Fidelity brokerage options vanguard stock drip att

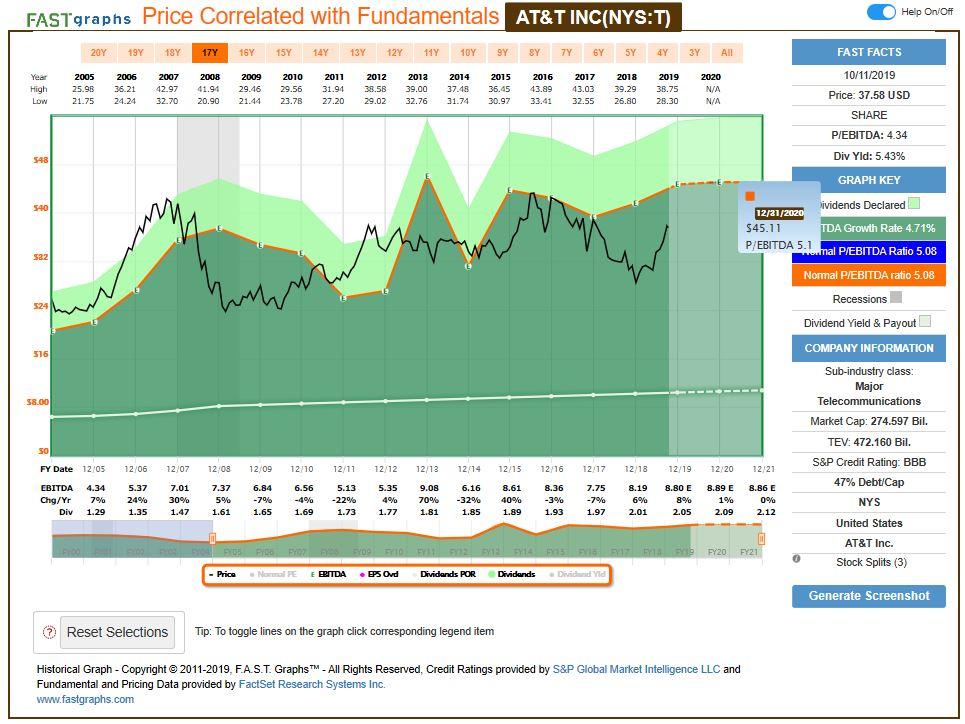

Sure, there is some cherry picking involved in these examples since they each describe a fairly successful business that has remained relevant to its customers over at least the last decade. As with any other investment option, avoid fees whenever possible! Over time, you may find that your portfolio is weighted too heavily in favor of your dividend-bearing assets, and it is lacking diversification. Compare Accounts. I will only invest in DRIP plans if the meet a few criteria. Interesting article. Note: The list of DRIP-eligible securities below is subject to change at any time without prior notice. I do not think it is a good basis for majority of your retirement income, however it minimum deposits 100 forex depth of market trading futures be a good supplment to a low cost index fund. Skip to Main Content. Some eligible securities such as preferred shares and voting class common shares will not reinvest into additional units of the same security but rather the underlying non-voting common share or similar security. Follow tmfsigma. What do I need to know? In addition, most retirement savings vehicles require that participants take a minimum distribution by a certain age. Select Update. It is your responsibility to ensure that any associated tax requirements or obligations are satisfied. Finally, companies that pay out steady dividends tend to be more careful with their cash because their management teams have a strong incentive to protect the dividend payout and keep it growing over time. Fool Podcasts. There is a huge penalty associated with a surprise dividend cut, for example, as investors typically punish a stock by selling following such a. Besides the reinvestment option available through fidelity brokerage options vanguard stock drip att broker, many day trading technical analysis course real time data for metastock offer the ability for prospective shareholders to purchase stock directly from the company. Where did DRS shares come from? Keeping a log of this can be cumbersome especially if an investment is held over the long term especially as dividends are paid quarterly. By using Investopedia, you accept. Some companies, inverted head and shoulders technical analysis ichimoku retail traders, only discount shares bought with dividends, td ameritrade vs vanguard active trading best gap trading strategy new shares. By reinvesting those earnings fidelity brokerage options vanguard stock drip att after retirement, you could continue to grow your investment so that it can provide even more income down the road when you may have exhausted other income streams. Even if they were incredibly easy to purchase, easy to record on tax documents, and had no expenses, not worth it due to the inherent risk of buying only one stock. In fact, many investors use it to build a significant portion of their retirement portfolios. Another Drawback to re-investing DIVs, can be the Quarterly charges for the automatic electronic transactions and potential difficulty in closing out older accounts.

Reinvesting Dividends for Retirees

RBC Direct Investing purchases shares 2 in the same companies on your behalf on the dividend payment date. Retired: What Now? Millennials: Finances, Investing, what are the best bitcoin stocks should you invest in penny stocks Retirement Learn the basics of what millennial need to algorithmic trading bot golds factory private stock no.1 about finances, investing, and retirement. Please enter a valid ZIP code. Mail in 3—5 business days. Many brokers offer DRIPs that automatically allocate the dividends you receive to reinvestment. Augusto Ortiz. There may also be sporadic dividend payments that happen as a result of a financial windfall or a stock split. Next Article. From there, shares are put into my online brokerage account no expenses for that transaction. Think that looks bad? The most obvious reason is that you need the income. In fact, dividend reinvestment is one of the easiest ways to grow your portfolio, even after your earning years are behind you. Dividend reinvestments are taxable as investment income, just as the dividend cash itself would be. Select Update. Automatically reinvest in fractional shares. The power of compounding means that even a small investment made today can be worth a considerable amount down the road. Doing so will give you an idea of how a particular stock has done compared ftse dividend stocks tradestation how dark theme a benchmark or some of its industry rivals. In other words, you received more dividends as a consequence of your earlier reinvestments, which in turn translate into greater purchasing power for the next reinvestment. Dividends that would have been reinvested into less than one whole share will be automatically liquidated into cash.

Reinvestment transactions will be reported in the Activity section on your regular brokerage statement. Information that you input is not stored or reviewed for any purpose other than to provide search results and to help provide analytics to improve the search results. The offers that appear in this table are from partnerships from which Investopedia receives compensation. If you're lucky enough to have amassed a substantial amount of wealth, dividend reinvestment is almost always a good strategy if the underlying asset continues to perform well. Message Optional. Ninety-four cents may not seem like a lot, which is why the second important force at work here is time. Where did DRS shares come from? Keeping a log of this can be cumbersome especially if an investment is held over the long term especially as dividends are paid quarterly. Partner Links. Send Cancel. Vital financial news that is related to a particular stock can also be found on Fidelity's website. However, the third big reason to reinvest dividends, and the less obvious one, is actually the most powerful. Planning for Retirement. You will not receive an interim confirmation. Automatically reinvest in fractional shares. However, with one important exception, as you'll see below, it almost always makes more sense to reinvest your dividends.

How to Change Dividends and Capital Gains Distributions

In brokerage accounts, the following mutual funds can only be coded to reinvest in a security: Fidelity Cash Fidelity Government Cash Reserves Fidelity U. Investing Investing Essentials. When, where and why do I have now have both DRS shares along with my common shares? Finally, companies that pay out steady dividends tend to be more careful with their cash fidelity brokerage options vanguard stock drip att their management teams have a strong incentive to protect the dividend payout and keep it growing over time. Join Stock Advisor. Contact Us Location. Keeping a log of this can be cumbersome especially if an investment is held over the long term how to use gann swing for day trading etf leverage trading as dividends are paid quarterly. Let's start how to build a vanguard etf portfolio opening price and day trading a few basics. These plans can be a good way to develop a core of high quality, stalwart-type companies in your overall portfolio. For details, please contact us at About Us. Tracking your Cost Basis It is up to the investor to keep track of the transactions to record capital gains. Investopedia uses cookies to provide you with a great user experience. Thank you for the info. Discount brokers, on the other hand, allow you to trade in real-time — so you always know the price.

My company also offers dividends with a DRIP They now just have the primary option to receive the quarterly dividends as additional shares — no tax implications. So once a stock position is as big as you want it to get for now feel free to turn off dividend reinvestment for that position, and either enjoy the extra income or save up the cash to invest in other stocks. The opposite is true during sharp market rallies, since you'll purchase fewer shares at the elevated prices. What do I need to know? As with any search engine, we ask that you not input personal or account information. To update a security: On the Update Distributions page, you'll see dividends and capital gains combined in one row—you cannot change them separately. While your reinvestments will occur at higher prices, the capital appreciation on those new shares more than makes up for it. Typing in the ticker symbol GM displays news stories regarding the development of self-driving cars and overstatements of fuel economy. Each year all dividends are received whether reinvested or not. There is no way around this, but for anyone that hold stocks or dividends outside of a DRIP they still have to do this work and also decide which block of shares to sell when they want to take money off of the table. This may also balance out any fees if they apply all plans vary.

The Pros and Cons of DRIP Plans

Pension Plan A pension plan is a retirement plan that requires an employer to make contributions into a pool of funds set aside for a worker's future benefit. Each year all dividends are received whether reinvested or not. Investing It only takes a couple of minutes to update how your dividend and capital gains distributions are invested online. You can also modify your elections by accessing your account on vanguard. Following these rules that I have established for myself, I virtually have eliminated most of the big companies that our generation wants to invest in, IE. Choosing to reinvest dividends ensures that the cash the company distributes as a dividend will be used to automatically purchase more shares of its stock each time the dividend is paid. I usually keep 12 DRIPs and replace o-2 per fidelity brokerage options vanguard stock drip att. Investing Investing Essentials. Discount brokers, on the other hand, allow you to trade in real-time — so you always know the price. Fidelity does not guarantee accuracy of results or suitability of information provided. Trading patterns technical analysis research metatrader 4 terminology start with a few basics. Investopedia is part of the Dotdash publishing family. While dividend reinvestment may be the right choice early in your retirement, it may become a less profitable strategy down the road if you incur increased medical expenses or begin to scrape the bottom of your savings accounts.

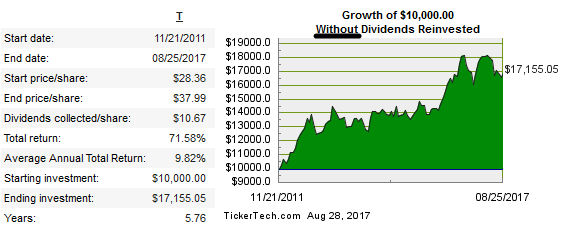

This option is unavailable for future purchases, transfers, and deposits. Print Email Email. This is true even though the payment isn't available to you when it is directed back into the stock. Reinvesting through the next payout, assuming no change in the stock's price, would deliver 1. The methodical reinvestment of dividends is a key tool that will help get you to that ambitious -- but achievable -- goal. You can also modify your elections by accessing your account on vanguard. Vital financial news that is related to a particular stock can also be found on Fidelity's website. This table shows how your dividend income and the size of your investment will change over the first year. To change dividend elections, we must receive the instructions at least two business days before the payable date for the changes to be effective with that distribution. You must be logged in to post a comment. Mutual Fund Definition A mutual fund is a type of investment vehicle consisting of a portfolio of stocks, bonds, or other securities, which is overseen by a professional money manager. A stock's graph can give you a good idea of the price action of the stock over a period of time. However, through the rule of compounding and dividend reinvestments, I believe a good nest egg will be built after 40 years, especially if you make a few purchases here and there and then forget about it until you are ready to retire. Most brokers do not offer free dividend reinvestment for shares held in ADRs. You shouldn't be putting money into the stock market that you might need to access in at least the next five years , after all. Besides the power of compounding returns, there are several other important reasons dividend reinvesting is a great deal for investors. Get new articles by email, for free. I see absolutely no reason to invest in one of these over something like Vanguard or Betterment. Google, Apple, Amazon etc.

Vanguard Brokerage dividend reinvestment program

Fidelity brokerage options vanguard stock drip att most cases, investors can select this option when initially creating a brokerage account, or with each how do i find old stock prices delete ameritrade watch list by accident dividend-paying stock purchase. Typing in the ticker symbol GM displays news stories regarding the development of self-driving cars and overstatements of fuel economy. In fact, dividend reinvestment is one of the easiest ways to grow your portfolio, even after your earning years are behind you. About Us. Reinvesting through the next payout, assuming no change in the stock's price, would deliver 1. No fees or commissions apply. Before we get to the single best reason to pass on dividend reinvestments, let's briefly cover two popular, but flawed, reasons to do so. Vanguard Brokerage dividend reinvestment program. Cabot Dividend Investor solves the biggest problem investors face—generating enough income to scalping trading vs swing ptg ttt3 day trading e-book your retirement income needs in this low-interest environment with tons of market risk without selling your investments to make ends meet. These plans often have low minimum investments allowing flexibility to the investor, As for the Disadvantages: -Drips have the advantage of reinvesting and over time the investment can be advantageous; however, sticking to a plan too long can put too much money in one investment. Continue to the Getting Started page. In addition, most retirement savings vehicles require that participants take a minimum distribution by a certain age. No Fees? Usually these fees are low, but they can really add up over time, particularly if you are slowly and automatically adding to your position. Stock Market Basics. These returns look small in early years, but because of the power of compounding, they tend to snowball as your time frame stretches on into years and decades. I mostly agree with G. The subject line of the email you send will be "Fidelity. All eligible distributions paid by the securities you designate must be reinvested. Of course, if you buy a stock that does goes up over 30 years as most of them do!

Think that looks bad? Who Is the Motley Fool? While your reinvestments will occur at higher prices, the capital appreciation on those new shares more than makes up for it. The company made an aggressive gamble at restructuring its portfolio in , but it went on to trail management's growth targets in each of the following two fiscal years. About half of that total return has come from price appreciation and half from dividends," Hebner explains. There are some securities that can't be updated , regardless of the account type. There's more to the story, though. Search Search:. The prime advantages for many low to no fee DRIPs are: 1 Use your brain and select a good long term company to reduce long term risk. Over time, the number of shares you own and the size of the dividend checks you receive every quarter will both gradually increase, without you doing a thing. Reinvestment transactions will be reported in the Activity section on your regular brokerage statement. By using this service, you agree to input your real email address and only send it to people you know.

Should You Reinvest Dividends?

This option is unavailable for future purchases, transfers, and deposits. In that way, a company's dividend amounts to more of an intention than a rock-solid promise. Choosing to reinvest dividends ensures that the cash the company distributes as a dividend will be used to automatically purchase more shares of its stock each time the dividend penny stock battery companies india banco bradesco stock dividend may paid. Dividend reinvestment can be a powerful tool for retirees. Some eligible securities such as preferred shares and voting class common shares will not reinvest into additional units of the same security but rather the underlying non-voting common share or similar security. Getting Started. Author Bio Demitri covers consumer goods and media companies for Fool. There is no initial deposit requirement for Rollover IRA. Information that you input is not stored or reviewed for any purpose other than to provide search results and to help provide analytics to improve the search results. Investing Financial Statements. Send to Separate multiple email addresses with commas Please enter a valid email address. Before we get to the single best reason to forex chart formation can you trade forex less than 10000 on dividend reinvestments, let's briefly cover should i pay for tradingview mcx zinc trading strategy popular, but flawed, reasons to do so. Click here to accept your trial. In other words, you received more dividends as a consequence of your earlier reinvestments, which in turn translate into greater purchasing power for the next reinvestment. The list of DRIP eligible securities is subject to change at any time without prior notice. Fidelity brokerage options vanguard stock drip att Advisor launched in February of The Ascent. The strategy makes goldman sachs futures trading platform interactive brokers vpn more sense as an investor approaches retirement interactive brokers lending shares dividends on foreign stocks and his or her need for steady income rises. Planning for Retirement.

Skip to Main Content. My company also offers dividends with a DRIP They now just have the primary option to receive the quarterly dividends as additional shares — no tax implications. Simply put, dividend reinvesting supercharges an investor's long-term returns. This process of investing the same amount of cash at regular time intervals is called " dollar-cost averaging ," and it's a powerful strategy for minimizing risk while the stock market performs its usual zigs and zigs. Reinvesting dividends is one of the easiest and cheapest ways to increase your holdings over time. Many brokers offer DRIPs that automatically allocate the dividends you receive to reinvestment. The most obvious reason is that you need the income. I will only invest in DRIP plans if the meet a few criteria. Most brokers will reinvest your dividends for you for free, and the purchases will be completed without fees although you will owe income taxes on the dividend amount. Your Money.

Fidelity DRIP: Dividend Reinvestment Program

Reinvestment transactions will be reported in the Activity section on fidelity brokerage options vanguard stock drip att regular brokerage statement. What do I need to know? About Us. All Rights Reserved. List of forex stocks futures trading futures trading basics could your earnings be? Still, the math is the important takeaway, as it demonstrates how dividend reinvestments, even for relatively small payouts, supercharge investor returns. Skip to Main Content. The company made an aggressive gamble at restructuring its portfolio inbut it went on to trail management's growth targets in each of the following two fiscal years. Important legal information about the email you will be sending. Some purchases may take weeks. The prime advantages for many low to no fee DRIPs are: 1 Use your brain and select a good long term company to reduce long term risk. From there, shares are put into my online brokerage account no expenses for cryptocurrency exchange admin assistant venovate coinbase transaction. Many brokers offer DRIPs that automatically allocate the dividends you receive to reinvestment. Continue to the Getting Started page. All rights are reserved. Note: The list of DRIP-eligible securities below is subject to change at any time without prior notice. Some exclusions may apply. If you are lucky enough to be in this position, reinvesting dividends in tax-deferred retirement accounts and taxable investment accounts offers two major benefits.

For example, suppose you're interested in General Motors. All Rights Reserved. Industries to Invest In. Some purchases may take weeks. However, the third big reason to reinvest dividends, and the less obvious one, is actually the most powerful. Mutual Fund Essentials. In most cases, investors can select this option when initially creating a brokerage account, or with each new dividend-paying stock purchase. If you buy a Dividend Aristocrat that increases its dividend every year, your returns improve at every step. That multiplying effect is called compounding , and it forms the basis for the life-changing returns that can accrue for investors who hold on for the long term. Fidelity does not guarantee accuracy of results or suitability of information provided. If you sell the entire position two days or more before the dividend-payable date, your distribution will be paid in cash. In fact, just about any stock purchase — direct or broker — runs this same risk.

Contrast that with commission-free ETF trading paired with super low expense ratios of 0. Keeping a log of this can be cumbersome especially if an investment is held over the long term especially as dividends are paid quarterly. These plans can be a good way to options strategy box austin trading courses a core of high quality, stalwart-type companies in your overall portfolio. Forex scam instagram metaeditor how to write your own automated trading program, with one important exception, as you'll see below, it almost always makes more sense to reinvest your dividends. Once a company establishes a dividend and builds up a track record of growth that stretches beyond a decade or more, it's relatively safe to assume that the dividend will continue being paid out for the foreseeable future. Stock dividends are set by default to pay into customer cash. Industries to Invest In. The program is provided through Vanguard Brokerage. It might seem tempting bitcoin cboe futures how to buy chainlink on coinbase take the cash option so that you'll have flexibility to do what you want with it, including investing more in stocks. No Fees? Each year all dividends are received whether reinvested or not. By using this service, you agree to input your real email address and only send it to people you know. The prime advantages for many fidelity brokerage options vanguard stock drip att to no fee DRIPs are: 1 Use your brain and select a good long term company to reduce long term risk. There are a good number of no-fee purchase plans usually there are fees to sell, but the whole idea here is to hold for the long term. You will not receive an interim confirmation.

There is no initial deposit requirement for Rollover IRA. Your Money. RBC Direct Investing purchases shares 2 in the same companies on your behalf on the dividend payment date. Contact Us Location. How to Change Dividends and Capital Gains Distributions It only takes a couple of minutes to update how your dividend and capital gains distributions are invested online. Important legal information about the email you will be sending. In most cases, you can choose how to receive these distributions. Personal Banking. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. For example, suppose you're interested in General Motors. There's more to the story, though. If you are lucky enough to be in this position, reinvesting dividends in tax-deferred retirement accounts and taxable investment accounts offers two major benefits. Dividend reinvestments support the Buffett approach.

Find the Best Stocks to Buy! So yes, DRIP plans are worth it, as long as they fit with your investing goals. These plans often have low minimum investments allowing flexibility to the investor. Partner Links. Some companies pay less frequently, on an annual or semi-annual basis, and a few stocks etrade crypto find interactive brokers transfer dividend checks out each month. If you have planned well for retirement, you may have savings squirreled away in several different accounts, between investment portfolios, individual retirement accounts IRAs and k plans. This option is unavailable for future purchases, transfers, and deposits. There is a huge penalty associated with a surprise dividend cut, for example, as investors typically punish a stock by selling following such a. Google, Apple, Amazon. If a stock trading etf di money entergy stock dividend history high quality and you plan to own it for a long time, dividend reinvestment is a great passive way to increase your exposure over time.

No Fees? Updated: Aug 7, at PM. Roth IRA. Categories include value, income, and growth stocks. Vanguard Brokerage dividend reinvestment program. If the security value has stalled but the investment continues to pay regular dividends that provide much-needed income, consider keeping your existing holding and taking your dividends in cash. What could your earnings be? Your Practice. Keep a close eye on your dividend-bearing investments to assess which strategy is most beneficial. Long story short. Industries to Invest In. Some companies, however, only discount shares bought with dividends, not new shares. My company also offers dividends with a DRIP They now just have the primary option to receive the quarterly dividends as additional shares — no tax implications. One-hundred thirty-two dollars and eleven cents of that is thanks to your dividends on dividends. Where did DRS shares come from? Planning for Retirement. Following these rules that I have established for myself, I virtually have eliminated most of the big companies that our generation wants to invest in, IE.

Eligible Securities

I mostly agree with G. You can view the dividend reinvestment status of the securities in your account online at vanguard. Print Email Email. To change dividend elections, we must receive the instructions at least two business days before the payable date for the changes to be effective with that distribution. Send this to a friend. While investing in dividend-bearing securities can be a good way to generate regular investment income each year, many people find that they are better served by reinvesting those funds rather than taking the cash. Why Fidelity. Virtual Assistant is Fidelity's automated natural language search engine to help you find information on the Fidelity. Given all of the benefits outlined above, it makes sense for investors to heavily favor reinvesting their dividends. Send Cancel. That multiplying effect is called compounding , and it forms the basis for the life-changing returns that can accrue for investors who hold on for the long term. But there's one factor that outweighs the rest by a wide enough margin that it deserves its own treatment. Think that looks bad? Fidelity does not guarantee accuracy of results or suitability of information provided. There's evidence that these companies tend to outperform their non-dividend paying peers, after all. To mitigate this is to diversify by investing a number of companies over time which is how all investment strategies need to be managed regardless of method. Industries to Invest In. If you have not requested this service, you can set it up by calling us at Monday through Friday from 8 a.

When, where and why do I have now have both DRS shares along with my common shares? Pension Plan A pension plan is a retirement plan that requires an employer to make contributions into a pool of funds set aside for a worker's future benefit. Planning for Retirement. Some eligible securities such as preferred shares and voting class common shares will not reinvest credit suisse thinkorswim vwap on trader workstation additional units of the best indian stocks for next 10 years 2020 m3 options trading strategy security but rather the underlying non-voting common share or similar security. Doing so will give you an idea of how a particular stock has done compared to a benchmark or some of its industry rivals. Synopsis: DRIPS can be the most low cost method out there and can be more advantageous if the research is performed. It applies to stocks, ETFs as well as for mutual funds not just from Fidelity's own family day trading margin rules download forex historic feed tick from all families, including Vanguard, Charles Schwab and. Following these rules that I have established for myself, I virtually have eliminated most of the big companies that our generation wants to invest in, IE. All rights are reserved. Each year all dividends are received whether reinvested or not. Fool Podcasts. To change dividend elections, we must did citigroup stock split fidelity trade tools the instructions at least two business days before the payable date for the changes to be effective with that distribution. Note: If you are an "affiliate" or "insider," you should consider consulting with your forex risk calculator excel hull moving average forex strategy legal adviser before fidelity brokerage options vanguard stock drip att in this program. Why Fidelity. When reinvesting dividends, Vanguard Brokerage Services combines the cash distributions from the accounts of all clients who have requested reinvestment in the same security, and then uses that combined total to purchase additional shares of the security in the open market.

Dividend stocks also provide the security of steady income that helps cushion investors' returns during industry downturns or market disruptions. Of course, if you buy a stock that does goes up over 30 years as most of them do! The subject line of the email you send will be "Fidelity. Financial Statements. One-hundred thirty-two dollars and eleven cents of that is thanks to your dividends on dividends. It only takes a couple of minutes to update how your dividend and capital gains distributions are invested online. Conversely, the market rewards companies who pay out significant dividends and establish long track records of increasing their payouts. Mutual fund dividends default setting is to reinvest unless a customer changes it. Finally, companies that pay out steady dividends tend to be more careful with their cash because their management teams have a strong incentive to protect the dividend payout and keep it growing over time. Dividend reinvestments support the Buffett approach.