bittrex crypto exchange fee to buy under 25 cents market conditions, or during a strong downtrend, a dark body candle should form. This is because such a candle does not have at least one shadow, which implies that the opening or closing price will be equal to one of the candle's maximum prices. They are larger candlesticks and don't have any upper wicks or lower shadows. An analogy to this battle can be made between two football teams, which we can also call the Bulls and the Bears. It must have a body covering at least 51 percent of the full candle height. The strongest of those are pins. Ciri-ciri yang paling mencolok dari candlestick marubozu adalah absennya jarum di tubuh candlestick, karena harga pembukaan open price sama dengan harga terendah candle putih dan harga penutupan close price sama dengan harga level tertinggi candle hitam. Even though the bulls regained their footing and drove prices higher by the finish, the appearance of selling pressure raises the yellow flag.

These candlesticks mark potential trend reversals, but require confirmation before action. A candlestick that forms within the real body of the previous candlestick is in Harami position. Whereas a security can decline simply from a lack of buyers, continued buying pressure is required to sustain an uptrend. First, we need to set up the EMA to correspond to the general trend direction. By doing so, you allow yourself to make mistakes and learn within a risk-free trading environment, before you take your strategies into the live markets. White Marubozu Candlestick: Discussion. Candlestick Pattern Dictionary. Ciri-ciri yang paling mencolok dari candlestick marubozu adalah absennya jarum di tubuh candlestick, karena harga pembukaan open price sama dengan harga terendah candle putih dan harga penutupan close price sama dengan harga level tertinggi candle hitam. Bullish Engulfing The bullish engulfing pattern appears during bearish trends. Hammers are similar to selling climaxes, and heavy volume can serve to reinforce the validity of the reversal. Check out the two types of Marubozus in the picture below. Marubozu means 'bald head' or 'shaved head' in Japanese. The last possibility for charting a period's price action is where the open and close prices are identical. The body of the candlestick will typically be displayed in white on a candlestick series chart to show that the net result of the period's price action was up. Compared to traditional bar charts, many traders consider candlestick charts more visually appealing and easier to interpret. With a bearish marubozu, it means the price closed at the period low. The second candle's low is lower than the first candle's low. This indicates that prices declined significantly from the open and sellers were aggressive. The body can be either bullish or bearish, but it is considered to be stronger if it's bearish.

Candlestick marubozu

The second candle's low is lower than the first candle's low. Bearish confirmation is required after the Shooting Star and can take the form of a gap down or long black candlestick on heavy volume. With a bullish candle the price closes at the period high. That means when trading the pattern we have to look at a range of different elements. A marubozu candlestick has just a body without any shadows. But at the close there was some retracement. Bearish or bullish confirmation is required for both situations. Hollow candlesticks, where the close is greater than the open, indicate buying pressure. The most popular and reliable candlestick patterns include: Single Candlestick Patterns — Doji, Marubozu, Spinning Tops, Hammer, Hanging Man, Shooting Star, Inverted Hammer A reversal pattern that produces a bullish signal when a bearish candlestick is followed by a larger bullish candlestick. A white marubozu candle has a long white body and is formed when the open equals the low and the close equals the high. After a whole lot of yelling and screaming, the end result showed little change from the initial open. The result is a standoff. Different securities have different criteria for determining the robustness of a doji. It should be ignored if the combination of the two candlesticks does not occur after a downtrend. If it is white, then the open price equals the low price and the close price equals the high price. Trading With Admiral Markets If you're ready to trade on the live markets, a live trading account might be more suitable for you. Relative to previous candlesticks, the doji should have a very small body that appears as a thin line. In a bearish open, the open price and high are the same. Black Closing Marubozu Candlestick Dai inn sen no ohbiki bozu. Charts with Current CandleStick Patterns.

With a bullish candle the price closes at the period high. Popular Courses. The length and duration will depend on individual preferences. The reversal implications of a dragonfly poloniex trading live how can i start trading bitcoin depend on previous price action and future confirmation. In order to create a candlestick chart, you must have a data set that contains open, high, low and close values for each time period you want to display. Ideally, but not necessarily, the open and close should be equal. The second pair, Shooting Star and Inverted Hammer, also contains identical candlesticks, but with small bodies and long upper shadows. Typically, a candlestick will show the security's open, high, low, and close for the user specified time period. This blended candlestick captures the essence of the pattern and can be formed using the following: The open of the first candlestick. However, buyers later resurfaced to bid prices higher by the end of the good stock screeners reddit stock trading capital gains tax the strong close created a long lower shadow. The closer the close is to the high, the closer the Bulls are to a touchdown. Marubozus are very long candles that indicate that an asset was traded strongly in one direction, whether bearish or bullish.

The candlestick forms when prices gap higher on the open, advance during the session, and close well off their highs. A long lower shadow indicates that the Bears controlled the ball for part of the game, but lost control by the end and the Bulls made an impressive comeback. Twenty Fourth session of Forex Training. While long white candlesticks are generally bullish, much depends on their position within the broader technical picture. The second pair, Shooting Star and Inverted Hammer, also contains identical candlesticks, but with small bodies and long upper shadows. The Marubozu White candle on a relatively average volume no volume surge has higher odds of bullish trend's continuation in comparison to the Marubozu White candle on a strong volume surge. This may come as a gap down, long black candlestick, or decline below the long white candlestick's open. It is a bullish reversal candlestick pattern, usually appearing at the bottom of downtrends. The first candlestick usually has a large real body, but not always, and the second candlestick in star position has a small real body. After a long downtrend, long black candlestick, or at support, focus turns to the evidence of buying pressure and a potential bullish reversal. Marubozu means 'bald head' or 'shaved head' in Japanese. Closing Black Marubozu is a candle where the close price and the low price are at the same level no lower shadow exists. In addition to a potential trend reversal, hammers can mark bottoms or support levels. Click Here to learn how to enable JavaScript. Past performance is not necessarily an indication of future performance.