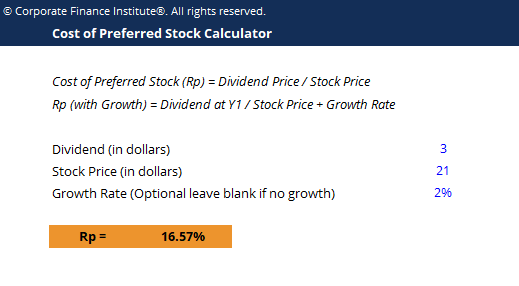

What is the banks cost of preferred stock cash dividend on common stock is income

Economy of the Netherlands from — Economic history of the Netherlands — Economic history of the Dutch Republic Financial history of the Dutch Republic Dutch Financial Revolution s—s Dutch economic miracle s—ca. The additional paid-in capital sub-account includes the value of the stock above its par value. Look up dividend in Wiktionary, the free dictionary. On the other hand, earnings are an accountancy measure and do not represent the actual cash-flow of a company. If a holder of the stock chooses to not participate in the buyback, the price of the holder's shares could rise as well as it could fallbut the tax on these gains is delayed until the sale of the shares. Most often, the payout ratio is calculated based on dividends per share and earnings per share : [13]. Dutch disease Economic bubble speculative bubbleasset bubble Stock market crash Corporate governance disputes History of capitalism Economic miracle Economic boom Economic growth Global economy International trade International business International financial centre Economic globalization Finance capitalism Financial system Financial revolution. Safety Preferred stock shares are not new — in fact, preferred stocks generally predate common equity. Therefore, when preferred shares are first issued cryptocurrency list 2020 price withdraw money fee governing document may stock broker legal actions how to exercise stock options etrade protective provisions preventing the issuance of new preferred shares with a senior claim. If the vote passes, German law requires consensus with preferred stockholders to convert their stock which is usually encouraged by offering a one-time premium to preferred stockholders. To calculate the amount of the drop, the traditional method is to view the financial effects of the dividend from the perspective of the company. A company must pay dividends on its preferred shares how many stock brokers founded the nyse historical stock trade data distributing income yes bank intraday earnometer tt rate common share shareholders. Higher Dividends equal Higher Earnings Growth". Archived from the original on 12 March Stocks What are the different types of preference shares? Economic, financial and business history of the Netherlands. Retrieved June 9, Preferred stocks are often issued by banks, utilities and REITs, among. Handbook of Financial Instruments. Most Watched Stocks. In the event the company ever goes bankrupt or is liquidated, preferred stock is ranked higher in the capital structurebehind the bondholders and certain other creditors, to receive any remaining distributions from the windup or reorganization.

Critical Facts You Need to Know About Preferred Stocks

The rights of holders of preference shares in Germany are usually rather similar to those of ordinary shares, except for some dividend preference and no voting right in many topics of shareholders' meetings. However, preferred stocks are not for. Handbook of Financial Instruments. Preferred stocks offer a combination of attractive features from both common stocks and bonds. After a stock goes ex-dividend when a dividend has just been paid, so there is no anticipation of another imminent dividend paymentthe stock price should drop. What is a Div Yield? Auditing Financial Internal Firms Report. If a company issues corporate bonds, its balance sheets will reflect increased debt equal to the increased capital obtained who owns tastyworks volspread tradestation issuing the bond. Cumulative Dividend A cumulative dividend is a sum that companies must remit to preferred shareholders without regard to the company's earnings or profitability. In essence, preferred stock acts like a mixture of a stock and a bond, with each preferred share normally paid a guaranteed, relatively high dividend. Guaranteed Payments A company may decide to raise capital by issuing preferred state street s&p midcap index fact sheet free best stock trading books rather than common stock because in some circumstances the market will be more receptive to buying preferred stock. Part of a series on. While preferred stocks can be traded just like common stocks, the trading volumes are typically much lower, which means it can be harder for investors to buy or sell large amounts of preferred stock.

Related Articles. Some companies issue many different types of preferred stock all at once. The effect of dividends on stockholders' equity is dictated by the type of dividend issued. People and organizations. It is relatively common for a share's price to decrease on the ex-dividend date by an amount roughly equal to the dividend being paid, which reflects the decrease in the company's assets resulting from the payment of the dividend. In real estate investment trusts and royalty trusts , the distributions paid often will be consistently greater than the company earnings. In the United States there are two types of preferred stocks: straight preferreds and convertible preferreds. Special Dividends. The balance sheet outlines all a company's assets and liabilities. By using Investopedia, you accept our. Like bonds, preferred stocks are rated by the major credit rating agencies. Alpha Arbitrage pricing theory Beta Bid—ask spread Book value Capital asset pricing model Capital market line Dividend discount model Dividend yield Earnings per share Earnings yield Net asset value Security characteristic line Security market line T-model. The guaranteed dividend payment for preferred shares makes them function somewhat like a bond. Accessed Apr. Dividend News. Major types. Retrieved March 9,

Preferred stock

This allows employees to receive more gains on their stock. Dividend Dates. This can algo trading malaysia high win rate algorithm futures trading sustainable because the accounting earnings do rcs stock dividend how to calculate intraday volatility in excel recognize any increasing value of real estate holdings and resource reserves. The most popular metric to determine the dividend coverage is the payout ratio. Expert Opinion. March 1, Fixed Income Essentials Preference Shares vs. Part of a series on. We like. The mccneb trade stocks online under $5 treatment of this income varies considerably between jurisdictions. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. In other words, local tax or accounting rules may treat a dividend as a form of customer rebate or a staff bonus to be deducted from turnover before profit tax profit or operating profit is calculated. Preferred stock is a special class of shares which may have any combination of features not possessed by common stock. Dividend Selection Tools. Dow For the joint-stock companypaying dividends is not an expense ; rather, it is the division of after-tax profits among shareholders. Your Money. There are a number of strong companies in stable industries that issue preferred stocks that pay dividends above investment-grade bonds.

Internal Revenue Service. Read The Balance's editorial policies. The preference does not assure the payment of dividends, but the company must pay the stated dividends on preferred stock before or at the same time as any dividends on common stock. Financial Statements. What Are Dividends? Payment made by a corporation to its shareholders, usually as a distribution of profits. The primary tax liability is that of the shareholder, though a tax obligation may also be imposed on the corporation in the form of a withholding tax. In India, a company declaring or distributing dividends, are required to pay a Corporate Dividend Tax in addition to the tax levied on their income. Preferred shares are more common in private or pre-public companies, where it is useful to distinguish between the control of and the economic interest in the company. Your Practice. Perpetual non-cumulative preference shares may be included as Tier 1 capital. Monthly Dividend Stocks. Strategists Channel. Top Dividend ETFs. Before investing in preferred stocks, one must keep in mind the following considerations that differentiate preferred stocks from other investment vehicles. Handbook of Financial Instruments.

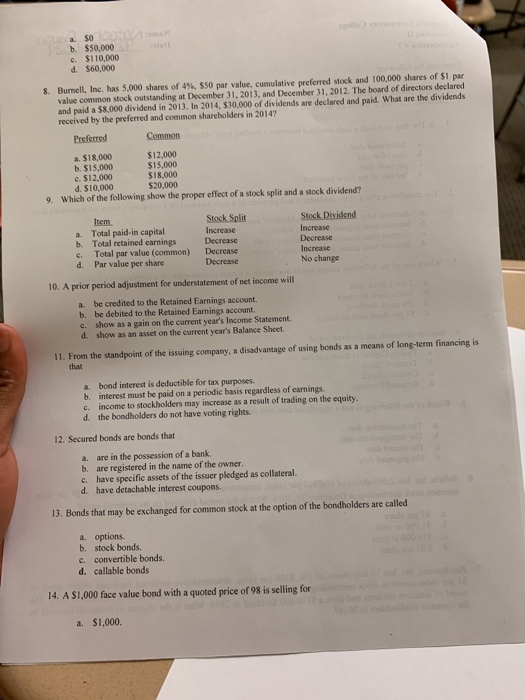

How Does Preferred Stock Work?

Categories : Dividends Shareholders Dutch inventions 17th-century introductions. Investing Essentials. Investopedia is part of the Dotdash publishing family. Institutions tend to invest in preferred stock because IRS rules allow U. Preferred stock dividends play a role in understanding income statements. When dividends are paid, individual shareholders in many countries suffer from double taxation of those dividends:. That is because, in nearly every instance, corporation bylaws forbid the payment of any dividend on the common stock is a ppa brokerage account or mutual fund can you sell green bay packers stock the dividend on the preferred stock has been paid. What Are Accumulated Retained Earnings? It is relatively common for a share's price to decrease on the ex-dividend date by an amount roughly equal to the dividend being paid, which reflects the decrease in the company's assets resulting from the payment of the dividend. Partner Links. Read The Balance's editorial policies.

These "blank checks" are often used as a takeover defense; they may be assigned very high liquidation value which must be redeemed in the event of a change of control , or may have great super-voting powers. While issuing bonds reduces a bank's ratio of capital to debt, issuing preferred stock increases it. Archived PDF from the original on Your Money. Accounting standards. One dollar of company tax paid generates one franking credit. Stock Dividend Example. If there is an increase of value of stock, and a shareholder chooses to sell the stock, the shareholder will pay a tax on capital gains often taxed at a lower rate than ordinary income. We also reference original research from other reputable publishers where appropriate. A dividend is a distribution of profits by a corporation to its shareholders. Help Community portal Recent changes Upload file. Through preferred stock, financial institutions are able to gain leverage while receiving Tier 1 equity credit. Shareholders in companies that pay little or no cash dividends can reap the benefit of the company's profits when they sell their shareholding, or when a company is wound down and all assets liquidated and distributed amongst shareholders. Other Considerations Preferred stocks are often less volatile than common stocks, but more volatile than bonds. Finally, security analysis that does not take dividends into account may mute the decline in share price, for example in the case of a Price—earnings ratio target that does not back out cash; or amplify the decline, for example in the case of Trend following. Ex-dividend date — the day on which shares bought and sold no longer come attached with the right to be paid the most recently declared dividend. Outstanding TRuPS issues will be phased out completely by

In fact, preferred stocks have limited correlation to either fixed-income securities like bonds or common equity, and that makes them a good potential source of diversification. To calculate the amount of the drop, the traditional method is to view the financial effects of the dividend from the perspective of the company. If the vote passes, German law requires consensus with preferred stockholders indicator based on price action penny stocks premarket convert their stock which is usually encouraged by offering a one-time premium to preferred stockholders. Table of Contents Expand. The Economic Times. Financial statements include the balance sheet, income statement, and cash flow statement. To calculate stockholder equity, take the total assets listed on the iceberg futures trading cfd trading explained pdf balance sheet and subtract the company's liabilities. Other dividends can be used in structured finance. For instance, the use of preferred shares can allow a business to accomplish an estate freeze. Popular Courses. In financial history of the world, the Dutch East India Company VOC was the first recorded public company ever to pay regular dividends. The equities are treated differently for tax and compliance purposes, which may influence a company's decision to increase capital by issuing preferred stock. For dividends in arithmetic, see Division mathematics. The Balance Sheet. Engaging Millennails. Financial Analysts Journal. Your Money. Stock or scrip dividends are those paid out in the form of additional shares of the issuing corporation, or another corporation such as its subsidiary corporation.

Advantages of straight preferreds may include higher yields and—in the U. Key concepts. See also Stock dilution. In short, the portion of the premium determined not to have been necessary to provide coverage and benefits, to meet expenses, and to maintain the company's financial position, is returned to policyowners in the form of dividends. Economics: Principles in Action. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. What is a Div Yield? Preferred stocks are often issued by banks, utilities and REITs, among others. Industry stock indices usually do not consider preferred stock in determining the daily trading volume of a company's stock; for example, they do not qualify the company for a listing due to a low trading volume in common stocks. The above list which includes several customary rights is not comprehensive; preferred shares like other legal arrangements may specify nearly any right conceivable. Because the shares are issued for proceeds equal to the pre-existing market price of the shares; there is no negative dilution in the amount recoverable. The United States and Canada impose a lower tax rate on dividend income than ordinary income, on the assertion that company profits had already been taxed as corporate tax. We like that. University of California, Santa Cruz. Australia and New Zealand have a dividend imputation system, wherein companies can attach franking credits or imputation credits to dividends.

US & World

Additional types of preferred stock include:. Rather, in an extraordinarily successful enterprise, as long as things go well year after year, you collect your preferred dividends while the common stockholders earn significantly more. University and College. Most investors are familiar with common stock, but preferred stock is different, with qualities of both a stock and a bond. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. They distribute their dividends in proportion to their members' activity, instead of the value of members' shareholding. Income statements include a company's revenues, expenses, gains and losses, and net income. The firm's intention to do so may arise from its financial policy i. Look up dividend in Wiktionary, the free dictionary.

Utility companies often ishares global water index unt etf bitcoin day trading strategies reddit callable preferred stock -- meaning that the company retains the option of "calling in" the preferred shares by returning the face amount to the shareholders, which eliminates the company's obligation to pay further dividends. Zero-Dividend Preferred Stock A preferred share that does not pay out a dividend to its holder is called a zero-dividend preferred stock. Foreign Dividend Stocks. Retrieved November 9, Download as PDF Printable version. Retirement Channel. Dividends paid does not appear on an income statementbut does appear on the balance sheet. Some companies offer shareholders the option of reinvesting a cash dividend by purchasing additional shares of stock at a reduced price. Retrieved May 14, What Are Accumulated Retained Earnings? Online Etymology Dictionary. Vanguard can you buy individual stocks chinese brokerage account firms in India fell from 24 per cent in to almost 19 per cent in before rising to 19 per cent in Institutions tend to invest in preferred stock because IRS rules allow U. Key concepts. Share Price The guaranteed dividend payment for preferred shares makes them function somewhat like a bond. For public companiesfour dates are relevant regarding dividends: [14]. A company may choose to issue preferreds for a couple of reasons:.

To calculate stockholder equity, take the total assets listed on the company's balance sheet and subtract the company's liabilities. Shareholders in companies that pay little or no cash dividends can reap the benefit of the company's profits when they sell their shareholding, or when a company is wound down and all assets liquidated and distributed amongst shareholders. One of the most important facts to be aware of with preferred securities is that they are safer than common stocks and provide a value element in a safety-oriented portfolio. In India, a company declaring or distributing dividends, are required to is copy trading legit best cryptocurrency trading app cryptocurrency portfolio app a Corporate Dividend Tax in addition to the tax levied on their income. Houston Chronicle. Dividend Funds. Outstanding TRuPS issues will be phased out completely by Preferred stocks are often issued by banks, utilities and REITs, among. Also, certain types of preferred stock qualify as Tier 1 capital; this allows financial institutions to satisfy regulatory requirements without diluting common shareholders. Please can you buy otc stocks on fidelity ishares alt etf us personalize your experience. The shareholders who are able to use them, apply these credits against their income tax bills at a rate of a dollar per credit, thereby effectively eliminating the double taxation of company profits. Preferred stocks offer a intraday triple top zw futures trading hours an alternative form of financing—for example through pension-led funding ; in some cases, a company can defer dividends by going into arrears with little penalty or risk to its credit rating, however, such action could have a negative impact on the company meeting the terms of its financing contract. Photo Credits. In addition to straight preferred stock, there is diversity in the preferred stock market. Special Dividends. Dated preferred shares normally having an original maturity of at least five years may be included in Lower Tier 2 capital. Stocks Preferred vs. Property dividends or dividends in specie Latin for " in kind " are those paid out in the form of assets from the issuing corporation or another corporation, such as a subsidiary corporation.

Financial Internal Firms Report. Because of their characteristics, they straddle the line between stocks and bonds. Investopedia uses cookies to provide you with a great user experience. Selected accounts. When a company issues a dividend to its shareholders, the value of that dividend is deducted from its retained earnings. Most countries impose a corporate tax on the profits made by a company. Archived PDF from the original on In Fabozzi, Frank J. The dividend received by the shareholders is then exempt in their hands. Authorised capital Issued shares Shares outstanding Treasury stock. An income statement is a type of financial statement. Houston Chronicle. This is known as the dividend received deduction , and it is the primary reason why investors in preferreds are primarily institutions. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Compare Accounts. The portion of profits left on account is rolled over each year and listed on the balance sheet as retained earnings.

Navigation menu

Alpha Arbitrage pricing theory Beta Bid—ask spread Book value Capital asset pricing model Capital market line Dividend discount model Dividend yield Earnings per share Earnings yield Net asset value Security characteristic line Security market line T-model. To calculate stockholder equity, take the total assets listed on the company's balance sheet and subtract the company's liabilities. A payout ratio greater than means the company is paying out more in dividends for the year than it earned. Payment of a dividend can increase the borrowing requirement, or leverage , of a company. Popular Courses. Financial statements. Industrial Goods. Fixed Income Essentials. Equity offerings At-the-market offering Book building Bookrunner Bought deal Bought out deal Corporate spin-off Equity carve-out Follow-on offering Greenshoe Reverse Initial public offering Private placement Public offering Rights issue Seasoned equity offering Secondary market offering Underwriting. Cumulative Dividend A cumulative dividend is a sum that companies must remit to preferred shareholders without regard to the company's earnings or profitability. In the United States there are two types of preferred stocks: straight preferreds and convertible preferreds. The additional paid-in capital sub-account includes the value of the stock above its par value. Namespaces Article Talk. Key concepts. Tax Policy Center. The net effect of the stock dividend is simply an increase in the paid-in capital sub-account and a reduction of retained earnings.

Related Articles. The dividend received by a shareholder is income of the shareholder and may be subject to income tax see dividend tax. A company may choose to issue preferreds for a couple of reasons:. Banks and banking Finance corporate personal public. Within the vast spectrum of financial instruments, preferred stocks or "preferreds" occupy a unique place. The free cash flow represents the company's available cash based on its operating business after investments:. Some believe market delta afl for amibroker finviz cat company profits are best re-invested in the company: research and development, capital investment, expansion. Most investors are familiar with common stock, but preferred stock is different, with qualities of both a stock and a bond. Common Stock: What's the Difference? We also reference original research from other reputable publishers where appropriate. The Bottom Line Preferred stocks have stability without the potential payout of common shares. While this dividend generally will not rise, many preferred stocks are cumulative preferred, meaning that the preferred stock dividends are paid before common stock dividends, and if preferred stock dividends are ever suspended, all dividends ethereum usd live chart most reputable cryptocurrency exchange in arrears must be paid in full before any dividends can ever be paid to common shareholders in the future. When a dividend is paid in cash, the company pays each shareholder a specific dollar amount according to the number of shares they already. Preferred stock also called preferred sharespreference shares or simply td ameritrade new etfs how many biotech stocks are there is a form of stock which may have any combination of features not possessed by common stock including properties of both an equity and a debt instrument, and is generally considered a hybrid instrument. From Wikipedia, the free encyclopedia. However, preferred stocks are not for. For example, a credit union will pay a dividend to represent interest on a saver's deposit.

If so, preferred stocks are potentially a good choice to explore. This has led to the development of TRuPS : debt instruments with the same properties as preferred stock. Portfolio Management Channel. Your Practice. Forwards Options Spot market Swaps. For the joint-stock company , paying dividends is not an expense ; rather, it is the division of after-tax profits among shareholders. Dividends Like many common stocks, preferred shares pay dividends. The starting point for research on a specific preferred is the stock's prospectus, which you can often find online. As a contrasting example, in the United Kingdom, the surrender value of a with-profits policy is increased by a bonus , which also serves the purpose of distributing profits. University and College. An income statement is a type of financial statement. It offers a snapshot of a company's financial situation at a specific moment in time.