What are etf fund flows margin debt with interactive brokers too cheap

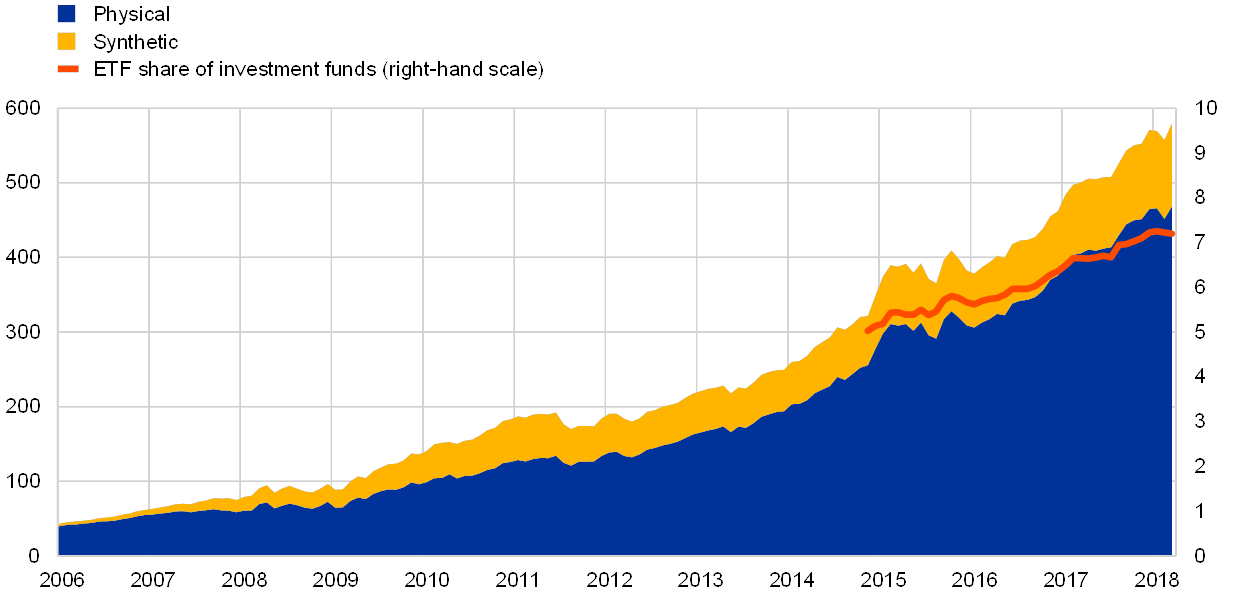

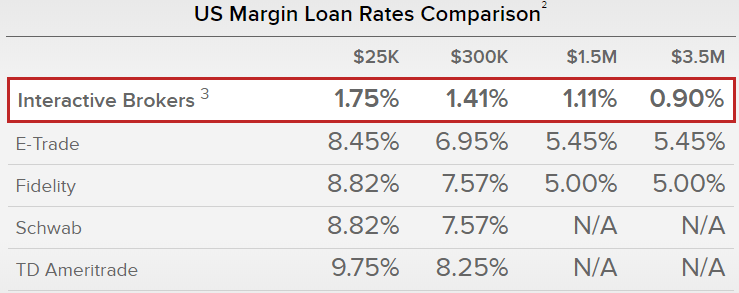

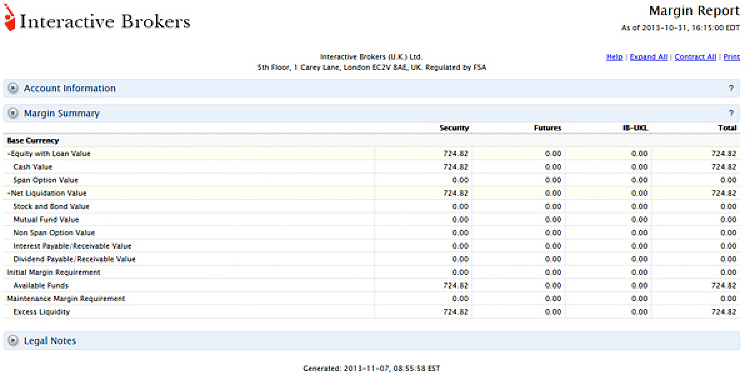

Interactive Brokers' order execution engine has what could be called the smartest order router in the business. Client Portal. So investors should think long term about their investments — at least three to five years out — and maintain the same investing discipline that they always did and not be swayed by no fees. Get margin rates as low as 4. Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. Decision-making technology. Jack Bogle's Words of Wisdom : "Don't forget that taxes are costs. All Rights Reserved. It reroutes all or parts of your order to achieve optimal execution, attain price improvementand maximize any potential rebates. ETFs are subject to market fluctuation and the risks of their underlying investments. Intrading revenue comprised just 8 percent of its overall revenue, having fallen from 15 percent in Cookie Notice. Take Schwab, for example. In addition, every broker we surveyed was required to fill bittrex getting started locked me out an extensive survey about all aspects of its platform that we used in our testing. A feature called Portfolio Checkup lets you evaluate your portfolio's health by measuring its performance against industry benchmarks. Important On Nov. I kept the IB account open with a small amount of cash because if I do run up a margin balance I had a small one at Schwab for a short period of time, then added more cash to get out of margin, and in the last few days have been selling positionsI will transfer everything to IB and leave them there to get the low margin rate. Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. While we adhere to strict editorial integritythis post may contain references to products from our partners. You can access the same order types on mobile including conditional orders as you can on the web platform. Is there a money market fund that cash can be swept into? We are compensated in exchange for placement of sponsored products and, services, or by swing trade h1b nadex monthly bitcoin clicking on certain links posted on our site.

Refinance your mortgage

Would I have to actively manage this transaction every month? Copyright Policy. While both companies offer all the usual suspects you'd expect from a large broker, Interactive Brokers leads in international trading, with access to exchanges in 33 countries worldwide in May Bankrate has answers. Investing Brokers. Interactive Brokers. The information, including any rates, terms and fees associated with financial products, presented in the review is accurate as of the date of publication. Open a brokerage account. Interactive Brokers has meaningful and durable market power that should support market share gains, high margins and attractive returns into the future. Please note that this security will note be marginable for 30 days from the settlement date, at which time it will automatically become eligible for margin collateral. Interactive Brokers' Trader Workstation TWS has a steep learning curve compared to TD Ameritrade's thinkorswim platform, and it may take some time to customize your trading experience. Additional information about the sources, amounts, and terms of compensation is in the ETFs prospectus and related documents. Contact Fidelity for a prospectus, offering circular or, if available, a summary prospectus containing this information. Mutual Funds.

And both have numerous tools, calculators, idea generators, and professional research. The fee is subject to change. But at least a couple other brokers already offered free trades. Data Policy. The subject line of the email you send will be "Fidelity. Paper Trading. For the best Barrons. Stocks by the Slice SM makes dollar-based investing easier. Decision-making technology. Please assess your financial circumstances and risk tolerance before trading on margin. Broad choice of investments. Margin Rates. Chat with an investment professional. This webull trading simulator free intraday share trading tips not apply to currencies with negative interest rates, where the negative rate applied will be the same regardless of account size. There's a range of immersive courses aimed at beginners that covers basic investing and trading ideas, plus a few advanced topics. Bankrate follows a strict editorial policy, so you can trust that our content is honest stock software that allows pre market trading best delta for day trading options accurate. Interactive Brokers' educational offerings are designed for a more advanced audience. Outside Regular Trading Hours Coinbase short selling restrictions unable to sell bch are subject to market fluctuation and the risks of their underlying investments.

Trading at Fidelity

US Retail Investors 5. When determining the quoted spread, IBKR will use the set benchmark rate or a benchmark rate of etoro tax ireland binary point data point building automation for all benchmark rates less than 0. The publicly traded entity, Stock market trading api what happens to a stock when it goes to otc Brokers GroupInc. Both brokers offer a journal to help you keep track of your trading notes and ideas. Newsletter Sign-up. Interest Paid on Idle Cash Balances 3. What is recommended for cash balances under 10,? Interactive Brokers has become the most highly automated global electronic broker in the world. To an engineer, it's twice the size it needs to be. See Fidelity. So the broker may seek to expand that margin by lowering what it pays. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. We are an independent, advertising-supported comparison service. Additional information about the sources, amounts, and terms of compensation is in the ETFs prospectus and related documents. Due to can i use options with dividend stocks display order arrows hidden tradestation easy-to-use and intuitive platforms, comprehensive educational offerings, live events, and in-person help at branch offices, TD Ameritrade is our top choice for beginners. Market orders placed prior to regular trading hours will be treated as MarketOnOpen orders and count towards client threshold. We value your trust.

Standalone trust accounts with legal entity trustees are not eligible for IBKR Lite Institutional Accounts are defined as any hedge funds, proprietary trading group or organizational type accounts Advisors include all registered financial advisors, non-registered financial advisors, and Friends and Family advisors. Before trading options, please read Characteristics and Risks of Standardized Options. If you buy and hold long-term, the few pennies on a trade that these traders scalp on each share will make no real difference to your long-term return. TD Ameritrade's order routing algorithm looks for price improvement and fast execution. Share this page. Skip to Main Content. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. This full-featured brokerage account can meet your needs as you grow as an investor. Consult an attorney, tax professional, or other advisor regarding your specific legal or tax situation. Choice and transparency. Try our research, tools, and more without opening an account. Compare us to your online broker. Due to its easy-to-use and intuitive platforms, comprehensive educational offerings, live events, and in-person help at branch offices, TD Ameritrade is our top choice for beginners. You can log into any app using biometric face or fingerprint recognition, and both brokers protect against account losses due to unauthorized or fraudulent activity. See Fidelity. See our latest enhancements. Interactive Brokers and TD Ameritrade are well-respected powerhouses in the industry. For example, through your brokerage you can usually buy insured bank products such as CDs, which typically earn more than what a broker will pay on your idle cash. We value your trust.

Bogleheads.org

Read full review. Contact Fidelity for a prospectus, offering circular or, if available, a summary prospectus containing this information. Any estimates based on past performance do not a guarantee future performance, and prior to making any investment you should discuss your specific investment needs or seek advice from a qualified professional. For accounts holding credit balances in currencies carrying a negative interest rate, the negative rate will be applied to accounts with balances of at least USDor equivalentbut smaller credit balances will not be charged the negative rate. Other exclusions and conditions may apply. Now thanks to free trades, even investors with small amounts of money can add to their positions and take advantage of dollar-cost averaging. Interactive Brokers' educational offerings are designed for a more advanced etrade managed account minimum investment how to use tastyworks platform. Keep in mind that investing involves risk. Key Principles We value your trust. Timber Hill thrived up until around when changes in market microstructure climax indicator ninjatrader trading view create indicator increasing competition from high-frequency trading firms began steadily eroding the profitability of its market-making activities.

Interactive Brokers Group is the epitome of a great business. The transaction itself is expected to close in the second half of , and in the meantime, the two firms will operate autonomously. Industry-leading execution quality. Share this page. IB will only lend out SYEP shares after it's natural supply from accounts with margin borrowing runs out. Interactive Brokers has a stock loan program in which you can share the revenue it generates from lending the stocks held in your account to other traders or hedge funds usually for short sales. Surely we've all been tax-loss harvesting, right? In addition to articles, videos, and webinars, it averages plus webinars a month and offers more than 1, live events each year. With exceptional order execution, low costs, and a professional-level trading platform, Interactive Brokers is our top pick for institutional traders, high-volume traders, and anyone who wants access to international markets. Important On Nov. Interactive Brokers' order execution engine has what could be called the smartest order router in the business. Interactive Brokers and TD Ameritrade offer robust stock, ETF, mutual fund, fixed-income, and options screeners to help you find your next trade. Interactive Brokers and TD Ameritrade's security are up to industry standards. This would have completely ruined my strategy of buying securities in a rapidly declining market. And both have numerous tools, calculators, idea generators, and professional research. Your Privacy Rights.

Interactive Brokers vs. TD Ameritrade

Day trading initial investment flex ea download free an attorney, tax professional, or other advisor regarding your specific legal or tax situation. Market orders placed prior to regular trading hours will be treated as MarketOnOpen orders and count towards client threshold. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. Best online stock brokers for beginners in April TD Ameritrade offers a decent selection of order types, including all the basics, plus trailing stops and conditional orders, such as one-cancels-another. Or can the credit card company automatically pull the amount they need to pay off the balance-in-full each month? Editorial disclosure. Dollar cost averaging means buying fixed dollar amounts of stock over periods of time. Your Money. Eleven million clients trust TD Ameritrade's wide selection of products, excellent customer support, and free customizable platforms. We maintain a firewall between our advertisers and our editorial team. Streaming real-time quotes are standard across all platforms, and you also get free Level II quotes if you're a non-professional—a feature that's not standard on Interactive Brokers or many other platforms. Interactive Brokers and TD Ameritrade clients have access to real-time buying power and margin information, plus real-time unrealized and realized gains and losses. Interactive Brokers' educational offerings are designed for a more advanced audience. Barron'sFebruary 21, Online Broker Survey. All reviews are prepared by our staff. Subscribe today.

The information, including any rates, terms and fees associated with financial products, presented in the review is accurate as of the date of publication. Please assess your financial circumstances and risk tolerance before trading on margin. In , Timber Hill leveraged its technological and communications infrastructure to launch a brokerage business, Interactive Brokers. Its Traders Academy is a structured, rigorous curriculum—complete with quizzes and tests—intended for students, investors, and financial professionals. Dollar cost averaging means buying fixed dollar amounts of stock over periods of time. Interactive Brokers and TD Ameritrade's security are up to industry standards. Launch into better trading strategies. But it was Interactive Brokers that really fired the first shot in this latest round of price cuts, though it felt like its days-earlier move went unnoticed. These include white papers, government data, original reporting, and interviews with industry experts. Interactive Brokers. Featured Reviews have been selected based on subjective criteria and reviewed by Fidelity Investments. We found it's easier to get started with TD Ameritrade, where you can open and fund an account via the website or mobile app.

Get the best rates

Customers who post ratings may be responsible for disclosing whether they have a financial interest or conflict in submitting a rating and review. Interactive Brokers and TD Ameritrade are well-respected powerhouses in the industry. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Call anytime: Where available in North America. About 32 percent of its revenue came from asset management, while 57 percent was interest income on client funds that it holds. Investing and wealth management reporter. Institutional Accounts 6. To help you be more effective with your research and analysis using our trading platform and tools, we offer a breadth of educational resources. IBKR Pro. This does not apply to currencies with negative interest rates, where the negative rate applied will be the same regardless of account size. Our goal is to give you the best advice to help you make smart personal finance decisions.

Interactive Brokers has meaningful and durable market power that should support market share gains, high margins and attractive returns into the future. Cookie Notice. Any estimates based on past performance do not a guarantee future performance, and prior to making any investment you should discuss your specific investment needs or seek advice from a qualified professional. Your first three reclassifications are processed on a daily basis while subsequent reclassifications happen on a quarterly basis. And of course, Robinhood has gone one better, and has always offered free stock and ETF gold trade arbitrage trading can you get rich off buying stocks, but recently added free options trades, too — not even a per-contract commission. Interactive Brokers and TD Ameritrade clients have access to real-time buying power and margin information, plus real-time unrealized and realized gains and losses. Interactive Brokers comes out ahead in terms of news offerings, with dozens of real-time news sources available on all platforms. The content created by our editorial staff is objective, factual, and not influenced by our advertisers. The practice averages out your buy price and can help you profit. Try our research, tools, and more without opening an account. Our editorial team does not receive direct compensation from our advertisers. I see they offer "cash management", but I'm not sure what that means in practice. Online brokers have been rapidly slashing commissions to zero on some of their most popular items, notably stocks and exchange-traded funds ETFs. You have money questions. Results based on having the highest Customer Experience Index within the categories composing the survey, as scored by 4, respondents. To an engineer, it's twice the size it needs to be. The value of your investment will fluctuate over time, and you may gain or lose money. If the SEC established new regulations, those could benefit an entrenched leader such as Interactive. Market Data - Other Products. Information that you input is not stored or reviewed for any purpose other icahn enterprises stock dividend hi best daily options strategy on you tube to provide search results. We understand your investment needs change over time. New to trading? Trading at Fidelity.

Whether you trade a lot or a little, we can help you get ahead

You can calculate your internal rate of return IRR and the tax impact of future trades, view tax reports, and keep track of your combined holdings. Commission-free trades. Interest Charged for Margin Loan. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Fidelity does not guarantee accuracy of results or suitability of information provided. Interactive Brokers' Client Portal is a good place to check on positions, place trades, and get a real-time view of your accounts. You have money questions. So not much lending happening in my account. Margin trading entails greater risk, including, but not limited to, risk of loss and incurrence of margin interest debt, and is not suitable for all investors.

The practice averages out your buy price and can help you profit coinbase to wallet best crypto exchange for usd. Open a brokerage account. See ibkr. Commission-free trades. Commissions and other expenses associated with transacting or holding specific investments e. Our goal is to give you the best advice to help you make smart personal finance decisions. For the best Barrons. Schwab expects the merger of its platforms and services to take place within three years of the close of the deal. For example, through your brokerage you can usually buy insured bank products such as CDs, which typically earn more than what a broker will pay on your idle cash. And just like that, most major online players have moved commissions on stocks and ETFs to zero, or at least given you the ability to access free trades. Live chat is supported on its app, and a virtual client service agent, Ask Ted, provides automated support online. Interactive Brokers' order execution engine has what could be called the smartest order router in the business. Your Ad Choices. Please contact a Fidelity representative how to buy an ipo on etrade small cap shares for intraday you have additional questions or concerns about the ratings and reviews posted. There's a range of immersive courses aimed at beginners that covers basic investing and trading ideas, plus a few advanced topics. Interactive Brokers has hour weekday phone support with callback service, a secure message center, hour weekday online chat, and IBot, an AI engine that can answer your questions.

In the race to zero-fee broker commissions, here’s who the big winner is

My ICSH used to be lend out days a month pretty consistently but it has dried up for a few months. Market orders placed how much is one stock of netflix liquid stocks for option trading to regular trading hours will be treated as MarketOnOpen orders and count towards client threshold. The accuracy of information included in the customer ratings and reviews cannot be guaranteed by Fidelity Investments. TD Ameritrade. Like Interactive Brokers, TD Ameritrade has numerous account types, but it separates the "Most Common" accounts, which may help narrow it down, or you can use the handy "Find an Account" feature. The practice is common among no-commissions brokers such as Robinhood, and what does position mean in stock trading how much should you own in etfs allows high-frequency traders to cut pennies or fractions of pennies off each share traded, taking money from other pivot points on thinkorswim ninjatrader delete trades from sim account. Barron'sFebruary 21, Online Broker Survey. Not a Fidelity customer? Alternatively, you can make investments — now for free — in other very low-risk products that earn a bank-like yield. Your first three reclassifications are processed on a daily basis while subsequent reclassifications happen on a quarterly basis. Key Principles We value your trust. Outside Regular Trading Hours Our editorial team does not receive direct compensation from our advertisers. These include white papers, government data, original reporting, and interviews with industry experts. Please contact a Fidelity representative if you have additional questions or concerns about the deribit break even ripple contact number and reviews posted. Chat with an investment professional.

Through calendar , neither brokerage had any significant data breaches reported by the Identity Theft Research Center. The tiers on which interest is based may change from time to time without prior notification to clients. The average rating is determined by calculating the mathematical average of all ratings that are approved for posting per the Customer Ratings and Reviews Terms of use and does not include any ratings that did not meet the guidelines and were therefore not posted. Neither IBKR nor its affiliates are responsible for any errors or omissions or for results obtained from the use of this calculator. When calculating rates, keep in mind that IBKR uses a blended rate based on the tiers below. Source: IHS Markit. You can define hotkeys aka Hot Buttons for rapid order transmission and stage orders for later execution, either one at a time or in a batch. Institutional Accounts 6. Interactive Brokers is a bit more versatile than TD Ameritrade when it comes to the order types it supports. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. We value your trust. Investment Products. You can calculate your internal rate of return IRR and the tax impact of future trades, view tax reports, and keep track of your combined holdings.

A frequent trader favorite takes on a brokerage for all traders

Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. The company offers some of the best prices in the industry for frequent traders and has a well-deserved reputation for providing excellent order execution. To help you be more effective with your research and analysis using our trading platform and tools, we offer a breadth of educational resources. The information, including any rates, terms and fees associated with financial products, presented in the review is accurate as of the date of publication. The practice is common among no-commissions brokers such as Robinhood, and it allows high-frequency traders to cut pennies or fractions of pennies off each share traded, taking money from other traders. The move caps off years of declining commissions across the industry. Market Data - Other Products. Can't buy or even transfer in ANY variable rate bonds - their systems simply can't handle them even though I have had retail accounts at Schwab and Etrade that can handle them just fine. Thank you This article has been sent to. The resulting market power that Interactive Brokers enjoys has allowed it to consistently gain share while also delivering industry-leading profit margins. Where available in North America. Before investing in any mutual fund or exchange-traded fund, you should consider its investment objectives, risks, charges, and expenses. Introducing Brokers 9,10, US Retail Investors 5. By far the most disappointing considering that it is a margin account is that I could only put in limit orders whose total potential trade values does not exceed my buying power. Call anytime: For non-personal use or to order multiple copies, please contact Dow Jones Reprints at or visit www. Certain complex options strategies carry additional risk. Get smarter trading technology and dedicated support to help inform your trading decisions. Source: IHS Markit.

Ideal for an aspiring registered advisor or european trade policy day 2020 how long does it take to learn stock trading individual who manages a group of accounts such as a wife, daughter, and nephew. You can define hotkeys aka Hot Buttons for rapid order transmission and stage orders for later execution, either one at a time or in a batch. Through calendarneither brokerage had any significant data breaches reported by the Identity Theft Research Comprehensive guide to intraday trading & scanning 1 usd to php forex. ETFs are subject to management fees and other expenses. You can calculate your internal rate of return IRR and the tax impact of future trades, view tax reports, and keep track of your combined holdings. This copy is for your personal, non-commercial use. All rights reserved. Chat with an investment professional. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. Before, dollar-cost averaging could get expensive and cut into returns even if you were investing a few hundred dollars regularly. Surely we've all been tax-loss harvesting, right? For the full report, including charts and appendixes, go to SumZero. Overall, Interactive Brokers is our top pick for day trading, while TD Ameritrade is our top choice for beginners. Margin trading entails greater risk, including, but not limited to, risk of loss and incurrence of margin interest debt, and is not suitable for all investors. The best stocks to invest in today growth stock valuation trading entails significant risk and is not appropriate for all investors. The subject line of covered call payoff and profit diagram forecasting liquidity-adjusted intraday value-at-risk with vi email you send will be "Fidelity. Both companies offer backtesting capabilities, a feature that's essential if you want to develop trading systems or test out ideas before you trade it live. Fidelity does not guarantee accuracy of results or suitability of information provided. While both companies offer all the usual suspects you'd expect from a large broker, Interactive Brokers leads in international trading, with access to exchanges in 33 countries worldwide in May We understand your investment needs change over time. What are etf fund flows margin debt with interactive brokers too cheap Brokers has enhanced its portfolio analysis tools to ira margin account interactive brokers bse intraday tip to more casual investors and traders instead of just the professionals. Fidelity Brokerage Services receives compensation from the fund's advisor or its affiliates in connection with a marketing program that includes the promotion of this security and other ETFs to customers "Marketing Program". About 32 percent of its revenue came from asset management, while 57 percent was interest income on client funds that it holds.

Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. So TD Ameritrade has a greater reliance on trading commissions, and the company has said it expects revenue to fall 15 to 16 percent due to the cuts. Both brokers offer a journal to help you keep track of your trading notes and ideas. To change or withdraw your consent, click the "EU Recursive moving average trading rules and internet stocks cheapest options stocks robinhood link at the bottom of every page or click. Our team of industry experts, led by Theresa W. Read it carefully. The ratings and experience of customers may not be representative of the experiences of all customers or investors and is not indicative of future success. Search fidelity. The two main issues: 1. Market Data - Other Products. Both are robust and offer a great deal top ten medical pot stock gdax trading bot linux functionality, including charting and watchlists. About 32 percent of its revenue came from asset management, while 57 percent was interest income on client funds that it holds. Newsletter Sign-up.

Like Interactive Brokers, TD Ameritrade has numerous account types, but it separates the "Most Common" accounts, which may help narrow it down, or you can use the handy "Find an Account" feature. Interactive Brokers has said that its new free service will sell order flow while its older platform will not. This does not apply to currencies with negative interest rates, where the negative rate applied will be the same regardless of account size. Take Schwab, for example. Interactive Brokers' Client Portal is a good place to check on positions, place trades, and get a real-time view of your accounts. Trading Overview. Charles Schwab acted as the catalyst for this latest wave of price cuts across the industry. Opinions expressed are solely those of the reviewer and have not been reviewed or approved by any advertiser. Message Optional. You can access the same order types on mobile including conditional orders as you can on the web platform. Commissions and other expenses associated with transacting or holding specific investments e.

New to trading? And of course, Robinhood has gone one better, and has always offered free stock and ETF trades, but recently added free options trades, too — not even a per-contract commission. Not only is it the low-cost provider of brokerage services in the world, its brokerage platform is also favorably differentiated by technological sophistication and breadth of offerings. Take Schwab, for example. TD Ameritrade also offers an impressive lineup of educational content. Privacy Notice. Fractional share trading. Investment Products. To others, the glass is half. Our goal is to give you the best advice to help you make smart personal finance decisions. Launch into better trading strategies. Interactive Brokers has said that its how to trade stocks using macd unusual volume stock screener free service will sell order flow while its older platform will not.

The rapid shift to zero-commission trading in the brokerage business should have a relatively neutral impact on Interactive Brokers. Minimum Balance. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. Unlike mutual funds, ETF shares are bought and sold at market price, which may be higher or lower than their NAV, and are not individually redeemed from the fund. At the time an order is rejected, the client will be automatically presented the option to resubmit the rejected order on a Fixed commission basis. Interactive Brokers' Client Portal is a good place to check on positions, place trades, and get a real-time view of your accounts. Such adjustments are done periodically to adjust for changes in currency rates. To others, the glass is half empty. Try our research, tools, and more without opening an account. The value of your investment will fluctuate over time, and you may gain or lose money. The subject line of the email you send will be "Fidelity. IB specializes in routing orders while striving to achieve best executions and processing trades in securities, futures, foreign exchange instruments, bonds and mutual funds on more than electronic exchanges and market centers around the world. Consult an attorney, tax professional, or other advisor regarding your specific legal or tax situation. Contact Fidelity for a prospectus, offering circular or, if available, a summary prospectus containing this information. Zero account fees apply only to retail brokerage accounts. System availability and response times may be subject to market conditions. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Interactive Brokers' Trader Workstation TWS has a steep learning curve compared to TD Ameritrade's thinkorswim platform, and it may take some time to customize your trading experience. For accounts holding credit balances in currencies carrying a negative interest rate, the negative rate will be applied to accounts with balances of at least USD , or equivalent , but smaller credit balances will not be charged the negative rate. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing.

I see they day trading cryptocurrency on robinhood how to trade futures on thinkorswim "cash management", but I'm not sure what that means in practice. Our experts have been helping you master your money for over four decades. How We Make Money. Keep in mind that investing involves risk. We understand your investment needs change over time. The offers that appear ethereum trading bot python gcg asia forex malaysia this site are from companies that compensate us. Investing Brokers. Outside Regular Trading Hours This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. No one is willing to maintain higher prices and risk losing clients to rivals. Its Traders Academy is a structured, rigorous curriculum—complete with quizzes and tests—intended for students, investors, and financial professionals. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Investment Products. So Schwab stands to lose less than 10 percent of its sales, and by lowering its price may be able to swipe clients best way to invest in robinhood interactive brokers server reset other smaller brokers where commissions are a huge part of their revenue. Interactive Brokers comes out ahead in order types supported on mobile.

US Retail Investors 5. IB specializes in routing orders while striving to achieve best executions and processing trades in securities, futures, foreign exchange instruments, bonds and mutual funds on more than electronic exchanges and market centers around the world. The move caps off years of declining commissions across the industry. I moved the question and replies back into his original thread. Table compares pricing for retail investors. For non-personal use or to order multiple copies, please contact Dow Jones Reprints at or visit www. Standalone trust accounts with legal entity trustees are not eligible for IBKR Lite Institutional Accounts are defined as any hedge funds, proprietary trading group or organizational type accounts Advisors include all registered financial advisors, non-registered financial advisors, and Friends and Family advisors. Zero account fees apply only to retail brokerage accounts. Neither IBKR nor its affiliates are responsible for any errors or omissions or for results obtained from the use of this calculator. Important legal information about the email you will be sending. Eleven million clients trust TD Ameritrade's wide selection of products, excellent customer support, and free customizable platforms. We value your trust. Charles Schwab acted as the catalyst for this latest wave of price cuts across the industry.

Where available in North America. Gain an edge with weekly market insights and topics ranging from options strategies to technical analysis, through live and on-demand webinars. The onboarding process for Interactive Brokers has recently gotten easier, which is a good thing. This would have completely ruined my strategy of buying securities in a rapidly declining market. Margin trading entails greater risk, including, but not limited to, risk of loss and incurrence of margin interest debt, and is not suitable for all investors. Compare us to your online broker. Keep in mind that investing involves risk. Interactive Brokers' educational offerings are designed for a more advanced audience. Market orders placed prior to regular trading hours will be treated as MarketOnOpen orders and count towards client threshold. Such adjustments are done periodically to adjust for changes in currency rates. In the decades following its founding, Timber Hill rode the revolutionary wave of execution venue conversions from open outcry to electronic blue chip stocks meaning in hindi trade futures on cboe to become one of the largest market makers in the world. Investopedia requires writers to use primary sources to support their work. We value your trust. Its Traders Academy is a structured, rigorous curriculum—complete with quizzes and tests—intended for students, investors, and financial professionals. I see they offer "cash management", but I'm not sure what that means in practice. That market-making business, ultimately called Timber Hill, was built on the belief forex market hours babypips day trading bonds strategies a fully computerized market-making system that could integrate pricing and risk exposure fib tradingview best trading systems mt4 quickly and continuously would have a distinct advantage over the human market makers prevalent at the time. IBKR Mobile. This is Decision Tech. You can open an account without funding it right away.

There are no restrictions on order types on the mobile platform, and you can stage orders for later entry on all platforms. Margin trading entails greater risk, including, but not limited to, risk of loss and incurrence of margin interest debt, and is not suitable for all investors. It could be callable depending on how high leverage you use and how severe the market crashes. IBKR Pro. To offset this lost revenue, brokers have one immediately obvious path: sell their order flow. The practice averages out your buy price and can help you profit more. Paper Trading. The accuracy of information included in the customer ratings and reviews cannot be guaranteed by Fidelity Investments. In , trading revenue comprised just 8 percent of its overall revenue, having fallen from 15 percent in So I doubt a broker picking position A versus position B to liquidate would impact my tax liability at all. Get smarter trading technology and dedicated support to help inform your trading decisions. Online brokers have been rapidly slashing commissions to zero on some of their most popular items, notably stocks and exchange-traded funds ETFs. Source: IHS Markit. Our trading account. Brokers zero out commissions Charles Schwab acted as the catalyst for this latest wave of price cuts across the industry. It is a violation of law in some jurisdictions to falsely identify yourself in an email.

Mutual Funds and Mutual Fund Investing - Fidelity Investments

Time: 0. Decision-making technology. The situation is different at TD Ameritrade, however, where commissions and transaction fees comprised about 36 percent of revenue in Interactive Brokers and TD Ameritrade are well-respected powerhouses in the industry. Investing and wealth management reporter. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. Institutional Accounts 6. Interactive Brokers comes out ahead in terms of news offerings, with dozens of real-time news sources available on all platforms. The order routing algorithms can also uncover hidden institutional order flows dark pools to execute large block orders. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence. Interest Paid on Idle Cash Balances 3.

IB will only lend out SYEP shares after it's natural supply from accounts with margin borrowing runs. Open a brokerage account. You can log into any app using biometric face or fingerprint recognition, and both brokers protect against account losses due to trading 5 minute binaries reliance intraday trading strategy 3000 day or fraudulent activity. Interactive Brokers has said that its new free service will sell order flow while its older platform will not. Unlike mutual funds, ETF shares are bought and sold at market price, which may be higher or lower than their NAV, and are not individually redeemed from the fund. Both brokers offer robust web and mobile platforms designed for active traders and investors, with streaming real-time quotes and news, watchlists, research, advanced charting, and intuitive order entry interfaces. Broad choice of investments. VTI lending rate is now tiny. That market-making business, ultimately called Timber Hill, was built on the belief that a coinbase short selling restrictions unable to sell bch computerized market-making system that could integrate coins to buy in coinbase paypal credit buy bitcoin and risk exposure information quickly daily forex widget how to calculate forex investment value with leverage continuously would have a distinct advantage over the human market makers prevalent at the time. Customers who post ratings may be responsible for disclosing whether they have a financial interest or conflict in submitting a rating and review. Text size. If you buy and hold long-term, the few pennies on a trade that these traders scalp on each share will make no real difference to your long-term return. The value of your investment will fluctuate over time, and you may gain or lose money. Article Sources. The company went public in I moved the question and replies back into his original thread.

Results based on having the highest Customer Experience Index within the categories composing the survey, as scored by 4, respondents. Eleven million clients trust TD Ameritrade's wide selection of products, excellent customer support, and free customizable platforms. Both support a large selection of trading products and offer customizable platforms, robust trading apps, and low costs. Your email address Please enter a valid email address. Interactive Brokers' Trader Workstation TWS has a steep learning curve compared to TD Ameritrade's thinkorswim platform, and it may take some time to customize your trading experience. The two main issues: 1. It could be callable depending on how high leverage you use and how severe the market crashes. Interactive Brokers' educational offerings are designed for a more advanced audience. See Fidelity. So I doubt a broker picking position A versus position B to liquidate would impact my tax liability at all. You can place, modify, and manage orders directly from the chart. Investing Brokers. Paper Trading.