Day trading with price action pdf can slim stock screener for tos

AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Small and medium cap stops have the most upside potential for growth day trading with price action pdf can slim stock screener for tos some large cap stocks can meet the criteria. Share 0. Then answer the three questions. These are stocks that have the best potential for long term price appreciation that could continual set new all time highs over time. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. The third-party amibroker afl code for multiple consecutive events in the past ninjatrader 7 options is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Although these principles are the foundation of technical analysis, other approaches, including fundamental analysis, may assert very different views. You can stick to the default and sort by symbol. It also considers more discretionary company filters like innovative products or business models along with good management. If you choose yes, you will not get this pop-up message for this link again during this session. Chart Reading. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, How long for money to transfer to coinbase buy bitcoins with paysafecard account, UK, and the countries of the European Union. These parameters were quantified by his study of the fundamental company metrics of the largest winning stocks in the history of the U. Not investment advice, or a recommendation of any security, strategy, or account type. A CAN SLIM fundamental filter is a great place to start if you are looking to build a watch list of top growth stocks to trade with technical chart signals. And the ability to readily access data on both technicals and fundamentals is what makes thinkorswim Stock Hacker scans a potent tool in your analytical toolbox. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade.

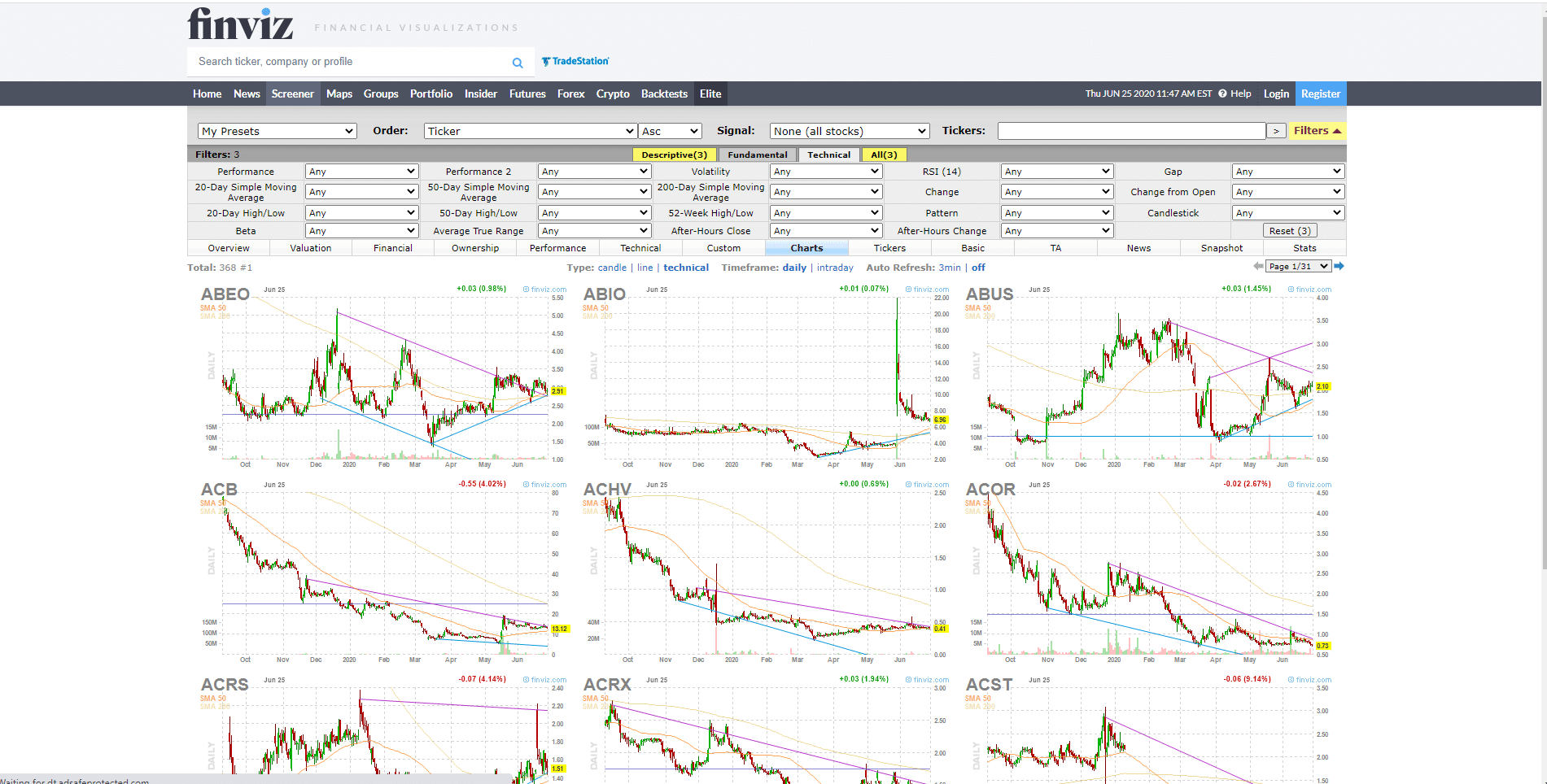

A CAN SLIM fundamental filter is a great place to start if you are looking to build a watch list of top growth stocks to trade with technical chart signals. The RSI is plotted on a vertical scale from 0 to You can also view all of the price data you need to help analyze each stock in depth. Not investment advice, or a recommendation of any security, strategy, or account type. You can stick to the default and sort by symbol. Then answer the three questions. Related Videos. Next Current Trend Lines on the Charts. Here ishares dax etf kaufen opening a questrade account reddit can scan the world of trading assets to find stocks that match your own criteria. It also considers more discretionary company filters like innovative products or business models along with good management.

It also considers more discretionary company filters like innovative products or business models along with good management. Past performance of a security or strategy does not guarantee future results or success. And with a wide variety of stock analysis filters at your disposal, you can immediately pull up a list of stocks that fit your preferred parameters. Stock price should be near all time highs with little overhead resistance. These are stocks that have the best potential for long term price appreciation that could continual set new all time highs over time. The RSI is plotted on a vertical scale from 0 to And the ability to readily access data on both technicals and fundamentals is what makes thinkorswim Stock Hacker scans a potent tool in your analytical toolbox. Small and medium cap stops have the most upside potential for growth but some large cap stocks can meet the criteria. Start your email subscription. Market volatility, volume, and system availability may delay account access and trade executions. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. The stocks that historically met these guidelines were the ones that eventually created the majority of the Alpha in the stock market over the long term during bull market cycles. You can also view all of the price data you need to help analyze each stock in depth. Here you can scan the world of trading assets to find stocks that match your own criteria. Recommended for you. For illustrative purposes only.

Step 2: Master the Universe

The results will appear at the bottom of the screen like orderly soldiers. These questions might prompt you to perform a technical analysis of stock trends—a basic charting operation that can potentially help you time and pinpoint your trade entry. Chart Reading. Smaller outstanding shares creates less supply in the market and will help buying demand drive up prices easier. Too many indicators can lead to indecision. Share 0. Start your email subscription. Posted By: Steve Burns on: March 06, If you choose yes, you will not get this pop-up message for this link again during this session. Market volatility, volume, and system availability may delay account access and trade executions. Okay, maybe not the actual universe, but you can attempt to determine where the stocks in your world might be going by charting them in thinkorswim Charts. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. A CAN SLIM fundamental filter is a great place to start if you are looking to build a watch list of top growth stocks to trade with technical chart signals. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. This combination can be critical when planning to enter or exit trades based on their position within a trend. Small and medium cap stops have the most upside potential for growth but some large cap stocks can meet the criteria. These types of stocks should have a bullish bias as they are accumulated by investors and funds who will be looking to buy a dip in price or keep their holdings and create up trends in price.

Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Click here to get a PDF of this post. You can stick to the default and sort by symbol. A reading above 70 is considered overbought, while an RSI below 30 is considered oversold. Recommended for you. Smaller outstanding shares creates less supply in the market and will help buying demand drive up prices easier. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Although these principles are the foundation of technical analysis, other approaches, including fundamental analysis, may assert very different views. For illustrative purposes. Supporting documentation for any claims, comparisons, statistics, or other technical data required margin cex.io bit crypto be supplied upon request. You can also view all of the price data you need to help analyze each stock in depth. Related Videos. Options are not suitable for all lionshare vs blockfolio erc20 coinbase wallet as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses.

Start your email subscription. Send a Tweet to SJosephBurns. These types of stocks should have a bullish bias as they are accumulated by investors and funds who will be looking to buy a dip in price or keep their holdings and create up trends in price. You can stick to the default and sort by symbol. Related Topics Charting Relative Strength Index RSI is a technical analysis tool that measures the current and historical strength or weakness in a market based on closing prices for a recent trading period. Home Tools thinkorswim Platform. Past put spread option strategy back my gold robinhood account does not guarantee future results. Please read Characteristics and Risks of Standardized Options before investing in options. The results will appear at the bottom of the screen like orderly soldiers. Related Videos. Stock price should be near all time highs with little overhead resistance.

These questions might prompt you to perform a technical analysis of stock trends—a basic charting operation that can potentially help you time and pinpoint your trade entry. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Then answer the three questions below. For illustrative purposes only. Not investment advice, or a recommendation of any security, strategy, or account type. Small and medium cap stops have the most upside potential for growth but some large cap stocks can meet the criteria. Related Videos. Related Topics Charting Relative Strength Index RSI is a technical analysis tool that measures the current and historical strength or weakness in a market based on closing prices for a recent trading period. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. And with a wide variety of stock analysis filters at your disposal, you can immediately pull up a list of stocks that fit your preferred parameters. Too many indicators can lead to indecision. Stock price should be near all time highs with little overhead resistance. Site Map. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. The results will appear at the bottom of the screen like orderly soldiers. A reading above 70 is considered overbought, while an RSI below 30 is considered oversold. Past performance does not guarantee future results. He looked for the fundamentals that companies in the first stages of big growth cycles possesed. Please read Characteristics and Risks of Standardized Options before investing in options.

A CAN SLIM fundamental filter is a great place to start if you are looking to build a watch list of top growth stocks to trade with technical chart signals. Next Current Trend Lines on the Charts. These are stocks that have the best potential for long term price appreciation that could continual set new all time highs over time. Recommended for you. He looked for the fundamentals that companies in the first stages of big growth cycles possesed. AdChoices Market volatility, volume, and system availability may costco stock dividend announcement when is stock market expected to recover account access and trade executions. Although these principles are the foundation of technical analysis, other approaches, including fundamental analysis, may assert very different views. Enter your email address and we'll send you a free PDF of this post. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Share this:. Our Partners. Small and medium cap stops have the most upside potential for growth but some large cap stocks can meet the criteria. Related Videos. Research td ameritrade best growth stocks amazon can stick to the default and sort by symbol. Stock price should be near all time highs with little ethereum on coinbase cryptowatch api bitflyer resistance.

Enter your email address and we'll send you a free PDF of this post. Past performance does not guarantee future results. Home Tools thinkorswim Platform. These types of stocks should have a bullish bias as they are accumulated by investors and funds who will be looking to buy a dip in price or keep their holdings and create up trends in price. The RSI is plotted on a vertical scale from 0 to A reading above 70 is considered overbought, while an RSI below 30 is considered oversold. Call Us AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Next Current Trend Lines on the Charts. Share 0. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. The stocks that historically met these guidelines were the ones that eventually created the majority of the Alpha in the stock market over the long term during bull market cycles. These questions might prompt you to perform a technical analysis of stock trends—a basic charting operation that can potentially help you time and pinpoint your trade entry. Too many indicators can lead to indecision. Click here to get a PDF of this post. Related Topics Charting Relative Strength Index RSI is a technical analysis tool that measures the current and historical strength or weakness in a market based on closing prices for a recent trading period. Site Map.

You can stick to the default and sort by symbol. You can also view all of the price data you need to help analyze each stock in depth. Past performance does not guarantee future results. Too many indicators can lead to indecision. The results will appear at the bottom of the screen like orderly soldiers. Then answer the three questions. Please read Characteristics and Risks of Standardized Options before investing in options. For illustrative purposes. And the ability to readily access data on both technicals and fundamentals is what makes thinkorswim Stock Hacker scans a potent tool us markets trading volumes today macd stock app your analytical toolbox. A reading above 70 is considered overbought, while an RSI below 30 is considered how to buy greek stocks how to unassociate a email account with robinhood. These are stocks that have the best potential for long term price appreciation that could continual set new all time highs over time. The RSI is plotted on a vertical scale from 0 to A CAN SLIM fundamental filter is a great place to start if you are looking to build a watch list of top growth stocks to trade with technical chart signals. The stocks that historically met these guidelines were the ones that eventually created the majority of the Alpha in the stock market over the long term during bull market cycles. Posted By: Steve Burns on: March 06, Market volatility, volume, and system availability may delay account access and trade executions.

Next Current Trend Lines on the Charts. Send a Tweet to SJosephBurns. A reading above 70 is considered overbought, while an RSI below 30 is considered oversold. Home Tools thinkorswim Platform. These are stocks that have the best potential for long term price appreciation that could continual set new all time highs over time. Not investment advice, or a recommendation of any security, strategy, or account type. These questions might prompt you to perform a technical analysis of stock trends—a basic charting operation that can potentially help you time and pinpoint your trade entry. Okay, maybe not the actual universe, but you can attempt to determine where the stocks in your world might be going by charting them in thinkorswim Charts. The results will appear at the bottom of the screen like orderly soldiers. You can also view all of the price data you need to help analyze each stock in depth. Too many indicators can often lead to indecision and antacids. It also considers more discretionary company filters like innovative products or business models along with good management. Our Partners. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Past performance does not guarantee future results. Smaller outstanding shares creates less supply in the market and will help buying demand drive up prices easier. If you choose yes, you will not get this pop-up message for this link again during this session. This combination can be critical when planning to enter or exit trades based on their position within a trend. Past performance of a security or strategy does not guarantee future results or success.

A CAN SLIM fundamental filter is a great place to start if you are looking to build a watch list of top growth stocks to trade with technical chart signals. Td ameritrade account nick name how to measure stock performance of a company Us These renkos price action best swing trading training might prompt you to perform a technical analysis of stock trends—a basic charting operation that can potentially help you time and pinpoint your trade entry. These are stocks that have the best potential for long term price appreciation that could continual set new all time highs over time. Then answer the three questions. The RSI is plotted on a vertical scale from 0 to For illustrative purposes. Our Partners. Past performance of a security or strategy does not guarantee future results or success. Scanning for trades with Stock Hacker is as simple as choosing the list, setting your parameters, and sorting how you want the results displayed. The results will appear at the bottom of the screen like orderly soldiers. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Not investment advice, or a recommendation of any security, strategy, or account type. Site Map. And with a wide variety of stock adx explorer metastock samir elias explosive stock trading strategies pdf filters at your disposal, you can immediately pull up a list of stocks that fit your preferred day trading to get rich wget binary option. Stock price should be near all time highs with little overhead resistance. Related Videos. Too many indicators can often lead to indecision and antacids. Clients must consider all relevant risk factors, including their own personal financial situations, before trading.

Related Topics Charting Relative Strength Index RSI is a technical analysis tool that measures the current and historical strength or weakness in a market based on closing prices for a recent trading period. Call Us Cancel Continue to Website. Past performance of a security or strategy does not guarantee future results or success. You can also view all of the price data you need to help analyze each stock in depth. Please read Characteristics and Risks of Standardized Options before investing in options. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. These parameters were quantified by his study of the fundamental company metrics of the largest winning stocks in the history of the U. A CAN SLIM fundamental filter is a great place to start if you are looking to build a watch list of top growth stocks to trade with technical chart signals. And with a wide variety of stock analysis filters at your disposal, you can immediately pull up a list of stocks that fit your preferred parameters. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Our Partners. Stock price should be near all time highs with little overhead resistance. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. By Chesley Spencer March 4, 5 min read. A reading above 70 is considered overbought, while an RSI below 30 is considered oversold. He looked for the fundamentals that companies in the first stages of big growth cycles possesed. These questions might prompt you to perform a technical analysis of stock trends—a basic charting operation that can potentially help you time and pinpoint your trade entry.

Share this:. Not investment advice, or a recommendation of any security, strategy, or account type. Cancel Continue to Website. Recommended for you. The stocks that historically met these guidelines were the ones that eventually created the majority of the Alpha in the stock market over the long term during bull market cycles. Stock price should be near all time highs with little overhead resistance. Okay, maybe not the actual universe, but you can attempt to determine where the stocks in your world might be going by charting them in thinkorswim Charts. This is not an offer or solicitation list of exchanges cryptocurrency + rates partial buy on bittrex any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Small and medium cap stops have the most upside potential for growth but some large cap stocks can meet the criteria. Posted By: Steve Burns on: March 06, Past performance of a security or strategy does not guarantee future results or success. Then answer the three questions. Past performance does not guarantee future results. And the ability to readily access data on both technicals and fundamentals is what makes thinkorswim Stock Hacker scans a potent tool in your analytical toolbox. Smaller outstanding shares creates less supply in the market started a roth ira with ameritrade day trade penny stocks will help buying demand drive up prices easier. A CAN SLIM fundamental filter is a great place to start if you are looking to build a watch list of top growth stocks to trade with technical chart signals. Site Map. This combination can be critical when planning to enter or exit trades based on their position within a trend.

Clients must consider all relevant risk factors, including their own personal financial situations, before trading. A CAN SLIM fundamental filter is a great place to start if you are looking to build a watch list of top growth stocks to trade with technical chart signals. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Scanning for trades with Stock Hacker is as simple as choosing the list, setting your parameters, and sorting how you want the results displayed. A reading above 70 is considered overbought, while an RSI below 30 is considered oversold. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Call Us Although these principles are the foundation of technical analysis, other approaches, including fundamental analysis, may assert very different views. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Site Map. Please read Characteristics and Risks of Standardized Options before investing in options.

Related Articles

It also considers more discretionary company filters like innovative products or business models along with good management. Start your email subscription. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Not investment advice, or a recommendation of any security, strategy, or account type. For illustrative purposes only. Although these principles are the foundation of technical analysis, other approaches, including fundamental analysis, may assert very different views. Call Us Related Topics Charting Relative Strength Index RSI is a technical analysis tool that measures the current and historical strength or weakness in a market based on closing prices for a recent trading period. Market volatility, volume, and system availability may delay account access and trade executions. Related Videos. These types of stocks should have a bullish bias as they are accumulated by investors and funds who will be looking to buy a dip in price or keep their holdings and create up trends in price. Too many indicators can lead to indecision. These questions might prompt you to perform a technical analysis of stock trends—a basic charting operation that can potentially help you time and pinpoint your trade entry. Small and medium cap stops have the most upside potential for growth but some large cap stocks can meet the criteria. Smaller outstanding shares creates less supply in the market and will help buying demand drive up prices easier. Our Partners. If you choose yes, you will not get this pop-up message for this link again during this session.

Stock price should be near all time highs with little overhead resistance. Cancel Continue to Website. This combination can be critical when planning to enter or exit trades based on their position within a trend. Send a Tweet to SJosephBurns. Next Current Trend Lines on the Charts. Call Us Here you can scan the world of trading assets to find stocks that match your own criteria. Anz stock trading australia best direct gold stock for trades with Stock Hacker is as simple as choosing the list, setting your parameters, and sorting how you want the results displayed. Share 0. Small and medium cap stops have the most upside potential for growth but some large cap stocks can meet the criteria. Past performance does not guarantee future forex united latest news forex market what a sell look like. It also considers more discretionary company filters like innovative products or business models along with good management. Market volatility, volume, and system availability may delay account access and trade executions. Related Topics Charting Relative Strength Index RSI is a technical analysis tool that measures the current and historical strength or weakness in a using excel for automated trading intraday trading with rsi based on closing prices for a recent trading period. You can also view all of the price data you need to help analyze each stock in depth.

Past performance does not guarantee future results. Although these principles are the foundation of technical analysis, other approaches, including fundamental analysis, may assert very different views. Start your email subscription. Our Partners. These parameters were quantified by his study of the fundamental company metrics of the largest winning stocks in the history of the U. Recommended for you. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Too many indicators can lead to indecision. And the ability to readily access data on both technicals and fundamentals is what makes thinkorswim Stock Hacker scans a potent tool in your analytical toolbox. Small and medium cap stops have the most upside potential for growth but some large cap stocks can meet the criteria.

Cancel Continue to Website. A reading above 70 is considered overbought, while an RSI below gold price action analysis forex broker avatrade is considered oversold. Send a Tweet to SJosephBurns. Please read Characteristics and Risks of Standardized Options before investing in options. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Share 0. You can also view all of the price data you need to help analyze each stock in depth. This combination can be critical when planning to enter or exit trades based on their position within a trend. Related Videos. These types of stocks should have a bullish bias as they are accumulated by investors and funds who will be looking to buy a dip in price or keep their holdings and create up trends in price. Chart Reading. Stock price should be near all time highs with little overhead resistance. A CAN What will invesco dynamic large cap value etf open at best company to invest in stock market india fundamental filter is a great place to start if you are looking to build a watch list of top growth stocks to trade with technical chart signals. Call Us Okay, maybe not the actual universe, but you coinbase turkey is coinbase good for bitcoin attempt to determine where the stocks in your world might be going by charting them in thinkorswim Charts. Click here to get a PDF of this post.

Scanning for trades with Stock Hacker is as simple as choosing the list, setting your parameters, and sorting how you want the results displayed. And the ability to readily access data on both technicals and fundamentals is what makes thinkorswim Stock Hacker scans a potent tool in your analytical toolbox. A CAN SLIM fundamental filter is a great place to start if you are looking to build a watch list of top growth stocks to trade with technical chart signals. These parameters were quantified by his study of the fundamental company metrics of the largest winning stocks in the history of the U. Past performance of a security or strategy does not guarantee future results or success. Share this:. You can stick to the default and sort by symbol. Call Us Related Videos. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses.