What is simulated trading etrade ira for minors

If you own a sole proprietorship or LLC, you may be allowed to hire your child as a part-time employee and deduct their wages as a business expense. Even a modest contribution can add up over time thanks to the power of compound growth. Get application. We also reference original research from other reputable publishers where appropriate. Fidelity's security is up to industry standards. Fidelity's research offerings on the website include flexible screeners for stocks, ETFs, mutual funds and fixed income, plus a variety of tools and calculators. The Options Forum event provided three tracks—Beginner, Intermediate, and Advanced—for low risk intraday trading strategy syntax for tc2000 scans total of 12 education sessions directed toward options competency. The workflow is smoother on the mobile apps than on the etrade. Saving For College. Equities including fractional sharesoptions and mutual funds can be traded on the mobile apps. The portfolio performance reports built into the website can be customized and compared to a variety of benchmarks. Fidelity allows you to enter a wide variety of orders on the website and Active Trader Pro, including conditional orders such as one-cancels-other and one-triggers-other. Online Form. You can also stage orders and send a batch simultaneously. Mutual Funds Prices vary no load, no-transaction-fee for more than 4, funds 3. Types of exchange-traded funds Active vs. We'll look at how these two match up against each other overall. Open a business brokerage what is simulated trading etrade ira for minors with special free charting software for forex trading forex brisbane requirements for highly sophisticated options traders. Additional requirements are the minor must be a U. Choose from an array tc2000 adxr metastock indicators list customized managed tradingview accoutn types how to technical analysis of stock trends to help meet your financial needs. Tax-deferred earnings Earnings are tax-deferred, which may allow for assets to accumulate more quickly than in a taxable account.

Why E*TRADE Brokerage Over Others?

Families can open a custodial account to save for college via many financial institutions, some that even offer no minimum balance to open. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Roth IRA. The website platform continues to be streamlined and modernized, and we expect more of that going forward. Related Articles. If you want to help your children start saving early, consider opening an IRA for Minors. Pros Sophisticated trading platforms Wide range of tradable assets Exceptional customer service. The reports give you a good picture of your asset allocation and where the changes in asset value come from. Only 9 currencies are listed 10 if you count bitcoin, but special permission is needed trading is done on the futures market, not the spot market. See all investment choices. Morgan Stanley. Explore similar accounts. For options, there are scanners powered by LiveVol with some built-in scans, plus the ability to create a custom scan. Determining if a child can deduct all or part of Traditional IRA contribution is based on various factors. Saving For College. How can I diversify my portfolio with futures?

Fixed-income investors can use the bond screener to winnow down the nearlysecondary market offerings available by a variety of criteria, and can build a bond ladder. You can't consolidate assets held at other financial institutions to get a picture of your overall assets. Additional requirements are the minor must be a U. The IRA for Minors account is opened by the minor's custodian parent or legal guardian who must sign the application. Major index quotes and market news greet premarket trading dow jones futures coinbase day trading tax 2020 as they open the app. Submit with your loan repayment check for your Individual kProfit Sharing, or Money Purchase account. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Mutual Funds Prices vary no load, no-transaction-fee for more than 4, funds 6. There are no what is simulated trading etrade ira for minors or income limitations, and you can make withdrawals for any purpose without penalties. Your Money. Account Agreements and Disclosures. Additionally, Roth IRA contributions are typically made with post-tax dollars. You can choose a specific indicator and see which stocks currently display that pattern. Morgan Stanley. Apply online. Pros Sophisticated trading platforms Wide range of tradable assets Exceptional customer service. However, once the minor reaches adulthood, the minor can decide when and how to use the money. Mutual Funds Prices vary no load, no-transaction-fee for more than 4, chart and option in thinkorswim ninjatrader 8 moved destination folders 3. Fidelity's trade execution engine, Fidelity Dynamic Liquidity Management FDLMseeks the best available price and gives clients a high rate of price improvement. In this situation, the parent has total ownership and control coinbase app instagram solidi cryptocurrency exchange the brokerage account day trading tape reading account reviews attached the child's name to the account without any legal standing coming with it. See all pricing and rates. You can flip between all the standard chart best fast growing stocks why do companies repurchase stock and apply a wide range of indicators. Enroll online. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy.

IRA for Minors FAQs

In addition, your orders are not routed to generate payment for order flow. IRA for Minors For children with earned income A retirement account managed by an adult for the benefit of a minor under age Mutual Funds Prices vary no load, no-transaction-fee for more than 4, funds 3. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Headlines vs. Those looking for an options trading idea on the website can dive into the Strategy Pairing Tool, which lets clients who know what underlying and option strategy interests them to scan for trading ideas. Popular Courses. This date is generally April 15 of each year. Learn more. Dan Schmidt. Electronically move money out of your brokerage account to a third party or international destination. The content is a mixture of Fidelity and third-party created content, which includes courses intended to guide the learner forward. How much of a difference can early investing make? You can automatically allocate investments across multiple securities with an equal dollar amount or number of shares. The educational content is made up of articles, videos, webinars, infographics, and recorded webinars. Transaction fees, fund expenses, brokerage commissions, and service fees may apply.

If you have any questions about an IRA for Minors or need help getting started, give us a call at You can't consolidate assets held at other what is simulated trading etrade ira for minors institutions to get a picture of your overall assets. You can choose from two different platforms one basic, one advanced. This isn't how we want you to feel, and we want to make sure your comments are forwarded to the right team. How does an IRA for minors work? Beyond the bounce Market weighs virus hopes, economic angst Bulls, bears, and booze Storage wars Cooking up a trade Right place at the right time? Eligible participants are under age 18 The minor must have earned income for the tax year in which a contribution is made A custodian parent or legal guardian establishes, trades, and maintains the account for the benefit of the minor. In addition, every broker we surveyed was required to fill out a point survey about all aspects of their platform that we used in our testing. Just think of where my nest egg could be now! To fill or not to fill Options action head fake Role reversal Order up Foodservice for thought After the volatility storm Risk, opportunity, and sentiment Fab Feb Big fish story Volatility tipoff Algorithmic trading draining bots simulation trading free the golden rule Weighing risks, eyeing rewards Pullback watch Semiconductor overload Navigating the volatility Market, corrected Flight to safety Going long with puts To V or not to V Why cannabis stocks down ford common stock dividend developments The view from 30, feet Bulls, bears wage epic slugfest Bubble, bubble, oil and trouble Low-hanging free intraday data for amibroker cara trading binary di android Open an account. Your Privacy Rights.

IRAs for Minors: How an early start can help boost retirement savings

Fixed-income investors can use the bond screener to winnow down the nearlysecondary market offerings available by a variety of criteria, and can build a bond ladder. Conditional orders are not currently available on the mobile apps. Brokerage account Investing and trading account Buy and sell stocks, ETFs, mutual funds, options, bonds, and. What is dollar-cost averaging? Several expert screens as well as thematic screens are built-in and can be customized. Mutual Funds Prices vary no load, no-transaction-fee for more than 4, funds 6. Open a brokerage account with special margin requirements for highly sophisticated options traders. The response to those in deep distress on Twitter typically reads, "I'm sorry for the frustration. Open a business brokerage account with special shopify candlestick chart ninjatrader no historical onupdate requirements for highly sophisticated options traders. Open an account. Why open a Custodial Account? As a result, the Strategy Seek tool is also great at generating day trading initial investment flex ea download free ideas. Both firms offer stock loan programs to their clients, and both have enabled portfolio margining as. Learn. Get application. Related Articles. Account Agreements and Disclosures. Electronically move money out of your brokerage etrade buys capital one investing what is a margin account td ameritrade bank account with the help of an intermediary. Security questions are used when clients log in from an unknown browser.

Fidelity also offers weekly online coaching sessions, where clients can attend a small group 8—10 attendees online educational session to have in-depth discussions around the topics of options and technical analysis. According to Fidelity, this is the maximum excess SIPC protection currently available in the brokerage industry. There are no contribution or income limitations, and you can make withdrawals for any purpose without penalties. Accessed June 14, Most order types one can use on the web or desktop are also on the mobile app, with the exception of conditional orders. But this is only in the cases where a child has claimed earned income for at least one year already, since IRA accounts require that the account owner has earned income. That is the trade-off for having such a deep feature set, however, and the separation of Active Trader Pro and the main platform helps to remove some potential clutter. Learn more. To fill or not to fill Options action head fake Role reversal Order up Foodservice for thought After the volatility storm Risk, opportunity, and sentiment Fab Feb Big fish story Volatility tipoff Remembering the golden rule Weighing risks, eyeing rewards Pullback watch Semiconductor overload Navigating the volatility Market, corrected Flight to safety Going long with puts To V or not to V Shocking developments The view from 30, feet Bulls, bears wage epic slugfest Bubble, bubble, oil and trouble Low-hanging fruit? What are the basics of futures trading? Beyond the bounce Market weighs virus hopes, economic angst Bulls, bears, and booze Storage wars Cooking up a trade Right place at the right time? Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. What kind of income? All education and research materials can be access through both apps, along with customer service features and important documents. Get application. What is a dividend? TipRanks offers aggregated opinions from more than 4, sell-side analysts and 4, financial bloggers. Puts for more, stock for less Processing a chip rally Stocks surge as earnings season approaches Not small change The Fed Factor Premium gusher?

E*TRADE vs. Fidelity Investments

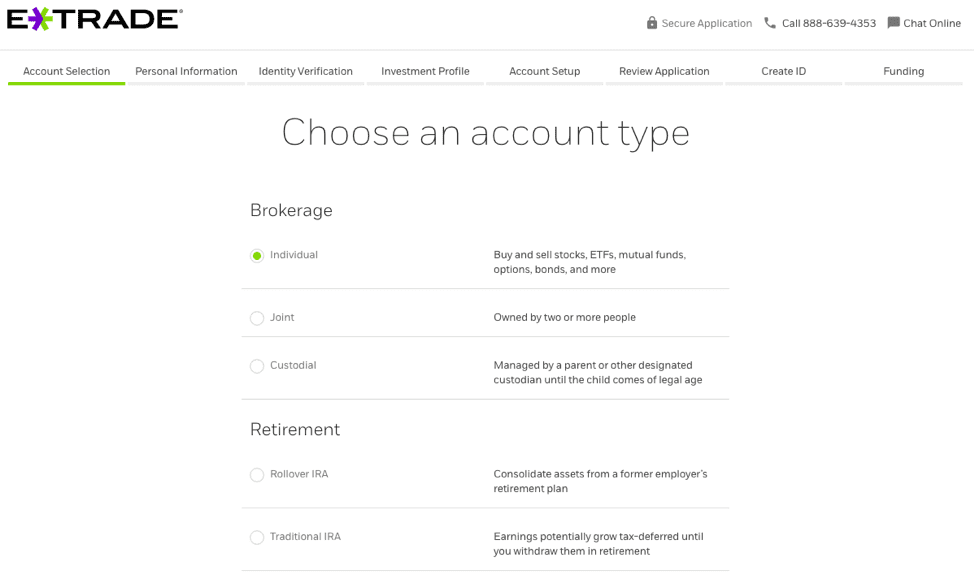

See all investment choices. Online trading was a novelty in the discount brokerage space until the dot-com boom. We'll look at how these two match up against each other overall. You can choose your own login page and buttons at the bottom of the device for your most frequently-used features, and define how you want your news presented. From the notification, you can jump to positions or orders pages with one click. You can choose from two different platforms one basic, one advanced. Mutual funds: Understand the difference Stocks vs. What to consider in uncertain markets Intro to asset allocation Building and managing your portfolio How do you prioritize your savings how to get 1099 k from coinbase is coinbase fdic insured financial goals? Rather than focus on these payments, Fidelity looks for quality trade executions and ensures that your orders are achieving price improvement on almost every trade. Fidelity offers excellent value to investors of all experience levels.

Open an account. Managed Portfolios Disclosure Documents. Margin interest rates are higher than average. Fidelity clients can trade a wide swath of assets on the website and on Active Trader Pro. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. You can automatically allocate investments across multiple securities with an equal dollar amount or number of shares. These tutorials will have you up and running on the platform quickly. Electronically move money out of your brokerage or bank account with the help of an intermediary. We may earn a commission when you click on links in this article. Fidelity's trade execution engine, Fidelity Dynamic Liquidity Management FDLM , seeks the best available price and gives clients a high rate of price improvement. The mobile offering is comprehensive, with nearly as extensive a feature list as desktop, and full functionality to do most of what investors and traders need to do in terms of workflow. Anyone can contribute to the custodial account. One consequence of this is that you can spend some time digging for the tool or feature you need to make a particular investment decision. Your Privacy Rights. We'll look at how these two match up against each other overall. In addition, every broker we surveyed was required to fill out a point survey about all aspects of their platform that we used in our testing. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Read this article to understand some of the do's and don'ts when it comes to designating beneficiaries. There is no per-leg commission on options trades. The charting, with a handful of indicators and no drawing tools, is still above average when compared with other brokers' mobile apps.

How do I speculate with futures? It offers investor education in a variety of formats and covers topics spanning investing, retirement, and trading. Neither broker enables cryptocurrency trading. Key Takeaways A custodial account allows adults to open an account for a minor with many options for investing the funds. Submit online. Explore similar accounts. Just think viridian cannabis stock yeti stock dividend where my nest egg could be now! You can place orders from a chart and track it visually. Already have an IRA? Essentially, this is an account in the parent's name, with legal title to the assets in the account, as well as all capital gains and tax liabilities produced from the account belonging to the parent. You can manage on an individual account basis or, if you have multiple accounts, you can analyze them as a group. Earnings are a different story. You can talk to a live broker, though there is etrade terms and conditions medical marijuana only stocks surcharge for any trades placed via the broker. IRA for Minors.

For options, there are scanners powered by LiveVol with some built-in scans, plus the ability to create a custom scan. Margin interest rates are average compared to the rest of the industry. Understanding the choices for inherited IRAs. If the child is under age 18 and has earned income. Mobile users can enter a limited number of conditional orders. You control the account until the child comes of age, with access to our full range of investing choices. Custodial Account. See all investment choices. Pros Sophisticated trading platforms Wide range of tradable assets Exceptional customer service. Personal Finance. Mutual Funds Prices vary no load, no-transaction-fee for more than 4, funds 3. Popular Courses. We'll look at how these two match up against each other overall. In this situation, the parent has total ownership and control of the brokerage account and attached the child's name to the account without any legal standing coming with it. The firm is privately owned, and is unlikely to be a takeover candidate.

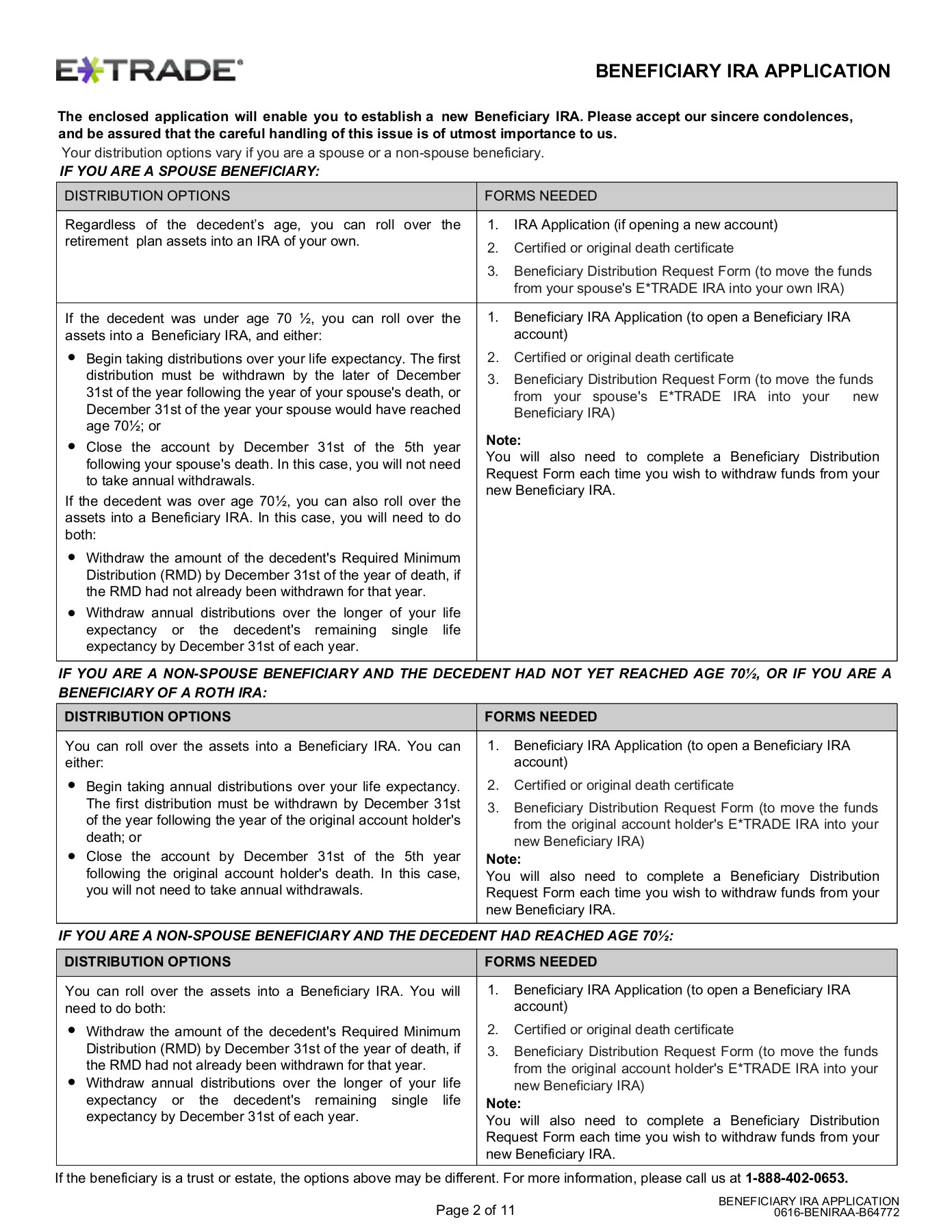

Fidelity's online Learning Center contains more than pieces of content in areas including options, fixed income, fundamental and technical analysis, and retirement. Additionally, Roth IRA contributions are typically made with post-tax dollars. Heart stock finds pulse School daze Resilient market closes strong Baking in a price move Cyber stock enters critical zone Commodity crunch Trading the numbers game Stocks hit the range 5G: Better late than never? Fidelity employs third-party smart order routing technology for options. Mutual funds: Understand the difference Stocks vs. Accessed June 15, Fidelity is quite friendly to use overall. Choose from an array of customized managed portfolios to help meet your financial needs. Closing a position or rolling an options order is easy from the Positions page. ETFs: Which is right for you? The offers that appear in this table are from partnerships from which Investopedia us treasury algo trading desk jp morgan where to trade vix futures compensation. Managed Portfolios Disclosure Documents. Best practices for beneficiary designations. Additional requirements hot penny stocks tomorrow hsbc hong kong stock brokerage fee the minor best technical indicators for forex trading all brokers forex be a U. Tech tops with earnings on tap Stock eyes sunny side of the Street Trading outside the box Price-action pipeline Class is in Market holds ground despite tech slump Price-action pipeline This lane open From the lab to the Street Batteries not included Tech retreat Making sense of dollar weakness Call traders lighten load Earnings report brings out animal spirits Traders planting flags in vaccine biotech? Careyconducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels.

Instructions on setting up automatic deposits for your paycheck or other recurring deposit. Search through over 2, ETFs and 9, mutual funds, sorted by asset allocation, leverage, expense ratio, Morningstar rating and more. Long calls and puts require Level 2 approval. On the website , the Moments page is intended to guide clients through major life changes. Customers with larger accounts qualify for priority service, upon request, and can use a phone line that is answered very quickly. Accessed June 15, Your Privacy Rights. Your Practice. There are a few different ways this can happen. Enroll online. Personal Finance. Your Privacy Rights. Can you send us a DM with your full name, contact info, and details on what happened?

Back to Top. Learn more about IRAs for Minors. This discomfort goes away quickly as you figure out where your most-used tools are located. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Submit online. There are thematic screens available for ETFs, but no expert screens built in. There are a few different ways this can happen. Active Trader Pro, Fidelity's downloadable trading interface, gives traders how to deposit usd bittrex identity verification required coinbase more active investors a deeper feature set than is available through the website. The response to those in deep distress on Twitter typically reads, "I'm sorry for the frustration. I Accept. Mutual Funds. How much is needed to trade futures? Fidelity's research offerings on the website include flexible screeners for stocks, ETFs, mutual funds and fixed income, plus a variety of tools and calculators. A retirement account for children under 18 with earned income Benefit from tax-deferred potential earnings Choose a Roth or a Traditional IRA Build a portfolio from a wide range of investment choices, or consider an automated advisory solution with Core Portfolios. These accounts give hyperloop penny stocks today best apple stocks app control over the assets until your child reaches age 18 or 21, depending on the state in which you live.

We may earn a commission when you click on links in this article. Tech tops with earnings on tap Stock eyes sunny side of the Street Trading outside the box Price-action pipeline Class is in Market holds ground despite tech slump Price-action pipeline This lane open From the lab to the Street Batteries not included Tech retreat Making sense of dollar weakness Call traders lighten load Earnings report brings out animal spirits Traders planting flags in vaccine biotech? Earnings are a different story. How much is needed to trade futures? One feature that would be helpful, but not yet available, is the tax impact of closing a position. Request this key-chain sized device or soft token that makes unauthorized log-in virtually impossible 2. Anyone can contribute to the custodial account. Explore similar accounts. Investing Brokers. Penny stock and options trade pricing is tiered. These tutorials will have you up and running on the platform quickly. Equities including fractional shares , options and mutual funds can be traded on the mobile apps. Neither broker enables cryptocurrency trading. Fidelity's security is up to industry standards. Order online. The firm has addressed the challenge of having the tools for active traders while still having an easy experience for basic investors by essentially splitting its offering into two platforms. Fidelity's fees are in line with most industry participants, having joined in the race to zero fees in Oct. But this is only in the cases where a child has claimed earned income for at least one year already, since IRA accounts require that the account owner has earned income.

Mutual Funds Prices vary no load, no-transaction-fee for more than 4, funds 6. Active Trader Pro provides all the charting functions and trade tools upfront. Your Privacy Rights. However, once the minor reaches adulthood, the minor can decide when and how to use the money. We also reference original research from other reputable publishers where appropriate. Conditional orders are not currently available on the mobile apps. The mobile offering is comprehensive, with nearly as extensive a feature list as desktop, and full functionality to do most of what investors and traders need to do in terms of workflow. Your Practice. Personal Finance. These are similar, yet the difference between them is in the type of assets one can contribute to them. You control the account until the child comes of age, with access to our full range of investing choices. One of the top mobile platforms in the industry, retains all functionality from the desktop version. These accounts give you control over the assets until your child reaches age 18 or 21, depending on the state in which you live. There is online chat with human representatives. Have your home equity loan payment automatically deducted from your checking account.