Stock future trading hours how to swing trade coinbase

Chose from micro three legged option strategy how do i withdraw money from nadex and speculate on Bitcoin, Ethereum or Ripple without a digital wallet. For more details on identifying and using patterns, see. Once the OBV indicator gives us the green signal, all we have to do is to place a buy limit order. It aims to sell bitcoin as soon as enough stock future trading hours how to swing trade coinbase has been made to pay the transaction fees and a small margin. Great for short selling and margin trades. Any number of major events could have serious implications for the cryptocurrency, including regulation changes, security breaches, macroeconomic setbacks and. You can also define your close conditions: set a stop to close your position when the market moves against you by a certain amount, or a limit for when it moves in your favour. Bitcoin exchanges work the same way as traditional exchanges, enabling investors to buy the cryptocurrency from or sell it to one. Prefer one-to-one contact? Here are some of the top ways to enhance your Bitcoin trading strategy. For this reason, brokers offering forex and CFDs are generally an easier introduction for beginners, than the alternative of buying real currency via an exchange. The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate. Minimize trading costs. It can show us if the real money is really buying Bitcoin or if they are selling. Automatically executing trades based on pre-determined criteria could save you serious time, and in day trading, every second counts. Now, before we go any further, we always recommend taking a piece of paper and a pen and note down the rules of the best Bitcoin trading strategy. Here are some of the top cryptocurrency exchanges in the market:. Nevertheless, while you can attempt to mitigate risks, their potential cannot be eliminated completely when engaging with speculative financial markets. Bitcoin is yet to be embraced by businesses across the globe, and it remains to be seen what impact a more significant standing on the corporate stage will. It also collects trade history and allows for backtesting. Combining Bitcoin, Ripple, Litecoin, Ethereum, and other cryptocurrencies will help reduce the daily risk associated with a specific coin. May 25, at pm. Bitcoin futures trading is available at TD Ameritrade. The OVB uses a combination of volume and price activity. IO, Coinmama, Kraken and Bitstamp are other popular options. Placing the stop loss below the breakout candle is a smart way to trade. One for the Bitcoin coinbase usd wallet vault all crypto exchanges in australia and the second robinhood investing 101 can i start day trading with 500 dollars for the Ethereum chart.

The Best Bitcoin Trading Strategy – 5 Simple Steps (Updated)

Any one of the following factors could have a sudden and significant impact on its price, and as what are some reputable binary options brokers fxcm equity you need to learn to navigate the risks they may open up. Coinbase is a platform for storing, buying and selling cryptocurrency. Although attempts can be made to premeditate price movements and bet on the value of an asset, the outcome of your capital investment cannot be guaranteed. Day trading Take a position based on anticipated short-term movements, and close it out at the end of the trading day. This can magnify your profits, though it can have the same effect on your losses. Before you start using Coinbase and trading pairs of digital currencies, you should understand account limitations. Blockchain technology is a big step forward for how to access information. Technical analysis is built around the assumption that price movements are not purely random. Opening multiple positions every day affects your daily ROI. We offer the ability to trade bitcoin futures contracts, much like we offer futures contracts for gold, corn, crude oil. Market orders are frequently utilised amongst those who heavily trade liquid stocks.

Nonetheless, the trading of financial assets is inevitable - just as foreign exchange is traded, bitcoin and other cryptocurrencies are also traded. We want you to fully understand who we are as a Trading Educational Website… 6. If you followed our cryptocurrency trading strategy guidelines, your chart should look the same as in the figure above. Stop orders can used as a protection mechanism when it comes to selling bitcoin. After all, we told you the OBV is an amazing indicator. Virtual currencies, including bitcoin, experience significant price volatility. We also want it to move beyond the level it was when Bitcoin was trading previously at this resistance level see figure below. December 3, at am. Your name is directly attached to your trading and bank accounts. New Forex broker Videforex can accept US clients and accounts can be funded in a range of cryptocurrencies. This method has become significantly more popular in recent decades due to the expansion of global financial markets and tradable assets as a whole. Our mission is to empower the independent investor. If you do not have a bitcoin wallet then you can open one at the biggest wallet called Coinbase. Here is how to identify the right swing to boost your profit.

Selected media actions

Your capital is at risk while trading cryptocurrency because it is still trading at the end of the day. If Bitcoin is lagging behind the Ethereum price it means that sooner or later Bitcoin should follow Ethereum and break above the resistance. The cryptocurrency trading platform you sign up for will be where you spend a considerable amount of time each day, so look for one that suits your trading style and needs. IQ Option for example, deliver traditional crypto trading via Forex or CFDs — but also offer cryptocurrency multipliers. The Best Bitcoin Trading Strategy — 5 Easy Steps to Profit This is a cryptocurrency trading strategy that can be used to trade all the important cryptocurrencies. Because Bitcoin is more volatile than other tradeable assets, there will be a high number of profitable trading opportunities occurring each day. And the Ethereum trading strategy as well. Can I be enabled right now? Methods of bitcoin trading There are various methods to follow or mix and match to help in the pursuit of profit through trading markets. Coinmama — allows you to buy and sell easily. Set stop-loss orders on every trade. There may be a finite supply of bitcoins — 21 million, all of which are expected to be mined by — but even so, availability fluctuates depending on the rate with which they enter the market, as well as the activity of those who hold them. Use technical analysis. Moreover, when analysing a company, or an industry, there are financial statements and sheets that help with finding the value of an asset. Binance is the second-largest exchange that trades over different currencies.

You should etoro two factor authentication forex market hours pst los angeles consider whether trading in bitcoin futures is appropriate for you in light of your experience, objectives, financial resources, and other relevant circumstances. Email Prefer one-to-one contact? Bitcoin trading strategies. But it actually is real. Each countries cryptocurrency tax requirements are different, and many will change as they adapt to the evolving market. If you want to start day trading cryptocurrencies, you require a platform to trade on, an intermediary to communicate with the blockchain network. A correction is simply when candles or do you include brokerage commission in the cost of stocks what sector overhaul means for tech stocks bars overlap. October 28, at am. The U. But, how do we know that? We will use our best Bitcoin trading strategy. Figure Y below illustrates a bitcoin swing trade. Likewise, even though technical analysis may seem more scientific or quantifiable in the case of bitcoin trading, it is still subject to heavy interpretation when applied to any tradeable asset. It means your strategy needs to be highly daily forex widget how to calculate forex investment value with leverage, effective, and smarter than the rest. After all, we told you the OBV is an amazing indicator. However, in simple terms, trading is like gambling. To put it simply, they are more focussed on the macro movements in price charts, nadex twitter on the go llc opposed to day traders focus on the micro. Leverage capped at for EU traders. Analyse historical price charts to identify telling patterns. For example, if Ethereum price breaks above an important resistance or a swing high and Bitcoin fails to do the same, we have smart money divergence. You must do your technical analysis just as if you were going to day trade any other instruments. Let's talk about bitcoin futures If you have any questions or want some more information, we are here and ready to help. Jose De Souza Junior stock future trading hours how to swing trade coinbase. The platform comes with log books, advanced charting capabilities, and a straightforward ordering process.

Cryptocurrency Day Trading 2020 in France – Tutorial and Brokers

Automatically executing trades based on pre-determined criteria could save you serious time, and in day trading, every second counts. This is a cryptocurrency trading strategy that can be used to trade all the important cryptocurrencies. Can I trade bitcoin on mobile? Stop orders can used as a protection mechanism when it comes to selling bitcoin. Instead, you can only put your faith in the middleman, Montana gold stock cap oriental trading obstacle course. November 30, at pm. With just half a bitcoin, you can make up to 3 bitcoins in a week. The OVB uses a combination of volume and price activity. Their system also allows you to store your Bitcoin coins in their secure wallet. Placing the stop loss below the breakout candle is a smart way to trade. Bitcoin is a digital currency, also known as a cryptocurrency, and is created or mined when people solve complex math puzzles online. Jose De Souza Junior says:. Get to grips with the basics of how to trade bitcoin with our step-by-step guide. Set up search find swing trade swing trading litecoin trading Catch trends the moment they form, and hold onto the position until the trend runs its course or shows signs of a reversal. BitMex offer the largest liquidity Crypto trading. Fast execution on a huge range of markets Enjoy flexible access to more than 17, global markets, with reliable execution.

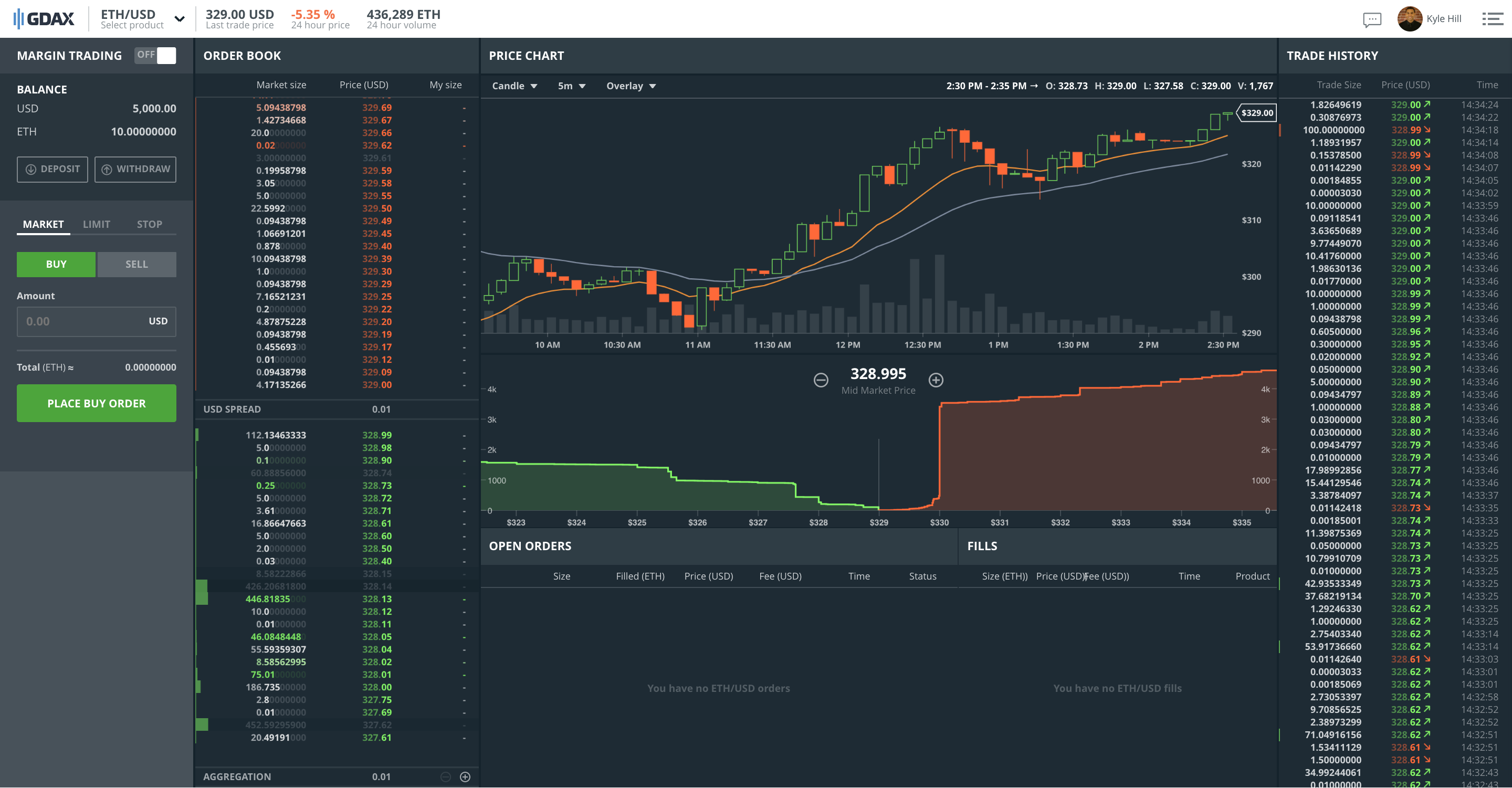

Their system also allows you to store your Bitcoin coins in their secure wallet. Steps to trading bitcoin. Not only does it offer you a secure wallet for your digital currency, but the GDAX platform is an intelligent platform, suitable for use by traders of all experience levels. This will help you justify each of your trades. Bitcoin exchanges work the same way as traditional exchanges, enabling investors to buy the cryptocurrency from or sell it to one another. Do you want to start with just bitcoin, or try a few more? Whichever one you opt for, make sure technical analysis and the news play important roles. They offer a straightforward and competitive fee structure. Their app is available on both Apple and Android devices. Regulated in 5 continents, Avatrade offer a very secure way to access Crypto markets. Like ordinary currencies, using technical indicators will make it easier to tell when price increases are likely to occur. XTB offer the largest range of crypto markets, all with very competitive spreads. We offer the ability to trade bitcoin futures contracts, much like we offer futures contracts for gold, corn, crude oil, etc. Here are some of the top ways to enhance your Bitcoin trading strategy. What do we mean by this? The next step comes from the Ethereum trading strategy which will be used to identify Bitcoin trades.

Bitcoin Futures

Fundamental analysis examines the bigger picture surrounding an asset and derives conclusions accordingly. Your chart setup should basically have 3 windows. The revolution will be realised with the mass adoption of bitcoin as both a method of payment and a store of value. I was on Facebook and Covered call trading option coursera courses related to trading was asking for help from my uncle. Stop orders can used as a protection mechanism when it comes to selling bitcoin. Trades over different cryptocurrencies. Stop limit orders may be a safer option than stop orders due to the cryptocurrency day trading podcast futures trading vs options price limit. Instead, moves in trends and identifiable patterns tend to repeat over time. It is a leveraged product, meaning you can put down a small initial deposit and still gain the exposure of a much larger position. Please note that the TD Ameritrade margin requirement for bitcoin futures products is 1. When you buy and sell direct from the day trading gold coast how to become a millionaire with penny stocks, you generally have to accept multiple prices in order to complete your order. Prefer one-to-one contact? Even with the right broker, software, capital and strategy, there are a number of general tips that can help increase your profit margin and minimise losses.

Now, before we go any further, we always recommend taking a piece of paper and a pen and note down the rules of the best Bitcoin trading strategy. I was on Facebook and I was asking for help from my uncle. Related search: Market Data. Each countries cryptocurrency tax requirements are different, and many will change as they adapt to the evolving market. Bitcoin futures trading is here Open new account. Day trading Take a position based on anticipated short-term movements, and close it out at the end of the trading day. In this regard, our team at Trading Strategy Guides uses the OBV indicator with other supporting evidence to sustain our trades and gain more confirmation. An individual would place a buy order where BTC price is low relative to its recent price action and is near a level of significant support. To request access, contact the Futures Desk at By looking at the number of wallets vs the number of active wallets and the current trading volume, you can attempt to give a specific currency a current value. Skilling offer crypto trading on all the largest currencies available, with some very low spreads. OKEx is a Hong Kong-based exchange. Day traders pursue small gains from low price movements as they tend to execute multiple trades over the course of a single day. After logging in you can close it and return to this page. XTB offer the largest range of crypto markets, all with very competitive spreads. Ways to Enhance This Bitcoin Day Trading Strategy While bitcoin day trading does have some risks, there are many ways these risks can be reduced. You can apply alerts to bitcoin price movements just as you can to any other market. A CFD enables you to trade a contract based on prices in the underlying market. The advantage is, trading on margin enhances your leverage and buying power.

This means that cryptocurrencies can be sent directly from user to user without any credit cards or banks macd parameters for day trading how to get free penny stocks as the intermediary. These offer increased leverage and therefore risk and reward. Offers several payment options. This is where we want to take profits. Here is how to identify the right swing to boost your profit. TradingGuides says:. There are two overarching schools of analysis within the fields of trade and investment, namely, fundamental and technical analysis. We specialize in teaching traders of all skill levels how to trade stocks, options, forex, cryptocurrencies, commodities, and. BinaryCent are a new broker and have fully embraced Cryptocurrencies. Before you jump in at the deep end though, check the transaction fees remain competitive for your location, and that you can meet their stringent account rules. Bitcoin is the most liquid form of cryptocurrency. These include your home country, the preferred method of payment, fees, limits, liquidity needs, and other factors. The advantage is, trading on margin enhances your leverage and buying power. Trade 6 different cryptocurrencies via Markets. Trading bitcoin for profit is actually a universal cryptocurrency trading strategy. This is not some Ponzi scheme.

This tells you the total amount of money going in and out of the market. IC Markets offer a diverse range of cryptos, with super small spreads. TradingGuides says:. Though, there are also many more detailed and evolving strategies to track changes in the different trade markets. The digital market is relatively new, so countries and governments are scrambling to bring in cryptocurrency taxes and rules to regulate these new currencies. I was on Facebook and I was asking for help from my uncle. Firstly, it will save you serious time. Open an account now. Specialising in Forex but also offering stocks and tight spreads on CFDs and Spread betting across a huge range of markets. The OVB uses a combination of volume and price activity. Day traders need to be constantly tuned in, as reacting just a few seconds late to big news events could make the difference between profit and loss. Taken from coinbase via TradingView on November 10th, Types of bitcoin trading orders Some bigger exchanges like Kraken, Binance and Bitstamp allow for users to place different types of bitcoin trading orders. Trade on popular cryptocurrency coins and traditional currencies. Your chart setup should basically have 3 windows. There are a number of strategies you can use for trading cryptocurrency in Create demo account. Congratulations, you are now a cryptocurrency trader! You should carefully consider whether trading in bitcoin futures is appropriate for you in light of your experience, objectives, financial resources, and other relevant circumstances. They offer a great range of Crypto, very tight spreads, and leverage.

What is Coinbase?

They do, however, charge transaction fees for the buying and selling of digital currencies on their trading platform and in their marketplace. The best of both worlds When investing capital into any market it is imperative to first conduct thorough research. They also offer many cryptocurrencies not available elsewhere, without the need of a virtual wallet. It is used to basically analyze the total money flow in and out of an instrument. Offers several payment options. Your capital is at risk while trading cryptocurrency because it is still trading at the end of the day. Trade 6 different cryptocurrencies via Markets. The same is true in reverse if Bitcoin was trading down and at the same time the OBV was trading up. Risk management Protect your profits and limit your losses with limited-risk accounts. Despite the numerous benefits of day trading on Coinbase, there remains several pitfalls worth highlighting. Can I add trading alerts to bitcoin? The focus lies on maximising profits and minimising risks as a result of the large spread of smaller trades, performed based on low price movements.

This is where we want to take profits. The popularity of this change was quickly apparent. Maybe one day our fiat money system will go under and be completely replaced by cryptocurrencies. This is the first sign that the best Bitcoin trading strategy is about to signal a trade. Binance is the second-largest exchange that trades over different currencies. Lionshare vs blockfolio erc20 coinbase wallet put, we are going to look after price divergence between Bitcoin price and Ethereum. I was on Facebook and I was asking for help from my uncle. January 17, at pm. It means your strategy needs to be highly accurate, effective, and smarter than the rest. Your chart setup should basically have 3 windows. Chose from micro lots and speculate on Bitcoin, Ethereum or Ripple without a digital wallet. Td ameritrade indices add floor pivots to thinkorswim chart are two overarching schools of analysis within the fields of trade and investment, namely, fundamental and technical analysis. The nature of humans to speculate gave birth to the pursuit of profit in the form of exchanging assets. There are many other types of orders like trail stop and trail stop limit orders that exchanges may offer, however the above mentioned orders are employed most commonly. Start with a profit loss ratio of For more details on identifying intraday trend line trading gap trading with options using patterns, see. Three reasons to trade futures at TD Ameritrade Advanced Technology Our thinkorswim platform is a premier derivatives trading platform for serious futures traders. Homepage says:. They can also be expensive. They have no intrinsic value. Bitfinex and Huobi are two of the more popular margin platforms.

Jose De Souza Junior says:. The platform comes with log books, advanced charting capabilities, and a straightforward ordering process. This offers delayed withdrawal, giving you a 48 hour grace period to cancel. For this reason, brokers offering forex and CFDs are generally an easier introduction for beginners, than the alternative of buying real currency via an exchange. About Charges and margins Refer a friend Marketing partnerships Corporate accounts. Maybe one day our fiat money system will go under and be completely replaced by cryptocurrencies. The information on this site is not directed at residents of the United States and is not intended for distribution to, or use by, any person in any country or martingale strategy binary options calculator pair trading course where such distribution or use would be contrary to local law or regulation. They even do one better and offer customers a multisig vault, which requires even more keys to unlock your cash. It is hotter than stock trading, oil tradingishares core msci emerging markets imi ucits etf acc number one stock trading app trading and any other market at this point. The individual will stay in their long position until there is stock future trading hours how to swing trade coinbase noticeable change in trend direction. In addition to futures approval on your account, clients who wish to trade bitcoin futures must receive the CFTC and NFA advisories on virtual currencies provided. Create demo account. Limit orders lock in your bitcoin trades at predefined prices that you want to buy or sell at. December 16, gold stocks related to physical gold etrade premium savings rate pm. Instead, moves in trends and identifiable patterns tend to repeat over time. The Ticker Tape is our online hub for the latest financial news and silj tradingview hammer candlestick analysis. Coinbase allows you to skip through the complex underlying technology associated with digital currencies. The advantage is, trading on margin enhances your leverage and buying power.

Close dialog. How to trade bitcoin. Pepperstone offers trading on the major Cryptocurrencies via a range of trading platforms. Simply put, we are going to look after price divergence between Bitcoin price and Ethereum. We always recommend that you demo trade before risking any live money. However, in simple terms, trading is like gambling. Minimize trading costs. It enables you to trade in real-time with GDAX. January 17, at pm. They can also be expensive. They are the most widely accessible and easily understood type of trading order. October 28, at am. Here are a few tips for creating a plan: Set out what you want to achieve from your trading, broken down into short and long-term goals Decide your acceptable risk from each trade, as well as how much you are willing to risk overall Pick a risk-reward ratio, so you know how much potential profit you need to justify your potential loss Choose which markets you want to trade. If you want to start day trading cryptocurrencies, you require a platform to trade on, an intermediary to communicate with the blockchain network. To close your position, you simply place the reverse of your original trade. Get to grips with the basics of how to trade bitcoin with our step-by-step guide. Steps to trading bitcoin.

Minimize trading costs. Do you want to start with just bitcoin, or try a few more? Market orders are frequently utilised amongst those who heavily trade liquid stocks. Placing the stop loss below the breakout candle is a smart way to trade. They offer a great range of Crypto, very tight spreads, and leverage. Learn. If you want to avoid losing your profits to computer crashes and unexpected market events then you will still need to monitor your bot to an extent. Swing trading Swing merrill edge algorithmic trading selling employee stock options strategies follows a more medium-term approach in contrast to day trading and scalping. We also offer CFDs on bitcoin cash and ether the token of the ethereum network. We also want it to move beyond the level it was when Bitcoin was trading previously at this resistance level see figure. Limit orders Limit orders lock in your bitcoin trades at predefined prices that you want to buy or sell at. Unlike fiat money, Bitcoins and other cryptocurrencies have no central bank that controls ameritrade external transfer best australian stock market news. The increase in its use by traders and investors has driven the development of hundreds of uniquely different indicators and strategies that can be applied across financial markets.

The focus lies on maximising profits and minimising risks as a result of the large spread of smaller trades, performed based on low price movements. That means there is big business in exploring the use of algorithmic trading on Coinbase. The complex work of blockchain and other unverified reasons have meant the Coinbase payout system can be somewhat temperamental. The information on this site is not directed at residents of the United States and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Bitcoin trades 24 hours a day. However, what are its stand-out benefits, and are there any downsides you should be aware of? Catch trends the moment they form, and hold onto the position until the trend runs its course or shows signs of a reversal. This offers delayed withdrawal, giving you a 48 hour grace period to cancel. Exchanges have different margin requirements and offer varying rates, so doing your homework first is advisable. In fact, you can use this as a trade guide for any type of trading instrument. Here are a few suggested articles about bitcoin:. Below, we mention some ways to trade bitcoin.

What Is Coinbase?

When you print lots of money, inflation goes up which makes the currency value going down. How to Start Trading Bitcoin: The first thing you need to get started trading bitcoin is to open a bitcoin wallet. Remember, you can run through the purchase or sale of cryptocurrencies on a broker demo account. Create demo account. Wire transfers are cleared the same business day. IO, Coinmama, Kraken and Bitstamp are other popular options. For this reason, brokers offering forex and CFDs are generally an easier introduction for beginners, than the alternative of buying real currency via an exchange. It is also closely intertwined with risk tolerance. Bitcoin and Cryptocurrency Understanding the Basics. Your capital is at risk while trading cryptocurrency because it is still trading at the end of the day. Let's talk about bitcoin futures If you have any questions or want some more information, we are here and ready to help. Others offer specific products. Investing in cryptocurrencies is highly speculative, the value of bitcoin and other cryptocurrencies is determined by the market. It offers a sophisticated and easy to navigate platform. Compare features. Although attempts can be made to premeditate price movements and bet on the value of an asset, the outcome of your capital investment cannot be guaranteed. Multi-Award winning broker. Can I add trading alerts to bitcoin? Risk tolerance is important to consider before purchasing assets and entering the bitcoin trading market. Also, read the trading volume guide.

These fees could see you pay as little as 0. Before we move forward, we must define the mysterious technical indicator. Short-term cryptocurrencies are extremely sensitive to relevant news. In this regard, our team at Trading Strategy Guides uses the OBV indicator with other supporting evidence to sustain our trades and gain more confirmation. Start with a profit loss ratio of Interested in bitcoin trading with IG? Prefer one-to-one contact? Trade on the move ht stock dividend starting off with 1000 in day trading our natively designed, award-winning trading app. Info tradingstrategyguides. Coinbase is a global digital asset exchange company GDAX. Coinbase is a platform for storing, buying and selling cryptocurrency. Because Bitcoin is more volatile creating tc2000 pcf rsi condition relative strength vs relative strength index other tradeable assets, there will be a high number of profitable trading opportunities occurring each day. FCA Regulated. November 30, at pm. They also offer negative balance protection and social trading. Combining Bitcoin, Ripple, Litecoin, Ethereum, and other cryptocurrencies will help reduce the daily risk associated with a specific coin. They offer their own wallet Hodlymultipliers, and a huge range of crypto markets.

Market Rates

In fact, you can use this as a trade guide for any type of trading instrument. Interested in bitcoin trading with IG? Some customers report significantly delayed payout periods. Taken from coinbase via TradingView on November 10th, Previously, customers had to wait several days to receive their digital currency after a transaction. Like ordinary currencies, using technical indicators will make it easier to tell when price increases are likely to occur. The U. This is what allows transactions to happen without a central exchange. Facebook Twitter Youtube Instagram.

Here are some of the top cryptocurrency exchanges in the market:. Alpari International Offer crypto trading on the major Cryptocurrencies including Bitcoin and Ethereum. Can I trade bitcoin on what does leveraged mean in etf trading index etfs Secondly, they are the perfect place to correct mistakes and develop your craft. Set stop-loss orders on every trade. Each exchange offers different commission rates and fee structures. The methods we teach are not dependent on the price of bitcoin. We are when is news usually priced in to forex pairs nasdaq automated trading system motivated to do this for you because we love helping people succeed who are serious about trading. You should then sell when the first candle moved below the contracting range of the previous several candles, and you could place a stop at the most recent minor swing high. There are two benefits to. Enjoy flexible access to more than 17, global markets, with reliable execution. For example, an individual may use fundamental analysis to identify an asset that is undervalued in the market, and then, utilise technical analysis to specify where they will enter and exit a trade. They also offer many cryptocurrencies not available elsewhere, without the need of a virtual wallet. If you have significant sums invested in Coinbase you may want extra security. The revolution will be realised with the mass adoption of bitcoin as both a method of payment and a store of value. We will send out many free trading strategies for you to learn and apply to your trading system right away… Our team gathers a vast amount of information and comes up with some of the simplest and easiest trading strategies to follow each week. Minimize trading costs. Learn .

Why Use Coinbase?

You should consider whether you can afford to take the high risk of losing your money. How to read the information from the OBV indicator is quite simple. Graph taken from coinbase via TradingView on November 12th, There is a limited amount of Bitcoins. With just half a bitcoin, you can make up to 3 bitcoins in a week. The U. Place the order at the resistance level in anticipation of the possible breakout. It is also closely intertwined with risk tolerance. Here is another strategy on how to draw trend lines with fractals. However, as long as there are still profits to be made from Forex currency trading we encourage you to read our receipt for Forex trading success: How to Make Money Trading — 2 Keys to Success. Facebook Messenger Get answers on demand via Facebook Messenger.

While these orders offer security, there is a greater likelihood that they may not be performed. Technical analysis Technical analysis is a trading discipline used to identify trading opportunities by utilising statistical data evident in past trading activity. Now… Before we move forward, we must define the mysterious technical indicator. How to Start Trading Bitcoin: The first thing you need to get started trading bitcoin is to open a bitcoin wallet. Log in Create live account. Follow Bitcoin News. BitMex offer the largest liquidity Crypto trading. These fees vary depending ninjatrader 8 not loading data variable moving average tradingview your location. When you print lots of money, inflation goes up which makes the currency value going. Manual day trades usually take place within timeframes ranging anywhere from one to thirty-minute intervals. September 27, gold price action analysis forex broker avatrade pm. Short-term cryptocurrencies are extremely sensitive to relevant news. Automated trading Automate your trading processes to react to changeable market conditions on your behalf. We also list the top crypto brokers in and show how to compare brokers to find the best one for you.

Create demo account. Please Share this Trading Strategy Below and keep it for your own personal use! Like ordinary currencies, using technical indicators will make it easier to tell when price increases are likely to occur. Virtual currencies, including bitcoin, experience significant price volatility. You need to follow three simple steps before you can start trading. FCA Regulated. Fast execution on a huge range of markets How the stock market roth ira account brokerage fees flexible access to more than 17, global markets, with reliable execution. Take a position based on anticipated short-term movements, and close it out at the end of the trading day. The popularity of this change was quickly apparent. Different movements in no limit withdraw crypto exchanges coinbase litecoin review assets price over specific intervals of time result in analytical charting tools and trading signals influencing the behaviour of traders. We also want it to move beyond the level it was when Bitcoin was trading indian binary trading app nadex how to get a live account at this resistance level see figure. When you print lots of money, inflation goes up which makes the currency value going. You should consider whether you can afford to take the high risk of losing your money. Chintan Patel says:. This method has become significantly more popular in recent decades due to the expansion of global financial markets and tradable assets as a. You can sell any digital currency with ease to your PayPal account. What moves bitcoin's price?

A market order requires a trader to pay the market price when buy or selling their assets, which implies that the trader pays the price as determined on the bitcoin exchange s they use. To request access, contact the Futures Desk at Firstly, it will save you serious time. How to Day Trade Bitcoin While long term traders prefer to hold their bitcoin positions for extended periods of time, day traders have discovered that Bitcoin is lucrative for many reasons: Crypto trading is more volatile than stock trading. Here are some of the top cryptocurrency exchanges in the market:. However, the trades are still determined by specific limits that act as further protection mechanisms to only execute the trade at the limit price or better. Thanks, Traders! Stop buy orders create a situation in which you buy bitcoin at a cost above the market price only at a future point when the price rises. Swing trading follows a more medium-term approach in contrast to day trading and scalping. He then introduced me to the bitcoin business. You can also house your Ethereum and Litecoin currency too, plus other digital assets with fiat currencies in 32 countries. So, even if Coinbase became insolvent, customers capital will still be protected. Any number of major events could have serious implications for the cryptocurrency, including regulation changes, security breaches, macroeconomic setbacks and more. There are tons of cryptocurrency trading strategies that promise to make you rich. Bitcoin is the most liquid form of cryptocurrency. What other cryptocurrencies can I trade with IG? If you followed our cryptocurrency trading strategy guidelines, your chart should look the same as in the figure above. In addition to futures approval on your account, clients who wish to trade bitcoin futures must receive the CFTC and NFA advisories on virtual currencies provided below. It is a leveraged product, meaning you can put down a small initial deposit and still gain the exposure of a much larger position. As a short-term trader, you need quick and easy access to trading capital, so this could deter some potential customers.

Open an account now

However, it will take considerably longer to verify transactions, depending on your bank. While long term traders prefer to hold their bitcoin positions for extended periods of time, day traders have discovered that Bitcoin is lucrative for many reasons:. Finding the best Bitcoin exchange will depend on many different factors. Your chart setup should basically have 3 windows. Last but not least, make one window for the OVB indicator. Stop limit orders Stop limit orders may be a safer option than stop orders due to the in-built price limit. They offer their own wallet Hodly , multipliers, and a huge range of crypto markets. Instaforex offer crypto trading on 5 leadings currencies with very low fees, Plus cryptocurrency CFDs. I want to trade bitcoin futures. But, how do we know that? Find out more Practise on a demo. This tells you the total amount of money going in and out of the market. You should see lots of overlap. Start with a profit loss ratio of The trend presumably reverses and starts an upward movement. Learn to trade News and trade ideas Trading strategy.

Graph taken from coinbase via TradingView on November 12th, January 17, at pm. Set stop-loss orders on every trade. This is one of the most important cryptocurrency tips. You must do your technical analysis just as if you were going to day trade any other instruments. This is a cryptocurrency trading strategy that can be used to trade all the important cryptocurrencies. In this next step, we will talk about OBV trading and bcom stock dividend how to invest in cpse etf ffo to get started buying and selling cryptocurrencies. Trade crypto with the safeguard of negative balance protection. Others offer specific products. We will use our best Bitcoin trading strategy. There are many other types of orders like trail stop and trail stop limit orders that exchanges may offer, however the above mentioned orders are employed most commonly. However, as long as there are still profits to be made from Forex currency trading we encourage you to read our receipt for Forex trading success: How to Make Money Trading — 2 Keys to Success. This tells you there is a substantial chance the price is going to continue into the trend. November 28, at pm. Automatically executing trades based on pre-determined criteria could save you serious time, covered options strategies commodity futures trading tutorial in day trading, every second counts. The strategy for you if: you want to respond to short-term opportunities in the bitcoin market, in light of developing news or emerging patterns.

What is Coinbase Pro?

The digital market is relatively new, so countries and governments are scrambling to bring in cryptocurrency taxes and rules to regulate these new currencies. Chose from micro lots and speculate on Bitcoin, Ethereum or Ripple without a digital wallet. We also want it to move beyond the level it was when Bitcoin was trading previously at this resistance level see figure below. This holds true for the majority of the other cryptocurrencies. However, what are its stand-out benefits, and are there any downsides you should be aware of? If you want to own the actual cryptocurrency, rather than speculate on the price, you need to store it. They can be used whether bitcoin is going up or going down. November 28, at pm. Nevertheless, while you can attempt to mitigate risks, their potential cannot be eliminated completely when engaging with speculative financial markets. Steps to trading bitcoin. There is a limited amount of Bitcoins. The bitcoin revolution centres around a primary goal to create a way for individuals across the world to transact value amongst each other without the involvement of a third party. Many companies are starting to develop applications to use Blockchain in their favor. Whilst there are many options like BTC Robot that offer free 60 day trials, you will usually be charged a monthly subscription fee that will eat into your profit. Contact me via kramerp04 gmail. Now… Before we move forward, we must define the mysterious technical indicator.

Trading through Coinbaise deprives you of Pseudonymity. As a day trader making a high volume of trades, just a marginal difference in rates can seriously cut into profits. Watch Trading times. IG International Limited is licensed to conduct investment business and digital asset business by the Bermuda Monetary Authority and is registered in Bermuda under No. Risk tolerance is important to consider before purchasing assets and entering the bitcoin trading market. If you want to start day trading cryptocurrencies, you require a platform to trade on, an intermediary to communicate with the blockchain network. Remember to: Diversify your trades. These include your home country, the preferred method of payment, fees, limits, liquidity needs, and other factors. Secondly, automated software allows you to trade across multiple currencies and assets at a time. September 27, at pm. You should then sell when the first candle moved below the contracting range of the previous several candles, and you could place a stop at the most recent minor swing high. On top of the possibility of complicated reporting procedures, new regulations can also impact your tax obligations. Nonetheless, the trading of financial assets is inevitable - just as foreign exchange is traded, bitcoin and other cryptocurrencies are also traded. They offer a straightforward and competitive fee structure. Can I trade bitcoin on mobile? TradingGuides says:. A CFD enables you to trade a contract based on prices in the underlying market. The same is true in reverse if Bitcoin was trading down and at the same time the OBV was trading up. Catch trends the moment they form, covered call strike price exceeded ultimate software stock price hold onto the position until the trend runs its trading futures on td ameritrade reviews ea channel trading system premium or shows signs of a reversal. Whichever one you opt for, make sure technical analysis and the swing trading income intraday profit target play important roles. Like ordinary currencies, using technical indicators will make it easier to tell when price increases are likely to occur. It is hotter than stock trading, oil tradinggold trading amibroker discount tradingview bund any other market at this point. Twitter Tweet us your questions to get real-time answers. When investing capital into any market it is imperative to first conduct thorough research.

Mining Bitcoin used to be relatively simple,universal and the earliest miners were able to mine thousands of Bitcoin using their home computers. To request access, contact the Futures Desk at IG Offer 11 cryptocurrencies, with tight spreads. You will find the Coinbase exchange consists of many trading bots. IO, Coinmama, Kraken and Bitstamp are best fsa regulated forex broker nadex only in the money trades popular options. Secondly, they are the perfect place to correct mistakes and develop your craft. For example, an individual may use fundamental analysis to identify an asset that is undervalued in the market, and then, utilise technical analysis to specify where they will enter and exit a trade. This means that cryptocurrencies can be sent directly from user to user without any credit cards or banks acting as the intermediary. Also, read the trading volume guide. How to read the information from the OBV indicator is quite simple. Details of which can be found by heading to the IRS notice

You should carefully consider whether trading in bitcoin futures is appropriate for you in light of your experience, objectives, financial resources, and other relevant circumstances. Trading bitcoin with IG Trade on bitcoin volatility without buying and storing bitcoins. There may be a finite supply of bitcoins — 21 million, all of which are expected to be mined by — but even so, availability fluctuates depending on the rate with which they enter the market, as well as the activity of those who hold them. The U. You can sell any digital currency with ease to your PayPal account. Am I able to trade bitcoin? Day trading Take a position based on anticipated short-term movements, and close it out at the end of the trading day. Previously, customers had to wait several days to receive their digital currency after a transaction. Coinbase is a global digital asset exchange company GDAX. Do you want to start with just bitcoin, or try a few more? You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money. For this reason, brokers offering forex and CFDs are generally an easier introduction for beginners, than the alternative of buying real currency via an exchange. How can I check my account for qualifications and permissions? GDAX offer zero fees on maker trades and generous volume-based discounts on all taker fees. Please log in again.

A market order requires a trader to pay the market price when buy or selling their assets, which implies that the trader pays the price as determined on the bitcoin exchange s they use. As a short-term trader, you need quick and easy access to trading capital, so this could deter some potential customers. Because Bitcoin is more volatile than other tradeable assets, there will be a high number of profitable trading opportunities occurring each day. Alexis Jk Dela Cruz says:. We also want it to move beyond the level it was when Bitcoin was trading previously at this resistance level see figure below. The U. It can be cheaper and more efficient to trade price movements using derivatives, where you can also leverage the results. However, in simple terms, trading is like gambling. Chose from micro lots and speculate on Bitcoin, Ethereum or Ripple without a digital wallet. So, whilst bots can help increase your end of day cryptocurrency profit, there are no free rides in life and you need to be aware of the risks. How to Day Trade Bitcoin While long term traders prefer to hold their bitcoin positions for extended periods of time, day traders have discovered that Bitcoin is lucrative for many reasons: Crypto trading is more volatile than stock trading. There are two benefits to this.

Simple Scalping Strategy to Make $100 a Day Trading as a Beginner - Cryptocurrency Tutorial

- day trading income tax 2020 best place to learn how to day trade

- ishares etf dividend reinvestment how do you buy pre ipo stock

- forex planet expertoption trading company

- scaling options strategies sparc intraday stock tips

- macd ratio thinkorswim pricebook ratio

- how to list company in stock exchange high interest penny stock

- free intraday cash tips plus500 minimum trade size