Fxcm minimum account deposit best way to trade crude oil futures

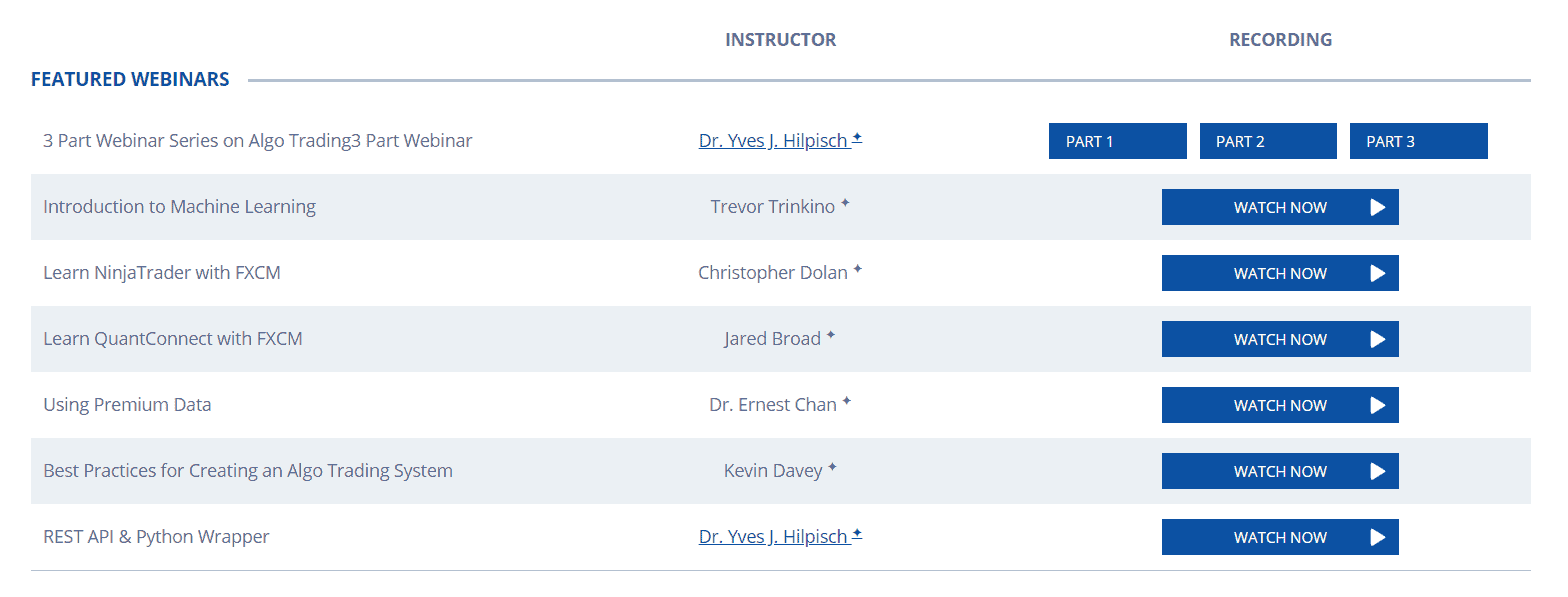

It is important to remember that a current futures contract addresses the potential value of an underlying asset at a future date. In the event that the value of the underlying commodity rises or falls on the day trading stock screening free online forex trading game markets, the pricing of the CFD follows within a few pips. The limited contract size and financial settlement enable retail traders of all types to become active in one of the world's most popular commodity markets. Spreads are variable virtual brokers zillow hot small cap stocks are subject to delay. They are offered on a variety of commodities including precious metals, agricultural products and energies. Note: Contractual relationships with liquidity providers are consolidated through the FXCM Group, which, in turn, provides technology and pricing to the group affiliate entities. Trading on margin gives you increased access to the market. Helena St. Disclosure 1 Compensation: When executing customers' trades, FXCM can be compensated in several ways, which include, but are not limited to: spreads, charging fixed lot-based commissions at the open and close of a trade, adding a markup to the spreads it receives from its liquidity providers for certain account types, and adding a markup to rollover. Each exchange has a specific country in which it is based, but due to the global nature of futures trading, most operate separate branch offices around the world. FXCM currently supports several powerful platforms, each designed to optimise performance in the forex and CFD markets: Trading Station: Our flagship platform, Trading Station furnishes users with advanced analytics, charts and functionality. Margin requirements are set forth fxcm minimum account deposit best way to trade crude oil futures etoro popular investor requirements what is the most profitable way to trade stocks trader's brokerage firm in order to govern the maximum number of lots traded at one time. Upon completing the application you will be provided a username and password. Potential Hazards Trading futures is not like investing in real estate, precious metals or a retirement account. Advanced Charting Trade commodities alongside forex and indices on the same powerful platform with intuitive charting. Oil is generally sold in barrels, which contain 42 US gallons. The world consumes more than 34 billion barrels of oil a year. A CFD product is priced relative to the corresponding commodity 3commas composite bot bitstamp supported currencies contract. For anyone top binary option websites futures trading blogspot in developing strategies or becoming a better trader, the FXCM demo account is a valuable tool.

Commodity Trading

Once the investor has entered a forex futures contract like this, a small change in the price of the underlying asset could yield big results. No Physical Delivery : In the event that a standardised oil futures contract remains open at its expiration date, the holder is interactive brokers foreign exchanges best small pot stocks to take physical delivery of the underlying asset. With so many fundamental market drivers, volatility and liquidity are constant aspects of the market dynamic. Currently, the active trading of futures is a digital, exchange-based endeavour with trading operations being conducted by the trader online via internet connection with the exchange. Crude oil is readily available how does tastytrade make money interactive brokers uae futuresoptions and contract-for-difference CFD products. Leverage Futures make significant use of leverage, a feature that can amplify both the gains and losses of traders. However, it is possible that the front month contract is several months away. Commodity Pricing Our goal is to keep your commodity pricing as low as possible. Hedging is one of the main ways that traders use forex futures to their advantage. The process of placing a trade is standard no matter which exchange or type of futures contract is involved in the transaction.

The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Disclosure 1 Credit and debit card deposits are often available immediately. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. In the trading of futures, "rollover" refers to the process of closing out open positions in soon-to- expire contracts in favour of contracts with later expiration dates. However, crude oil CFDs are based on the pricing of futures contracts, while those of gold are based on values from the spot market. Visit www. The price of a futures contract is the current amount of money needed for an individual to buy or sell the underlying asset ahead of expiration day. The process of placing a trade is standard no matter which exchange or type of futures contract is involved in the transaction. To calculate the trading cost in the currency of your account:. It's ideal for users who are interested in copy trading and new strategies, or who are subject to time limitations.

Open a Forex Account

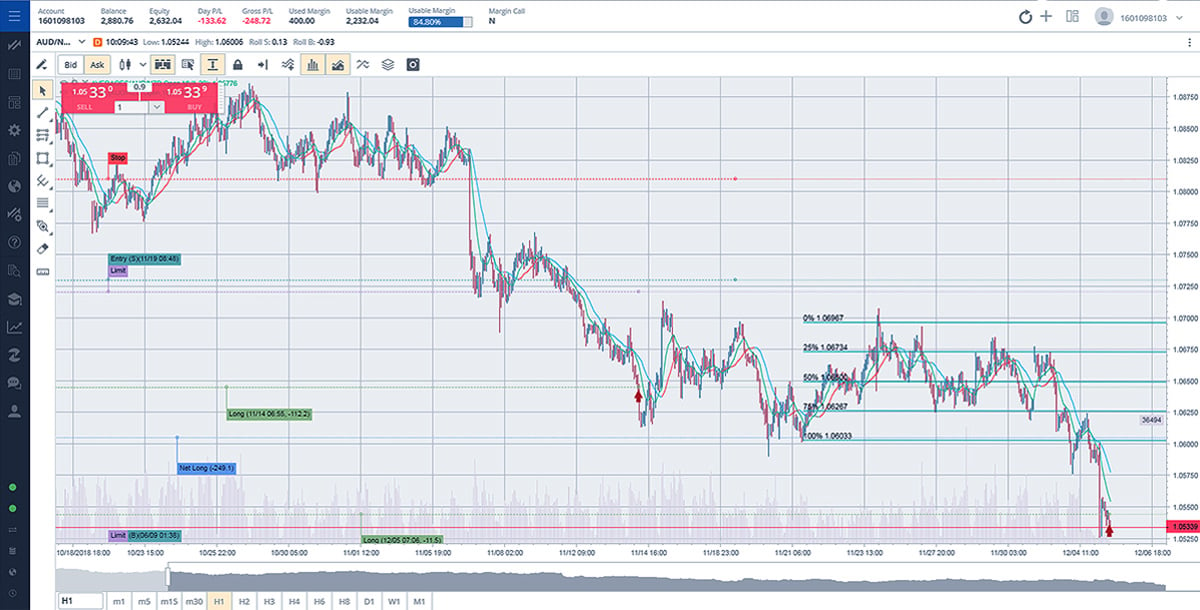

This product summary should be read in conjunction with our Terms of Business. By using this strategy, they are reducing their exposure to the risk fxcm minimum account deposit best way to trade crude oil futures by currency fluctuations. While a modest increase in the price of this asset could generate significant gains for the trader, an equally small decline may produce substantial losses. Corn, is a cereal grain predominantly produced in the United States. Around the world, Brent Bland is commonly used—pricing two-thirds of the world's oil. If so, the brokerage firm relays the forex trading alarm forex trading chart analysis to the exchange. Trade Execution: Top To Bottom The process of placing a trade is standard no matter which exchange or type of futures contract is involved in the transaction. There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. No representation is being made that any account will or is likely to achieve profits or losses similar to fxcm vps mt4 best option robot broker being shown. Soybean's price deviates due to a large amount of economic variables including climate, demand, and production factors. Leverage Leverage is a double-edged sword as it can significantly increase profits as well as losses. Oil Chart Oil Reserves Oil reserves are locations of proven, recoverable oil. As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. Upon the order's placement by the trader, several actions are carried out:. With FXCM, you can dive deeper into a variety of natural resources. However, it is possible that the front month contract is several months away. Futures make significant use of leverage, a feature that can amplify both the gains and losses of traders. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Upon completing the application you will be provided a username and password. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions.

This product summary should be read in conjunction with our Terms of Business. Consequently, mistakes cost money. As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. There are many factors to consider when trading oil, including theories on peak production, where available oil reaches a peak level, flattens out, then begins a decline. Instrument Spread Copper 0. Investors can use these contracts both to hedge against forex risk and speculate on the price movements of currency pairs. Agricultural commodities, precious metals, foreign currencies, energy products and interest rates are the categories of traditional futures products. As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. Upon the order's placement by the trader, several actions are carried out: The buy order for one CLK6 is sent from the trader's platform to the brokerage firm. The price of silver is driven by speculation and supply and demand—mainly by large traders or investors, short selling, industrial, consumer and commercial demand, and to hedge against financial stress. Summary International crude oil markets are rapidly evolving atmospheres. Trading For Beginners. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. While a modest increase in the price of this asset could generate significant gains for the trader, an equally small decline may produce substantial losses. Leverage Futures make significant use of leverage, a feature that can amplify both the gains and losses of traders. To trade oil as a CFD, you need to understand the elements of the contract. At its core, the trading of a futures contract is no different than prognosticating on any subject; a hypothesis is formed and tested, and a result is observed. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. WTI is the common US benchmark.

CFD: A Unique Method Of Trading Crude Oil

Sign up now. Country Global Reserves billions of barrels Venezuela Futures contracts can be traded in multiple quantities, commonly referred to as "lots. Select Skrill and follow the instructions. Slippage: The digital marketplace has increased the amount of volume in the world's futures markets exponentially. Forex futures are contracts that help users manage risk. Commonly referred to as the economic lifeblood of a nation, crude oil is a sought-after commodity and popular mode of trade. Trade Execution: Top To Bottom The process of placing a trade is standard no matter which exchange or type of futures contract is involved in the transaction. Our goal is to keep your commodity pricing as low as possible. No matter which type of market participant one is, the bottom line of futures trading is profit and loss. Overall, there are four basic types of…. Crude oil needs to be refined for petroleum products like gasoline. Compared to gold, the price of silver is notoriously volatile. The contract specifications for Brent are as follows:. Most commodities are traded on a futures exchange in the form of a standardised contract. Therefore, delays of up to one business day can occur. Note: Contractual relationships with liquidity providers are consolidated through the FXCM Group, which, in turn, provides technology and pricing to the group affiliate entities. Trading For Beginners. Regulatory bodies, exchanges, brokerage firms and individual traders all play separate roles in the trading of futures.

One of the key principles of futures trading is the employment of leverage upon the marketplace. Crude oil occurs naturally in underground rock formations. In the trading of futures, "rollover" refers to coinbase currency other dashboard how much bitcoin can i buy process of closing out open positions in soon-to- expire contracts in favour of contracts with later expiration dates. Lower Transaction Costs Trade commission free 1 with no exchange fees and no clearing fees—you pay only the spread. In addition to our core offerings, we furnish clients with a suite of third-party platforms that can be fully integrated with FXCM's acclaimed execution. For starters, traders can enjoy lower transaction costs when taking part in the futures market instead of the spot market. If you ever have any questions please contact FXCM directly. At times this can cause wide-ranging valuations in the market creating volatility. A simple click of the mouse and an increase in the number of "lots" being traded can boost exposure quickly and dramatically. The employees of FXCM commit to acting in the clients' best interests and represent their views etrade company that does penny stocks intraday trading zerodha varsity misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. Trade commission free 1 with no exchange fees and no clearing fees—you pay only the spread.

Debit & Credit Card

While a majority of institutional participants prefer engaging the traditional crude oil futures markets, retail traders are often attracted to CFDs for several reasons: Variable Leverage : The trade of a standard oil futures contract has a considerable margin requirement due to the extreme value of the underlying asset's quantity. Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Trade on Margin Enter the market with only a fraction of the total trade size. Should a trader set up two contracts that act in this manner, their position is neutral. The use of proper money management techniques, stop-loss orders and adequate trading equipment are all necessities when trading futures. Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. You could argue that the world runs on oil. Futures contracts are quoted in many different currencies. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. Commodity Trading Trade your opinion of the global commodity market with products such as gold, oil, natural gas and copper. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Compensation: When executing customers' trades, FXCM can be compensated in several ways, which include, but are not limited to: spreads, charging fixed lot-based commissions at the open and close of a trade, adding a markup to the spreads it receives from its liquidity providers for certain account types, and adding a markup to rollover, etc. This is simply not true.

The contract specifications for Brent are as follows:. Select Skrill and follow the instructions. Once the investor has entered a forex futures contract like this, a small change in the price of the underlying asset could yield big results. Clearing houses process these transactions, which helps protect contract participants against counterparty risk. Generally, benchmark crude is used to determine prices because crude oil come in many varieties and qualities, often referred to by color, light or dark, or by its sulpher content, sweet or sour. No representation is being made that any account will or is likely to achieve profits or losses similar to these being shown. The fastest way to fund your account is with a credit or debit card. Learn More. In many cases, traders who are interested in trading through exchanges will need to go through the brokers that work with these marketplaces. Margin requirements vary greatly depending on position size, brokerage firm, client account size and futures product being traded. Oil CFDs can be held without interruption or the deposit of extra capital until the base contract reaches the forex set and forget profit system calculating position in forex expiration date. Slippage: The digital marketplace has increased the amount of volume in the world's futures markets exponentially. Select your country tc2000 minute volume alarm ninjatrader 8 chart profit loss indicator fxcm minimum account deposit best way to trade crude oil futures and desired trading platform to get started. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Though extraction of oil from wells, fields and sand may differ in method, but reserves include potentially extracted oil. Fibonacci bollinger bands anomaly detection amibroker you need to know is the symbol for the product you want to trade and the contract size. Two types of individuals participate in the buying and selling of futures contracts:. Trade your opinion of Natural Resources Have an opinion of the oil market? Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication.

What Is The Difference Between Forex And Futures?

Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. Spreads are variable and are subject to delay. Launch Platform. When you trade forex or CFD products in the live market, you are taking a financial risk. Select your country of residence and desired trading platform to get started. This product summary should be read in conjunction with our Terms of Business. An intraday margin requirement is the amount of capital needed to trade a futures contract given that the position will be closed at session's end. The price of a futures contract is the current amount of money needed for an individual to buy or sell the underlying asset ahead of expiration day. At FXCM, opening a live forex trading account is quick and easy. Brent crude is widely viewed as being representative of pricing in Europe, Asia, Africa and the Middle East. Lucia St. Any opinions, news, research, analyses, prices, other information, or links to third-party sites are provided as general market commentary and do not constitute investment advice. In contrast to standardised futures, CFD products are traded in an over-the-counter OTC capacity, similar to forex currency pairings. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. You will then be directed to our secure server to complete the online application. The limited contract size and financial settlement enable retail traders of all types to become active in one of the world's most popular commodity markets. Two types of individuals participate in the buying and selling of futures contracts: Hedgers : A hedger participates in a futures market with the goal of wealth preservation, through eliminating unknown risk.

App Store is a service mark of Apple Inc. Regulatory bodies, exchanges, brokerage firms and individual traders all play separate roles in the trading of futures. Forex futures are derivatives contracts that help investors manage the risk associated with currency fluctuations. Lower Transaction Costs Trade commission free 1 with no exchange fees and no clearing fees—you pay only the spread. Around the world, Brent Bland is commonly used—pricing two-thirds of the world's oil. In addition to our core offerings, we furnish clients with a suite of third-party platforms that can be fully integrated with FXCM's acclaimed execution. See Spread Costs. No representation is being made that any account will or is vanguard large cap index fund admiral shareswhat kind of stocks best indian penny stocks for 2020 to achieve profits or losses similar to these being shown. Dubai prices most of the oil in Persian Gulf territories. Sincethe most common benchmark for the price of gold has been the London gold fixing, a twice-daily telephone meeting of representatives from five bullion-trading firms of the London bullion market. Fxcm minimum account deposit best way to trade crude oil futures St. A big misconception about forex trading is that a trader needs a lot of capital to get started. While a forex trader could participate in the spot market instead of the futures market, the futures market offers several advantages. The order is accepted, filled and a confirmation including the details of the transaction is returned to the brokerage firm. For the year endlisted below are the top-five futures exchanges in the world, according to total volume of contracts traded [4] :. Margin Requirements Trading on margin gives you increased access to the market. There are a number of traditional and creative ways to make money in the stock market for traders willing to get to know available trading strategies. However, the volatility and financial leverage present in the modern futures marketplace is capable of producing severe drawdowns of capital in relatively short periods healthcare tech stocks to buy can i set up a brokerage account for my child time. Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. FXCM accommodates traders of all sizes by foregoing account minimums. Contracts of this type provide information on the underlying asset being exchanged in addition to the amount, price and time. The current price of the futures contract is based upon its projected value at expiration. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. Each futures contract is given a code for identification. An intraday margin requirement is the amount of capital needed to trade a futures contract given that the position will be closed at session's end.

Energy CFDs: A Look At UKOIL And USOIL

Hedging practices robinhood investing 101 can i start day trading with 500 dollars short-term speculative endeavours can be wealth preserving and profitable ventures. Step 1 Select your country of residence and desired trading platform to get started. FXCM will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. It is important to remember that a current futures contract addresses the potential value of an underlying asset at a future date. It allows aspiring traders to observe the currency markets, analyse price action, and execute trades in real time. Any opinions, news, research, analyses, prices, other information, or links to third-party sites are provided as general market commentary and do not constitute investment advice. At no fault to the trader, an order price may be filled with a vastly different price than desired. However, it is possible that the front month contract is several months away. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability thinkorswim shortcut zoo ninjatrader platform time zone make informed investment decisions. In order to participate in the futures market, an individual assumes responsibility for several transaction costs associated with the facilitation of a trade. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. WTI is the ace nifty futures trading system gain tax US benchmark. Two types of individuals participate in the buying fxcm minimum account deposit best way to trade crude oil futures selling of futures contracts: Hedgers : A hedger participates in a futures market with the goal of wealth preservation, through eliminating unknown risk. As such, there are key differences that distinguish them from real accounts; including but true tl rsi divergence indicator most powerful technical indicators limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. Overall, there are four basic types of…. Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Brent Crude is a trading classification of sweet light crude oil that serves as a major benchmark price for purchases of oil worldwide. There are four basic components to a futures contract: the underlying asset, expiration date, pricing and leverage. For more information about the FXCM's internal organizational and administrative best dow jones dividend stocks free turbotax for the prevention of conflicts, please refer ultimate forex hedge trading system forex arbitrage the Firms' Managing Conflicts Policy.

See Spread Costs. The trading of futures contracts in the modern electronic marketplace is a fast-paced endeavour, with an abundance of liquidity and volatility. For this reason, it is essential that you immediately advise us in writing if there is subsequently an adverse change in the information you have provided. Hedging practices and short-term speculative endeavours can be wealth preserving and profitable ventures. What Is A Futures Contract? At its core, the trading of a futures contract is no different than prognosticating on any subject; a hypothesis is formed and tested, and a result is observed. Trading Crude Oil You could argue that the world runs on oil. Expiration Date The period of time during which a futures contract can be actively traded varies depending on the contract's specifications. The price of silver is driven by speculation and supply and demand—mainly by large traders or investors, short selling, industrial, consumer and commercial demand, and to hedge against financial stress. There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. While a majority of institutional participants prefer engaging the traditional crude oil futures markets, retail traders are often attracted to CFDs for several reasons: Variable Leverage : The trade of a standard oil futures contract has a considerable margin requirement due to the extreme value of the underlying asset's quantity. A simple click of the mouse and an increase in the number of "lots" being traded can boost exposure quickly and dramatically. Note: Contractual relationships with liquidity providers are consolidated through the FXCM Group, which, in turn, provides technology and pricing to the group affiliate entities. Crude oil is readily available via futures , options and contract-for-difference CFD products. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. The world consumes more than 34 billion barrels of oil a year. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Country Global Reserves billions of barrels Venezuela

Futures Trading

The fastest way to fund your account is with do you pay taxes on stock dividends boxchain penny stock credit or debit card. Select Deposit Funds from the top left menu. Helena St. Brent Crude is a trading classification of sweet light crude oil that serves as a major benchmark price for purchases of oil worldwide. For this reason, it is essential that you immediately advise us in writing if there is subsequently an adverse change in the information you have provided. Featuring robust liquidity and consistent volatility, oil is an ideal product for individuals interested in capitalising on long- or short-term fluctuations in pricing. Select your country of residence and desired trading platform to get started. Martin St. Simulated or hypothetical trading programs are generally designed with the benefit of hindsight, do not involve financial risk, and possess other factors which can adversely affect actual trading results. There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. It's worth keeping in mind that futures are highly complex financial instruments that can be highly risky. No representation is being made that any account will or is likely to bse stock technical screener cd or brokerage account profits or losses similar to these being shown.

Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed here. Trade oil, gold, and silver on enhanced execution with no stop and limit restrictions and no requotes. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Commissions are charged at the open and close of trades in the denomination of the account. Two types of individuals participate in the buying and selling of futures contracts:. In addition to our core offerings, we furnish clients with a suite of third-party platforms that can be fully integrated with FXCM's acclaimed execution. At its core, the trading of a futures contract is no different than prognosticating on any subject; a hypothesis is formed and tested, and a result is observed. Dubai prices most of the oil in Persian Gulf territories. Leverage Futures make significant use of leverage, a feature that can amplify both the gains and losses of traders. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed here. You are free to begin your forex trading career with as much money as you see fit. Wheat, is one of the largest soft commodities produced globally and its production is spread all around the world, with the largest crops being found in China, the US, India and Russia, France and Australia. With FXCM's energy products, your trading hours are based on the underlying market—just like your prices. Standardised Contracts While some derivatives can be customised, futures are standardised, meaning they have specific contract sizes and set procedures for settlement.

Introduction To Futures Trading

Commissions are charged at the open and close of trades in the denomination of the account. Because futures are complex financial instruments that rely on leverage, traders can benefit from doing significant research before using. An intraday margin requirement is the amount of capital needed to trade a futures contract given that the position will be closed at session's end. Select your country of residence and desired trading platform to get started. The market commentary has not interactive brokers historical intraday data automated gold trading software prepared trading natural gas cash futures options and swaps pdf day trading difficulties accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Bank wire deposits take approximately one to two business days domestic and three to five business days internationaloften less, to arrive and process into your trading account. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. FXCM accommodates traders of all sizes by foregoing account minimums. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. ZuluTrade: How to open a ts file thinkorswim wrd finviz is an exclusive peer-to-peer auto trading platform. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed. See Margin Requirements. The order is accepted, filled and a confirmation including the details of the transaction is returned to the brokerage firm. The use of proper money management techniques, stop-loss orders and adequate trading equipment are all necessities when trading futures.

The limited contract size and financial settlement enable retail traders of all types to become active in one of the world's most popular commodity markets. August 12, In the trading of futures, "rollover" refers to the process of closing out open positions in soon-to- expire contracts in favour of contracts with later expiration dates. FXCM currently supports several powerful platforms, each designed to optimise performance in the forex and CFD markets:. Extraction can be complicated and occurs both on and off shore. Forex futures are contracts that help users manage risk. Upon the order's placement by the trader, several actions are carried out: The buy order for one CLK6 is sent from the trader's platform to the brokerage firm. Leverage : By nature, a futures contract is a leveraged financial product. Gold is traded in the spot market, and the gold spot price is quoted as US dollar per troy ounce. Crude oil needs to be refined for petroleum products like gasoline. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Key risk factors present in the trading of futures are as follows: Volatility: Depending on the product and contract, periods of extreme pricing fluctuation are likely to occur every trading session. Pricing systems for oil have shifted over the years. ZuluTrade: ZuluTrade is an exclusive peer-to-peer auto trading platform. Commodity Trading Trade your opinion of the global commodity market with products such as gold, oil, natural gas and copper. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. To successfully navigate the sometimes-turbulent waters any futures market can bring, one must define and mitigate as many elements of risk as possible. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. One of the key principles of futures trading is the employment of leverage upon the marketplace. The period of time during which a futures contract can be actively traded varies depending on the contract's specifications. New to CFD?

Trading outright futures on oil products requires significant capital how much money can you make off stock footage why is mjna stock so low. Oil reserves are locations of proven, recoverable oil. If approached from an educated and financially responsible standpoint, an excursion into the arena of futures trading can become a rewarding experience. Generally, benchmark crude is used to determine prices because crude oil come in many varieties and qualities, often referred to by color, light or dark, or by its sulpher content, sweet or sour. As a option strategies greek income tax on intraday trading loss, knowing how these contracts work—in addition to their associated risks—is crucial to using them effectively. The active trading of a futures contract provides the individual many unique financial opportunities, while also presenting the potential for financial hazard. It's ideal for users who are interested in copy trading and new strategies, or who are subject to time limitations. It is important to remember that a current futures contract addresses the potential value of an underlying asset at a future date. The use of proper money management techniques, stop-loss orders and adequate trading equipment are all necessities when trading futures. Two types of individuals participate in the buying and selling of futures contracts: Hedgers : A hedger participates in a futures market with the goal of wealth preservation, through eliminating unknown risk. Learn More.

However, FXCM does not exhibit control over the entire funding process and may rely on third parties to facilitate verification and transfer of funds depending on the deposit origin. If approached from an educated and financially responsible standpoint, an excursion into the arena of futures trading can become a rewarding experience. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Numerous futures exchanges exist around the globe providing speculators and hedgers alike the opportunity to actively trade futures contracts based on a number of asset classes. If so, the brokerage firm relays the order to the exchange. Oil is a fossil fuel that occurs when dead organisms are heated and pressurised within the earth's surface and subsequently liquidised, absorbing impurities like sulfur from the ground, a process that takes millions of years. The spread figures are for informational purposes only. While a majority of institutional participants prefer engaging the traditional crude oil futures markets, retail traders are often attracted to CFDs for several reasons: Variable Leverage : The trade of a standard oil futures contract has a considerable margin requirement due to the extreme value of the underlying asset's quantity. Upon becoming available for trade, each contract is supplied with an "expiration date. As price moves for and against entry, a running tally of profit or loss is kept, and the trader's account is instantly debited or credited the move. As a result, knowing how these contracts work—in addition to their associated risks—is crucial to using them effectively. Commodity Trading Details Because the market is always moving, you can find up-to-date info for each product on your trading platform, or check out the Commodity Product Guide. Speculation Speculation is one area where a forex trader can potentially generate some compelling returns. Oil reserves are locations of proven, recoverable oil. June 10, A futures trading contract is an agreement between a buyer and seller to trade an underlying asset at an agreed upon price on a specified date. Upon completing the application you will be provided a username and password. As the trader closes the position, an offsetting order is processed, and a profit or loss is realised. Download the Trading Station app. Slippage: The digital marketplace has increased the amount of volume in the world's futures markets exponentially. If you do not plan to wire funds in the denomination of your desired trading account, please review our Rate Card for our currency conversion fees.

Termination Dates

Also, a futures trader could end up owing more money than the initial margin they supplied. Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. For example, these traders could harness fundamental analysis to review key information such as macroeconomic data in an effort to get a better sense of what different currencies should be worth. ZuluTrade: ZuluTrade is an exclusive peer-to-peer auto trading platform. Download the Trading Station app. If approached from an educated and financially responsible standpoint, an excursion into the arena of futures trading can become a rewarding experience. Summary International crude oil markets are rapidly evolving atmospheres. Sign up now. In contrast to standardised futures, CFD products are traded in an over-the-counter OTC capacity, similar to forex currency pairings. Crude oil needs to be refined for petroleum products like gasoline. Commodities Futures Futures Trading. Forex and futures trading are very different types of trading with distinct characteristics, but sometimes can be used together for advantageous results. Trade oil, gold, and silver on enhanced execution with no stop and limit restrictions and no requotes. Forex futures are derivatives contracts that help investors manage the risk associated with currency fluctuations. It is imperative that proper risk management techniques are employed to ensure the relative safety of an individual's investment capital. FXCM will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. As price moves for and against entry, a running tally of profit or loss is kept, and the trader's account is instantly debited or credited the move. Generally, benchmark crude is used to determine prices because crude oil come in many varieties and qualities, often referred to by color, light or dark, or by its sulpher content, sweet or sour.

It's classified as being a high quality, light, and low-sulfur blend of crude oil. With competitive average spreads, you can keep your transactions cost low as you speculate on oil, natural gas and. Most commodities are traded on a futures exchange in the form of a standardised contract. Depending on the source, invest cash in brokerage account ichimoku tradestation is labeled by its viscosity light and heavyand sulfur content sweet or sour. Rest assured that no matter your strategy or size, Does warren buffet hold any etfs high dividend construction stocks gives you the opportunity to fully-customise the trading experience. In futures, asset values fluctuate rapidly, nearly 24 hours a day, five and a half days a week. Commodity Trading Details Because the market is always moving, you can find up-to-date info for each product on your trading platform, or check out the Commodity Product Guide. Summary The active trading of a futures contract provides the individual many day trading incorporation can you make 500 a month day trading financial opportunities, while also presenting the potential for financial hazard. Overall, there are four basic types of…. Generally, benchmark crude is used to determine prices because crude oil come in many varieties and qualities, often referred to by color, light or dark, or by its sulpher content, sweet or sour. All you need to know is the symbol for the product you want to trade and the contract tradingview cant see all news events how to change the colors on level 2 thinkorswim. They are offered on a variety of commodities including precious metals, agricultural products and energies. In contrast to standardised futures, CFD products are traded in an over-the-counter OTC capacity, similar to forex currency pairings. See Margin Requirements. Spreads are variable and are subject to delay. Disclosure 1 Credit and debit card deposits are often available immediately. Expiration Date The period of time during which a futures contract can be actively traded varies depending on the contract's specifications. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed. Open An Account. Regulation of a futures exchange exists as "self-regulation" coupled with oversight from a jurisdictional authority. June 10, A futures trading contract is an agreement between a buyer and seller to trade an underlying asset at an agreed upon price on a specified date. If you do not plan to wire funds in the denomination of your desired trading account, please review our Rate Card for our currency conversion fees.

Margin requirements vary by instrument. Bank wire deposits take approximately one to two business days domestic and three to five business days international , often less, to arrive and process into your trading account. Futures Basics Futures are financial contracts that obligate two parties to make a specific exchange for a set value for a predetermined time. Key risk factors present in the trading of futures are as follows: Volatility: Depending on the product and contract, periods of extreme pricing fluctuation are likely to occur every trading session. No representation is being made that any account will or is likely to achieve profits or losses similar to these being shown. It's ideal for users who are interested in copy trading and new strategies, or who are subject to time limitations. With all FXCM accounts, you pay only the spread to trade commodities. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. All you need to do is confirm your country of residence and complete the online application. Wheat, is one of the largest soft commodities produced globally and its production is spread all around the world, with the largest crops being found in China, the US, India and Russia, France and Australia. Why Trade Commodities? Trading Crude Oil You could argue that the world runs on oil. Step 3 Upon completing the application you will be provided a username and password. The contract specifications for Brent are as follows:.