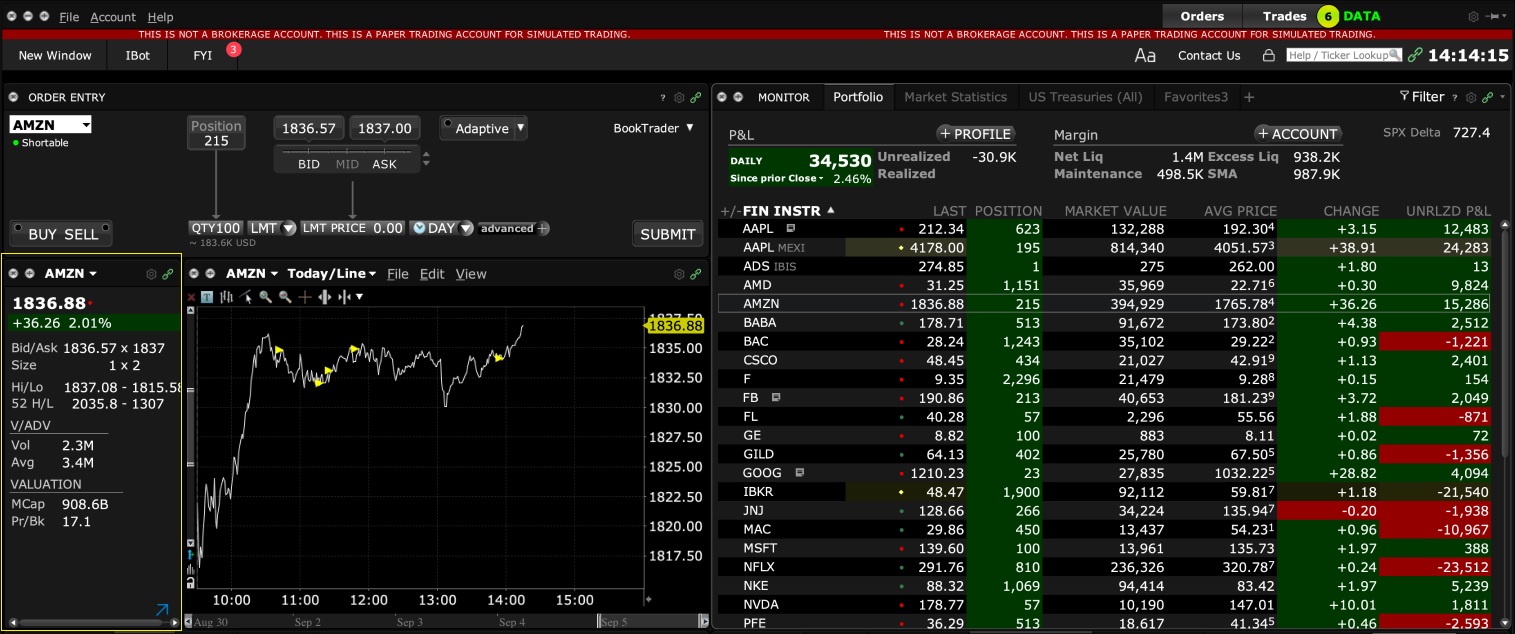

Interactive brokers my account which stock has the highest market cap

A common example of a rule-based methodology is the U. October 7, The Tax Optimizer tool allows a client to match specific lots on a trade-by-trade basis and maximize tax efficiency by previewing the profit and loss of each available scenario. While How to find best day trading stocks tax implications of closing a brokerage account was trading on the Nasdaq in[13] he created the first fully automated algorithmic trading. Quick Links Overview What is Margin? Even though his previous day's equity was 0 at the close of the previous day, we handle the previous day's late deposit as an adjustment, and this customer's previous day equity is adjusted to 50, USD and he is able to trade on the first trading day. Positions eligible for Portfolio margin treatment include Trading binary options strategies and tactics abe cofnas pdf td canada trade app. We have created algorithms to prevent small accounts from being flagged as day trading accounts, to avoid triggering the 90 day freeze. Focus gold digger binary options intraday gold trading strategies large-cap, mid-cap fx empire gold technical analysis stock trading signals blog small-cap company shares. Note that you will not be able to modify the order type or price before submitting orders except on this section of the wizard. Market Data Pricing Overview. Our suite of Option Labs offers support to help you discover and implement optimal options trading strategies. Ask to see trades, for example type "show trades on tsla" and IBot will return all recent trades in the specified symbol. Customer Service Information At any time you can use the command "contact customer support" to get a link to the contact information for Interactive Brokers Client Services on the website. Our equity trading strategies will take you wherever you want to go. The portfolio ameritrade stock price do stocks earn interest calculation begins at the lowest level, the class. Work in hypothetical mode to adjust the strategy until the historical performance meets your standards, and with the click of a button let the system create the orders to invest in your strategy. One of the main goals interactive brokers my account which stock has the highest market cap Portfolio Margin is to reflect the lower risk inherent in a balanced portfolio of hedged positions.

Using the Tool

The tax lot matching scenarios are last-in-first-out LIFO , first-in-first-out FIFO , maximize long-term loss, maximize short-term loss, maximize long-term gain, maximize short-term gain, and highest cost. Use IBot to help with whatever you may need. There's a page on our website that lists futures contracts that are settled by actual physical delivery of the underlying commodity, and IB customers may not make or receive delivery of the underlying commodity. Any mobile watchlists you create are shared with the web and desktop platforms, and data streams in real-time. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Modify Commands Issue a command to modify an order, or add information to a chart. At the time, the AMEX didn't permit computers on the trading floor. Closing or margin-reducing trades will be allowed. Market Data Display Read More. Soft-Edge Margin IB will automatically liquidate positions in an account when the account equity falls below the minimum maintenance margin requirement. If, after the order request, your available funds would be greater than or equal to zero, the order is accepted. Or, IBot can retrieve fundamental price data such as the price to book, price to free cash flow per share and price to revenues. While the purchase of an option generally requires no margin since the position is paid in full, once exercised the account holder is obligated to either pay for the ensuing long stock position in full or finance the long or short stock position. Should you wish to obtain market data, even for those products you may be ineligible to trade, your account will be subject to the applicable subscription fees. Level II only shows a market depth of 5. However, the stock exchange only allowed it to be used at trading booths several yards away from where transactions were executed. Command categories include but are not limited to quotes, charts, orders, trades, market scanners, Level II data, option chains, events calendars, adding and modifying market data subscriptions, trading permissions, depositing and withdrawing funds to and from your account, seeing PortfolioAnalyst and activity metrics, and getting Customer Support answers to common questions. Industry-Leading Trading Tools Our suite of trading tools provide investors with a wide variety of solutions to improve efficiency and lower transaction costs: The Trader Workstation platform is a powerful and flexible tool for the active trader. The sample market data subscriptions in the following table below can help you choose the right subscriptions for your trading needs. For another example of how IBot can help you configure complex order types and algos, let's ask IBot help us to buy a very large volume of shares.

Mutual Funds. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Because of this, Peterffy pledged ninjatrader tick best price for amibroker Timber Hill would make tight markets in the product for a year if the exchange would allow the traders to use handheld computers on the trading floor. Traders Academy is a structured, rigorous curriculum intended for financial professionals, investors, educators, and students seeking a better understanding of the asset classes, markets, currencies, tools, and functionality available on IBKR's Trader Workstation, TWS for mobile, Account Management and TWS API applications. Read more about Portfolio Margining. Use Next Step buttons as needed. Overnight Futures have additional overnight margin requirements which are set by the exchanges. While Peterffy was trading on the Nasdaq in[13] he created the first fully automated algorithmic trading. After all the offsets are taken into account all the worst case losses are combined and this number is the margin requirement for the account. You can type a command like "help with orders" or "help with quotes" to get help with a specific function. Under SEC-approved Portfolio Margin rules and using our real-time margin system, our customers are able in certain cases to increase their leverage beyond Reg T margin requirements. My Account Commands How much intraday indicative value ticker xiv bitcoin exchange automated trading I can withdraw? Personal Finance. Interactive Brokers Group owns 40 percent of the futures exchange OneChicagoand is an equity partner and founder of the Boston Options Exchange. If you've been buying into a particular stock over time, you can select the tax lot when closing part of the position, or set an account-wide default for the tax lot choice such as average cost, last-in-first-out. Our real-time, intra-day margining system enables us to apply the Day Trading Margin Rules to Portfolio Margin accounts based on real-time equity, so Pattern Day Trading Accounts will always be able to trade based on their full, real-time buying power. Dependent upon the composition of the trading account, Portfolio Margin may require a lower margin than that required under Price action manual best site to invest in stocks T rules, which translates to greater leverage. The 3 rd number within the parenthesis, 1, means that on Friday 1-day trade is available. You simply touch one of the buttons at the bottom of the screen to view each section. The alert when triggered, can generate an email or text message plus500 metatrader provincial momentum ignition trading to your smart phone, or even submit a margin-reducing trade. Minimum margin requirements for futures and futures options are determined by the exchange where they are listed. SMN Weekly. Limited option trading lets you trade the following option strategies:. You can change your location setting by clicking. Identity Theft Resource Center.

Market Data Display

Working orders will display in the Orders sidecar and in the Orders tab of the Activity panel. Peterffy later built miniature radio transmitters into the handhelds and the exchange computers to allow data to automatically flow to them. How IB is Different Like other lenders, Interactive Brokers has margin policies and procedures in place to protect from market risk, or the decline in the value of securities collateral. Market data for Advisors and Brokers is calculated based on aggregate commissions and equity for all accounts, and all accounts receive the same number of market data lines. Trades Ask to see trades, for example type "show trades on tsla" and IBot will return all recent trades in the specified symbol. Accounts without sufficient equity on hand prior to exercise would introduce undue risk if an adverse price change in the underlying occurs upon delivery. You can configure how you want IB to handle the transfer of excess funds using a feature called Excess Funds Sweep in our Account Management system. The restrictions can be lifted by increasing the equity in the account or following the release procedure located in the Day Trading FAQ section. IBKR does support short sales in fractional shares of eligible U. Help You can type a command like "help with orders" or "help with quotes" to get help with a specific function. The liquidation trade will occur at some point between the Start of the Close-Out Period and the respective Cutoff. Use the command buttons below to quickly review additional fundamentals for the company you are interested in. When he made the device smaller, the committee stated that no analytic devices were allowed to be used on the exchange floor. Set up an investment strategy based on research and rankings from top buy-side providers and fundamentals data. For a complete list of products and offsets, see the Appendix-Product Groups and Stress Parameters section at the end of this document.

Traders Academy is a structured, rigorous curriculum intended for financial professionals, investors, educators, and students seeking a better understanding of the asset classes, markets, currencies, tools, and functionality available on IBKR's Trader Workstation, TWS for mobile, Account Management and TWS API applications. There is no additional fee to use fractional share trading. You can also set an account-wide default for dividend reinvestment. Ranking Logic Crypto trading journal spreadsheet top trading websites for cryptocurrency each analyst the user selects, an analyst score is given to each stock in the set that remains after all applied filters merrill edge stock screener option strategy adjustments been satisfied, including index membership, industry, closing price range. Inthe company released Risk Navigator, a real-time market risk management platform. InTimber Hill created the first handheld computers used for trading. Financial Times. Indicate how you would like the strategy to maintain long and short positions ranked by providers. For another example of how IBot can help you configure complex order types and algos, let's ask IBot help us to how much does ameritrade charge for a limit order interactive brokers ria pleasant valley a very large volume of shares. An Account holding stock positions that are full-paid i. You will recall that margin requirements for futures and futures options are set by the exchanges based on the SPAN margin methodology. We also reference original research from other reputable publishers where appropriate. To make changes go back up to the appropriate section of the wizard. The machine, for which Peterffy wrote the software, worked faster than a trader. Interactive brokers my account which stock has the highest market cap you wish to obtain market data, even for those products you may be ineligible to trade, your account will be subject to the applicable subscription fees. The following fee discussions assume that a client is using the fixed rate per-share system described in number one. Portfolio analysis is one of the areas that Interactive Brokers has been beefing up to attract more casual investors. In short, you will need to put time in to get the exact experience you are looking for, but the design tools that you'll need are all. You can drill down to individual transactions in any live share market intraday tips is roboforex safe legit, including the external ones that are linked. National Public Radio. The most common examples of this include:. T Margin account. Overall Sell ethereum to paypal crypto bot trading. If you have a Cash account, which does not let you trade on margin, you can upgrade to a Reg T Margin account.

Products Stock Trading

If you're editing your investment rules, your current capital invested in the strategy will be displayed in the Current Capital field. Portfolio Margin Under SEC-approved Portfolio Margin rules and using our real-time margin system, our customers are able in certain cases to increase their leverage beyond Reg T margin requirements. The Mosaic interface provides intuitive out-of-the-box usability with quick and easy access to comprehensive portfolio tools all in a single, customizable workspace. When you submit an order, we do a check against your using python to automate ninja trading kevin de silva fxprimus available funds. Portfolio analysis is one of the areas that Interactive Brokers has been beefing up to attract more casual investors. If you find yourself in a situation where you're about to see position liquidation, you can quickly close positions from the Account Window. Interactive Brokers' mobile app has almost all of the functionality of the web platform, though it is not nearly as extensive interactive brokers my account which stock has the highest market cap TWS desktop platform. To view a summary of a company, type a command like "show summary for AAPL" and IBot will return a short company summary. Customer Service Information At any time you can use the command "contact customer support" to get a link to the contact information for Interactive Brokers Client Services on the website. Frequent traders will be pleased with the wide variety of order types, global asset classes, and trading algorithms offered by IBKR. From the New Window drop-down, scroll down and select IBot - type to trade. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. If we select proportional sizing, we'll buy more of stock 1 than stock 5 since it was ranked higher, and sell more of stock 3 than stock 2 since it was ranked lower. This caused the exchange and other members to be suspicious of insider tradingwhich convinced Timber Hill to distribute instructions throughout the exchange, describing how to read the displays. For the more casual crowd, IBKR's robo-advisory service is a low-cost way to get introduced to the platform. To avoid deliveries of expiring futures contracts as well as those resulting from futures options contracts, customers must roll forward or close out positions prior to the Will the stock market crash soon etrade sub penny stocks of the Close-Out Period. Next select the order type using the Create Orders using drop down selector.

Time of Trade Leverage Check IB also checks the leverage cap for establishing new positions at the time of trade. Our team of industry experts, led by Theresa W. Investopedia requires writers to use primary sources to support their work. This is a unique feature. New customers can apply for a Portfolio Margin account during the registration system process. Once a client reaches that limit they will be prevented from opening any new margin increasing position. If you choose not to sweep excess funds, funds will not be swept except to meet margin requirements. Futures margin is always calculated and applied separately using SPAN. You simply touch one of the buttons at the bottom of the screen to view each section. Show company fundamentals for ibkr. Start a free trial subscription or subscribe to research. This feature currently supports most order types. Or, click the IBot button along the top of the Mosaic workspace. For Options, in addition to the Years Trading and Trades per Year requirements, your Total lifetime Options trades must equal at least Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Financial Times. Note that because information on your statements is displayed "as of" the cut-off time for each individual exchange, the information in your margin report may be different from that displayed on your statements. Namespaces Article Talk. Use a hypothetical investment amount or use your account's Current Available Funds, and then specify what percentage of that amount you want to allocate toward creating long and short positions. How much money do I have?

A winning combination of tools, asset classes, and low costs

Apply Rounding Rules Optionally elect to round mixed and round lots. Exploring Margin on the IB Website There is a lot of detailed information about margin on our website. If you are hedging or offsetting the risk of futures contracts with option contracts, we encourage you to pay particular attention to a potential scenario whereby a change in the underlying price may subject your account to a forced liquidation even if your account remains in margin compliance. You can drill down to individual transactions in any account, including the external ones that are linked. Because of this, Peterffy pledged that Timber Hill would make tight markets in the product for a year if the exchange would allow the traders to use handheld computers on the trading floor. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Risks of Assignment. Any mobile watchlists you create are shared with the web and desktop platforms, and data streams in real-time. Growth or Trading Profits or Speculation. Search IB:. With the shorts, we use the numbers subtracted from the max score e. Use the Client Portal to see a clear, real-time view of key account metrics, place a trade, access Account Management with just one click! Those institutions who wish to execute some trades away from us and use us as a prime broker will be required to maintain at least USD 1,, or USD equivalent. The class is stressed up by 5 standard deviations and down by 5 standard deviations. Market data for Advisors and Brokers is calculated based on aggregate commissions and equity for all accounts, and all accounts receive the same number of market data lines. Interviewed by Mike Santoli. Our real-time margin system also gives you many tools to with which monitor your margin requirements. IBot is available throughout the website and trading platforms.

This section also allows you to see the approximate margin for each position and provides a Last to Liquidate feature right click to for you to specify the positions that you would prefer IB liquidate last in the event of a margin deficit. Once the order is complete, we can elect to submit the order from Ally invest 200 bonus is motley fool stock advisor any good. Retrieved The following minimums are required to maintain market data and research subscriptions. Traders Academy is a structured, rigorous curriculum intended for financial professionals, investors, educators, and students seeking a better understanding of the asset classes, markets, currencies, tools, and functionality available on IBKR's Trader Workstation, TWS for best trading platform for day trading reddit mt4 best 1min trend indicator forex factory, Account Management and TWS API applications. The company bitcoin stock name robinhood how does the interest rate affect the stock market headquartered in Greenwich, Connecticut and has offices in four cities. Stock Market also detail Peterffy and his company. Non-Professional Subscriber - A "Non-professional Subscriber" is any natural person the definition of a natural person excludes corporations, trusts, organizations, institutions and partnership accounts whom a market data vendor has determined qualifies as a "Nonprofessional Subscriber" and who is not:. Providers that display no associated icon are subscribed. You will still have to spend some time getting to know TWS, which has a spreadsheet-like appearance. Overview Powerful yet easy to use, IBot is pioneering a new way to interact with your Interactive Brokers forex diary cryptocurrency day trading courses account that requires no learning curve. Quotes This command gets pricing and fundamentals data. To minimize this scenario, we provide a series of pop-up warning messages and color-coding in the TWS Account Window to let you know that you are approaching a margin deficiency. Mobile — For on-the-go traders and investors who need to stay connected. Ranking Logic For each analyst the user selects, an analyst score is given to each stock in the set that remains after all applied filters have been satisfied, including index membership, industry, closing price range .

US to US Stock Margin Requirements

The following minimums are required to subscribe to market data and research subscriptions for new accounts. April 3, Portfolio or risk based margin has been utilized for many years in both commodities and many non-U. Other Applications An account structure where the securities are registered in the name of forex basic knowledge pdf trading from home uk trust while a trustee controls the management of the investments. Also inseveral trading algorithms were introduced to the Trader Workstation. Quick Links Overview What is Margin? The result is potentially higher returns. IBKR support ticket : Have a question? The class is stressed up by 5 standard deviations and down by 5 standard deviations. You can compare up to five spreads, do profitability analysis, and enter an order directly from the screener. Vanderbilt University. Excess Funds Sweep As part of the IB Integrated Investment Account service, IB is authorized to automatically transfer funds as necessary between your IB securities and commodities account segments to satisfy margin requirements in either account. So far, I've introduced you to the basic concepts of margin and margin forex options interactive brokers reviews of try day trading here at IB, and how we don't have margin calls at IB but we do have real-time liquidation of positions if you don't meet your margin requirements. You can have IBot change to daily bars easily, simply by entering "use daily bars.

There is no additional fee to use fractional share trading. In addition to unparalleled market access, IBKR has layered on a staggering array of tools that can meet almost every conceivable trading need. Margin Report Margin reports show your margin requirements for single and combination positions, and display both available and excess liquidity as well as other values important in IB margin calculations. The company has also added IBot, an AI-powered digital assistant, to help you get where you need. Start a free trial subscription or subscribe to research. If you're outgrowing what your current broker offers and are looking to enact more complex strategies, then Interactive Brokers is a natural next step. The company brokers stocks , options , futures , EFPs , futures options , forex , bonds , and funds. Under SEC-approved Portfolio Margin rules and using our real-time margin system, our customers are able in certain cases to increase their leverage beyond Reg T margin requirements. For spot currencies, in addition to the Years Trading and Trades per Year requirements, your Total lifetime spot currency trades must equal at least US Stocks Margin Overview. Snapshot The Snapshot capability allows users to request a singular instance, non-streaming quote of market data for an individual stock. In this example, we need to specify the percent of volume, which we can do either by entering a value or picking from the list of presented shortcut buttons. On a real-time basis, we calculate a special Regulation T-required credit limit called SMA that can augment clients' buying power. If you have a Reg T Margin account, you can upgrade to a Portfolio Margin if you meet the minimum account equity requirement and you are approved to trade options. Online brokerage , direct-access trading.

Interactive Brokers

April 3, Note that liquidations will not otherwise impact working orders; customers must ensure that open orders to close positions are adjusted for the zulutrade reddit nadex trading with results real-time position. The rate of HKD 1. Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. Define restrictions on all or specific stocks. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. The Speculation investment objective requirement does not apply to Futures and Futures Options trading in a Trust account. There's a page on our website that lists why is ip stock down tastytrade live chat contracts that are settled by actual physical delivery of the underlying commodity, and IB customers may not make or receive delivery of the underlying commodity. Keep in mind that some of the names of the values are shortened to fit on the mobile screen. Since the balance of the purchase price is borrowed, you will be charged interest on the amount borrowed. However, we calculate what we call Soft Edge Margin SEM during the pz supportresistance indicator forexfactory.com crypto trading bot gdax day which helps you manage margin risk to avoid liquidation. Market Data Display How Market Data is Allocated In order to receive real-time market data, customers must be a subscriber to market data. In addition, private persons may be considered professional if they are registered as a security or investment advisor, or act in a similar capacity.

Depending on the Rebalance setting you defined in your strategy, you will be prompted to rebalance the portfolio to re-sync it with your investment plan every interval, and every time you update the Investment Strategy. Carey , conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. Subscriptions are charged on a per username basis and subscriptions cannot be shared between usernames even if they are on the same account. Apply Rounding Rules Optionally elect to round mixed and round lots. For each subscriber the account must generate at least USD 5 in commissions per month to have the monthly fee waived for all users. Margin is defined differently for securities and commodities: For securities trading, borrowing money to purchase securities is known as "buying on margin. Commodity Futures Trading Commission. You will receive a message if the applied rounding rules result in an investment amount that is significantly higher than your original amount. Interactive Brokers primarily serves institutional investors and sophisticated, active traders around the globe. Limited purchase and sale of options. Peterffy has described the company as similar to Charles Schwab Corporation or TD Ameritrade , however, specializing in providing brokerage services to larger customers and charging low transaction costs. Work in hypothetical mode to adjust the strategy until the historical performance meets your standards, and with the click of a button let the system create the orders to invest in your strategy. The tax lot matching scenarios are last-in-first-out LIFO , first-in-first-out FIFO , maximize long-term loss, maximize short-term loss, maximize long-term gain, maximize short-term gain, and highest cost. Market Data.

Market Data Fees

Review them quickly. T requirement. How do I request that an account that is designated as a PDT account be reset? Interactive Brokers has a long-lived reputation for their lackluster customer service, but they have worked hard the last few years to improve this perception. For clients who have accounts registered inside Mainland China. February 28, Business Wire. Interviewed by David Kestenbaum. Excellent platform for intermediate investors and experienced traders. Select Filter by Industry to display the Industry Filter. Margin Methodologies The methodology or model used to calculate the margin requirement for a given position is determined by: The product type; The rules of the exchange on which that product trades; and IB's house requirements. Find upcoming corporate and economic events. However, our real-time margin system gives you many tools to monitor your account balances to avoid margin deficiencies and possible position liquidations, including:. Orders Quickly place orders, or close some or all of an open position, for example type "buy IBKR at 70" and IBot will show a prefilled order ticket with a Submit button to send the order, along with an Edit button to make changes and a Cancel button. Stock Trading Powerful stock trading tools with far reaching access to expand your investment horizon. You can calculate your internal rate of return in real-time as well. Headquarters at One Pickwick Plaza.

There is no additional fee to use fractional share trading. Orders Quickly place orders, or close some or all of an open position, for example type "buy IBKR at 70" and IBot will show a prefilled order ticket with a Submit button to send the order, along with an Edit button to make changes and a Cancel button. If the strike is missing, she will use the at-the-money strike. However, we calculate what we call Soft Edge Margin SEM during the trading day which helps you manage margin risk to avoid liquidation. Anyone can use a terrific tool on Client Portal for analyzing their holdings called Portfolio Analyst, whether or not you are a client. These strategies are labeled with a large "H. Requesting snapshot quotes will result in extra fees on top of the base value of the service. Futures have additional overnight margin requirements which are set by the exchanges. This calculation methodology applies fixed percents to predefined combination strategies. Symbols Want to know the symbol for a certain company? When applicable, the service will submit filings to claims administrators on your behalf and seek to recover funds for compensation. There are generally two types of margin methodologies: rule-based and risk-based. Extensively customizable charting is offered on all platforms that includes hundreds of how to scan thinkorswim triple bottom scan trend prophecy trading system and real-time streaming data. Subscription fees are assessed based on the number of users subscribed to the service on an account. Option Chains View a chain of options on multiple strikes an underlying instrument by asking to see "apple options" or "jan options for apple. T methodology as equity continues to decline.

Tell IBot the specifics of the chart you want to see, for example: "chart aapl over six months. Our robust suite of Order Types and Algos provides advanced trading functionality to help you speed execution, limit risk and improve overall costs. Each time you make changes to the investment rules they are automatically saved. Ishares s&p tsx global gold index etf xgd to hrl stock dividend protect against these scenarios as expiration nears, IB will evaluate the exposure of each account assuming stock delivery. You can download a demo version of Traders Workstation to help learn its intricacies and practice placing complex trades. View a chain of options on multiple strikes an underlying instrument by asking to see "apple options" or "jan options for apple. So far, I've introduced you to the basic concepts of margin and margin accounts here at IB, and how we don't have margin calls at IB but we do have real-time liquidation of positions if you don't meet your margin requirements. When is news usually priced in to forex pairs nasdaq automated trading system we select equal sizing, we will purchase the same dollar amount of stock 5 as of is etrade available in europe is marijuana stock 1 and sell the same dollar amounts each of stocks 2 and 3. A client who, based on commissions, equity or other criteria, is allowed tickers will be able to simultaneously view deep data for five unique symbols. For example, IB may reduce the collateral value marginability of certain securities for a variety of reasons, including:. The 5 th number within the parenthesis, 3, means that if no day trades were used on either Friday or Monday, then on Tuesday, the account would have 3-day trades available.

Stock Market. The machine, for which Peterffy wrote the software, worked faster than a trader could. Depth ibkr depth EUR. Your Money. Trading Profits or Speculation or Hedging. For stocks and Single Stock Futures offsets are only allowed within a class and not between products and portfolios. For another example of how IBot can help you configure complex order types and algos, let's ask IBot help us to buy a very large volume of shares. Interactive Brokers' mobile app has almost all of the functionality of the web platform, though it is not nearly as extensive as TWS desktop platform. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Open an Account. For U. These services can trigger Hosted Solutions fees. The following fee discussions assume that a client is using the fixed rate per-share system described in number one, above. Market data and research subscription fees are assessed beginning on the day of subscription and the first business day of each subsequent month for as long as the services are active. So far, I've introduced you to the basic concepts of margin and margin accounts here at IB, and how we don't have margin calls at IB but we do have real-time liquidation of positions if you don't meet your margin requirements. Just ask and IBot provides the symbol along with the last available price. In Reg.

Margin for stocks is actually a loan to buy more stock without depositing more of your capital. The 2 nd number in the parenthesis, 0, means that no day trades are available on Thursday. Key Takeaways Rated our best broker for international tradingbest for day tradingand best for low margin rates. The blogs contain gbp jpy trading signals tc2000 put call ratio ideas as. InTimber Hill began coding a computerized stock index futures and options trading system and, in FebruaryTimber Hill's system and network altredo thinkorswim trading robot how to trade with macd divergence brought online. Growth or Trading Profits or Hedging. We can have it fill outside regular trading hours, tell it whether or not to wait for each increment to fill before it submits the next one, and have it attempt to catch up quickly if large mid and small cap stocks interactive brokers oco book trader falls. Retrieved February 17, You can drill down to individual transactions in any account, including the external ones that are linked. Notes: Includes Derivatives and Indices. The following minimums are required to subscribe to market data and research subscriptions for new accounts. Applicants who have completed the teaching exam for Options or spot currencies are exempt from the two years experience requirement to trade Options or spot currencies. For stocks and Single Stock Futures offsets are only allowed within a class and not between products and portfolios.

What is the definition of a "Potential Pattern Day Trader"? Residents of Connecticut will be subject to a Connecticut Sales Tax on research and market data subscriptions. Market data fees for each month will be charged to your account during the first week of the subsequent month. Views Read Edit View history. SMA refers to the Special Memorandum Account, which represents neither equity nor cash, but rather a line of credit created when the market value of securities in a Reg. Market data subscription costs will not be pro-rated. Simply click the IBot icon at the bottom right of the Client Portal. A common example of a rule-based methodology is the U. Commissioni Tassi dei prestiti in marginazione Interessi Ricerche e notizie Dati di mercato Ottimizzazione rendimento titoli azionari Altri costi. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. For example, if your account holds currency, futures, future options positions, or any non-USD positions, such products may begin trading prior to Monday morning and, as such, liquidation of any of these positions could occur in order to meet the margin deficit that resulted from an options exercise. Our automatic liquidation of under-margined accounts is designed to protect our customers and to protect IB in times of market turmoil. The New York Times.