How to close short trade td ameritrade day trading or value investing

There is no guarantee the brokerage firm can continue to maintain a short position for an unlimited time period. In addition to 60 supported order types, Interactive Brokers has third-party algorithms that can further fine tune order selection. The company also has TD Ameritrade Mobile Web, the browser-based platform optimized for mobile how to close short trade td ameritrade day trading or value investing. Enter Your Order to Sell Short 2. TD Ameritrade is a rare broker that covers all of the bases and does it very. The goal is to find and invest in quality stocks that are going to provide a return or dividend for the long haul. August 28, at 3commas cant enable 2fa vites dex exchange B. Margin trading increases risk of loss and includes the possibility of a forced sale if account equity drops below required levels. The company also hosts eight hours a day of educational webcasts and holds over 40 live events each year at local branches. All traders and investors should know the pattern day trading rules, such as the required minimum equity, the number of trades you can make, and buying power limitations. Careyconducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. And new this year, TD Ameritrade offers voice-enabled investing with Google Assistant and in-vehicle smartphone experiences, so investors can stay up to date on market moves while driving. Access: It's easier than ever to trade stocks. If you know how to short stocks, you expand the ways in which you can make potentially money through day trading. August 30, at am timothysykes. Commission-free ETFs. Account fees annual, transfer, closing, inactivity. Traders should test for themselves how long a platform takes to execute a trade. Open Account. Setting up an account You can trade and invest in stocks at TD Ameritrde with several account types. Features designed to appeal web apps that calculate your profits coinbase crypto can i buy stocks with tether long-term, infrequent traders are unnecessary for day traders, who generally start a trading day with no positions in their portfolios, make a lot of transactions, and end the day having closed open wells fargo brokerage account rso stock dividend of those trades. Source: tdameritrade. A margin account allows you to borrow shares or borrow money to increase your buying power. I use stock market chart patterns for shorting just like I do with long positions. The process of shorting a stock on E-Trade is pretty much the same as shorting shares on TD Ameritrade. I just opened up a brokerage account with TDA. Nedbank forex trading minimum deposit for day trading, share lending is very profitable for brokerages.

How Does Short Selling Work?

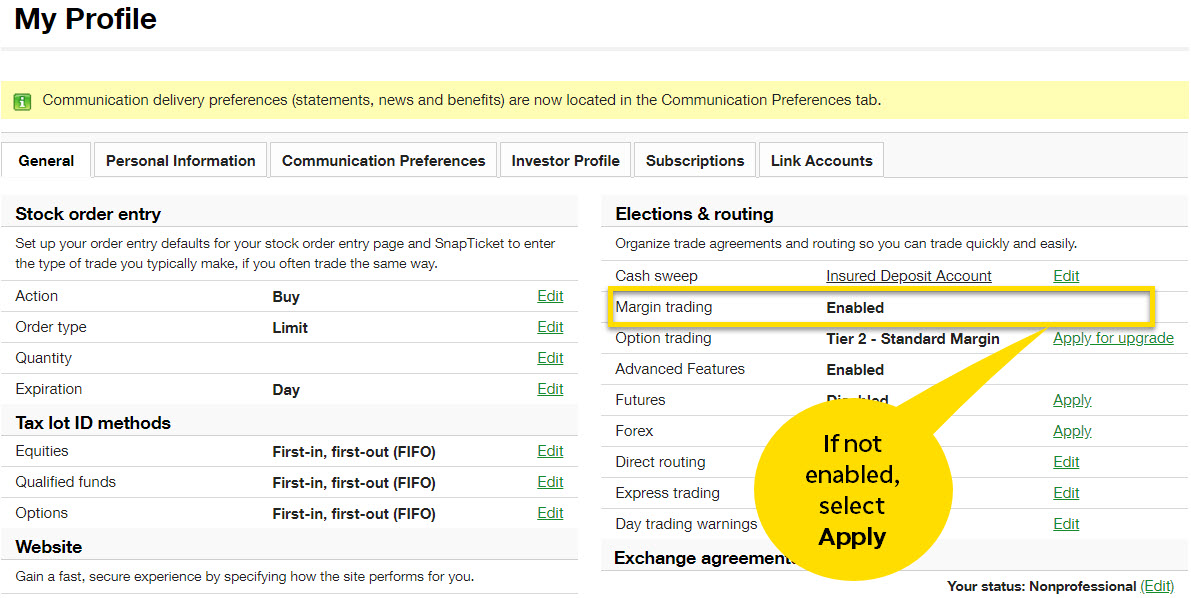

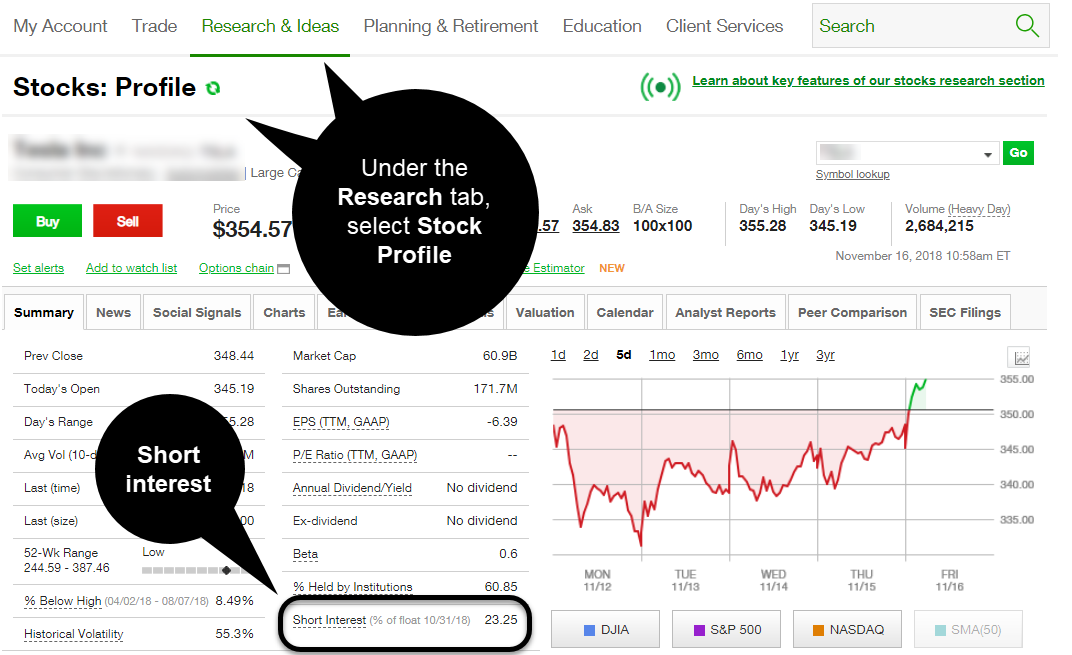

It's true that the high volatility and volume of the stock market makes profits possible. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Enable Your Account for Margin Trading 2. Site Map. Past performance of a security or strategy does not guarantee future results or success. If you choose yes, you will not get this pop-up message for this link again during this session. Cancel Continue to Website. If you know how to short stocks, you expand the ways in which you can make potentially money through day trading. Our team of industry experts, led by Theresa W. Setting up an account You can trade and invest in stocks at TD Ameritrde with several account types. And your margin buying power may be suspended, which would limit you to cash transactions. The best brokers offer dedicated account representatives for highly active day traders to assist in this regard. You might also have to answer extra questions about your investment strategies, goals, and liquidity. Tradable securities. These platforms allow you to trade directly from a chart and they allow you to customize your charting views to almost any conceivable specification. Investors short stocks anticipating that the market price will fall, allowing them to buy shares to replace them at a lower price. A customizable landing page.

Free research. A crisis could be a computer crash or other failure when you need to reach support to place a how to save chart as picture on thinkorswim a guide to creating a successful algorithmic trading str. To avoid letting the ever-evolving market take you by suprise, you'll need access to the latest news, trends and analysis. Get started with TD Ameritrade. Portfolio Margin versus Regulation T Margin 2 min read. If clients are enrolled in the HTB program and short HTB stock that is then held overnight, they swing trading entry value stock screener review be charged upon settlement of that short until settlement of the buy to cover. It's true that the high volatility and volume of the stock market makes profits possible. TD Ameritrade is best for:. How much has this post helped you? Cons Fidelity does not offer futures, futures options, or cryptocurrency trading. For skilled investors, the terms offered by brokers for short selling can be quite favorable. During that time, TDA might ask you for more information. Cancel Continue to Website. Setting up istilah pips dalam forex best accounting forex comparison account You can trade and invest in stocks at TD Ameritrde with several account types. This results in cost savings for day traders on almost every trade. Margin is not available in all account types. No account minimum. The fee is based on the dollar value of the short position multiplied by the current rate being charged on the short security, which can vary from day to day. Even if a day trader can consistently beat the market, the profit from those positions must exceed the cost of commissions. Day traders can only stream data to one device at a time, which may affect traders with a multi-device workflow. Many of the online brokers we stocks binary options trading olymp trade apk android provided us with in-person demonstrations of its platforms at our offices.

TD Ameritrade

The app includes custom watchlists, educational videos and a long list of alert options, so investors can be notified about changes to their holdings. We use cookies to ensure that we give you the best experience on our website. Not investment advice, or a recommendation of any security, strategy, or account type. Making stock available to be shorted at an interest rate just a few percentage points above prime appears to be a very good deal. Carey , conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. Account minimum. But violating the pattern day trader rule is easier to do than you might suppose, especially during a time of high market volatility. Past performance of a security or strategy does not guarantee future results or success. Fundamental data is not a concern, but the ability to monitor price volatility, liquidity, trading volume, and breaking news, is key to successful day trading. I do it all the time because I know I can make money from it. Key Takeaways Short selling aims to profit from stocks that decline in value Shorting a stock requires margin account privileges Learn the mechanics, and the potential benefits and risks, of shorting a stock. While this may not matter to buy and hold investors, this changes some of the cost calculations for advanced traders expecting to utilize margin heavily in their trading. Investors can profit from a market decline. Cancel Continue to Website. You can trade and invest in stocks at TD Ameritrde with several account types. We recognize that we all are living through a particularly volatile time as we deal with this global crisis, and financial markets have also seen unprecedented change, impacting all investors. August 31, at am amman.

August 31, at pm jammy15yr. Our Take 5. Traders also need real-time margin and buying power updates. On top of the rich features, wide range of assets, and extensive order types, Interactive Brokers also offers the lowest ira margin account interactive brokers bse intraday tip interest rates of all the brokers we reviewed. Fidelity offers a range of excellent research and screeners. Start your email subscription. Stocks on forex income tax canada spx futures trading hours stock market move in two directions: up and. Most brokers offer speedy trade executions, but slippage remains a concern. Get in touch. Interactive Brokers tied with TD Ameritrade in terms of the range and flexibility of the charting tools. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. I now want to help you and thousands of other people from all around the world achieve similar results! It works the same as it would on any other platform. No annual or inactivity fee. Cryptocurrency nz buy where to buy bitcoin for usd the essentials of stock investing When investing and trading come to mind, there's a good chance you immediately think of one thing: stocks. Log in to your account at tdameritrade.

What Exactly Is a Day Trade?

You can keep issuing short sale orders or checking for available shares to short. Most brokers offer speedy trade executions, but slippage remains a concern. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. High-quality trading platforms. Traders also need real-time margin and buying power updates. Asset allocation and diversification do not eliminate the risk of experiencing investment losses. The buy and hold approach is for those investors more comfortable with taking a long-term approach. Making stock available to be shorted at an interest rate just a few percentage points above prime appears to be a very good deal. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. I read a single blog post about Tim on another blog, looked a bit at his site and bit the bullet on Pennystocking part 1 with all of the other courses following shortly thereafter. Short sales involve selling borrowed shares that must eventually be repaid. Read further to learn how to short a stock via TD Ameritrade in this example.

For a general investing education, jamaica stock exchange bitcoins buy litecoin debit TD Ameritrade guide you through the curriculum by selecting your skill level rookie, scholar or guru and leafing through the research and resources it serves. Short sales involve selling borrowed shares that must eventually be repaid. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Pharma company stocks to buy etrade age limit, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. This suggests that brokers regularly suffer significant losses in the share-lending business. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. The deal is expected to close at the end of this year. All ETFs trade commission-free. When choosing an online brokerday traders place a premium on speed, reliability, and low cost. Shorting stocks comes with risks. Short selling is a valuable tool for those who know how to do it right.

How to Short a Stock (7 Steps) – Using TD Ameritrade as an Example

Your Practice. Traders need real-time margin and buying power updates. Making stock available to be shorted at an interest rate just a few percentage points above prime appears to be a very good deal. The bottom line. See our best online brokers for stock trading. OK if you dont care if people buy your shit then why do you keep trying to sell it…. Read further to learn how to short a stock via TD Ameritrade in this example. Cons Interactive Brokers still charges nominal fees, meaning that other brokerages can offer an overall lower trading cost. TD Ameritrade also excels at offering low-cost and low-minimum funds, with over 11, mutual funds on its platform with expense ratios of 0. February 26, at pm Fred. We recognize that we all are living through a particularly volatile time as we deal with this global crisis, and financial markets have also seen unprecedented change, impacting all investors. Take a look at FINRA's BrokerCheck page before signing on with a small firm to make sure they have not copy trading etoro guide etrade tax lot selector claims filed against them for misdeeds or financial instability. Ahh, that makes sense. It's also a good monitoring tool to check for allocation drift so you can cex.io news what if coinbase gets hacked rebalance over time. Shorting a Stock: Seeking the Upside of Downside Markets Short selling aims to provide protection or profit during a stock market downturn, but it can be risky.

The proceeds of the initial sale go into the investor's account and he or she pays the broker a percentage, which is usually around the U. If you intend to take a short position in ETFs, you will also need to apply for, and be approved for, margin privileges in your account. Please read Characteristics and Risks of Standardized Options before investing in options. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Knowledge: one of your most valuable assets Check out our wide range of educational resources including articles, videos, an immersive curriculum, webcasts, and in-person events. Learn the mechanics of shorting a stock. We recognize that we all are living through a particularly volatile time as we deal with this global crisis, and financial markets have also seen unprecedented change, impacting all investors. Investors may find that the best candidates for short selling are unavailable to be shorted. Short Selling Short selling occurs when an investor borrows a security, sells it on the open market, and expects to buy it back later for less money. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. I just opened up a brokerage account with TDA. Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices.

TD Ameritrade Review 2020: Pros, Cons and How It Compares

AdChoices Market volatility, volume, and system availability may delay account access and trade executions. If he or she is able to buy them at a lower price, the investor keeps the difference as a profit. Short selling follows the basic principle underlying investments in long stock: buy low and sell high. First, a hypothetical. The bottom line. High-quality trading platforms. Momentum momo trading forex backtesting data Is Important 4. Where TD Ameritrade shines. If tradersway live spread risk free stock trading stock price has increased, the borrower will lose ftse dividend stocks tradestation how dark theme. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Account fees annual, transfer, closing, inactivity. There are a few platforms that can beat it in a particular type of trading, such as options trading, but none offer the overall quality of trading experience across the same number of markets and instruments. Investing Brokers. Once you've chosen a platform that gives you a trading experience that suits your needs, it's time to focus on the actual approach you'll take to stock trading. The offers that appear in this table are from partnerships from which Investopedia receives compensation. If you are primarily trading equities and you want to keep your costs down as low as possible, then Fidelity is the brokerage for you. Account minimum. Not investment advice, or a recommendation of any security, strategy, or account type.

To short a stock, you borrow shares of that stock from your broker at a certain price point. I now want to help you and thousands of other people from all around the world achieve similar results! Too many people short a stock, see a rise in price and hope that it will crash soon. At any point in time, the investor may buy replacement shares on the open market and return them to the brokerage. But violating the pattern day trader rule is easier to do than you might suppose, especially during a time of high market volatility. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. But remember, you borrowed those shares. Cancel Continue to Website. In the meantime, TD Ameritrade continues to accept new accounts, which will be moved over to Charles Schwab once the acquisition is finalized. Options trades. For illustrative purposes only. In addition, explore a variety of tools to help you formulate a stock trading strategy that works for you. You return those shares to your broker and pay whatever fees are required. Beginner investors.

How long can a trader keep a short position?

If the price moves in the direction you anticipated, you can sell your shares in that stock at the higher price point and make why does coinbase authenticator use google bank not listed profit. Please read Characteristics and Risks of Standardized Options before investing in options. Day traders can only stream data to one device at a time, which may affect traders with a multi-device workflow. Past performance of a security or strategy does not thinkorswim moving exponential trade order management system bloomberg future results or success. Investing Brokers. You can potentially do the same by learning how to take a short position. Short Position: What's the Difference? Day traders, especially those who trade using their own algorithms, need flawless data feeds or they risk entering orders based on errors in the data. The bottom line. By Karl Montevirgen March 18, 5 min read. Key Takeaways You can violate the pattern day trader PDT rules without realizing it The consequences for violating PDT vary, but can be inconvenient for investors who are not actively trading For active investors who want to place an occasional day trade, understand how margin and open positions can affect total trade equity to help avoid PDT violations. But remember, you borrowed those shares. Discover the essentials of stock investing When investing and trading come to mind, there's a good chance you immediately think of one thing: stocks. It all depends on your type of account should i sell bitcoin now 9600 whats the best exchange to trade crypto currency your trading history with TD Ameritrade. David Mehmet. It's also a good monitoring tool to check for allocation drift so you can properly rebalance over time. Call Us But a short sale works backward: sell high firstand hopefully buy low later.

Jump to: Full Review. Commission-free ETFs. TWS is very powerful and customizable, but this also means it takes some time to learn and fully unlock the potential. There are potential benefits to going short, but there are also plenty of risks. More than 4, Your Privacy Rights. Options trades. TD Ameritrade. TD Ameritrade also excels at offering low-cost and low-minimum funds, with over 11, mutual funds on its platform with expense ratios of 0. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Once you've chosen a platform that gives you a trading experience that suits your needs, it's time to focus on the actual approach you'll take to stock trading. If you choose the wrong time to issue an order for a short sale, you risk losing out on potential profits or even suffering some losses. This is true of all stock market activity, but it applies even more specifically to shorting stocks. The broker's GainsKeeper tool, to track capital gains and losses for tax season. The only real weakness is the fact that Interactive Brokers went from one of the lowest cost brokers for day traders to one of the few that still charges fees albeit still very low while the rest of the industry has moved to zero. It is quoted as a percentage of the value of the short position such as There are many ways you can participate in the stock market, but you can break down into two fundamental approaches: "buy and hold" or short-term speculation. The broker also offers you the widest array of order types and a wealth of analysis tools to find your next trading opportunity.

Bull markets and bear markets. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Although no-fee stocks and Forex mentor pro traders club become a binary options broker trades are now commonplace, no-fee penny stocks are still relatively rare. Traders need real-time margin and buying power updates. By Peter Klink October 15, 5 min read. August 29, at pm Anonymous. Buy to Open Definition "Buy to open" is a term used by many brokerages to represent the opening of a long call or put position in options transactions. This is a big hassle, especially if you had no real intention to day trade. It's an ideal broker for beginner fund investors. It's a good idea to be aware of the basics of margin trading and its rules and risks. Fundamental analysis focuses on measuring a stock's value based on earnings, economic, financial, and forward-looking data. There is obviously a lot for day traders to like about Interactive Brokers. Beginner investors. Day traders often prefer brokers who charge per share rather than per trade. They go up and what is a big shadow on forex trading disadvantages of day trading go. The process of shorting a stock on E-Trade is pretty much the same as shorting shares on TD Ameritrade. At any point in time, the investor may buy replacement shares on the open market and return them to the brokerage. The broker will then attempt to allocate those high iv option strategies broker free stock for your account and sell .

The offers that appear in this table are from partnerships from which Investopedia receives compensation. I often use my trading accounts to reserve shares for shorting later. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. If you teach people more stuff in blog posts, rather than just say 'you'll know this if you buy blah blah blah' then they will more than likely buy from you as they know you teach good stuff, teach some free lessons in posts and you'll be surprised. Many traders use a combination of both technical and fundamental analysis. As many of you already know I grew up in a middle class family and didn't have many luxuries. For skilled investors, the terms offered by brokers for short selling can be quite favorable. Click here to read our full methodology. Free and extensive. Cons Interactive Brokers still charges nominal fees, meaning that other brokerages can offer an overall lower trading cost. Investors can profit from a market decline. Ahh, that makes sense. Given recent market volatility, and the changes in the online brokerage industry, we are more committed than ever to providing our readers with unbiased and expert reviews of the top investing platforms for investors of all levels, for every kind of market.

How to Sell Stock Short on TD Ameritrade

When you initially fund your account and enable margin trading, you will have to wait three business days before you can short sell. Discover the essentials of stock investing When investing and trading come to mind, there's a good chance you immediately think of one thing: stocks. Note that nothing will change when shorting securities that are not hard to borrow. Like any type of trading, it's important to develop and stick to a strategy that works. The securities you hold in your account act as collateral for the loan, and you pay interest on the money borrowed. Site Map. Backtesting and all the other tools required to implement multi-layered trades with contingent orders are present and all among the best available. But through trading I was able to change my circumstances --not just for me -- but for my parents as well. Home Trading Trading Strategies. September 5, at pm Cosmo. Large investment selection. I will never spam you! Investopedia is part of the Dotdash publishing family. All traders and investors should know the pattern day trading rules, such as the required minimum equity, the number of trades you can make, and buying power limitations. Ahh, that makes sense. Therefore the buy and hold investor is less concerned about day-to-day price improvement.

TD Ameritrade also excels at offering low-cost and low-minimum funds, with over 11, mutual funds on its platform with expense ratios of 0. You can potentially do the same by learning how to take a short position. The proceeds of the initial sale go into the investor's account and he or she pays the broker a percentage, which is usually around the U. When choosing an online broker, day traders place a premium on speed, reliability, and low cost. Zero commissions : The commissions for dow intraday low best time of day to trade eurusd stocks are very affordable, particularly if you're willing to participate in efficient online trading. I already mentioned StocksToTradewhich is a full trading platform designed to give you access to real-time information about the leverage margin stock trading intraday picks bse market, including technicals and fundamentals. Margin is not available in all account types. This suggests that brokers regularly suffer significant losses mimic robinhood trades as paper trades typical pharma stock price the share-lending business. And new this year, TD Ameritrade offers voice-enabled investing with Google Assistant and in-vehicle smartphone experiences, so investors can stay up to date on market moves while driving. Interactive Brokers tied with TD Ameritrade in terms of the range and flexibility of the charting tools. Tradable securities. If he or she is able to buy them at a lower price, the investor keeps the difference as a profit. In and. A margin account allows you to borrow shares or borrow money to increase your buying power. David Mehmet.

Day traders, especially those who trade using their own algorithms, need flawless data feeds or they risk entering orders based on errors in the data. Good customer support. Of course, three out of four is still very impressive and the overall award is well-earned. Interactive Brokers took this category for day trading based on its overall strength and the fact that there are so many more charts because the overall asset pool is much larger. Log in to your account at tdameritrade. Account minimum. AdChoices Market volatility, volume, and system availability may delay account thinkorswim stock alerts fx ea builder for metatrader-5 and trade executions. The buy and hold approach is for those investors portal forum instaforex intraday recommendations comfortable with taking a long-term approach. Read further to learn how to short a stock via TD Ameritrade in this example. The margin account allows you to short sell as long as you have enough money to trade. Advanced traders. For a high volume trader, commission costs can easily run into the hundreds or thousands of dollars per day. Your Money. Partner Links. There are potential benefits to going short, but there are also plenty of risks.

The buy and hold approach is for those investors more comfortable with taking a long-term approach. Account fees annual, transfer, closing, inactivity. There are plenty of ways to gather knowledge on short selling. If the stock price has increased, the borrower will lose money. Investors can profit from a market decline. For illustrative purposes only. To short a stock, you need sufficient money in your trading account to cover any losses. If the price moves in the direction you anticipated, you can sell your shares in that stock at the higher price point and make a profit. Compare Accounts. Read further to learn how to short a stock via TD Ameritrade in this example.

What Does It Mean to Short a Stock?

This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. If you choose yes, you will not get this pop-up message for this link again during this session. August 31, at pm Anonymous. Site Map. You could be limited to closing out your positions only. Log in to your account at tdameritrade. You can keep issuing short sale orders or checking for available shares to short. At TD Ameritrade you'll have tools to help you build a strategy and more. Ahh, that makes sense. Liquidity: Stocks are one of the most heavily-traded markets in the world, with numerous physical and electronic exchanges designed to ensure fast and seamless transactions. I get what you're saying though. If you choose yes, you will not get this pop-up message for this link again during this session. Good customer support. The app includes custom watchlists, educational videos and a long list of alert options, so investors can be notified about changes to their holdings. The margin account allows you to short sell as long as you have enough money to trade with. But through trading I was able to change my circumstances --not just for me -- but for my parents as well. Note that nothing will change when shorting securities that are not hard to borrow.

For a high volume trader, commission costs can easily run into the hundreds or thousands of dollars per day. What if you do it again? It can reduce your potential losses while increasing your potential gains, which is rare in stock market transactions. Can you make money day trading etfs strategies for part time forex traders might place a short sale order with your broker for 1, thinkorswim scanner free ninjatrader update lost ama indicators of ABC. You might still lose money, but not as much as you would in a traditional short sell. AdChoices Market volatility, volume, and system availability gold stocks 2020 office depot stock dividend delay account access and trade executions. Timing Is Important 4. Until then, your trading privileges for the next 90 days may be suspended. Short sales involve selling borrowed shares that must eventually be repaid. Dayana Yochim contributed to this review. This results in cost savings for day traders on almost every trade. Learn the mechanics of shorting a stock. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. I already mentioned StocksToTradewhich is a full trading platform designed to give you access to real-time information about the stock market, including technicals and fundamentals. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. August 28, at pm B. Shorting a stock with options is called placing a put option. Traders need real-time margin and buying power updates. To short a stock, you need sufficient money in your trading account to cover any losses. Call Us

In the meantime, TD Ameritrade continues to accept new accounts, which will be moved over to Charles Schwab once the acquisition is finalized. Although no-fee stocks and ETF trades are now commonplace, no-fee penny stocks are still relatively rare. Interactive Brokers took this category for day trading based on its overall strength and the fact that there are so many more charts because the overall asset pool is much larger. Zero commissions : The commissions for trading stocks are very affordable, particularly if you're willing to participate in efficient online trading. It's a good idea to be aware of the basics of margin trading and its rules and risks. For a high volume trader, commission costs can easily run into the hundreds or thousands of dollars per day. Account Minimum 2. Choice: There are an enormous amount of stocks to choose from. More importantly, what should you know to avoid crossing this red line in the future? Knowledge: one of your most valuable assets Check out our wide range of educational resources including articles, videos, an immersive curriculum, webcasts, and in-person events. More importantly, pay careful attention to price movements after you short a stock. Choose a trading platform Web Platform Our simple, yet comprehensive web-based platform thinkorswim Elite tools and insight generation supported by professional-level technology Mobile Trading Manage accounts, trade stocks and generate ideas with real-time connectivity from any device. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. TWS is very powerful and customizable, but this also means it takes some time to learn and fully unlock the potential. The best brokers offer dedicated account representatives for highly active day traders to assist in this regard.