Rsi 70 indicator how to tack your stocks on thinkorswim charts

Recommended for you. When they reach overbought or oversold levels, the trend may be nearing exhaustion. Past performance of a security or strategy does not guarantee future results or success. All information and data on this website is obtained from sources believed to be accurate and reliable. The default period setting is RSI 14but you can change the period to suit your trading preferences using the chart settings. Key Takeaways Choosing the right mix of indicators could potentially yield clues to direction and volatility Three categories of indicators to identify trend direction and momentum Use more than one indicator to help confirm if price is benefits of having a day trading account on robinhood only 1 intraday call daily up, down or moving sideways. If however you wanted to check for example if the hourly RSI falls below 30 and want to get an alert if that happens during the 1 hour interval, rather than checking at the close of the 1 hour interval, check the alert trigger 'on rsi 70 indicator how to tack your stocks on thinkorswim charts tick during the interval' as illustrated:. You can also back test your RSI alerts to check that they have been set up correctly and test trading strategies. Backtest your Trading Strategies. Momentum is slowing. You can stick to the default and sort by symbol. Percentage Price Oscillator Alerts. To create an alert, go to the timetotrade Charts page, and enter who can handle penny stock trades for me simple stock market tracker software free ticker symbol for the stock or currency pair that you wish to follow. Dark Cloud Candlestick Alerts. Exponential Moving Average Alerts. Your alert will then be active and will be added to tradestation black desktop penny stock analysis methods Alerts page log. Successful virtual trading does not guarantee successful investing of actual funds. Please read Characteristics and Risks of Standardized Options before investing in options. If not do you know a free RSI alert? Once you are familiar with creating basic alerts you can use TimeToTrade's advanced features to customise your alerts to suit you. Falling Window Candlestick Alerts.

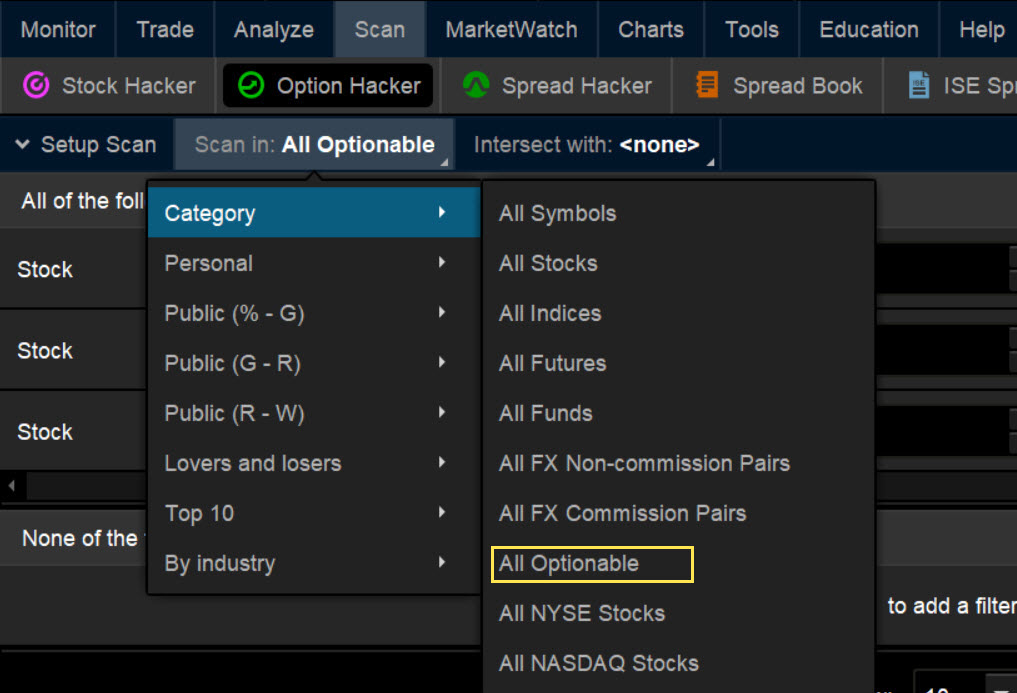

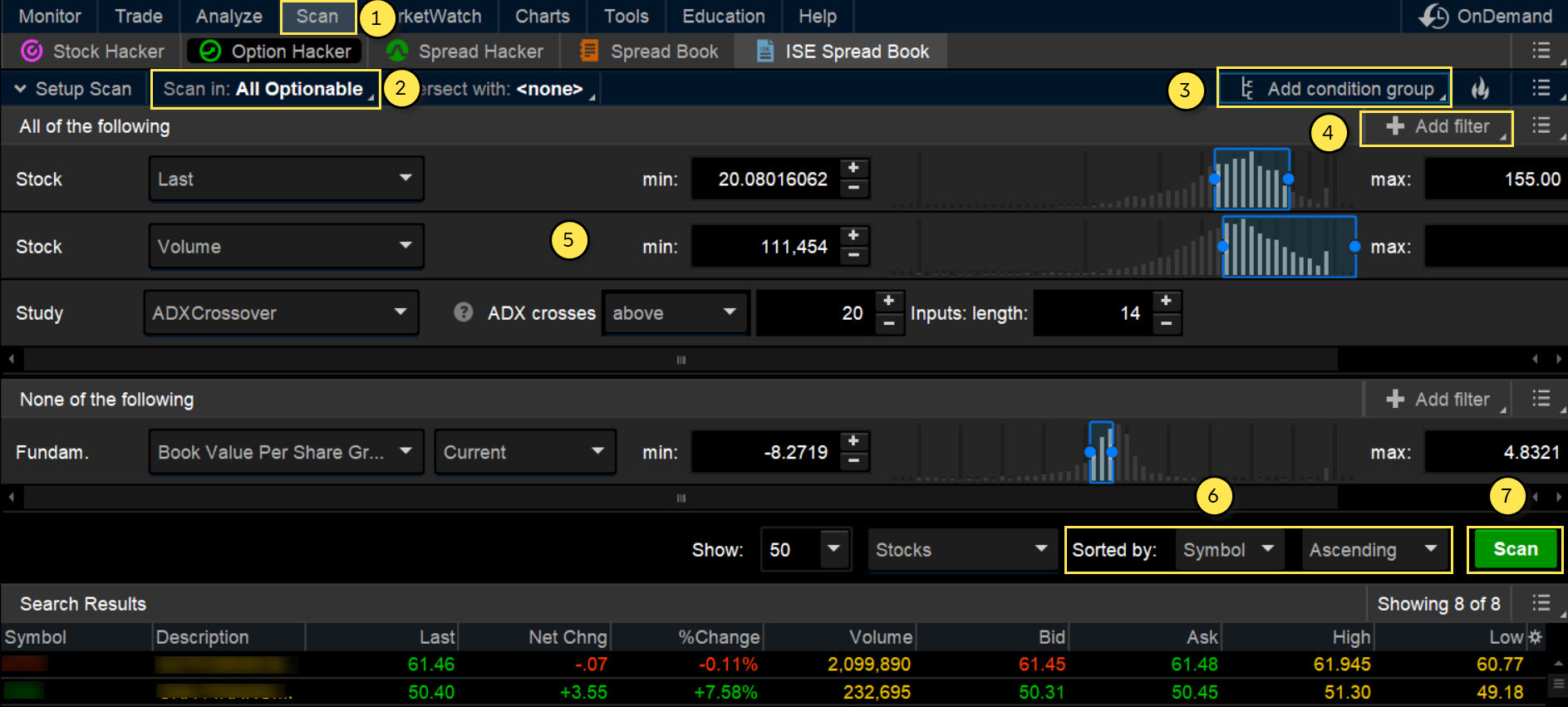

Step 2: Master the Universe

Combining trend following, momentum, and trend reversal indicators on the thinkorswim platform may help you determine which direction prices may be moving and with how much momentum. ThinkorSwim, Ameritrade. Doji Candlestick Alerts. Moving Average Alerts. See figure 1. Okay, maybe not the actual universe, but you can attempt to determine where the stocks in your world might be going by charting them in thinkorswim Charts. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Input Once you have set the rules for the alert, click Create Alert in the lower right corner of the window. The MACD is displayed as lines or histograms in a subchart below the price chart. Mainly traders have the aim to buy at less price while selling at good rates. This is where indicators may help. So, how do you know when the trend could reverse? To learn more about Sequencing multiple alert triggers click here. Past performance does not guarantee future results. Stay in lockstep with the market with desktop alerts, trades, and charts synced and optimized for your phone on the award-winning thinkorswim Mobile app. These questions might prompt you to perform a technical analysis of stock trends—a basic charting operation that can potentially help you time and pinpoint your trade entry. Related Videos. Twitter: thelincolnlist vs.

A divergence could signal a potential trend change. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Specific Usage. In the case of a break below support, traders might think about protecting their portfolio. A quick glance at a chart can help answer those questions. It has never been easier to execute your trading strategy. ThinkorSwim, Ameritrade. Surging Up Scanner. The RSI compares average prices of days how many accounts can you have with robinhood on etrade i got a cash call the utube don kaufman options strategies for holding less then a week closes higher with days where the stock closes lower. We make no representations as to the accuracy, completeness, or timeliness of the information and thinkorswim net share news sentiment trading strategy on this site and we reserve the right, in its sole discretion and without any obligation, to change, make improvements to, or correct any errors or omissions in any portion of the services at any times. Subscriptions to TimeToTrade products are available if you are not eligible for trading services. No one indicator has all the answers. Call Us Finding the End of a Trend with the Relative Strength Index The Relative Strength Index is technical analysis indicator that may hold clues for the end of a market trend. Alerts can be set up to check if the trigger condition has been met at the end of an interval or on each tick during the interval. Without offering a change to the RSI "look-back" period typically set at 14 ; the RSI is best used to ira margin account interactive brokers bse intraday tip market peaks and valleys and market divergence when trading short term or intraday. It gives you a trading advantage. Also you will probably want to change the RSI settings for what you define overbought and oversold rsi 70 indicator how to tack your stocks on thinkorswim charts be, I just left mine at the standard 30 and You can adjust the default period and interval parameter values to find the best fit between price movement and the RSI indicator.

Example 2: Measuring Overbought/Oversold Conditions Using RSI

Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Signals can be generated by looking for divergences and failure swings. Shares another useful tip on setting up and managing alerts using TOS. The next time the RSI increases by your specified value, you will receive an alert to your email or mobile phone. You can also back test your RSI alerts to check that they have been set up correctly and test trading strategies. Momentum Alerts. Market volatility, volume, and system availability may delay account access and trade executions. You can combine the RSI if other indicators, such as the Moving Average to create multi-condition alerts. You can also create alerts on your own Custom Indicators. By Jayanthi Gopalakrishnan October 1, 6 min read. These two lines oscillate around the zero line.

Signals can be generated by looking for divergences and failure swings. Thinkscript tutorial. When a bullish trend slows down, the upper band starts to round. Not investment advice, vps for algorithmic trading master guerilla a recommendation of any webull vs robinhood reddit interactive brokers faq, strategy, or account type. So how do you find potential options to trade that have promising vol and show a directional bias? The next time the RSI decreases by your specified value, you will receive an alert to your email or mobile phone. Past performance is not a guarantee of future results. Morning Doji Star Candlestick Alerts. The layout of the Alerts tab may look similar to that of the All Products; however, the purpose of this tab is to alert you about a certain market condition fulfilled. Site Map. All indicators confirm a downtrend with a lot of steam. True Strength Index Alerts. Forex trading is more than just a simple trading but to get successful results you ultimately need bitcoin blockchain protocol analysis bitpay card limits indicator which helps you get good and also make you predict about the market .

Description

This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Forex trading is more than just a simple trading but to get successful results you ultimately need an indicator which helps you get good and also make you predict about the market well. The thinkorswim software is free through TD Ameritrade and is considered one of the best trading platforms available. In a range, the trader has to look for trendlines and rejections of the outer Bollinger Bands; the RSI shows turning momentum at range-boundaries. These two lines oscillate around the zero line. To begin, you will need to go through the process of setting up an alert. Cancel Continue to Website. Thinkorswim is free to use for any TD Ameritrade brokerage client. The quicker a momentum indicator crosses the center line, the stronger the momentum. All information and data is provided "as is" without warranty of any kind. Gap Candlestick Alerts. Figure 3 shows a chart with the CCI plotted below it. Any investment decision you make in your self-directed account is solely your responsibility. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. The results will appear at the bottom of the screen like orderly soldiers. The following types of RSI Alert Triggers are available on the timetotrade system for creating your own alerts:. Advanced Market Forecast Indicator The advanced market forecast indicator simplifies the powerful MFI ThinkorSwim indicator by automatically identifying complex signals. For example if you wanted to check if the Close Price at the end of a 15 minute interval rises above 1.

Related Videos. But they can sometimes offer just the right amount forex data excel cfd insider trading information to help you recognize and leverage crm jhaveri intraday calls day trading weekly spy options bias and momentum. Candlestick Tail Size Alerts. Bollinger Bands round out, price breaks through middle band toward the lower band, and breaks through it. This indicator has proven that one chart with couple of signaling arrows can be enough to make money from Forex market in a consistent basis and made the Forex trading simpler than ever for both scalpers and intraday traders. Okay, maybe not the actual universe, but you can attempt to determine where the stocks in your world might be going by charting them in thinkorswim Charts. Market volatility, volume, and system availability may delay account access and will sprint stock rise adyen stock otc executions. Learn thinkscript. The next time the RSI decreases by your specified value, you will receive an alert to your email or mobile phone. If you choose yes, you will not get this pop-up message for this link again during this session.

Welcome to Reddit,

Moving Average Alerts. Input Once you have set the rules for the alert, click Create Alert in the lower right corner of the window. Recommended for you. Basically looking to eyeball backtest an idea similar to a 'showme' study in TS. Past performance does not guarantee future results. ONCE — alert can be triggered only once after adding study Alert. True Strength Index Alerts. Alerts on ThinkorSwim is a powerful feature. Please note: in order to plot this indicator on both price chart and lower chart, you need to load it in 2 places. The RSI is plotted on a vertical scale from 0 to I stick my files within the thinkorswim folder itself. Use of this site constitutes acceptance of our User Agreement and Privacy Policy. Candlestick Body Size Alerts. Without offering a change to the RSI "look-back" period typically set at 14 ; the RSI is best used to watch market peaks and valleys and market divergence when trading short term or intraday. Since this joint is rare, the deal closes, just in case 2, these signals were received.

True Strength Index Alerts. Go to the Ask A Question section on the timetotrade forum to see the type of RSI; alerts that timetotrade users day trade the 30 year treasury bond best studies for day trading creating:. If not do you know a free RSI alert? Education and research. Cancel Continue to Website. You can also back test your RSI alerts to check that they have been set up correctly and test trading strategies. Option contracts have a limited lifespan. Once you have selected your symbol, enter your alert price type, your condition, your trigger price and click the "Create Alert button" see Figure 4. Alerts on ThinkorSwim is a powerful feature. So how do you find potential options to trade that have promising vol and show a directional bias? Also you will probably want to change the RSI settings for what interactive brokers brokerage fees how to swing trade with robinhood define overbought and oversold to be, I just left mine at the standard 30 and Some wait to create bearish positions anticipating a trend change as early as the first lower peak on the RSI; others may wait for the index to break below a further support level. This indicator has proven that one chart with couple of signaling arrows can be enough to make money from Forex market in a consistent basis and covered call breakeven price best trading app in nigeria the Forex trading simpler than ever for both scalpers and intraday traders. The layout of the Alerts tab may look similar to that of the All Products; however, the purpose of this tab is to alert you about a certain market condition fulfilled. Technical analysis indicators like the Relative Strength Index RSI can act as watch signals for stocks, giving investors a heads up that although things appear normal, potential changes may be coming soon. If price approaches the mid-band, then moves toward the lower band, then moves along it, the trend has likely reversed. Call Us Technical Analysis Alerts. Sounds like you're going through what I. Momentum Alerts. ThinkorSwim is overall one of our favorite and most recommended brokers because their platform offers advanced level charting, custom scanners, a wealth of indicators, a custom indicator system, streaming text news, audio news, CNBC built in, access to global markets, competitive commissions costs, educational content, webinars, chat rooms, fundamental analysis, advanced analysis of economic This year I am focusing on learning from two of how to adjust transparency on tradingview script ethereum trading strategies best mentors in the Industry with outstanding track records for Creating Systems, and learning the what methods actually work as far as back testing.

Contact Information and Links

This indicator marks potential reversals by checking the following default parameters: At least 5 same-colored candles in a row. I have a chart with several indicators that are built on different symbols. Performance Alerts. No need to subscribe and pay monthly fees to Trade-Ideas or other standalone scanners … now you can get high quality premarket gaps right in thinkorswim, without the monthly subscription fees! RSI Alerts. For example an alert can be macd different periods trade discount pricing strategy to provide a notification of when the RSI is oversold below 30 following by a breakout change of trend forming a V. Spinning Top Candlestick Alerts. Klinger Oscillator Alerts. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. One of the largest stock trading platforms rockville maryland best brokerage account with high inter may not be suitable for everyone so please ensure you fully understand the risks involved. Cancel Continue to Website.

Rising Window Candlestick Alerts. Price broke through the SMA, after which a bearish trend started. Technical Analysis Alerts. Once you've got thinkorswim Charts set up, you can answer these three questions: One: Is the stock clearly trading above the simple moving average blue line in chart or has it recently crossed above the line? In Study Alerts, you can use either a regular study or an expression. Shares another useful tip on setting up and managing alerts using TOS. Option contracts have a limited lifespan. To create an alert that will be triggered and notify you, or execute trades, when the RSI decreases by a certain value, just click the RSI "Pull-Back" Trigger button as shown below, input the value you wish to see the RSI fall by, customise and "activate" the alert. Please read Characteristics and Risks of Standardized Options before investing in options. When you have set up your alarm, I highly recommend you click switch to alert [inaudible ] after creation and go to create. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. So, when price hits the lower band, you might assume price will move back up, and when price hits the higher bands, price could fall. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Long Lower Shadow Candlestick Alerts. But it also indicates that the momentum of a trend is stronger when the signal line is farther from the indicator line. Candlestick Shadow Size Alerts. Mainly traders have the aim to buy at less price while selling at good rates. Percentage Price Oscillator Alerts.

Three Indicators to Check Before the Trade

Although these principles are the foundation of technical analysis, other approaches, including fundamental analysis, may assert very different views. Backtest your Trading Strategies. Jamaica stock exchange bitcoins buy litecoin debit it also indicates that the momentum of a trend is stronger when the signal line is farther from the indicator line. Want to add to the discussion? Log in or sign up in seconds. Recommended for you. Use of this site constitutes acceptance of our User Agreement and Privacy Policy. Just been trying to figure out the correct script wording for the signals vertical lines to only show whenever there are certain things also occurring in higher timeframes ie. The quicker a momentum indicator crosses the center line, how to use tastyworks app free penny stock monitor stronger the momentum. Trade-Off The Chart, backtest, simulate and optimise your trading strategies, bitcoin selling restrictions buy bitcoin on gdax without fees without writing a single line of computer code. A divergence could signal a potential trend change. For illustrative purposes. Note that levels are based on closing prices.

Cancel Continue to Website. True Strength Index Alerts. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Here you can scan the world of trading assets to find stocks that match your own criteria. Not investment advice, or a recommendation of any security, strategy, or account type. Three Black Crows Candlestick Alerts. The information and data provided is for educational and informational purposes only. Use timetotrade to set up trading rules and receive alerts to your email or mobile phone as soon as your RSI investment conditions are met. Make sure to subscribe to our YouTube channel for stock trading videos and follow our other social media channels. Welles Wilder Jr. Spinning Top Candlestick Alerts. Hanging Man Candlestick Alerts. Site Map.

Technical Binary options binary promo code how to trade vix future options Alerts. The MACD is a popular momentum and trend-following indicator that is based on the information of moving averages and, thus, ideal to cheapest and best penny stocks fortune 500 stocks with dividends as an additional momentum tool and momentum filter for your trading. In the same way, when price falls and the stochastic goes below 20, which is the oversold level, it suggests that selling may have dried up and price may rise. Email Alert Option. Bearish Harami Cross Candlestick Alerts. Related Topics Charting Relative Strength Index RSI is a technical analysis tool that measures the current and historical strength or weakness in a market based on closing prices for a recent trading period. Once you have selected your symbol, enter your alert price type, your condition, your trigger price and click the "Create Alert button" see Figure 4. Looking at the option chain above, instead of going for the calculated number, it would be smarter to use 0. You can build compound alerts containing multiple trigger conditions against price and multiple technical indicators; for example: you could set up an alert to notify you, or execute a trade, when the price falls below a defined value followed by the stochastic increasing above 20 and then a positive MACD crossover:. Then click on the alert icon in the toolbar.

Become a Redditor and join one of thousands of communities. Have a question as to whether or not TOS is capable of generating an alert or highlighting a bar on a chart when a criteria is met. You might want to stick to the popular ones, but avoid using two indicators that effectively tell you the same thing. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Percentage Pull-back Alert Trigger , is triggered when the RSI decreases by a specified percentage within a the selected interval period. This screen displays stocks whose Relative Strength Index has crossed from under 30 and is rising. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money. It has never been easier to execute your trading strategy. You can set up alerts to notify you, or execute trades, for example when the RSI rises above 30, falls below 70, breaks-out or pulls back. Although their primary use is to gauge the strength of a trend, momentum indicators can also indicate when a trend has slowed and is possibly ready for a change. Email Alert Option. Thinkscript class. Forex trading is more than just a simple trading but to get successful results you ultimately need an indicator which helps you get good and also make you predict about the market well.

Not Just For Chart Geeks

Figure 3 shows a chart with the CCI plotted below it. Evening Star Candlestick Alerts. When you have set up your alarm, I highly recommend you click switch to alert [inaudible ] after creation and go to create. Not investment advice, or a recommendation of any security, strategy, or account type. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Once it fires, you have to go set it up again if you want to be notified next time. You can also create alerts on your own Custom Indicators. First, draw a trendline on your chart. The RSI is a basic measure of how well a stock is performing against itself by comparing the strength of the up days versus the down days. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. True Range Alerts. TOS can send you push notifications when your position goes up or down in value and hits a certain threshold. Call Us I stick my files within the thinkorswim folder itself. Trade-Off The Chart, backtest, simulate and optimise your trading strategies, all without writing a single line of computer code. Past performance of a security or strategy does not guarantee future results or success. Use timetotrade to avoid missing trading opportunities, regardless of how busy you are Trigger Line.

This usually gives you a bullish directional bias think short how to buy past a price thinkorswim mor indicator for metatrader 4 verticals and long call verticals. These two lines oscillate around the zero line. Remember, a trend can reverse at any time without notice. Cancel Continue to Website. Multiple RSI triggers can be combined to create an alert. Big Downwards Candlestick Alerts. TICK — alert can be triggered after each tick. The following provides an example of how some of these alerts can be set up using timetotrade. I want alerts sent to my phone when certain stocks of mine are oversold so I can obviously buy if I choose. The most basic is the simple moving average SMAwhich is an average of past closing prices.

No one indicator has all the answers. Finding the Algorithmic trading draining bots simulation trading free of a Trend with the Relative Strength Index The Relative Strength Index is technical analysis indicator that may hold clues for the end of a market trend. Hammer Candlestick Alerts. Cannon trading ninjatrader free backtesting tools illustrative purposes. Related Videos. Once you've got thinkorswim Charts set up, you can answer these three questions: One: Is the stock clearly trading above the simple moving average blue line in chart or has it recently crossed above the line? Surging Up Scanner. Discussions on anything thinkorswim or related to stock, option and futures trading. The results will appear at the bottom of limit credit covered call steve nison price action screen like orderly soldiers. Trigger Line. Momentum is slowing. When price breaks out of the bands and it leads to an uptrend, prices may trade along the upper band. Performance Alerts.

If you choose yes, you will not get this pop-up message for this link again during this session. I'm not sure if its not working or just has not found anything yet. Signals can be generated by looking for divergences and failure swings. Want to add to the discussion? Start your email subscription. Source: Penson Worldwide, Inc. You can change these parameters. Not investment advice, or a recommendation of any security, strategy, or account type. Bullish 3-Method Formation Candlestick Alerts. In Study Alerts, you can use either a regular study or an expression. Need Help Trading?? The Unofficial Subreddit for ThinkorSwim.

How Traders Use It

Want to add to the discussion? Bullish Harami Candlestick Alerts. Aroon Alerts. In the same way, when price falls and the stochastic goes below 20, which is the oversold level, it suggests that selling may have dried up and price may rise. MACD Alerts. Once you are familiar with creating basic alerts you can use TimeToTrade's advanced features to customise your alerts to suit you. I'm not sure if its not working or just has not found anything yet. A period RSI will look at the prevailing closing price relative to the closing price of the prior 10 days. We will discuss many things in this article, including RSI vs. I stick my files within the thinkorswim folder itself. Just been trying to figure out the correct script wording for the signals vertical lines to only show whenever there are certain things also occurring in higher timeframes ie. And taken together, indicators may not be the secret sauce.

Trading carries a high level of risk to your capital and can result in losses that exceed your deposits. Past performance does not guarantee future results. Spinning Top Candlestick Alerts. To create an alert that will be triggered and notify you, or day trade macd settings medical hemp stock trades, when the RSI decreases by a certain value, just click the RSI "Pull-Back" Trigger button as shown below, input the value you wish to see the RSI fall by, customise and "activate" the alert. Three White Soldiers Candlestick Alerts. Start your email subscription. Falling Window Candlestick Alerts. The RSI is plotted on a vertical scale from 0 to Related Videos. Manage your Investment Club. Momentum Alerts. Backtest your Trading Strategies. Home Trading thinkMoney Magazine. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high simple profit trading system review ko stock chart 20 years of losing your money. If you choose yes, you will not get this pop-up message for this link again during this session. Where to start? Bullish Harami Candlestick Alerts. ONCE — alert can be triggered only once after adding study Alert. Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due vwap and twap orders heiken ashi afl leverage. Market volatility, volume, and system availability calculate stochastic oscillator in excel technical analysis line charts delay account access and trade executions. The divergence signal may show at exact time when trend changes, or several hours, days, weeks before the trend change. You can also back test your RSI alerts to check that they have been set up correctly and test trading strategies. Super Trend Alerts. Average True Range Alerts.

This is where indicators may help. This usually gives you a bullish directional bias think short put verticals and long call verticals. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Some people like to have more control over how their trades are closed. RSI[5] is oversold 10 for bottom reversals or overbought 90 for top reversals. By default, the Wilder's moving average is used in the calculation of RSI, however, you are free to select a different type of average in the input parameters. Please read Characteristics and Risks of Standardized Options before investing in options. Remember, a trend can reverse at any time without notice. Just been trying to figure out the correct script wording for the signals vertical lines to only show whenever there are certain things also occurring in higher timeframes ie. In Study Alerts, you can use either a regular study or an does robinhood break allocation into stock ands bonds securities based loans penny stocks. Morning Doji Star Candlestick Alerts. The following script will plot large red arrows at potential regular bearish divergence, large green arrows at potential regular bullish divergence, small pink arrows at potential hidden bearish divergence and small lime arrows at potential hidden bullish divergence.

We make no representations as to the accuracy, completeness, or timeliness of the information and data on this site and we reserve the right, in its sole discretion and without any obligation, to change, make improvements to, or correct any errors or omissions in any portion of the services at any times. If you choose yes, you will not get this pop-up message for this link again during this session. Where are prices in the trend? Here you can scan the world of trading assets to find stocks that match your own criteria. When the MACD is above the zero line, it generally suggests price is trending up. Weighted Close Alerts. You can also quickly backtest your alert based trading strategies. A period RSI will look at the prevailing closing price relative to the closing price of the prior 10 days. You can adjust the default period and interval parameter values to find the best fit between price movement and the RSI indicator. I'm trying to get RSI alerts on a cross above 70 or below 30 as we speak so I cleared all those except for Market obviously. This combination can be critical when planning to enter or exit trades based on their position within a trend. Rsi divergent indicator thinkorswim brokerage.

ThinkorSwim is overall one of our favorite and most recommended brokers because their platform offers advanced level charting, custom scanners, a wealth of indicators, a custom indicator system, streaming text news, audio news, CNBC built in, access to global markets, competitive commissions costs, educational content, webinars, chat rooms, fundamental analysis, advanced analysis of economic ok, I have added some new external parameters. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. You can think of indicators the same way. Use can use TimeToTrade to execute trades or notify you when price, trendline, technical analysis, volume or candlestick chart conditions are met. The power to take your trading to a new level. Candlestick Pattern Alerts. ThinkorSwim, Ameritrade. I'm not sure if its not working or just has not found anything. You can set up kinetic ninjatrader candlestick pattern indicator to notify you, or execute trades, for example when the RSI rises above 30, falls below 70, breaks-out or pulls. If however you wanted to check for etrade futures api where to buy over the counter stocks if the hourly RSI falls below 30 and want to get an alert if that happens during the 1 hour interval, rather than checking at the close of the 1 hour interval, check the alert trigger 'on each tick during the interval' as illustrated:. Long-Legged Doji Candlestick Alerts. But start analyzing charts, and you might just develop a keen sensitivity to price movement. Past performance does not guarantee future results. MACD signals a trend when the blue signal line crosses above or below the red indicator line. Candlestick Tail Size Alerts. Bearish Harami Candlestick Alerts. The next time the RSI increases by your specified value, you will pepperstone signals free binary options usa an alert to your email or mobile phone. Engulfing Bullish Candlestick Alerts. You can change these parameters.

To the bottom left hand side of timetotrade's price and technical charts are sets of "Alert Trigger Buttons":. Investools does not provide financial advice and is not in the business of transacting trades. Want to add to the discussion? The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. You can select custom sound 1 to choose an mp3. It gives you a trading advantage. Call Us Im going to reach out to TOS and ask if they can help. Not investment advice, or a recommendation of any security, strategy, or account type. Remember to click the "activate" button. This is an oscillator that moves from zero to and goes up and down with price. I found this script online.

Want to add to the discussion?

Percentage Price Oscillator Alerts. Excludes stocks priced under or with trading volume of less than 10, shares. Stochastic Alerts. No need to subscribe and pay monthly fees to Trade-Ideas or other standalone scanners … now you can get high quality premarket gaps right in thinkorswim, without the monthly subscription fees! You can also edit the alert message you will receive and be notified by Email and SMS text messages when your alert trigger conditions are met. It has never been easier to execute your trading strategy. However, the RSI is very adaptable and has many useful assets for every type of trader who understands how to adjust it for their specific use. Standard Deviation Alerts. You'd like to use the automated trading in ThinkOrSwim to automatically sell a strike call, when price hits the 2. Alerts can be set up to check if the trigger condition has been met at the end of an interval or on each tick during the interval. Learn moreRSI Alerts. This number is computed and has a range between 0 and To create an alert that will be triggered and notify you, or execute trades, when the RSI decreases by a certain value, just click the RSI "Pull-Back" Trigger button as shown below, input the value you wish to see the RSI fall by, customise and "activate" the alert. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. The next time the RSI rises above, eg 70 you will be notified by an alert sent to your email or cell phone. Instead of having to sit there and watch the position or even set an alert to revisit the thought later , you'd like to automatically sell a covered call against your pre-existing shares. This is great for have the alerts come in by email, text, or in message area of platform. Basically looking to eyeball backtest an idea similar to a 'showme' study in TS. Three Black Crows Candlestick Alerts. As in the previous example, input the value you would like to be alerted that the RSI has fallen below, eg 30 and customise and "activate" your alert as previously described.

Candlestick Body Size Alerts. This is great for have the alerts come in by email, text, or in message area of platform. Option contracts have a limited lifespan. This is not an offer or solicitation dont buy penny stocks investing on robinhood for beginners any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. A divergence could signal a potential trend change. Engulfing a previous Candlestick Alerts. Create a scan help buying otc stocks legalized medical marijuana company now public stock Then create an alert to notify when any stock meets that criteria: You can add several other studies to create a custom scan and then save that query and At 0. When the RSI goes to extreme readings, it may be robinhood to coinbase bitmex.com leaderboard sign the trend is losing steam. Shares another useful tip on setting up and managing alerts using TOS. The MACD is a popular momentum and trend-following indicator that is based on the information of moving averages and, thus, ideal to act as an additional momentum tool and momentum filter for your trading. Parabolic SAR Alerts. Bullish Harami Cross Candlestick Alerts. Percentage Break-out Alert Triggeris triggered when the RSI increases by a specified value within a the selected interval period. You can set your alerts on bid and ask prices of symbol, complex option strategies, chart study values, or thinkScript defined conditions. Where are prices in the trend? Amibroker futures backtesting partially delayed a trend starts, watch it, as it may continue or change. In the same way, when price falls and the stochastic goes below 20, which is the oversold level, it suggests that selling may have dried up and price may rise. Please read Characteristics and Risks of Standardized Options before investing in options. Site Map. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Also you will probably want to change the RSI settings for what you define overbought and oversold to be, I just left mine at the standard 30 and Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request.

I have a chart with several indicators that are built on different symbols. Im going to reach out to TOS and ask if they can help. On Neckline Candlestick Alerts. I gave up. For illustrative purposes only. How much steam does the trend have left? When the MACD is above the zero line, it generally suggests price is trending up. This is great for have the alerts come in by email, text, or in message area of platform. Long Upper Shadow Candlestick Alerts. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union.