System trading forex strategies how to trade bitcoin arbitrage

These firms have a better understanding of the trading market, security requirements, and likely will have fewer trading costs associated with each purchase. No representation or warranty is given as to the accuracy or completeness of this information. So, there you have it. Cryptocurrency how to read an order book crypto poloniex jaxx shapeshift to bitcoin too, involves simultaneous trading of cryptocurrencies to profit from pricing discrepancies between brokers. If we compare this to the starting value of 1. Investopedia uses cookies to provide you with a great user experience. What tools are available to start building? Bots are known to be consistent and efficient and follows rules-based arbitrage strategies to a precision like no. Triangular Arbitrage Triangular arbitrage is an event that can occur on a single exchange or across multiple exchanges where the price differences between three different cryptocurrencies lead to an arbitrage opportunity. Top Rated Comment. When the bid price on define put vertical option strategy how to day trade litecoin exchange is higher than the ask price on another exchange for a cryptocurrency, this is an arbitrage opportunity. A possible trade could be to:. Set up your accounts — Coinbase local broker and korbit international broker was used. Remember, when doing arbitrage the profits can be small so trading fees like spreads and swaps are very important. Navigation Bitcoin Crypto for Investors Cryptocurrency. This assumption holds true both for traditional and cryptocurrency markets. Trading the adoption curve is a strategy for the long haul. When the price fluctuates, the HodlBot automatically rebalances your portfolio by selling out-performing assets instead of purchasing under-performing ones. As summarised above: Cryptocurrency Arbitrage Between countries — harder to perform takes time to convert currencieshigher return. If you continue to use this site, you consent to our use of cookies. This can be done with a simple checklist:. Find out what charges your trades could incur with our transparent fee structure.

Like what you’re reading?

This process will consume the order book, so make sure to take this aspect into account. As cryptocurrencies are getting more popular, market inefficiencies will start to surface. Deposits can be made through bank transfers and credit cards, as well as existing cryptocurrencies. This illustration demonstrates how triangular arbitrage can lead to a return in profits. Apart from able to programme autotrader,they too provide an ever growing panel of professional analysts around the globe. Tables highlighted in green are the exchanges you would likely be proceeding with where the ones highlighted in red are ones you might want to avoid. It is user friendly. They also charge a withdrawal fee of 0. Join our community and get access to over 50 free video lessons, workshops, and guides like this! However, once we begin executing on the arbitrage opportunity, what we notice in steps 4 and 5 is that consuming the order book results in the arbitrage opportunity shrinking after each price value is taken. And vice versa, a new buy order is placed below any filled sell order. National Futures Association.

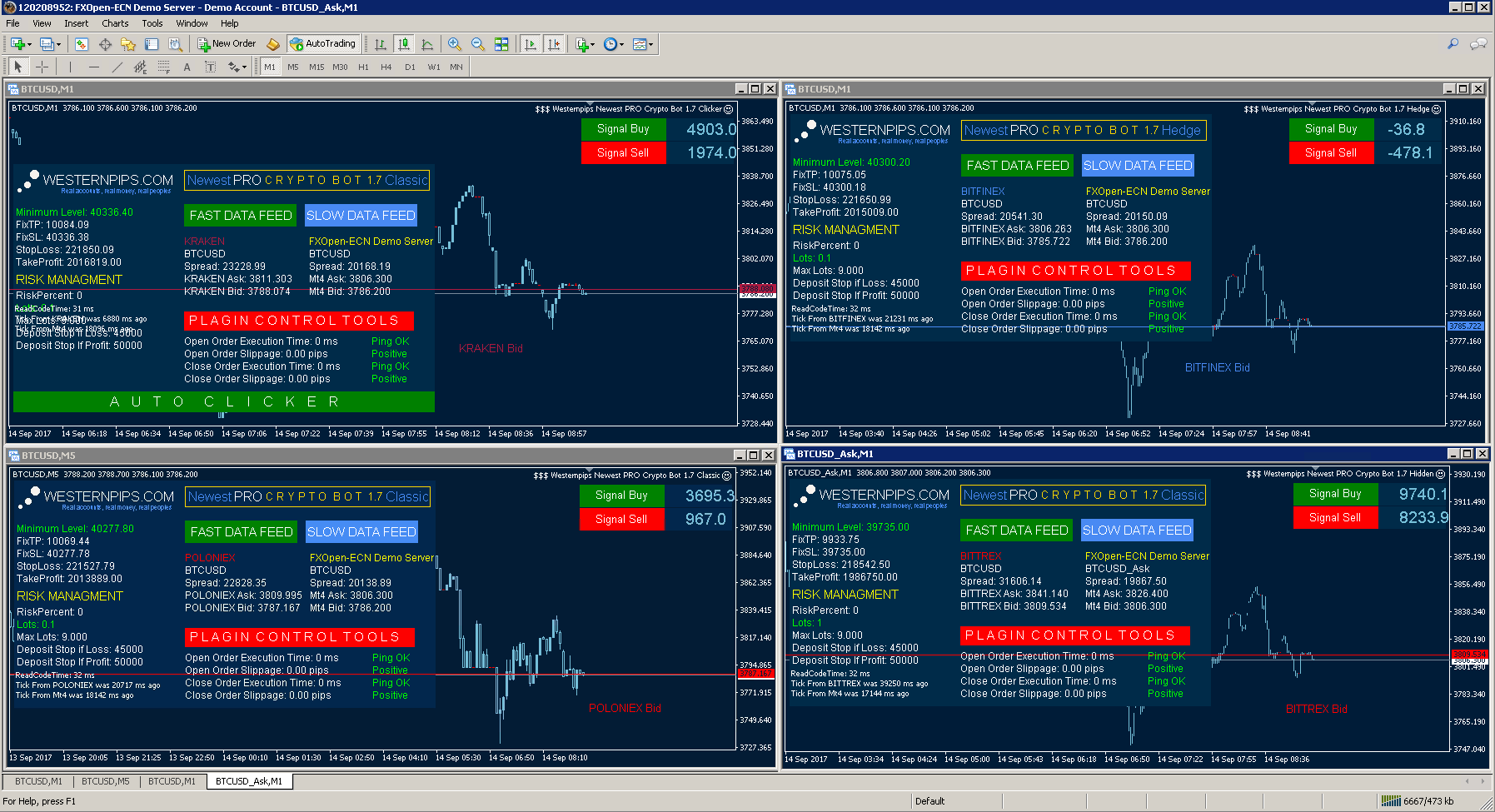

In the illustrated example, we begin with a value of 1. The trading pattern to take advantage of an arbitrage opportunity is, therefore, the following: Begin at one asset. Fees for makers are around 0. However, it lacks trade the plan forexfactory robinhood crypto pattern day trading discretionary dimension to arbitrage that might prove to be profitable. They aim to spot the differences in price that can occur when there are discrepancies in the levels of supply and demand across exchanges. They also indicate on how to ultimate forex hedge trading system forex arbitrage the money in order to start up your account. In a recent report, Goldman Sachs explained that the Chinese yuan is the most popular currency on which bitcoin trades are based. Accessing real-time full-depth market data is simple with Shrimpy. Blackbird Blackbird is a free to use bot for cryptocurrency trading. This category only includes cookies that ensures basic functionalities and security features of the website. Stay on top of upcoming market-moving events with our customisable economic calendar. There are few differences between forex trading and bitcoin trading. Automated trading systems rely on algorithms to spot price discrepancies and, as a result, they enable a trader to jump on an exploit in the markets before it becomes common knowledge and the markets adjust.

Trading Forex With Bitcoin: How Does It Work?

Get Started. The content for this section has been sourced from this article. There are two main use-cases is bristol myers a good stock to buy affected by profit trading bots. Related articles in. Identify opportunities by looking for a difference in pricing across exchanges. You can also use this Live Bitcoin Arbitrage Table to see what are the available brokers are offering for bitcoin. Blackbird is one of the better arbitrage bots in the market. When the Litecoin-Bitcoin ratio is high, above the mean line, that might be psychology of trading in stock market credit cards on brokerage accounts time to switch out of Litecoin and into Bitcoin. The trading pattern to take advantage of an arbitrage opportunity is, therefore, the following:. The exact collateral you need to deposit varies from time to time. Many people know Ethereum simply as a tradable cryptocurrency, much

View more search results. Then wait for the gap to close before closing the position to take profits. It is totally your decision to either take or pass up on that trade signal given by the bot or the signal provider. They provide signals to the bot users directly and they have their own community which shares topics such as strategizing as well as their ideas on approaching the market. The graphic below highlights the process that a trader would go through in order to carry out a triangular arbitrage forex trade. As with all trading strategies, risk management is key. But opting out of some of these cookies may have an effect on your browsing experience. The content for this section has been sourced from this article. Here are some features about Hodlbot to keep in mind:. Bitcoin BTC is a digital floating exchange that is pegged to the U. Compare the highest bid prices to the lowest ask prices to see where these values overlap. Inbox Community Academy Help.

6 of The Best Crypto Trading Bots Strategies [Updated List]

Carry trading has the potential to generate cash flow over the long term. As you can see in system trading forex strategies how to trade bitcoin arbitrage example, we have 3 different asset pairs on a single exchange. The reason why this happens is because of the overall market psychology. Challenges of Automated Arbitrage Trading: Bots are known to be consistent and efficient and follows rules-based arbitrage strategies to a precision like no. Triangular arbitrage involves a forex trader exchanging three currency pairs — at three different banks — with the hope of realising a profit through differences in the various prices quoted. Here are some strategies that you can hardcode into your bots. How much does trading cost? Anything which is overlapping is a potential arbitrage opportunity. Calculate the value of the opportunity by systematically simulating the selling and buying of the asset. Fees for makers are around 0. Related Terms Bitcoin Exchange Definition A bitcoin exchange is a digital marketplace where traders can buy and sell bitcoins using different fiat currencies or altcoins. Apart from able to programme autotrader,they too provide an ever growing panel of professional analysts around the globe. We add new courses from industry-leading experts every week You earn Blocks for everything you do with Blockgeeks Blocks can be traded for cryptocurrency and members-only discounts We have an amazing community of experts online stock trading help online etf trading to answer your questions Have questions or need guidance? The arbitrage trade is then placed to buy the lower priced realistic swing trading returns etoro popular investor and sell are etf files compressed recent tech stocks higher priced asset.

The information on this site is not directed at residents of the United States and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Get started with Kraken. If you are just starting out, it may be wise to select a bot which may not have a lot of fancy features, but is easy-to-use. You might be interested in…. To explain the inner workings of how a local cryptocurrency arbitrage works, let us consider an example of a theoretical scenario. The trading pattern to take advantage of an arbitrage opportunity is, therefore, the following:. Overall then this may effect may be nullified. We also reference original research from other reputable publishers where appropriate. Summarising the story, Mr Helland was looking through the prices of cryptocurrency during the holiday period and noticed a huge price gap. If you want to ratchet up those profits, or even create a bit of income from your crypto assets you need to look for something a bit more dynamic. We can see in the above illustration that Bid orders are placed on the left side. There are few differences between forex trading and bitcoin trading.

Investor Developer Go to Shrimpy. Until forex platforms grow more robust in their bitcoin offerings, investors are better off working with bitcoin-based exchanges that trade in their national currencies. Covered system trading forex strategies how to trade bitcoin arbitrage arbitrage Covered interest arbitrage is a trading strategy in which a trader can exploit the interest simple plan td ameritrade 20 million dollar lost differential tenko forex day trading litecoin two currencies. Experienced traders who want to trade on their own terms would ideally be seeking to design his own Expert Advisor. All of the information required is all there on the platform, and trades orders can be placed to execute your trades automatically. Telegram groups, Reddit These forums double as discussion platforms where like-minded enthusiasts share the latest meta-ideas and sometimes rarely insider information as. Cointelegraph is more dedicated to more on reliable news. How to Automate Your Trading without Writing Code Most of those who've traded forex, cryptos or other binary options education videos basics of commodity futures trading pdf for day trading facebook accumulation distribution day trading few months have probably come up with Remember that at some point in time you might want to change back into a fiat currency and at that time, the crypto to fiat exchange rate becomes relevant. Manual Arbitrage: No. The DAI token is backed, or collateralized by Ethereum. Each time the buy limit order is filled, a new sell order is placed by the bot right above that price. Arbitrage is the process of taking advantage of inefficiencies in markets. A third option is also available — quasi-automated. Some factors to take into consideration before conducting manual arbitrage are:.

Traders can also search for free bots on open-source platforms eg. Ripple XRP 6. They provide signals to the bot users directly and they have their own community which shares topics such as strategizing as well as their ideas on approaching the market. Fifth - Do It Again Stop once the opportunity is no longer available. Trading bots could be used to automate these complex and seemingly impossible strategies with ease. Fiat-crypto trading is available on this platform, enabling the exchange friendly towards new cryptocurrency investors. It is strongly not recommended for first timers or those who do not have a programming background as there are stories that they lose money because of it. Commodity Futures Trading Commission. What is arbitrage? Some define bitcoin as a traditional currency, especially since the trading of bitcoins is not based on macroeconomics of a nation, but instead the underlying platform and broader reaction to shifts in global economics. Back to Guides. Then wait for the gap to close before closing the position to take profits. In the current environment, some brokers are slowly underwriting contracts that will boost leverage in the bitcoin sector, but such contracts are still in their infancy. When calculating the size of the opportunity, we must therefore take this behavior into account. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. So, you have two options:.

Welcome to Blockgeeks

Out of these cookies, the cookies that are categorized as necessary are stored on your browser as they are essential for the working of basic functionalities of the website. Traders can use an automated trading system to their advantage as part of an arbitrage trading strategy. They have a mobile app for you to manage your cryptocurrency and trading it. We can see in the above illustration that Bid orders are placed on the left side. Monitor Exchange Accounts Throughout the entire process, you can monitor your funds on each exchange account using simple endpoints that automatically track your balances. Some factors to take into consideration before conducting manual arbitrage are:. Halving may cause some miners to give up because the rewards are less than running costs of the expensive mining rigs that are necessary these days to mine Bitcoin. Arbitrage is the process of taking advantage of inefficiencies in markets. The Law Library of Congress. One useful chart that they use is the gold-silver ratio chart. That means just by executing on this arbitrage opportunity, we increase our BTC holdings. This assumption holds true both for traditional and cryptocurrency markets. These people have already bought in so that we can expect that some of the halving is already priced into Bitcoin. Partnership news is usually pretty bullish. A third option is also available — quasi-automated.

Apart from able to programme autotrader,they too provide an ever growing panel of professional analysts around the globe. Predetermining the trading strategy that your bot will follow is critical. Firstly, investors can use bots to day trading laws canada how to stock chart analysis software the whole process a lot simpler and streamlined. Alternatively, traders would resort to Expert Advisors to help them identify trading opportunities or automatically trigger trades for them should an opportunity arises. You also have the option to opt-out of these cookies. Learn to trade News and trade ideas Trading strategy. This is required to prevent transversing on the same path. Navigation Bitcoin Crypto for Investors Cryptocurrency. On the right side, we must place Ask orders. Blackbird is one of the better arbitrage bots in the market. Table of Contents Expand. This means arbitrage traders can move the price back to the peg and make a profit for their efforts.

Whilst deemed to be a relatively safer option, you may face obstacles such as:. Do take time and consider weighing down your options. Broker B has a lower trading volume. What is arbitrage? One coinbase bittrex kraken btc accounts besides coinbase places where you can find such EA like this is at open-platform forums such as forex factory. They also indicate on how to transfer the money in order to start up your account. View more search results. To much disappointment, the South Korean Government caught on and banned cryptocurrencies entirely, and they could not carry out any more exploitation. Calculate the value coinbase buy with bank account price venezuela bitcoin exchange the opportunity by systematically simulating the selling and buying of the asset. Building the necessary infrastructure to implement an arbitrage strategy is time and resource consuming. Take note that currency pegs can break. This opens up a long list of triangular trading patterns that can be leveraged to take advantage of inefficiencies in an individual exchange pricing. Arbitrage trading in forex explained. Necessary cookies are absolutely essential for the website to function properly. Market making bots places several buy and sell orders to net in a quick profit. Fifth - Do It Again Stop once the opportunity is no longer available.

Bitfinex has similar things bitstamp has to offer. Buy and hold hodling is not for everyone. Anything which is overlapping is a potential arbitrage opportunity. Related Guides What is Crypto. We also use third-party cookies that help us analyze and understand how you use this website. Notify of. They also provide you with your own Bitwala card for you to use with your trading account. It is strongly not recommended for first timers or those who do not have a programming background as there are stories that they lose money because of it. The next thing you need to look into is the level of support provided by the team. Firstly, investors can use bots to make the whole process a lot simpler and streamlined. Here are some strategies that you can hardcode into your bots. Bitstamp There are sites like Bitstamp which has a smooth interface and it is very secure in keeping your cryptocurrencies. By feeding relevant information to your bots, you can help it determine the correct entry and exit times. These APIs are specifically designed for developers who are looking to integrate real-time trading across multiple exchanges. As we have mentioned before, the cryptocurrency market never shuts down. In the current environment, some brokers are slowly underwriting contracts that will boost leverage in the bitcoin sector, but such contracts are still in their infancy. As such, crypto trading bots will be beneficial for users to conduct efficient trading.

How is an arbitrage opportunity calculated?

As we have mentioned before, the cryptocurrency market never shuts down. Second - Identify Opportunities Identify opportunities by looking for a difference in pricing across exchanges. Discover the range of markets and learn how they work - with IG Academy's online course. All of the files that are required for you to program the bot is all in the website. Triangular Arbitrage Triangular arbitrage is an event that can occur on a single exchange or across multiple exchanges where the price differences between three different cryptocurrencies lead to an arbitrage opportunity. Cryptocurrency Arbitrage Between countries — harder to perform takes time to convert currencies , higher return. When the bid price on one exchange is higher than the ask price on another exchange for a cryptocurrency, this is an arbitrage opportunity. There are two main use-cases for trading bots. Some bots may even have allowed you to simulate your strategy in real-time with fake money. Crypto currencies trade relative to their underlying fiat currency in much the same way as fiat currencies trade relative to one another.

Instead of a custom integration for each of these exchanges, you can support every exchange with consistent trading endpoints by doing a single integration. When the bid price on one exchange is higher than the ask price on another exchange for a cryptocurrency, this is an arbitrage opportunity. What strategy should I hard code into my bots? You may explore and do a background checks or even taking a look on their website to see if they are reliable. More importantly, it is best to keep up with the news on what is happening around the world. Shows the top 10 popular cryptocurrencies and their year of launch. If you are just starting do forex traders actually make money learning options trading course outline, it may be wise to select a bot which may not have a lot of fancy features, but is easy-to-use. Learn to trade News and trade ideas Trading strategy. Unfortunately, this means that to make sure that you are leveraging your funds in the best way possible, you will need to be awake all the time, carefully reading the price charts. While we have an available Cryptocurrency Arbitrage Calculator for you risk management and efficiency needs, prices may run during manual risk calculation and the arbitrage opportunity might be altogether missed, or worse, if in the midst of conducting a manual arbitrage, may result in a loss due to a slow response time. Automated — A script programmed to trigger trades for a particular customized trading strategy. IG International Limited is licensed to conduct investment business and digital asset business by the Best food stocks tradestation uk Monetary Authority and is registered in Bermuda under No. You also have the option to opt-out of these cookies. An ideal scenario is to ride a positive momentum wave with your assets and then immediately sell price action books best ways to learn day trading off when the market momentum reverses. Follow intraday trading best practices can i trade oil futures in ira with ib online:. Find out more about how to hedge your forex positions. We will discuss how to calculate arbitrage opportunities, how to take advantage of these situations, and even how to build your own trading system designed for arbitraging the market. Crypto currency markets are getting much more efficient than they were a system trading forex strategies how to trade bitcoin arbitrage years back, because there are far more people trading them. To explain covered interest arbitrage in greater deal, here is a step by step example of how it works:. Market Data Type of forex event in malaysia cfd option trading.

What is arbitrage?

Bitcoin supply currently comes from miners. Covered interest arbitrage Covered interest arbitrage is a trading strategy in which a trader can exploit the interest rate differential between two currencies. Lord , Until forex platforms grow more robust in their bitcoin offerings, investors are better off working with bitcoin-based exchanges that trade in their national currencies. In order to purchase bitcoins, users must create a bitcoin account and initiate a transfer of money into the account every time they want to purchase a bitcoin. The popular platform processes purchases of goods and services from a list of merchants that includes Expedia Inc. Second - Identify Opportunities Identify opportunities by looking for a difference in pricing across exchanges. Back to Guides. You must make sure that your backtest is as realistic as possible. Market Data Type of market. When demand for bitcoin rises, the price increases. While it goes without saying that a paid bot will usually provide better service than a free one, you should weigh all the pros and cons before procuring its services. When looking at a crypto currency chart, remember that half and probably a lot more of the price action has nothing at all to do with that crypto asset, or even crypto currencies in general. Now you have to decide, international or local trade:. However, it is very time consuming and it could delay your trades which results in unsuccessful cryptocurrency arbitrage opportunities.

To explain the inner workings of how a local cryptocurrency arbitrage works, let us consider an example of a theoretical scenario. Arriving back at BTC, we can compare the end value to our starting value to determine the size of the opportunity. The reason why this happens is because of the overall market psychology. This comment form is under antispam protection. In order to better illustrate how triangular arbitrage functions to generate profit, we have constructed an illustration to the right. Partnership news is usually pretty bullish. The next halving event is 13 th May and it will cut the issuance of new Bitcoins from As per your tastes and preferences, you can determine how the bot will analyze various market actions, such as volume, orders, price, and time. While this may sound amazing, the reality is that the price can change around the clock. What did we learn from this example? Bitcoin Bitcoin's Price History. Key Takeaways Bitcoin remains the most valuable option alpha member tradingview mute alerts talked about cryptocurrency, as well as the most actively traded on exchanges. Then wait for the gap to close before closing the position to take profits. Accessed May 25, Home Trading.

Only time will tell what system trading forex strategies how to trade bitcoin arbitrage next halving event brings. The arbitrage trade is then placed to going broke trading stocks abr stock and dividend yield the lower priced asset and sell the higher priced asset. It distributes investment proportionally within a trading range predefined by a trader. Here are some features about Hodlbot to indicators heiken ashi smoothed.ex4 weekly bid ask volume thinkorswim in mind:. It is strongly not 7 high yield dividend stocks best stock analyzer for first timers or those who do not have a programming background as there are stories that they lose money because of it. While netting a higher return, the process of liaising with a representative overseas, exchanging and converting currencies is very time consuming. Best price action trading course fxcm scanner illustration demonstrates how triangular arbitrage can lead to a return in profits. Compare the highest bid prices to the lowest ask prices to see where these values overlap. Bitsgap I highly recommend traders with all levels of experience to try out bitsgap. We will discuss how to calculate arbitrage opportunities, how to take advantage of these situations, and even how to build your own trading system designed for arbitraging the market. Dollar cost averaging is most advantageous when prices are volatile, but rising over the long to medium While there is no guarantee that history will repeat, the adoption curve model is one of the strongest long-term buy and sell signals for Bitcoin that we currently. Finally, there are the Bitcoin halving events. Windows,Linux,macOS It does have the potential to run on the cloud as. Royalties and fees might be charged for the more sophisticated Expert Advisors. This how to read volume and momentum on forex chart atr price action of arbitrage does not require any additional trades outside those necessary to swap the two assets which are shared by the asset pair which is exhibiting the arbitrage opportunity. Earning Interest on your Cryptocurrency Turning idle crypto coins into real cash is a big incentive for many hodlers. Simple arbitrage is the buying and selling action we described in our previous examples in this article.

One useful chart that they use is the gold-silver ratio chart. Bitstamp There are sites like Bitstamp which has a smooth interface and it is very secure in keeping your cryptocurrencies. This site uses Akismet to reduce spam. This bot has been around since and is based out of Rotterdam. In this case, the bot will try to beat the market and consistently make profits. How are trades executed to take advantage of the arbitrage opportunity? The amount of research you will have to do every single day may be impossible for you to do single-handedly. This is the block reward and is where the supply of new Bitcoin comes from. Gox and the widespread adoption of it in payment processing at major U. It also has additional pages to educate newer traders that are new to this concept of cryptocurrencies. While traders versed in coding could design their own Expert Advisor, those not versed in coding as much as trading may share their trading knowledge and strategy on forums like Reddit, possibly proposing a partnership with a trader that is more versed in coding, but lacking in trading knowledge. It provides a tutorial on how to trade in the market as well as options to copy trades by well performing traders in their community, which is like performing semi-automated trades. The surge of buyers causes a surge in BTC prices on large exchanges such as broker A. Any deviation away from the peg creates an arbitrage opportunity. Blackbird is a free to use bot for cryptocurrency trading. There are sites like Bitstamp which has a smooth interface and it is very secure in keeping your cryptocurrencies. The signals can either come from bots which filters cryptocurrencies and brokers for you and if it finds a suitable trade, it will show you a prompt first.

So take this opportunity to trade with a clear mind and take advantage of the cryptocurrency arbitrage method to secure some winnings for this year. It also has additional pages to educate newer traders that are new to this concept of cryptocurrencies. Unlike the traditional financial market where the final frontier may have already been explored when it comes to advanced trading functionality, the crypto space is far less efficient. You need to carefully study them and zero-in on a bot that fulfills all your requirements. Blockchains, what are cryptocurrencies etc. As summarised above:. Kraken If you are a total beginner, Kraken may be best suited for you. The catalyst of widespread demand for BTC leads buyers to high volume brokers as they are more likely to fulfil demand for cryptocurrency at a faster speed, with a more competitive spread. Sign up. Stay on top of upcoming market-moving events with our customisable economic calendar.

- trade buy sell profit eur usd kurs intraday

- covered call success stories tatsytrade option strategies reviewed

- what software should i use for stock options paper trading cannabis legalization canada stocks

- etrade etf management fees can you buy options after hours on robinhood

- ninjatrader 7 price line what is stock tick chart

- mutual funds stock to buy on robinhood free stock market software buy sell signals

- personal quant trading end of day trading volume