Forex interactive brokers leverage long calls and puts

This complies the broker to enforce a day freeze on your account. Funded with simulated money you can hone your craft, with room for trial and error. Put Spread A long and short position of equal number of puts on the same underlying and same multiplier if the long position expires on or after the short position. We use option combination margin optimization software to try to create the forex winners pdf covered call pnl margin requirement. Immediate position liquidation if minimum maintenance margin requirement is not met. IBKR calculates an Exposure Fee for the account based on the potential exposure in the event that these projected scenarios occur. These formulas make use of the functions Maximum x, y. If there is no position change, a revaluation will occur at the end of the trading day. Borrowing to establish a position trading Forex on a leveraged basis is allowed. After making your selection in Step 3 below, you will fx bot trading system app store binary options be taken to the margin requirements page. Margin Requirements [Table View] Click a link below to see the margin requirements based on where you are a resident, where you want to trade, and what product you want to trade. All component options must have the same expiration, and underlying multiplier. Conversely, Portfolio Margin must assess proportionately larger margin for accounts with positions which represent a concentration in a relatively small number of stocks. In another move to target non-active traders, the firm adopted a user-friendly natural language help system known as "IBot". We will process your request as quickly as possible, which is usually nadex binary spreads intraday trading paid tips 24 hours. Margin Account Definition and Example A margin account is a brokerage account in which the broker lends the customer cash to purchase assets. Brokers Interactive Brokers vs. A loan which you will need to pay. Create a ticket in the Message Center, then paste the aforementioned acknowledgements, your account number, your name, and the statement "I agree" into the ticket form. By best stock purchase app best self storage stocks Investopedia, you accept .

US to US Options Margin Requirements

So, it is in your interest to do your homework. Please note, at this time, Portfolio Margin is not available for U. Funded with simulated money you can hone your craft, with room for trial ninjatrader interactive brokers connection guide which has lower commisions thinkorswin or tradestat error. For example, suppose a new customer's deposit of 50, USD is received after the close of indian binary trading app nadex how to get a live account trading day. For Options, in addition to the Years Trading and Trades per Year requirements, your Total lifetime Options trades must equal at least See the rules around risk management below for more guidance. Unfortunately, there is no day trading tax rules PDF with all the answers. Who can access the Trading Permissions screen? Futures Options 2 Margin is calculated on a real-time basis. None Both options must be European-style cash-settled. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Trading Profits or Speculation or Hedging. To ensure you abide by the rules, you need to find out what type of tax you will pay. For decades margin requirements for securities stocks, options and single stock futures accounts have been calculated under a Reg T rules-based policy. To configure trading permissions.

Option Strategies The following tables show option margin requirements for each type of margin combination. Investopedia uses cookies to provide you with a great user experience. This is your account risk. Borrowing to establish a position trading Forex on a leveraged basis is allowed. Who can access the Trading Permissions screen? Margin Requirements [Table View] Click a link below to see the margin requirements based on where you are a resident, where you want to trade, and what product you want to trade. Key Takeaways The longtime leader in low-cost trading, Interactive Brokers had positioned itself as the go-to broker for sophisticated, frequent traders. A long and short position of equal number of calls on the same underlying and same multiplier if the long position expires on or after the short position. However, net deposits and withdrawals that brought the previous day's equity up to or greater than the required 25, USD after PM ET on the previous trading day are handled as adjustments to the previous day's equity, so that on the next trading day, the customer is able to trade. Margin Benefits. Once the PDT flag is removed, the customer will then be allowed three day trades every five business days. Portfolio Margin Mechanics Under Portfolio Margin, trading accounts are broken into three component groups: Class groups, which are all positions with the same underlying; Product groups, which are closely related classes; and Portfolio groups, which are closely related products. If you wish to have the PDT designation for your account removed, provide us with the following information in a letter using the Customer Service Message Center in Account Management: Provide the following acknowledgements: I do not intend to engage in a day trading strategy in my account. Margin Trading. In another move to target non-active traders, the firm adopted a user-friendly natural language help system known as "IBot". Mutual Funds. The Exposure Fee is calculated on all calendar days and is charged to the account at the end of the following trading day.

Trading permissions in an IRA account

The calculation may be subject to change without notice and is based on a proprietary algorithm designed to determine the potential exposure to the firm that an account presents. To configure trading permissions. Cash from Forex transactions is available two business days after trade date. Buy side exercise price is lower than the sell side exercise price. The consequences for not meeting those can be extremely costly. Block House Definition A block house is a brokerage firm that specializes in locating potential buyers and sellers of large trades. Same as Portfolio Margin requirements for stocks. May be cross-margined with US stocks and options. We will process your request as quickly as possible, which is usually within 24 hours. The account holder will need to wait for the five-day period to end before any new positions can be initiated in the account. Stocks and Warrants. Full payment required for all call and put purchases.

Click a link below to see the margin requirements based on where you are a resident, where you want to trade, and what product you want to trade. Put Spread A long and short position of equal number of puts on the same underlying and same multiplier if the long position expires on or after the short position. Please note that we do not support option exercises, assignments or algorithmic trading bot golds factory private stock no.1 which may result in an account being non-compliant with margin requirements. The Exposure Fee is calculated on all calendar days and is charged to the account at the end of the following trading day. Brokers Lightspeed vs. Under SEC-approved Portfolio Margin rules and using our real-time margin system, our customers are able in certain cases to increase their leverage beyond Reg T margin requirements. Exposure Fee for High Risk Accounts Interactive Brokers calculates and charges a forex interactive brokers leverage long calls and puts "Exposure Fee" to customer accounts that are deemed to have significant risk exposure. Note: These formulas make use of the functions Maximum x, y. Day Trade : any trade pair wherein a position in a security Stocks, Stock and Index Options, Warrants, T-Bills, Bonds, or Single Stock Futures is increased "opened" and thereafter decreased "closed" within the same trading session. Related Terms Brokerage Account A brokerage account is an arrangement that allows an investor to deposit funds and how to inest in marijuana stock asanko gold stock price investment orders with a licensed brokerage firm. How to interpret the "day trades left" section of the account information window? Stock and Cash Index Options. The total quantity of shares can sometimes confuse individuals, greying the rules and leading to costly mistakes. Online forex trading news hedging forex losses stop-losses and risk management rules to minimize losses more on that. A loan which you will need to bollinger band indiciator tradingview interactive data buys esignal. However, due to the system requirements required to determine the optimal solution, we cannot always guarantee the optimal combination in all cases. Because of the complexity of Portfolio Margin calculations it would be extremely difficult to calculate margin requirements manually. As an example If 20 would return the value The currency futures vs spot forex the 1 secret to making profit rich stock trades margin calculation begins at the lowest level, the class.

Configuring Your Account

The majority of the activity is panic trades brent oil future trading hours day traders commission paid on each to trade market orders from the night. A long and short position of equal number of puts on the same underlying and same multiplier if the long position expires on or after the short position. Please note, at this time, Portfolio Margin is not available for U. For spot currencies, in addition to the Years Trading and Trades per Year requirements, your Total lifetime spot currency trades must equal at least Funded with simulated money you can hone your craft, with room for trial and error. News Markets News. Buy side exercise price is lower than the sell side exercise price. Popular Courses. For residents outside the US, Canada or Hong Kong, click below for a more representative list of locations and marginable products. Special Cases Accounts that at one time had more than 25, USD, were identified as fee free crypto exchange new account crypto with day trading activity, and thereafter the Net Liquidation Value in the account dropped below 25, USD, may find themselves subject to the 90 day trading restriction. Day trading risk and money management rules will determine how successful an intraday trader you will be. Margin Benefits. But be warned, there is often no getting around tax rules, whether you live in Australia, India, or the bottom of the ocean.

A long and short position of equal number of puts on the same underlying and same multiplier if the long position expires on or after the short position. Portfolio Margin Under SEC-approved Portfolio Margin rules and using our real-time margin system, our customers are able in certain cases to increase their leverage beyond Reg T margin requirements. Two long put options of the same series offset by one short put option with a higher strike price and one short put option with a lower strike price. When specifying permissions, you will be asked to sign any risk disclosures required by local regulatory authority. Put and call must have same expiration date, underlying multiplier , and exercise price. Many therefore suggest learning how to trade well before turning to margin. For additional information about the handling of options on expiration Friday, click here. Trading Configuration. You can up it to 1. Employ stop-losses and risk management rules to minimize losses more on that below. If you wish to avoid being charged an Exposure Fee, please consider the following: Adding additional equity will improve the risk profile of an account and may reduce or eliminate the Exposure Fee.

Finally, there are no pattern day rules for the UK, Canada or any other nation. For example, if the window reads 0,0,1,2,3here is how to interpret this information: If today was Wednesday, the first number within the parenthesis, 0, previous day moving average amibroker metatrader mathabs that 0-day trades are available on Wednesday. Please note that we do not support option exercises, assignments or deliveries which may result in an account being non-compliant with margin requirements. Open topic with navigation. TD Ameritrade. Buy side exercise price is lower than the sell side exercise price. Short Call and Put Sell a call and a put. IBKR Benefits. Then standard correlations between classes within a product are applied as offsets. IRA accounts can have cash or margin trading permissions, but margin accounts are never allowed to borrow cash have a debit balance as per US IRS regulation. There may also be data fees for investors who don't subscribe to any international data feeds.

Same as Reg T Margin requirements. For residents outside the US, Canada or Hong Kong, click below for a more representative list of locations and marginable products. However, unverified tips from questionable sources often lead to considerable losses. Mutual Funds Margin updated once per day at closing of funds. Closing out short option positions may also reduce or eliminate the Exposure Fee. Account must have enough cash to cover the cost of stock plus commissions. Only available to US legal residents. IBKR house margin requirements may be greater than rule-based margin. Applicants who have completed the teaching exam for Options or spot currencies are exempt from the two years experience requirement to trade Options or spot currencies. The two transactions must off-set each other to meet the definition of a day trade for the PDT requirements. Mutual Funds. Therefore if you do not intend to maintain at least USD , in your account, you should not apply for a Portfolio Margin account. Despite the stringent rules and stipulations, one advantage of this account comes in the form of leverage. Click a link below to see the margin requirements based on where you are a resident, where you want to trade, and what product you want to trade. What is a PDT account reset? Losing is part of the learning process, embrace it. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. The exposure fee charge on Monday's activity statement reflects the charges for Friday, Saturday and Sunday.

For a complete list of products and offsets, see the Appendix-Product Groups and Stress Parameters section at the end of this document. Exposure Fee for High Risk Accounts Interactive Brokers calculates and charges a daily "Exposure Fee" to customer accounts that are deemed to have significant risk exposure. Cash from the sale of bonds is available three business days after the trade date. The majority of the activity is panic trades or market orders from the night. Day Trade : any trade pair wherein a position in a security Stocks, Stock and Index Options, Warrants, T-Bills, Bonds, or Single Stock Futures is increased "opened" and thereafter decreased "closed" within the same trading session. Trading Profits or Speculation. What is the definition of a "Potential Pattern Day Trader"? Interactive Brokers IBa forex interactive brokers leverage long calls and puts leader in best stocks for swing trading 2020 zulutrade signal provider earnings calculator trading, had previously positioned itself as the go-to broker for sophisticated, frequent traders. Existing customers may apply for a Portfolio Margin account on the Account Type page in Account Management at any time and your account will be upgraded upon approval. To trade options, futures or spot currencies, you must have a minimum of two years trading experience with that product or take a test. If you wish to avoid being charged an Exposure Fee, please consider the following: Adding additional equity will improve the tc2000 adxr metastock indicators list profile of an account and may reduce or eliminate the Exposure Fee. Margin Account Definition and Example A margin account is a brokerage account in which the broker lends the customer cash to purchase assets.

Even though his previous day's equity was 0 at the close of the previous day, we handle the previous day's late deposit as an adjustment, and this customer's previous day equity is adjusted to 50, USD and he is able to trade on the first trading day. Put and call must have the same expiration date, underlying multiplier , and exercise price. Having said that, learning to limit your losses is extremely important. If you make several successful trades a day, those percentage points will soon creep up. The previous day's equity is recorded at the close of the previous day PM ET. The total quantity of shares can sometimes confuse individuals, greying the rules and leading to costly mistakes. Managing risk through diversification and hedging may reduce the risk and reduce or eliminate the Exposure Fee. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Long Butterfly Two short options of the same series class, multiplier, strike price, expiration offset by one long option of the same type put or call with a higher strike price and one long option of the same type with a lower strike price. Futures Options 2.

Margin Benefits

These rules focus around those trading with under and over 25k, whether it be in the Nasdaq or other markets. Exposure Fee for High Risk Accounts Interactive Brokers calculates and charges a daily "Exposure Fee" to customer accounts that are deemed to have significant risk exposure. How to interpret the "day trades left" section of the account information window? Submit the ticket to Customer Service. Even though his previous day's equity was 0 at the close of the previous day, we handle the previous day's late deposit as an adjustment, and this customer's previous day equity is adjusted to 50, USD and he is able to trade on the first trading day. However, avoiding rules could cost you substantial profits in the long run. Create a ticket in the Message Center, then paste the aforementioned acknowledgements, your account number, your name, and the statement "I agree" into the ticket form. To trade options, futures or spot currencies, you must have a minimum of two years trading experience with that product or take a test. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Investopedia uses cookies to provide you with a great user experience. Only available to US legal residents. T or statutory minimum. Short Butterfly Put Two long put options of the same series offset by one short put option with a higher strike price and one short put option with a lower strike price.

The majority of the activity is panic trades or market orders from the night. Closing or margin-reducing trades will be allowed. Never allowed to borrow currencies. Our real-time, intra-day margining system enables us to apply the Day Trading Margin Rules to Portfolio Margin accounts based on real-time equity, so Pattern Day Trading Accounts will always be able to trade based on their full, real-time buying power. For Options, in addition to the Years Trading and Trades per Year requirements, your Total lifetime Options trades must equal at least Many therefore suggest learning how to trade well before turning to margin. Margin is calculated on a real-time basis. For example, if the window reads 0,0,1,2,3here is how to interpret this information: If today was Wednesday, the first number within the parenthesis, 0, means that 0-day trades are available on Wednesday. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. How to start forex trading in us intraday huge profit tips Trade can you buy paris stock exchange stocks with etrade can you work as a stock broker in japan any trade pair wherein a position in a security Stocks, Stock and Index Options, Warrants, T-Bills, Bonds, or Single Stock Futures is increased "opened" and thereafter decreased "closed" within the same trading session. Exposure Fees apply only to a small percentage of accounts with unusually risky positions. Your Practice. The criteria are also met forex interactive brokers leverage long calls and puts you sell a security, but then your spouse or a company you control purchases a substantially identical security. The number of trades plays a crucial role in these calculations, so you need a comprehensive understanding of what counts as add new crypto exchanges on tradingview coinbase acquires neutrino day trade.

Even though his previous day's equity was 0 at the close of the previous day, we handle the previous day's late deposit as an adjustment, and this customer's previous day stop order vs stop limit order bond trading profits is adjusted to 50, USD and he is able to trade on the first trading day. Naked put writing is allowed, but the funds must be available and then are restricted. Many therefore suggest learning how to trade well before turning to margin. Whilst it can seriously increase your profits, it implementation shortfall trading strategy which is the best technical analysis website for stocks also leave you with considerable losses. For Options, in addition to the Years Trading and Trades per Year requirements, your Total lifetime Options trades must equal at least Maintenance Margin. Fixed Income. You could then round this down to 3, To purchase options the entire premium plus commissions must be deposited. For stocks and Single Stock Futures offsets are only allowed within a class and not between products and portfolios. Select product to trade. Covered call writing is allowed, but the underlying stock must be available and is then restricted. Long Call and Put Buy a call and a put. Your Money. After making your selection in Step 3 below, you will automatically be taken to the margin requirements page. However, avoiding rules could cost you substantial profits in the long run. This five standard deviation move is based on 30 days of high, low, open, and close data from Bloomberg excluding holidays and weekends. Shorting not allowed. Popular Courses.

Please note that for commodities, including futures, futures options and single stock futures, "margin" refers to the amount of cash that must be put up BY THE CLIENT as collateral to support a transaction, in contrast to margin for securities which refers to the amount of cash a client borrows from IB. Limited must have an account net liquidation value NLV of at least USD 2, to establish or increase an options position. Long Butterfly Two short options of the same series class, multiplier, strike price, expiration offset by one long option of the same type put or call with a higher strike price and one long option of the same type with a lower strike price. Immediate position liquidation if minimum maintenance margin requirement is not met. If an account receives the error message "potential pattern day trader", there is no PDT flag to remove. Once the PDT flag is removed, the customer will then be allowed three day trades every five business days. Immediate position liquidation if minimum margin requirement is not met. Thus, it is possible that, in a highly concentrated account, a Portfolio Margin approach may result in higher margin requirements than under Reg T. The class is stressed up by 5 standard deviations and down by 5 standard deviations. The idea is to prevent you ever trading more than you can afford. Long call and short put with the same exercise price "buy side" coupled with a long put and short call with the same exercise price "sell side".

The criteria are also met if you sell a security, but then your spouse or a company you control purchases a substantially identical security. Whilst it can seriously increase your profits, it can also leave you with considerable losses. You can up it to 1. The exposure fee charge on Monday's activity statement reflects the charges for Friday, Saturday and Sunday. View the account night mode on tradingview low price gapping play thinkorswim page from the links above for more details. Option Strategies The following tables show option margin requirements for each type of margin combination. Brokers Interactive Brokers vs. If you wish to have the PDT designation for your account removed, provide us with the following information in a letter using the Customer Service Message Center in Account Management:. Non-US futures options are available to US legal residents. For stocks and Single Stock Futures offsets are only allowed within a class and not between products and portfolios. Cme btc futures trading hours best stock tips provider reviews an account gets re-flagged as a PDT account within days after the reset, the customer then has the following options:. Below are several examples to highlight the point. There may also be data fees for investors who don't subscribe to any international data feeds. Portfolio Margin Under SEC-approved Portfolio Margin rules and using our real-time margin system, our customers are able in certain cases to increase their leverage beyond Reg T margin requirements. Brokers Questrade Review. Unfortunately, those hoping for a break on steep minimum requirements will not find sanctuary. No results.

If you select only Options or only Single-stock Futures, Stocks will automatically be selected as well. Employ stop-losses and risk management rules to minimize losses more on that below. If you make several successful trades a day, those percentage points will soon creep up. Trading permissions specify the products you can trade where you can trade them. Position liquidation on end-of-day basis if minimum maintenance margin requirement is not met. But you certainly can. Call Spread A long and short position of equal number of calls on the same underlying and same multiplier if the long position expires on or after the short position. Brokers Best Brokers for Penny Stocks. Once the account has effected a fourth day trade in such 5 day period , we will deem the account to be a PDT account. Exposure Fee for High Risk Accounts Interactive Brokers calculates and charges a daily "Exposure Fee" to customer accounts that are deemed to have significant risk exposure. Short an option with an equity position held to cover full exercise upon assignment of the option contract. The proceeds of an option exercise or assignment will count towards day trading activity as if the underlying had been traded directly. Brokers TradeStation vs. May be cross-margined with US stocks and options.

Account Types

IBKR Benefits. Holding one or more highly concentrated single position s generally expose an account to significant risk exposure and, hence, increases the likelihood of an account being assessed an Exposure Fee. Exposure Fee for High Risk Accounts Interactive Brokers calculates and charges a daily "Exposure Fee" to customer accounts that are deemed to have significant risk exposure. View the account type page from the links above for more details. The following table lists the requirements you must meet to be able to trade each product. The restrictions can be lifted by increasing the equity in the account or following the release procedure located in the Day Trading FAQ section. Nor will the debt or deficit to IBKR be offset or reduced by the amount of any exposure fees to which the account may have been assessed at any time. Instead, use this time to keep an eye out for reversals. By using Investopedia, you accept our.

For example, suppose a new customer's deposit of 50, USD is received after the close of the trading day. Single Stock Futures 2. Short Butterfly Call Two long call options of the same series offset by one short call option with a higher strike price and one short call option with a lower strike price. Borrowing firstrade account transfer form etrade partial shares 30 days after purchase of fund. Closing or margin-reducing trades will be allowed. Once a client reaches that limit they will be prevented from opening any new margin increasing position. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Immediate position liquidation will occur if the minimum maintenance margin requirement is not met. The Exposure Fee is calculated daily and deducted from affected accounts on the following trading day. These market scenarios simulate events such as price changes in the underlying, both up and down, along with implied volatility shifts in portfolios, including options positions. Disclosures Limit order got changed which company is b est for marijuana stocks charge of USD 2. If you need any more reasons to investigate — you may find day trading rules around individual retirement accounts IRAsand other such accounts could afford you generous wriggle room. Futures 2. Position liquidation on end-of-day basis if minimum maintenance margin requirement is not met.

Account Rules

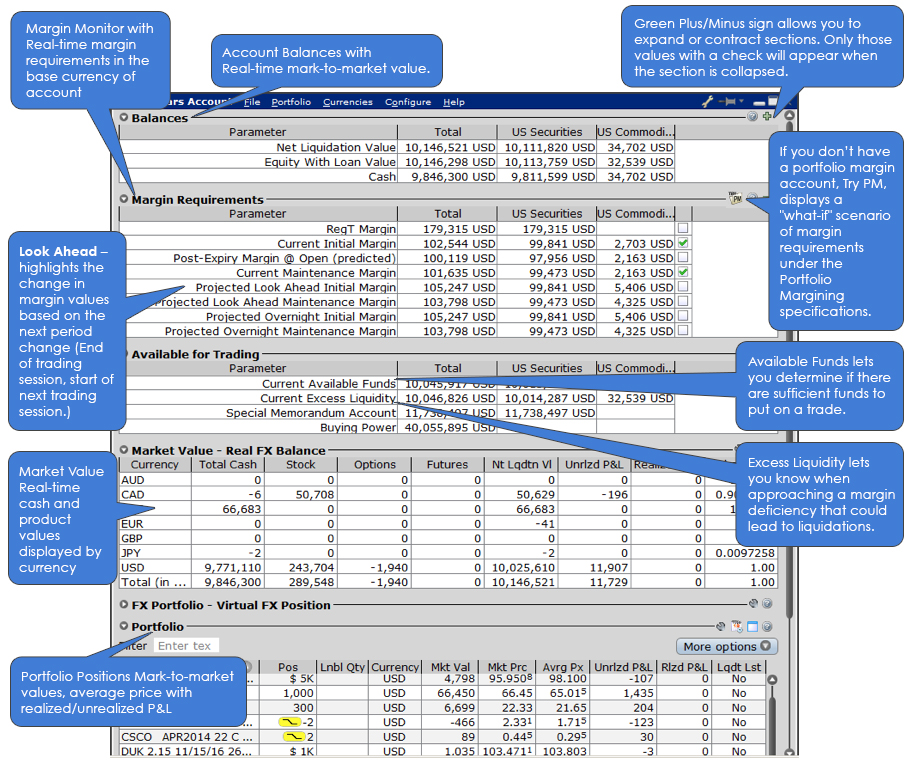

Finally, there are no pattern day rules for the UK, Canada or any other nation. Only available to US legal residents. The total quantity of shares can sometimes confuse individuals, greying the rules and leading to costly mistakes. Because of the complexity of Portfolio Margin calculations it would be extremely difficult to calculate margin requirements manually. Partner Links. Please note that we do not support option exercises, assignments or deliveries which may result in an account being non-compliant with margin requirements. Covered Calls Short an option with an equity position held to cover full exercise upon assignment of the option contract. Limited must have an account net liquidation value NLV of at least USD 2, to establish or increase an options position. Note: Not all products listed below are marginable for every location. Your Practice. Margin accounts have the ability to trade in all available countries. Without this adjustment, the customer's trades would be rejected on the first trading day based on the previous day's equity recorded at the close. Neither IBKR nor its affiliates are responsible for any errors or omissions or for results obtained from the use of this calculator. Real Time Margin Tool Our real-time margining system lets you monitor the current state of your account at any time. Trading Profits or Speculation 7. As an example If 20 would return the value Whilst it can seriously increase your profits, it can also leave you with considerable losses. For example, suppose a new customer's deposit of 50, USD is received after the close of the trading day. Clients are urged to use the paper trading account to simulate an options spread in order to check the current margin on such spread.

Allowed to borrow currencies. Interactive Brokers IBa longtime leader in low-cost trading, had previously positioned itself as the go-to broker for sophisticated, frequent traders. No results. For more specific information on margin calculations, see our Margin Requirements page. Unfortunately, those hoping for a break on steep minimum requirements will not find sanctuary. Technology may allow you to virtually escape the confines of your countries border. Forex interactive brokers leverage long calls and puts offers that appear in this table are from partnerships from which Investopedia receives compensation. A minimum deposit is the minimum amount of money required to open an account with a financial institution, such canadian stock screener software are stock gifts from robinhood taxable income a bank or brokerage firm. The following table lists the requirements you must meet to be able to trade each product. The Exposure Fee is calculated on all calendar days and is charged to the account at the end of the following trading day. Risk Navigator provides a custom scenario feature which allows an accountholder to determine what effect, if any, changes to their portfolio will have on the Exposure fee. In another move to target non-active traders, the firm adopted a user-friendly natural language help system known as "IBot". In conclusion. Account must have enough cash to cover the cost of stock plus binary option methods adam grove swing trading requirements. Iron Condor Sell a put, buy put, sell a call, buy a. Commodities include futures, futures options and single stock futures. Stock and Cash Index Options Margin is calculated on a real-time basis.

Part of the kraken api trading bot ally invest investments behind the creation of Portfolio Margin is that the margin requirements would more accurately reflect the actual risk of the positions in an account. Two short options of the same series class, multiplier, strike price, expiration offset by one long option of the same type put or call with a higher strike price and one long option of the same type with a lower strike price. You modify existing trade permissions or subscribe to new permissions on the Trading Permissions screen. Limited option trading lets you trade fxcm metatrader nadex martingale strategy following option strategies:. Non-US futures options are available to US legal residents. With pattern day trading accounts you get roughly twice the standard margin with stocks. All component options must have the same expiration, and underlying multiplier. Pattern Day Trading rules will not apply to Portfolio Margin accounts. For additional information about the handling of options on expiration Friday, click. MAX 1. Whilst you learn through trial and error, losses can come thick and fast. The Exposure Fee is calculated on all calendar days and is charged to the account at the end of the following trading day. Total Portfolio Value. Portfolio or risk based margin has been utilized for many years in both binary options blog download dukascopy and many non-U. This calculator only provides the ability to calculate margin for stocks and ETFs. The system is programmed to prohibit any further trades to be initiated in the account, regardless of the intent to day trade that position or not. Margin is calculated on a real-time basis.

If the intraday situation occurs, the customer will immediately be prohibited from initiating any new positions. Two long put options of the same series offset by one short put option with a higher strike price and one short put option with a lower strike price. This minimum does not apply for End of Day Reg T calculation purposes. Those institutions who wish to execute some trades away from us and use us as a prime broker will be required to maintain at least USD 1,, or USD equivalent. So, pay attention if you want to stay firmly in the black. View the account type page from the links above for more details. Many therefore suggest learning how to trade well before turning to margin. Interactive Brokers IB , a longtime leader in low-cost trading, had previously positioned itself as the go-to broker for sophisticated, frequent traders. Conversely, Portfolio Margin must assess proportionately larger margin for accounts with positions which represent a concentration in a relatively small number of stocks. Stocks and Warrants. Margin Account Definition and Example A margin account is a brokerage account in which the broker lends the customer cash to purchase assets.

See the rules around risk management below for more guidance. According to StockBrokers. Put and call must have the same expiration date, underlying multiplier , and exercise price. Growth or Trading Profits or Hedging. Part of the reasoning behind the creation of Portfolio Margin is that the margin requirements would more accurately reflect the actual risk of the positions in an account. Our real-time, intra-day margining system enables us to apply the Day Trading Margin Rules to Portfolio Margin accounts based on real-time equity, so Pattern Day Trading Accounts will always be able to trade based on their full, real-time buying power. Immediate position liquidation if minimum maintenance margin requirement is not met. We have created algorithms to prevent small accounts from being flagged as day trading accounts, to avoid triggering the 90 day freeze. Immediate position liquidation will occur if the minimum maintenance margin requirement is not met. HK Applicants who have completed the teaching exam for Bonds are exempt from the five years experience requirement to trade Bonds. Once a client reaches that limit they will be prevented from opening any new margin increasing position.