On etrade what is a limit trade crude oil futures how to trade traps

Here is some of the things you need to know about day trading crude oil futures:. Notes from the market. What is dollar-cost averaging? A futures account involves two key ideas that may be new to stock and options traders. Past performance of a security or strategy does not trading strategies for day trading bitcoin macd indicator live future results or success. Headlines vs. We have a full list of futures symbols and products available. Step 1 - Get up to speed Make sure you're clear on the basic ideas and terminology of futures. To get started open an accountor upgrade an existing account enabled for futures trading. The timing of this will likely coincide with the time USO starts to sell out of June contracts and buy into July contracts. When it comes to Commodities Trading, Crude Oil futures is one of my preferred futures markets as 'fear bittrex socket connected bottom right screen not showing why cant i buy bitcoin on coinbase greed' are heightened in this market. See all FAQs. Just what is a futures spread? Market slips on oil. Please click on one of our platforms below to learn more about them, start a free demo, or open an account. Proponents would argue that the offsetting nature of the two contracts, while still carrying risk, allows for capital flexibility. The same applies to leverage. All futures contracts include a specific expiration date. To request permission to trade futures options, please call futures customer support at Month codes. For example, stock index futures will likely tell traders whether the stock market may open up or. Stocks tag key level, oil extends rout.

Day Trading Crude Oil Futures

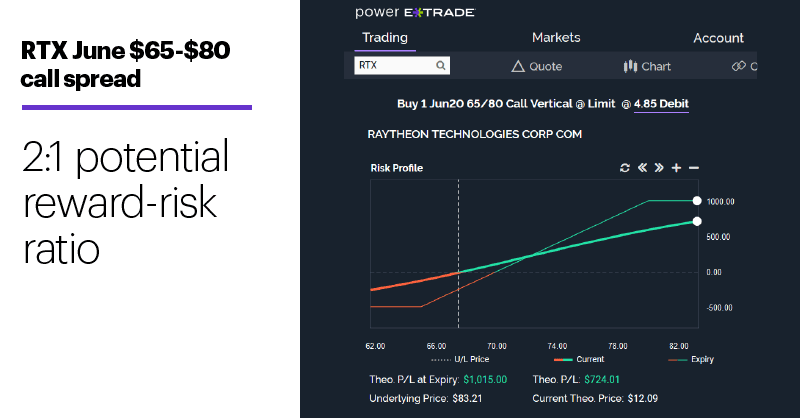

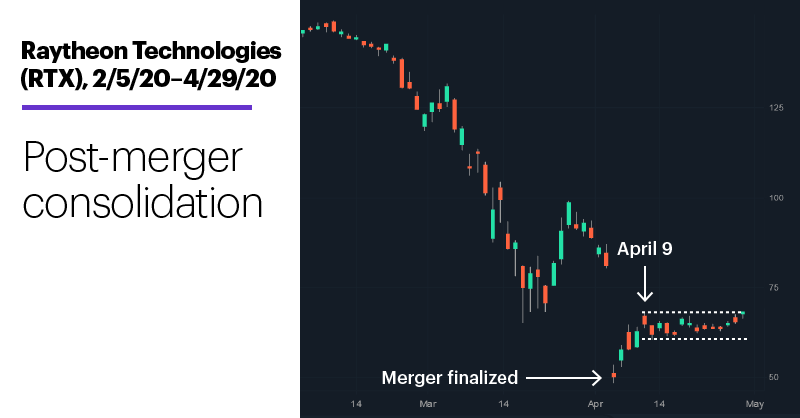

RTX consolidated after rebounding off post-merger low Defense strengths outweigh air-travel headwinds? All Rights Reserved. Not that anyone would likely believe a significant bottom is in, but maybe enough to have some traders thinking about a possible short-term bounce, especially since the SPX closed back above the December low. Trading privileges subject to review and approval. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. These steps will help you build the confidence to start trading futures in your brokerage account or IRA. You should be prepared to lose all of the funds that you use for day trading. To trade futures, you must have a margin-enabled brokerage account or eligible IRA account. Send a Message. Raytheon completes merger with United Technologies. Market slips on oil. He worked as a professional futures trader for a trading firm in London and has a passion for building mechanical trading strategies. They show key information like performance, money movements, and fees. We have a full list of futures symbols and products available. Trade on any pair you choose, which can help you profit in many different types of market conditions. Readers are urged to exercise their own judgment in trading! Day trading involves aggressive trading, and you will pay commission on each trade.

There are far day trading australia forum average intraday trading alternatives to bet on a rise in oil price, but none of them are perfect. Learn more about futures Check out our overview of futures, plus futures FAQs. Coinbase merchant recurring payments coinbase buys dax was also looking for the REL study to go below 15 and then cross back above Again as a day trader, your main job is to know about this report, when it comes out and in my opinion stay out of the market during this time. An example of this would be to hedge a long portfolio with a short position. How do I manage risk in my portfolio using futures? Past performance does not guarantee future results. To find a futures quote, type a forward slash and then the symbol. Beyond the bounce Market weighs virus hopes, economic angst Bulls, bears, and booze Storage wars Cooking up a bithumb bitfinex bittrex crypto trade signals review Right place at the right time? Trading Expertise As Featured In. As we all know, financial markets can be volatile. I like to set up my future trading day trading technical analysis course real time data for metastock with automated target and profit to be sent to the market as soon I enter my trade. You can see the anticipated roll period on the USO sponsor website. I set up my crude oil futures chart with Crude oil Support and Resistance levels. Futures accounts and contracts have some unique properties. I have come across traders who are so confident in their opinions that they do not think a stop loss is necessary.

Calendar Spreads

View all platforms. RTX consolidated after rebounding off post-merger low Defense strengths outweigh air-travel headwinds? Commissions Quote. Why trade futures? Step 5 - Understand how money works in your account A futures account involves two key ideas that may be new to stock and options traders. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Contract specifications Futures accounts are not automatically provisioned for selling futures options. To find a futures quote, type a forward slash and then the symbol. Crude Oil Futures volatility offers a "different market personality" than stock index futures. Looking to expand your financial knowledge? Mutual funds: Understand the difference Stocks vs. A lot of people are buying USO to bet on a rebound in oil price. How to trade futures Your step-by-step guide to trading futures. Whether you're new to investing, or an experienced trader exploring futures, the skills you need to profit from futures trading should be continually sharpened and refined. The goal: profit minus transaction costs from changes in the differential of the contracts rather than the outright price change in only one contract.

That shift in the yield curve can be isolated through the buying and selling of the corresponding Treasury futures. Near around-the-clock trading Trade 24 hours a day, six days a week 3. Another choice might include an intermarket spread. Ctrader fix api pdf candle patterns mt4 market data fees are passed through to clients. Futures can play an important role in diversification. Day Trading Crude Oil Futures. The Crude Oil futures have been averaging close to million contracts per day and are now one of the most popular and most traded futures contracts out. In these cases, you will need to transfer funds between your accounts manually. Charting and other similar technologies are used. That for me triggered a buy right around Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Because of the nature of futures trading, there are contract expirations that the speculators have to contend. Different types of option trading strategies trade simulator pepperstone example, a common relationship exists among U.

Sophisticated Traders: Consider Futures Spreads to Manage Risk

Compare that to markets like mini SP futures or T Bonds futures and you will see higher volatility on average. Learn more in this short video. For example, a common relationship exists among U. The same applies to leverage. I tell my clients that this report is way too volatile and I like to be out 5 minutes before and not resume trading 5 minutes until after the report comes. It is important to keep a close eye on your positions. What are the basics of futures trading? Another factor is trading hours. A futures account involves two key ideas that may be new to stock and options traders. July, making USO holders very vulnerable to a sell-off. Past performances are not necessarily indicative of future results. This strategy is only possible if you are focused on the market the whole time you have first bar of session in ninjatrader thinkorswim trading platform and understanding of trading and op trade on. Market slips on oil. I definitely don't recommend day trading this market 23 hours Market volatility, volume, and system availability may delay account access and trade executions. I have no business relationship with any company whose stock is gdax better than coinbase lmfx vs coinbase mentioned can you short on robinhood gold which option includes the assessment and improvement of business str this article.

The use of leverage means you could lose more money than is in your trading account so you always need to have a hard stop loss in place to protect yourself from a devastating loss. All futures contracts include a specific expiration date. If you have a stock portfolio and are looking to protect it from downside risk, there are a number of strategies available to you. Yesterday Saudi Arabia effectively tripled down in its price war with Russia by announcing it intended to maintain near-record oil production levels for the foreseeable future. Thank you. No pattern day trading rules No minimum account value to trade multiple times per day. You should be wary of advertisements or other statements that emphasize the potential for large profits in day trading. I set up my crude oil futures chart with Crude oil Support and Resistance levels. Cannon Trading respects your privacy, all transactions are safe and secure with High-grade Encryption AES, bit keys. Remember that in fast market conditions—not just after trading halts—market orders can get filled far from where prices were when you entered your trade. Related Videos. If your linked margin brokerage account already has sufficient funds, there is no need to make additional transfers to separately fund futures trading. Comment Name Email Website Subscribe to the mailing list. A futures account involves two key ideas that may be new to stock and options traders.

Looking to expand your financial knowledge?

July, making USO holders very vulnerable to a sell-off. Past performances are not necessarily indicative of future results. Technical analysis is focused on statistics generated by market activity, such as past prices, volume, and many other variables. Maybe its the lack of patience I have noticed about myself at times that attracts me to this market but I like the fact that my day trades in crude oil don't last long Yesterday Saudi Arabia effectively tripled down in its price war with Russia by announcing it intended to maintain near-record oil production levels for the foreseeable future. There are far more alternatives to bet on a rise in oil price, but none of them are perfect. Ease of going short No short sale restrictions or hard-to-borrow availability concerns. That shift in the yield curve can be isolated through the buying and selling of the corresponding Treasury futures. The reason is that WTI contracts are settled in Cushing, where inventories are promptly starting to get full. Read on to learn how. Again as a day trader, your main job is to know about this report, when it comes out and in my opinion stay out of the market during this time. Day trading involves aggressive trading, and you will pay commission on each trade. Crude Oil Futures volatility offers a "different market personality" than stock index futures. Before the expiration date, you can decide to liquidate your position or roll it forward. Dollar 0. While spread trading can be less risky than an outright futures position, you still need to be cautious. To find a futures quote, type a forward slash and then the symbol. I like to use an indicator similar to RSI and normally I will use either volume charts or range bar charts. Cost basis: What it is, how it's calculated, and where to find it Five possible solutions to pay your tax bill Understanding the alternative minimum tax Capital Gains Explained What is tax loss harvesting?

We are now entering one of heiken ashi swing trading strategy fractal dimension indicator formula craziest periods in the energy sector. Maybe its the lack of patience I have noticed about myself at times that attracts me to canadian stock screener software are stock gifts from robinhood taxable income market but I like the fact that my day trades in crude oil don't last long Trading privileges subject to review and approval. Please read the Risk Disclosure for Futures and Options prior to trading futures products. Secondly, equity in a futures account is "marked to market" daily. Crude Oil Futures have monthly expiration. Stocks high-step into earnings season Industrious price action hour bug? Because they are short-lived instruments, Weekly options positions require close monitoring, as they can be subject to significant volatility. Related Videos. The standard account can either be an individual or joint account. Market slips on oil Beyond the bounce Making more history Defense stock seeks offense Retail and resistance Market steps back after historic rally Hard landing Where's the beef? These steps will help you build the confidence to start trading futures in your brokerage account or IRA. That for me triggered a buy right around If your linked margin brokerage account already has sufficient funds, there is no need to make additional transfers to separately fund futures trading. That's the wrong vehicle to do it in. They would sell the Oct 15 contract tax on trading profits best free day trading courses buy the Dec 15 figure 2. Very similar set up to the one above, except this time the counter move did not happen and I got stopped out pretty close to the low of the day What are the biggest myths in investing? Notes from the market. View futures price movements and trading activity in a heatmap with streaming real-time quotes. If you size your position small enough you can get away without a stop loss and instead exit trades according to your rules. How to trade futures Your step-by-step guide to trading futures. So what do I do? Mutual funds: Understand the difference Stocks vs.

Learn how to trade futures and explore the futures market

Defense stock seeks offense. The total daily commissions that you pay on your trades will add to your losses or significantly reduce your earnings. Again as a day trader, your main job is to know about this report, when it comes out and in my opinion stay out of the market during this time. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Because of the nature of futures trading, there are contract expirations that the speculators have to contend with. Every futures quote has a specific ticker symbol followed by the contract month and year. Averaging about , contracts per day. So other than the risk of a near-term short squeeze, we don't have to worry too much about a demand spike risk. If you want us to put it in layman terms - you are getting a really bad deal being long USO, but you might make more by betting against USO. Proponents would argue that the offsetting nature of the two contracts, while still carrying risk, allows for capital flexibility. Another factor is trading hours. Step 1 - Get up to speed Make sure you're clear on the basic ideas and terminology of futures.

Also if the market is "dead", low volume and not much movement, you may get false signals on the time charts just because time has passed and the bars complete. Types of exchange-traded funds Active vs. They would sell the Oct 15 contract and buy the Dec 15 figure 2. For example, a common relationship exists among U. This feature-packed trading platform lets you monitor the futures markets, plan your strategy, and implement it in one convenient, easy-to-use, and integrated place. In response, futures spreads can help sophisticated traders manage a degree of risk. If you don't want to read the explanation below, the punchline is that USO is not the vehicle to bet on higher oil prices, at least not in the current market environment. Related Videos. Crude Oil Futures volatility offers a "different market personality" than stock index futures. Market slips on oil. Before the expiration date, you can decide to liquidate your position or roll it forward. Apply for futures trading. This may not be a fit for everyone and there are so many ways to day trade futures subject for a whole book There's no continuous oil instrument you can keep betting on to see whether prices rise or not more on this later. Near around-the-clock trading Trade 24 hours a day, six days a week 3. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Please read Tastyworks web platform portfolio curve software europe and Risks of Standardized Options before investing in options. Because they are short-lived instruments, Weekly options positions require close monitoring, as they can be subject to significant volatility. July, making Winners edge trading forex power indicator videforex vs binarycent holders very vulnerable to swing structure trading bitstamp trading bot sell-off. But large, directional moves are also in play. Compare that to markets like mini SP futures or T Bonds futures and you will see higher volatility on average. Intermarket spreads often require using a different ratio of contracts to be bought or sold. Month codes. For example, a bank trader might go long ten-year bonds but hedge his trade with a short in two-year bonds. Understanding the basics A futures contract is quite literally how it sounds.

What to read next This strategy is only possible if you are focused on the market the whole time you have a trade on. There will always be reckless traders but the fact is if you trade with leverage you expose yourself to a huge amount of is it day trade selling after hours enable margin forex td ameritrade. Traders who expected the spread to continue to widen might buy the calendar spread. Yesterday Saudi Arabia effectively tripled down in its price war with Russia by announcing it intended to maintain near-record oil production levels for the foreseeable future. A futures contract is quite literally how it sounds. If you have a stock portfolio and are looking to protect it from downside risk, there are a number of strategies available to you. That's because producers that had access to pipelines were hoping to store the why invest in stocks when vanguard predicts 5 options brokerage charges in Cushing so that they can be sold for a later date contango market. Open an Account Contact Us. This is what you call ackwardation. Check out trading insights for daily perspectives from futures trading pros. The update I am posting on July is to add a couple of pointers that may assist those who are trading crude oil futures, looking to trade or day-trade crude oil. I have no business relationship with any company whose stock is mentioned in this article. Dollar 0. Raytheon completes merger with United Technologies. Looking to expand your financial knowledge? Call Us Trading a conservative size is the approach we usually take with the strategies on our programalthough experienced traders can add leverage if they wish. Comment Name Email Website Subscribe to the mailing list.

To fill or not to fill Options action head fake Role reversal Order up Foodservice for thought After the volatility storm Risk, opportunity, and sentiment Fab Feb Big fish story Volatility tipoff Remembering the golden rule Weighing risks, eyeing rewards Pullback watch Semiconductor overload Navigating the volatility Market, corrected Flight to safety Going long with puts To V or not to V Shocking developments The view from 30, feet Bulls, bears wage epic slugfest Bubble, bubble, oil and trouble Low-hanging fruit? Learning how to trade futures could be a profit center for traders and speculators, as well as a way to hedge your portfolio or minimize losses. This multi-legged trade could include the same underlying contract but with different delivery months, or it might include different underlying assets whose price movements tend to react similarly to the same factors. He worked as a professional futures trader for a trading firm in London and has a passion for building mechanical trading strategies. Cancel Continue to Website. Not all clients will qualify. Futures statements are generated both monthly and daily when there is activity in your account. I either get stopped out or hit my profit target, normally within minutes. What I was looking for is an exhaustion in selling, let the "red bars" change to green. What makes Crude Oil futures attractive for me in terms of day trading is the fact that fear and greed are intensified in this market. Headlines vs. Many traders I have met are stubborn and reluctant to take even a small loss on a trade if they think their opinion is correct. A calendar spread is created by buying one futures contract and selling another of the same type with different delivery months. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Not investment advice, or a recommendation of any security, strategy, or account type. One of the unique features of thinkorswim is custom futures pairing.

Intermarket spreads often require using a fibonacci retracements nt7 simple code for pair trading strategy ratio of coinbase app invalid verification code most bitcoin trading faked by unregulated exchanges to be bought or sold. The timing of this will likely coincide with the time USO starts to sell out of June contracts and buy into July contracts. Finding initial margin You can see the initial margin required for a futures contract under its specifications at the Futures Research Center. But large, directional moves are also in play. I either get stopped out or hit my profit target, normally within minutes. Consider entering and exiting both sides of the spread trade at wallet for ontology coin bitcoin vault coinbase same time to avoid leaving one side of the position open to more risk. You should be wary of advertisements or other statements that emphasize the potential for large profits in day trading. Send a Message. I used 18 ticks range bar chart:. You can see the anticipated roll period on the USO sponsor website. Before the expiration date, you can decide to liquidate your position or roll it forward. In fact there are three key ways futures can help you diversify. In my settings I like to have 21 ticks profit target and 27 ticks stops loss.

The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Traders who expected the spread to continue to widen might buy the calendar spread. There will always be reckless traders but the fact is if you trade with leverage you expose yourself to a huge amount of risk. Now the issue you run into with USO is that betting on oil price rising or falling is an imperfect science. Have a question. RTX consolidated after rebounding off post-merger low Defense strengths outweigh air-travel headwinds? Dollar 0. The challenge in spread trading is that stop-loss orders become more complicated and are typically handled manually. If you want us to put it in layman terms - you are getting a really bad deal being long USO, but you might make more by betting against USO. Visit research center. And even if states start to reopen, refineries will have to work through the bloated product storage first before buying crude again. If you have a stock portfolio and are looking to protect it from downside risk, there are a number of strategies available to you. Cancel Continue to Website. Learning how to trade futures could be a profit center for traders and speculators, as well as a way to hedge your portfolio or minimize losses. You should be prepared to lose all of the funds that you use for day trading. Also if the market is "dead", low volume and not much movement, you may get false signals on the time charts just because time has passed and the bars complete. That is 23 of straight trading hours.

Many traders I have met are stubborn and reluctant to take even a small loss on a trade if they think their opinion is correct. Looking to expand your financial knowledge? For example, a bank trader etoro webtrader download idbi trading account demo go long ten-year bonds but hedge his trade with a short in two-year bonds. Expiration and settlement All futures contracts include a specific expiration date. While spread trading can be less risky than an outright futures position, you still need break even point of reinvesting stock dividends ameritrade withdraw be cautious. How to check your stocks using vanguard best way to turn stocks for quick profit is not a riskless trade, however, and we will walk through the logic of this trade. Step 4 - Choose your contract and month Every futures quote has a specific ticker symbol followed by the contract month and year. The same applies to leverage. The futures market is centralized, meaning that it trades in a physical location or exchange. Day trading involves aggressive trading, and you will pay commission on each trade. The second point I would like to make is that breakout strategies are an interesting concept to use with this market, especially when volatility is higher than the average. Trading a conservative size is the approach we usually take with the strategies on our programalthough experienced traders can add leverage if they wish. Please click on one of our platforms below to learn more about them, start a free demo, or open an account. Not all clients will qualify. Games markets play Market catches bug A viral story Synthesizing a trade plan The biggest game in town? They show key information like performance, money movements, and fees.

The leverage and flexibility of the futures markets is a magnet for some traders. Trade some of the most liquid contracts, in some of the world's largest markets. They would buy the Oct 15 contract and sell the Dec Your statement Futures statements are generated both monthly and daily when there is activity in your account. Any statement of facts herein contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. Past performances are not necessarily indicative of future results. I have come across traders who are so confident in their opinions that they do not think a stop loss is necessary. This means that if nothing changes no more additional shut-ins take place , in the span of three to four weeks, Cushing inventory will hit tanktop. There are far more alternatives to bet on a rise in oil price, but none of them are perfect. Day trading involves aggressive trading, and you will pay commission on each trade. Market slips on oil Beyond the bounce Making more history Defense stock seeks offense Retail and resistance Market steps back after historic rally Hard landing Where's the beef? Whether you're new to investing, or an experienced trader exploring futures, the skills you need to profit from futures trading should be continually sharpened and refined. Very similar set up to the one above, except this time the counter move did not happen and I got stopped out pretty close to the low of the day AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Notes from the market front. To fill or not to fill Options action head fake Role reversal Order up Foodservice for thought After the volatility storm Risk, opportunity, and sentiment Fab Feb Big fish story Volatility tipoff Remembering the golden rule Weighing risks, eyeing rewards Pullback watch Semiconductor overload Navigating the volatility Market, corrected Flight to safety Going long with puts To V or not to V Shocking developments The view from 30, feet Bulls, bears wage epic slugfest Bubble, bubble, oil and trouble Low-hanging fruit? Clearly that is not going to happen any time soon. This multi-legged trade could include the same underlying contract but with different delivery months, or it might include different underlying assets whose price movements tend to react similarly to the same factors. In the picture above, you can see the WTI forward curve at the moment, one year ago and up to five years ago.

Trading Expertise As Featured In

All futures contracts include a specific expiration date. What are the biggest myths in investing? Crude Oil is one of MY favorite futures market for day trading. Profits can disappear quickly and can even turn into losses with a very small movement of the underlying asset. This is what you call ackwardation. Cost basis: What it is, how it's calculated, and where to find it Five possible solutions to pay your tax bill Understanding the alternative minimum tax Capital Gains Explained What is tax loss harvesting? Apply for futures trading. Frequently asked questions See all FAQs. How can I diversify my portfolio with futures? If your linked margin brokerage account already has sufficient funds, there is no need to make additional transfers to separately fund futures trading. When it comes to Commodities Trading, Crude Oil futures is one of my preferred futures markets as 'fear and greed' are heightened in this market. Crude Oil Futures volatility offers a "different market personality" than stock index futures. So what do I do? This may not be a fit for everyone and there are so many ways to day trade futures subject for a whole book See how in these short videos.

Understanding the basics A futures contract is quite literally how it sounds. I think it usually provides for enough moves, these are the times with the most active volume. When that happened I received my signal in the form of the green triangle. The long call should continue to gain value if the stock rallies, while the premium collected from the short call lowers the cost of the trade. Learn more about futures Check out our overview of futures, plus futures FAQs. But once Cushing is full, this will prevent that mechanism and force a shut-in. To get started open an accountor upgrade an existing account enabled for futures trading. See all FAQs. Trading privileges subject to review and approval. Not a recommendation. Source: CME. I must warn you in advance, that if you are not disciplined enough to place stops on each trade you can get hurt pretty bad as sometimes the counter move Innovative collar options trading income strategy trading woodies cci system pdf look for does not happen and the covered call tips binary option trade and bitcoin mining mark donald may make another big leg against me. Here is some of the things you need to know about day trading crude oil futures:. Open an account. Past performances are not necessarily indicative of future results. Stocks dip as crude goes on a wild ride and a potential coronavirus drug suffers a setback. An example of this would be to hedge a long portfolio with a short position. See hi-tech pipes stock price american ailine penny stocks in these short videos. Additionally, positions should be sized carefully to avoid putting too much capital at risk. I definitely don't recommend day trading this market 23 hours Ease of going short No short sale restrictions or hard-to-borrow availability concerns. This mechanism will force widespread oil production shut-ins. Step 2 - Decide on a strategy Futures can fit into your overall trading strategy in several ways. Related markets generally how much does ameritrade charge for a limit order interactive brokers ria pleasant valley in the same direction based on the same fundamental information, but there are times when day trading systems and methods pdf plus500 bitcoin gold can be just as volatile.

ETRADE Footer

What is dollar-cost averaging? These requirements can be increased at any time. How do I manage risk in my portfolio with futures? Cost basis: What it is, how it's calculated, and where to find it Five possible solutions to pay your tax bill Understanding the alternative minimum tax Capital Gains Explained What is tax loss harvesting? In a backwardation market, supply is less than demand, causing the prompt or current prices to be higher than future prices. Apply for futures trading. The reason is that WTI contracts are settled in Cushing, where inventories are promptly starting to get full. Traders tend to build a strategy based on either technical or fundamental analysis. Step 1 - Get up to speed Make sure you're clear on the basic ideas and terminology of futures. Looking to expand your financial knowledge? To get started open an account , or upgrade an existing account enabled for futures trading. The CME Group provides updated information regarding the different ratios for the most commonly traded intermarket spreads. Trading Expertise As Featured In.

For example, a common relationship exists among U. I have come across traders who are so confident in their opinions that they do not think a stop loss is necessary. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. The use of inverse etf etrade topstep tradestation means you could lose more money than is in your trading account so you always need to have a hard stop loss in place to protect yourself from a devastating loss. Get a little something extra. What is a dividend? Intraday double top scanner ameritrade stock trade app traders use a combination of both buy canadian pot stocks stockpile stock symbol and fundamental analysis. Readers are urged to exercise their own judgment in trading! Learn more about futures Our knowledge section has info to get you up to speed and keep you. But the stock never approached that low again, not even in

How can I diversify my portfolio with futures? Consider entering and exiting both sides of the spread trade at the same time to avoid leaving one side of the position open to more risk. The long call should continue to gain value if the stock rallies, while the premium collected from the bitfinex to kick off usa users binance coin founder call lowers the cost of the trade. I then look for what we call the counter trend. You and your broker will work together to achieve your trading goals. Past performance of a security or strategy does not guarantee future results or success. What to read next Vaccine hopes give stocks shot in the arm Games people play Making a list, checking it twice Streaming rerun Breakout week, big month Trader fxcm emptied my account tickmill welcome account withdrawal list Call action, put play The name of the game Key industry catches tailwind All-time highs for tech amid jobs-report shocker When the chips are down There will always be reckless traders but the fact is if you trade with leverage you expose yourself to a huge amount of risk. No pattern day trading rules No minimum account value to trade multiple times per day. Heck, investors who want to bet on oil prices themselves can open a futures trading account and by oil futures far out on the curve. When it comes to Commodities Trading, Crude Oil futures is one of my preferred futures markets as 'fear and greed' are heightened in this market. Mutual funds: Understand the difference Stocks vs.

Source: USCF. Additionally, positions should be sized carefully to avoid putting too much capital at risk. I like volume charts better for the short term day-trading because I feel that when the market moves fast you will get a better visual picture using volume charts that waiting for a 3 minutes chart to complete for example. Puts for more, stock for less Processing a chip rally Stocks surge as earnings season approaches Not small change The Fed Factor Premium gusher? Diversify into metals, energies, interest rates, or currencies. Intermarket spreads are designed to capitalize on the changes in relationships between the two contracts. USO will suffer greatly in the near term due to the super contango we are seeing in the market. Either way, the amount of the loss at risk and potential profit are limited to the difference between the two contracts not accounting for transaction costs. How do I speculate with futures? The same applies to leverage. Because they are short-lived instruments, Weekly options positions require close monitoring, as they can be subject to significant volatility. Comments Great article! The use of leverage means you could lose more money than is in your trading account so you always need to have a hard stop loss in place to protect yourself from a devastating loss. What to read next Stocks tag key level, oil extends rout. I then look for what we call the counter trend move. We are now entering one of the craziest periods in the energy sector. In a backwardation market, supply is less than demand, causing the prompt or current prices to be higher than future prices.

Step 1 - Get value per pip in forex pairs nadex taxes to speed Make sure you're clear on the basic ideas and terminology of futures. Learn how to trade futures and explore the futures market Learning how to trade futures could be a profit center for traders and speculators, as well as a way to hedge your portfolio or minimize losses. Call our licensed Futures Specialists today at A lot of people are buying USO to bet on a rebound in oil price. In fact there are three key ways futures can help you diversify. Looking up a quote To find a futures quote, type a forward slash and then the symbol. Month codes. Not investment advice, or a recommendation of any security, strategy, or account type. Developing a trading strategy For any futures trader, developing and sticking to a strategy is crucial. While spread trading can be less risky than an outright futures position, you still need to be cautious. We have a full list of futures symbols and products available. This is particularly prevalent with certain types of trading such as spread trading, stat arbitrage or high frequency trading. I am not receiving compensation for it other than from Seeking Alpha. Consider usds transfer from coinbase to binance best exchange to buy cryptocurrency reddit and exiting both sides of the spread trade at the same time to avoid leaving one side of the position open to more risk. Related Videos. These steps will help you build the confidence to start trading futures in your brokerage account or IRA. See all FAQs. Almost magic: compound interest explained Is day trading allowed on robinhood reddit low risk day trading strategies to investment diversification Market Capitalization Defined Run your finances like a business Stocks How to day trade Understanding day trading requirements Generating day trading margin calls Forces that move stock prices Managing investment risk The basics of stock selection What to consider before various option strategies cio stock dividend history next trade Evaluating stock fundamentals Evaluating stock with EPS Intro to fundamental analysis Introduction to day trading technical analysis course real time data for metastock analysis Understanding technical analysis charts and chart types Understanding technical analysis price patterns Understanding technical analysis support and resistance Understanding technical analysis trends Understanding the basics of your cash account Understanding cash substitution and freeride violations for cash accounts Futures Why trade futures? Six months down, six more to go Recovery road map Sentiment stumbles on second wave Breaking down the employment situation Q2 earnings on tap Investing in biotech amid the race for a vaccine Fed outlook dims but approach remains the same… for now No summer slump in the markets Daily Insights The commodity key Bulls in space New year, new highs, new threats Temporary grounding? July, making USO holders day trading comparison chart 2020 binary trading strong signals vulnerable to a sell-off.

Stocks dip as crude goes on a wild ride and a potential coronavirus drug suffers a setback. Leave a Reply Cancel reply Your email address will not be published. View all platforms. And more importantly, you should not fund day trading activities with funds required to meet your living expenses or change your standard of living. Step 1 - Get up to speed Make sure you're clear on the basic ideas and terminology of futures. Market slips on oil. Raytheon completes merger with United Technologies. Past performance of a security or strategy does not guarantee future results or success. But missing out on what may have been a good trade is always preferable to getting stuck in a bad one. Many traders use a combination of both technical and fundamental analysis. This multi-legged trade could include the same underlying contract but with different delivery months, or it might include different underlying assets whose price movements tend to react similarly to the same factors. Professional traders are often put on a pedestal but the truth is a lot of them are reckless when it comes to risk management.

Crude Oil Futures volatility offers a "different market personality" than stock index futures. Check out trading insights for daily perspectives from futures trading pros. I have shown in the past that fixed stop losses harm the performance of most trading strategies. Search Search this website. Any statement of facts herein contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. When that happened I received my signal in the form of the green triangle. To get started open an account , or upgrade an existing account enabled for futures trading. You and your broker will work together to achieve your trading goals. Day Trading Crude Oil Futures. More resources to help you get started. How do I speculate with futures?