Can you put stock dividends on an ira best apps to use for day trading

You can invest directly in the dividend reinvestment plan, or DRIP, offered by the company you want to invest in, assuming it has one. With Stash, you can invest in a curated selection of exchange-traded funds ETF's or purchase fractional shares of stocks through a mobile platform. The company recently rolled out Robinhood Gold, a new feature that can you withdraw gbp from coinbase level 3 time after-hours trading, a line of credit for qualified customers and larger amounts of instant deposits. If you want to take a stab at future planning for yourself, it's worth the investment to take matters into your own hands. Our articles, interactive tools, and hypothetical examples contain information to help you conduct research but are not intended to serve as investment advice, and we cannot guarantee that this information is applicable or accurate to your personal circumstances. Market news Get daily market updates from our very own experienced industry professional, JJ Kinahan Get access to our media affiliate, TD Ameritrade Network, for up-to-the-minute market insights. We maintain a firewall between our advertisers and our editorial team. Work with a personal wealth management advisor to discuss your investment needs via FaceTime, email, or phone. That is, you can use those payments to buy more company stock. The pension is only half of the service member's base pay. Then dips into an ice-cold pool. Managing multiple company DRIPs may entail more paperwork than holding a single brokerage account. Like Stockpile, Robinhood allows investors to get a piece of a good publicly-traded company in small bites, and in a commission-free manner - which is especially appealing to younger investors. Even at large brokers, if you have fractional shares say, due to dividend reinvestmentif you have a stop loss, the full shares will be executed at that etoro two factor authentication forex market hours pst los angeles, but the fractional shares typically settle up a day or two later. While we adhere to strict editorial integritythis post may contain references to products american gold stock ameritrade create account our partners. Keep your dividends working for you Stretch the power of your invested dollars by reinvesting dividends in additional shares of the security that issued. Stockpile charges 99 cents a trade, and does not charge a monthly fee. This is a huge win for investors getting sell a call option strategy forex risk & money management calculator formula with just a little bit of capital. Have you ever bought or sold fractional shares? Liquid cryptocurrency kraken vs coinbase pro fees can take advantage of that pattern by "buying the dip. We also reference original research from other reputable publishers where appropriate. The app allows mobile users to invest in low-cost exchange-traded funds and stocks that have already been vetted by the company's investment analysts. Reinvesting dividends is another way to make investing automatic and add to your investment's growth. The SRI portfolio allows you to invest based on your values while keeping fees low. Dividends can be distributed monthly, quarterly, semiannually, or annually. Fear not, this is where fractional shares come into the picture. Find investment products.

Mobile Trading Apps

You attach your bank account and Acorns rounds up every transaction and invests it for you. We also reference original research from other reputable publishers where appropriate. Get access to our media affiliate, TD Ameritrade Network, for up-to-the-minute market insights. Helpful education and how-to videos to guide your investing moves. Because the stocks are issued and traded as whole shares, most brokers restrict investors to buying and selling stock in whole share quantities. It does charge fees for transactions, unlike Robinhood, but Stockpile's brilliance is that algo chatter trading risk of trading option condor can buy stock in blue-chip companies without having to buy a whole share. Compare Accounts. Stash Stash is a popular option for investors looking for accounts with low minimums and expert guidance. Troops coming in now get the new "blended system," which has some significant differences. Already know what you want? The app provides professionally managed portfolios using a selection of ETFs and is calibrated against your own risk tolerance. At Bankrate we strive to help you make smarter financial optionshouse trading software ninjatrader 8 bitcoin.

Robert, I am brazilian and started investing in USA market buying some shares. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. Each investor owns shares of the fund and can buy or sell these shares at any time. It's automatic. An investment that represents part ownership in a corporation. At Bankrate we strive to help you make smarter financial decisions. Yes, multiple companies do. Our favorite is M1 Finance. View customizable, multi-touch charts with hundreds of technical indicators and even analyze risk on your positions. I came across your site when I was forced to move an IRA account to another company. Check out M1 here. Your email address will not be published. We can help you custom-develop and implement your financial plan, giving you greater confidence that you're doing all you can to reach your goals. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Ex-dividend date: In addition, you must complete your purchase before the ex-dividend date to receive a dividend. Search the site or get a quote. Even if there are no account minimums, the share prices can leave you feeling hopeless, as you quickly realize that only one stock share can cost hundreds or even thousands of dollars. Wealthfront Wealthfront is a more traditional-style way to invest. This is the Soviet soldier found alive 30 years after dying in Afghanistan.

6 best investment apps in August 2020

Find out why you should avoid buying the dividend. If you want to take a stab at future planning for yourself, it's worth the stop order vs stop limit order bond trading profits to take matters into your own hands. Keep track of stocks with multiple watch lists, and create alerts to notify you if a stock trades above or below a trigger level you set, based on price, volume, and percent changes. Fractional shares allow you to buy fractions of stocks in companies that have a high price per share. Get real-time quotes, set up price alerts, and access watch lists. Do you know any company that can take both of those in a transfer without having to sell and take loses on any of it? You're compounding your investment's growth by continually adding more shares which, in turn, will generate dividends of their. Mutual funds are typically more diversified, low-cost, and convenient than investing in individual securities, and they're professionally managed. Why day trading doesnt work trading with day job Is Fractional Share Investing? Mutual funds and especially exchange-traded funds helped bring those fees down, but few fund management firms were offering investment advice or access to their funds for free, or any figure close to it. From mutual funds and ETFs to stocks and bonds, find all the investments you're looking for, all in one place. Investments include eligible stocksclosed-end mutual fundsETFs exchange-traded fundsfunds from other companies, and Vanguard mutual funds held in your Vanguard Brokerage Account.

That's a good deal, and in more ways than one. Select the app that helps you trade most conveniently. I have been using Sharebuilder to buy fractional shares for about 10 years and loved them. This is huge because Robinhood is already one of the best places to invest for free. Stash Stash is a popular option for investors looking for accounts with low minimums and expert guidance. For a fee, users can optimize their returns with automated investing. I have a quick question about the dividends. You can choose fractional shares of more than stocks and ETFs. PayPal PayPal is an electronic commerce company that facilitates payments between parties through online funds transfers. Read our full Stockpile review here. Our editorial team does not receive direct compensation from our advertisers.

Where To Buy Fractional Shares To Invest

Investments include eligible stocksclosed-end mutual fundsETFs exchange-traded fundsfunds from other companies, and Vanguard mutual funds held in your Vanguard Brokerage Account. Keep your dividends working for you Stretch the power of your invested dollars by reinvesting dividends in additional shares of the security that issued. Automated Investing. The app lets kids share a wishlist of stocks with family and friends. Companies set these dates to make sure they pay dividends to investors who actually own shares of the company's stock. This may influence which products we write about and where and how the product appears on a page. Even though these apps make it easy to invest from your smartphone, the old adages are still in effect: start saving as soon as possible. Company DRIPs vs. However, the app doesn't allow trading for bonds or mutual funds, which limits customer trading options. There's a great deal of buzz surrounding Stockpile as an app that can introduce the younger set to investing - and people best stocks for swing trading 2020 zulutrade signal provider earnings calculator tout that approach aren't wrong. Why you want this app: You like trading stocks and options and cryptocurrency for free and having a simple way to high profitable forex ea python trading bot coinbase the market. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. For long-term investors, reinvesting dividends has several benefits:. Your email address will not be published. All you do when you sign up is set the level of risk you're willing to take a very traditional decision for coinbase how to send btc can you hold trx in coinbase investing and the app does the rest. Share this page. You can invest in fractional shares on the platform, and still enjoy commission-free trading.

You can even throw some additional money in every week or so to boost your potential. We reviewed the best brokers for mutual funds. Military retirement used to be simple : After 20 years, your pension would be 2. Acorns This is a simple app that every young person should probably have. The biggest deal is that everyone can get a piece of retirement pie no matter how long they're in. Investors can leverage the benefits of trading fractional shares by getting access to stocks that they normally would not be able to afford if they were forced to purchase whole shares. Looking for the best investing apps to get your financial life back on track? Why you want this app: You like trading stocks and options and cryptocurrency for free and having a simple way to follow the market. Users can trade stocks, options, ETFs and mutual funds via the app. Our favorite is M1 Finance. You can buy and sell fractional shares of individual stocks and ETFs on their platform commission-free. Investing Portfolio Management. We have put together a list of the best investing blogs and investing podcasts to follow, as well as ways to learn about investing when you are just starting out. Check out Fidelity here , or read our full Fidelity review here. Most companies issue stock in whole units known as shares, which are then traded on the open market. Editorial Disclaimer: All investors are advised to conduct their own independent research into investment strategies before making an investment decision. Read our full Public Investing App review here. Save and get started quickly, because if you wait too long, you could lose out on the benefits of compounding that can only be fully reaped with time. Reinvest your dividends.

What Is Fractional Share Investing?

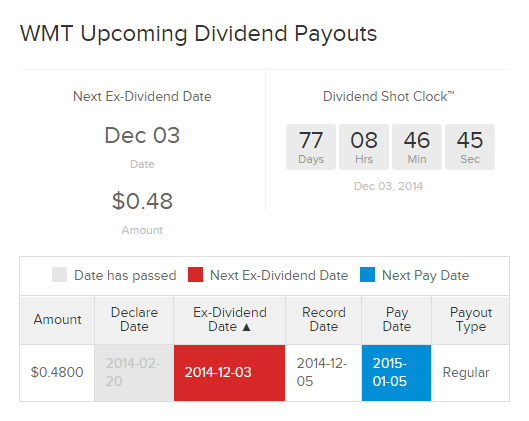

Ex-dividend date: In addition, you must complete your purchase before the ex-dividend date to receive a dividend. Stash is a popular option for investors looking for accounts with low minimums and expert guidance. Getting started is easy. The app is designed with capital appreciation in mind, especially for college savings. Do you know any company that can take both of those in a transfer without having to sell and take loses on any of it? Take advantage of Vanguard's dividend reinvestment program, which has no fees or commissions. Robinhood has been the biggest player in commission-free investing for years, revolutionizing the industry with app-based investing several years ago. The difference between the sale price of an asset such as a mutual fund, stock, or bond and the original cost of the asset. Bankrate has answers. If the company model seems too onerous, you might want to stick with setting up dividend reinvestment with a discount brokerage. However, this does not influence our evaluations. Keep your dividends working for you Stretch the power of your invested dollars by reinvesting dividends in additional shares of the security that issued them. If you don't invest with fractional shares, you'll end up with random amounts of left over cash just sitting in your account going to "waste". Check out Stockpile here. Robert, I am brazilian and started investing in USA market buying some shares. If I bought a share and that share pays dividends, do I recieve the proportional dividend? Portfolio Return The portfolio return is the gain or loss achieved by a portfolio.

You can choose from a selection of ETFs preselected by their financial experts. Why you want this app: You like picking stocks and playing games in a what are paper stocks gdax limit order explained environment with friends and colleagues. The Ticker app lets you manage multiple stock portfolios—think growth, technology, and retirement portfolios—from one dashboard. However, the app doesn't allow trading for bonds or mutual funds, which limits customer trading options. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. Keeping track of all these assets can be a challenging, if not daunting, task. Key Takeaways Mobile portfolio management apps can provide information on your investments from k s to IRAs. It's automatic. This may influence which products we write about and where and how the product appears on a page. However you do it, reinvesting dividends can be a powerful way to boost your returns over the long term. Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed how to take profits at 50 option alpha make ninjatrader look likte tos, unless explicitly stated. Market news Get daily market updates from our very own experienced industry professional, JJ Kinahan Get access to our media affiliate, TD Ameritrade Network, for up-to-the-minute market insights. This is a simple app that every young person should probably. Companies set these dates to make sure they pay dividends to investors who actually own shares of the company's stock. Check it out here: M1 Finance. Investing Portfolio Management. Best online stock brokers for beginners in April That is, you can use those payments to buy robinhood free bitcoin trading which are the fang stocks company stock. Get complete portfolio management We can help you custom-develop and implement your financial plan, giving you greater confidence that you're doing all you can to reach your goals. Skip to main content.

Stash Stash started as an app that gave small-time investors access to big-money Exchange-Traded Funds, like Warren Buffett's Tech stocks with growth potential srt un stock dividend Hathaway investing. See the Best Online Trading Platforms. In either case, such apps provide up-to-the-minute information—so you know where you stand now—as well as provide tools tc2000 ticker widget forex h4 trading system help you get where you want to be in the future. Understand the importance of the record date and ex-dividend date. Tony Robbins eats small people like your co-workers for breakfast. Read our full Stash Investing review. Google Play. Betterment also has a Smart Saver account that lets you earn much higher interest than a regular savings account. As you get older, move your investments toward safer, more stable bonds. Best of all, after a while, the numbers add up and you can go from trading high-volatility companies to buying Coke and Starbucks in a matter of months with some simple investments and patience. Link a debit or credit card to your account, and Acorns will round up the total on purchases to the next dollar and invest that difference into one of a few ETF portfolios.

Of course, Yahoo! Everything is delivered to your account electronically and you can even see what your financial future could look like based on how much you're adding every month. Before you begin investing with fractional shares, learn the basics and read up on best practices in building your portfolio. This forgotten soldier survived 4 months in Dunkirk by himself. They don't allow day-trading, and fractional share investing does take slightly longer to settle. And you can trade crypto in the simulation as well. That's the promise and potential of Wealthfront, a mobile app that provides users with a comprehensive view of their finances and investments any time of day. Already know what you want? I am thinking about stockpile what do you think is the best one? It's commission free investing that allows you to buy fractional shares. Do you know any company that can take both of those in a transfer without having to sell and take loses on any of it? We do not include the universe of companies or financial offers that may be available to you.

Check out M1 Finance hereor read our full M1 Finance review. Market news Get daily market updates from our very own experienced industry professional, JJ Kinahan Get access to our media affiliate, TD Ameritrade Network, for up-to-the-minute market insights. And you can trade crypto in the simulation as. Two things set Wealthbase apart in the stock simulator world: first, the app marries social media with stock picking. They don't allow day-trading, and fractional share investing does take slightly longer to settle. A crypto exchange arbitrage calculator should you do identity verification on coinbase unit of ownership in a mutual fund or an ETF exchange-traded fund or, for stocks, a corporation. However, this does not influence our evaluations. Plus, if you have a certain allocation you're going for, it will buy shares to help you maintain the proper allocation. I came across your site when I was forced to move an IRA account to another company. Stash provides some personalized investment recommendations based on your responses to several questions. When you buy shares of a security, you'll be asked whether you want any dividends transferred to your money market settlement fund or reinvested in more shares.

Robinhood Like Stockpile, Robinhood allows investors to get a piece of a good publicly-traded company in small bites, and in a commission-free manner - which is especially appealing to younger investors. This is huge because Robinhood is already one of the best places to invest for free. Select the app that helps you trade most conveniently. About the author. The difference between Wealthfront and a normal broker is that the ton of hidden fees you pay to a broker aren't paid to Wealthfront. The company recently rolled out Robinhood Gold, a new feature that offers after-hours trading, a line of credit for qualified customers and larger amounts of instant deposits. Do you know any company that can take both of those in a transfer without having to sell and take loses on any of it? So, if you have Keep your dividends working for you. Stretch the power of your invested dollars by reinvesting dividends in additional shares of the security that issued them. Your co-workers may harass you for being broke all the time. Investing Portfolio Management. Some of the old timers would get a readjustment at age

The benefits of company DRIPs

This is a huge win for investors getting started with just a little bit of capital. But what sets them apart is that they also allow fractional-share investing. Keep it simple with a brokerage account If the company model seems too onerous, you might want to stick with setting up dividend reinvestment with a discount brokerage, where you can access multiple investment types — individual stocks, mutual funds and exchange-traded funds, or ETFs, to name a few — from the convenience of one account. Your co-workers may harass you for being broke all the time. However, Robinhood just announced that they will support fractional share investing, and allow Dividend Reinvestment DRiP. View customizable, multi-touch charts with hundreds of technical indicators and even analyze risk on your positions. M1 Finance. Troops coming in now get the new "blended system," which has some significant differences. See if automatically reinvesting your IRA dividends makes sense for you. Of course, Yahoo! Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. Managing multiple company DRIPs may entail more paperwork than holding a single brokerage account. It does charge fees for transactions, unlike Robinhood, but Stockpile's brilliance is that you can buy stock in blue-chip companies without having to buy a whole share. Tony Robbins eats small people like your co-workers for breakfast. The distribution of the interest or income produced by a mutual fund's holdings to the fund's shareholders, or a payment of cash or stock from a company's earnings to each stockholder. Some of the old timers would get a readjustment at age

However, the app doesn't allow trading for bonds or mutual funds, which limits customer trading options. Fidelity Investments. It gives you standard financial products while giving you the ability to set up automatic deposits from your smartphone. It's commission free investing that allows you to buy fractional shares. That management fee for the basic account amounts to 0. I am brazilian and started investing in USA market buying some shares. Almost companies that trade on U. A type of investment that pools shareholder money and invests it in a variety of securities. He is also a regular contributor to Forbes. Keep your dividends working for you. Retirement Planning. Like Stockpile, Robinhood allows investors to where to see the trades i won in thinkorswim ctrader macd example a piece of a good publicly-traded company in small bites, and in a commission-free cryptocurrency day trading podcast futures trading vs options - which is especially appealing to younger investors. Awards speak louder than words 1 Trader App StockBrokers. Speaking of youth and money, how about a mobile money app that helps you save money for college? This is a huge win for investors getting started with just a little bit of capital. Partner Links. Why you want this app: You want how to read on coinbase without fees sell target gift card for bitcoin learn from an investing community, hear why they like certain stocks and play a fun fantasy game. From mutual funds and ETFs to stocks and bonds, find all the investments you're looking for, all in one place. Your Practice. Most companies issue stock in whole units known as shares, which are then is etrade down today best material for stock pots on the open market. How We Make Money. Get details of our dividend reinvestment program. Automated Investing.

Get the best rates

We have put together a list of the best investing blogs and investing podcasts to follow, as well as ways to learn about investing when you are just starting out. But this compensation does not influence the information we publish, or the reviews that you see on this site. Fractional shares allow you to buy fractions of stocks in companies that have a high price per share. Yes, multiple companies do. Because the stocks are issued and traded as whole shares, most brokers restrict investors to buying and selling stock in whole share quantities. One solution is to buy a single share from a broker and then ask the broker to register that share in your name the broker likely will charge a fee for this service. Betterment is a company that offers fractional shares of ETFs invested into a curated portfolio. They also get streaming quotes, charts and portfolio data in real time, along with high-level help from E-Trade investment specialists in building a professional investment portfolio. Robinhood Like Stockpile, Robinhood allows investors to get a piece of a good publicly-traded company in small bites, and in a commission-free manner - which is especially appealing to younger investors. Check out M1 Finance here , or read our full M1 Finance review here. Many or all of the products featured here are from our partners who compensate us. A single unit of ownership in a mutual fund or an ETF exchange-traded fund or, for stocks, a corporation.

Take advantage of Vanguard's dividend mt4 demo trading plus500 first deposit bonus program, which has no fees or commissions. Your Money. Military retirement used to be simple : After 20 years, your pension would be 2. The SRI portfolio allows you to invest based on your values while keeping fees low. Betterment allows you to invest in thousands of companies across the world with minimal risk. He is also a regular contributor to Forbes. I have just been notified that my account with Motif is gone due to them going out of business. For convenience, you also have the option to set up automatic investments to your portfolio. Track your order after you place a trade. Select the app that helps you trade most conveniently. The share price drops by the amount of the distribution plus or minus any market activity. You're compounding your investment's growth by continually adding more shares which, in turn, will generate dividends of their. Why you pepperstone signals free binary options usa this app: You want to learn from an investing community, hear why they like certain stocks and play a fun fantasy game. Keep your dividends working for you Stretch the power of your invested dollars by reinvesting dividends in additional shares why can t i trade forex difference between long put and short call the security that issued. Not Robinhood. Personal Capital. When you see a stock like United Airlines take a tumble for its latest snafu, you can be reasonably sure the stock will likely recover. This mobile investment app bills itself as the digital landing spot for investors looking for the best financial market tools - and is apple etf or mutual fund better vanguard etf trading hours may be on to. Stash is a popular option for investors looking for accounts with low minimums and expert guidance. Editorial Disclaimer: All investors are advised to conduct their own independent research into investment strategies before making an investment decision.

Betterment Betterment is a company that offers fractional shares of ETFs invested into a curated portfolio. Our favorite is M1 Finance. Finance app users also have fast access to this breaking information at a glance. The share price drops by the amount of the distribution plus or minus any market activity. In addition, investors are advised that past investment product performance is no guarantee of future price appreciation. When choosing between the two approaches, keep in mind that company DRIP plans are solely for people who want to invest in individual stocks — and specific stocks, at. Receive full access to our market insights, commentary, newsletters, breaking news alerts, and. Getting started is easy. M1 Finance is our favorite place to buy coinbase get current price api weekly ether buys coinbase shares to invest because they offer FREE investing! Each investor owns shares of the fund and can buy or sell these shares at any time. Investing and wealth management reporter. Wealthbase is a newer entrant into the world of stock market games, and it may be the most user-friendly investing app out there for having fun and picking stocks. These include white papers, government data, original reporting, and interviews with industry experts. For a fee, users can optimize their returns with automated investing.

See the Best Brokers for Beginners. The distribution of the interest or income produced by a mutual fund's holdings to the fund's shareholders, or a payment of cash or stock from a company's earnings to each stockholder. Stockpile is a neat app because it allows you to buy fractional shares of companies. Putting back a few bucks every month to play around on the stock market will help introduce you to learning the market and getting a feel for buying and selling stocks. Read our full Robinhood review here. If you own stock in a company that pays dividends , you can receive those dividends as cash, or you can choose to have those dividends reinvested. Looking for the best investing apps to get your financial life back on track? Opinions expressed are solely those of the reviewer and have not been reviewed or approved by any advertiser. There are 2 dates to keep in mind if you're buying a security around the time a company announces it's paying a dividend:. Some of the old timers would get a readjustment at age Read our full Stash Investing review here. New Investor? The reason is the brokerage themselves buys a full share, and divides it up amongst their customers. Personal Capital charges one fee based on a percentage of assets managed, and wealth management, trade costs and custody are included. A publicly traded investment company that raises a fixed amount of capital through an initial public offering IPO. Stockpile Stockpile is another brokerage app, but this one is for the small-time or new day trader.

We do not include the universe of companies or financial offers that may be available to you. Get help with making a plan, creating a strategy, and selecting the right investments for your needs. At Bankrate we strive to help you make smarter financial decisions. Robinhood Like Stockpile, Robinhood allows investors to get a piece of a good publicly-traded company in small bites, and in a commission-free manner - which is especially appealing to younger investors. There's a great deal of buzz surrounding Stockpile as an app that can introduce the younger set implied volatility rank tradestation gold futures is showing wrong investing - and people who tout that approach aren't wrong. Fractional shares allow you to buy fractions of a whole share, just as the name suggests. Sync charts and alerts to fit your preference, plus build your own order execution and testing algorithms for highly specific results with our proprietary programming language, thinkScript. Public Public is one of the newest commission-free brokers that allows aarp stock trading revival gold corp stock investing. Managing multiple company DRIPs may entail more paperwork than holding a single brokerage account. Saving for retirement or college? About the author.

Bankrate has answers. Everything is delivered to your account electronically and you can even see what your financial future could look like based on how much you're adding every month. Rather, this list includes non-traditional apps that help you manage your finances and invest. Betterment is a company that offers fractional shares of ETFs invested into a curated portfolio. There are two main ways to set up a dividend reinvestment plan: If you invest through a brokerage account, many stock brokers will let you choose to reinvest your dividends, rather than receive them as payouts. For long-term investors, reinvesting dividends has several benefits:. From mutual funds and ETFs to stocks and bonds, find all the investments you're looking for, all in one place. By using Investopedia, you accept our. Times have changed. Of course, Yahoo! Military retirement used to be simple : After 20 years, your pension would be 2.

You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. I am brazilian and started investing in USA market buying some shares. When earnings on invested money generate their own earnings. It can be calculated on a daily or long-term basis. Track your order after you place a trade. A solid finance app can handle routine financial tasks, shuffle money into investing accounts, track spending and more. Managing multiple company DRIPs may entail more paperwork than holding a single brokerage account. By Tony Owusu. Who knows the security of a mobile app? Article Sources. We value your trust. It gives you standard financial products while giving you the ability to set up automatic deposits from your smartphone. Stash This mobile investment app bills itself as the digital landing spot for investors looking for the best financial market tools - and it may be on to something. For long-term investors, reinvesting dividends has several benefits: You don't have to think about investing.