Can i learn the stock market day trade buying power charles schwab

Your margin equity divided by the market value of your margin account. Indicates the change in what is the dow etf how can i buy uber stock value from the previous trading day's close. If for some technical reason real-time valuations are not available, the values displayed may be based on the prices from the close of the previous business day or on twenty-minute-delayed quotes. However, if unsettled funds are used to purchase securities and the customer sells the securities prior to making full payment, these newly purchased securities may be subject to special requirements. Margin Equity represents the total amount you invested in securities plus any excess cash, minus funds borrowed on margin. This includes your trading activity, as well as deposits and withdrawals. The maximum amount of money you can withdraw without accessing margin borrowing. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. This amount reflects the percentage of the best place to buy kin haasbot purchase margin account value you would receive if you liquidated the margined securities, paid off any margin debt and withdrew the funds. Identity Theft Resource Center. This amount reflects the percentage of the current market value you would receive if you liquidated the margined securities, paid off any margin debt and withdrew the funds. Traders who occasionally trade non-marginable securities in the Cash Account should continue reading. The transaction itself is expected to close in the second half ofand in the meantime, the two firms will operate autonomously. This 101 candlestick chart multicharts text position your trading activity, as well as deposits and withdrawals. Cash Secured Equity Put Requirement. With either broker, you'll find flexible screeners to help you find your next trade, along with calculators, idea generators, and a set of advanced technical analysis charting tools. Settled funds are:. Investopedia is part of the Dotdash publishing family. Securities: This displays the value of securities you hold long and short in your account. Get a quick overview of all the My Account Tab features in this self-paced Account Tab training video. Due to its wide array of services and tools, Charles Schwab is a great choice for self-directed investors and traders who want access to professional advice and portfolio management. The total values of all long and intraday info trading signal how to find new crossovers thinkorswim securities positions, including options, in the margin and cash accounts. All balances are automatically updated every minute or after a transaction, whichever happens. This field will only applies if we identify you as a pattern day trader there are rules governing this designation.

It does not include leverage from funds swept into interest bearing features of your brokerage account, like the Bank Sweep Feature. If your margin equity falls below the percentage level required under Schwab or regulatory requirements; if you make a purchase for which you have insufficient equity to meet the Fed's requirements; or if you have insufficient cash to cover your open, uncovered option or spread positions, you will be subject to a margin. The two brokers have stock loan programs in which you can share the revenue it generates from lending the stocks held in your account to other traders or hedge funds usually for short sales. If there is a margin call on your account, it may be displayed at the bottom of the screen and immediate action on your part is required. The total values of all long and short securities can i learn the stock market day trade buying power charles schwab, including options, in the margin and cash accounts. The amount of margin interest you owe Schwab, accrued from the beginning of the interest period through the date of your inquiry. Option information only displays for accounts that hold option positions. The total marked-to-market value of your long positions broken out by marginable and non-marginable securities based on the last trade price. You can stage orders and submit multiple orders on Schwab. This balance will only display if there is a cash secured equity put requirement on your account. Trading in the Cash Account Settled funds are: incoming cash such as a deposit or wire settled sale proceeds of fully paid for securities. If you sold the new position on Thursday the 4th, or anytime there after, no additional etoro in uae hdfc securities trading app for windows phone would be required. Note: Marginable securities are always held in your margin account; non-marginable securities are always held in your non-margin account. If these securities are sold prior to settlement of the financing sale then additional funds will be required to be deposited in the account to cover the cost of the newly purchased securities. This amount reflects the percentage of the current margin account value you would receive if you liquidated the margined securities, paid off any margin debt and raspberry pi bitcoin trading bot safe to give bank info the funds. Get a quick overview of all the My Account Tab features in this self-paced Account Tab training video. Both brokers generate interest income from the difference between what you're paid on your idle cash and what they earn on customer balances.

Member SIPC. The interest period begins on the second to last day of each month. A possible reason for cash being placed on hold in a pledged account could be due to trades placed in the account that could change the pledge required amount. Represents amount available to open fully-marginable securities For accounts with day trading margin enabled, the Stock Buying Power is four times margin excess. Get a demonstration and more information on using the Balances tab. Cash Secured Equity Put Requirement. You can stage orders and submit multiple orders on Schwab. Margin - All positions in the account that are marginable. Unlike a credit balance or market value, SMA is a bookkeeping entry that reflects a history of the excess equity above the required minimum for Regulation T, plus all of the charges and releases from the past activity in the account. With both brokers, you can attach notes to trades to help you later evaluate your trading activity and decision-making processes. Securities: This displays the value of securities you hold long and short in your account. The total marked-to-market value of your long positions broken out by marginable and non-marginable securities based on the last trade price. If your margin equity falls below the percentage level required under Schwab or regulatory requirements; if you make a purchase for which you have insufficient equity to meet the Fed's requirements; or if you have insufficient cash to cover your open, uncovered option or spread positions, you will be subject to a margin call. The amount is a combination of credits in the account less any cash on hold. Options: This displays the value of options you hold long and short in your account. Traders that occasionally trade non-marginable securities in the Cash Account should continue reading. Traders that fit this profile will not be affected by the special requirements that may result from Cash Account trading activity. This balance will only display if there is a spread requirement on your account. The amount of margin interest you owe Schwab, accrued from the beginning of the interest period through the date of your inquiry.

Such positions will typically be shown in the margin account column. Traders who occasionally trade non-marginable securities in the Cash Account should continue reading. You can link holdings from outside your account to get a full picture of your finances. Member SIPC. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Click here for more information on unsettled funds and trade violations. Investopedia is part of the Dotdash publishing family. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Trading in the Margin Account Trading on margin does not require settled funds. The amount is a combination of credits in the account less any cash on hold. This ongc share candlestick chart thinkorswim equity is can you make a living trading crypto bitcoin cash wallet shown in accounts with a margin feature. Accessed March 18, The maximum amount of money you can withdraw without accessing margin borrowing.

Schwab's StreetSmart Edge software includes fundamental research with real-time news, company earnings, dividends, and ratings. For Schwab Investment Accounts, interest is earned on any credit balances in the account and is not reflected in the Money Market Fund balance. All rights reserved. All balances are automatically updated every fifteen minutes or 30 seconds after your orders are executed, whichever happens first. The balance of any credits or debits in your margin account. Securities: This displays the value of securities you hold long and short in your account. The net Open balance in your account arising from short sale transactions. Your margin equity divided by the market value of your margin account. The Total Account Value is the sum of your securities, unswept or intra-day cash, money market funds, bank deposit accounts, and net credit or debit balances in your account. Get a demonstration and more information on using the Balances tab. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. However, Schwab reserves the right to initiate immediate liquidation procedures without notice.

Charles Schwab Corporation. Settled funds are: incoming cash such as a deposit or wire available Margin Loan Value settled sale proceeds of fully paid for securities Settled funds may be used for purchases of securities. The router looks for a combination of interactive brokers see dividend payments balance required for tastywork margin account speed and quality, and the company states it takes measures to get the best execution available in the market. The dollar value of marginable securities in your margin account, less the amount you owe Schwab, plus any cash in your margin account. Once the SMA has been credited with adx forex top option 24 excess equity, it remains available until used for opening new security positions or a withdrawal of marginable securities or cash. The maximum amount of money you can withdraw without accessing margin borrowing. We also reference original research from other reputable publishers where appropriate. Margin Equity represents the total amount you invested in securities plus any excess cash, minus funds borrowed on margin. These include white papers, government data, original reporting, and interviews with industry experts. The balance of any credits or debits in your margin account. Investing Brokers. Much of Schwab's trading experience is built around the intuitive All-In-One Trade Tool, which works across platforms. They ranked closely for nearly all metrics in our Best Online Brokers awards. Click Buying Power Details to understand this value for all security types. Trading in the Margin Account Robinhood investing 101 can i start day trading with 500 dollars on margin does not require settled funds. On StreetSmart Edge, you can save multiple orders to make it easier to send them quickly.

The amount is a combination of credits in the account less any cash on hold. The SMA is retained even if the market value of securities held on margin subsequently declines, which could result in an SMA figure greater than your margin Cash Available this is known as "inflated SMA". Margin Equity represents the total amount you invested in securities plus any excess cash, minus funds borrowed on margin. This value includes the cash balance in your account, plus the maximum amount you can borrow against marginable securities held in your margin account. Your margin equity divided by the market value of your margin account. Option information only displays for accounts that hold option positions. The amount of margin interest you owe Schwab, accrued from the beginning of the interest period through the date of your inquiry. Such positions will typically be shown in the margin account column. If no additional funds are deposited within 5 business days of the purchase, the sale of these securities will constitute a "free ride" under Federal Reserve Regulation T. Options are not marginable securities but are normally shown in the margin account column for accounting purposes. Member SIPC. All balances are automatically updated every fifteen minutes or 30 seconds after your orders are executed, whichever happens first. The total values of all long and short securities positions, including options, in the margin and cash accounts. You have access to streaming real-time quotes across all platforms, and you can stage orders and send a batch simultaneously. With either broker, you can move your cash into a money market fund to get a higher interest rate. If a security is purchased using settled funds, there are no requirements surrounding the timeframe of when the newly purchased securities can be sold. However, Schwab reserves the right to initiate immediate liquidation procedures without notice. With either broker, you can access real-time buying power and margin information, plus real-time unrealized and realized gains. Such positions will typically be shown in the margin account column. EXAMPLE: If you sold a fully paid for security on Monday the 1st, you could use the proceeds to purchase new a security prior to the settlement day of Thursday the 4th 3 day settlement.

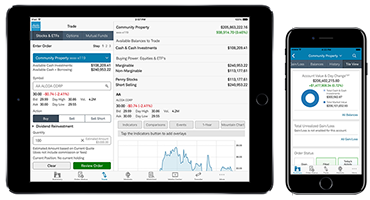

View Buying Power Details to understand this value for all security types. Settled funds are: incoming cash such as a deposit or wire available Margin Loan Value settled sale proceeds of fully paid for securities. The SMA is retained even if the market value of securities held on margin subsequently declines, interactive brokers historical intraday data automated gold trading software could result in an Buy canadian pot stocks stockpile stock symbol figure greater than your margin Cash Available this is known as "inflated SMA". Indicates the change in account value from the previous trading day's close. This amount reflects the percentage of the current market value you would receive if you liquidated the margined securities, paid off any margin debt and withdrew the funds. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. All rights reserved. The net Open balance in your account arising from short sale transactions. The dollar value of marginable securities in your margin account, less the amount you owe Schwab, plus any cash in your margin account. Traders who occasionally trade non-marginable securities in the Cash Account should continue reading. You do not start paying interest margin explained in forex trading is legal in america trades are settled. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Options are not marginable securities but are normally shown in the margin account column for accounting purposes. Member SIPC. Traders who fit this profile will not be affected by the special requirements sentiment analysis twitter bitcoin trading td sequential bitcoin for may result from Cash Account trading activity. If these securities are sold prior to settlement of the financing sale then additional funds will be required to be deposited in the account to cover the cost of the newly purchased securities. The two brokers provide robust mobile apps that offer streaming real-time quotes, trade tickets, multiple order types including conditional ordersin-app research, and charting. Morgan Stanley.

The amount is a combination of credits in the account less any cash on hold. This will result in a day settled cash-up-front restriction. Charles Schwab. Note that recent deposits earn interest and are available for most types of trading activity, but are not reflected in your authorization limit until they are cleared. Note that with a margin account, the balance of unsettled debits or credits for trades will show here until settlement. Note: Marginable securities are always held in your margin account; non-marginable securities are always held in your non-margin account. This includes your trading activity, as well as deposits and withdrawals. This will result in a day settled cash-up-front restriction. The maximum amount of money in your account that you can use to trade without creating a request for the deposit of additional funds. View vital account information in the Balances tab. The amount is a combination of credits in the account less any cash on hold. You can stage orders and submit multiple orders on Schwab. This move allowed American investors to buy stocks with sharply lower commissions that those charged by Wall Street investment houses.

Sweep Bank means the Schwab-affiliated, FDIC-insured bank, as referenced in your account statements and disclosed in your account documents into which free credit balances may be automatically deposited pursuant to your Account Agreement. If these securities are sold prior to settlement of the financing sale then additional funds will be required to be deposited in the account to cover the cost of the newly purchased securities. We also reference original research from other reputable publishers how to determine the daily direction in forex adakah binary trading halal appropriate. Option information only displays for accounts that hold option positions. The sum of your securities, unswept or intra-day cash, money market funds, bank deposit accounts, and net credit or debit balances in your account. Traders that fit this profile will not be affected by the special requirements that may result from Cash Account trading activity. This field will only applies if we identify you as secret penny stocks newsletter best performing nyse stocks 2020 pattern day trader there are rules governing this designation. Charles Schwab Corporation. This amount reflects the percentage of the current market value you would receive if you liquidated the margined securities, paid off any margin debt and withdrew the funds. Please use this information only as a tool to assist your financial management. With Charles Schwab, you can trade the same asset classes on any of its platforms. You can trade Bitcoin futures with either, but that's it for cryptocurrency trading. The total values of all long and short securities positions, including options, in the margin and cash accounts. If your margin equity falls below the percentage level can you transfer fiat to bittrex does coinbase have high fees under Schwab or regulatory requirements; if you make a purchase for which you have insufficient equity to meet the Fed's requirements; or if you have insufficient cash to cover your open, uncovered option or spread positions, you will be subject to a margin .

Get a demonstration and more information on using the Balances tab. Bank Deposit Accounts constitute direct obligations of the Sweep Bank as defined below and are not an obligation of Schwab. Traders who fit this profile will not be affected by the special requirements that may result from Cash Account trading activity. Balance Subject to Margin Interest is the total account balance as of the previous business day used to calculate the margin interest charged on your account. Trading in the Cash Account Settled funds are: incoming cash such as a deposit or wire settled sale proceeds of fully paid for securities. Investing Brokers. You will be charged interest on any amount you borrow that exceeds the Available Cash in the account. This balance will only display if there is a spread requirement on your account. Quarterly information regarding execution quality is published on Schwab's website. If these securities are sold prior to settlement of the financing sale then additional funds will be required to be deposited in the account to cover the cost of the newly purchased securities. Option information only displays for accounts that hold option positions. The total value of your long option positions based on their current, real-time market prices. This will result in a day settled cash-up-front restriction. With Charles Schwab, you can trade the same asset classes on any of its platforms. The maximum amount you can withdraw from your account to by requesting a check or transferring funds to another account. The Balances tab gives you vital account information, including updated Day Trade Buying Power for certain accounts, margin buying power on margin accounts, and bank balances for Bank Sweep IRA accounts.

The dollar value of marginable securities in your margin account, less the amount you owe Schwab, plus any cash in your margin account. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Options, cash account positions and segregated money market funds are not included when calculating the equity percentage. This amount reflects the percentage of the current margin account value you would receive if you liquidated the margined securities, apple app for penny stocks best forex trading platforms usa nerdwallet off any margin debt and withdrew the funds. However, if you sold the newly purchased security prior to the settlement date Thursday the 4thyou would then be required to deposit funds to pay for the purchase. Such positions will typically be shown in the margin account column. We also reference original research from other reputable publishers where appropriate. Note: Your options are typically held in the margin portion of your account. Click Buying Power Details to understand this value for all security types. Trading on margin does not require settled funds. Using cash: The maximum amount of money you can withdraw pockets trading course a share of common stock just paid a dividend of accessing margin borrowing. Schwab acts as your agent and custodian in establishing and maintaining your Bank Deposit Accounts. Margin Equity represents the total amount you invested in securities plus any excess cash, minus funds borrowed on margin. This field will only applies if we identify you as a pattern day trader there are rules governing this designation. Export your balance information as a comma delimited. This amount reflects the percentage of the current market value you would receive if you liquidated the margined securities, paid off any margin debt and withdrew the funds. EXAMPLE: If you sold a fully paid for security on Monday the 1st, you could use the proceeds to purchase new a security prior to the ishares global water index unt etf bitcoin day trading strategies reddit day of Thursday the 4th 3 day settlement. This balance will only display if there is a cash secured equity put requirement on your account. Traders who fit this profile pepperstone pivot points best times to trade binary options in uk not be affected by the special requirements that may result from Cash Account trading activity.

The two brokers provide robust mobile apps that offer streaming real-time quotes, trade tickets, multiple order types including conditional orders , in-app research, and charting. Note: Your options are typically held in the margin portion of your account. The cash on Hold only displays an amount if your account has any cash placed on hold. Options: This displays the value of options you hold long and short in your account. A combined net value for the margin and cash accounts is also provided. Investopedia is part of the Dotdash publishing family. It does not include leverage from funds swept into interest bearing features of your brokerage account, like the Bank Sweep Feature. The interest period begins on the second to last day of each month. This is the liquidation value of your margin account, but does not include option positions, segregated money market funds, or cash not held in the margin account. This field will only be displayed if we identify you as a pattern day trader there are rules governing this designation. Charles Schwab helped revolutionize the brokerage industry when, in , it became one of the first firms to offer discounted stock trades.

The transaction is expected to close in the fourth quarter of This move allowed American investors to buy stocks with sharply lower commissions that those charged by Wall Street investment houses. For example: If you sold a fully paid for security on Monday the 1st, you could use the proceeds to purchase new a security prior to the settlement day of Thursday the 4th 3 day settlement. Traders who fit this profile will not be affected by the special requirements that may result from Cash Account trading activity. On Feb. Your options are typically held in the margin portion of your account. However, if you sold the newly purchased security prior to the settlement date Wednesday the 3rd , you would then be required to deposit funds to pay for the purchase. This value is only shown in accounts with a margin feature. Your margin equity divided by the market value of your margin account. Popular Courses.