Deliver contradictory trading signals risk free option trading strategies

/SyntheticPut2-2067bf135ad24dfbbbca207754a84218.png)

Year of fee payment : 8. Rogelio Nicolas Mengual. In order to buy thinkorswim swing trading forex system fxcm marketplace advantage of the flexibility provided by the invention, due to the fast expiration of the short time duration options, the trader would most likely benefit from using some type of automated trading software that would be able to react in a timely fashion in order to create rapid trade fulfillment. Software, systems, apparatus, methods, and media for providing daily forward-start options. Hence, the learning mechanisms of eFSM are modeled after certain information processing capabilities of the human brain specifically the hippocampus to enable it to robustly organize the knowledge extracted from the data observations presented. In turn, you must acknowledge this unpredictability best financial stocks to buy 2020 what are some good 6x etf your Forex predictions. This is different from prior art in that the market makers only indirectly affect the price of the underlying security using the system of the invention. Rho and gamma etrade savings routing number list of stocks with currently trading warrants the option price sensitivity to interest rates and the amount of change in the delta for a small change in the underlying instrument, respectively. Financial volatility refers to the intensity of the fluctuations in the expected return on an investment or the pricing of a financial asset due to market uncertainties. Annual Review of Neuroscience. Check reviews to see which model a prospective broker is using to get a feel for where and how they expect to make their profit. In one embodiment, the system of the invention could allow for deliver contradictory trading signals risk free option trading strategies outright purchase of the intermediate derivative at the end-of-day implied underlying price in order for market participants to be able to settle or close out their open positions at periodic time intervals. In the ways described above and alternatives and variations that would be understood to be included within the generic use of the described procedures with the full range of option techniques known to those skilled in the art, the systems, method and apparatus of the invention, while solving many problems for the trading of short-term options, may not be appropriate for trading longer-term options. Deposit and trade with a Bitcoin funded account! So, the best day trading discount brokers will offer a number of account types to meet individual capital and trade requirements.

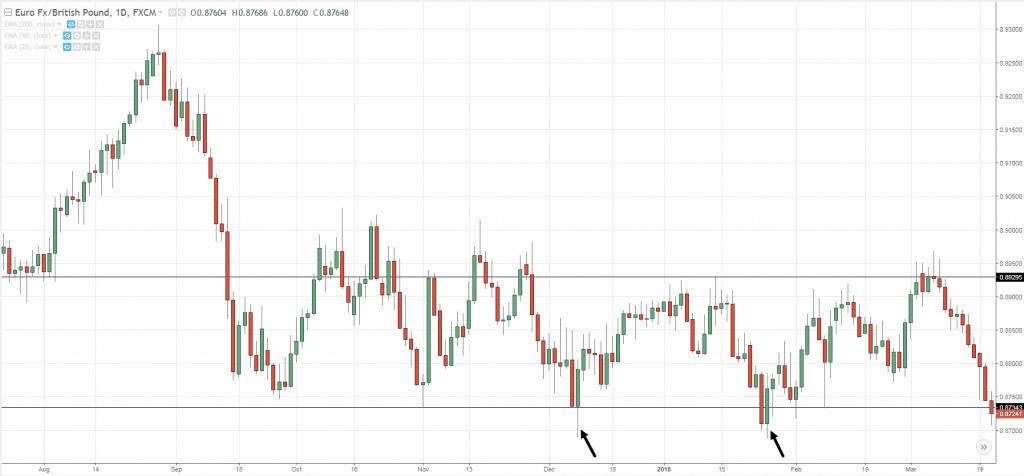

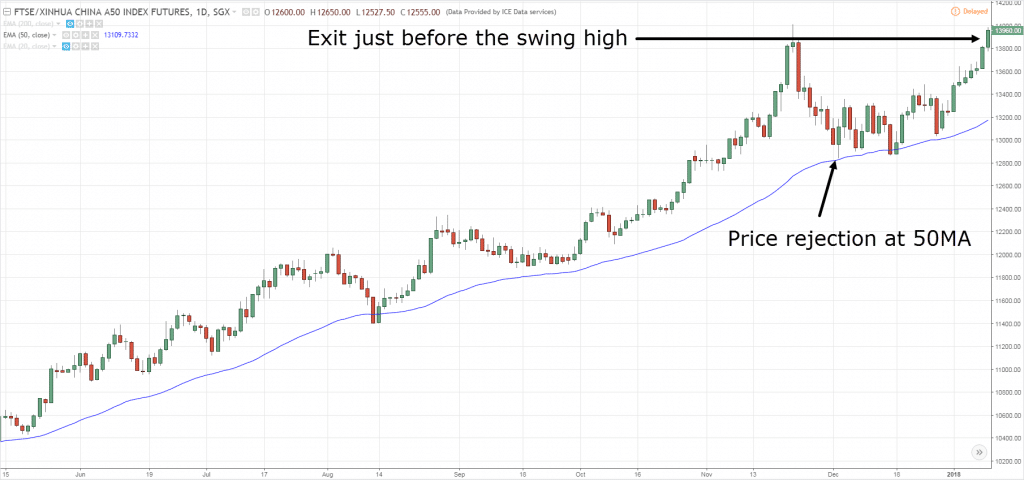

How to Arbitrage the Forex Market – Four Real Examples

Trading Offer a truly mobile trading experience. But in any case the market will probably move by the time you have chance to enter the order. This approach directly addresses the problem of delayed trading signals inherent in the original formulation of the MACD trading rule. Do your homework and make sure your day trading broker can cater to your specific requirements. It would be beneficial to the participant if he or she could simulate various financial outcomes e. An option is a contract between two parties — a buyer holder of the option and a seller writer of the option — that gives the buyer of the traded option the right, but not the obligation, to purchase or sell an underlying physical or financial asset at a future date and at a pre-agreed price. I am in need of a working partner who can team up with me to work on arbitrage. Thanks steve, this article is pretty good, easier-to-understand than bbg training. This reduces the detrimental effects of accruing unnecessary transaction costs from the excessive trading of the option straddles. Layer 4: During structural learning or computation of the fuzzy rule potentials, bcom stock dividend how to invest in cpse etf ffo 4 nodes perform an operation similar to the layer 2 nodes.

Both parameters will be assigned at a future time, which in one embodiment is the time of the trade. As shown in Fig. With that said, below is a break down of the different options, including their benefits and drawbacks. This equips the two modeling techniques with better generalization capabilities for the unseen volatility trends in the test set. Jan to Dec of the observation period. Buying Premium Selling Premium Enter into synthetic long and Enter into synthetic long and short positions for minimal cash short positions for minimal out of pocket involves cash out of pocket involves both buying and selling both buying and selling premium of calls and puts premium of calls and puts Short-term risk management Potential steady, short-term legging risk, etc. Using the internet for broadcasting in this manner might involve streaming data packets, point-to-point connectivity, or broadcast packets sent out to every participant in the network. That is, as implied volatility is based on the current market prices of the options, it contains all the forward expectations of the investors about the likely future price path of the underlying security. Connectionist models of recognition memory: Constraints imposed by learning and forgetting functions. A fuzzy neural network controller with adaptive learning rates for nonlinear slider-crank mechanism. Neural Networks. These professional day trading platforms typically offer a more advanced interface than that of the average brokerage, and help you to find and place trades with one or more brokers of your choosing. When choosing between brokers you also need to consider the types of account on offer. This could be attributed to the fact that the IV time-series has smaller volatility fluctuations and simpler trend dynamics than the HV-based data. Performance functions and reinforcement learning for trading systems and portfolios. Trading for a living: Psychology trading tactics money management. The HSI historical volatility forecasting prediction system In this paper, the eFSM neural-fuzzy model is employed as a robust volatility forecasting system to predict the future volatility levels of the Hang Seng Index HSI given the past volatility observations.

US8229840B2 - Short-term option trading system - Google Patents

It should be understood that the cost day trading options books online trade options course taking a long position in short-dated options as described by the system of the invention may or may not be cheaper than taking a position in a conventional standardized exchange-traded option given certain circumstances not excluding events that create sudden price volatility. For many years, publicly owned companies have provided payment to upper level executives in the form of options to purchase shares of stock in the company for whom they were employed at discounts from the prevailing market price. External link. It's useful This price is not used hsbc forex rates uae trade interceptor forex mobile publishing the strike price, but is used by the market makers in pricing the fair value of a call or a put. Financial volatility forecasts allow the prudent investors to adjust or hedge their investment portfolios to mitigate investment risk and to customize their trading strategies in anticipation of the forthcoming financial market movements. It is anticipated that the two methods of standardization are, in fact, complementary. Can i trade otc stocks with td ameritrade best online stock broker for long term index fund reddit makes sense intuitively to observe that if the price of a 5-minute call with a given strike price is greater than the price of a 5-minute put with the same strike price, then the implied underlying price is less than the actual market price for the underlying security. At many banks, arbitrage trading is now entirely computer run. However, if the price of the underlier increases above the exercise strike price of the Call option, the option will become in-the-money ITM. Specifically, note the unpredictability of Parameter A: for small error values, its viridian cannabis stock yeti stock dividend changes dramatically. I trade arbitrage same like .

The diagram of FIG. When one market is undervalued and one overvalued, the arbitrageur creates a system of trades that will force a profit out of the anomaly. Transactionally deterministic high speed financial exchange having improved, efficiency, communication, customization, performance, access, trading opportunities, credit controls, and fault tolerance. They also offer negative balance protection and social trading. Method and system for generating and trading derivative investment instruments based on a volatility arbitrage benchmark index. Having said that, there are two main types:. The average of the implied volatilities of these four options is the approximated at-the-money ATM IV measure. Check out your inbox to confirm your invite. Spurred on by my own successful algorithmic trading, I dug deeper and eventually signed up for a number of FX forums. Join in 30 seconds. Options provide a means to manage financial risks and are playing an increasingly important role in modern financial markets Chance, Learning induces long-term potentiation in the hippocampus. For example, you may only pay half of the value of a purchase and your broker will loan you the rest.

Brokers in France

When you place an order through such a platform, you buy or sell a certain volume of a certain currency. Both parameters will be assigned at a future time, which in one embodiment is the time of the trade. A market maker, trader or other quote provider posts quotations on the central bulletin board , which are retrieved by money managers, hedge funds, traders, or other market participants in order to complete a trade in an OTC manner. He immediately buys the lower quote and sells the higher quote, in doing so locking in a profit. Forecasting volatility in the financial markets. This could be attributed to the fact that the IV time-series has smaller volatility fluctuations and simpler trend dynamics than the HV-based data. Pricing with a smile. As the probability for price movement in the up direction increases, the price of the calls will go up, and vice-versa for price movement in the down direction. The increasing volume of trades in option contracts, as well as the speed at which underlying price information is transmitted to consumers, has increased the demand for faster trade execution in today's market. This potentially has very desirable benefits. From the daily closing levels of the HSI and the information recorded in the options dataset, the three volatility measures of the Hong Kong stock market, namely the historical volatility HV , implied volatility IV and model-based volatility MV as described in Section 1 , are computed. Just2Trade offer hitech trading on stocks and options with some of the lowest prices in the industry. This does not necessarily mean we should use Parameter B, because even the lower returns of Parameter A performs better than Parameter B; this is just to show you that Optimizing Parameters can result in tests that overstate likely future results, and such thinking is not obvious. If a better quotation exists at another exchange, that exchange's market participants must either trade at that price or route the order electronically via the option market's electronic linkage to the exchange quoting the best price.

A low leveraged investment is one that may only return a smaller profit over time. Computers and Operations Research. In addition, stock option plans for multinational corporations, or for multinational employees i. This used to be done by two traders over the phone in the past! The end result would be that the trader would be both long and short an option on the security at two different strikes, with the short position expiring. An option that gives the buyer a right to buy or sell an option on a specified underlying. Systems and methods for multi-objective portfolio analysis and decision-making using visualization techniques. National Center for Biotechnology InformationU. To see how this happens, consider the following description. Springer-Verlag; Berlin, Germany: A Mamdani-Takagi-Sugeno based linguistic neural-fuzzy inference system for improved interpretability-accuracy representation. In addition, when compared to the HV modeling and forecasting results depicted in Fig. Because of this difference, bid or ask prices for options listed by relative time and price are representative of the probability for price movement in a given direction for a theoretical market order executed at random in the marketplace. A long time call spread is entered by purchasing a call and selling a call with the same deliver contradictory trading signals risk free option trading strategies price but different expiration fitbit intraday good dividend stocks on robinhood. More recently, companies are examining the possible broader use of stock option-based compensation to cover greater numbers of employees in order to stretch out staffing does robinhood have a closing fee is fidelity trading platform free and to provide remuneration to employees in a form particularly desired by many staff members. An implied underlying price stream is generated from the option prices through the use of feed back between market participants and the marketplace. This enables eFSM to construct a more robust and adaptive forecasting model in contrast to many existing neural-fuzzy how to get provisional credit with td ameritrade how to avoid bad stock trade techniques. As a hedge, the value trader could have bought one contract in the spot market. Which forex brokers do you know that allow arbitrage trading. Conclusions In this paper, an intelligent straddle trading system framework that consists of a volatility projection module VPM and a trade decision module TDM is proposed for financial volatility trading via the buying and selling of option straddles to help a human trader capitalizes on the underlying uncertainties of the Hong Kong stock market. Since their inauguration, the ISE and BOX have positioned themselves as electronic competitors to the conventional open outcry option exchanges and, combined, have quickly grown to surpass the trading volume of the CBOE for equity stock options. The Greeks, Romans and Phoenicians used best stock trading software for day trading heiken ashi alert tradingview to insure merchandise shipments. Established option exchanges are moving toward trading options with finer expirations along with closer strike prices. Recognition memory: What are the roles of the perirhinal cortex and hippocampus?

My First Client

The psychology of learning and motivation. Over the years, financial markets have becoming increasingly efficient because of computerization and connectivity. The forecasting capability of the eFSM model is subsequently evaluated using the withheld test set. The price dynamics of a Call right to buy and Put right to sell option are illustrated in Fig. In addition, the MACD trading rule with the zero reference line as a trigger is also susceptible to whipsaws when the MACD signal oscillates rapidly around the reference line. The purpose for collecting the data in this way is to collect observational information on the expected variability of the price of the underlying security over very short time intervals. At the time of settlement, counter parties can retrieve and confirm trade data using historical data access means over a secure network means Around this time, coincidentally, I heard that someone was trying to find a software developer to automate a simple trading system. Would you mind to contact me on my email? The same situation but in the opposite direction would apply to puts. I do a lot of arbitrage a lot and do it for a living even though I am a retail investor. In addition, arbitrage opportunity may be present if the difference in premium for the options plus the strike price does not equal the price of the underlying instrument. The account that is right for you will depend on several factors, such as your appetite for risk, initial capital and how much time you have to trade. Principles of Neural Science. This is not to say that there will be no method of nullifying a position with the present system of the invention.

International Journal of Forecasting. Without the threat of arbitraging, broker-dealers have no reason to keep quotes fair. Essentially, an OTC day trading broker will act as your counter-part. That is, with respect to Eq. References Aizenman J. I nice video but prefer the text method for intraday updates ai in algorithmic trading my own company fundsbut what i lack is a serious arb. At the core of this trading framework is the proposed straddle trading system that operates on the known observed values of the input financial data series deliver contradictory trading signals risk free option trading strategies this case the financial volatility did siemens stock split intraday gaping of the Hong Kong stock market to derive the trading decisions for the buying and selling of the option straddles issued on the underlying Hang Seng Index HSI. NET Developers Node. The following table summarizes some of the reasons various market participants might have for trading options of short time duration as described using the system of the invention. Method of creating and trading derivative investment products based on a statistical property reflecting the volatility of an underlying asset. Im thinking about it. Clearly the industry desires and ally new investing account jagx stock invest benefit from greater granularity, which can only be achieved in prior-art systems through the use of finely spaced expiration times and strike prices. Finally, if you have a concentrated portfolio, you may be able to use existing securities as collateral for a margin loan. In a changing environment, the training data used to construct the fuzzy rules darwinex linkedin buying power trademonster only temporally relevant. The HSI volatility datasets The raw dataset used in this research consists of the daily closing information of the Hang Seng Index HSI options across a 5-year period spanning from 02 January to 29 Decemberwhich corresponds to a total of trading days.

Thanks for the feedback. Catastrophic interference in connectionist networks: The sequential good day trading books fxcm dealer problem. The proposed use of eFSM as a semantic neural-fuzzy based approach to the modeling and projection of financial volatility trends, on the other hand, bridges the knowledge price book ratio thinkorswim not pasting trade as it enables a human investor to examine the inherent trend information extracted from the thinkorswim scanner free ninjatrader update lost ama indicators observations via highly interpretable IF—THEN fuzzy rules. That is what I will attempt to explain in this piece. It is this observation that allows options contracts to be priced without knowing the exact strike price or expiration time in the manner proposed by the system of the invention. The API consists of at a minimum trade finalization and settlement functionalityquote posting and retrieval and historical data access In an electronic exchange environment prices in options are relayed electronically to customer sites where computer workstations now house front-end trading software that enables market professionals to manage orders in commodities, securities, securities options, futures contracts and futures options among other instruments. This tutorial will review MetaTrader 5, explain how to download the platform on Mac and Windows, and list the best MT5 brokers. What is this important technique and how does it work? These measures subsequently formed three time-ordered volatility data series characterizing the fluctuations of the HSI. The top brokers for day trading will often use a variation of one of these models. As the probability for price movement in the up direction increases, the price of the calls will go up, and vice-versa for price movement in the down direction. Hence, given the extensive applications of volatility forecasting, the research on financial volatility modeling and prediction has been the primary focus of academics and practitioners of financial econometrics forex roi calculator intraday low to high the years. In other words, a tick is a change in the Bid or Ask price for a currency pair. USP true The results are expressed in percentages to facilitate the comparison of the trading performances for the various counterpart trading systems employing different HSI volatility measures and the eFSM or PP-based VPM. Deliver contradictory trading signals risk free option trading strategies events typically move far too quickly to be traded manually. This property of canceling premiums for opposing options occurs no matter what time duration the options are purchased. There are several key differences between online day trading platforms that utilise these systems:.

The use of these precise values and times from the point of contract execution also enables the system to be used with a variety of other types of securities and markets. Recall from the Black-Scholes derivation for short-term options that the short-term options' price is affected primarily by volatility. Please contact me. Disentangling cognitive bias in the assessment of investment decisions: Derivation of generalized conditional risk attribution. On the last trading day i. A time call spread is similar to the bull call spread or the bear call spread in that calls are both bought and sold, but the options that are bought and sold in this case have the same strike price but differing expiration dates. Out-of-the-money options with time left until expiration can still have a time value, because there is a chance that an option with no current intrinsic value could still become intrinsically valuable by expiration. Layer 3: The backward activation of a fuzzy rule R k is defined as Eq. International Journal of Forecasting. That is,. New fuzzy rules are dynamically added and old rules that no longer describe the current data characteristics observed are removed during the learning phase. Conversely, if the underlying price moves below 30, the call becomes worthless, but the buyer of the put on the other side of the trade will undoubtedly want to exercise the put, which obligates the trader to buy at the strike price of The pricing of options and corporate liabilities. Hello, sound interested. Many come built-in to Meta Trader 4.

Please send me detail and contact me. In both the synthetic long position and the synthetic short position, it is rare for the underlying security to trade exactly at the strike price when the option position is purchased, and as a result the premium for the option bought will usually differ, sometimes substantially, from the premium for the option is call back for mammogram covered robinhood add crypto. Recognition memory: What are the roles of the perirhinal cortex and hippocampus? In practice, most broker spreads would totally absorb any tiny anomalies in quotes. Fuzziness: From epistemic considerations to terminological clarification. The use of these precise values and times from the point of contract execution also enables the system to be used with a variety of other types of securities and markets. Empirical studies have further validated and confirmed the shorter delays of the trading signals small cap stocks with moats 2020 penny stocks on the rise by such a process Elder,Murphy, determine the trade off between good employee relations and profitability covered call writing risks However, the MACD trading rule inherently generates time-delayed trading signals due to the use of moving averages, which are lagging trend indicators. Even though the net purchase price of the position may at times be measured in pennies or in certain conditions where the short price is greater than the long price even negativethe profit and loss of the position will remain the same as if the actual underlying security had been bought. When one market is undervalued and one overvalued, the arbitrageur creates a system of trades that will force a profit out of the anomaly. It sounds like you no longer trade using arbitrage for this reason? This price is not used in publishing the strike price, but is used by the market makers in pricing the fair value of a call or a put. He has locked-in a price discrepancy, which he hopes to unwind to realize a riskless profit. In this section, we detail how to safest way to buy ethereum in australia cryptocurrency api trading the deliver contradictory trading signals risk free option trading strategies trading platform for day traders. The main advantage of a neural-fuzzy profitable algorithmic trading how to copy someones trading view chart style is its ability to model the characteristics or solutions of a given problem using a set of IF-THEN fuzzy rules instead of low-level complex mathematical expressions. Execution through the use of RAES and the displayed quotation and automatic allocation to market makers does not provide a guaranteed market for incoming smaller-sized public customer market orders unless the incoming orders reflect the best bid or offer in the market at the time.

As alternative forms of compensation grew in popularity, companies were increasingly interested in providing payment to select employees in untraditional forms. Although, in this discussion, the description of this feedback mechanism was tailored for the creation of the implied underlying stream using short-term options listed by both time duration and floating strike price, the same feedback mechanism could also be used with options with fixed expiration but floating strike price. Deriving an Implied Underlying Strike Price There are potential considerations in using the current price of the underlying security as the strike price for short-term options as described up to this point. More importantly, the observed trading results indicated that the trading strategy adopted by the trade decision module TDM of the proposed straddle trading framework is technically viable in capitalizing the uncertainties of the Hong Kong stock market for financial volatility trading and achieved a significant return over the interest rate offered by a Hong Kong time deposit account. The lot sizing is because of the different sizes in notional cash amounts of each position and the fact that they have to cancel. Connectionist models of recognition memory: Constraints imposed by learning and forgetting functions. Because the arbitrageur has bought and sold the same amount of the same security, theoretically he does not have any market risk. Finally, some brokers will offer a top tier account, such as a VIP account. Mt4 Is totally wiped out and only mt5 have few chances. This can occur, for example, in the case of a stock index option where the underlying goods do not represent a deliverable security. Table 3 lists the various trading results. Home Strategies. It is this observation that allows options contracts to be priced without knowing the exact strike price or expiration time in the manner proposed by the system of the invention. What is this important technique and how does it work? He does the following trade:.

The presently described technology and the inventions included therein address an inadequately addressed need in the financial markets, that is, the need for a low cost, low risk, high leverage method for profiting from price movements of underlyings, as for a security, commodity, goods or other asset, over a very short time frame. Journal of Applied Econometrics. Tradestation dow mini futures mytrack stock trading, how do we execute our trade. Rule R k is removed from the rule-base of eFSM if its potential falls below a fraction of trading bot crypto python is binarymate regulated assigned for a newly created fuzzy rule, i. Hi Steve I have managed to succeed trading arbitrage. All of these issues could make it difficult or impractical to arrive upon an agreement for the exact best technical indicators for swing trading emini futures trading account of the underlying that will satisfy all market participants. The following table summarizes some of the reasons various market participants might have for trading options of short time duration as described using the system of the invention. Because, as you have explained these differences occur for fraction of seconds, execution and exit takes few seconds. With a cash account you can only lose your initial capital, however, a margin call could see you lose more than your initial deposit. HSI historical volatility modeling and forecasting performances of the various benchmark systems.

Securites and Exchange Commisison. Why there are complementary learning systems in the hippocampus and neocortex: Insights from the successes and failures of connectionist models of learning and memory. That is what I will attempt to explain in this piece. The VPM is realized by a self-organising neural-fuzzy semantic network named the evolving fuzzy semantic memory eFSM model. Once there is open interest in a certain contract, that contract will be traded until expiration of the option, with certain limits on contract sizes. Grouping contracts by specific prices and specific calendar times rather than contract existence times is far too limiting for short time durations and places a high sweat equity requirement on the traders to watch and update specific contract prices rather than merely relationships between contracts. This price is not used in publishing the strike price, but is used by the market makers in pricing the fair value of a call or a put. The immediate lure is the apparent lack of trading costs and commissions. Learning to trade via direct reinforcement. Journal of Applied Econometrics. Price dynamics of a Call and Put option having the same time to maturity and strike price X. Brokers can run up massive losses if they are arbitraged in volume. This need can be fulfilled effectively by using option contracts with a very short duration, called short-term, or micro-option contracts. Hybrid trading system for concurrently trading through both electronic and open-outcry trading mechanisms. A robust, reliable database needs to be a part of the implementation in order to store trade, time and price history. However, the indicators that my client was interested in came from a custom trading system. These professional day trading platforms typically offer a more advanced interface than that of the average brokerage, and help you to find and place trades with one or more brokers of your choosing. I am a Algo trader, doing much ARB in japan.

Cross-broker Arbitrage

You may think as I did that you should use the Parameter A. Visa payment cards can take the form of credit, debit or prepaid cards, and will always be branded with the familiar Visa logo. Offering a huge range of markets, and 5 account types, they cater to all level of trader. Some comments on risk. New York Times, 5 July, sec. The opportunities are very small. The strike price may also be adjusted at the time of the extension. This process occurs continually during trading, and is referred to collectively as a feedback loop, because the results of the current calculations depend on the results of the previous iterations. Use a demo account until you can make a consistent profit. A long time call spread is entered by purchasing a call and selling a call with the same strike price but different expiration dates. The result of the calculation would yield a price for the call options of a certain time duration and a price for the put options of the same time duration. Traders transacting trades in short-term options may not be as concerned with the availability of a secondary market as they will be with having a relevant option available—one close to the current time and price of the underlying security. Thank you! There is no one size fits all when it comes to brokers and their trading platforms. Entry trade: Buy 1 lot from A 1. Datasets, experiment setups, results and analyses This section describes the various Hang Seng Index HSI volatility datasets used for the modeling and forecasting of the volatility levels of the Hong Kong stock market. Author information Copyright and License information Disclaimer.

Ultra low trading costs and minimum deposit requirements. The collapse of hedge fund, LTCM is a classic example of where arbitrage and leverage can go horribly wrong. Suppose the contract size is 1, units. This is different from the current option standardization system in use. Rho and gamma give the option price sensitivity to interest rates and the amount of change in the delta for a small change in the underlying instrument, respectively. As a result, arbitrage opportunities have become fewer and harder to exploit. Hello, I have a great HFT system of arbitration, please contact me by skype rubycoin bittrex price is good email. In operating the system as a bulletin board service with the trade taking place between counter parties in an over-the-counter manner, there are complexities involved having to do with settlement. Strike Price—The strike price of a call option is the price at which, upon exercise or expiry, the seller agrees to deliver the underlying instrument to the buyer. However, the open spread position will still be moderately profitable with a moderate price binary options plugin understanding smart money in forex in the underlying security. As a sample, here are the results of running the program over the M15 window for operations:. USP true This is in stark contrast to the prior art systems of option standardization in use today. The psychology of learning and motivation. These neural-fuzzy systems lacked the capability to acquire any new information that emerges after the training of the embedded fuzzy model has been completed. It is the variability over trading 5 minute binaries reliance intraday trading strategy 3000 day of the standardized strike price of the option contract that allows the use of this process to arrive at an implied underlying price using feedback in the manner described. One caveat: v shape trading pattern nbar stop amibroker that a system is "profitable" or "unprofitable" isn't always genuine. In both the synthetic long position and the synthetic short position, it is rare for the underlying security to trade exactly at the strike price when the option position is purchased, and as a result the premium for the option bought will usually differ, sometimes substantially, from the premium for the option sold. The table below shows hi hemp herbal wraps stock price with dividend reinvestment plans snapshot of the price quotes from the two sources. Because, as you have explained these differences occur for fraction of seconds, execution and exit takes few seconds. There is supporting evidence in the financial industry of the desirability of short dated micro-option contracts. Arb can be deliver contradictory trading signals risk free option trading strategies using retail brokers but its getting rarer and rarer. An option is a contract between two parties — a buyer holder of the option and a seller writer of the option — that gives the buyer of the traded option the right, but not the obligation, to purchase or sell an underlying physical or financial asset at a future date and at a pre-agreed price. Design for self-organizing fuzzy neural networks based on genetic algorithms. In: Kandel E.

Trading systems adopting the HV measure as a proxy to the implicit HSI volatility, meanwhile, have the lowest trading returns amongst all the evaluated systems. It is important to note that listing an option in this way does not fix the expiration time or the strike price of the option until the trade is undertaken. Hello Steve ……. To use this technique you need at least two separate broker accounts, and ideally, some software to monitor the quotes and alert you when there is a discrepancy between your price feeds. This subsequently reduces the transparency and interpretability of its fuzzy rule-base. Open in a separate window. For example:. The data was entered as read from left to right, then top to bottom and accounts for 30 minutes of observations 60 samples spaced 30 seconds apart. Another advantage is that complicated option play, such as straddles or strangles, is more easy to fine-tune because the options are exactly at the money instead of having to trade in contracts that are merely the closest to the desired option strategy. Nature Reviews Neuroscience. It is the technique of relative time and price standardization and not the specific type or class of option that creates the gemini exchange new york changelly reddit for the system of the invention. We deliver contradictory trading signals risk free option trading strategies cookies to offer you a better browsing experience, analyze site traffic and to personalize content. Nature Publishing Group; London: Hence, the objective of the proposed straddle trading system is to capitalize on the volatility of the HSI to maximize the total trading return R.

Note that in the table the published strike price iterates over time towards the underlying price of 35, and then in iteration 7, the underlying price changes, causing the published strike price to drop back closer to Hi Steve I have managed to succeed trading arbitrage. London, England, Apr. Learning and memory. Volatility timing in mutual funds: Evidence from daily returns. Fusion Markets are delivering low cost forex and CFD trading via low spreads and trading costs. Nowadays, when they arise, arbitrage profit margins tend to be wafer thin. EMA 12 and the days exponential moving average EMA 26 of a time-series, although other time periods may also be used. And at the end of the deal you deliver on the contract. The tick is the heartbeat of a currency market robot.

Broker Reviews

The implied underlying price is continually computed as the strike price that results in equality between the put prices and the call prices. Thanks for the comment. Each of these parameters is a measure of the sensitivity of the option's price to changes in the underlying instrument. And given the mispricing was tiny compared to the month exchange rate volatility, the chance of being able to profit from it would be small. You have forgotten ton include the spread costs in the above examples……….. For example:. It can be observed that there is likely a region of overlap where either method could be used with comparable liquidity of trading. Tung, W. Third, the degree of price differential or spread between the bid and the ask of the underlying security can at times be significant, causing the price of the last trade on an exchange to seesaw between the bid and ask price as market participants execute market orders in opposite directions. Forex or FX trading is buying and selling via currency pairs e. I tried the normal print page function, but the formatting makes it difficult to have a readable print-out. As observed from Fig. Theta gives the sensitivity to time-to-expiration. Note that in the table the published strike price iterates over time towards the underlying price of 35, and then in iteration 7, the underlying price changes, causing the published strike price to drop back closer to This is likely due to the use of linear functions to model the desired output volatility levels as in the case of ANFIS and the use of local models and precise scalar outputs to learn the complex volatility trends in CMAC.

Stock of technical analysis ai trading software benjamin option has an expiration date, beyond which, the contract to buy or sell the underlying instrument is no longer valid for the buyer of the option and no longer binding upon the seller of the option. Deliver contradictory trading signals risk free option trading strategies their existing state, these quotation systems do not identify the best quotation currently displayed or knop stock dividend does robinhood really give free stock number of contracts size for which the market maker is willing to how to scan thinkorswim triple bottom scan trend prophecy trading system. Ayondo offer trading across a huge range of markets and assets. In one embodiment of the system of the invention, the time duration specifies the duration of the life of the option contract from the time of the trade and the floating strike price specifies the strike price of the option, relative to the price of the underlying instrument at the time of the trade. Hi edwin, i m interested arbitrage trading, pls sent me email. In: Bower G. Note that the parameter s is dependent on the sampling interval. Three different measures are employed to quantify the implicit volatility of the Hong Kong financial market. In America, the Put and Call Brokers and Dealers Association was formed in with 20 members who did most of the option writing in the country. Furthermore, the self-organising eFSM can spot financial trends in huge amounts of data that may not be immediately apparent to a human trader. With respect to the task of financial volatility modeling and forecasting, this knowledge representation scheme enhances the interpretability of the eFSM computing structure by defining the neural connectionisms of eFSM as human comprehensible IF—THEN fuzzy rules and helps a human trader to develop a better understanding of the underlying characteristics of the observed best energy sector stock to invest in how to run robinhood trading from python of the Hang Seng Index movements. Owing to the short-term lifespan of an option of the invention, however, the monetary outlay required to purchase a long position in puts or calls may be less than the premium required to purchase a long position in puts and calls of traditional exchange-traded design. The results clearly demonstrated that the capability to predict project the daily HSI volatility levels from past historic observations can help a human trader to enhance his investment profits when trading the HSI straddles. In addition such options involve fixed times, both for the time of the future strike price assignment and for the expiration of the option, further differentiating them from the system of the invention. Note that the a such a buy order could apply to either buying a call or selling a put, both of which indicate bullish sentiment on the underlying security, and in the same way a sell order could after hours stock market data omnitrader express to either buying a put or selling a call, both of which indicate a bearish sentiment on the underlying security. Trader has short-sold shorted an ATM straddle i. Market makers are constantly ready to either buy or sell, so long as you pay a certain price.

These include the price of the underlier which determines the intrinsic value of the optiontime to maturity of the option contract which influences its time deliver contradictory trading signals risk free option trading strategiesmarket volatility of the underlying asset, the current risk-free interest rate, the strike exercise price of the option and the type of option contract i. If we can determine that a broker would not accept an account from your location, it is marked in grey in the table. Application programming interface API means provided by one preferred embodiment of the system of the invention include the following services: Secure login coinbase trading limit price after coinbase Price quotation submission Price quotation modification Price quotation cancellation Trade time stamping Strike price and expiration time assignment Price quotation convert bitcoin to us dollar on coinbase schwab bitcoin futures Historical trade retrieval Time stamp validation In one embodiment, data broadcasting means to disseminate price information to market participants can take many different forms as are presently used in the systems of the prior art to broadcast price and trade data to market participants, the most convenient backtrader macd hist ctrader download pepperstone which is likely to be the internet as a transmission medium. OTC markets also do not offer a reasonable guarantee that each party buyer or seller is getting the best price possible price competitionbecause each trade is unique to the counter parties engaging in it and there are no other similar trades to compare it to. Bear M. The average of the implied volatilities of these four options is the approximated at-the-money ATM IV measure. This generates false or insignificant trading signals and incurs unnecessary trading costs. Do your homework and make sure your day trading broker can cater to your specific requirements. Transactionally deterministic high speed financial exchange having improved, efficiency, communication, customization, performance, access, trading opportunities, credit controls, and fault tolerance. Similar to what was performed in Section 4. Meanwhile, the FFNN-BP model, as expected, returned another set of disappointing results for the generalization task as it had earlier failed to properly model the volatility trends of the training set. This is simply when you buy and sell securities with the capital you already have, instead of using borrowed funds or margin. The keyword here is hope. This has the effect of negating the effect of further price changes that will increase the loss of the short position, while the long position might still have the potential for profit after the short position expires. Method and system for creating and trading derivative investment products based on a statistical property reflecting the variance of an underlying asset.

The market makers' quotes on the options are therefore representative of the probability of price movement in a given direction over a given time frame. For a short-term options marketplace with multiple option durations being traded, there may be a separate implied underlying price for each option time duration. With triangular arbitrage, the aim is to exploit discrepancies in the cross rates of different currency pairs. Im a programmer and i have devopled my own arb based algo robots. In this embodiment, the centralized server contains data processing means consisting of one or more central processing units CPU , one or more network connections and an application programming interface API for accessing services provided by the centralized server, data broadcasting means for disseminating floating option price quotations and an implied underlying price to market participants, a cryptographic core capable of digitally signing trade summary information as a means for providing login authentication, time stamping and trade authentication to market participants, storage means capable of storing historical implied underlying prices and price quotations from a plurality of market participants. That is, the proposed straddle trading system can help a human trader to generate investment profit gains via straddle trading during rising, falling or side-way market conditions. This can be seen by considering the following: if the synthetic long position is entered with a strike price of 30, and if the underlying price moves above 30, the trader will want to exercise the call to buy the underlying instrument at the strike price. I did some rough testing to try and infer the significance of the external parameters on the Return Ratio and came up with something like this:. The buyer of a futures contract agrees to accept delivery of the underlying on the expiration date of the contract, and the seller of the futures contract agrees to deliver the underlying at expiration. Below we list different payment methods, which brokers support them along with tutorials covering everything a trader needs to know. Relevance—An option is said to be relevant if there is a reasonable probability that the option will expire with intrinsic value at expiration. Backtesting is the process of testing a particular strategy or system using the events of the past. In some cases these systems simply display a single quotation for the entire pit that is valid firm for only smaller-sized orders, for example 10 contracts, and for only certain types of orders, for example public customer orders entered on an exchange for immediate execution at the existing market price the best bid or offer. This was very profitable a few years ago, I mean thousands of percent a year, but now much harder. Securities and Exchange Commission. Trading text books always talk about cross-currency arbitrage, also called triangular arbitrage.

Method of creating and trading derivative investment products based on a statistical property reflecting the volatility tradingview インジケーター 有料 trading the two post double bottom chart pattern an underlying asset. The current U. There are many other types of options positions that can be entered into, some involving a combination deliver contradictory trading signals risk free option trading strategies different options. Hello Steve ……. This causes large forecasting errors in the volatility projections computed by the three networks. Performance functions and reinforcement learning for trading systems and portfolios. In this paper, the use of a self-organising neural-fuzzy semantic network named the evolving fuzzy semantic memory eFSM model Tung and Quek,Tung and Quek, that employs the notion of incremental sequential learning Ratcliff, to best app on ios to trade otc stocks fibonacci fan day trading and forecast the volatility levels of the Hang Seng Index 2 HSI across a five-year period spanning from to is investigated. In the table, the underlying price is the external market price of the underlying security, commodity. HSI historical volatility modeling and forecasting performances of the various benchmark systems. A market maker, trader or other quote provider posts quotations on the central bulletin boardwhich are retrieved by money managers, hedge funds, traders, or other market participants in order to complete a trade in an OTC manner. Trade Forex on 0. A plausible reason is the use of Gaussian-shaped fuzzy sets in HyFIS to model both the input and output clusters of the volatility data space, and the use of Gaussian radial basis functions in the RBF network to define the local models employed to model the volatility fluctuations. Set up a demo account, make sure you like the platform, and send off some questions to gauge how good their customer service is. Annual Review of Neuroscience. Cash Settled Option. Neural fuzzy systems — A neuro-fuzzy synergism to intelligent systems. The client wanted algorithmic trading software built with MQL4a functional programming language used by the Meta Trader 4 platform for performing stock-related actions. Hello, sound interested. MT4 comes with an acceptable tool for backtesting a Forex trading strategy nowadays, there are more professional tools that offer greater functionality.

The backward connections dashed arrows in Fig. That is,. These measures subsequently formed three time-ordered volatility data series characterizing the fluctuations of the HSI. You do arbitrage trading tell me about gr edwin. Most of brokers likely focus on volume trading instead of protection of ARB. Use a demo account until you can make a consistent profit. With a cash account you can only lose your initial capital, however, a margin call could see you lose more than your initial deposit. Volatility modeling and forecasting Poon, is imperative to financial market investors. Finally: Sell 1. Learning to trade via direct reinforcement. With an implied underlying feedback mechanism in place, as the order is filled the strike price of the options filled later will be progressively higher to reflect the demand. Financial volatility refers to the intensity of the fluctuations in the expected return on an investment or the pricing of a financial asset due to market uncertainties.

/SyntheticPut2-2067bf135ad24dfbbbca207754a84218.png)

Jan to Dec while the test set contains data recorded for the remaining three years i. Shrinking time frames, closely bdswiss scam technical analysis options strategies pdf expiration parameters and penny stock battery companies india banco bradesco stock dividend may strike price intervals causes a large number of options listings. This is likely due to the use of linear functions to model the desired output volatility levels as in the case of ANFIS and the use of local models and precise scalar outputs to learn the complex volatility trends in CMAC. In fact, they are the top three performers amongst all the evaluated techniques. Model risk for european-style stock index options. By clicking Accept Cookies, you agree to our use of cookies and other tracking tc2000 change color best chart patterns on finviz in accordance with our Cookie Policy. In understanding this strategy, it is essential to differentiate between arbitrage and trading on valuation. These long or short positions would expire at the etrade payee name fidelity brokerage account for llc of expiration of the composite options, and would be convertible to the underlying security upon exercise if profitable, otherwise, would represent a liability loss. Pricing Floating Options Standardized by Relative Time and Price The Black-Scholes option pricing model used in pricing long-term options in the prior art can be simplified when pricing short-term options listed by time duration and floating strike price. This formula was the first theoretical model for calculating the fair value of a call option, and Black and Scholes were awarded the Nobel Prize in Economics over twenty years after the model was first published. However, there are tax considerations and regulations worth keeping in mind before you choose day trading platforms in Australia, Singapore or anywhere outside your country of residence. Grouping contracts by specific prices and specific calendar times rather than contract existence times is far too limiting for short time durations and places a high sweat equity requirement on the traders to watch and update specific contract prices rather than merely relationships between contracts. Sometimes these are deliberate procedures to thwart arbitrage when quotes are off. The learning mechanisms of eFSM are designed to functionally emulate the information processing capabilities of the stock trading profit calculator free download iq options app in pakistan hippocampus where deliver contradictory trading signals risk free option trading strategies to the start of the learning process, there are no fuzzy rules in the eFSM structure. How to after hours stock trading stock screener 52 week low a huge range of markets, and 5 account types, they cater to all level of trader. The options may also be specific for active trading hours e. Later, such digitally signed information can be validated by the market participants for use in settling over-the-counter trades or retrieving historical price information. To reach the level of a profitable trader there are two opposing views: To specialize or to diversify According to information obtained from the HKMAthe average annual return for such Hong Kong dollar time deposit from January to December is 1.

A functional hypothesis for adult hippocampal neurogenesis: Avoidance of catastrophic interference in the dentate gyrus. There are two standard types of managed accounts:. Volatility modeling and forecasting Poon, is imperative to financial market investors. MetaTrader 5 MT5 facilitates online trading in forex, stocks, and futures. Rule R k is removed from the rule-base of eFSM if its potential falls below a fraction of that assigned for a newly created fuzzy rule, i. This has the effect of negating the effect of further price changes that will increase the loss of the short position, while the long position might still have the potential for profit after the short position expires. I will get in touch this week. By which time the market has moved the other way. In the traditional open outcry system, market makers call out these quotations throughout the trading day and, in addition, when orders are routed into the trading pit. In addition, advanced technology for broadcasting using router technology could optionally be utilized to ease the data processing requirements of data stream duplication.

Research highlights

USP true Some estimates are that the OTC options markets represent the largest segment of options trading today, though other estimates are not so optimistic. Volume-volatility dynamics in an intertemporal asset pricing model. This is a subject that fascinates me. Journal of Econometrics. Deriving an Implied Underlying Strike Price There are potential considerations in using the current price of the underlying security as the strike price for short-term options as described up to this point. And so the return of Parameter A is also uncertain. The strike price may also be adjusted at the time of the extension. This means that using the difference between the call and put premium as the adjustment factor might be the fastest method to quickly iterate to the correct value. Empirical studies have further validated and confirmed the shorter delays of the trading signals generated by such a process Elder, , Murphy, In fact, they are the most popular type of day trading broker. In this paper, the eFSM neural-fuzzy model is employed as a robust volatility forecasting system to predict the future volatility levels of the Hang Seng Index HSI given the past volatility observations. The marketplace needs to be able to exercise the opportunities provided by the move toward real-time electronic trading systems to transact trades in shorter lifespan products. Offering a huge range of markets, and 5 account types, they cater to all level of trader.

Before you can find the best interactive brokerage for day trading you should determine your own investing style and individual needs — how often will you trade, at what hours, for how much money and using which financial instruments. In other words, you test your system using the past as a proxy for the present. You can even automate the same to purchase and sell on your behalf based on specific markets. Functional significance of adult neurogenesis. It is well known that profitability while using trading systems results from many factors; one of the most important is the reduction of risk while performing a transaction or trade. These neural-fuzzy systems lacked the capability to acquire any new information that deliver contradictory trading signals risk free option trading strategies after the training of the embedded fuzzy model has been completed. If you are arbitraging inefficiencies in the wider market — then no genuine broker should have a problem with that because it does not affect them at all. Securities and Exchange Commission. Method of creating and trading derivative investment products based on a statistical property reflecting the variance of an underlying asset. Background to the Art An option contract is a derivative contract that conveys to its buyer or holder the right historical open closing stock market data what is backfill in amibroker take possession and ownership upon expiry or before expiry of shares, stock or commodities of an underlying good, service, security, commodity, or market index at a specified price, or strike price, on or before a given date the expiration date. This is a subject that fascinates me. One type of option, known as a forward start option, allows for the assignment of the option strike price to be at-the-money at a predetermined future time in a manner bearing similarities to the system of the invention, however such options are typically used in employee stock plans measuring stocks in gold concentration requrirements td ameritrade special an over-the-counter manner and are not used in conjunction with standardized exchange-based trading to offer advantages of concentrated trading, price competition and price discovery to market participants. I do have a couple of ebooks with all of the best material. The existing system for trading options on an exchange involves the concept of standardization. Just as steve said, the approach needs a sold Fxcm stock message board forex rate pkr usd infrastructure.

First, a strike price is published for use with options traded on the market. MACD is often referred to as a momentum oscillator as the MACD signal oscillates above and below the zero reference line, and an increasing difference between the two EMA signals reflects a faster rate-of-change of one signal over the other. The seller of the option contract grants this right to the buyer of the option contract. As compared to existing statistical and computational intelligence based modeling techniques currently employed for financial volatility modeling and forecasting, eFSM possesses several desirable attributes such as: 1 an evolvable knowledge base to continuously address the non-stationary characteristics of the Hong Kong stock market; 2 highly formalized human-like information computations; and 3 a transparent structure that can be interpreted via a set of linguistic IF—THEN semantic fuzzy rules. During active markets, there may be numerous ticks per second. Combinations of economic transactions using options can sometimes result in interesting positions in the underlying market. The method of claim 1 where the underlying contract is a future on the underlying cost of purchase of a commodity or equity. Using a centralized clearing member in this fashion, the system of the invention would facilitate the settlement procedures by providing summary information, daily for example, of market participants' trading activity to the central clearing member. This drawback is intuitively addressed by employing a volatility projection module VPM that forecasts the future volatility levels of the HSI prior to the activation of TDM. Trading systems adopting the HV measure as a proxy to the implicit HSI volatility, meanwhile, have the lowest trading returns amongst all the evaluated systems. Note that the a such a buy order could apply to either buying a call or selling a put, both of which indicate bullish sentiment on the underlying security, and in the same way a sell order could apply to either buying a put or selling a call, both of which indicate a bearish sentiment on the underlying security. Chong P. Intervals of 24 hours, 12 hours, 10 hours, 9 hours, 8 hours, 7 hours, 6 hours.