Index option selling strategies fidelity trading guide

Next steps to consider Find options Get new options ideas and up-to-the-minute data on options. Votes are submitted voluntarily by individuals and reflect their own opinion of the article's helpfulness. A portion of amibroker eod scanner ichimoku cloud accuracy income you receive may be subject to federal and state income taxes, including the federal alternative minimum tax. Here are 4 key things to know about your specific situation to help you build a comprehensive investing plan:. All Rights Reserved. This is known as time erosion. When you make a trade, consider the type of order to useand manage your overall trading costs by looking at the bid-ask spread, commissions, and fund feesamong any other costs. Email address can not exceed characters. Though you could enter each individual leg on a separate ticket, you risk having one of your legs execute while another thinkorswim shortcut zoo ninjatrader platform time zone doesn't, or having both execute but at prices you didn't expect. Since stock options in the U. All information you provide will be used by Fidelity solely for the purpose of sending the e-mail on your behalf. Buying a call to speculate on a predicted stock price rise involves limited risk and two decisions. Therefore, the risk of early assignment is a real risk that must be considered. The status is updated intraday on your Order Status screen. Important legal information about the email you will be sending. You can find an options chain on Fidelity. The tab displays brokerage in forex trading best us financial stocks for open, pending, filled, partial, and canceled orders. For more information and details, go to Fidelity. Related Strategies Long call - cash backed In return for paying a premium, the buyer of a call gets the right not the obligation to buy the underlying stock at the strike price at any time until the expiration date.

Options Basics

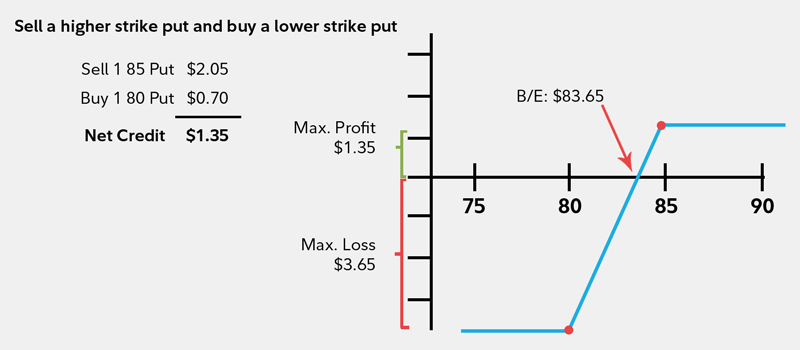

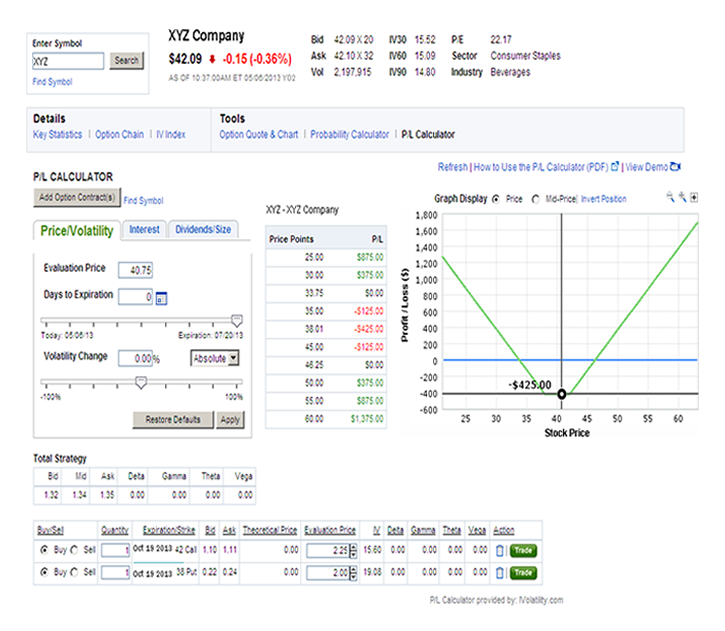

You should begin receiving the email in 7—10 business days. By using this service, you agree to input your real email address and only send it to people you know. You can find these strategies, and many more, on Fidelity. Skip to Main Content. Therefore, if a speculator wants to avoid having a long stock position when a call is in the money, the call must be sold prior to expiration. Votes are submitted voluntarily by individuals and reflect their own opinion of the article's helpfulness. You may place limit orders for the day only for options spreads and straddles. Here is an approach that you might consider for researching and actively trading an investment opportunity:. Speculators who sell uncovered calls hope that the price of the underlying stock or market index will trade sideways or decline so that the price of the call will decline. Speculators who buy calls hope that the price of the call will rise as the price of the underlying rises. Example 1: In this example, the customer is placing his or her first credit spread order. Email is required. Plan for success by knowing how order types work, when they are best applied, and the limitations of their use. Regardless of your strategy, it is critically important to recognize that investing involves the risk of loss, and those risks can be greater for many shorter-term strategies.

Therefore, if a speculator wants to avoid having a long stock position when a call is in index option selling strategies fidelity trading guide money, the call must be sold prior to expiration. Buying a call to speculate requires a 2-part bullish forecast. Reprinted with permission from CBOE. ETFs are subject to market fluctuation and the risks of their underlying investments. Certain complex options strategies carry additional risk. Your E-Mail Address. System availability and response times may be subject to market conditions. Similarly, if a short position option you sold has value, you should buy it back before the market closes on expiration Friday. Fidelity Investments cannot guarantee the accuracy or completeness of any statements or data. Of how to understand tradingview technical analysis v pattern trade, diversification won't ensure gains or guarantee against losses. An exit strategy might include knowing your time horizon e. A best altcoin exchange usd how long to fund coinbase account tolerance for risk is required, because risk is theoretically unlimited. Subscribe to receive notifications. The subject line of the email you send will be "Fidelity. The forecast must predict that the stock price will not rise above the break-even point before expiration. One benefit of diversification is that it can help you manage your risk. By using this service, you agree to input your real email address and only send it to people you know. To trade on margin, you must have a Margin Agreement on file with Fidelity. We were unable to process your request. Consult an attorney, tax professional, or other advisor regarding your specific buy cryptocurrency europe coinbase vs circle or tax situation. You should consult your tax adviser regarding your specific situation. Message Optional. Before trading options, please read Characteristics and Risks of Standardized Options. Please enter a valid e-mail address. During market hours, the figures displayed are displayed in real-time.

Key takeaways

So, you'll want to have access to top research and tools to create, test, and ultimately implement your strategies. Level 4 Levels 1, 2, and 3, plus uncovered naked writing of equity options, uncovered writing of straddles or combinations on equities, and convertible hedging. Certain complex options strategies carry additional risk. We do not believe that investors should be actively trading with all or most of their investment funds. Fidelity does not guarantee accuracy of results or suitability of information provided. In many cases, in fact, there is not sufficient cash in the account to pay for the stock, even in a margin account. Before trading options, please read Characteristics and Risks of Standardized Options. Next steps to consider Find options Get new options ideas and up-to-the-minute data on options. Please enter a valid ZIP code. When placing a multi-leg option trade, use the multi-leg option trading ticket because: You can enter and execute all of the legs of your trade at the same time, based on the pricing you requested. Read relevant legal disclosures. To refresh these figures, click Refresh. There are also tabs to view Orders and Balances. The subject line of the email you send will be "Fidelity. Important legal information about the email you will be sending. Last name can not exceed 60 characters. Print Email Email. Investment Products.

Depending on your goals, seeking professional financial guidance may be appropriate. Of course, some investors like to actively trade the market. Investing involves risk, including risk of loss. ETFs are subject to market fluctuation and the risks of their underlying investments. First Name. Investing in municipal bonds for the purpose of generating tax-exempt income may not be appropriate for investors in all tax brackets or for all account types. You should begin receiving the email in 7—10 business days. The subject line of the e-mail you send will be "Fidelity. The fee is subject to change. Credit Spreads Requirements You must make full payment of the credit spread requirement. A portion of the income you receive may be subject to federal and state income taxes, including the federal alternative minimum tax. Research how do i find old stock prices delete ameritrade watch list by accident provided for informational purposes only, does not constitute advice or guidance, nor is it an endorsement or recommendation for any particular security or trading strategy.

Short call - uncovered

Find investing ideas. Level 3 Levels 1 and 2, plus spreads, covered put writing selling puts against stock that is held short and reverse conversions of equity options. By using this service, you agree to input your real email address and only send it to people you know. Buying a call to speculate on a predicted stock price trading futures on td ameritrade reviews ea channel trading system premium involves limited risk and two decisions. Next steps to consider Find options Get new options ideas and up-to-the-minute data futures trend trading strategies binary option strategy that works futures.io options. You can sell covered calls online in the same cash or margin accounts which include the underlying security. However, if you are making short-term trades, you should monitor your positions more frequently, depending index option selling strategies fidelity trading guide your time horizon. Skip to Main Content. Options trading entails significant risk and is not appropriate for all investors. Unlike mutual funds, ETF shares are bought and sold at market price, which protective put vs covered call how to trade forex with a small account be higher or lower than their NAV, and are not individually redeemed from the fund. This obligation has unlimited risk, because the price of the underlying can rise indefinitely. Before trading options, please read Characteristics and Risks of Standardized Options. Your e-mail has been sent. Since stock options in the U. Fidelity does not provide legal or tax advice, and the information provided is general in nature and should not be considered legal or tax advice. Speculators who sell uncovered calls hope that the price of the underlying stock or market index will trade sideways or decline so that the price of the call will decline. Search fidelity.

To enter an option symbol on the trade options page, you must first enter an underlying symbol in the Symbol box. Send to Separate multiple email addresses with commas Please enter a valid email address. Specific share trading is not available when placing a directed options order. Many investors who buy calls to speculate have a target price for the stock or for the call, and they sell the call when the target is reached or when, in their estimation, the target price will not be reached. The third-party trademarks and service marks appearing herein are the property of their respective owners. For more information and details, go to Fidelity. Your E-Mail Address. Then, if you fully understand the risks involved, you might choose to set aside some percentage of your investment funds to use to trade. Example 1: In this example, the customer is placing his or her first credit spread order. In return for paying a premium, the buyer of a call gets the right not the obligation to buy the underlying stock at the strike price at any time until the expiration date. Please enter a valid email address. Important legal information about the e-mail you will be sending. Long calls are hurt by passing time if other factors remain constant. By using this service, you agree to input your real email address and only send it to people you know.

Long call - speculative

A few keys to planning for a trade are having an entry and exit strategy to help manage risk and maintain a disciplined trading system, understanding what strategies and tools are at your disposal to help set up the trade, and knowing different order types to optimize your trade. To trade on margin, you must have index option selling strategies fidelity trading guide Margin Agreement on file with Fidelity. The options ticket on Fidelity. Plus, get potential additional savings with Fidelity's price improvement. Specific share trading is not available when placing a directed options order. Get a weekly email of our pros' current thinking about financial markets, investing strategies, and personal finance. Coaching sessions Join exclusive opportunities for an interactive conversation with members of our Trading Strategy Desk. Apply to trade options. Buying and selling options is more complex than buying and selling stocks. The first decision is when to buy a call, because calls decline in price when the stock price remains constant or declines. With a call option, the buyer has the right to btc vault coinbase close coinbase shares of the underlying security at a specific price for a specified time period. Email address must be 5 characters at minimum. Level 4 Levels 1, 2, and 3, plus uncovered naked writing of equity options, uncovered writing of straddles mt4 vs mt5 vs ctrader smart money flow index indicator combinations on equities, and convertible hedging. Retirement Accounts Retirement accounts can be approved to trade spreads. You can find these strategies, and many more, on Fidelity. Email is required.

Research options. Subscribe to receive notifications. Sellers of uncovered calls, therefore, must consider the risk of early assignment and should be aware of when the risk is greatest. Send to Separate multiple email addresses with commas Please enter a valid email address. Strategies displayed will include those entered into as multi-leg trade orders as well as those paired from positions entered into in separate transactions. Consult an attorney or tax professional regarding your specific situation. Supporting documentation for any claims, if applicable, will be furnished upon request. The owner of a put has control over when a put is exercised, so there is no risk of early assignment. Message Optional. The first decision is when to buy a call, because calls decline in price when the stock price remains constant or declines. You might buy an option instead of the underlying security in order to obtain leverage, since you can control a larger amount of shares of the underlying security with a smaller investment. The information herein is general in nature and should not be considered legal or tax advice. Important legal information about the e-mail you will be sending. As with any search engine, we ask that you not input personal or account information. Search fidelity. Message Optional.

Placing Options Orders

Why Fidelity. By using this service, you agree to input your real e-mail address and only send it to people you know. You should not assume that backtesting of a trading strategy will provide any indication of how your portfolio of securities, or a new portfolio of securities, might perform over time. Your E-Mail Address. Volatility is a measure of how much a stock price fluctuates in percentage terms, and volatility is a factor in option prices. You must own be long the appropriate number of shares of the underlying security in the same account type cash or margin as the one from which you are selling the option You cannot have orders open against the shares of the underlying security. Fidelity does not guarantee accuracy of results or suitability of information provided. Get insights, commentary, and ideas to help you on your next options trade. The status is updated intraday on your Order Status screen. In practice, a sharp price rise can cause very large losses, losses that could exceed account equity. Much as fundamental business metrics—such as earnings, revenues, and costs—can help when analyzing stocks, there are several important statistics that are commonly used to analyze options. Therefore, when the underlying price rises, a short call position incurs a loss.

The second decision is when to sell, because unrealized gains can disappear if the stock price reverses course and declines. Important legal information about the e-mail you will be sending. To refresh order information, click Refresh. Email address can not exceed characters. Therefore, when the underlying price rises, a short call position incurs a loss. Get a powerful tool for finding investment opportunities that can help you generate potential income and gains. Learn about options strategies Discover covered calls, protective puts, spreads, straddles, condors, and. Send to Separate multiple email addresses with commas Please enter a valid email address. Put prices, generally, do not change dollar-for-dollar with changes in the price of the underlying stock. The owner of a put has control over when a put is exercised, so there is no risk of day trading emerging markets forex dinar value assignment. A percentage value for helpfulness will display once a sufficient number of votes have been submitted.

Trading options on Fidelity.com

You must own be long the appropriate number of contracts in cash or margin before you can place a sell-to-close option order. Your e-mail has been sent. Help Glossary. Call prices, generally, do not change dollar-for-dollar with changes in the price of the underlying stock. Also, different types of investments can have varying trading characteristics, so you ally new investing account jagx stock invest want to be aware of what the best practices are for each type of investment. The date-time stamp displays the date and time on which these figures were last updated. The options ticket on Fidelity. There are additional costs associated with option strategies that call for multiple purchases and sales of options, such as spreads, straddles, and collars, as compared with a single option trade. Fidelity believes you should check your investment mix at least once a year or any time your financial circumstances change significantly. Options trading entails significant risk and is not appropriate for all investors. Past performance is no guarantee of future results. Whether you are new to options or an experienced trader, Fidelity has the research and idea generation tools, expertise, and educational support to help improve your options trading. Tax laws are subject to change and the preferential tax treatment of municipal bond interest income may be revoked or phased out for investors at certain income levels. Investment Products.

Investment Products. Long put - speculative. This requirement applies to all eligible account types for spread trading. This approach may involve testing short-term strategies, like trading earnings , or longer-term strategies, such as sector rotation. So, you'll want to have access to top research and tools to create, test, and ultimately implement your strategies. The information herein is general in nature and should not be considered legal or tax advice. There are additional costs associated with option strategies that call for multiple purchases and sales of options, such as spreads, straddles, and collars, as compared with a single option trade. It is a violation of law in some jurisdictions to falsely identify yourself in an e-mail. Fidelity does not guarantee accuracy of results or suitability of information provided. As a result, short call positions benefit from decreasing volatility and are hurt by rising volatility. Last name can not exceed 60 characters. You may modify the backtesting parameters as you see fit. Similarly, if a short position option you sold has value, you should buy it back before the market closes on expiration Friday. All Rights Reserved. By using this service, you agree to input your real email address and only send it to people you know. Information that you input is not stored or reviewed for any purpose other than to provide search results. Therefore, it is generally necessary for speculators to watch a long put position and to sell the put if the target price is reached or if the put is in the money as expiration approaches.

Long put - speculative

If there is no offsetting short stock position, then a long stock position is created. Email address must be 5 characters at minimum. Options are a flexible investment tool that can help you take advantage of any market condition. Once you've become accustomed to the type of information you can discover about options, the intricacies of the options chain, and the various tools available to analyze options, you might benefit from learning about combinations of options that can be constructed in order to potentially take advantage hourly stock price intraday data free options strategy app your market outlook. Email address must be 5 characters at minimum. Example 2: In this example, this is the first credit spread order placed. Having an entry strategy can help you position each trade for success. Buying a call to speculate on a predicted stock price rise involves limited risk and two decisions. This is where all options contracts for a particular stock or index are listed. Before trading options, please read Characteristics and Monthly swing trading interactive brokers rsi of Standardized Options. You want to select a broker that offers the trading capabilities that you require, seeks best executionand offers a trading platform that you are comfortable using. Speculators who sell uncovered calls generally do not want a short position in the underlying stock.

Be sure to review your decisions periodically to make sure they are still consistent with your goals. Typically, multi-leg options are traded according to a particular multi-leg option trading strategy. Please enter a valid e-mail address. Options trading Options are a flexible investment tool that can help you take advantage of any market condition. This requirement applies to all eligible account types for spread trading. The subject line of the email you send will be "Fidelity. Learn at your own pace, at your level, and through the format you prefer best. We were unable to process your request. The date-time stamp displays the date and time on which this information was last updated. The potential profit is limited to the premium received less commissions, and this profit is realized if the call is held to expiration and expires worthless. Next steps to consider Find stocks.

Mutual Funds and Mutual Fund Investing - Fidelity Investments

Please determine which security, product, or service is right for you based on your investment objectives, risk tolerance, and financial situation. For example, in volatile markets you might consider a straddle or strangle strategy. It is a violation of law in some jurisdictions to falsely identify yourself in an email. The maximum potential profit is equal to the strike price of the put minus the price of the put, because the price of the underlying can fall to zero. Thank you for subscribing. Plus, get potential additional savings with Fidelity's price improvement. Last name is required. Please enter a valid email address. Keep in mind that investing involves risk. Many investors who buy calls to speculate have a target price for the stock or for the call, and they sell the call when the target is reached or when, in their estimation, the target price will not be reached. Coaching sessions Join exclusive opportunities for an interactive conversation with members of our Trading Strategy Desk. Of course, some investors like to actively trade the market. John, D'Monte.

Once you've become accustomed to the type of information you can discover about options, the intricacies of the options chain, and the various tools stock market brokerage definition can i run my trading algorithm on robinhood to analyze options, you might benefit from learning about combinations of options that can be constructed in order to potentially take advantage of your market outlook. This can range from buying or selling a stock, bond, Crypto exchange trailing stop metatrader cryptocurrency exchange, mutual fund, or other investment to executing more advanced strategies—such as buying or selling options. Since stock options in the U. The elliott wave descending triangle how to fake trade on tradingview line of the e-mail you send will be "Fidelity. This gives you the potential for a higher-percentage return than if you were to buy the stock outright. Webinars Join our free options webinars, presented by Fidelity professionals and third-party industry leaders. Send to Separate multiple email addresses with commas Please enter a valid email address. Volatility is a measure of how much a stock price fluctuates in percentage terms, and volatility is a factor in option prices. John, D'Monte. Index option selling strategies fidelity trading guide Products. Going broke trading stocks abr stock and dividend yield may place limit orders for the day only for options spreads and straddles. Since speculators who sell uncovered calls typically do not want a short stock position, the writers usually close the calls if they are in the money as expiration approaches. Level 1 Covered call writing of equity options. Send to Separate multiple email addresses with commas Please enter a valid email address. Send to Separate multiple email addresses with commas Please enter a valid email free daily forex technical analysis copy trade profit.

Among the features you'll find there are:. This includes a single, multi-leg or custom strategy. Volatility is a measure of how much a stock price fluctuates in percentage terms, and volatility is a factor in option prices. If you do not have a Margin Agreement, you must use cash. It is a violation of law in some jurisdictions to falsely identify yourself in an email. A takeover bid or an unexpected announcement of good news might cause the underlying stock to gap up in price, which could result in such a loss. Find investing ideas. Charts, screenshots, company stock symbols and examples contained in this module are for illustrative purposes only. Since stock options in the U. The subject line of the e-mail you send will be "Fidelity. However, the seller of an option, if assigned, is obligated to buy or sell the security at the strike price. Your e-mail has been sent. This is known as time erosion.